Home>Finance>What Are Futures Contracts And Forward Contracts? Describe Two Differences Between Them

Finance

What Are Futures Contracts And Forward Contracts? Describe Two Differences Between Them

Published: December 23, 2023

Learn about the key differences between futures and forward contracts in the field of finance. Explore the concepts and understand their unique characteristics.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, there are various instruments and derivatives that allow traders and investors to manage risks and speculate on future price movements of underlying assets. Two commonly used instruments are futures contracts and forward contracts. These contracts provide a way to buy or sell an asset at a predetermined price and date in the future. While both contracts serve similar purposes, there are key differences between them that are important to understand.

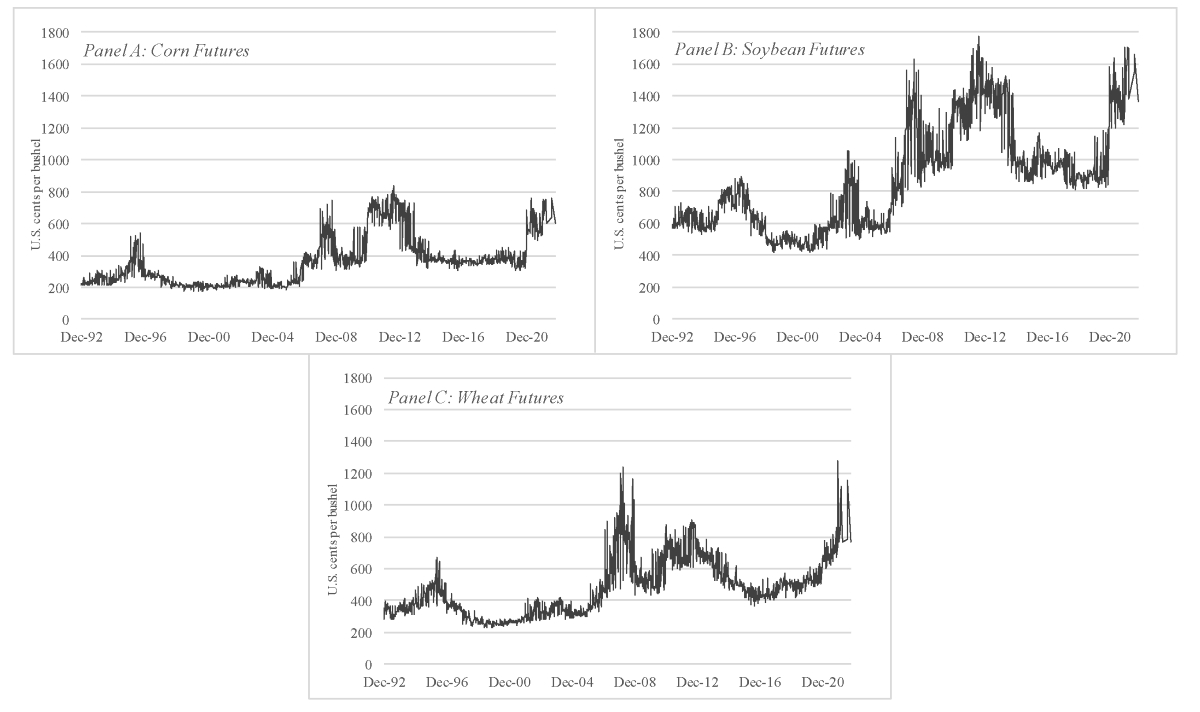

A futures contract is a standardized agreement traded on an exchange. It represents a commitment to buy or sell a specific quantity of an underlying asset at a predetermined price and date. The underlying assets can include commodities like crude oil or gold, financial instruments like stock indices or interest rates, or even cryptocurrencies like Bitcoin. Futures contracts are created and regulated by exchanges, such as the Chicago Mercantile Exchange (CME) or the New York Stock Exchange (NYSE).

In contrast, a forward contract is a customized agreement between two parties that allows them to buy or sell an asset at a predetermined price and date in the future. Unlike futures contracts, forward contracts are not traded on exchanges and do not have standardized terms. Instead, they are negotiated directly between the buyer and seller, often with the help of intermediaries like banks or brokers. Forward contracts can be tailored to specific needs and can include unique terms and conditions that are agreed upon by both parties.

Now that we have a basic understanding of futures contracts and forward contracts, let’s dive deeper into two key differences between them: standardization and trading platform.

Definition of Futures Contracts

Futures contracts are standardized agreements that specify the terms of the buying or selling of an asset at a future date. These contracts are traded on exchanges and are regulated by regulatory bodies. They are typically used by traders and investors to speculate on the future price movements of the underlying asset or to hedge against potential price fluctuations.

The key elements of a futures contract include the underlying asset, contract size, delivery date, and delivery location. The underlying asset could be commodities like crude oil, natural gas, agricultural products, or precious metals. It could also be financial instruments like stock indices, bonds, currencies, or interest rates. The contract size specifies the quantity of the underlying asset that is being traded, and it is standardized for each futures contract. The delivery date is the date on which the buyer is obligated to take delivery of the asset or settle the contract in cash. The delivery location specifies the place where physical delivery of the asset will take place if the contract is not settled in cash.

Futures contracts have standardized terms and conditions that are determined by the exchange on which they are traded. This standardization ensures ease of trading and liquidity in the market. It means that all contracts of the same type and expiry date are identical, except for price and quantity. This standardization allows for ease of comparison and transparency, making it more efficient for buyers and sellers to enter and exit positions.

When trading futures contracts, buyers and sellers can take two positions: long or short. Taking a long position means buying a futures contract with the expectation that the price of the underlying asset will rise. Taking a short position means selling a futures contract with the expectation that the price of the underlying asset will decrease. Profits and losses are realized based on the difference between the contract price and the eventual price of the asset at the time of settlement.

Overall, futures contracts provide a standardized and regulated way for traders and investors to participate in the financial markets. They offer opportunities for speculation and hedging, and they play a crucial role in price discovery and risk management.

Definition of Forward Contracts

Unlike futures contracts, forward contracts are customized agreements between two parties to buy or sell an asset at a specified price and date in the future. These contracts are privately negotiated and are not traded on exchanges, meaning they lack the standardized terms and regulatory oversight present in futures contracts.

Forward contracts are often used by businesses and individuals to manage future price risks associated with various assets. This can include commodities like oil, agricultural products, or metals, as well as currencies or interest rates. The terms of a forward contract, including the asset, quantity, price, and delivery date, are mutually agreed upon by the parties involved.

Since forward contracts do not trade on exchanges, they offer greater flexibility compared to futures contracts. The parties are free to negotiate terms that meet their specific needs, including unique delivery locations, non-standard contract sizes, and customized settlement terms. This flexibility can be particularly beneficial for businesses that require tailored agreements to address their specific risk exposures.

However, the absence of standardized terms and a centralized exchange brings certain challenges and risks. The lack of market liquidity in forward contracts means that it can be more difficult to find a counterparty willing to enter into the contract. Additionally, the absence of a clearinghouse introduces counterparty risk, as there is no guarantees or mechanisms in place to ensure contract performance. This means that both parties must carefully assess the creditworthiness and reputation of their counterparties before entering into a forward contract.

Forward contracts can be settled by physical delivery of the underlying asset or through cash settlement. Physical delivery involves the actual transfer of the asset from the seller to the buyer at the agreed-upon delivery date. Cash settlement, on the other hand, involves settling the contract’s value in cash without the need for physical transfer. The choice between physical delivery and cash settlement is typically outlined in the terms of the forward contract.

In summary, forward contracts are privately negotiated agreements that offer flexibility and customization for managing future price risks. While they lack the standardization and regulatory oversight of futures contracts, forward contracts are valuable tools for businesses and individuals looking to tailor agreements to their specific needs.

Difference in Standardization

One of the key differences between futures contracts and forward contracts lies in their level of standardization. Futures contracts are highly standardized agreements, while forward contracts are customized and tailored to the specific needs of the parties involved.

Futures contracts are traded on exchanges and are subject to strict regulatory oversight. This standardization ensures that all contracts of the same type and expiry date have identical terms and conditions, apart from price and quantity. The standardized nature of futures contracts allows for ease of trading, transparency, and liquidity in the market. Traders can easily compare different contracts and enter or exit positions efficiently. The uniformity and transparency provided by standardization also contribute to more efficient price discovery in the market.

On the other hand, forward contracts are privately negotiated agreements and do not trade on exchanges. As a result, they lack the standardized terms and conditions of futures contracts. Instead, forward contracts are tailored to the specific needs and requirements of the parties involved. The terms of a forward contract, such as the asset, quantity, price, and delivery date, are mutually agreed upon by the buyer and seller. The absence of standardization provides flexibility, allowing the parties to negotiate terms that best suit their risk exposures and objectives. However, this customization also means that each forward contract can have unique terms, making it more challenging to compare and trade them.

Standardization in futures contracts also extends to the settlement process. Futures contracts are typically settled through the exchange’s clearinghouse. The clearinghouse acts as a central counterparty, guaranteeing the performance of the contract by ensuring that the buyer receives the underlying asset and the seller receives the payment at the time of settlement. This minimizes the counterparty risk associated with default. In contrast, forward contracts do not have the benefit of a centralized clearinghouse. Instead, the settlement process relies on the buyer and seller fulfilling their obligations as agreed upon in the contract. The lack of a clearinghouse introduces counterparty risk, as there is no guarantee or mechanism to ensure contract performance. Therefore, counterparties must carefully evaluate the creditworthiness and reliability of each other before entering into a forward contract.

In summary, futures contracts are highly standardized and regulated agreements traded on exchanges, allowing for easy comparison, transparency, and liquidity. Forward contracts, however, are customized agreements tailored to the specific needs of the parties involved, offering greater flexibility but lacking standardization and a centralized clearinghouse.

Difference in Trading Platform

Another notable difference between futures contracts and forward contracts is the platform on which they are traded. Futures contracts are traded on established exchanges, while forward contracts are not traded on any centralized platform.

Futures contracts are traded on organized exchanges such as the Chicago Mercantile Exchange (CME), the New York Stock Exchange (NYSE), or the London Metal Exchange (LME). These exchanges provide a centralized marketplace where buyers and sellers can come together to trade standardized futures contracts. The use of exchanges ensures transparency, efficiency, and liquidity in the trading process. Traders can access real-time price quotes, depth of market information, and order book data, allowing for quick execution of trades. The exchange also provides rules and regulations to govern the trading activities, ensuring fair and orderly markets.

Trading futures contracts on exchanges also offers advantages such as increased market liquidity. The centralized nature of exchanges attracts a wide range of market participants, including institutional investors, speculators, and hedgers, enhancing the depth and breadth of the market. This liquidity allows for tighter bid-ask spreads, reducing transaction costs for traders. The clearinghouse, which acts as the central counterparty, also reduces counterparty risk by guaranteeing the performance of the contract.

On the other hand, forward contracts do not have a centralized trading platform. They are privately negotiated agreements between two parties, typically facilitated by intermediaries such as banks or brokers. The absence of a centralized platform means that each forward contract is unique and customized to the needs of the individuals or businesses involved. The negotiation process may involve detailed discussions on contract terms, including the underlying asset, quantity, price, and delivery date. This customization allows for flexibility but can make it more challenging to find a counterparty willing to agree to the terms.

The lack of a centralized trading platform for forward contracts also means that there is limited transparency and liquidity. Since forward contracts are not publicly traded, it can be more difficult to determine the prevailing market price and assess market conditions. Additionally, the absence of a clearinghouse means that counterparties assume the risk of default. It’s important for both parties to conduct thorough due diligence and assess the creditworthiness and reliability of each other before entering into a forward contract.

In summary, futures contracts are traded on organized exchanges, providing transparency, liquidity, and efficient execution. Forward contracts, on the other hand, do not have a centralized trading platform and are privately negotiated, offering flexibility but with limited transparency and liquidity.

Conclusion

In summary, futures contracts and forward contracts are both valuable tools in the world of finance for managing risks and speculating on future price movements. While they serve similar purposes, there are significant differences between the two.

Futures contracts are standardized agreements traded on exchanges, providing transparency, liquidity, and ease of trading. They have uniform terms and conditions, allowing for efficient comparison and execution of trades. The standardized nature of futures contracts also includes the use of centralized clearinghouses, which minimizes counterparty risk.

On the other hand, forward contracts are customized agreements between two parties and are not traded on exchanges. They offer flexibility in terms of negotiation and customization, allowing for tailoring the terms to fit specific needs. However, the lack of standardization and centralized trading platform brings challenges of decreased liquidity, transparency, and increased counterparty risk.

Both futures and forward contracts have their advantages and considerations. The choice between the two depends on the individual or business’s specific objectives, risk appetite, and preferences. Traders and investors who prioritize standardized terms, liquidity, and ease of trading may prefer futures contracts. Meanwhile, those seeking customizable agreements to address their unique risk exposures may opt for forward contracts.

Overall, understanding the differences between futures contracts and forward contracts is crucial for navigating the financial markets effectively. By grasping the distinctions in standardization and trading platforms, market participants can make informed decisions and utilize the appropriate instrument to manage risks and achieve their financial goals.