Finance

How To Manage Investment Risk

Published: October 16, 2023

Learn how to effectively manage investment risk in the finance industry and make informed decisions for your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of investing! As you embark on your journey to build wealth and secure your financial future, it’s crucial to understand the concept of investment risk and how to effectively manage it. Investing offers the potential for great rewards, but it also comes with inherent risks that can impact your returns.

Investment risk refers to the possibility of losing money or achieving a lower-than-expected return on your investment. While risk can’t be completely eliminated, it can be managed and mitigated through various strategies and considerations.

In this article, we will explore the importance of understanding your risk tolerance, setting investment goals, diversifying your portfolio, assessing and adjusting your risk, and monitoring your investments. By following these steps and incorporating them into your investment strategy, you can navigate the world of investing with more confidence and maximize your chances of long-term success.

Before we dive deeper into managing investment risk, it’s essential to acknowledge that risk tolerance varies from person to person. Some individuals may have a higher tolerance for risk, while others prefer a more conservative approach. It’s crucial to identify your risk tolerance and align your investment strategy accordingly.

Additionally, it’s important to note that investing is a long-term endeavor. While markets may experience short-term fluctuations and volatility, the key to successful investing lies in a disciplined approach that takes into consideration both short-term and long-term goals and objectives.

Now, let’s delve into the various aspects of managing investment risk to help you make informed decisions and navigate the complex world of finance.

Understanding Investment Risk

Investment risk is an integral part of the investing process. It’s the uncertainty and potential for loss that investors face when allocating their funds to various assets, such as stocks, bonds, real estate, or commodities. By understanding the different types of investment risk, you can make informed decisions and develop strategies to mitigate potential losses.

There are several types of investment risk to be aware of:

- Market Risk: This type of risk arises from the fluctuations of the overall market. Economic conditions, geopolitical events, and investor sentiment can impact the value of investments. Market risk affects all investment types and can cause the value of your portfolio to decline.

- Interest Rate Risk: Changes in interest rates can impact the value of fixed-income investments, such as bonds. When interest rates rise, the value of existing bonds decreases, leading to potential capital losses for bondholders.

- Inflation Risk: Inflation erodes the purchasing power of money over time. If the rate of return on your investments does not keep pace with inflation, your real returns may diminish.

- Liquidity Risk: Liquidity risk refers to the ease with which an investment can be bought or sold without causing a significant impact on its price. Investments with low liquidity may be harder to sell, potentially leading to delays or unfavorable pricing.

- Default Risk: Default risk is the likelihood that the issuer of a bond or other debt instrument will fail to make interest payments or repay the principal amount. Lower-rated bonds have a higher default risk, but they also offer higher yields to compensate investors.

- Political and Regulatory Risk: Political instability and regulatory changes can impact investments, especially in foreign markets. Government policies, trade disputes, and legislative actions can influence the value and performance of investments.

It’s important to note that different investments have varying levels of risk. Stocks, for example, typically carry higher market risk compared to bonds. By diversifying your portfolio across different asset classes and investment options, you can potentially reduce the overall risk and volatility of your investments.

Understanding investment risk is the first step towards effective risk management. By assessing and acknowledging the risk factors associated with your investments, you can make informed decisions and employ strategies to mitigate potential losses. Keep in mind that risk and return go hand in hand, and striking a balance that aligns with your risk tolerance and financial goals is key to successful investing.

Identifying Your Risk Tolerance

One of the most crucial elements in managing investment risk is understanding your own risk tolerance. Your risk tolerance is your ability and willingness to endure fluctuations or potential losses in your investment portfolio. It is influenced by various factors, including your financial situation, time horizon, investment goals, and personal comfort level with risk.

Identifying your risk tolerance is a critical step in aligning your investments with your individual circumstances and objectives. Here are some considerations to help you determine your risk tolerance:

- Financial Situation: Assess your current financial situation, including your income, expenses, and existing savings. Consider your overall net worth, as well as any outstanding debts or financial obligations. A stable financial position may allow for a higher risk tolerance, while a more precarious situation may warrant a more conservative approach.

- Goals and Time Horizon: Determine your investment goals and the time period over which you aim to achieve them. Short-term goals, such as saving for a down payment on a house, may call for less risk exposure. On the other hand, long-term goals, like funding your retirement, may allow for a higher risk tolerance as you have more time to ride out market fluctuations.

- Experience and Knowledge: Consider your level of experience and knowledge in investing. If you are new to investing or feel uncomfortable with the complexities of the market, you may prefer a more conservative approach. Conversely, if you have experience and a good understanding of investment principles, you may be more comfortable taking on higher levels of risk.

- Emotional Resilience: Reflect on your ability to handle market volatility and potential losses without making hasty or emotional investment decisions. Some investors are more emotionally resilient and can tolerate short-term fluctuations, while others may feel anxious or stressed during periods of market turbulence.

- Diversification and Risk Mitigation: Consider your willingness to diversify your portfolio and employ risk mitigation strategies. Diversification involves spreading your investments across different asset classes, industries, and geographies to reduce the impact of any single investment’s performance on your overall portfolio. Risk mitigation strategies, such as using stop-loss orders or investing in low-risk assets, can also influence your risk tolerance.

It’s important to note that risk tolerance is not a static trait and may change over time. Life events, changes in financial circumstances, or a shift in personal preferences can impact your risk tolerance. Regularly reassessing your risk tolerance and adjusting your investment strategy accordingly is crucial for maintaining a healthy and suitable investment approach.

By identifying your risk tolerance, you can develop an investment strategy that aligns with your comfort level, goals, and financial situation. Remember, there is no one-size-fits-all approach to risk tolerance – what works for one person may not work for another. Take the time to understand your own risk tolerance and make informed decisions that best suit your individual needs.

Setting Investment Goals

Setting clear and realistic investment goals is a crucial step in managing investment risk effectively. Your investment goals serve as the guiding force behind your investment decisions, helping you determine the appropriate level of risk and the time horizon for your investments. Here are the key factors to consider when setting your investment goals:

Financial Objectives: Determine the specific financial objectives you want to achieve through your investments. These objectives may include saving for retirement, funding your child’s education, purchasing a home, or building a substantial investment portfolio. Clearly defining your financial objectives helps you prioritize your investments and align them with your long-term financial targets.

Time Horizon: Consider the time horizon for each of your investment goals. Your time horizon refers to the length of time you have to achieve a particular objective. Short-term goals, such as buying a car or taking a vacation, typically have a time horizon of a few years. Long-term goals, such as retirement planning or building generational wealth, may span several decades. Understanding your time horizon allows you to select appropriate investment vehicles and adjust your risk tolerance accordingly.

Risk vs. Reward: Assess the trade-off between risk and reward for each investment goal. Generally, higher-risk investments offer the potential for greater returns, but they also come with increased volatility and the possibility of losses. Lower-risk investments may provide more stable returns, but their potential for substantial growth is typically limited. Balancing your risk and reward is critical to achieving your investment goals while managing the associated risks.

Investment Strategy: Your investment goals will shape your overall investment strategy. Once you have identified your objectives, you can determine the asset allocation, diversification, and investment vehicles that align with each goal. For instance, long-term goals may benefit from a higher allocation to equities, while short-term goals may require a more conservative approach with a greater emphasis on fixed-income investments.

Review and Adjustment: Regularly review and reassess your investment goals to ensure they remain relevant and achievable. Life circumstances and market conditions can change, affecting your financial goals and risk tolerance. By periodically evaluating your goals, you can make necessary adjustments to your investment strategy to stay on track.

Remember, setting investment goals is not a one-time process. It is an ongoing practice that requires continuous monitoring and adaptation. As you progress toward your goals, you may need to make adjustments to your investment portfolio and risk tolerance to align with changing circumstances and market conditions.

Setting investment goals provides a roadmap for your investment journey and helps you make informed decisions in managing your investment risk. By clearly defining your objectives, understanding your time horizon, and balancing risk and reward, you can create a sound investment plan that supports your financial aspirations and helps you navigate the ever-changing financial landscape.

Diversifying Your Portfolio

Diversification is a fundamental strategy for managing investment risk. It involves spreading your investments across different asset classes, industries, and geographic regions to reduce the impact of any single investment’s performance on your overall portfolio. Diversification aims to achieve a balance between risk and potential returns. Here’s why diversifying your portfolio is essential:

Reduces Single Asset Risk: By investing in a variety of assets, you lower the risk associated with a single investment. If one investment underperforms or faces challenges, your overall portfolio will be less affected since other investments are likely to compensate for the loss. Diversification helps protect your portfolio from significant downturns caused by the performance of any particular asset.

Spreads Market Risk: Different assets may perform differently in various market conditions. By diversifying across asset classes like stocks, bonds, real estate, and commodities, you spread the risk of market fluctuations. When the stock market experiences a downturn, for example, your portfolio may benefit from the stability of bonds or the potential growth of real estate holdings.

Capitalizes on Opportunities: Diversification allows you to tap into multiple investment opportunities. By investing in different sectors or geographic regions, you increase your chances of capturing potential growth in various markets. This strategy helps you take advantage of favorable economic conditions in one area while minimizing the impact of unfavorable conditions in another.

Controls Portfolio Volatility: Diversification helps smooth out the overall volatility of your portfolio. As different assets have varying levels of volatility, combining them together can create a more stable investment mix. This can provide a level of comfort and confidence, especially during market downturns, as the impact of any single investment’s volatility is reduced.

Rebalancing Potential: Diversification requires periodic portfolio review and rebalancing. Rebalancing ensures that your investments remain aligned with your intended asset allocation. Through this process, you buy assets that have become underrepresented in your portfolio due to market performance and sell assets that have become overrepresented. This helps maintain your desired risk and return profile.

When diversifying your portfolio, it’s important to consider different asset classes, such as stocks, bonds, cash equivalents, and alternative investments. Furthermore, diversify your investments within each asset class by selecting a mix of large-cap and small-cap stocks, government and corporate bonds, and various geographic regions.

However, diversification does not guarantee profi

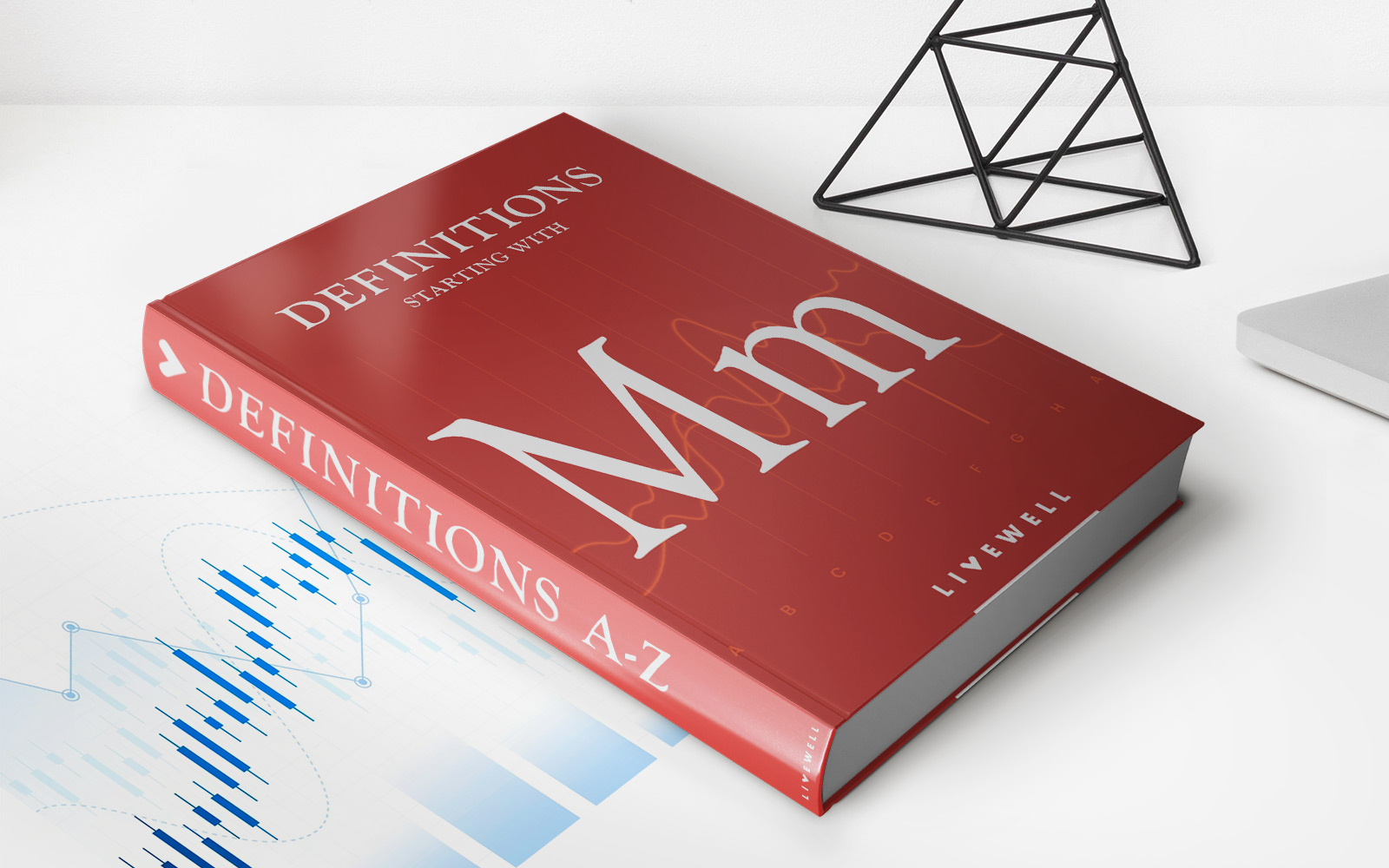

Assessing and Adjusting Your Risk

Assessing and adjusting your risk is an ongoing process that allows you to evaluate the potential risks associated with your investments and make necessary adjustments to your portfolio. It’s important to regularly review your risk exposure to ensure it aligns with your risk tolerance, investment goals, and the prevailing market conditions. Here’s how you can effectively assess and adjust your risk:

Regular Portfolio Review: Begin by conducting a comprehensive review of your investment portfolio. Evaluate the performance of each asset and their contribution to your overall risk exposure. Identify investments that may have become overly concentrated or may no longer align with your investment strategy.

Consider Market Conditions: Assess the current market environment and its potential impact on your investments. Evaluate economic indicators, geopolitical factors, and other relevant market information. Identify any risks or opportunities that may arise from these conditions and make adjustments to your portfolio accordingly.

Review Asset Allocation: Review your asset allocation and ensure it aligns with your risk tolerance and investment goals. Take into consideration the risk and return characteristics of each asset class. Adjust your portfolio by increasing or decreasing exposure to different asset classes to achieve a balance that suits your risk profile and objectives.

Rebalance Your Portfolio: Rebalancing is the process of restoring your portfolio to your desired asset allocation. Regularly review your portfolio’s performance and adjust the weights of different assets to maintain your target allocation. This involves selling overperforming assets and reinvesting in underperforming or underrepresented assets.

Consider Risk Management Tools: Utilize risk management tools to protect your portfolio against potential downside risks. For example, you can opt for stop-loss orders, which automatically sell a security if it reaches a predetermined price level. This can help limit losses in case of rapid market declines.

Seek Professional Advice: If you feel overwhelmed or uncertain about assessing and adjusting your risk, consider seeking guidance from a financial advisor or investment professional. They can provide insights, expertise, and objective analysis to help you make informed decisions and manage your risk effectively.

Remember that assessing and adjusting your risk is not a one-time process. It requires continuous monitoring and adaptation to changing market conditions, personal circumstances, and investment goals. Regularly reassess your risk appetite and portfolio to ensure they remain aligned with your long-term objectives.

In summary, assessing and adjusting your risk allows you to identify potential risks, take advantage of market opportunities, and ensure your investment portfolio remains in line with your risk tolerance and objectives. By staying proactive and vigilant, you can navigate the ever-changing investment landscape with confidence and achieve your financial goals.

Monitoring and Reviewing Your Investments

Monitoring and reviewing your investments is crucial for maintaining a healthy portfolio and managing investment risk effectively. Regularly assessing the performance and progress of your investments allows you to identify any red flags, seize opportunities, and make informed decisions. Here are key considerations for monitoring and reviewing your investments:

Performance Evaluation: Track the performance of your investments against your expectations and benchmarks. Evaluate the returns generated by each investment and assess whether they are in line with your goals. Identify underperforming investments and determine if they require adjustment or removal from your portfolio.

Financial Statements and Reports: Review the financial statements and reports provided by your investment providers. This includes brokerage statements, mutual fund reports, and annual reports from individual companies. Analyze the information presented, including key financial metrics, earnings growth, debt levels, and management commentary.

Stay Informed: Stay up-to-date with the latest news, market trends, and economic developments. Monitor financial media, industry publications, and reliable online sources. Stay informed about geopolitical events, regulatory changes, and other external factors that may impact your investments.

Rebalance Your Portfolio: Regularly rebalance your portfolio to maintain your desired asset allocation. As certain investments outperform or underperform, your original asset allocation may become skewed. Rebalancing involves selling investments that have become overweight and reinvesting in those that have become underweight, ensuring your portfolio remains in line with your risk tolerance and investment objectives.

Review Risk Factors: Assess the potential risks associated with your investments. Consider changes in market conditions, interest rates, geopolitical events, and industry-specific risks. Identify any new risks that may have emerged and determine if they require adjustments or a reallocation of your portfolio.

Seek Professional Advice: Consider consulting with a financial advisor or investment professional. They can provide valuable insights, analysis, and guidance on monitoring and reviewing your investments. An advisor can help you assess performance, evaluate investment options, and make informed decisions based on your financial goals and risk tolerance.

Document and Track: Maintain accurate records of your investments, including purchase prices, sales prices, dividends, and any other relevant details. This documentation helps you track your investments and provides a comprehensive overview of your portfolio’s performance over time.

Regularly Reassess Goals: Continuously reassess your investment goals and objectives. As your financial situation or life circumstances change, your goals may also evolve. Regularly review your goals and align your investments accordingly to ensure they remain relevant and achievable.

Remember, monitoring and reviewing your investments is an ongoing process. Stay disciplined, maintain a long-term perspective, and adapt your investment strategy as needed. By actively monitoring and reviewing your investments, you can proactively manage risk, optimize performance, and work towards achieving your financial goals.

Conclusion

Effectively managing investment risk is essential for long-term financial success and achieving your investment goals. By understanding the various types of investment risk, identifying your risk tolerance, setting clear investment goals, diversifying your portfolio, and regularly assessing and adjusting your risk, you can navigate the complex world of investing with confidence and increase your chances of achieving favorable outcomes.

Investment risk cannot be completely eliminated, but it can be managed through a balanced and disciplined approach. Diversifying your portfolio across different asset classes, industries, and geographic regions helps reduce the impact of market fluctuations on your investments. Regularly monitoring and reviewing your portfolio allows you to make informed decisions based on performance, market trends, and your changing risk tolerance.

It’s important to remember that managing investment risk is a continuous process. Risk tolerance, financial goals, and market conditions can change over time. Regularly reassessing your risk tolerance and investment objectives, and adjusting your portfolio accordingly, is crucial for maintaining an optimal investment strategy.

Seeking professional advice from a financial advisor can provide you with valuable insights and guidance tailored to your individual circumstances. They can help you navigate market complexities, evaluate investment options, and develop a robust risk management strategy.

Remember, investing is a long-term endeavor. It requires patience, discipline, and a commitment to your investment goals. By properly managing investment risk, you can be better prepared to weather market volatility, capitalize on growth opportunities, and ultimately achieve financial stability and success.

Start taking the necessary steps to manage your investment risk today and embark on your journey towards a more secure financial future.