Home>Finance>What Are The Main Differences Between Forward And Futures Contracts?

Finance

What Are The Main Differences Between Forward And Futures Contracts?

Published: December 23, 2023

Discover the key distinctions between forward and futures contracts in the finance industry. Learn how these instruments differ in terms of expiry, settlement, and pricing.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Forward Contracts

- Definition of Futures Contracts

- Key Similarities between Forward and Futures Contracts

- Main Differences between Forward and Futures Contracts

- Pricing and Settlement Differences

- Contract Execution Differences

- Contract Standardization Differences

- Counterparty Risk Differences

- Regulation Differences

- Conclusion

Introduction

When it comes to trading financial instruments, there are several ways to participate in the market. Two popular methods are through forward contracts and futures contracts. While these contracts may seem similar at first glance, they have distinct characteristics that set them apart.

In this article, we will explore the main differences between forward and futures contracts. Understanding these differences is crucial for investors and traders who want to navigate the complex world of financial markets.

A forward contract is a customizable agreement between two parties to buy or sell an asset at a predetermined price on a specific date in the future. It is a private contract and is typically executed over-the-counter (OTC) rather than on an exchange.

On the other hand, a futures contract is a standardized derivative contract that obligates both parties to buy or sell an asset at a predetermined price on a specified date in the future. Unlike forward contracts, futures contracts are traded on exchanges, and their terms and conditions are predetermined and regulated.

While both forward and futures contracts serve the purpose of managing price risk by allowing parties to lock in a future price, there are key differences between them in terms of pricing and settlement, contract execution, standardization, counterparty risk, and regulation.

By gaining a deeper understanding of the distinctions between forward and futures contracts, traders and investors can make informed decisions and effectively manage their exposure in the financial markets.

Definition of Forward Contracts

A forward contract is a private agreement between two parties to buy or sell an asset at a specific price on a predetermined future date. The asset can be just about anything, including commodities, currencies, stocks, or bonds. The terms of the contract, such as the price, quantity, and delivery date, are negotiated by the parties involved.

Unlike futures contracts, which are standardized, forward contracts offer flexibility in terms of their terms and conditions. This means that the parties have the freedom to tailor the contract to their specific needs and requirements.

One of the defining features of forward contracts is that they are typically traded over-the-counter (OTC). This means that they are privately negotiated between the buyer and the seller, without the involvement of an exchange. As a result, forward contracts can be customized to suit the preferences of the parties involved.

Another important aspect of forward contracts is that they are settled at the expiration of the contract. This means that the buyer and the seller are obligated to fulfill their end of the agreement by delivering the asset and making the payment according to the terms specified in the contract.

Due to their customizable nature, forward contracts are commonly used by individuals and businesses to hedge against price fluctuations, lock in future prices, and manage risks associated with their assets. For example, a company that relies on importing raw materials may enter into a forward contract to secure a future price for the materials, protecting themselves from potential price increases.

It is worth noting that forward contracts are not standardized and are not regulated by a central authority. As a result, the terms and conditions of the contract are subject to negotiation and agreement between the parties.

Definition of Futures Contracts

A futures contract is a standardized agreement to buy or sell a specified asset at a predetermined price on a specific date in the future. Unlike forward contracts, futures contracts are traded on regulated exchanges, such as the Chicago Mercantile Exchange (CME) or the Intercontinental Exchange (ICE).

One of the key characteristics of futures contracts is their standardization. This means that the terms and conditions of the contract, including the quantity, quality, and delivery date, are predetermined and uniform for all contracts traded on the exchange. Standardization ensures transparency and ease of trading as all parties know precisely what they are agreeing to.

The standardized nature of futures contracts allows for a high level of liquidity. Traders can easily enter and exit positions by buying or selling contracts on the exchange. This liquidity is a result of the active participation of market participants, including institutional investors, speculators, and hedgers.

Another distinctive feature of futures contracts is the concept of daily mark-to-market. This means that the value of the contract is adjusted daily based on the market price movements. As a result, gains or losses are settled on a daily basis, and the margin account of each party is adjusted accordingly.

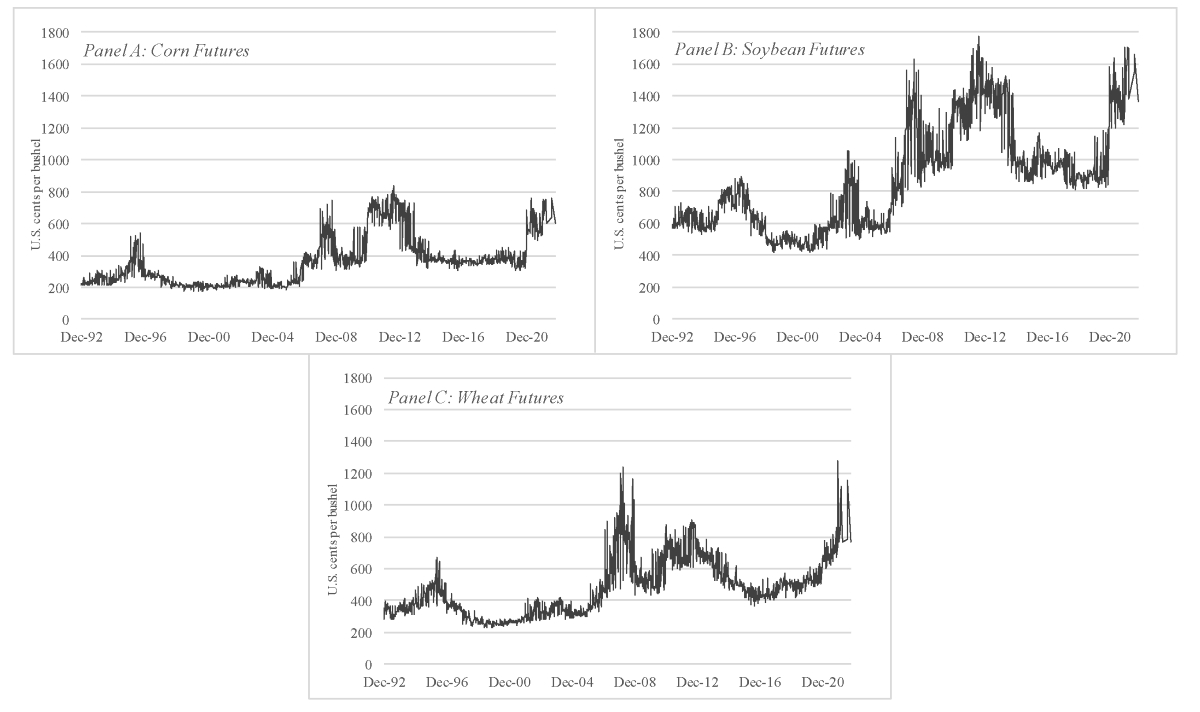

Futures contracts are typically used by market participants to speculate on price movements, hedge against price risk, or gain exposure to a particular asset class. For example, a farmer may sell futures contracts to hedge against a potential decrease in the price of their crops, ensuring a certain level of revenue regardless of market conditions.

Due to their standardized and regulated nature, futures contracts offer transparency and reduced counterparty risk. The exchange acts as the counterparty to all trades, guaranteeing the performance of the contracts. This eliminates the need to worry about the creditworthiness or financial stability of the other party involved in the trade.

It is important to note that futures contracts are subject to strict rules and regulations set by the exchange and regulatory bodies. These regulations ensure fair trading practices, market integrity, and investor protection.

Key Similarities between Forward and Futures Contracts

Although forward and futures contracts have distinct characteristics, there are some key similarities between the two types of contracts. Understanding these similarities can help investors and traders grasp the fundamental concepts of both instruments. Here are the main similarities:

- Price Risk Management: Both forward and futures contracts serve the purpose of managing price risk. They allow parties to lock in a future price for an asset, protecting them from potential price fluctuations.

- Exchange of Assets: Both contracts involve an agreed-upon exchange of assets in the future. The underlying asset can be commodities, currencies, stocks, or bonds.

- Contractual Obligations: In both forward and futures contracts, there is a mutual obligation for the parties to fulfill the terms of the contract at its expiration. This includes delivering the asset and making the payment as specified in the contract.

- Profit Opportunities: Both types of contracts offer the potential for profit. Traders can take positions in the market based on their expectations of future price movements. They can profit from correctly predicting price direction and timing their entry and exit points.

- Margin Requirements: Both forward and futures contracts often require an initial margin deposit as collateral. This ensures the financial commitment of the parties involved and covers potential losses.

These similarities highlight the core purposes and functions of both forward and futures contracts. They provide a framework for managing price risk and participating in the market based on future price expectations.

Main Differences between Forward and Futures Contracts

While forward and futures contracts share some similarities, there are several key differences that set them apart. These differences affect various aspects of the contracts, including pricing and settlement, contract execution, standardization, counterparty risk, and regulation. Here are the main differences:

- Pricing and Settlement Differences: Forward contracts are settled at the expiration of the contract. The buyer and seller are obligated to fulfill their end of the agreement by delivering the asset and making the payment according to the terms specified in the contract. In contrast, futures contracts have daily mark-to-market settlement. This means that gains or losses are settled on a daily basis, and margin accounts are adjusted accordingly.

- Contract Execution Differences: Forward contracts are privately negotiated between the buyer and seller, typically over-the-counter (OTC). The terms and conditions of the contract are customized to the parties’ specific needs. On the other hand, futures contracts are traded on regulated exchanges. The terms and conditions of futures contracts are standardized and predetermined.

- Contract Standardization Differences: Forward contracts offer flexibility in terms of their terms and conditions. This means that the parties have the freedom to tailor the contract to their specific needs. In contrast, futures contracts are standardized, with predetermined terms and conditions. All contracts traded on the exchange have the same specifications.

- Counterparty Risk Differences: Forward contracts carry higher counterparty risk compared to futures contracts. As forward contracts are privately negotiated, the risk lies with the financial stability and creditworthiness of the counterparty. Futures contracts, on the other hand, have reduced counterparty risk as the exchange acts as the counterparty to all trades, guaranteeing the performance of the contracts.

- Regulation Differences: Forward contracts are not standardized and are not subject to regulation by a central authority. The terms and conditions of forward contracts are negotiated and agreed upon by the parties involved. In contrast, futures contracts are regulated by exchanges and regulatory bodies. These regulations ensure fair trading practices, market integrity, and investor protection.

These differences contribute to the unique characteristics and advantages of both forward and futures contracts. Understanding these distinctions is crucial for market participants, as it influences the choice of contract based on their specific needs, risk tolerance, and trading objectives.

Pricing and Settlement Differences

One of the key differences between forward and futures contracts lies in their pricing and settlement mechanisms. Understanding these differences is crucial for investors and traders who want to effectively manage their exposure in the financial markets. Here are the pricing and settlement differences between forward and futures contracts:

Forward contracts are settled at the expiration of the contract. The buyer and the seller are obligated to fulfill their end of the agreement by delivering the underlying asset and making the payment according to the terms specified in the contract. The price agreed upon at the initiation of the contract is typically referred to as the forward price. The difference between the forward price and the spot price at the time of settlement determines the profit or loss of each party.

In contrast, futures contracts have daily mark-to-market settlement. This means that the value of the contract is adjusted daily based on the prevailing market price. At the end of each trading day, the gains or losses are calculated and settled. If a trader incurs a loss, it is deducted from their margin account, and if they make a profit, it is added to their margin account. This process ensures that both parties remain financially secure throughout the duration of the contract.

The daily mark-to-market settlement in futures contracts offers an important advantage in terms of liquidity. As gains and losses are settled daily, traders have the opportunity to exit or enter positions without having to wait until the contract expires. This flexibility allows for the efficient management of risk and capital, and it provides increased liquidity in the market.

Another factor to consider is the variation margin, which is the amount of money that traders must deposit or maintain in their margin account to cover potential losses. In the case of forward contracts, no variation margin is exchanged, and the initial margin is the only requirement. However, for futures contracts, the variation margin must be regularly adjusted based on the daily mark-to-market settlement. This ensures that traders maintain sufficient funds to cover any losses incurred.

Overall, the pricing and settlement differences between forward and futures contracts impact the trading experience and risk management strategies of market participants. Understanding these differences allows traders and investors to select the most suitable contract type based on their specific needs and preferences.

Contract Execution Differences

Contract execution is an important aspect of both forward and futures contracts. How these contracts are executed and traded differs significantly, impacting the market dynamics and accessibility for investors and traders. Here are the contract execution differences between forward and futures contracts:

Forward contracts are privately negotiated between two parties, usually over-the-counter (OTC). The terms of the contract, including the price, quantity, and delivery date, are customized and agreed upon by the buyer and the seller. As a result, forward contracts provide a high degree of flexibility, allowing the parties to tailor the terms to their specific needs.

Since forward contracts are OTC products, they are not traded on exchanges. This means that the buyer and the seller are exposed to counterparty risk, as the performance of the contract relies on the financial stability and creditworthiness of the counterparty. This makes forward contracts more suitable for institutional investors or sophisticated market participants who are willing to assume this risk and have the resources to evaluate the creditworthiness of their counterparties.

In contrast, futures contracts are traded on regulated exchanges, such as the Chicago Mercantile Exchange (CME) or the Intercontinental Exchange (ICE). The terms and conditions of futures contracts are standardized, meaning that all contracts of a particular underlying asset are identical in terms of quantity, quality, and delivery date.

The exchange acts as an intermediary and guarantees the performance of the contracts, reducing counterparty risk. The presence of a central clearinghouse ensures that the buyer and the seller do not have direct exposure to each other, as the exchange becomes the counterparty to all trades. This provides market participants with increased confidence and peace of mind.

Futures contracts are highly liquid due to their standardized nature and exchange listing. Traders can easily enter and exit positions by placing orders through their brokerage accounts. The standardized structure also facilitates price discovery and transparency, as the continuous trading on the exchange results in publicly available market prices.

Contract execution in futures markets is done through electronic trading platforms or pit trading, depending on the exchange. Electronic trading platforms allow for efficient and rapid execution of orders, while pit trading involves face-to-face interaction between traders in a physical trading floor.

In summary, forward and futures contracts differ in terms of contract execution. Forward contracts are privately negotiated and customizable, while futures contracts are standardized and traded on regulated exchanges. These differences impact liquidity, counterparty risk, and accessibility, making it important for market participants to consider their specific trading objectives when choosing between the two.

Contract Standardization Differences

One of the key differences between forward and futures contracts lies in their level of standardization. This distinction impacts various aspects of the contracts, including trade execution, market accessibility, and transparency. Here are the contract standardization differences between forward and futures contracts:

Forward contracts offer a high degree of flexibility in terms of their terms and conditions. These contracts are privately negotiated between the buyer and the seller, allowing them to customize the terms based on their specific needs. This includes determining the price, quantity, and delivery date of the underlying asset.

Due to the customizable nature of forward contracts, each contract can differ from one to another. This lack of standardization makes forward contracts unique to the parties involved and can result in a wide range of contract specifications. While this flexibility provides the opportunity for tailored agreements, it also makes pricing, execution, and liquidity more complex.

In contrast, futures contracts are highly standardized. The terms and conditions, including the quantity, quality, and delivery date of the underlying asset, are predetermined and uniform for all contracts traded on the exchange. This standardization enables greater transparency, efficiency, and ease of trading.

Standardized futures contracts have several advantages. First, there is a centralized marketplace for trading, such as the Chicago Mercantile Exchange (CME), where buyers and sellers can easily find counterparties. The standardized structure facilitates the matching of buyer and seller orders, resulting in increased liquidity and price efficiency.

The uniformity of futures contracts also allows for price discovery. As contracts trade on the exchange, publicly available market prices are continuously updated, providing traders and investors with valuable information about the fair value of the underlying asset.

Furthermore, the standardization of futures contracts enables efficient clearing and settlement processes. Since all contracts have the same terms, the exchange acts as the counterparty, assuming the counterparty risk for all participants. This reduces the credit risk associated with forward contracts, where the creditworthiness of the counterparty must be evaluated individually.

In summary, forward and futures contracts differ in terms of their standardization. Forward contracts offer customization, allowing parties to tailor the terms to their specific requirements. Futures contracts, on the other hand, are highly standardized, promoting transparency, liquidity, and efficient trading on regulated exchanges.

Counterparty Risk Differences

Counterparty risk refers to the risk that a party involved in a contract may default on their obligations. It is an important consideration for market participants when choosing between forward and futures contracts. Here are the counterparty risk differences between the two:

Forward contracts carry higher counterparty risk compared to futures contracts. Since forward contracts are privately negotiated agreements, the creditworthiness and financial stability of the counterparty become crucial. If one party fails to fulfill their obligations upon contract settlement, the other party may suffer financial losses.

Counterparty risk in forward contracts can be mitigated through due diligence and credit assessment of the counterparty. However, these processes require resources and expertise, making it a challenging task for individual investors or smaller market participants.

On the other hand, futures contracts have reduced counterparty risk. This is because all futures contracts are traded on regulated exchanges, which act as intermediaries and guarantors of each trade. The exchange becomes the counterparty to all transactions, ensuring the performance and settlement of the contracts.

By eliminating direct counterparty exposure, futures contracts offer greater security and confidence to market participants. Regardless of the creditworthiness or financial stability of the other party involved in the trade, the exchange guarantees the fulfillment of contractual obligations.

Furthermore, futures contracts require participants to maintain margin accounts. These accounts ensure that each trader has sufficient funds to cover potential losses. If a trader incurs a loss, it is deducted from their margin account to fulfill their obligations. This system provides an additional layer of protection against counterparty risk.

The regulated nature of futures contracts, combined with the guarantee of the exchange and requirements for margin accounts, significantly mitigates counterparty risk. As a result, futures contracts are often considered more secure and reliable compared to forward contracts.

It’s important to note that while futures contracts have reduced counterparty risk, there is still a minimal risk associated with the exchange itself. However, exchanges are regulated entities that implement risk management practices to ensure their financial stability and integrity.

In summary, forward contracts involve higher counterparty risk compared to futures contracts. The regulated exchange environment and margin requirements of futures contracts significantly reduce counterparty risk, providing market participants with enhanced security and confidence.

Regulation Differences

Regulation is a critical aspect of the financial markets, ensuring fair trading practices, market integrity, and investor protection. When it comes to forward and futures contracts, there are significant differences in the level of regulation. Here are the regulation differences between the two:

Forward contracts are not standardized and are not subject to regulation by a central authority. These contracts are privately negotiated between the buyer and the seller, with the terms and conditions determined by the parties involved. The lack of regulation allows for greater flexibility but also increases counterparty risk and the need for due diligence.

Without regulatory oversight, forward contracts are not subject to standardized reporting requirements or transparency. As a result, the terms and prices of forward contracts are typically not publicly available, hindering price discovery and making it challenging for other market participants to gauge the fair value of the underlying asset.

On the other hand, futures contracts are extensively regulated. They are traded on regulated exchanges, such as the Chicago Mercantile Exchange (CME) or the Intercontinental Exchange (ICE). These exchanges are subject to strict regulatory oversight by regulatory bodies, ensuring compliance with established rules, fair trading practices, and investor protection.

The regulation of futures contracts includes the enforcement of standardized terms and conditions for all contracts of a particular underlying asset. This ensures consistency and transparency in the trading process, making it easier for market participants to understand and access the market.

In addition, regulated exchanges implement risk management practices, such as margin requirements and position limits, to safeguard the integrity of the markets and protect participants from excessive risk exposure. This further enhances market stability and reduces the potential for manipulation or unfair practices.

Regulation also benefits market participants by providing dispute resolution mechanisms and access to legal recourse in the event of conflicts or breaches of contract. Exchanges have established procedures to handle disputes and ensure that customers are protected in their trading activities.

The regulation of futures contracts contributes to overall market confidence and integrity. It helps attract a broader range of participants, including institutional investors, who may have stringent requirements for trading in regulated markets. Additionally, the standardized nature of futures contracts and the transparency provided by exchanges contribute to efficient price discovery and market liquidity.

In summary, forward contracts lack centralized regulation, while futures contracts are subject to extensive regulation by exchanges and regulatory bodies. The regulation of futures contracts ensures market integrity, transparency, and investor protection, making them a preferred choice for market participants seeking a regulated and standardized trading environment.

Conclusion

Forward and futures contracts are two popular methods for participating in the financial markets and managing price risk. While they share some similarities, including their purpose of locking in future prices and facilitating asset exchange, there are significant differences that impact their usage and suitability for different market participants.

Forward contracts offer flexibility and customization, allowing parties to negotiate terms based on their specific needs. However, they also carry higher counterparty risk and lack standardized regulation, making them more suitable for sophisticated market participants who can assess and manage such risks.

Futures contracts, on the other hand, are standardized and traded on regulated exchanges. They provide transparency, liquidity, and reduced counterparty risk, making them accessible to a broader range of market participants, including institutional investors. The daily mark-to-market settlement and strict regulations ensure market integrity and investor protection.

Understanding the differences between forward and futures contracts is crucial for investors and traders. It enables them to make informed decisions based on their risk tolerance, trading objectives, and access to resources. Market participants seeking flexibility and customized terms may opt for forward contracts, while those prioritizing liquidity, transparency, and reduced counterparty risk often turn to futures contracts.

In conclusion, the choice between forward and futures contracts depends on an individual’s risk appetite, trading preferences, and specific requirements. Both contracts have their advantages and considerations, and market participants should carefully assess their needs to determine which instrument aligns best with their objectives in the dynamic world of financial markets.