Home>Finance>What Percentage Of Personal Finance Is Head Knowledge?

Finance

What Percentage Of Personal Finance Is Head Knowledge?

Modified: February 21, 2024

Learn the essentials of personal finance and the role of head knowledge in managing your finances. Discover the percentage of finance that relies on knowledge and practical application. Explore key insights and strategies for financial success.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

The Role of Head Knowledge in Personal Finance

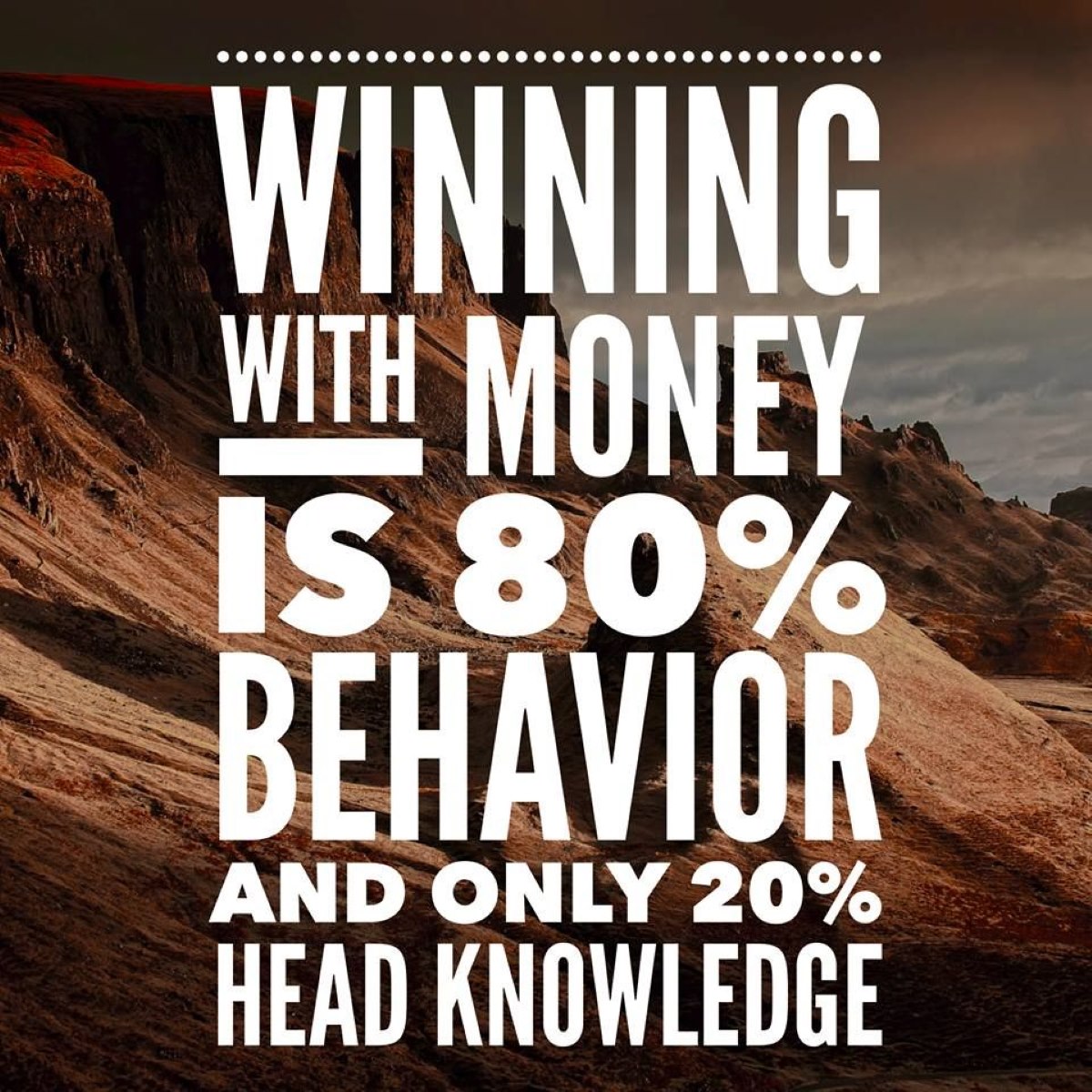

Understanding the significance of head knowledge in personal finance is essential for making informed decisions and achieving long-term financial well-being. While possessing financial knowledge is undoubtedly valuable, it is equally important to recognize the impact of behavior, habits, and emotional intelligence on one's financial journey. This article aims to explore the intricate relationship between head knowledge and personal finance, shedding light on the multifaceted aspects that contribute to financial success.

In the realm of personal finance, head knowledge encompasses a broad spectrum of financial literacy, including understanding investment principles, budgeting, saving strategies, and debt management. This knowledge equips individuals with the necessary tools to navigate the complexities of the financial landscape, empowering them to make sound financial choices. However, it is crucial to acknowledge that head knowledge alone does not guarantee financial success. Behavioral patterns and emotional intelligence play pivotal roles in shaping financial outcomes, often influencing decision-making processes and long-term financial stability.

As we delve deeper into the interplay between head knowledge and personal finance, it becomes evident that a holistic approach is paramount. While acquiring financial literacy is a crucial foundation, the application of this knowledge through prudent financial behaviors and emotional intelligence is equally indispensable. By examining these interconnected elements, individuals can gain a comprehensive understanding of how head knowledge, behavior, and emotional intelligence collectively shape their financial reality. Through this exploration, readers will glean valuable insights into optimizing their financial journey by embracing a balanced approach that integrates head knowledge with behavioral and emotional acumen.

The Role of Head Knowledge in Personal Finance

Head knowledge serves as the cornerstone of personal finance, providing individuals with the essential understanding of financial concepts and strategies necessary for navigating the complexities of the modern financial world. This encompasses a broad spectrum of financial literacy, including comprehension of investment principles, budgeting, saving strategies, and debt management. Such knowledge empowers individuals to make informed decisions, optimize their financial resources, and plan for long-term stability.

Financial literacy equips individuals with the tools to assess investment opportunities, evaluate risks, and make strategic financial decisions. Understanding the intricacies of budgeting and saving enables individuals to effectively manage their income, allocate resources efficiently, and cultivate a healthy financial foundation. Moreover, comprehending debt management principles empowers individuals to navigate borrowing responsibly and mitigate the risks associated with indebtedness.

While head knowledge forms the bedrock of financial competence, it is imperative to recognize that its impact extends beyond mere theoretical understanding. The application of financial knowledge in real-world scenarios is pivotal, as it enables individuals to translate theoretical concepts into tangible financial outcomes. By applying head knowledge effectively, individuals can optimize their financial decisions, cultivate wealth, and safeguard against potential financial pitfalls.

Furthermore, the continuous evolution of financial markets and economic landscapes underscores the importance of staying abreast of financial trends and developments. Head knowledge enables individuals to adapt to changing financial environments, capitalize on emerging opportunities, and navigate potential challenges with confidence and acumen.

In essence, head knowledge forms the bedrock of financial empowerment, providing individuals with the essential tools to make informed decisions, optimize resources, and navigate the dynamic terrain of personal finance.

The Impact of Behavior and Habits

While head knowledge lays the foundation for financial literacy, the impact of behavior and habits on personal finance cannot be overstated. Behavioral patterns and habits play a pivotal role in shaping an individual’s financial journey, often influencing decision-making processes and long-term financial stability. Understanding the psychological and behavioral aspects of financial management is essential for cultivating positive financial habits and mitigating potential pitfalls.

Behavioral economics has shed light on the cognitive biases and behavioral patterns that influence financial decision-making. Individuals often exhibit tendencies such as loss aversion, present bias, and herd mentality, which can impact their financial choices. Recognizing these behavioral tendencies is crucial for developing strategies to counteract their influence and make sound financial decisions.

Moreover, the cultivation of positive financial habits, such as consistent saving, prudent spending, and disciplined investment, is instrumental in achieving long-term financial goals. These habits contribute to financial resilience, enabling individuals to weather economic uncertainties and pursue their financial aspirations with confidence.

Addressing detrimental financial behaviors and cultivating positive habits requires a blend of self-awareness, discipline, and strategic planning. By recognizing the influence of behavior on financial outcomes, individuals can proactively implement measures to align their habits with their long-term financial objectives. This may involve setting clear financial goals, creating structured budgets, and seeking accountability through financial advisors or support networks.

Furthermore, the role of habits in shaping financial outcomes extends beyond individual behaviors to encompass broader lifestyle choices. Factors such as health and wellness, work-life balance, and personal development can significantly impact an individual’s financial well-being. Cultivating holistic habits that prioritize physical, mental, and emotional well-being can create a foundation for sustained financial success.

In essence, the impact of behavior and habits on personal finance underscores the interconnected nature of financial well-being, emphasizing the need for a holistic approach that integrates head knowledge with prudent behavioral practices.

The Importance of Emotional Intelligence

Emotional intelligence plays a pivotal role in personal finance, complementing head knowledge and behavioral acumen to shape individuals’ financial decisions and outcomes. While head knowledge equips individuals with financial literacy and behavioral insights inform their habits, emotional intelligence empowers individuals to navigate the emotional complexities inherent in financial decision-making and wealth management.

One of the key tenets of emotional intelligence in personal finance is the ability to manage and mitigate the influence of emotions on financial decisions. Emotions such as fear, greed, and overconfidence can significantly impact investment choices, risk assessment, and long-term financial planning. By cultivating emotional intelligence, individuals can develop self-awareness and self-regulation, enabling them to make rational, informed financial decisions while mitigating the influence of impulsive or emotionally-driven choices.

Moreover, emotional intelligence fosters empathy and effective communication, which are invaluable in financial planning and wealth management. Understanding the emotional needs and priorities of family members, business partners, or clients can facilitate collaborative decision-making and the development of financial strategies that align with diverse emotional perspectives and aspirations.

Emotional intelligence also plays a crucial role in managing financial setbacks and navigating periods of economic volatility. Resilience, adaptability, and optimism, key components of emotional intelligence, enable individuals to weather financial challenges, learn from setbacks, and pivot towards new opportunities. This capacity to maintain emotional equilibrium in the face of financial adversity is instrumental in sustaining long-term financial well-being.

Furthermore, emotional intelligence contributes to the cultivation of healthy financial relationships, whether in personal finance or professional wealth management. Building trust, fostering transparency, and navigating conflicts with emotional intelligence can enhance financial partnerships and facilitate collaborative decision-making that aligns with long-term financial objectives.

In essence, emotional intelligence complements head knowledge and behavioral acumen, enriching individuals’ financial acumen and empowering them to make sound, emotionally informed financial decisions that align with their long-term aspirations and well-being.

Conclusion

Personal finance is a multifaceted domain that intertwines head knowledge, behavioral patterns, and emotional intelligence to shape individuals’ financial journeys. While head knowledge forms the bedrock of financial literacy, encompassing a broad spectrum of financial concepts and strategies, its impact is enriched and amplified by the influence of behavior and emotional intelligence.

Understanding the intricate relationship between head knowledge, behavior, and emotional intelligence is essential for achieving holistic financial well-being. While head knowledge equips individuals with the essential tools to make informed financial decisions, the impact of behavior and habits on financial outcomes underscores the need for cultivating positive financial practices and countering detrimental behavioral tendencies. Moreover, emotional intelligence empowers individuals to navigate the emotional complexities inherent in financial decision-making, fostering resilience, effective communication, and the capacity to manage financial setbacks with equanimity.

By embracing a balanced approach that integrates head knowledge with prudent behavioral practices and emotional intelligence, individuals can optimize their financial decisions, cultivate wealth, and navigate the dynamic terrain of personal finance with confidence and acumen.

In conclusion, the interplay of head knowledge, behavior, and emotional intelligence in personal finance underscores the interconnected nature of financial well-being, emphasizing the need for a holistic approach that encompasses financial literacy, positive behavioral habits, and emotional acumen. By recognizing the symbiotic relationship between these elements, individuals can embark on a journey towards sustained financial success, informed decision-making, and emotional well-being in their pursuit of financial goals.