Home>Finance>What Is The Risk You Are Taking When Investing In Bonds

Finance

What Is The Risk You Are Taking When Investing In Bonds

Modified: February 21, 2024

Understand the financial risk involved in bond investments and make informed decisions. Learn how to navigate the world of finance and maximize your returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Bonds

- Types of Bonds

- How Bonds Work

- Benefits of Investing in Bonds

- Risks Associated with Bond Investments

- Credit Risk

- Interest Rate Risk

- Inflation Risk

- Liquidity Risk

- Default Risk

- Market Risk

- Considerations for Bond Investors

- Diversification

- Research and Due Diligence

- Duration and Yield

- Conclusion

Introduction

When it comes to investing, there are various asset classes to consider. One popular option is bonds, which offer a way for individuals and organizations to lend money to governments, corporations, and other entities. In return, bondholders receive regular interest payments and the repayment of the principal amount at the bond’s maturity date. While bonds can provide a stable source of income and diversification for investment portfolios, it is essential to understand the risks associated with bond investments.

In this article, we will explore the different types of bonds, how they work, and the benefits of investing in bonds. We will also highlight the various risks involved in bond investments, including credit risk, interest rate risk, inflation risk, liquidity risk, default risk, and market risk. Lastly, we will discuss some considerations for bond investors, such as diversification, research and due diligence, and understanding duration and yield.

By gaining a comprehensive understanding of the risks involved in bond investments, investors can make informed decisions and effectively manage their portfolios. It is vital to note that while bonds offer relative stability compared to other investment options, they are not without risks. Therefore, it is essential to carefully assess these risks and consider your risk tolerance and investment goals before committing to bond investments.

Understanding Bonds

Bonds are fixed-income securities that represent a loan made by an investor to a borrower. The borrower can be a government, municipality, corporation, or other entity. When you invest in bonds, you essentially become a lender, lending your money to the issuer in exchange for regular interest payments and the return of your principal investment at the bond’s maturity date.

Bonds have a predetermined maturity date, which is the date on which the issuer is obligated to repay the principal amount to the bondholder. The maturity period of bonds can range from short-term (less than one year) to long-term (up to 30 years or more). The interest payments, known as coupon payments, are typically made semi-annually or annually throughout the life of the bond.

Bonds can be classified into various types based on different factors such as the issuer, maturity, interest rate, and purpose. Some common types of bonds include government bonds, corporate bonds, municipal bonds, treasury bonds, and high-yield bonds.

Government bonds are issued by national governments and considered to be the least risky among all bonds since they are backed by the full faith and credit of the government. Corporate bonds, on the other hand, are issued by corporations to raise capital for various purposes. Municipal bonds are issued by state and local governments to fund public projects such as schools, hospitals, and infrastructure.

Treasury bonds, also known as T-bonds, are issued by the government and have longer maturity periods. These bonds are considered to be safer than other types of bonds as they are backed by the government’s ability to tax and print money. High-yield bonds, also known as junk bonds, are issued by entities with lower credit ratings and offer higher yields to compensate for the increased risk.

Understanding the different types of bonds helps investors diversify their portfolios and tailor their investments to their risk tolerance and financial goals. Bonds offer an opportunity to generate income and preserve capital, making them a valuable asset class for both individual and institutional investors.

Types of Bonds

Bonds come in various types, each with its own unique characteristics and investment considerations. Understanding the different types of bonds can help investors make informed decisions and diversify their portfolios effectively. Here are some common types of bonds:

- Government Bonds: These bonds are issued by national governments and are generally considered to be low-risk investments. Government bonds offer a fixed interest rate and are backed by the full faith and credit of the issuer, making them a popular choice among conservative investors.

- Corporate Bonds: Corporate bonds are issued by corporations to raise capital for various purposes, such as funding expansion projects or acquiring new assets. These bonds typically offer higher interest rates than government bonds to compensate for the increased risk associated with investing in individual companies.

- Municipal Bonds: Municipal bonds are issued by state and local governments to finance public projects, such as building schools, hospitals, and infrastructure. The interest earned from municipal bonds is often exempt from federal taxes, making them attractive to investors seeking tax-advantaged income.

- Treasury Bonds: Treasury bonds, also known as T-bonds, are issued by the government and are considered one of the safest investments available. These bonds have longer maturities, ranging from 10 to 30 years, and offer regular interest payments until maturity.

- Zero-Coupon Bonds: Zero-coupon bonds do not pay regular interest like traditional bonds. Instead, they are sold at a discount to their face value and provide a lump-sum payment at maturity. These bonds can be attractive to investors looking for long-term capital appreciation.

- Convertible Bonds: Convertible bonds give investors the option to convert their bonds into a specified number of common stock shares of the issuing company. This feature allows investors to participate in potential stock price appreciation while still receiving regular interest payments.

- High-Yield Bonds: High-yield bonds, also known as junk bonds, are issued by entities with lower credit ratings. These bonds offer higher yields to compensate for the increased risk of default. High-yield bonds can be appealing to investors seeking higher income potential, but they also come with higher volatility and credit risk.

Each type of bond carries its own set of risks and rewards. It is important for investors to carefully assess their risk tolerance, investment objectives, and market conditions before deciding which types of bonds to include in their portfolios. Diversification across different types of bonds can help mitigate risks and enhance overall portfolio stability.

How Bonds Work

Bonds work by establishing a contractual agreement between the issuer of the bond and the bondholder. When an investor purchases a bond, they are essentially lending money to the issuer, whether it’s a government, corporation, or municipality. In return for this loan, the issuer agrees to pay the investor periodic interest payments and repay the principal amount at the bond’s maturity date.

The key components of a bond include:

- Face Value: This is the nominal or par value of the bond, representing the amount that the issuer agrees to repay the investor at maturity.

- Coupon Rate: Also known as the interest rate, it is the fixed percentage of the bond’s face value that the issuer agrees to pay to the bondholder as periodic interest payments. For example, if a bond has a face value of $1,000 and a coupon rate of 5%, the bondholder will receive $50 in interest payments per year.

- Maturity Date: This is the date on which the bond reaches its full term, and the issuer is obligated to repay the bondholder the face value of the bond.

- Issuer: The entity, whether it’s a government or corporation, that is borrowing funds by issuing the bond.

When a bond is issued, it is typically sold through an initial offering, in which investors can purchase the bonds either directly from the issuer or through the secondary market. The secondary market allows investors to trade bonds with other investors before their maturity date.

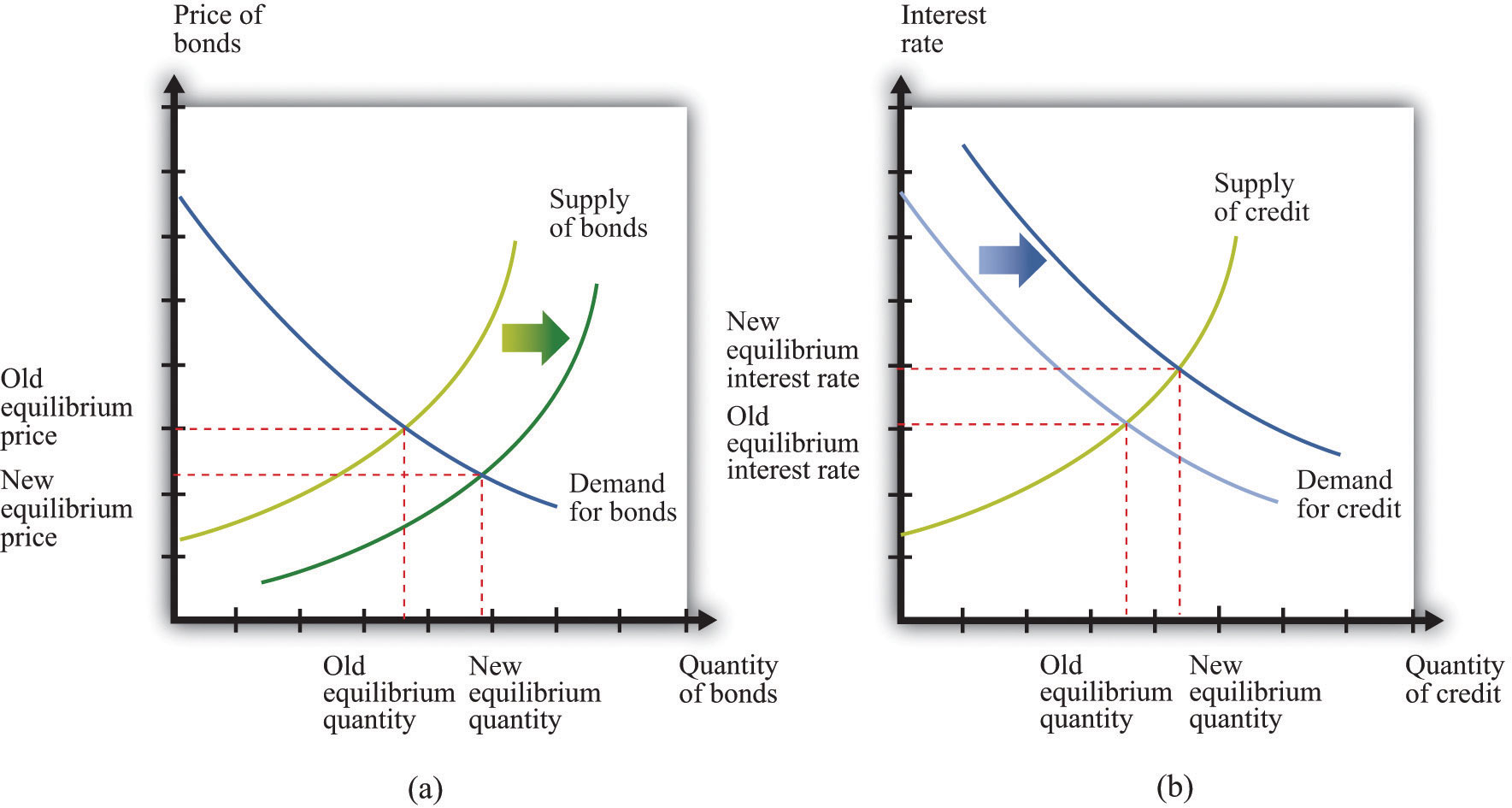

The price of a bond in the secondary market can fluctuate due to changes in interest rates, credit ratings, and market perception of the issuer’s financial health. If interest rates rise, the value of existing bonds with lower interest rates may decrease, as investors can find better returns elsewhere. Conversely, if interest rates decrease, the value of existing bonds with higher interest rates may increase, making them more attractive to investors.

When a bond reaches its maturity date, the issuer repays the bondholder the face value of the bond. At this point, the bond ceases to exist, and the investor receives their principal investment back in full. However, it is important to note that bondholders can also choose to sell their bonds before maturity in the secondary market, potentially earning a profit or loss depending on the prevailing market conditions.

In summary, bonds work by providing a mechanism for investors to lend money to issuers in exchange for periodic interest payments and the return of the principal at maturity. Understanding how bonds function can help investors make informed decisions and effectively incorporate bonds into their investment portfolios.

Benefits of Investing in Bonds

Investing in bonds can offer several benefits to individual and institutional investors. Bonds serve as a crucial asset class for diversifying portfolios and generating stable income. Here are some key advantages of investing in bonds:

- Income Generation: Bonds provide a predictable and reliable source of income through regular interest payments. The fixed coupon rate ensures that bondholders receive a consistent stream of income throughout the life of the bond. This makes bonds particularly attractive for income-focused investors, such as retirees, who rely on steady cash flow.

- Preservation of Capital: Bonds are generally considered less volatile than stocks, and they have a fixed repayment date. This makes them a valuable tool for preserving capital. The contractual obligation of the issuer to repay the bondholder the face value of the bond at maturity provides a level of security and allows investors to plan and manage their financial goals effectively.

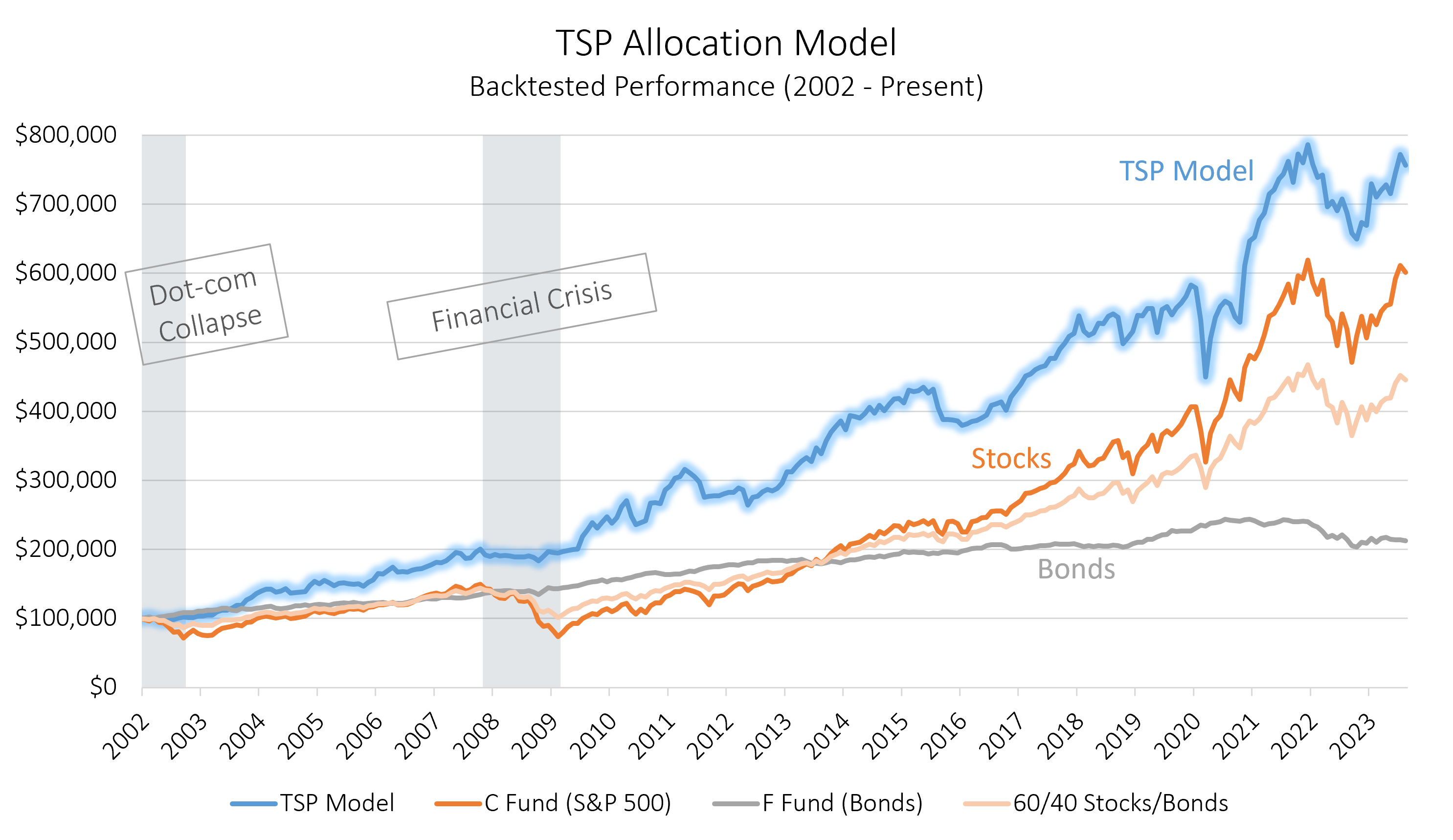

- Portfolio Diversification: Bonds offer an opportunity to diversify investment portfolios beyond stocks and other asset classes. Adding bonds to a portfolio can help reduce overall portfolio risk by offsetting potential losses during market downturns. Bonds have historically exhibited lower correlations with stocks, meaning that their performance can be independent of equity market fluctuations.

- Potential Capital Appreciation: While the primary objective of investing in bonds is income generation, there is also potential for capital appreciation. If interest rates decrease after the bond is issued, the price of the bond in the secondary market may rise, resulting in a capital gain if the bondholder decides to sell before maturity.

- Liquidity Options: Bonds can be bought and sold in the secondary market, providing investors with liquidity options. If the need arises, investors can sell their bonds to access their funds before the bond’s maturity date. However, it’s important to note that bond prices in the secondary market can fluctuate, and selling before maturity may result in gains or losses.

- Tax Advantages: Depending on the type of bond and the investor’s jurisdiction, certain bonds may offer tax advantages. For example, municipal bonds issued by local governments often provide tax-exempt interest income at the federal level. This can be particularly advantageous for investors in higher tax brackets seeking to minimize their tax liabilities.

By incorporating bonds into their investment strategies, investors can benefit from the stability, income generation, and diversification opportunities that these fixed-income securities offer. It is important to consider individual financial goals, risk tolerance, and market conditions when determining the appropriate allocation to bonds within a diversified investment portfolio.

Risks Associated with Bond Investments

While bonds offer several benefits, it is crucial for investors to understand the risks associated with bond investments. Here are some key risks to consider:

- Credit Risk: Bondholders face the risk of default, where the issuer may be unable to repay the principal and interest payments as agreed. This risk is higher for bonds issued by entities with lower credit ratings or in sectors that may face financial challenges. Conducting thorough credit analysis and diversifying across issuers and sectors can help mitigate credit risk.

- Interest Rate Risk: Interest rates and bond prices generally move in opposite directions. When interest rates rise, existing bonds with lower interest rates become less attractive to investors, causing their prices to decline. This can result in capital losses if the bondholder sells before maturity. Duration, a measure of a bond’s sensitivity to interest rate changes, can help investors assess and manage interest rate risk.

- Inflation Risk: Inflation erodes the purchasing power of future interest payments and the principal returned at bond maturity. If inflation exceeds the bond’s fixed interest rate, the bondholder may experience a decline in real returns. Investing in inflation-protected bonds or diversifying investments across different asset classes can help mitigate inflation risk.

- Liquidity Risk: Some bonds may have limited liquidity, making it challenging to buy or sell them in the secondary market. Illiquid bonds may result in delays or difficulties in executing trades, potentially affecting the investor’s ability to access funds when needed. Evaluating the liquidity of bonds and understanding the market conditions can help mitigate liquidity risk.

- Default Risk: Bondholders face the risk that the issuer may fail to make timely interest payments or repay the principal amount at maturity. This risk is particularly relevant for bonds issued by entities with weak financial stability or facing economic difficulties. Thorough credit analysis and diversification can help manage default risk.

- Market Risk: Bonds, like other financial securities, are subject to market fluctuations. Changes in economic conditions, investor sentiment, and geopolitical events can impact bond prices in the secondary market. These market movements can result in capital gains or losses for bondholders, depending on the prevailing market conditions.

It is essential for investors to assess their risk tolerance, investment objectives, and time horizon when considering bond investments. A diversified portfolio that includes different types of bonds, issuers, and maturities can help mitigate specific risks and enhance overall risk-adjusted returns. Furthermore, conducting thorough research, staying informed about market conditions, and regularly reviewing and adjusting the bond portfolio can help investors navigate the potential risks associated with bond investments.

Credit Risk

Credit risk is one of the primary risks associated with bond investments. It refers to the potential for the issuer of a bond, whether it’s a government, corporation, or municipality, to default on their obligations to make interest payments or repay the principal amount at maturity. While credit risk can be mitigated by investing in highly rated bonds, it is important for investors to understand and evaluate the creditworthiness of the issuer before investing.

Factors that contribute to credit risk include the financial stability of the issuer, the overall economic climate, and the specific industry or sector the issuer operates in. Bonds issued by entities with weaker credit ratings are typically associated with higher credit risk and, consequently, offer higher yields to compensate for the increased likelihood of default.

To assess credit risk, investors can consider credit ratings provided by rating agencies such as Standard & Poor’s, Moody’s, and Fitch. These agencies analyze the financial health, repayment capacity, and creditworthiness of bond issuers and assign ratings that serve as indicators of the issuer’s risk profile.

Bonds with higher credit ratings, such as AAA or AA, are considered more stable and less likely to default. These bonds generally offer lower yields compared to bonds with lower credit ratings. On the other hand, bonds with lower credit ratings, such as BB or below, often referred to as “junk bonds,” carry higher credit risk and, therefore, provide higher yields to compensate investors for the increased level of uncertainty.

To manage credit risk, diversification is key. By investing in bonds issued by different entities, across various industries and sectors, investors can spread their credit exposure. This diversification helps mitigate the impact of a potential default by any single issuer. Additionally, conducting thorough credit analysis, examining the issuer’s financial statements, assessing their repayment history, and staying updated on market news and industry trends can provide valuable insights into the creditworthiness of bond issuers.

While credit risk exists in bond investing, it is important to note that many bond issuers have solid financial positions and repayment capabilities. By carefully evaluating credit risk and diversifying bond holdings, investors can mitigate the impact of potential defaults and build a portfolio that aligns with their risk tolerance and investment objectives.

Interest Rate Risk

Interest rate risk is a significant factor to consider when investing in bonds. It refers to the potential impact of changes in interest rates on the value of existing bonds. Bond prices and interest rates have an inverse relationship – when interest rates rise, bond prices generally fall, and vice versa. This interrelationship creates interest rate risk for bond investors.

The reason behind this relationship is that when interest rates rise, newly issued bonds with higher yields become more attractive to investors. As a result, the market value of existing bonds with lower yields decreases since they offer less competitive returns compared to newly issued bonds. On the other hand, if interest rates were to decrease, the market value of existing bonds with higher yields would generally rise as they become more desirable to investors.

The level of interest rate risk depends on the maturity period of the bond. Generally, longer-term bonds are more susceptible to interest rate risk than shorter-term bonds. This is because the longer the bond’s duration, the greater the potential impact of interest rate fluctuations on its price. Bonds with shorter maturities, also known as short-term bonds, have less exposure to interest rate changes and are considered to have lower interest rate risk.

To manage interest rate risk, investors can consider the concept of duration. Duration measures a bond’s sensitivity to changes in interest rates. Bonds with longer durations are more sensitive to interest rate fluctuations, while bonds with shorter durations are less affected. By selecting bonds with durations that align with their investment horizons and risk tolerance, investors can better manage the impact of interest rate risk.

However, it is important to note that interest rate risk cannot be entirely eliminated. Changes in interest rates are influenced by a variety of factors, including economic conditions, inflation expectations, and monetary policy decisions. These factors are difficult to predict with certainty, which adds an element of uncertainty to bond investments.

Despite the inherent interest rate risk, bonds can still play a vital role in investment portfolios. By diversifying bond holdings across different maturities and types of bonds, investors can mitigate some of the impacts of interest rate fluctuations. Additionally, a long-term investment horizon and a focus on the income-generating aspect of bonds can help investors weather short-term interest rate volatility and benefit from the stability that bonds can provide to a well-balanced portfolio.

Inflation Risk

Inflation risk is an important consideration for bond investors. It refers to the potential loss of purchasing power of future interest payments and the principal amount due to the erosion of the value of money over time. Inflation occurs when the general level of prices in an economy rises, reducing the real value of each unit of currency.

When inflation outpaces the fixed interest rate offered by a bond, the purchasing power of the interest income generated by the bond diminishes. Additionally, the future value of the bond’s principal repayment may be eroded by inflation. This can result in a decline in the real returns earned by bondholders and reduce the overall effectiveness of the investment.

Investors can manage inflation risk by considering bonds that offer inflation protection. Treasury Inflation-Protected Securities (TIPS) issued by the U.S. government are specifically designed to offset the impacts of inflation. TIPS adjust both their principal value and interest payments based on changes in the Consumer Price Index (CPI), providing investors with a hedge against inflation. By investing in TIPS, bondholders can ensure that their returns remain linked to changes in the purchasing power of the currency.

Another way to mitigate inflation risk is through diversification. By allocating investments among different asset classes such as stocks, real estate, and commodities, investors can potentially benefit from the inflationary environment. These asset classes have historically demonstrated an ability to surpass the rate of inflation over the long term, helping to preserve and grow the real value of investments.

Furthermore, investors can actively monitor inflation trends and adjust their investment strategies accordingly. This may involve considering investments that have historically performed well during inflationary periods, such as inflation-protected bonds, stocks of companies with pricing power, and commodities like gold or real estate.

It is important to note that while inflation presents risks, some level of inflation is considered normal in a growing economy. Moderate inflation can stimulate economic activity and support rising corporate revenues and profits. Investors should also be aware that higher inflation expectations can lead to higher interest rates, which can negatively impact the prices of existing bonds in the secondary market.

By considering bonds that offer inflation protection, diversifying across asset classes, and staying informed about inflation trends and monetary policy decisions, investors can effectively manage and mitigate the impact of inflation risk on their bond investments.

Liquidity Risk

Liquidity risk is an important consideration for bond investors, referring to the potential difficulty of buying or selling a bond at a fair price due to a lack of market participants or depth. Bonds that are illiquid are typically associated with higher liquidity risk, as there may be limited buyers or sellers in the market, resulting in challenges when executing trades.

Liquidity risk can arise for various reasons. Some bonds, especially those issued by smaller companies or in less-traded markets, may have lower trading volumes and limited market activity. Additionally, bonds with longer maturities or with unique features such as restrictive covenants may be less liquid compared to more standardized bonds.

Investors facing liquidity risk may encounter difficulties in selling their bonds at desired prices or accessing their invested funds within a reasonable timeframe. During periods of market stress or economic uncertainty, liquidity risk can increase significantly as market participants become more cautious and trading activity slows down.

To manage liquidity risk, investors can consider a few strategies:

- Assessing Bond Liquidity: Before investing, it is essential to evaluate the liquidity of a bond by considering factors such as trading volume, bid-ask spreads, and the depth of the market. Bonds with higher liquidity tend to have lower spreads and a more active secondary market, offering greater ease of buying and selling.

- Diversification: By diversifying bond holdings across different issuers, sectors, and maturities, investors can spread their liquidity risk. Holding a mix of highly liquid bonds and less liquid bonds helps ensure access to funds while minimizing the impact of illiquidity in specific investments.

- Investing in Exchange-Traded Funds (ETFs) or Mutual Funds: Investing in bond ETFs or mutual funds can provide exposure to a diversified portfolio of bonds managed by professionals. These funds pool investor assets and have dedicated managers who actively manage liquidity risk by ensuring that the fund itself maintains liquid holdings.

- Monitoring Market Conditions: Keeping an eye on market conditions and staying informed about economic developments can help investors anticipate potential changes in liquidity conditions. Periods of heightened market volatility or economic uncertainty may warrant particular attention to liquidity risk.

It is important to note that while liquidity risk exists, it may not be a significant concern for all investors. Long-term investors with a buy-and-hold strategy and a focus on income generation may not be as reliant on frequent trading or immediate liquidity. However, investors who anticipate the need for more immediate access to their invested funds should carefully consider liquidity risk in their bond investment decisions.

By conducting thorough research, diversifying holdings, and remaining vigilant about market conditions, investors can effectively manage and mitigate liquidity risk associated with their bond investments.

Default Risk

Default risk, also known as credit risk, is an important factor to consider when investing in bonds. It refers to the possibility that the issuer of a bond may be unable or unwilling to meet its financial obligations, such as making interest payments or repaying the principal amount at maturity.

Default risk can vary among bond issuers based on factors such as their creditworthiness, financial stability, industry conditions, and overall economic health. Bonds issued by entities with lower credit ratings or in sectors that face financial challenges are generally associated with higher default risk.

To assess default risk, investors can utilize credit ratings provided by rating agencies such as Standard & Poor’s, Moody’s, and Fitch. These agencies evaluate the issuer’s financial health, debt repayment history, and future prospects, assigning ratings that indicate the level of default risk associated with the bond. Higher credit ratings, such as AAA or AA, imply lower default risk, while lower ratings, such as BB or below (often referred to as “junk bonds”), indicate higher default risk.

To manage default risk, investors can employ a few strategies:

- Diversification: Spreading investments across different issuers, industries, and sectors can help mitigate default risk. By diversifying bond holdings, investors reduce their exposure to any single issuer, reducing the potential impact of a default.

- Thorough Credit Analysis: Conducting thorough credit analysis before investing is important to assess the issuer’s financial strength, debt levels, cash flow, and overall creditworthiness. Examining an issuer’s financial statements and analyzing relevant factors can help investors make more informed decisions about default risk.

- Staying Informed: Monitoring news and market trends can provide valuable insights into the financial condition and potential risks faced by bond issuers. Keeping up-to-date with economic developments and industry-specific news can help investors stay vigilant about default risk.

- Considering Collateralized Bonds: Some bonds are backed by collateral, such as assets or property, which serves as an additional layer of security for bondholders. Collateralized bonds may provide greater protection against default risk compared to unsecured bonds.

- Assessing Recovery Rates: When investing in lower-rated bonds, it is essential to consider the potential recovery rates in the event of a default. Recovery rates represent the percentage of the principal that can be recovered. Understanding potential recovery rates can help investors evaluate the overall risk-reward tradeoff.

It is important to note that even with careful analysis and risk management, default risk cannot be entirely eliminated. The possibility of default exists with any bond investment. However, by diversifying holdings, conducting thorough credit analysis, and staying informed about market conditions and issuer-specific risks, investors can effectively manage and mitigate default risk associated with their bond investments.

Market Risk

Market risk is an inherent risk associated with bond investments, stemming from fluctuations in the overall market conditions. It refers to the potential for changes in investor sentiment, macroeconomic factors, and geopolitical events to impact bond prices and overall bond market performance.

Bonds, like other financial securities, are influenced by supply and demand dynamics in the market. Changes in interest rates, inflation expectations, economic indicators, and geopolitical developments can significantly impact bond prices in the secondary market. When market conditions are favorable, bond prices may rise, resulting in capital gains for bondholders. Conversely, during market downturns or periods of uncertainty, bond prices may decline, potentially leading to capital losses.

Market risk can be particularly relevant for investors who trade bonds in the secondary market or hold bond funds. Fluctuations in market sentiment, such as a change in risk appetite or economic outlook, can influence the pricing and liquidity of bonds. During periods of heightened market volatility, it may be more challenging to execute trades at desired prices, potentially affecting the investor’s ability to buy or sell bonds.

To manage market risk, investors can consider the following strategies:

- Diversification: By diversifying their bond holdings across different issuers, sectors, and regions, investors can spread their exposure to market risk. Diversification helps mitigate the impact of adverse developments in any single bond or market segment.

- Long-Term Perspective: Taking a long-term perspective can help investors ride out short-term market fluctuations. Instead of reacting to every market move, focusing on the underlying strength and income-generating potential of the bonds can help investors navigate market volatility and potentially benefit from the stability and income provided by bonds.

- Regular Portfolio Review: Regularly reviewing and rebalancing the bond portfolio can help investors maintain their desired asset allocation and risk profile. Periodic adjustments can be made to align the portfolio with changing market conditions and investment objectives.

- Staying Informed: Monitoring market trends, economic indicators, and geopolitical developments can provide valuable insights into potential risks and opportunities. Staying informed about changing market conditions can help investors make more informed decisions and manage market risk effectively.

- Utilizing Professional Management: Investors who feel less confident in managing market risk themselves can consider investing in bond funds managed by professionals. These funds typically have experienced managers who actively monitor market conditions and make investment decisions on behalf of the investors.

While market risk cannot be eliminated entirely, it can be managed and mitigated through diversification, a long-term perspective, regular portfolio review, staying informed, and potentially seeking professional management. By taking a well-informed and prudent approach, investors can effectively navigate market risk and make bond investments aligned with their risk tolerance and investment goals.

Considerations for Bond Investors

Investing in bonds requires careful consideration of various factors to ensure that the investment aligns with your financial goals and risk tolerance. Here are some key considerations for bond investors:

- Diversification: Diversifying your bond holdings across different types of bonds, issuers, sectors, and maturities can help spread risk and enhance portfolio stability. By avoiding over-concentration in a single bond or issuer, you can minimize the impact of potential defaults or adverse events.

- Research and Due Diligence: Conducting thorough research and due diligence is crucial when selecting bonds. Analyze the issuer’s financial health, creditworthiness, industry conditions, and macroeconomic factors. Review credit ratings, financial statements, and any relevant news or events that may impact the issuer’s ability to fulfill their obligations.

- Duration and Yield: Consider the duration and yield of bonds to match your investment objectives. Longer-dated bonds typically offer higher yields but are more sensitive to interest rate changes, while shorter-dated bonds may provide more stability but with lower yields. Assess your risk tolerance and income needs to determine the optimal duration and yield for your portfolio.

- Income versus Capital Appreciation: Clarify whether your primary goal is generating income or seeking capital appreciation from your bond investments. Income-focused investors may prioritize steady interest payments, while others may seek opportunities for capital gains by buying and selling bonds in response to market fluctuations.

- Tax Considerations: Understand the tax implications of your bond investments. Certain types of bonds, such as municipal bonds, offer tax advantages, such as exemption from federal income taxes. Assess your tax situation and consult with a tax professional to determine how different bonds may affect your overall tax liability.

- Costs and Fees: Be aware of the costs associated with buying and selling bonds, such as transaction fees and commissions. Consider low-cost investment options, such as bond index funds or ETFs, to minimize expenses and maximize your returns.

- Monitoring and Adjustments: Regularly review your bond portfolio and adjust your holdings as needed. Keep track of market conditions, interest rate trends, and changes in credit ratings. Rebalancing your portfolio periodically can help maintain your desired asset allocation and risk profile.

Additionally, consider seeking advice from financial professionals or consulting with a financial advisor to assist you in making informed decisions about your bond investments. They can provide guidance based on your individual circumstances, risk tolerance, and financial goals.

By carefully considering these factors and staying informed about market trends and economic conditions, bond investors can make well-informed decisions that align with their investment objectives and risk tolerance. Remember to regularly reassess your portfolio and adjust your bond holdings as necessary to ensure that they remain in line with your evolving financial circumstances.

Diversification

Diversification is a crucial consideration for bond investors, as it helps spread risk and enhance the stability of investment portfolios. It involves investing in a variety of bonds that span different types, issuers, sectors, and maturities to minimize the impact of any single bond or issuer on overall portfolio performance. Diversification allows investors to potentially earn more consistent returns and reduce the potential for significant losses.

One key advantage of diversification is mitigating credit risk. By holding bonds from various issuers, investors reduce their exposure to the default risk of any single issuer. If one issuer faces financial difficulties or defaults on its obligations, the impact on the overall portfolio is reduced because losses from one bond can be offset by gains in others.

Furthermore, diversification helps manage specific risks associated with particular sectors or industries. Different sectors can have varying sensitivities to economic conditions or market trends. By including bonds from various sectors, investors can minimize the impact of any adverse events or downturns specific to a particular industry.

Diversification also plays a role in managing interest rate risk. Bonds with different maturities have varying levels of sensitivity to changes in interest rates. By holding bonds with different maturity periods, investors can potentially balance the impact of interest rate fluctuations on their portfolio. When short-term rates rise, shorter-term bonds may be less affected, while longer-term bonds can benefit from higher coupon payments. Conversely, when rates decrease, longer-term bonds may experience price appreciation.

Additionally, diversification can help manage liquidity risk. Holding a mix of highly liquid bonds and less liquid bonds ensures that investors have access to funds when needed. While some bonds may have limited trading volumes or be subject to market illiquidity, others can be easily traded, providing greater flexibility to rebalance portfolios or take advantage of investment opportunities.

It is important to note that diversification does not guarantee profits or protect against all potential risks. While it can reduce the impact of individual bond defaults or adverse events, it cannot eliminate market-wide risks. However, through careful selection and allocation of bonds, diversification serves as a risk management tool to enhance the overall stability of investment portfolios.

Investors can achieve diversification by considering a mix of bonds, including government bonds, corporate bonds, municipal bonds, and bonds with different credit ratings and durations. Furthermore, bond index funds or exchange-traded funds (ETFs) can provide instant diversification by holding a basket of bonds, making them a convenient option for diversifying bond investments efficiently.

By adopting a well-diversified approach, investors can reduce the impact of individual bond risks and create a balanced portfolio that aligns with their risk tolerance and investment goals. Regularly reviewing and rebalancing the portfolio can help ensure that diversification remains intact and in line with evolving market conditions.

Research and Due Diligence

Research and due diligence are essential steps for bond investors to make informed decisions and effectively manage risks. Conducting thorough research helps investors evaluate the financial health, creditworthiness, and potential risks associated with potential bond investments. By dedicating time and effort to research and due diligence, investors can enhance the likelihood of making successful investment choices.

One key aspect of research is assessing the issuer’s financial stability. This involves analyzing key financial indicators, such as revenue, cash flow, debt levels, and profitability. Examining financial statements, such as balance sheets, income statements, and cash flow statements, provides valuable insights into the issuer’s ability to make regular interest payments and repay the bond’s principal amount at maturity.

Additionally, understanding the issuer’s creditworthiness is crucial. Credit ratings assigned by reputable rating agencies such as Standard & Poor’s, Moody’s, and Fitch provide a snapshot of the issuer’s credit quality and default risk. It is important to consider the credit ratings before investing, as higher-rated bonds typically exhibit lower default risk but may offer lower yields compared to lower-rated bonds.

Furthermore, industry conditions and macroeconomic factors can significantly impact the performance of bonds. Evaluating the prospects of the industry in which the issuer operates can help anticipate potential risks and opportunities. Consider factors such as regulatory changes, competition, and emerging trends that may affect the issuer’s ability to generate cash flows and honor their debt obligations.

Monitoring market trends and interest rate movements is also important for bond investors. Changes in interest rates can impact bond prices and overall bond market performance. By staying informed about economic indicators, central bank policies, and market sentiment, investors can anticipate potential changes and adjust their investment strategies accordingly.

While performing research, it is crucial to conduct due diligence on the specific bond being considered. This involves reviewing the bond’s terms and conditions, such as its coupon rate, maturity date, call provisions, and any special features. Understanding the bond’s structure and its implications on investment returns is crucial for making informed decisions.

Moreover, staying informed about news and events related to the issuer is important. News regarding management changes, legal issues, or industry-specific developments can impact the issuer’s creditworthiness and financial stability. Regularly monitoring relevant news sources and staying updated on these developments can help investors make timely and well-informed investment decisions.

Lastly, professional advice or consultation with a financial advisor can be beneficial in conducting research and due diligence. Financial professionals can provide insights, access to research reports, and guidance based on their expertise and market knowledge.

By dedicating time to research and due diligence, investors can gain a comprehensive understanding of potential bond investments, assess their risks and rewards, and make well-informed investment decisions. Thorough research and due diligence provide a strong foundation for building a successful bond investment portfolio.

Duration and Yield

Duration and yield are key considerations for bond investors as they serve as important metrics in assessing potential returns and managing interest rate risk. Understanding duration and yield can help investors make informed decisions about bond investments based on their financial goals and risk tolerance.

Duration is a measure of a bond’s sensitivity to changes in interest rates. It provides an estimate of the bond’s price volatility in response to fluctuating interest rates. Bonds with longer durations are more sensitive to interest rate changes, while bonds with shorter durations are less affected.

For example, if a bond has a duration of 5 years, a 1% increase in interest rates would theoretically result in a 5% decrease in the bond’s price. Conversely, a 1% decrease in interest rates would result in a 5% increase in the bond’s price. Duration allows investors to assess the potential impact of interest rate fluctuations on the value of their bond holdings.

Investors with a lower risk tolerance or a need for more stable income may prefer bonds with shorter durations. These bonds are less affected by interest rate changes and typically exhibit lower price volatility. On the other hand, investors seeking higher returns or willing to accept more risk may consider bonds with longer durations, as they offer the potential for higher yields but come with greater price volatility.

Yield refers to the return an investor earns from a bond relative to its price. It is usually expressed as a percentage. Yield can be classified into various categories, including coupon yield, current yield, and yield to maturity. Understanding these different yield measures helps investors gauge the income potential of bonds.

The coupon yield represents the interest payments received annually or semi-annually as a percentage of the bond’s face value. For example, if a bond with a face value of $1,000 pays $50 in interest annually, the coupon yield is 5%. The coupon yield is a key determinant of the regular income generated by a bond.

The current yield is another measure of a bond’s income potential. It is calculated by dividing the bond’s annual interest payments by its current market price. For example, if a bond with a $1,000 face value is trading at $950 and pays $50 in annual interest, the current yield would be 5.26% ($50/$950). The current yield provides a snapshot of the bond’s income relative to its current market value.

The yield to maturity (YTM) represents the total return an investor can expect if the bond is held until maturity. YTM incorporates the bond’s current market price, coupon payments, and the face value at maturity. It takes into account any capital gains or losses arising from the difference between the purchase price and maturity value. YTM is a useful measure for comparing the potential returns of different bonds.

Investors should consider their risk tolerance, income needs, and investment goals when assessing the duration and yield of bond investments. A balance between duration and yield can be achieved by diversifying bond holdings across different maturities and types of bonds, allowing investors to manage interest rate risk while meeting their income objectives.

It’s important to note that duration and yield are not the sole determinants of a bond’s attractiveness. Other factors such as credit risk, liquidity, and market conditions should also be evaluated. Consulting with a financial advisor can provide additional guidance to make informed decisions based on individual circumstances and investment objectives.

Conclusion

Investing in bonds can be a valuable addition to an investment portfolio, offering stability, income generation, and diversification benefits. However, it is important for investors to understand and manage the risks associated with bond investments.

By comprehending the different types of bonds, such as government bonds, corporate bonds, and municipal bonds, investors can tailor their bond investments to their risk tolerance and financial goals. Understanding how bonds work, including their structure, interest payments, and maturity dates, enables investors to make informed decisions regarding their investment strategy.

The benefits of investing in bonds include the potential for regular income, preservation of capital, portfolio diversification, and potential capital appreciation. Bonds can provide stability in times of market volatility and serve as a reliable source of income, particularly for income-focused investors.

On the other hand, bond investments come with inherent risks that need to be carefully managed. Credit risk, interest rate risk, inflation risk, liquidity risk, default risk, and market risk should all be considered when evaluating potential bond investments. Diversification, thorough research, and monitoring market conditions can help investors mitigate these risks and make informed investment decisions.

Key considerations for bond investors include diversifying bond holdings, conducting research and due diligence, considering duration and yield, and being mindful of tax implications and costs associated with bond investments. Regularly reviewing and adjusting bond portfolios in response to changing market conditions can help investors maintain a balanced and optimized investment strategy.

In conclusion, bonds can offer stability, income generation, and diversification for investment portfolios. Understanding the risks, benefits, and considerations associated with bond investments is essential for making informed decisions and managing risk effectively. By combining research, diversification, and a long-term perspective, investors can navigate the world of bonds and position themselves for potential success in achieving their financial objectives.