Home>Finance>What Is The Difference Between The Three Wheat Futures Contracts

Finance

What Is The Difference Between The Three Wheat Futures Contracts

Published: December 23, 2023

Discover the key distinctions between the three wheat futures contracts - understand the differences in pricing, delivery, and expiration dates. Enhance your financial knowledge with this insightful guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of Wheat Futures Contracts

- Chicago Board of Trade (CBOT) Wheat Futures

- Kansas City Board of Trade (KCBT) Wheat Futures

- Minneapolis Grain Exchange (MGEX) Wheat Futures

- Differences in Contract Specifications

- Trading Volume and Liquidity

- Market Influence and Price Discovery

- Contract Settlement and Delivery

- Conclusion

Introduction

The world of finance can be complex and overwhelming, especially when it comes to trading commodities. For those interested in trading wheat, understanding the different futures contracts is essential. Futures contracts provide a way for traders to speculate on the future price of a commodity, such as wheat, and manage their risk.

In the wheat market, there are three main futures contracts that traders can choose from: Chicago Board of Trade (CBOT) Wheat Futures, Kansas City Board of Trade (KCBT) Wheat Futures, and Minneapolis Grain Exchange (MGEX) Wheat Futures. While all three contracts involve trading wheat, each has its own unique specifications and characteristics.

This article aims to provide a comprehensive overview of the three wheat futures contracts, highlighting their key differences and helping traders make informed decisions. Whether you are a seasoned trader looking to expand your portfolio or a beginner entering the world of commodity trading, understanding the nuances of these contracts is crucial.

Before diving into the specifics of each contract, it’s important to note that the primary purpose of wheat futures contracts is to provide a mechanism for hedging against price volatility. However, they can also be used for speculative purposes, allowing traders to profit from price fluctuations.

By understanding the differences between the CBOT, KCBT, and MGEX wheat futures contracts, traders can choose the one that best fits their risk tolerance, trading strategy, and market preferences. In the following sections, we will delve deeper into these contracts, exploring their contract specifications, trading volume, market influence, and settlement and delivery procedures.

Overview of Wheat Futures Contracts

Wheat futures contracts are standardized agreements to buy or sell a specific quantity of wheat at a predetermined price and delivery date in the future. They provide a platform for traders to speculate on the price of wheat and manage their risk exposure in the volatile agricultural commodities market.

The three primary wheat futures contracts are the CBOT Wheat Futures, KCBT Wheat Futures, and MGEX Wheat Futures. Each contract represents a different grade of wheat and is traded on a separate exchange.

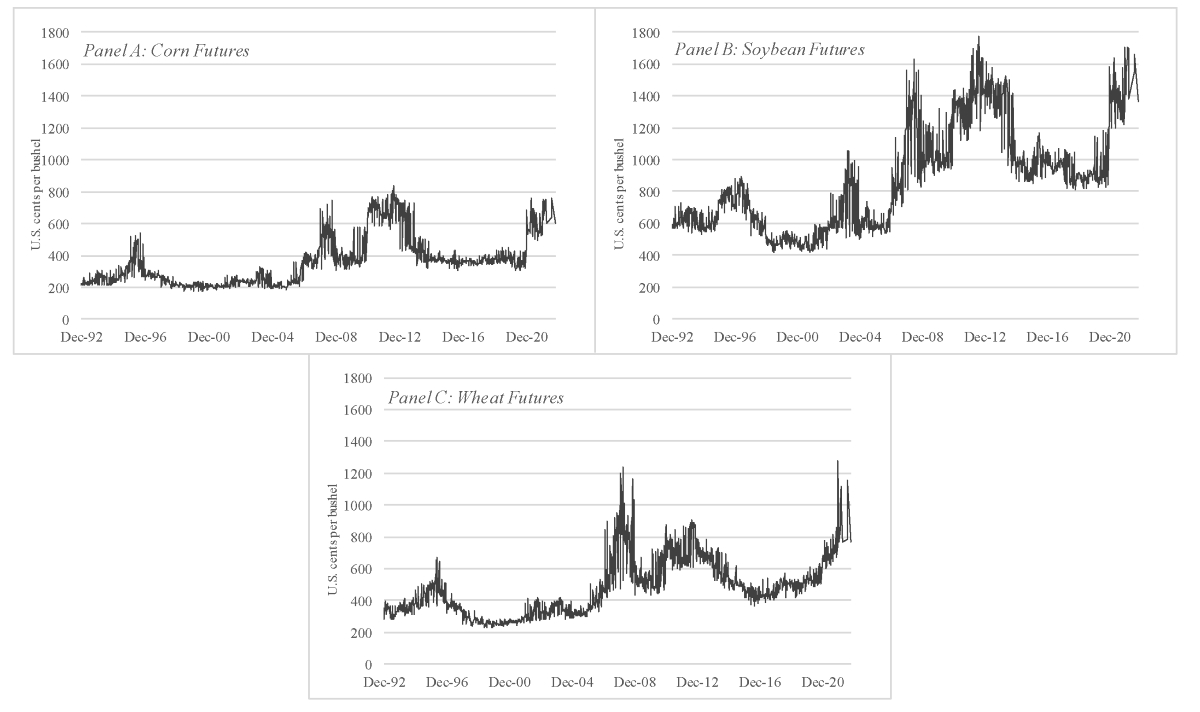

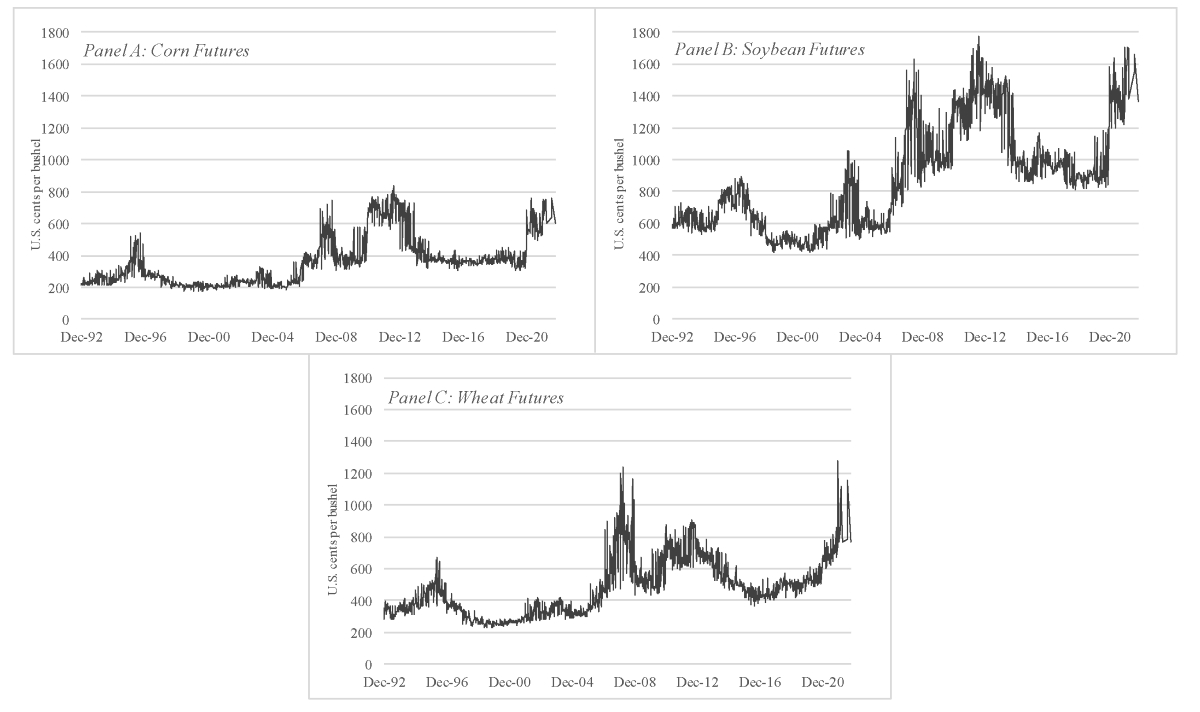

The CBOT Wheat Futures contract represents soft red winter (SRW) wheat, which is primarily used for flour milling and baking. SRW wheat is grown in the Midwest region of the United States, including states like Illinois, Indiana, and Ohio. This contract is traded on the Chicago Board of Trade.

The KCBT Wheat Futures contract, on the other hand, represents hard red winter (HRW) wheat. HRW wheat is known for its high protein content and is mainly used for bread making. It is predominantly grown in the Great Plains region, encompassing states like Kansas, Oklahoma, and Nebraska. The KCBT Wheat Futures contract is traded on the Kansas City Board of Trade.

The MGEX Wheat Futures contract represents hard red spring (HRS) wheat, which is known for its excellent milling and baking qualities. HRS wheat is primarily cultivated in the northern states of the U.S., such as Minnesota, Montana, and North Dakota. This contract is traded on the Minneapolis Grain Exchange.

All three wheat futures contracts share common characteristics, such as standardized contract sizes, minimum price fluctuations, and expiration months. However, their contract specifications, trading volumes, and market influences can vary, depending on factors such as geographical location, weather conditions, and supply and demand dynamics.

When trading wheat futures contracts, it is essential to understand the underlying fundamentals of the wheat market, including crop outlooks, global supply and demand trends, weather patterns, and government policies. These factors can significantly impact the price movements of wheat futures and should be carefully analyzed before making trading decisions.

In the following sections, we will explore the differences in contract specifications, trading volume and liquidity, market influence and price discovery, as well as contract settlement and delivery processes for the CBOT, KCBT, and MGEX wheat futures contracts.

Chicago Board of Trade (CBOT) Wheat Futures

Chicago Board of Trade (CBOT) Wheat Futures is one of the oldest and most widely traded wheat futures contracts in the world. It represents soft red winter (SRW) wheat, which is primarily used for flour milling and baking purposes.

The CBOT Wheat Futures contract has specific contract specifications that distinguish it from other wheat futures contracts. The contract size is 5,000 bushels, with a minimum price fluctuation of 0.25 cents per bushel. The contract months extend up to 18 months into the future, providing traders with ample trading opportunities.

Traders interested in CBOT Wheat Futures can access the market electronically through the CME Globex platform, which offers 24-hour trading. This allows traders from around the world to participate in the market at any time.

When it comes to trading volume and liquidity, the CBOT Wheat Futures contract consistently exhibits high levels of participation. With its long history and established position as a benchmark for wheat prices, the CBOT contract attracts a significant number of market participants, including hedgers, speculators, and institutional investors.

One of the key advantages of trading CBOT Wheat Futures is the market influence it carries. As one of the largest wheat futures contracts globally, price movements in the CBOT contract can have an impact on wheat prices worldwide, providing valuable price discovery and hedging capabilities.

CBOT Wheat Futures contract settlement occurs through a process called cash settlement. This means that instead of physical delivery of wheat, the final settlement price is based on a weighted average of daily settlement prices during a specific period. This feature allows traders to avoid the complexities and logistical challenges associated with physical delivery.

For those interested in physical delivery, the CBOT Wheat Futures contract offers delivery points situated in Illinois, Indiana, and Ohio, where the majority of soft red winter wheat is produced. Traders who choose to take delivery must meet specific requirements and procedures outlined by the exchange.

In summary, CBOT Wheat Futures is a highly liquid and influential wheat futures contract, representing soft red winter wheat. Traders can take advantage of its 24-hour trading availability, cash settlement option, and the ability to participate in price discovery for wheat in the global market. Whether hedging against price volatility or speculating on wheat price movements, CBOT Wheat Futures offers valuable opportunities for traders in the wheat market.

Kansas City Board of Trade (KCBT) Wheat Futures

Kansas City Board of Trade (KCBT) Wheat Futures is another prominent wheat futures contract, representing hard red winter (HRW) wheat. HRW wheat is known for its high protein content and is primarily used for bread making.

The KCBT Wheat Futures contract has its own unique contract specifications. The contract size is 5,000 bushels, with a minimum price fluctuation of 0.25 cents per bushel, similar to the CBOT contract. It offers trading months up to 12 months in the future, providing traders with a range of trading opportunities within a year.

Trading the KCBT Wheat Futures contract is accessible through the CME Globex platform, allowing traders to participate in the market electronically. This platform offers extended trading hours, ensuring flexibility for market participants located in different time zones.

In terms of trading volume and liquidity, KCBT Wheat Futures is a well-established and actively traded contract. While it may not have the same level of volume as the CBOT contract, it still attracts a significant number of participants, including producers, processors, and traders seeking exposure to the HRW wheat market.

Market influence and price discovery in KCBT Wheat Futures are primarily focused on the HRW wheat market, especially in the Great Plains region of the United States. The contract’s price movements and trends often reflect the underlying supply and demand dynamics specific to the HRW wheat market.

The settlement of KCBT Wheat Futures contracts can be done through cash settlement. Similar to CBOT Wheat Futures, this means that traders do not have to physically deliver or accept HRW wheat. The final settlement price is determined based on a weighted average of daily settlement prices during a specified period.

For traders interested in physical delivery, KCBT Wheat Futures allows for the delivery of HRW wheat at specific delivery points in Kansas City, Missouri. Traders who choose this option must comply with delivery requirements set by the exchange.

In summary, KCBT Wheat Futures is a robust contract representing the hard red winter wheat market. It offers traders an opportunity to participate in the price discovery of HRW wheat and manage their risk exposure. Whether looking to hedge against HRW wheat price volatility or profit from price movements, KCBT Wheat Futures provides an avenue for traders to engage in the HRW wheat market.

Minneapolis Grain Exchange (MGEX) Wheat Futures

Minneapolis Grain Exchange (MGEX) Wheat Futures is a prominent wheat futures contract that represents hard red spring (HRS) wheat. HRS wheat is known for its excellent milling and baking qualities and is primarily cultivated in the northern region of the United States, including states like Minnesota, Montana, and North Dakota.

The MGEX Wheat Futures contract has specific contract specifications that differentiate it from other wheat futures contracts. The contract size is 5,000 bushels, with a minimum price fluctuation of 0.25 cents per bushel, mirroring the CBOT and KCBT contracts. It offers trading months up to 12 months in the future, allowing traders to take advantage of various market conditions throughout the year.

Trading MGEX Wheat Futures is facilitated through the electronic trading platform, offering market access to participants around the globe. The exchange also provides market participants with real-time market data and analytics to make informed trading decisions.

Similar to the other wheat futures contracts, MGEX Wheat Futures exhibits a notable level of trading volume and liquidity. The contract attracts a diverse range of market participants, including farmers, grain elevators, flour millers, and speculators, resulting in a vibrant and active market.

Market influence and price discovery in MGEX Wheat Futures are centered around the HRS wheat market. The contract’s price movements and trends are strongly influenced by the planting, growing, and harvesting conditions in the northern wheat-growing regions of the United States.

The settlement process for MGEX Wheat Futures can be done through the physical delivery of HRS wheat. Traders who choose this option must follow the delivery requirements outlined by the exchange, including specifications for the quality and quantity of wheat to be delivered.

Alternatively, traders have the option for cash settlement, similar to CBOT and KCBT wheat futures. This allows them to avoid the complexities associated with physical delivery and settle the contracts based on the final settlement price calculated from a weighted average of daily settlement prices during a specific period.

In summary, MGEX Wheat Futures is a significant contract representing the hard red spring wheat market. With its focus on HRS wheat, the contract offers traders a unique opportunity to participate in the price discovery of this specific wheat variety. Whether hedging against HRS wheat price fluctuations or speculating on market movements, MGEX Wheat Futures provides valuable trading opportunities for those interested in the HRS wheat market.

Differences in Contract Specifications

While all three wheat futures contracts, CBOT, KCBT, and MGEX, provide a platform for trading wheat, there are key differences in their contract specifications that traders should be aware of.

Firstly, the underlying wheat varieties vary for each contract. CBOT Wheat Futures represent soft red winter (SRW) wheat, primarily used for flour milling and baking. KCBT Wheat Futures represent hard red winter (HRW) wheat, known for its high protein content and bread-making qualities. Lastly, MGEX Wheat Futures represent hard red spring (HRS) wheat, valued for its excellent milling and baking properties.

The contract sizes also differ for each exchange. CBOT and KCBT Wheat Futures have a contract size of 5,000 bushels, while MGEX Wheat Futures also have a contract size of 5,000 bushels. This standardization allows for consistent trading and enables traders to accurately calculate their positions and risk exposures.

The minimum price fluctuations, or tick size, also varies slightly. CBOT, KCBT, and MGEX Wheat Futures contracts have a minimum tick size of 0.25 cents per bushel. This price increment represents the minimum price change for each contract.

Additionally, the contract months available for trading differ across the exchanges. CBOT Wheat Futures offers trading months that extend up to 18 months into the future, providing traders with an extended trading horizon. KCBT Wheat Futures and MGEX Wheat Futures offer trading months up to 12 months into the future, offering a slightly shorter trading timeframe.

Another important consideration is the trading hours for each contract. CBOT Wheat Futures and KCBT Wheat Futures offer 24-hour electronic trading on the CME Globex platform, allowing traders to participate at any time. MGEX Wheat Futures also provides electronic trading but with specific trading hours, which are typically during the regular trading hours of the exchange.

Lastly, the contract settlement methods differ slightly between the contracts. CBOT Wheat Futures and KCBT Wheat Futures provide the option for both physical delivery and cash settlement. Traders can choose to either physically deliver or receive the specified wheat grade or settle in cash based on the final settlement price determined by the exchange. MGEX Wheat Futures also offer both settlement methods, but physical delivery is more commonly utilized.

In summary, the main differences in contract specifications among CBOT Wheat Futures, KCBT Wheat Futures, and MGEX Wheat Futures lie in the underlying wheat variety, contract size, tick size, trading months, trading hours, and settlement methods. Understanding these differences is key to selecting the most suitable contract for trading wheat based on individual trading strategies, risk tolerances, and preferences.

Trading Volume and Liquidity

Trading volume and liquidity play a crucial role in the efficiency and attractiveness of a futures contract. Let’s examine the trading volume and liquidity of the CBOT, KCBT, and MGEX wheat futures contracts.

The CBOT Wheat Futures contract has historically exhibited significant trading volume and high liquidity. As one of the most actively traded wheat futures contracts globally, it attracts a wide range of market participants, including hedgers, speculators, and institutional investors. The deep liquidity in the CBOT contract translates into tight bid-ask spreads and efficient execution of trades, allowing traders to enter and exit positions with ease.

Similarly, KCBT Wheat Futures has established itself as a liquid market for hard red winter (HRW) wheat. While it may not have the same trading volume as the CBOT contract, it still attracts a substantial number of participants, including producers, processors, and grain merchants. The liquidity in the KCBT contract ensures that there is sufficient market depth and competitiveness, enabling traders to execute their trades efficiently.

MGEX Wheat Futures, representing hard red spring (HRS) wheat, also displays a noteworthy level of trading volume and liquidity. Market participants, such as farmers, elevators, millers, and speculators, actively engage in trading the contract. The liquidity in the MGEX contract provides traders with ample opportunities to enter and exit positions, facilitating smooth trading operations.

It is worth noting that the trading volume and liquidity of each contract can vary throughout the year due to seasonal factors, market conditions, and crop cycles. The availability and quality of market data, along with the electronic trading platforms offered by the exchanges, contribute to the overall trading volume and liquidity of these contracts.

High trading volume and liquidity in wheat futures contracts are desirable as they reduce the impact of large orders on market prices and increase the likelihood of traders finding counterparties for their trades. Additionally, liquid markets offer tighter bid-ask spreads, minimizing the cost of trading and enhancing the overall trading experience for participants.

Traders seeking active and liquid markets benefit from the CBOT, KCBT, and MGEX wheat futures contracts. Whether hedging against price risk or speculating on wheat price movements, the presence of ample trading volume and liquidity enhances the efficiency and effectiveness of trading strategies.

In summary, CBOT, KCBT, and MGEX wheat futures contracts display robust trading volume and liquidity. The active participation of a diverse range of market participants ensures tight spreads and efficient execution of trades. Understanding the trading volume and liquidity dynamics of these contracts is vital for traders looking to engage in wheat futures trading.

Market Influence and Price Discovery

The market influence and price discovery process in the wheat futures market are essential factors to consider when analyzing the CBOT, KCBT, and MGEX wheat futures contracts.

The CBOT Wheat Futures contract, being one of the oldest and most actively traded wheat futures contracts, carries significant market influence. Price movements in the CBOT contract can impact global wheat prices, as it serves as a benchmark for soft red winter (SRW) wheat. The trading activity and participation in the CBOT contract contribute to efficient price discovery, allowing market participants to gauge the supply and demand dynamics of SRW wheat.

KCBT Wheat Futures, representing hard red winter (HRW) wheat, also carries market influence, particularly within the Great Plains growing region. The pricing and trading activity in the KCBT contract reflect the conditions specific to the HRW wheat market. Traders and market participants closely monitor the KCBT contract to gain insights into HRW wheat price direction and related supply and demand fundamentals.

In the case of MGEX Wheat Futures, with its focus on hard red spring (HRS) wheat grown in the northern region of the United States, the contract’s pricing behavior influences the HRS wheat market. The market activity and price discovery in the MGEX contract provide valuable information about HRS wheat supply and demand dynamics and the overall market sentiment of the HRS wheat market.

Price discovery is a crucial process in the commodity futures market, and these wheat futures contracts facilitate it by integrating and reflecting market participants’ views on wheat prices. The convergence of various market participants’ expectations and market fundamentals within each contract creates a mechanism for discovering fair and efficient wheat prices.

The price discovery process is driven by a multitude of factors such as global supply and demand dynamics, weather conditions affecting crop quality and yields, geopolitical events, and policy changes. Traders and investors analyze these factors and actively participate in trading the wheat futures contracts, contributing to the price discovery process.

It is important to recognize that while these three wheat futures contracts play a significant role in price discovery, they do not provide the sole determinants of wheat prices. Factors such as spot market prices, regional differences in supply and demand, and global market dynamics also influence overall wheat price levels.

In summary, the CBOT, KCBT, and MGEX wheat futures contracts serve as key platforms for market influence and price discovery in their respective wheat varieties. These contracts integrate market expectations and fundamentals, providing traders, hedgers, and market participants with insights into wheat price direction and associated supply and demand dynamics. Understanding the market influence and price discovery processes facilitates informed decision-making in the wheat futures market.

Contract Settlement and Delivery

The settlement and delivery procedures for wheat futures contracts are important aspects to consider when trading and understanding the CBOT, KCBT, and MGEX wheat futures contracts.

CBOT Wheat Futures offers two settlement options: cash settlement and physical delivery. Cash settlement means that the final settlement price is determined based on a weighted average of daily settlement prices during a specific period, removing the need for physical delivery. However, traders have the option to request physical delivery of soft red winter (SRW) wheat at designated delivery points in Illinois, Indiana, and Ohio. Traders who choose to take delivery must adhere to the delivery requirements outlined by the exchange.

Similarly, KCBT Wheat Futures provides traders with the choice between cash settlement and physical delivery. Cash settlement involves the final settlement price calculated from a weighted average of daily settlement prices during a specified period. Physical delivery of hard red winter (HRW) wheat is also an option at designated delivery points in Kansas City, Missouri. Traders opting for physical delivery must fulfill delivery requirements specified by the exchange.

MGEX Wheat Futures follows a similar pattern, allowing traders to settle contracts through cash settlement or physical delivery. Cash settlement involves determining the final settlement price based on a weighted average of daily settlement prices during a specific period. Physical delivery of hard red spring (HRS) wheat can be made at designated delivery points. Traders who choose physical delivery must meet the delivery requirements set by the exchange.

It’s important to note that the majority of futures contracts are settled through cash settlement rather than physical delivery. Cash settlement provides flexibility for traders, allowing them to offset their positions without the logistical complexities associated with physical delivery.

For those interested in physical delivery, it’s crucial to understand the delivery requirements, including the quality and quantity specifications for the specific variety of wheat represented by the contract. Traders must ensure that they can meet these requirements if they intend to take or make physical delivery.

It’s worth mentioning that the majority of traders close out their positions before the contract’s expiration date, either through a reverse trade or offsetting their positions with an opposing trade. This allows traders to avoid the need for physical delivery and manage their positions effectively, aligning them with their trading strategies or risk management objectives.

In summary, the CBOT, KCBT, and MGEX wheat futures contracts offer both cash settlement and physical delivery options. Cash settlement involves a weighted average of daily settlement prices, while physical delivery involves meeting specific requirements regarding quality and quantity specified by the exchange. Traders should carefully consider their preferences and trading strategies when determining their approach to contract settlement and delivery.

Conclusion

Understanding the differences between the three main wheat futures contracts, CBOT, KCBT, and MGEX, is crucial for traders looking to engage in the wheat market. Each contract represents a specific variety of wheat and offers unique contract specifications, trading volume and liquidity, market influence and price discovery, and settlement and delivery processes.

The CBOT Wheat Futures contract represents soft red winter (SRW) wheat, while the KCBT Wheat Futures contract represents hard red winter (HRW) wheat, and the MGEX Wheat Futures contract represents hard red spring (HRS) wheat. Traders must consider the specific characteristics and uses of each wheat variety to align their trading strategies and risk profiles accordingly.

When evaluating trading volume and liquidity, the CBOT contract stands out for its deep liquidity and high trading volume, followed by KCBT and MGEX contracts, which also demonstrate significant participation and liquidity in their respective wheat markets. The volume and liquidity of these contracts contribute to efficient execution and competitiveness for traders.

Market influence and price discovery are vital considerations when analyzing the wheat futures contracts. The CBOT, KCBT, and MGEX contracts have their own market influence, reflecting the dynamics of SRW, HRW, and HRS wheat markets, respectively. These contracts contribute to the price discovery process, allowing traders and market participants to assess supply and demand factors and make informed trading decisions.

Contract settlement and delivery procedures vary among the contracts. All three contracts offer the option of cash settlement, where the final settlement price is determined based on a weighted average of daily settlement prices. Moreover, physical delivery is available for those who prefer to receive or deliver the actual wheat. Traders must familiarize themselves with the specific requirements and procedures outlined by each exchange concerning physical delivery.

In conclusion, the CBOT, KCBT, and MGEX wheat futures contracts serve as essential tools for traders looking to participate in the wheat market. By understanding the differences in contract specifications, trading volume and liquidity, market influence and price discovery, and settlement and delivery processes, traders can strategically engage in these contracts while aligning their trading objectives and risk management strategies.

Whether one is looking to hedge against price volatility, manage risk exposure, or speculate on wheat price movements, the CBOT, KCBT, and MGEX wheat futures contracts provide valuable opportunities and avenues for market participation in the dynamic and ever-changing world of wheat trading.