Finance

What Is Tri Merge Credit Report

Published: October 20, 2023

Learn all about the tri merge credit report in finance and how it impacts your financial standing. Discover its importance and benefits today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Tri Merge Credit Report

- Why Tri Merge Credit Reports are Important

- How Tri Merge Credit Reports Work

- Differences between a Tri Merge Credit Report and a Single Credit Report

- Benefits of Tri Merge Credit Reports

- How to Access a Tri Merge Credit Report

- Factors Considered in a Tri Merge Credit Report

- How to Interpret a Tri Merge Credit Report

- Limitations and Drawbacks of Tri Merge Credit Reports

- Frequently Asked Questions about Tri Merge Credit Reports

- Conclusion

Introduction

Welcome to the world of credit reports! If you’re unfamiliar with the concept of a tri merge credit report, don’t worry – you’re not alone. Tri merge credit reports are an essential tool in the world of finance, providing a comprehensive view of an individual’s creditworthiness. In this article, we will dive into the details of tri merge credit reports, discussing what they are, why they are important, how they work, and much more.

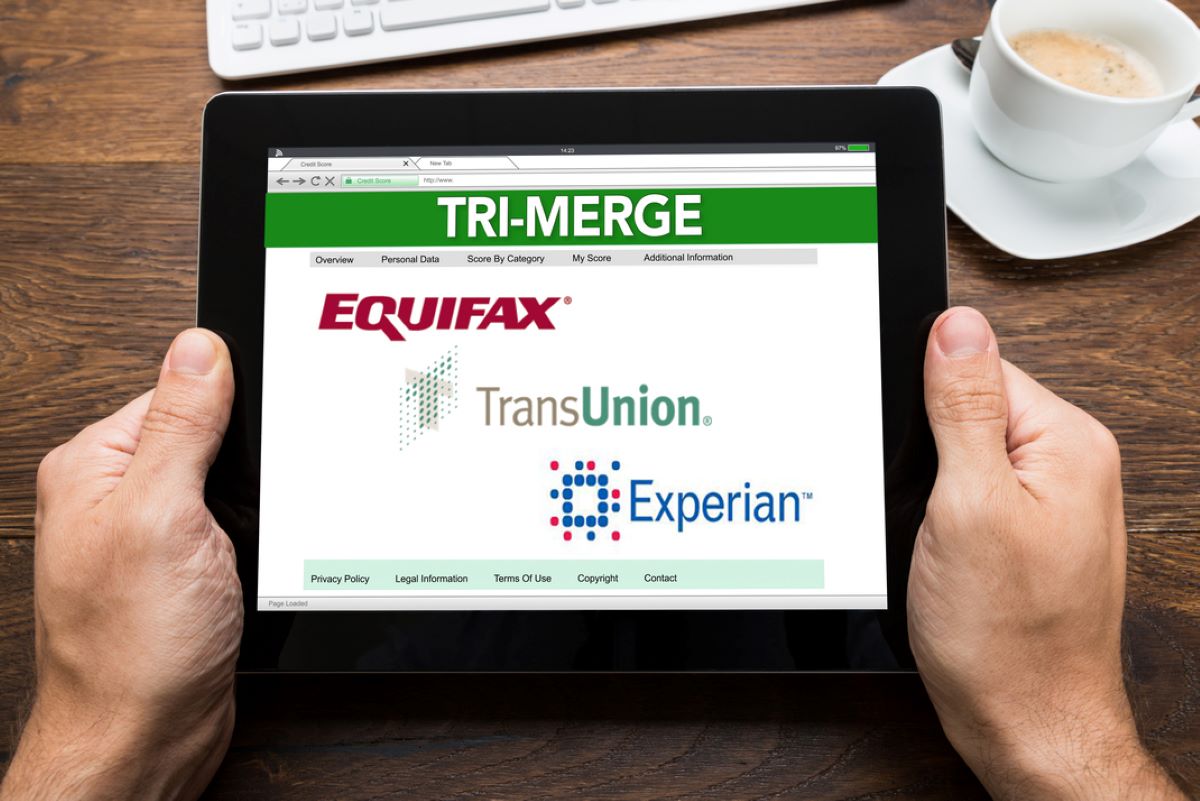

So, what exactly is a tri merge credit report? In simple terms, it is a report that combines information from the three major credit bureaus – Experian, Equifax, and TransUnion – into a single document. These bureaus collect and maintain data on individuals’ credit histories, including their payment history, current debts, and overall creditworthiness. By merging the data from these three bureaus, a tri merge credit report provides a comprehensive and accurate snapshot of an individual’s credit profile.

Tri merge credit reports have become increasingly important in the world of finance. Creditors, lenders, and financial institutions rely on these reports to make informed decisions when considering an individual for a loan, credit card, or other financial products. By reviewing a tri merge credit report, these entities can assess an individual’s creditworthiness, gauge the risk involved in lending to them, and determine suitable interest rates and credit limits.

Now that we have an understanding of the importance of tri merge credit reports, let’s explore how they work. When a request is made for a tri merge credit report, the three major credit bureaus are contacted, and they compile and consolidate their respective data into a single comprehensive report. This report presents a holistic view of an individual’s credit history, financial obligations, and payment behaviors. It is important to note that while the data from the three bureaus is combined, they do not merge or duplicate information. Instead, they present a unified report that reflects the most updated and accurate information available from each bureau.

Tri merge credit reports differ from single credit reports in that they provide a more comprehensive view of an individual’s credit profile. Single credit reports, on the other hand, only provide information from one credit bureau. Having access to a tri merge credit report allows a more thorough evaluation of an individual’s creditworthiness, as it takes into account information from multiple sources. This comprehensive view helps lenders and financial institutions make well-informed decisions when it comes to extending credit or offering financial products.

In the following sections, we will dive deeper into the benefits of tri merge credit reports, the factors considered in these reports, how to interpret them, and any limitations or drawbacks that may exist. So, let’s continue our journey into the world of tri merge credit reports!

Definition of Tri Merge Credit Report

A tri merge credit report, also known as a merged credit report or a 3-bureau credit report, is a comprehensive report that combines information from the three major credit bureaus — Experian, Equifax, and TransUnion. This report gives lenders, financial institutions, and individuals a complete view of an individual’s credit history and creditworthiness.

Each of the three major credit bureaus collects and maintains credit information on individuals. This information includes details about an individual’s credit accounts, payment history, balances, and any negative information such as late payments or defaults. However, the information held by each credit bureau may differ, as not all creditors report to all three bureaus. That’s where the tri merge credit report comes in.

When a person applies for credit or a loan, the lender will typically request a credit report to assess the individual’s creditworthiness. Instead of pulling a single credit report from one bureau, lenders often rely on a tri merge credit report to get a broader and more comprehensive picture of an individual’s credit history.

The tri merge credit report combines the credit information from all three major credit bureaus into one consolidated report. It provides an in-depth overview of an individual’s credit accounts, payment history, credit utilization, credit inquiries, public records, and other relevant financial information. By combining data from multiple sources, the tri merge credit report offers a comprehensive and accurate assessment of an individual’s creditworthiness.

Having access to a tri merge credit report can be beneficial for both lenders and individuals. Lenders can make more informed decisions about extending credit based on a thorough evaluation of an individual’s credit profile. On the other hand, individuals can review their tri merge credit report to ensure accuracy and to identify areas where they can improve their creditworthiness.

It’s important to note that although a tri merge credit report combines information from all three major credit bureaus, it doesn’t merge or duplicate the data. Instead, it presents a unified report that showcases the most up-to-date and accurate information available from each credit bureau. This ensures that lenders and individuals have the most comprehensive and accurate view of an individual’s credit history.

Now that we have a clear understanding of what a tri merge credit report is, let’s explore why these reports are essential in financial decision-making.

Why Tri Merge Credit Reports are Important

Tri merge credit reports play a vital role in financial decision-making for both lenders and individuals. Here are some key reasons why tri merge credit reports are important:

- Comprehensive Credit Evaluation: A tri merge credit report provides a comprehensive evaluation of an individual’s creditworthiness by combining information from all three major credit bureaus. This comprehensive view allows lenders to assess an individual’s credit history, payment patterns, and overall financial responsibility. It helps lenders make informed decisions when considering whether to approve a loan, credit card application, or other financial products.

- Accurate Credit Profile: By consolidating data from multiple credit bureaus, tri merge credit reports offer a more accurate representation of an individual’s credit profile. It helps ensure that the information used to evaluate creditworthiness is up-to-date and comprehensive. Lenders can have confidence in the accuracy and reliability of the information provided in a tri merge credit report.

- Identification of Inconsistencies and Errors: Tri merge credit reports enable individuals to identify any inconsistencies, errors, or inaccuracies in their credit information. By reviewing all three bureaus’ data in a single report, it becomes easier to spot any discrepancies. This empowers individuals to take steps to correct any inaccuracies, which can have a significant impact on their creditworthiness and financial opportunities.

- Monitoring Credit Health: Regularly monitoring a tri merge credit report allows individuals to keep a close eye on their credit health. By reviewing the report, individuals can track their credit accounts, payment history, credit utilization, and any negative marks such as late payments or collections. This helps individuals understand their financial standing and identify areas for improvement, such as reducing debt, making timely payments, or disputing any inaccuracies.

- Protection Against Identity Theft: Tri merge credit reports serve as a crucial tool in detecting and preventing identity theft. By monitoring the report for any unauthorized accounts, inquiries, or unusual activity, individuals can quickly identify signs of potential fraud. This early detection gives individuals the opportunity to take immediate action to protect themselves and prevent further damage to their credit and financial well-being.

- Negotiating Better Terms: Having a strong credit profile, as reflected in a tri merge credit report, can give individuals the upper hand when negotiating better terms for loans, mortgages, or credit cards. A positive credit history and a higher credit score can enable individuals to secure lower interest rates, higher credit limits, and more favorable terms, saving them substantial amounts of money over time.

Overall, tri merge credit reports are important because they provide a comprehensive, accurate, and reliable assessment of an individual’s creditworthiness. Whether you’re a lender making informed credit decisions or an individual monitoring and improving your credit health, tri merge credit reports are an invaluable tool in the realm of finance.

How Tri Merge Credit Reports Work

Tri merge credit reports are generated by combining information from the three major credit bureaus – Experian, Equifax, and TransUnion. Let’s take a closer look at how these reports work:

1. Data Collection: Each of the three credit bureaus collects and maintains credit information on individuals. They receive data from various sources, including lenders, credit card companies, and public records. This information includes details about an individual’s credit accounts, payment history, balances, and any negative marks.

2. Merge Process: When a request for a tri merge credit report is made, the credit reporting agency contacts each of the three credit bureaus. The bureaus then compile and consolidate their respective data into a single comprehensive report. The merge process combines the data from each bureau, ensuring that the report contains a comprehensive overview of an individual’s credit history.

3. Data Standardization: During the merge process, the credit bureaus standardize the data to make it consistent across the report. This ensures that the information is presented uniformly and can be easily interpreted by lenders and individuals.

4. Elimination of Duplicates: The tri merge credit report eliminates duplicates and redundant information. It presents a unified report that reflects the most up-to-date and accurate information available from each credit bureau. This helps avoid confusion and provides a clear picture of an individual’s credit profile.

5. Report Generation: Once the data from all three credit bureaus is merged and standardized, the tri merge credit report is generated. The report includes sections that detail an individual’s personal information, credit accounts, payment history, credit inquiries, public records, and other relevant financial information. It presents a holistic view of an individual’s creditworthiness and financial responsibility.

6. Accessibility: Tri merge credit reports are typically accessed by lenders, financial institutions, or individuals who have a legitimate need to evaluate an individual’s creditworthiness. Lenders use these reports to assess the risk involved in extending credit and to determine suitable interest rates and credit limits. Individuals can also access their tri merge credit reports to review their credit profiles, identify errors, and monitor their credit health. They can obtain their tri merge credit reports either through authorized credit reporting agencies or by using online credit monitoring services.

It’s important to note that tri merge credit reports are dynamic and can change over time. As new information is reported to the credit bureaus, it is reflected in the report. Regularly checking and reviewing the tri merge credit report is crucial to stay informed about any updates or changes in credit history.

In the next section, we will explore the differences between a tri merge credit report and a single credit report, highlighting the benefits of the comprehensive view provided by the tri merge report.

Differences between a Tri Merge Credit Report and a Single Credit Report

While both tri merge credit reports and single credit reports provide valuable information about an individual’s credit history, there are some key differences between the two. Let’s explore these differences:

1. Data Sources: A tri merge credit report combines information from all three major credit bureaus – Experian, Equifax, and TransUnion. On the other hand, a single credit report only provides information from one credit bureau. Depending on the lender or entity requesting the report, they may only consider data from a specific credit bureau when evaluating an individual’s creditworthiness.

2. Credit History Coverage: Because a tri merge credit report includes data from multiple credit bureaus, it provides a more comprehensive view of an individual’s credit history. It captures information from various creditors and financial institutions, giving a more thorough picture of payment history, credit utilization, and other credit-related factors. In contrast, a single credit report covers a narrower range of credit information, potentially leaving out crucial details from other credit bureaus.

3. Accuracy and Consistency: Since different credit bureaus may gather and report slightly different information, a single credit report may not accurately reflect an individual’s complete credit profile. Inconsistencies in data can arise due to variations in reporting practices among creditors. Tri merge credit reports, however, help mitigate this issue by combining information from multiple sources, resulting in a more accurate and consistent representation of an individual’s credit history.

4. Detailed Credit Analysis: Tri merge credit reports often provide a more detailed analysis of an individual’s credit information compared to single credit reports. The comprehensive nature of tri merge reports allows for a deeper examination of credit accounts, payment history, credit inquiries, and public records. This level of detail helps lenders make more informed decisions when determining creditworthiness and designing appropriate loan terms.

5. Access to Unreported Accounts: Lenders may report an individual’s credit activity to only one or two credit bureaus, omitting the third. This means that a single credit report may not reflect all credit accounts or loan applications. Tri merge credit reports, on the other hand, can fill in these gaps by including information from all three credit bureaus. This ensures a more complete credit assessment and a better understanding of an individual’s overall creditworthiness.

6. Discrepancy Identification: In cases where there are discrepancies or errors in credit reporting, having access to a tri merge credit report increases the likelihood of identifying these inconsistencies. By comparing data from all three credit bureaus, individuals can spot any variations or inaccuracies and take necessary steps to rectify them. This allows for a more precise credit evaluation and can potentially improve an individual’s credit score.

Overall, tri merge credit reports offer a more comprehensive and holistic view of an individual’s credit history compared to single credit reports. They provide a detailed analysis of credit accounts and payment patterns, increase the accuracy and consistency of credit information, and aid in identifying discrepancies or errors. Lenders and individuals alike can benefit greatly from the comprehensive assessment provided by tri merge credit reports.

In the next section, we will discuss the benefits of tri merge credit reports and why individuals should consider accessing them.

Benefits of Tri Merge Credit Reports

Tri merge credit reports offer numerous benefits to both lenders and individuals. Here are some key advantages of utilizing tri merge credit reports:

- Comprehensive Credit Assessment: Tri merge credit reports provide a comprehensive assessment of an individual’s creditworthiness by combining data from all three major credit bureaus – Experian, Equifax, and TransUnion. This comprehensive view allows lenders to make well-informed decisions when evaluating credit applications and determining loan terms. It also enables individuals to have a complete understanding of their credit standing.

- Accurate and Reliable Information: By consolidating data from multiple sources, tri merge credit reports offer a more accurate and reliable representation of an individual’s credit history. The reports provide a unified and standardized view of credit accounts, payment history, credit inquiries, and other relevant financial information. This enhances the credibility of the information used for assessing creditworthiness and reduces potential errors or discrepancies.

- Identifying Areas for Improvement: Tri merge credit reports allow individuals to identify areas where they can improve their creditworthiness. By reviewing the report, individuals can identify factors that may be negatively impacting their credit, such as high credit utilization, late payments, or collection accounts. This empowers them to take proactive steps towards improving their credit health, such as paying off debts, making timely payments, and disputing any inaccuracies.

- Monitoring Credit Health: Regularly monitoring a tri merge credit report enables individuals to keep a close eye on their credit health. It helps track changes in credit accounts, new inquiries, and any negative marks on the report. This monitoring allows individuals to promptly address any issues that may arise, such as unauthorized accounts or fraudulent activity. It also provides an opportunity to track progress over time and see the impact of positive financial habits on credit scores.

- Streamlining Decision-Making: For lenders, tri merge credit reports streamline the credit evaluation process. By consolidating credit information from multiple sources into a single report, lenders can efficiently assess an individual’s creditworthiness. This helps save time and resources, allowing for faster decision-making and improved operational efficiency.

- Negotiating Better Loan Terms: A strong credit profile, as reflected in a tri merge credit report, can provide individuals with leverage to negotiate better loan terms. A positive credit history and a higher credit score increase the likelihood of obtaining lower interest rates, higher credit limits, and more favorable loan conditions. This can potentially save individuals significant amounts of money over the lifetime of the loan.

- Protection Against Identity Theft: Tri merge credit reports are a valuable tool in detecting and preventing identity theft. By regularly monitoring the report, individuals can spot any suspicious or unauthorized activity, such as new accounts opened in their name or unfamiliar inquiries. Early detection is crucial in addressing identity theft and taking the necessary steps to minimize the damage to one’s credit and personal finances.

Overall, the benefits of tri merge credit reports include comprehensive credit assessment, accuracy of information, identifying areas for improvement, credit health monitoring, streamlined decision-making for lenders, ability to negotiate better loan terms, and protection against identity theft. These advantages make tri merge credit reports a crucial tool for both lenders and individuals in the realm of finance.

In the next section, we will explore how individuals can access tri merge credit reports and gain valuable insights into their credit profiles.

How to Access a Tri Merge Credit Report

Accessing a tri merge credit report provides individuals with valuable insights into their credit profiles. To obtain a tri merge credit report, follow these steps:

- Identify Authorized Credit Reporting Agencies: Start by identifying authorized credit reporting agencies that offer tri merge credit reports. These agencies have access to data from all three major credit bureaus and can generate comprehensive tri merge credit reports.

- Provide Personal Information: When requesting a tri merge credit report, you will need to provide personal information such as your full name, date of birth, social security number, and contact details. This information is necessary to verify your identity and ensure the report is generated for the correct individual.

- Complete the Application: Fill out the application form provided by the authorized credit reporting agency. The form may ask for additional details, such as current and previous addresses, employment history, and financial information. Be sure to provide accurate and up-to-date information to ensure the report is comprehensive and accurate.

- Pay the Fee, if Applicable: Some credit reporting agencies may charge a fee for accessing a tri merge credit report. The fee covers the cost of processing your request and generating the report. Be aware of any associated costs and ensure you understand the payment requirements before proceeding.

- Verify Identity: In some cases, the credit reporting agency may require additional verification steps to ensure your identity. This may involve providing copies of identification documents or answering security questions to confirm your identity.

- Review and Interpret the Report: Once you have received your tri merge credit report, take the time to review and understand the information provided. Pay attention to credit accounts, payment history, credit inquiries, and any negative marks. Use the report to gain insights into your creditworthiness and identify areas for improvement.

- Address Inaccuracies or Discrepancies: If you identify any inaccuracies or discrepancies in your tri merge credit report, take steps to address them promptly. Contact the respective credit bureaus to dispute any incorrect information and provide supporting evidence to rectify the errors. Correcting inaccuracies will help ensure the report accurately reflects your credit history.

- Monitor Your Credit Health: Regularly monitoring your tri merge credit report is essential for staying informed about any changes or updates in your credit profile. Consider utilizing credit monitoring services or subscribing to credit monitoring platforms that provide ongoing access to your tri merge credit report and alert you of any significant changes or suspicious activity.

By following these steps, individuals can access their tri merge credit reports and gain valuable insights into their credit profiles. Remember, reviewing and understanding your credit report is crucial for maintaining good credit health and making informed financial decisions.

In the next section, we will explore the factors considered in a tri merge credit report and how they contribute to assessing creditworthiness.

Factors Considered in a Tri Merge Credit Report

A tri merge credit report takes into account various factors that contribute to an individual’s creditworthiness. Lenders and financial institutions evaluate these factors when assessing credit applications. Here are some key factors considered in a tri merge credit report:

- Payment History: Your payment history is one of the most crucial factors in a tri merge credit report. It reflects whether you make payments on time or have a history of late or missed payments. Consistently making timely payments positively impacts your credit score and demonstrates your ability to manage credit responsibly.

- Credit Utilization: Credit utilization refers to the amount of available credit you are actively using. It is expressed as a percentage and calculated by dividing the total credit balance by the total credit limit. Lower credit utilization ratios are generally favorable, as they indicate responsible credit usage and can positively impact your credit score.

- Credit History Length: The length of your credit history plays a role in credit evaluations. Longer credit histories provide more data points for lenders to assess your creditworthiness. Your payment patterns, account history, and overall credit behavior over time contribute to determining your creditworthiness.

- Type of Credit Accounts: The types of credit accounts you have can impact your credit evaluation. A well-rounded mix of credit accounts, such as credit cards, installment loans, and mortgage accounts, may demonstrate your ability to handle various types of credit responsibly.

- Recent Credit Inquiries: The number of recent credit inquiries constitutes another factor in a tri merge credit report. Multiple inquiries within a short period may be seen as a red flag, suggesting a higher credit risk. However, inquiries related to rate shopping for a specific type of credit, such as a mortgage or auto loan, are typically treated as a single inquiry and have a minimal impact.

- Public Records and Negative Marks: Public records and negative marks, such as bankruptcies, foreclosures, and collections, are considered in a tri merge credit report. These records can have a significantly negative impact on your creditworthiness and may take time to recover from. Demonstrating positive credit behavior over time can help mitigate the impact of these negative marks.

- Debt-to-Income Ratio: Although not directly included in the credit report, lenders often consider an individual’s debt-to-income ratio along with the tri merge credit report. This ratio measures the percentage of an individual’s monthly income that goes towards debt payments. Lenders use this ratio to assess an individual’s ability to manage additional credit responsibilities and ensure they have sufficient income to meet their financial obligations.

These factors, along with other individual circumstances, contribute to an overall assessment of an individual’s creditworthiness. It’s important to note that the weight given to each factor may vary depending on the lender’s specific criteria and the type of credit being applied for.

Understanding the factors considered in a tri merge credit report can help you proactively manage your credit. By focusing on maintaining a positive payment history, keeping credit utilization low, and managing your credit responsibly, you can enhance your creditworthiness and improve your chances of obtaining favorable credit terms.

In the next section, we will delve into how to interpret a tri merge credit report to gain valuable insights into your credit health.

How to Interpret a Tri Merge Credit Report

Interpreting a tri merge credit report is essential for understanding your credit health and making informed financial decisions. Here are the key steps to effectively interpret a tri merge credit report:

- Review Personal Information: Begin by carefully reviewing the personal information section of the tri merge credit report. Ensure that your name, address, date of birth, and other identifying details are accurate. Any discrepancies or errors in personal information should be addressed promptly by contacting the credit reporting agency.

- Check Account Information: Examine the account information section, which provides details about your credit accounts. Review open and closed accounts, including credit cards, loans, and mortgages. Verify that the reported balances, credit limits, and payment history for each account are accurate. Look for any accounts that you do not recognize, as they may indicate fraudulent activity or errors in reporting.

- Assess Payment History: Evaluate the payment history section to understand your track record of making timely payments. Look for any late payments, missed payments, or defaults. A consistent history of on-time payments is crucial for maintaining good credit and demonstrating responsible credit behavior.

- Analyze Credit Utilization: Calculate your credit utilization ratio by dividing your total credit card balances by your total credit limits. A low credit utilization, typically below 30%, is considered favorable. High credit utilization may indicate a higher credit risk. Adjusting your credit utilization by paying down balances can positively impact your credit score.

- Identify Negative Marks: Pay attention to negative marks, such as collections, bankruptcies, or late payments, as they can significantly impact your creditworthiness. Note the date of the negative marks, as they may have different weightings on your credit score over time. Take steps to address and rectify any errors or inaccuracies in this section.

- Review Credit Inquiries: Analyze the credit inquiries section, which lists entities that have accessed your credit report in the past few years. Verify that you recognize and authorized each inquiry. Multiple inquiries within a short period that you didn’t initiate may indicate fraudulent activity and should be reported to the credit reporting agency.

- Check Public Records: If applicable, review the public records section, which includes information about bankruptcies, judgments, or tax liens. Verify the accuracy of this information and take necessary steps to address any errors or discrepancies.

- Monitor Trends and Changes: Look for any patterns, trends, or changes in your credit report over time. Positive changes, such as an increased credit score or resolved negative marks, indicate progress in managing your credit. On the other hand, sudden drops in your score or new negative marks may warrant further investigation and action.

- Compare with Credit Goals: Compare the information in the tri merge credit report with your credit goals. Assess whether you are on track to achieve your desired credit objectives. Identify areas for improvement and develop strategies to address them, such as paying down debts, disputing inaccuracies, or establishing a consistent payment history.

Remember, interpreting a tri merge credit report is not a one-time task. Regularly reviewing your report allows you to stay informed about changes, address any errors, and track your progress in improving your credit health over time.

In the next section, we will discuss the limitations and drawbacks of tri merge credit reports that you should be aware of.

Limitations and Drawbacks of Tri Merge Credit Reports

While tri merge credit reports are valuable tools for assessing creditworthiness, it’s important to be aware of their limitations and drawbacks. Here are some key limitations to consider:

- Incomplete Reporting: Tri merge credit reports rely on the information reported by creditors to the credit bureaus. Not all creditors report to all three major credit bureaus, which means that certain credit accounts or loan applications may not be included in the report. This can result in an incomplete representation of an individual’s credit history, potentially impacting credit assessments.

- Data Discrepancies: Discrepancies in credit data can occur due to differences in reporting practices among creditors. These discrepancies may lead to variations in information across the three credit bureaus and can result in differing credit scores and evaluations. It’s crucial to review the tri merge credit report carefully and identify any inconsistencies or errors that may exist.

- Timing of Updates: The timing of data updates across the three credit bureaus may differ. An account update or credit inquiry may be reflected on one bureau’s report but not on another’s, leading to discrepancies in the tri merge credit report. This can impact credit evaluations, especially if recent positive changes or negative marks are missed in the report.

- Weighting of Credit Factors: Different lenders and financial institutions may weigh credit factors differently when making credit decisions. While a tri merge credit report provides a comprehensive view of an individual’s credit profile, the specific weight attributed to each factor may vary depending on the lender’s internal criteria. This means that evaluations and outcomes can differ among creditors, making it essential to consider multiple factors in credit assessments.

- No Contextual Information: Tri merge credit reports present credit data without providing context for individual circumstances. They do not account for external factors that may have influenced an individual’s credit history, such as medical emergencies, job loss, or economic downturns. Lenders may consider additional factors beyond the tri merge report, such as income stability and employment history, to understand the full picture of an individual’s creditworthiness.

- No Customization: Tri merge credit reports follow a standardized format and do not provide customization options specific to individual needs. While the reports offer an overview of credit information, they may not highlight specific areas of interest or provide detailed insights tailored to individual goals or financial situations.

Despite these limitations, tri merge credit reports remain an essential tool for evaluating creditworthiness. It’s important to recognize the limitations and consider them alongside other relevant factors when making credit decisions or assessing your credit profile.

In the concluding section, we will address some frequently asked questions about tri merge credit reports.

Frequently Asked Questions about Tri Merge Credit Reports

Here are the answers to some commonly asked questions about tri merge credit reports:

- Q: How often should I check my tri merge credit report?

A: It is recommended to check your tri merge credit report at least once a year. Regularly monitoring your credit report allows you to stay informed about any changes, identify errors or discrepancies, and track your progress in improving your credit health. - Q: Will accessing my tri merge credit report impact my credit score?

A: No, accessing your own credit report will not impact your credit score. When you check your own credit report, it is considered a soft inquiry, which does not affect your credit scoring. However, hard inquiries made by lenders or financial institutions when you apply for credit can impact your credit score slightly. - Q: How long do negative marks stay on my tri merge credit report?

A: Negative marks, such as late payments, collections, or bankruptcies, can remain on your tri merge credit report for a specific period depending on the type of negative mark. Generally, late payments remain on the report for seven years, while bankruptcies may stay for up to ten years. It’s important to focus on improving your credit habits to minimize the impact of negative marks over time. - Q: Can I dispute errors or inaccuracies on my tri merge credit report?

A: Yes, if you find errors or inaccuracies in your tri merge credit report, you have the right to dispute them with the credit reporting agencies. Contact the credit bureau that provided the report and provide supporting documentation to support your claim. The agency will investigate the dispute and correct any errors if necessary. - Q: Can I improve my credit score by using a tri merge credit report?

A: While a tri merge credit report itself does not directly improve your credit score, it provides you with the information needed to identify areas for improvement. By reviewing the report and addressing negative factors such as high credit utilization or late payments, you can take positive steps towards improving your credit health, which may ultimately lead to an improvement in your credit score over time. - Q: Can lenders access my tri merge credit report when I apply for credit?

A: Yes, lenders and financial institutions can access your tri merge credit report when you apply for credit. They use the report to evaluate your creditworthiness and make decisions on loan approvals, interest rates, and credit limits. The information in your tri merge credit report helps them assess the risk involved in lending to you and determine suitable terms for the credit you are seeking. - Q: Do I need to request a separate credit report from each credit bureau?

A: No, when you request a tri merge credit report, you will receive a single comprehensive report that combines information from all three major credit bureaus — Experian, Equifax, and TransUnion. This report provides an overview of your credit history, accounts, payment history, and other relevant credit information from all three bureaus in one document.

It’s important to clarify any additional questions or concerns you may have about your tri merge credit report with the relevant credit reporting agencies or a financial professional. Understanding the intricacies of your tri merge credit report is crucial for managing your credit effectively and making informed financial decisions.

After exploring tri merge credit reports in-depth, we can conclude that they provide a comprehensive view of an individual’s credit history and play a significant role in credit evaluations. Regularly reviewing and understanding your tri merge credit report empowers you to take control of your credit health and make proactive improvements.

Conclusion

Tri merge credit reports offer a comprehensive and detailed assessment of an individual’s creditworthiness by combining data from the three major credit bureaus – Experian, Equifax, and TransUnion. These reports are crucial for lenders, financial institutions, and individuals in making informed credit decisions, monitoring credit health, and identifying areas for improvement.

Throughout this article, we explored the definition of tri merge credit reports, their importance, how they work, and the differences between tri merge credit reports and single credit reports. We also discussed the benefits of tri merge credit reports, including providing a comprehensive credit evaluation, accurate credit profile, and the ability to negotiate better loan terms. Additionally, we outlined how to access a tri merge credit report, the factors considered in these reports, how to interpret them, and their limitations and drawbacks.

By regularly monitoring tri merge credit reports, individuals can stay informed about their credit profiles, identify errors or discrepancies, and track their progress in improving their credit health. Understanding the factors and information presented in the reports allows individuals to make informed decisions regarding their financial well-being and credit goals.

Remember, maintaining good credit health requires responsible credit management, such as making timely payments, keeping credit utilization low, and rectifying errors in credit reports promptly. By doing so, individuals can enhance their creditworthiness, open doors to favorable credit opportunities, and secure better financial outcomes.

In conclusion, tri merge credit reports provide a holistic and comprehensive view of an individual’s credit history, aiding lenders, financial institutions, and individuals in assessing creditworthiness, making informed decisions, and working towards achieving better credit health.