Finance

What Is Another Name For A Checking Account

Published: October 28, 2023

Discover the alternative term for a checking account in the world of finance and learn more about its features and benefits.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

A checking account is an essential financial tool that allows individuals to manage their day-to-day finances efficiently. Also known as a transactional account or a current account, a checking account provides a convenient way to receive and make payments, pay bills, and access funds easily.

In today’s rapidly evolving financial landscape, having a checking account has become increasingly necessary for individuals to stay financially organized and participate in the modern economy. Whether you’re paying for groceries, settling utility bills, or receiving your salary, a checking account is the go-to financial instrument that simplifies these transactions.

Throughout this article, we will explore the key aspects of a checking account, including its definition, purpose, features, benefits, drawbacks, and alternatives. Understanding these details will help you make informed decisions when it comes to managing your finances effectively.

So, let’s dive into the world of checking accounts and unveil the various facets that make them an indispensable tool for everyday financial management.

Definition of a Checking Account

A checking account is a type of bank account that allows individuals to deposit and withdraw funds easily for everyday financial transactions. It serves as a secure and accessible repository for holding money that can be used for various purposes, such as paying bills, making purchases, and transferring funds to other accounts.

One of the distinguishing features of a checking account is its liquidity. Unlike other types of accounts that may have restrictions on withdrawals or require notice before accessing funds, a checking account allows individuals to withdraw money on-demand, usually through methods like writing checks, using a debit card, or making electronic transfers.

When opening a checking account, individuals are typically provided with a unique account number and routing number, which they can use to authorize transactions and receive direct deposits. These account details are also necessary when setting up automatic bill payments or receiving funds through online platforms.

Checking accounts may be offered by traditional brick-and-mortar banks, online banks, credit unions, or other financial institutions. Each institution may have its own terms and conditions for operating a checking account, such as monthly maintenance fees, minimum balance requirements, and overdraft fees.

It’s important to note that a checking account is different from a savings account. While both accounts offer a safe place to store money, a savings account typically offers a higher interest rate and is designed for accumulating funds over time, while a checking account focuses on immediate access and transactional needs.

Now that we have a clear understanding of what a checking account is, let’s explore its purpose and how it can benefit individuals in managing their finances effectively.

Purpose of a Checking Account

A checking account serves several important purposes in personal finance management. Let’s take a closer look at the key reasons why having a checking account is beneficial:

- Convenient Payment Method: One of the primary purposes of a checking account is to facilitate easy and convenient payment methods. Whether you need to pay bills, purchase goods and services, or transfer funds to others, a checking account allows you to do so efficiently. You can write checks, use a debit card, or make online payments directly from your checking account, eliminating the need for carrying around large amounts of cash or relying on cash-based transactions.

- Safe Storage of Funds: By depositing your money into a checking account, you ensure its safety. Banks and other financial institutions have security measures in place to protect your funds, reducing the risk of loss due to theft or misplacement. Furthermore, many checking accounts are federally insured by the FDIC (Federal Deposit Insurance Corporation) up to a certain amount, providing an additional layer of protection for your money.

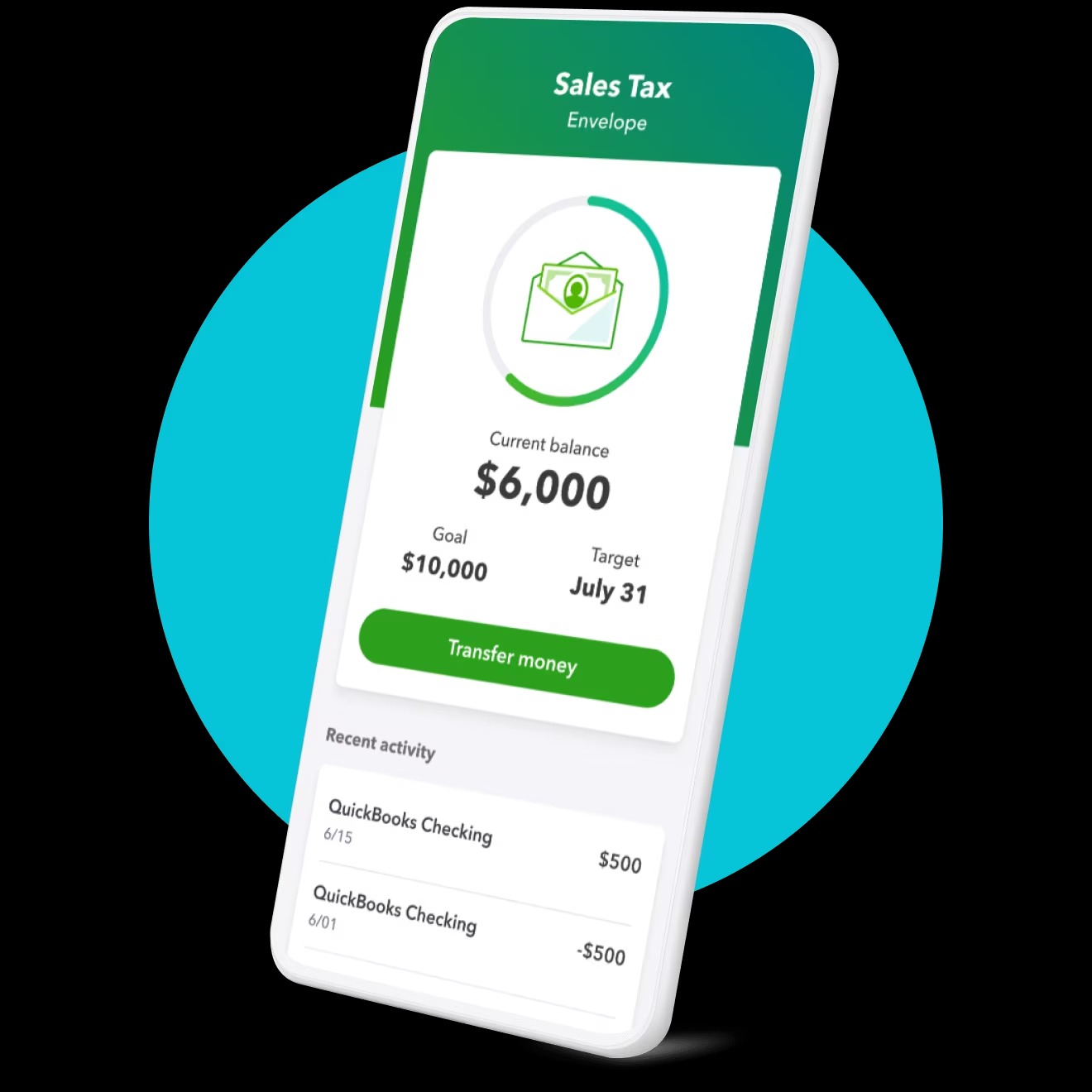

- Tracking and Documentation: A checking account acts as a centralized location for tracking and documenting your financial transactions. Each deposit, withdrawal, or payment made from your account is recorded, providing a clear and organized record of your financial activities. This documentation can be beneficial for budgeting, tax purposes, or resolving any discrepancies that may arise.

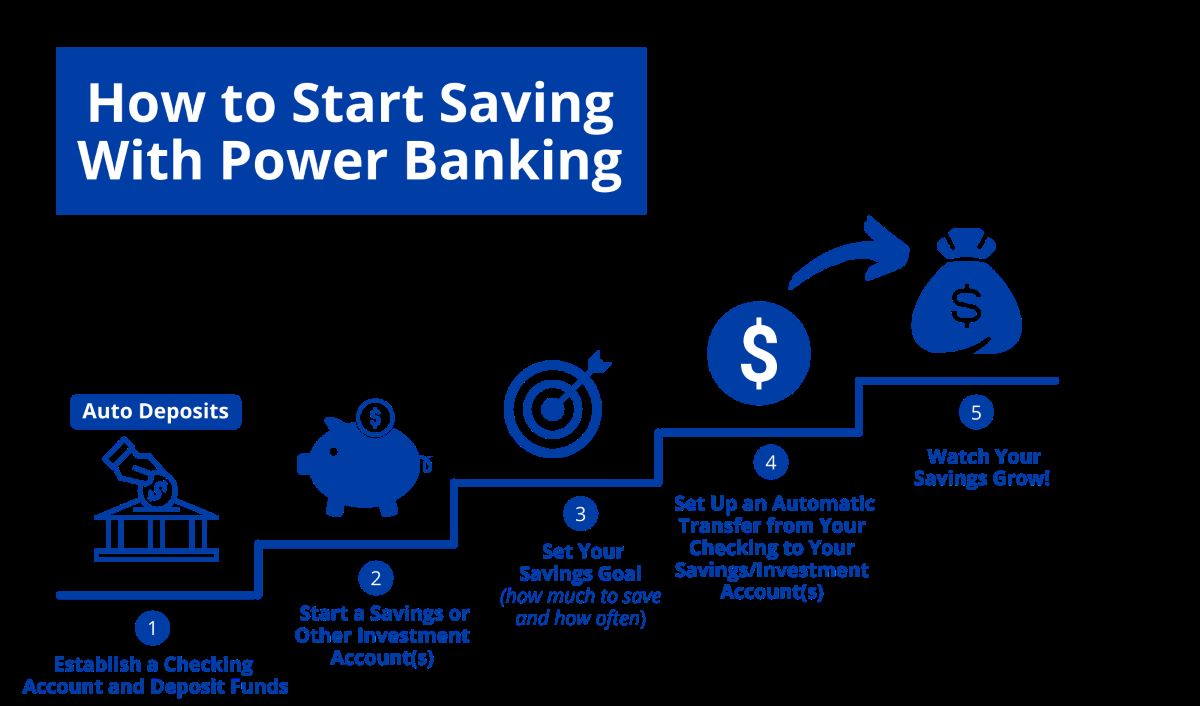

- Direct Deposit and Automatic Payments: Many employers offer direct deposit options to pay their employees, which allows the funds to be directly deposited into their checking accounts. This eliminates the need for physical checks and provides timely access to your earnings. In addition, a checking account enables you to set up automatic bill payments, saving you time and effort in managing recurring expenses.

- Online and Mobile Banking: With the advent of technology, most checking accounts come with online and mobile banking features. This allows you to access your account information, view statements, make transfers, and perform other banking tasks conveniently from the comfort of your home or on-the-go using your smartphone or computer.

Overall, the purpose of a checking account is to provide individuals with a secure, convenient, and efficient way to manage their day-to-day financial transactions. By utilizing a checking account, you can streamline your payment processes, safeguard your funds, maintain organized records, and leverage digital banking features for added convenience.

Features of a Checking Account

Checking accounts come with a range of features that make them versatile and user-friendly. Let’s explore some of the key features of a checking account:

- Debit Card: Most checking accounts provide a debit card, which allows you to withdraw cash from ATMs and make purchases at various merchants. The debit card is linked to your checking account, and the transactions are directly debited from your available balance.

- Check Writing: Traditional checking accounts offer the option to write personalized checks. These checks can be used to make payments to individuals or businesses. When you write a check, the specified amount is deducted from your account, and the recipient can deposit it into their own account.

- Electronic Transfers: Checking accounts enable you to initiate electronic transfers, which facilitate seamless and quick money movement. You can transfer funds between your own accounts within the same bank, send money to other individuals, or receive funds from others.

- Overdraft Protection: Many checking accounts offer overdraft protection, which prevents your account from going into a negative balance if you make a transaction that exceeds your available funds. This can help you avoid costly overdraft fees and ensure uninterrupted banking services.

- Online and Mobile Banking: With the advancement of technology, checking accounts often come with online and mobile banking capabilities. This allows you to manage your account, check balances, view statements, and conduct transactions from your computer or smartphone. Online bill payment features are commonly available as well.

- Account Alerts: Checking accounts may offer account alert services, through which you can receive notifications via email or text message for various activities and events, such as low balance alerts, deposit confirmations, or suspicious transactions. These alerts can help you stay on top of your account activity and quickly address any concerns.

- Access to ATMs: With a checking account, you typically have access to ATMs nationwide, allowing you to withdraw cash or perform other transactions. Some banks offer fee-free access to a network of ATMs, while others may charge a small fee for using out-of-network machines.

These are just a few of the common features found in checking accounts. Keep in mind that specific features may vary depending on the financial institution and the type of checking account you choose. It’s important to consider your personal banking needs and preferences when selecting a checking account that aligns with your requirements.

Benefits of a Checking Account

A checking account offers several benefits that can greatly enhance your financial management and daily transactions. Let’s explore some of the key advantages of having a checking account:

- Convenience: A checking account provides a convenient way to transact and manage your finances. Whether you need to pay bills, make purchases, or transfer funds, a checking account offers multiple options such as writing checks, using a debit card, or making electronic transfers. This convenience saves you time and effort compared to traditional cash-based transactions.

- Safety and Security: Keeping your money in a checking account offers a higher level of safety and security compared to carrying large amounts of cash. Banks and financial institutions have security measures in place to protect your funds, reducing the risk of theft or loss. Additionally, most checking accounts are backed by federal deposit insurance, providing further protection for your deposits.

- Record Keeping: A checking account helps you maintain accurate and organized records of your financial transactions. Each deposit, withdrawal, or payment made from the account is recorded, providing a clear audit trail of your activities. This makes it easier to track your spending, budget effectively, and review your financial history when needed.

- Access to Banking Services: Having a checking account grants you access to a wide range of banking services. You can easily set up automatic bill payments, receive direct deposits from your employer, and access online and mobile banking platforms. These services allow you to manage your finances efficiently and take advantage of the digital banking revolution.

- Building Credit History: Some checking accounts offer the opportunity to build credit history through features like overdraft protection and linked credit products. Consistently managing your checking account responsibly and avoiding overdrafts can help establish a positive credit profile, which can be beneficial when applying for loans or credit cards in the future.

- Budgeting and Financial Planning: With a checking account, you can effectively manage your budget and financial planning. By reviewing your account statements, tracking expenses, and categorizing transactions, you can gain insights into your spending habits and make informed decisions to improve your financial well-being.

- Accessibility: Checking accounts offer easy access to your funds through a variety of channels. Whether it’s withdrawing cash from ATMs, making purchases with a debit card, or transferring money electronically, accessing your funds is convenient and quick. This accessibility is especially beneficial in emergency situations or when you need fast access to money.

Overall, a checking account provides numerous benefits that simplify your financial life, offer greater security, and empower you to manage your money effectively. By utilizing the features and services associated with a checking account, you can streamline your transactions, gain financial control, and enhance your overall financial well-being.

Drawbacks of a Checking Account

While checking accounts offer many advantages, it is important to be aware of the potential drawbacks associated with them. Let’s explore some of the common drawbacks of having a checking account:

- Fees and Charges: Some checking accounts may come with monthly maintenance fees, minimum balance requirements, or transaction fees. These fees can eat into your account balance and reduce the overall value of the account. It’s important to understand the fee structure and choose a checking account that aligns with your financial needs and budget.

- Overdraft Fees: If you spend more money from your checking account than what is available in your account balance, it can result in an overdraft. Overdrafts typically incur high fees, which can add up quickly and impact your finances. It’s important to closely monitor your account balance and avoid spending more than what you have available.

- Limited Interest Earning Potential: Compared to savings accounts or other investment options, checking accounts generally offer lower interest rates. This means that the funds in your checking account may not grow at a significant rate. If you are looking to maximize your savings and earn interest over time, it may be wise to explore alternative options.

- Potential for Fraud and Identity Theft: While banks have security measures in place, there is always a risk of fraudulent activity or identity theft associated with using a checking account. It is important to regularly monitor your account statements, protect your personal information, and report any suspicious activity to your bank promptly.

- Excessive Spending: Using a debit card or writing checks from a checking account can make it easier to overspend. Without careful budgeting and monitoring of your account balance, it can be tempting to make impulsive purchases or exceed your available funds. It’s crucial to establish good financial discipline and regularly track your spending to avoid falling into a cycle of debt.

- Dependency on Technology: Many checking accounts now rely heavily on online and mobile banking platforms for transactions and account management. While this offers convenience, it also means that you are dependent on technology and vulnerable to technical glitches or system outages that can temporarily hinder access to your funds.

Understanding the potential drawbacks of a checking account allows you to make informed decisions and take proactive steps to mitigate these challenges. By carefully managing your account, being mindful of fees, and practicing good financial habits, you can navigate the drawbacks and maximize the benefits of your checking account.

Alternatives to a Checking Account

While a checking account is a popular choice for managing everyday finances, there are alternative options available that may better suit your needs. Let’s explore some of the alternatives to a traditional checking account:

- Savings Account: A savings account is a popular alternative to a checking account, especially if you primarily want to save and accumulate funds rather than conduct frequent transactions. Savings accounts often offer higher interest rates, allowing your money to grow over time. However, keep in mind that savings accounts may have limitations on withdrawals and may not offer the same convenience for everyday payments as checking accounts.

- Online-only Banks: Online-only banks have gained popularity in recent years, offering a range of financial services without the need for physical branches. These banks often have lower fees and competitive interest rates on deposit accounts, including checking and savings accounts. They provide the convenience of online and mobile banking platforms, making it easy to manage your finances from anywhere. However, it is important to ensure that the online bank is reputable and offers the necessary security measures to protect your funds.

- Prepaid Debit Cards: Prepaid debit cards function similarly to a checking account but without the need for a bank account. These cards are loaded with a certain amount of money and can be used for purchases and withdrawals up to the loaded balance. Prepaid cards can be a suitable alternative for individuals who are unable to qualify for a traditional checking account or prefer to have more control over their spending.

- Money Market Accounts: Money market accounts are a hybrid option that combines features of savings and checking accounts. These accounts typically offer higher interest rates than traditional checking accounts, while still providing some limited check-writing and transaction capabilities. Money market accounts often require a higher minimum balance compared to regular checking accounts.

- Credit Unions: Credit unions are member-owned financial cooperatives that offer a wide range of services, including checking accounts. They often have lower fees and competitive interest rates, making them an attractive alternative to traditional banks. Credit unions also tend to have a community focus and may offer additional perks, such as financial education resources and personalized customer service.

- Digital Wallets: Digital wallets, such as Apple Pay, Google Pay, or Samsung Pay, allow you to store your debit and credit card information securely on your mobile device. They offer a convenient and contactless way to make payments at various merchants, eliminating the need to carry physical cards or cash. While not a direct alternative to a checking account, digital wallets can complement your banking needs and simplify your payment experiences.

When considering alternatives to a checking account, it is essential to evaluate your specific financial goals, transactional needs, and preferred banking features. Each alternative has its own advantages and limitations, so choose the option that aligns with your priorities and enhances your financial management.

Conclusion

A checking account is a versatile and valuable financial tool that simplifies your day-to-day financial transactions and helps you stay organized. It offers convenience, safety, and accessibility, making it an essential component of personal finance management. By providing features such as debit cards, check writing, electronic transfers, and online banking, checking accounts streamline your financial activities and empower you to manage your money efficiently.

While checking accounts come with benefits, it is important to be aware of their potential drawbacks, such as fees, overdraft charges, and limited interest earning potential. Understanding these drawbacks allows you to navigate them effectively and make informed choices that align with your financial goals.

Furthermore, exploring alternative options like savings accounts, online-only banks, prepaid debit cards, and credit unions can provide alternative ways to manage your money depending on your unique needs and preferences.

In conclusion, a checking account serves as a fundamental tool for financial management, offering convenience, security, and accessibility. It is crucial to choose a checking account that fits your financial requirements and to utilize it responsibly. Whether you opt for a traditional checking account or explore alternatives, the key is to select the option that aligns best with your financial goals and helps you effectively manage your day-to-day finances. By utilizing the features and benefits of a checking account, you can enhance your financial well-being and achieve greater control over your money.