Home>Finance>How Do I Find My Stride Online Banking ID Number

Finance

How Do I Find My Stride Online Banking ID Number

Modified: December 30, 2023

Find your Stride online banking ID number easily with our simple guide. Access your finances and take control of your accounts with confidence.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Online Banking ID Number

- Why is the Online Banking ID Number important?

- How to Find your Online Banking ID Number

- Option 1: Check your Bank Statement

- Option 2: Call the Customer Service

- Option 3: Visit a Branch in Person

- Option 4: Use the Bank’s Mobile App or Website

- Option 5: Resetting or Retrieving your Online Banking ID Number

- Conclusion

Introduction

Welcome to the digital age where convenience and efficiency reign supreme. With the rise of technology, the world of banking has undergone a major transformation, making it easier than ever for individuals to access and manage their finances online. Online banking offers a wide range of benefits, from the ability to check account balances and make transfers at any time, to the convenience of paying bills with just a few clicks.

However, to fully reap the benefits of online banking, you need to have an Online Banking ID Number. This unique identifier acts as your virtual key, granting you access to your online banking account and ensuring the security of your personal and financial information. Without it, navigating the online banking world can be challenging and frustrating.

In this article, we’ll dive deeper into the importance of the Online Banking ID Number, as well as provide you with various methods to find or retrieve it when needed. Whether you’re a seasoned online banking user or new to the digital banking realm, understanding how to find and utilize your Online Banking ID Number is crucial for managing your finances effectively and securely.

Understanding Online Banking ID Number

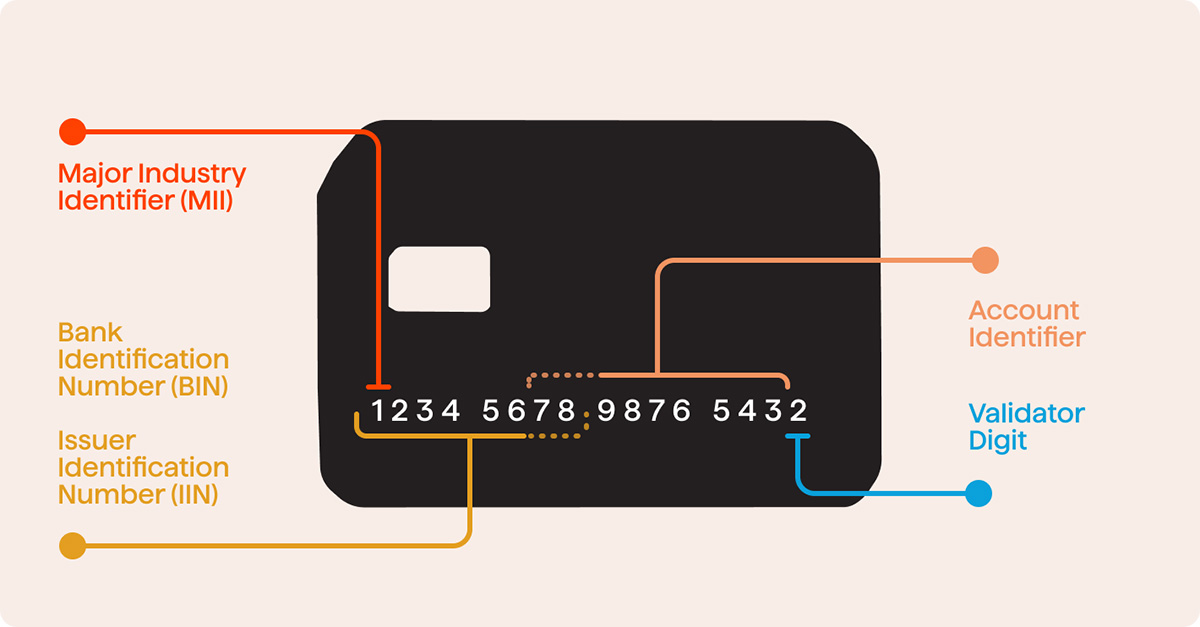

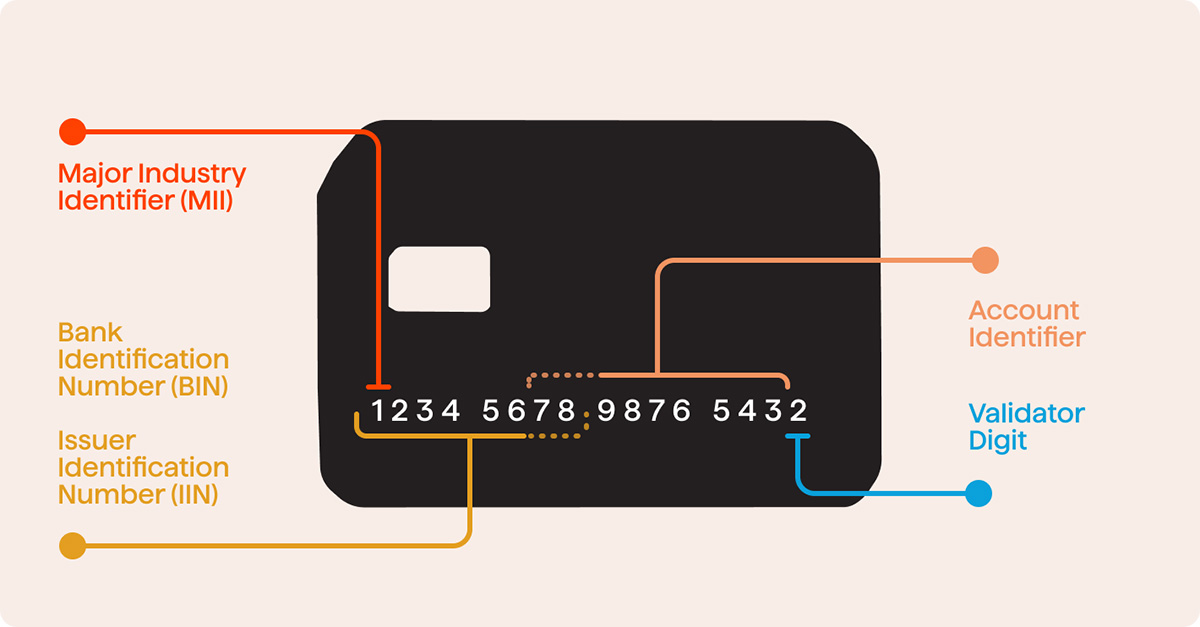

The Online Banking ID Number, sometimes referred to as the Online Banking User ID, is a unique identifier assigned to each individual who registers for online banking. Think of it as your username or login credentials that grant you access to your online banking account.

This ID number is typically provided by your bank when you sign up for online banking services. It may consist of a series of letters, numbers, or a combination of both. While the specific format may vary depending on the bank, the purpose remains the same – to ensure the security of your online banking activities.

It’s important to note that the Online Banking ID Number is different from other banking credentials, such as your account number or debit card number. While these other numbers are used for specific transactions, the Online Banking ID Number is solely for accessing your online banking portal.

Additionally, the Online Banking ID Number is typically unique to each individual and should not be shared with anyone. Treat it as a confidential piece of information, much like your password, to prevent unauthorized access to your online banking account and to protect your personal and financial data.

Now that we have a better understanding of what the Online Banking ID Number is, let’s explore why it is important and how it plays a crucial role in online banking.

Why is the Online Banking ID Number important?

The Online Banking ID Number is a fundamental component of online banking and serves several important purposes. Understanding its significance can help you appreciate the value it adds to your online banking experience.

1. Secure Access: The Online Banking ID Number acts as a gatekeeper for your online banking account, ensuring that only authorized individuals can access your financial information. By requiring a unique identifier, banks add an extra layer of security to protect against unauthorized access and potential fraud.

2. Personalized Experience: Your Online Banking ID Number allows you to personalize your online banking experience. Once you log in, you can view your account information, transaction history, and customize your settings based on your preferences. This personalized approach enhances usability and makes managing your finances online more convenient.

3. Simplified Transactions: With an Online Banking ID Number, you can perform various transactions online, such as transferring funds between accounts, paying bills, and managing direct deposits. The ID Number streamlines these processes, eliminating the need for physical paperwork or visits to the bank, saving you time and effort.

4. Account Security: The Online Banking ID Number plays a crucial role in protecting your account from unauthorized changes or activities. It acts as a unique identifier that ensures only you can make changes, update personal information, or access account details. This added security measure helps safeguard your financial well-being.

5. Customer Support: When seeking assistance from customer support representatives, you may be asked to provide your Online Banking ID Number to verify your identity. By doing so, banks can ensure that they are providing assistance to the correct account holder, providing an extra layer of protection and privacy.

Ultimately, the Online Banking ID Number is important because it grants you secure and personalized access to your online banking account, simplifies transactions, enhances account security, and enables efficient customer support. Understanding its significance will assist you in utilizing online banking services effectively and securely.

How to Find your Online Banking ID Number

If you’ve misplaced or forgotten your Online Banking ID Number, don’t worry! There are several options available to help you retrieve or find this crucial piece of information. Here are some methods you can try:

1. Check your Bank Statement: One of the easiest ways to find your Online Banking ID Number is by checking your bank statement. Your ID Number may be listed on the statement, along with other account information. Look for a section that specifically mentions your online banking details.

2. Call the Customer Service: Contacting your bank’s customer service is another reliable option. They have access to your account information and can provide you with your Online Banking ID Number. Take note that you may need to verify your identity by providing personal details or answering security questions.

3. Visit a Branch in Person: If you prefer a more hands-on approach, you can visit your bank’s branch in person. A bank representative can assist you in retrieving your Online Banking ID Number. Make sure to bring a valid ID and any necessary account information for verification purposes.

4. Use the Bank’s Mobile App or Website: Many banks provide convenient options for finding your Online Banking ID Number through their mobile apps or websites. Log in to your account using your login credentials and navigate to the account settings or profile section. Here, you may find your Online Banking ID Number listed.

5. Resetting or Retrieving your Online Banking ID Number: If none of the above methods yield your Online Banking ID Number, there may be a process for resetting or retrieving it. This process varies by bank, but typically involves following the instructions on the bank’s website or contacting customer support for guidance. Be prepared to provide personal information and answer security questions to verify your identity.

No matter which method you choose, it’s important to exercise caution and prioritize security when retrieving your Online Banking ID Number. Avoid sharing personal information or Online Banking ID Number through unsecured channels such as email or social media.

Once you’ve successfully retrieved your Online Banking ID Number, make a note of it in a secure place. Consider using a password manager or encrypted file to store this information, ensuring its accessibility while maintaining its security.

Remember, your Online Banking ID Number is a key to accessing your online banking account, so treat it with the same level of caution as your password or other sensitive information.

Option 1: Check your Bank Statement

One of the easiest and quickest ways to find your Online Banking ID Number is by checking your bank statement. Most banks include important account information, such as your Online Banking ID Number, on their statements.

Here’s how you can locate your Online Banking ID Number on your bank statement:

- Retrieve your most recent bank statement. This can either be a physical copy that you received in the mail or an electronic statement that you can access through your online banking portal.

- Take a close look at the statement, specifically focusing on sections that contain your account details.

- In many cases, you’ll find your Online Banking ID Number listed alongside your account information, such as your account number, balance, and transaction history.

- Make a note of your Online Banking ID Number and store it in a secure location for future reference.

If you can’t find your bank statement or your Online Banking ID Number is not listed, there’s no need to panic. Simply move on to the next option to retrieve your Online Banking ID Number.

Checking your bank statement is a convenient method, as it allows you to find your Online Banking ID Number without having to reach out to customer support or visit a branch. However, it’s important to note that this method may not be suitable if you need your Online Banking ID Number quickly, as you may need to wait for your next statement to arrive.

Remember to keep your bank statements secure and dispose of them properly, whether by shredding physical copies or deleting electronic copies from your devices. Safeguarding your bank statements helps protect your personal and financial information from falling into the wrong hands.

Option 2: Call the Customer Service

If you need immediate assistance in retrieving your Online Banking ID Number, one of the most effective ways is to call your bank’s customer service hotline. The customer service representatives are trained to handle such requests and can provide you with the necessary information.

To retrieve your Online Banking ID Number through customer service, follow these steps:

- Locate the customer service phone number for your bank. This can usually be found on your bank’s website, mobile app, or on the back of your debit or credit card.

- Call the customer service hotline and be prepared to answer a series of security questions to verify your identity. This is done to protect your account from unauthorized access.

- Once you have passed the security verification process, inform the representative that you need assistance in retrieving your Online Banking ID Number.

- The customer service representative will guide you through the process and provide you with your Online Banking ID Number.

- Make a note of your Online Banking ID Number and store it securely for future reference.

When contacting customer service, it’s best to call during their operating hours to ensure a prompt and efficient response. Be patient as you may experience some wait time, especially during peak hours.

Remember to have your identification documents handy, such as your account number, social security number, or other information requested by the customer service representative, as they may require these details to verify your identity.

Calling customer service is a reliable and convenient option, especially if you need your Online Banking ID Number urgently. The customer service representatives are there to assist you and provide the necessary support you need to access your online banking account.

Option 3: Visit a Branch in Person

If you prefer a more hands-on approach or face-to-face interaction, visiting your bank’s branch in person is an excellent option for retrieving your Online Banking ID Number.

Here’s a step-by-step guide on how to retrieve your Online Banking ID Number by visiting a branch:

- Find the nearest branch of your bank. This information can usually be found on your bank’s website or mobile app.

- Plan your visit during the bank’s operating hours, ensuring that you have enough time to speak with a bank representative and complete the necessary process.

- Bring proper identification documents, such as your government-issued ID, passport, or driver’s license. These documents will be required to verify your identity.

- Upon arrival at the bank branch, inform a bank representative that you need assistance in retrieving your Online Banking ID Number.

- The bank representative will guide you through the necessary steps, which may involve filling out a form or providing additional personal information for verification purposes.

- After confirming your identity, the bank representative will provide you with your Online Banking ID Number.

- Make sure to make a note of your Online Banking ID Number and store it securely for future reference.

Visiting a branch in person allows you to receive immediate assistance and interact directly with a bank representative. They can answer any additional questions you may have and provide personalized guidance regarding your Online Banking ID Number.

Keep in mind that visiting a branch may require more time and effort compared to other methods, so be prepared to wait in line or schedule an appointment in advance if necessary. However, this option can be highly beneficial if you prefer face-to-face communication and value the assistance of a bank representative.

Remember to bring all the necessary documents and be patient throughout the process. Your Online Banking ID Number is a vital piece of information, and visiting a branch ensures that you retrieve it in a secure and reliable manner.

Option 4: Use the Bank’s Mobile App or Website

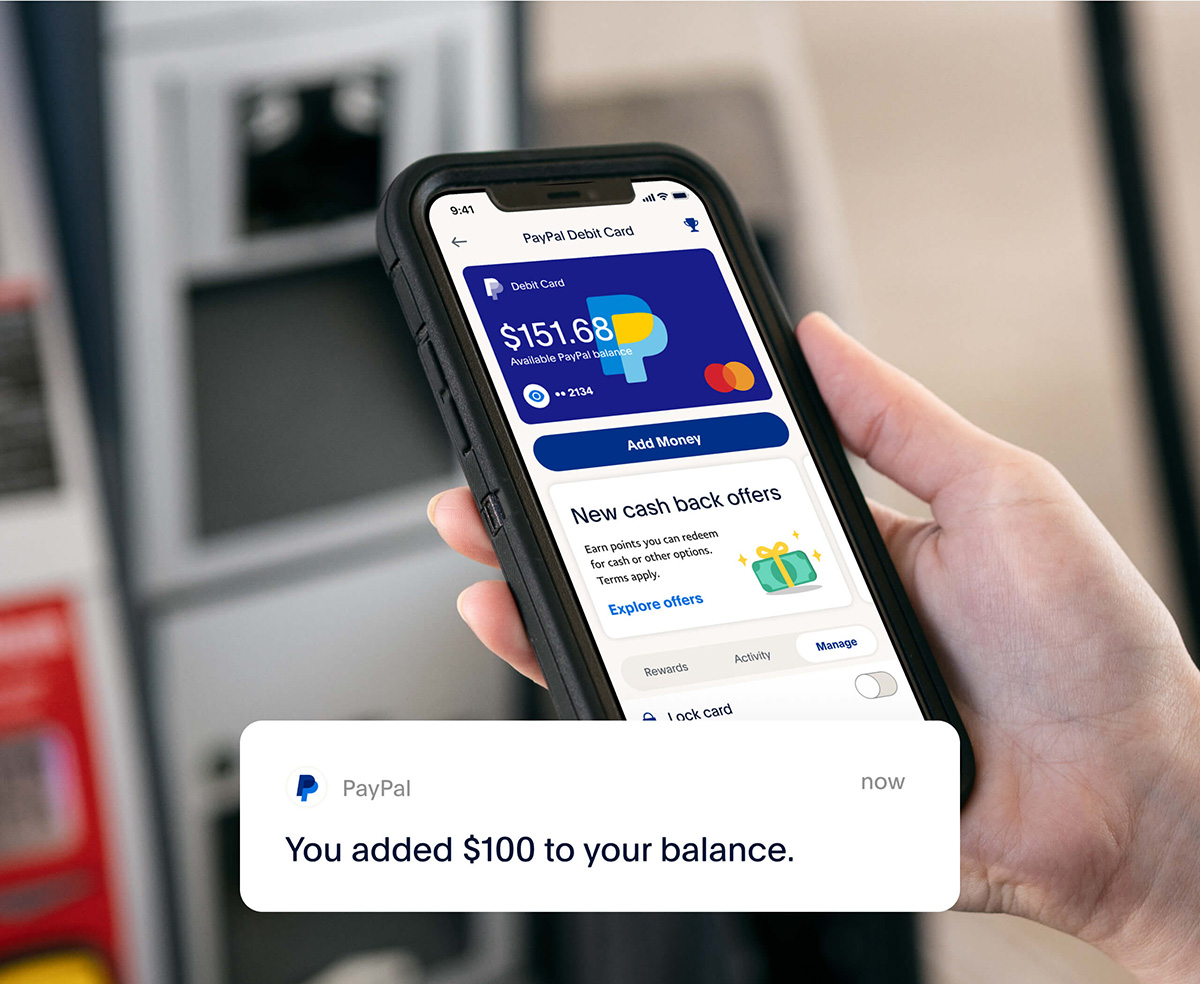

With the advancement of technology, many banks now offer the convenience of accessing your Online Banking ID Number through their mobile apps or websites. This option allows you to retrieve your Online Banking ID Number quickly and conveniently from the comfort of your own device.

Here’s how you can find your Online Banking ID Number using the bank’s mobile app or website:

- Ensure that you have downloaded and installed your bank’s official mobile app from the app store, or navigate to your bank’s website using a web browser on your device.

- Launch the mobile app or access the website and enter your login credentials. This typically includes your username and password.

- Once logged in, navigate to the account settings or profile section of the mobile app or website. Look for an option specifically related to your online banking ID or user ID.

- Click on the relevant option, and your Online Banking ID Number should be displayed on the screen.

- Make a note of your Online Banking ID Number and store it securely for future reference.

If you encounter any difficulties or cannot find the specific option within the mobile app or website, consult the app’s or website’s user guide or FAQ section for further instructions.

Using the bank’s mobile app or website provides a convenient and efficient means of retrieving your Online Banking ID Number. It eliminates the need to contact customer service or visit a branch, saving you time and effort.

Remember to always keep your login credentials and device secure. Protect your Online Banking ID Number by using strong and unique passwords, activating biometric authentication, and ensuring the security of your mobile device or computer.

Using the bank’s mobile app or website to find your Online Banking ID Number is a user-friendly option, designed to provide you with easy access to your online banking information.

Option 5: Resetting or Retrieving your Online Banking ID Number

If you have exhausted the previous options and still can’t find your Online Banking ID Number, don’t worry. Many banks provide a process for resetting or retrieving your Online Banking ID Number. This option ensures that you can regain access to your online banking account and obtain your ID Number.

Here’s how you can reset or retrieve your Online Banking ID Number:

- Visit your bank’s official website and navigate to the online banking login page.

- Look for the “Forgot Online Banking ID” or “Retrieve Online Banking ID” option. This may be located near the login section or within the online banking support or help section.

- Click on the appropriate option to initiate the process of resetting or retrieving your Online Banking ID Number.

- Follow the instructions provided by the bank. This may involve entering personal information, answering security questions, or providing verification details to confirm your identity.

- Once your identity is verified, the bank will provide you with your Online Banking ID Number.

- Make sure to make a note of your Online Banking ID Number and store it securely for future reference.

If you cannot find the necessary information or instructions on the bank’s website, consider reaching out to their customer service for guidance. They can assist you in the process of resetting or retrieving your Online Banking ID Number.

It’s important to note that the process for resetting or retrieving your Online Banking ID Number may vary depending on the bank’s policies and procedures. Some banks may require additional steps or documentation to complete the process.

Remember to keep your personal information confidential and be cautious of providing sensitive information through unsecured channels. Utilize the bank’s official website or trusted communication channels to ensure the security of your information.

By utilizing the bank’s process for resetting or retrieving your Online Banking ID Number, you can regain access to your online banking account and continue managing your finances effectively and securely.

Conclusion

Understanding and accessing your Online Banking ID Number is crucial for navigating the world of online banking effectively and securely. With this unique identifier, you can access your online banking account, personalize your experience, and conduct various transactions conveniently. If you find yourself needing to retrieve or find your Online Banking ID Number, you have several options available.

Checking your bank statement is a convenient starting point, as it often includes your Online Banking ID Number alongside other account details. Calling customer service provides personalized assistance and immediate access to your ID Number. Visiting a branch in person allows for face-to-face interaction with a bank representative who can assist you in retrieving your ID Number. Using the bank’s mobile app or website offers a convenient self-service option. Lastly, if all else fails, the bank’s process for resetting or retrieving your Online Banking ID Number ensures that you can regain access to your online banking account.

Regardless of the option you choose, prioritizing security is essential. Treat your Online Banking ID Number as a confidential piece of information, protect your personal and financial data, and be cautious of sharing information through unsecured channels.

By understanding the importance of your Online Banking ID Number and utilizing the available options, you can successfully retrieve or find your ID Number and continue to manage your finances effectively and securely in the online banking world.

Maintaining awareness of your Online Banking ID Number, along with other best practices for online banking security, helps ensure a smooth, convenient, and safe banking experience.