Home>Finance>What Savings Vehicle Usually Requires A High Minimum Balance

Finance

What Savings Vehicle Usually Requires A High Minimum Balance

Published: January 16, 2024

"

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Savings Vehicles

- Importance of Minimum Balance Requirements

- Types of Savings Vehicles with High Minimum Balance Requirements

- High-Yield Savings Accounts

- Certificates of Deposit (CDs)

- Money Market Accounts

- Individual Retirement Accounts (IRAs)

- Factors to Consider When Choosing Savings Vehicles

- Conclusion

Introduction

Welcome to the world of savings vehicles, where individuals can store their hard-earned money and watch it grow over time. From traditional savings accounts to more specialized options, there is a wide array of financial tools available to suit different needs and goals. However, not all savings vehicles are created equal. Some require a minimum balance that may seem daunting to those just starting their financial journey. In this article, we will explore the savings vehicle that usually requires a high minimum balance.

Before diving into the specifics, let’s first understand what savings vehicles are. Savings vehicles are financial products designed to help individuals accumulate and manage their savings effectively. These accounts typically offer interest on the deposited funds, allowing for potential growth over time. While savings accounts are commonly used by individuals to hold their cash, there are also other options available, each with its own features and advantages.

Minimum balance requirements play a critical role when considering which savings vehicle to choose. A minimum balance is the minimum amount of money that must be maintained in the account to avoid fees or qualify for certain benefits. While some savings vehicles have low or even no minimum balance requirements, others have higher thresholds, which can be a barrier for some individuals.

So which savings vehicle usually requires a high minimum balance? Let’s explore some of the popular options below.

Definition of Savings Vehicles

Before delving into the specifics of savings vehicles with high minimum balance requirements, it’s essential to have a clear understanding of what savings vehicles are. Essentially, a savings vehicle refers to any financial instrument or account designed to hold and grow an individual’s savings over time.

Common savings vehicles include traditional savings accounts offered by banks and credit unions. These accounts allow individuals to deposit their money and earn a modest interest rate on the balance. Savings accounts are typically easily accessible, allowing for withdrawals and deposits as needed. They are a popular choice for individuals looking for a safe and liquid option to store their funds.

Aside from traditional savings accounts, there are other types of savings vehicles that offer different features and benefits.

Certificates of Deposit (CDs) are one such option. CDs are time deposits that have a fixed term, usually ranging from a few months to several years. They often offer higher interest rates compared to regular savings accounts because they require the account holder to keep the funds locked in for the agreed-upon term. Withdrawing the money before the term ends typically incurs penalties.

Money market accounts are another type of savings vehicle. These accounts combine some features of checking accounts and savings accounts. Money market accounts generally offer higher interest rates than regular savings accounts and often come with limited check-writing privileges and a higher minimum balance requirement.

Individual Retirement Accounts (IRAs) are specialized savings vehicles designed to help individuals save for retirement. IRAs offer tax advantages, such as tax-deferred growth (Traditional IRA) or tax-free withdrawals in retirement (Roth IRA). These accounts typically have contribution limits and may have penalties for early withdrawals.

These are just a few examples of the savings vehicles available in the financial market. Each type of savings vehicle has its own set of rules, restrictions, and benefits. Understanding these differences is crucial in making an informed decision about which savings vehicle is the most suitable for individual financial goals and circumstances.

Now that we have a general understanding of savings vehicles, let’s take a closer look at those that typically require a high minimum balance.

Importance of Minimum Balance Requirements

Minimum balance requirements are a crucial aspect to consider when choosing a savings vehicle. These requirements determine the minimum amount of money that must be maintained in the account to avoid fees or qualify for certain benefits. While some accounts may have no minimum balance or lower requirements, others have higher thresholds that individuals must meet to reap the full advantages of the savings vehicle.

One of the primary reasons why minimum balance requirements are important is to ensure the financial stability of the institution offering the savings vehicle. By imposing a minimum balance, banks and other financial institutions can have a certain level of assurance that they have a stable pool of funds to work with. This can help them manage their own expenses and maintain sufficient liquidity to fulfill customer demands.

From the account holder’s perspective, maintaining a minimum balance is also beneficial. Meeting this requirement often allows individuals to avoid monthly maintenance fees that can eat into their savings. By meeting the minimum balance, individuals can enjoy the full benefits of the savings vehicle without incurring additional costs.

Furthermore, some savings vehicles offer perks and advantages to customers who maintain higher balances. For example, high-yield savings accounts may offer higher interest rates to individuals who meet the minimum balance requirement. This means that the account holder can potentially earn more on their savings and accelerate their wealth-building journey.

Meeting a minimum balance requirement can also be an indicator of financial discipline and stability. It demonstrates the account holder’s ability to maintain a certain level of savings and responsibility in managing their finances. This can reflect positively on their financial history and be advantageous when applying for loans or other financial products in the future.

However, it’s important to note that not everyone may be able to meet the high minimum balance requirements of certain savings vehicles. Some individuals may be just starting their financial journey or facing financial constraints that make it difficult to maintain a large balance. In such cases, it’s crucial to do thorough research and consider other savings vehicle options that have lower or no minimum balance requirements.

Now that we understand the importance of minimum balance requirements, let’s explore the specific types of savings vehicles that typically have high minimum balance requirements.

Types of Savings Vehicles with High Minimum Balance Requirements

When it comes to savings vehicles, some options require a higher minimum balance compared to others. While this may seem daunting for individuals who are just starting to save or have limited funds, these savings vehicles often offer greater benefits and potential returns. Let’s explore four types of savings vehicles that typically have high minimum balance requirements:

1. High-Yield Savings Accounts

High-yield savings accounts are a popular choice for those looking for a savings vehicle that offers higher interest rates than traditional savings accounts. These accounts are offered by online banks and often have competitive rates to attract customers. However, they typically have a higher minimum balance requirement, which can range from a few hundred to a few thousand dollars. Meeting this requirement allows individuals to earn a more significant return on their savings.

2. Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are time deposits where individuals deposit a specific amount of money for a predetermined period. CDs offer higher interest rates compared to regular savings accounts but come with a catch – they have a fixed term, and withdrawing the funds before the term ends may incur penalties. CDs often have high minimum balance requirements, making them more suitable for individuals with a significant amount of savings to invest.

3. Money Market Accounts

Money market accounts are a type of savings vehicle that offers a combination of a checking account and a savings account. These accounts typically provide a higher interest rate compared to regular savings accounts and offer limited check-writing capabilities. Money market accounts often come with a higher minimum balance requirement to access the higher interest rates and additional features.

4. Individual Retirement Accounts (IRAs)

Individual Retirement Accounts (IRAs) are specialized savings vehicles that are designed to help individuals save for retirement. IRAs offer various tax advantages, depending on whether you choose a Traditional IRA or a Roth IRA. While IRAs do not have strict minimum balance requirements, some financial institutions may set their own thresholds to open an account or invest in certain assets within the IRA.

It’s important to remember that the minimum balance requirements for these savings vehicles can vary widely among different financial institutions. It is always advisable to research and compare the account terms and offerings to find a savings vehicle that aligns with your financial goals and capabilities.

Now that we have explored the types of savings vehicles with high minimum balance requirements, let’s consider the factors to consider when choosing the right savings vehicle for your needs.

High-Yield Savings Accounts

High-yield savings accounts have gained popularity among savers looking to maximize their returns on cash deposits. These accounts offer higher interest rates compared to traditional savings accounts, making them an attractive option for individuals who want their money to work harder for them.

One key feature of high-yield savings accounts is their higher minimum balance requirements. While traditional savings accounts may have little to no minimum balance requirement, high-yield savings accounts typically have minimum balance thresholds that can range from a few hundred to a few thousand dollars.

The reason for these higher requirements is because financial institutions that offer high-yield savings accounts are able to provide competitive interest rates by investing the funds in higher-yielding investments. By setting a minimum balance, these institutions ensure that customers’ deposits are sufficient to generate the desired returns without incurring excessive costs.

Meeting the minimum balance requirement of a high-yield savings account can be advantageous for several reasons. Firstly, it allows individuals to access higher interest rates, which means that their savings grow at a faster pace compared to traditional savings accounts. Over time, this can lead to a significant difference in the overall interest earned.

Additionally, high-yield savings accounts often come with other perks such as no monthly maintenance fees or unlimited transactions. These benefits can further enhance the overall value of the account and provide a more seamless banking experience.

It’s important to note that the interest rates offered on high-yield savings accounts can fluctuate based on market conditions. While these accounts generally provide higher rates compared to traditional savings accounts, the rates can still vary from one institution to another. Therefore, it’s essential to shop around and compare the rates and terms offered by different financial institutions to find the best high-yield savings account for your needs.

When considering a high-yield savings account, it’s also important to evaluate the overall financial stability and reputation of the institution. Look for institutions that are FDIC-insured, which means that your deposits are protected up to the maximum allowed by law, giving you peace of mind.

While high-yield savings accounts do come with higher minimum balance requirements, they can be a great option for individuals looking to grow their savings more effectively. By meeting the minimum balance and taking advantage of the higher interest rates, individuals can boost their financial goals and make their money work harder for them.

Now that we understand high-yield savings accounts, let’s move on to explore another savings vehicle with a high minimum balance requirement, certificates of deposit (CDs).

Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are another type of savings vehicle that often requires a high minimum balance. CDs are time deposits where individuals deposit a specific amount of money for a predetermined period, ranging from a few months to several years. During this time, the funds are locked in, and individuals generally cannot access them without paying penalties.

CDs are known for their higher interest rates compared to regular savings accounts, making them an attractive option for individuals who want to earn more on their savings. However, these higher interest rates come with higher minimum balance requirements, which can be a barrier for some savers.

The minimum balance requirements for CDs can vary depending on the financial institution and the specific terms of the CD. While some CDs may have minimum balance requirements as low as $500, others may require several thousand dollars or more.

The reason for the higher minimum balance requirements of CDs is twofold. Firstly, financial institutions use the funds deposited in CDs to generate income by investing them in other ventures such as loans or securities. A higher minimum balance ensures that the institution has a substantial amount to work with and earn returns from these investments.

Secondly, CDs require customers to keep their funds locked in for a fixed period. This commitment allows the institution to plan and allocate the funds effectively for the predetermined duration, knowing that the funds will not be withdrawn prematurely.

Despite the higher minimum balance requirements, CDs offer several advantages to savers. The fixed term of the CD provides stability and guarantees a specific interest rate for the duration of the deposit. This means that individuals can have peace of mind knowing exactly how much interest they will earn over time.

CDs are also considered low-risk investments, as they are typically insured by the FDIC up to the maximum allowed by law. This insurance protects individuals in case the financial institution fails or experiences financial difficulties.

If you have the funds to meet the minimum balance requirement of a CD, it can be a suitable option for short-term savings goals or to diversify your savings portfolio. However, it’s important to carefully consider the duration of the CD term, as withdrawing the funds before the term ends can result in penalties and a loss of interest.

To find the right CD, it’s advisable to compare offerings from different financial institutions, including their interest rates, minimum balance requirements, and terms. This way, you can choose a CD that aligns with your financial goals and circumstances.

Now that we have explored CDs, let’s move on to another savings vehicle with a high minimum balance requirement, money market accounts.

Money Market Accounts

Money market accounts are a type of savings vehicle that typically requires a high minimum balance. These accounts offer a combination of features from both checking and savings accounts, making them a popular choice for individuals seeking higher interest rates while maintaining access to their funds.

One distinguishing characteristic of money market accounts is that they generally offer higher interest rates compared to traditional savings accounts. However, these higher rates often come with a higher minimum balance requirement.

The minimum balance requirements for money market accounts can vary depending on the financial institution and the specific account terms. While some institutions may require a minimum balance of a few hundred dollars, others may have higher thresholds that range from several thousand to tens of thousands of dollars.

The reason for the higher minimum balance requirement is that money market accounts allow financial institutions to invest the deposited funds in various low-risk securities such as short-term government bonds and certificates of deposit. By requiring a higher minimum balance, institutions can ensure that they have a substantial amount of funds to invest, generate income, and offer competitive interest rates.

In addition to the higher interest rates, money market accounts often come with other benefits such as limited, but still available, check-writing abilities. This feature makes them more flexible than traditional savings accounts, as individuals can make payments directly from their money market accounts up to a certain number of transactions per month.

It’s important to note that money market accounts are subject to regulatory restrictions on the number of monthly transactions and withdrawals. Financial institutions may charge fees for exceeding these limits, so it’s crucial to review the account terms and restrictions before opening the account.

Money market accounts can be an ideal choice for individuals who have a higher amount of savings and want a balance of accessibility and higher interest rates. By meeting the minimum balance requirement, individuals can take advantage of the increased interest rates and potentially earn more on their savings compared to traditional savings accounts.

To find the right money market account, it’s advisable to compare offerings from different financial institutions, considering factors such as interest rates, minimum balance requirements, check-writing privileges, and associated fees.

Now that we have explored money market accounts, let’s move on to another savings vehicle that is typically associated with a high minimum balance requirement – individual retirement accounts (IRAs).

Individual Retirement Accounts (IRAs)

Individual Retirement Accounts (IRAs) are specialized savings vehicles designed to help individuals save for retirement. IRAs offer tax advantages, allowing individuals to grow their retirement savings in a tax-efficient manner. While IRAs do not have strict minimum balance requirements, some financial institutions may set their own thresholds for opening an account or investing in certain assets within the IRA.

IRAs come in two main types: Traditional IRAs and Roth IRAs. Traditional IRAs allow individuals to make tax-deductible contributions, which can help reduce their taxable income in the year of contribution. The earnings in a Traditional IRA are tax-deferred, meaning they are not subject to taxes until the funds are withdrawn during retirement.

Roth IRAs, on the other hand, are funded with after-tax contributions. This means that contributions to a Roth IRA are not tax-deductible in the year they are made. However, the earnings in a Roth IRA grow tax-free, and qualified withdrawals in retirement are tax-free as well.

While IRAs themselves do not have strict minimum balance requirements, the investments within the IRA may have minimums set by the financial institutions or the investment products themselves. For example, some mutual funds may require a specific minimum investment amount to be held within the IRA.

It’s important to note that IRAs have contribution limits set by the IRS each year, which determine how much individuals can contribute to their account annually. These limits may vary depending on factors such as age, income, and employment status. Individuals should be mindful of these contribution limits to ensure they comply with the IRS regulations.

Choosing the right IRA and meeting any minimum balance requirements is important for long-term retirement planning. By contributing to an IRA and meeting the requirements, individuals can benefit from tax advantages and potentially grow their savings more effectively for retirement.

When considering an IRA, individuals should carefully evaluate their financial goals, investment time horizon, and risk tolerance. It’s generally advised to consult with a financial advisor to determine the most suitable IRA and investment strategy based on individual circumstances.

Now that we have explored individual retirement accounts (IRAs), let’s move on to the factors to consider when choosing a savings vehicle.

Factors to Consider When Choosing Savings Vehicles

When it comes to choosing the right savings vehicle, there are several factors that individuals should consider to ensure it aligns with their goals and financial circumstances. By evaluating these factors, individuals can make an informed decision and select the most suitable savings vehicle for their needs. Here are some key factors to consider:

1. Minimum Balance Requirements

One of the first factors to consider is the minimum balance requirement of the savings vehicle. Determine if you can comfortably meet the minimum balance or if it aligns with your current financial situation. Be aware that failing to maintain the minimum balance may result in fees or the loss of certain benefits.

2. Interest Rates

Compare the interest rates offered by different savings vehicles. Higher interest rates can significantly impact the growth of your savings over time. Look for accounts that offer competitive rates to maximize your earnings.

3. Access to Funds

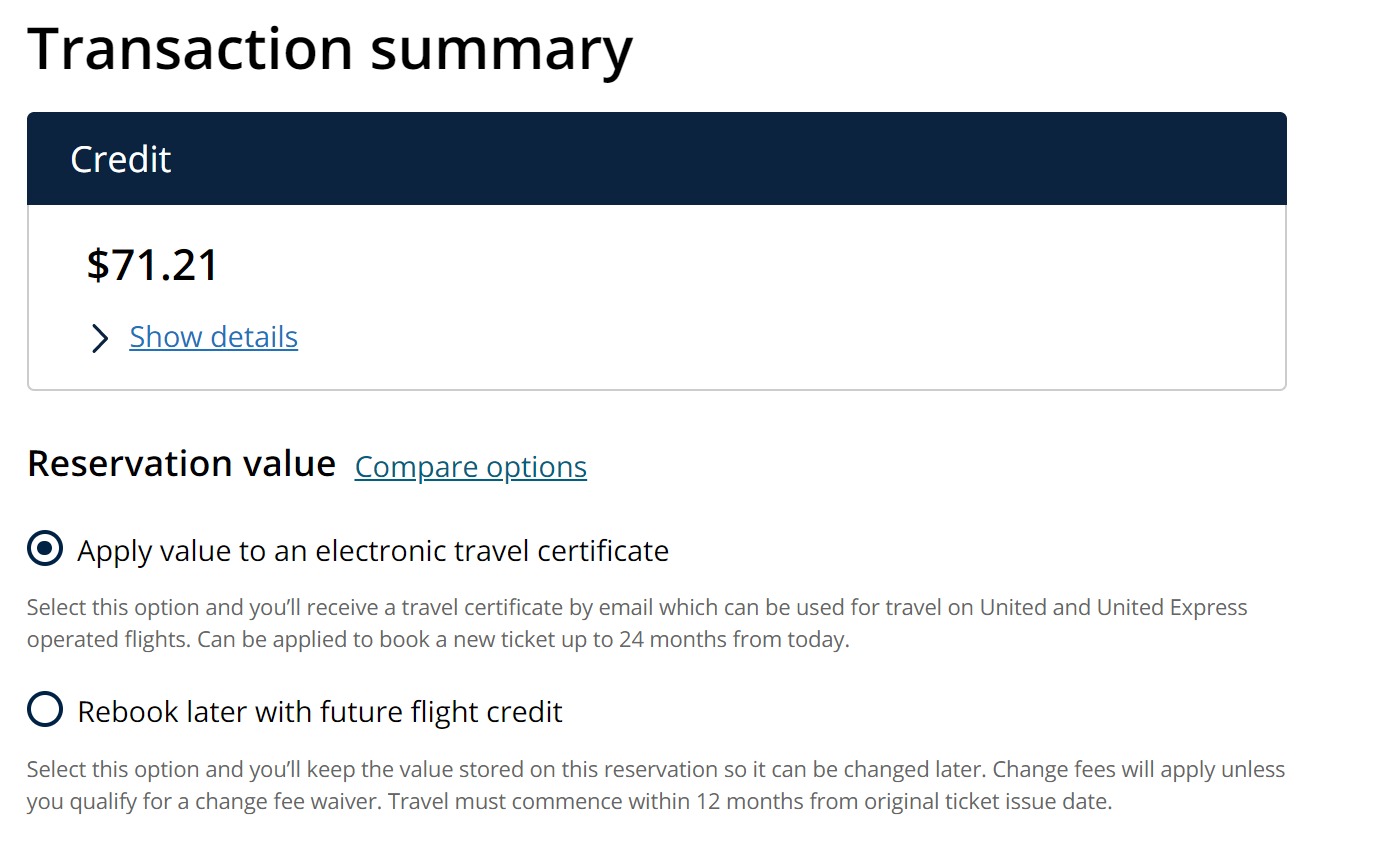

Consider how easily you can access your funds when needed. Some savings vehicles, like regular savings accounts, provide easy access for withdrawals and deposits. Others, such as CDs, may have penalties for early withdrawals. Evaluate your financial goals and determine if you need immediate access to your funds or can afford to lock them in for a specific period.

4. Risk Tolerance

Assess your risk tolerance when choosing a savings vehicle. Some options, like high-yield savings accounts and money market accounts, offer relative stability and low risk. Others, like investments in the stock market, may carry higher risk but potentially higher returns. Consider your risk tolerance and choose a savings vehicle that aligns with your comfort level.

5. Tax Considerations

Be aware of any potential tax implications related to the savings vehicle. For example, IRAs offer tax advantages for retirement savings, while regular savings accounts may be subject to taxable interest. Consult with a tax advisor to understand the tax consequences of different savings vehicles.

6. Financial Institution Reputation

Research the reputation and stability of the financial institution offering the savings vehicle. Look for institutions that are established, reputable, and FDIC-insured to ensure the safety of your deposits.

It’s important to note that these factors are not mutually exclusive, and the choice of a savings vehicle may involve trade-offs depending on individual circumstances. Consider your specific goals, time horizon, and financial situation to select the most appropriate savings vehicle that meets your needs.

Now that we have discussed the factors to consider when choosing a savings vehicle, let’s conclude our exploration.

Conclusion

Choosing the right savings vehicle is an important decision that can have a significant impact on your financial journey. While some savings vehicles require a high minimum balance, they often offer greater benefits such as higher interest rates and potential returns. Understanding the different types of savings vehicles and their associated minimum balance requirements empowers individuals to make informed choices that align with their goals and financial capacity.

High-yield savings accounts, certificates of deposit (CDs), money market accounts, and individual retirement accounts (IRAs) are examples of savings vehicles that typically have high minimum balance requirements. Each of these options comes with its own features, advantages, and considerations that individuals should evaluate based on their unique financial situations and objectives.

Considering factors such as minimum balance requirements, interest rates, accessibility of funds, risk tolerance, tax implications, and the reputation of the financial institution helps individuals choose the most suitable savings vehicle. By doing thorough research and comparing options, individuals can make confident decisions that support their short-term and long-term financial goals.

It’s important to keep in mind that financial circumstances can change over time. Regularly reviewing and reassessing your savings vehicle choices is essential to ensure they continue to align with your evolving needs and objectives. Consulting with financial advisors can provide valuable guidance and expertise when navigating the world of savings vehicles.

Remember, the path to financial well-being and achieving your goals starts with finding the right savings vehicle that can help you effectively grow and manage your savings. By considering the factors discussed in this article, you can make informed decisions and embark on a successful savings journey.