Home>Finance>What Is The Average Cost Of Car Insurance For A 21-Year-Old Female?

Finance

What Is The Average Cost Of Car Insurance For A 21-Year-Old Female?

Published: November 20, 2023

Find out the average cost of car insurance for a 21-year-old female and compare quotes from top providers. Get your finances in order with the right coverage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Factors Affecting Car Insurance Rates for a 21-Year-Old Female

- Average Cost of Car Insurance for a 21-Year-Old Female

- Discounts and Ways to Lower Car Insurance Premiums

- Comparison of Car Insurance Rates from Different Providers

- Tips for Shopping for Car Insurance as a 21-Year-Old Female

- Conclusion

Introduction

Car insurance is a necessity for every driver, including 21-year-old females who are just starting to navigate the roads. As a young driver, it is important to understand the factors that influence the cost of car insurance. Insurers take various criteria into account, such as age, driving experience, location, and type of vehicle, when calculating insurance premiums.

For 21-year-old females, the average cost of car insurance can be higher compared to older drivers due to their limited driving history and higher perceived risk. However, several strategies can help young drivers find affordable coverage and save money on premiums.

In this article, we will explore the factors that affect car insurance rates for 21-year-old females, discuss the average costs they can expect, and provide tips on how to lower insurance premiums. Additionally, we will compare car insurance rates from different providers and offer advice on how to effectively shop for car insurance.

By understanding the nuances of car insurance for young female drivers, you will be equipped with the knowledge to make informed decisions and find the best coverage to protect you on the road.

Factors Affecting Car Insurance Rates for a 21-Year-Old Female

When it comes to determining car insurance rates for 21-year-old females, several factors come into play. Insurance companies consider these factors to assess the risk associated with insuring a young driver. Understanding these factors can give you insight into why your insurance premium may be higher and how you can potentially reduce it:

- Age and Driving Experience: For 21-year-olds, car insurance rates tend to be higher compared to more experienced drivers. This is because statistically, younger drivers have a higher likelihood of being involved in accidents. As you gain more driving experience and reach milestones like turning 25 or 30, your insurance rates may start to decrease.

- Driving Record: Your driving history plays a significant role in determining your car insurance rates. If you have a clean driving record with no accidents or tickets, you are considered less of a risk and may qualify for lower premiums. On the other hand, a history of accidents or traffic violations can result in higher rates.

- Location: The area where you live and park your car can impact your insurance rates. Urban areas with higher traffic congestion and crime rates tend to have higher insurance premiums compared to rural areas. If you live in a densely populated city, you may be subject to increased rates.

- Type of Vehicle: The make and model of your vehicle can also affect your insurance rates. Cars that are known for their performance, higher horsepower, or expensive repairs may have higher premiums. Additionally, vehicles with lower safety ratings may pose a higher risk and be subject to increased insurance costs.

- Insurance Coverage and Deductibles: The type and level of coverage you choose will impact your insurance rates. Opting for comprehensive coverage or a lower deductible can increase your premium, while choosing basic liability coverage or a higher deductible can help lower your costs.

It’s important to note that each insurance provider may weigh these factors differently when determining rates. As a result, it’s always beneficial to compare quotes from multiple companies to find the best coverage at the most affordable price.

Average Cost of Car Insurance for a 21-Year-Old Female

On average, car insurance for a 21-year-old female can be more expensive compared to older drivers. Insurance companies consider younger drivers to be higher-risk and may charge higher premiums to account for this perceived risk. However, the exact cost of car insurance can vary based on several factors, including the ones mentioned earlier.

According to industry estimates, the average annual cost of car insurance for a 21-year-old female driver is around $2,000 to $3,000. Keep in mind that this is just a ballpark figure and your actual rates may differ based on your specific circumstances. It’s essential to obtain personalized quotes from different insurance providers to get a more accurate estimate.

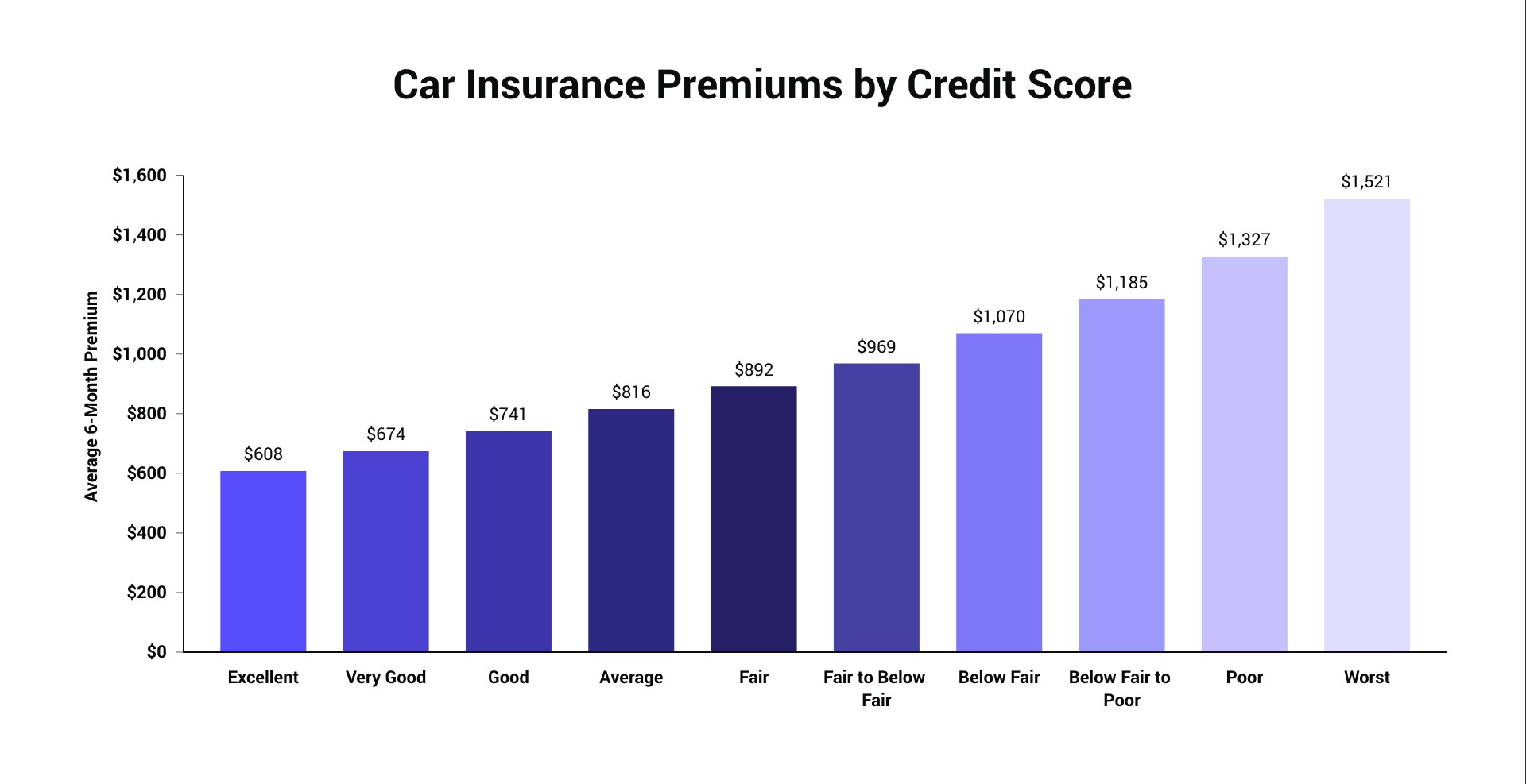

In addition to these basic factors, other considerations like credit score, marital status, and annual mileage can also influence the cost of car insurance. Young female drivers who maintain good credit scores and have low annual mileage may be eligible for discounts or lower rates.

It’s important to remember that car insurance is a premium you pay to protect yourself financially in case of an accident or damage to your vehicle. While the cost may seem high, the coverage can provide valuable peace of mind and protect you from significant financial burdens.

As a young driver, it’s also worth exploring discounts and strategies to lower your car insurance premiums, which we’ll discuss in the next section.

Discounts and Ways to Lower Car Insurance Premiums

While car insurance premiums for 21-year-old females may be higher compared to older drivers, there are various discounts and strategies that can help lower these costs. Here are some effective ways to reduce your car insurance premiums:

- Good Student Discount: Many insurance companies offer discounts to students who maintain a high GPA. If you’re a full-time student and have good grades, inquire about this discount to potentially lower your premium.

- Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving and may make you eligible for discounts. Check with your insurance provider to see if they offer this discount and which courses are accepted.

- Bundle Your Policies: If you have other insurance policies, such as renter’s or homeowner’s insurance, consider bundling them with your car insurance. Many providers offer multi-policy discounts, which can result in significant savings.

- Usage-Based Insurance: Some insurance companies offer programs that track your driving habits using telematics devices or smartphone apps. If you are a safe driver, you may be eligible for discounts based on your driving behavior and mileage.

- Choose a Higher Deductible: Opting for a higher deductible can lower your monthly premium. However, make sure you can comfortably afford the deductible amount in case of an accident or damage to your vehicle.

- Shop Around and Compare Rates: Insurance rates can vary widely between providers, so it’s crucial to get quotes from multiple companies. Take the time to compare rates and coverage options to find the best policy for your needs at the most affordable price.

By taking advantage of these discounts and implementing strategies to lower your car insurance premiums, you can potentially save a significant amount of money. It’s important to review your policy on an annual basis and reassess your insurance needs as you gain more driving experience and reach different milestones.

Comparison of Car Insurance Rates from Different Providers

When it comes to car insurance, it’s essential to shop around and compare rates from different providers. Insurance companies use various factors to determine rates, so obtaining quotes from multiple sources can help you find the most competitive pricing for your coverage.

There are several ways you can compare car insurance rates from different providers:

- Online Comparison Tools: Websites and online tools allow you to compare car insurance rates from multiple providers in one place. Simply enter your information and coverage needs, and you’ll receive quotes from various companies to compare side-by-side.

- Contact Insurance Agents: Reach out to insurance agents from different companies and provide them with your information to get personalized quotes. Agents can help you understand the coverage options and discounts available, making it easier to compare the overall value of each policy.

- Research Customer Reviews: Alongside price, it’s crucial to consider the reliability and customer service of insurance providers. Read customer reviews and ratings to gauge how satisfied policyholders are with the company. Look for companies with positive reviews, good claim handling, and a reputation for excellent customer service.

When comparing car insurance rates, make sure to consider not only the cost but also the coverage limits, deductibles, and additional benefits provided by each policy. While it’s natural to be drawn to the cheapest option, it’s essential to ensure that the policy meets your specific needs and offers the protection you require.

Remember that rates can vary based on individual factors, such as your age, driving record, location, and the type of vehicle you drive. By comparing rates from different providers, you can find the policy that offers the best combination of coverage and affordability for your situation.

Tips for Shopping for Car Insurance as a 21-Year-Old Female

As a 21-year-old female in the market for car insurance, it’s important to approach the shopping process strategically. Here are some tips to help you navigate the process and find the right coverage at an affordable price:

- Research and Compare: Take the time to research different insurance providers and compare their rates, discounts, and coverage options. This will give you a better understanding of the market and help you make an informed decision.

- Consider Your Needs: Assess your specific insurance needs. Determine the level of coverage you require based on your car’s value, your driving habits, and your finances.

- Bundle Policies: If you have other insurance policies, such as renter’s or homeowner’s insurance, consider bundling them with your car insurance. This can often lead to discounts and savings.

- Take Advantage of Discounts: Ask insurance providers about available discounts, such as good student discounts or safe driving discounts. These can significantly reduce your premiums.

- Improve Your Driving Habits: Practice safe driving habits to maintain a clean driving record. Avoid accidents and traffic violations, as they can lead to higher insurance rates.

- Consider a Higher Deductible: Increasing your deductible can lower your monthly premium. However, make sure you can comfortably afford the deductible amount in case of an accident.

- Ask for Recommendations: Seek recommendations from family and friends who have experience with car insurance providers. Their insights can help you find reliable companies with good customer service.

- Review Your Policy Regularly: Periodically review your car insurance policy to ensure it still meets your needs. As you gain more driving experience and reach different life milestones, your insurance needs may change.

Remember that finding the right car insurance policy involves more than just considering the cost. It’s crucial to strike a balance between affordability and adequate coverage. By following these tips and being diligent in your research, you can find the best car insurance policy as a 21-year-old female.

Conclusion

As a 21-year-old female driver, car insurance can be a significant expense. However, by understanding the factors that affect car insurance rates, comparing quotes from different providers, and taking advantage of discounts, you can find affordable coverage without compromising on protection.

Factors such as age, driving experience, location, and vehicle type all play roles in determining insurance premiums. It’s important to be aware of these factors and take steps to improve your driving record and mitigate risk factors whenever possible.

Shopping for car insurance requires research and comparison. Online tools, contacting insurance agents, and reviewing customer feedback are effective ways to find competitive rates and reputable providers. When comparing quotes, don’t just consider the lowest price, but also the coverage options and customer service offered by each provider.

By following tips such as bundling policies, improving driving habits, and considering higher deductibles, you can further lower your car insurance premiums. Regularly reviewing your policy and reassessing your needs will ensure that you have adequate coverage as your circumstances change over time.

Remember, car insurance is a valuable investment that protects you financially in case of accidents or damages. While the cost may be an initial concern, it provides invaluable peace of mind and safeguards your financial well-being.

As a 21-year-old female driver, you have the power to navigate the world of car insurance and find the best coverage at the most affordable price. By being proactive and informed, you can secure the protection you need on the road while saving money in the process.