Home>Finance>What Is The Monthly Periodic Rate On A Loan With An APR Of 18.6%?

Finance

What Is The Monthly Periodic Rate On A Loan With An APR Of 18.6%?

Published: March 3, 2024

Learn how to calculate the monthly periodic rate for a loan with an 18.6% APR in this comprehensive finance guide. Understand the key factors impacting your loan payments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Monthly Periodic Rate on a Loan

When you're considering taking out a loan, it's crucial to understand the various terms associated with borrowing money. One of the key elements to comprehend is the Annual Percentage Rate (APR), which represents the annual cost of borrowing funds, including interest and certain fees. However, to gain a comprehensive understanding of the financial implications of a loan, it's equally important to grasp the concept of the monthly periodic rate.

In this article, we will delve into the intricacies of the monthly periodic rate and its significance in the realm of borrowing and lending. By shedding light on the calculation of this rate and its practical implications, we aim to empower you with the knowledge necessary to make informed financial decisions.

Understanding the monthly periodic rate is essential for anyone seeking to borrow money, as it directly impacts the amount of interest accrued on a loan. Whether you're considering a mortgage, auto loan, or personal loan, comprehending this aspect will enable you to assess the true cost of borrowing and make sound financial choices.

Now, let's embark on a journey to unravel the mystery behind the monthly periodic rate and its role in the realm of finance.

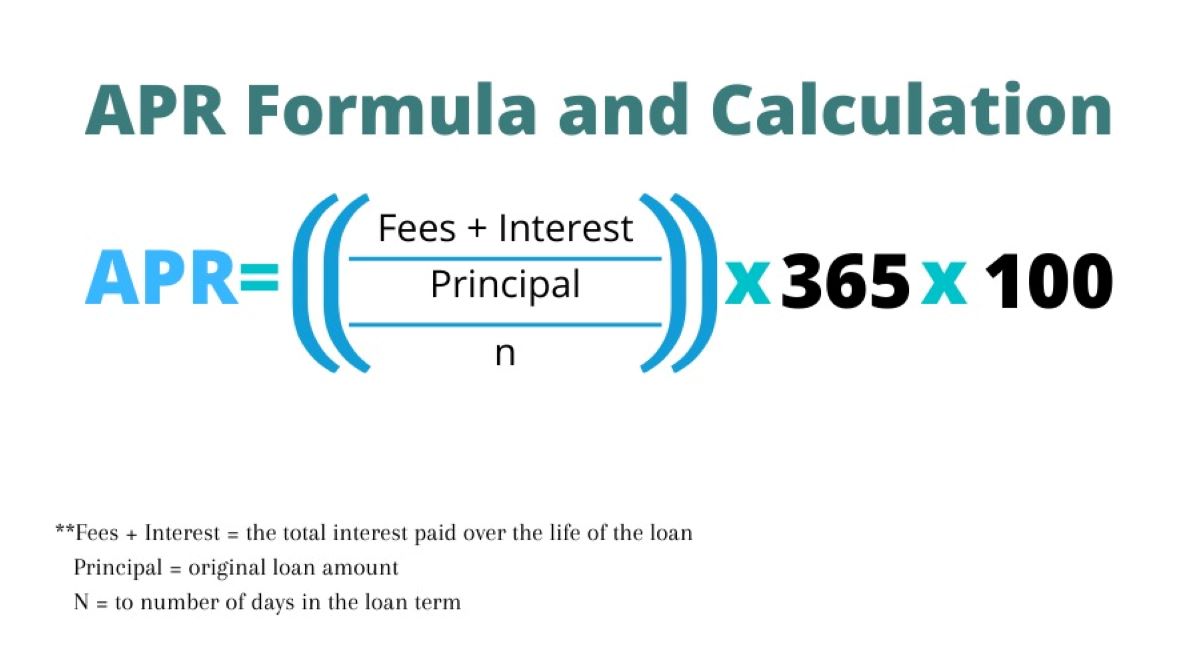

Understanding APR

Before delving into the specifics of the monthly periodic rate, it’s essential to grasp the concept of the Annual Percentage Rate (APR). The APR represents the annual cost of borrowing, expressed as a percentage, and encompasses not only the interest on the loan but also certain fees and charges associated with the borrowing. It provides a comprehensive view of the total cost of the loan, making it a valuable tool for comparing different loan offers from various financial institutions.

When evaluating loan options, it’s crucial to consider the APR, as it gives a more accurate understanding of the total cost of borrowing than the nominal interest rate alone. By including additional fees and charges, the APR provides a more holistic representation of the financial commitment associated with a loan.

It’s important to note that the APR may vary depending on the type of loan and the lender. For example, mortgages may have different APR calculations compared to credit cards or personal loans. Understanding the nuances of APR calculations for different types of loans is pivotal in making well-informed financial decisions.

Moreover, the Truth in Lending Act requires lenders to disclose the APR to borrowers, ensuring transparency and enabling individuals to compare loan offers effectively. This empowers consumers to make educated choices when selecting a loan product, ultimately leading to better financial outcomes.

By comprehending the significance of the APR, borrowers can gain insight into the true cost of borrowing and make informed decisions based on a comprehensive understanding of the financial implications of their choices. With this foundational knowledge in place, let’s proceed to unravel the intricacies of the monthly periodic rate and its relevance in the context of borrowing and lending.

Calculating the Monthly Periodic Rate

Once you have a solid understanding of the Annual Percentage Rate (APR), it’s time to explore the calculation of the monthly periodic rate. This rate is a crucial component in determining the interest accrued on a loan on a monthly basis, providing insight into the ongoing cost of borrowing.

The monthly periodic rate is derived from the APR and is used to calculate the interest that accrues each month on the outstanding balance of a loan. To calculate the monthly periodic rate, you can follow a straightforward formula:

- Determine the APR: The first step is to identify the APR, which is expressed as a percentage.

- Convert the APR to a Decimal: To convert the APR to a decimal, divide the APR by 100. This step is essential for accurate calculations.

- Calculate the Monthly Periodic Rate: Once the APR is in decimal form, divide it by 12 to obtain the monthly periodic rate. This rate represents the cost of borrowing on a monthly basis.

By following these steps, you can determine the monthly periodic rate, which serves as a fundamental tool for understanding the ongoing interest expenses associated with a loan. This rate enables borrowers to gauge the monthly financial implications of their borrowing decisions and plan their finances accordingly.

Understanding the monthly periodic rate empowers individuals to make informed choices, as it provides clarity on the recurring interest charges that will impact their financial obligations each month. With this knowledge in hand, borrowers can assess the affordability of a loan and make strategic decisions aligned with their financial goals.

Now that we’ve explored the calculation of the monthly periodic rate, let’s delve into an example to illustrate its practical application in the context of a loan.

Example Calculation

Let’s consider a hypothetical scenario to demonstrate the practical application of the monthly periodic rate. Suppose you are exploring a personal loan with an Annual Percentage Rate (APR) of 18.6%. To gain insight into the monthly cost of borrowing, we’ll calculate the monthly periodic rate using the formula discussed earlier.

First, we need to convert the APR to a decimal. By dividing the APR by 100, we obtain the decimal representation of the APR: 18.6% becomes 0.186 as a decimal.

Next, we calculate the monthly periodic rate by dividing the decimal APR by 12. Applying the formula, we arrive at the monthly periodic rate:

Monthly Periodic Rate = 0.186 / 12 = 0.0155, or 1.55%

With the monthly periodic rate determined, we now have insight into the monthly interest cost associated with the loan. This rate allows us to estimate the ongoing interest expenses that will impact the loan balance on a monthly basis.

By understanding the monthly periodic rate, borrowers can assess the affordability of the loan and make informed decisions based on a clear understanding of the ongoing financial implications. This knowledge empowers individuals to manage their finances effectively and plan for the monthly costs associated with borrowing.

Through this example, we’ve illustrated how the monthly periodic rate plays a pivotal role in understanding the recurring interest charges on a loan, providing valuable insight into the ongoing financial commitment associated with borrowing funds.

Now that we’ve explored the example calculation, let’s summarize the key takeaways and conclude our discussion on the monthly periodic rate and its significance in the realm of finance.

Conclusion

In conclusion, understanding the monthly periodic rate is essential for anyone navigating the realm of borrowing and lending. By comprehending this rate, individuals can gain valuable insight into the ongoing cost of borrowing and make informed financial decisions.

Through our exploration, we’ve highlighted the significance of the Annual Percentage Rate (APR) as a comprehensive indicator of the total cost of borrowing, encompassing interest and certain fees. The APR serves as a crucial starting point for evaluating loan offers and understanding the financial commitment associated with borrowing funds.

Furthermore, we’ve delved into the calculation of the monthly periodic rate, emphasizing its role in determining the monthly interest expenses on a loan. By following a simple formula based on the APR, borrowers can derive the monthly periodic rate and gain clarity on the ongoing financial implications of their borrowing decisions.

Our example calculation illustrated the practical application of the monthly periodic rate, showcasing how this rate enables individuals to estimate the monthly interest costs and assess the affordability of a loan. This knowledge empowers borrowers to make sound financial choices aligned with their long-term goals.

Ultimately, the understanding of the monthly periodic rate equips individuals with the tools to manage their finances effectively, plan for recurring interest expenses, and make informed decisions when considering borrowing options. By integrating this knowledge into their financial literacy, individuals can navigate the borrowing landscape with confidence and clarity.

As you embark on your financial journey, remember that the monthly periodic rate serves as a valuable compass, guiding you through the intricacies of borrowing and lending. Armed with this understanding, you can make informed decisions that align with your financial well-being and long-term aspirations.

With a firm grasp of the monthly periodic rate and its implications, you are empowered to navigate the borrowing landscape with confidence and clarity, ensuring that your financial decisions are anchored in knowledge and foresight.