Finance

Which Secured Card Builds Credit The Fastest?

Published: March 1, 2024

Find the best secured credit card to build your credit quickly. Compare options and start improving your finances today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of secured credit cards, where individuals can lay a solid foundation for their credit history and work towards achieving financial stability. In this comprehensive guide, we will explore the dynamic realm of secured credit cards and unravel the mysteries behind building credit swiftly through these powerful financial tools.

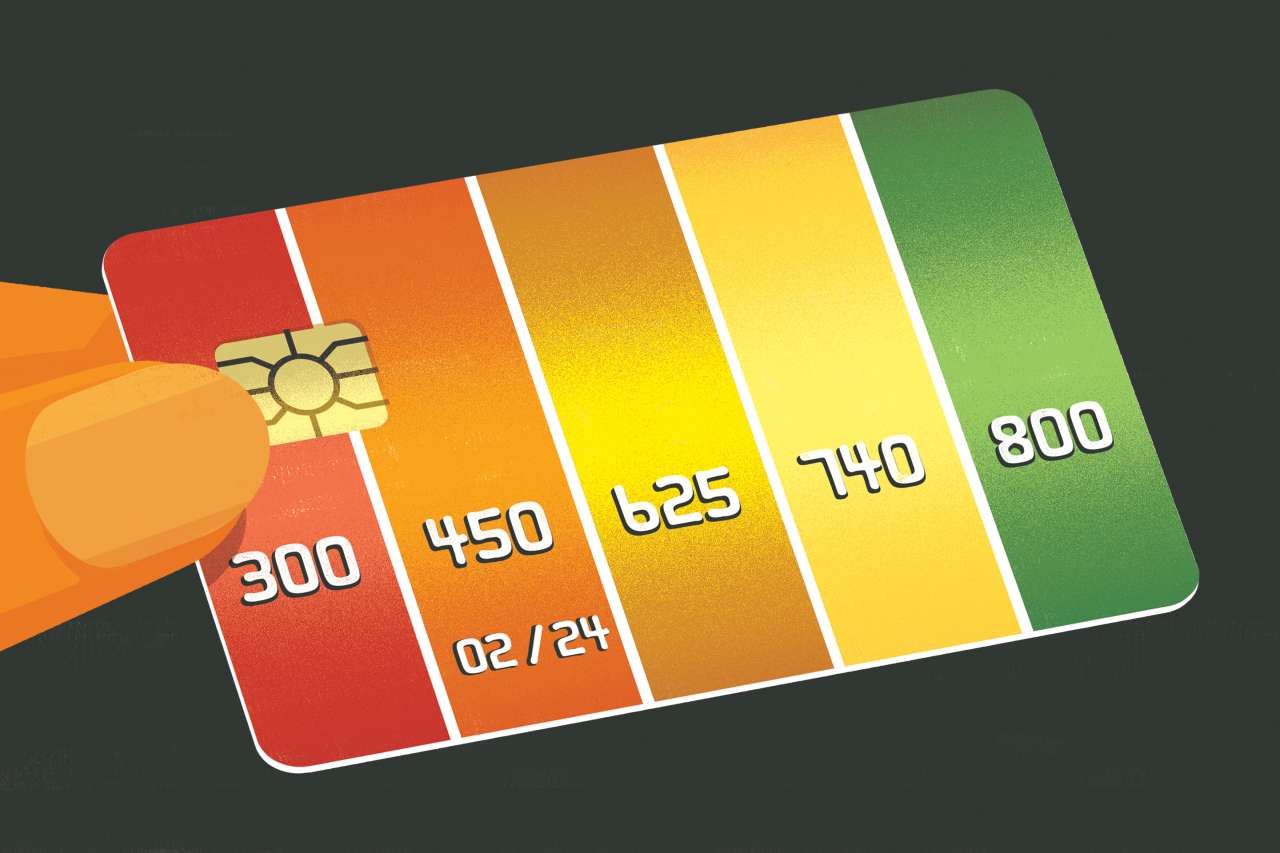

As we delve into this topic, it’s important to recognize that establishing and enhancing one’s credit score is a crucial aspect of personal finance. A healthy credit score can open doors to various opportunities, including favorable loan terms, competitive interest rates, and the ability to secure rental properties. However, for individuals with limited or damaged credit history, accessing traditional credit cards can be challenging. This is where secured credit cards emerge as a beacon of hope, offering a viable pathway to bolstering creditworthiness.

Throughout this guide, we will navigate through the fundamental concepts of secured credit cards, shed light on the key factors that influence credit building, compare different secured card options, and provide actionable tips to expedite the credit-building process. By the end of this journey, you will be equipped with the knowledge and insights needed to make informed decisions and embark on a transformative credit-building journey.

What is a Secured Credit Card?

A secured credit card is a powerful financial tool designed to help individuals establish or rebuild their credit. Unlike traditional unsecured credit cards, secured cards require the cardholder to provide a security deposit, which serves as collateral and determines the card’s credit limit. This deposit mitigates the risk for the card issuer, making secured cards an accessible option for individuals with limited credit history, a low credit score, or a history of financial setbacks.

One of the defining characteristics of secured credit cards is their ability to function as a stepping stone toward obtaining an unsecured credit card. By responsibly managing a secured card and demonstrating consistent, on-time payments, cardholders can gradually improve their creditworthiness, paving the way for potential upgrades to unsecured cards with higher credit limits and additional perks.

Secured credit cards operate much like traditional credit cards, allowing cardholders to make purchases, build credit through responsible usage, and pay off balances over time. As the cardholder continues to exhibit financial responsibility, their credit score can experience a positive upswing, unlocking opportunities for more favorable financial products and services in the future.

It’s important to note that while secured credit cards require a security deposit, this deposit is fully refundable upon closing the account, provided the cardholder has settled any outstanding balances. This feature offers peace of mind and reassurance to individuals who may be hesitant about venturing into the realm of credit building.

Overall, secured credit cards serve as a valuable tool for individuals aiming to kickstart their credit journey or bounce back from past financial challenges. By understanding the mechanics of secured cards and leveraging them responsibly, individuals can set themselves on a path toward financial empowerment and enhanced creditworthiness.

Factors That Affect Credit Building

When it comes to building credit, several key factors play a pivotal role in shaping an individual’s credit profile. Understanding these factors is essential for making informed decisions and optimizing the credit-building process. Here are the primary elements that influence credit building:

- Payment History: Timely payments on credit accounts, including secured credit cards, are a cornerstone of a healthy credit score. Consistently meeting payment deadlines demonstrates financial responsibility and reliability to potential lenders and creditors.

- Credit Utilization Ratio: This ratio reflects the amount of credit being used relative to the total available credit. Maintaining a low credit utilization ratio, ideally below 30%, signals responsible credit management and can positively impact credit scores.

- Length of Credit History: The duration of credit accounts, including the age of the oldest account and the average age of all accounts, influences credit scores. While individuals new to credit may have limited control over this factor, responsibly managing accounts over time can contribute to a positive credit history.

- New Credit Inquiries: When individuals apply for new credit, each inquiry can have a minor, temporary impact on their credit score. Managing the frequency of credit applications is important to avoid potential red flags for lenders.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards, installment loans, and mortgages, can contribute to a well-rounded credit profile. Secured credit cards, when managed prudently, can enrich this mix and demonstrate a capacity for responsible credit management.

For individuals leveraging secured credit cards to build or rebuild credit, these factors underscore the importance of conscientious financial habits. By consistently making on-time payments, maintaining a healthy credit utilization ratio, and strategically managing credit inquiries, individuals can lay a solid foundation for a robust credit history.

Understanding these credit-building factors empowers individuals to navigate the financial landscape with confidence, optimize their credit-building journey, and position themselves for long-term financial success.

Comparison of Secured Cards

When exploring the realm of secured credit cards, it’s essential to assess and compare various options to identify the most suitable card for individual financial needs and goals. Several key factors should be considered when comparing secured cards:

- Security Deposit Requirements: Different secured cards may have varying minimum and maximum security deposit requirements. Understanding these parameters is crucial for individuals with specific budget constraints or those seeking to maximize their initial deposit’s impact.

- Annual Fees: Some secured cards may entail annual fees, while others may offer fee-free options. Assessing the fee structures and evaluating the associated benefits is critical for selecting a card that aligns with one’s financial preferences.

- Interest Rates: The annual percentage rate (APR) on purchases and any applicable balance transfers should be compared across different secured cards. Lower APRs can lead to reduced interest expenses, especially for individuals carrying balances from month to month.

- Rewards and Perks: While secured cards traditionally offer fewer rewards and perks compared to unsecured cards, some secured options may feature cashback rewards, credit monitoring services, or other valuable incentives. Assessing these offerings can add value to the cardholder’s experience.

- Upgrade Opportunities: Understanding the potential for transitioning from a secured card to an unsecured card is crucial. Some issuers may review cardholder accounts periodically for upgrade eligibility, offering a pathway to unsecured credit and the return of the initial security deposit.

By meticulously comparing these factors, individuals can make informed decisions and select a secured credit card that aligns with their financial objectives. Additionally, reviewing and comprehending the terms and conditions, as well as any potential fees associated with secured cards, is essential for maintaining transparency and making the most of the credit-building journey.

Ultimately, the right secured credit card can serve as a catalyst for credit enhancement and financial empowerment, providing a solid platform for individuals to progress toward their long-term financial aspirations.

Tips for Building Credit Quickly

Building credit swiftly through secured credit cards entails a strategic approach and disciplined financial habits. Here are valuable tips to expedite the credit-building process:

- Timely Payments: Consistently making on-time payments on all credit accounts, including the secured card, is paramount. Payment history significantly influences credit scores, and punctual payments demonstrate reliability to creditors.

- Low Credit Utilization: Maintaining a low credit utilization ratio by using a small portion of the available credit can positively impact credit scores. Keeping balances well below the credit limit showcases responsible credit management.

- Regular Monitoring: Monitoring credit reports for inaccuracies and identity theft is crucial. Addressing any discrepancies promptly can safeguard credit health and prevent potential setbacks in the credit-building journey.

- Gradual Credit Expansion: As credit profiles strengthen, individuals can consider gradually diversifying their credit mix. This can involve responsibly exploring additional credit options, such as installment loans or unsecured credit cards, to enrich their credit history.

- Strategic Credit Card Usage: Using the secured card for small, routine purchases and promptly paying off the balances can demonstrate responsible credit utilization and payment management. This approach showcases financial prudence and contributes to positive credit behavior.

Implementing these tips consistently and conscientiously can accelerate the credit-building process, leading to tangible improvements in credit scores and overall creditworthiness. By leveraging secured credit cards as a springboard and embracing prudent financial practices, individuals can lay a robust foundation for their financial future.

Conclusion

Embarking on a credit-building journey through secured credit cards offers individuals a transformative opportunity to fortify their financial standing and pave the way for future prosperity. By comprehending the mechanics of secured cards, understanding the factors that influence credit building, and implementing strategic tips, individuals can navigate the path to credit enhancement with confidence and purpose.

Secured credit cards serve as a bridge to financial empowerment, offering a viable means for individuals to establish or rebuild their credit profiles. As individuals diligently manage their secured cards, making timely payments, maintaining low credit utilization, and monitoring their credit health, they set in motion a positive trajectory toward improved credit scores and expanded financial opportunities.

Comparing secured card options and selecting a card that aligns with one’s financial objectives is a pivotal step in the credit-building process. By choosing a secured card with favorable terms, reasonable fees, and potential upgrade opportunities, individuals can optimize their credit-building endeavors and position themselves for long-term success.

As individuals progress along their credit-building journey, the ultimate goal is to transition to unsecured credit, unlock higher credit limits, and access a broader range of financial products and services. Secured credit cards, when managed prudently, serve as a catalyst for this evolution, empowering individuals to transcend past financial challenges and embrace a future defined by financial stability and resilience.

In conclusion, the realm of secured credit cards offers a gateway to financial renewal and empowerment. By leveraging these powerful tools, individuals can embark on a transformative credit-building journey, charting a course toward enhanced creditworthiness, expanded financial opportunities, and a brighter financial future.