Home>Finance>What Is The Minimum Requirements For Car Insurance In Maryland

Finance

What Is The Minimum Requirements For Car Insurance In Maryland

Published: November 24, 2023

Learn about the minimum car insurance requirements in Maryland and ensure your finances are protected. Find out what you need to drive legally in MD.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Car Insurance Requirements in Maryland

- Bodily Injury Liability Coverage

- Property Damage Liability Coverage

- Personal Injury Protection (PIP) Coverage

- Uninsured/Underinsured Motorist Coverage

- Additional Optional Coverages

- Penalties for Driving Without Insurance in Maryland

- Conclusion

Introduction

Car insurance is a necessity when it comes to owning and operating a vehicle. Not only does it provide financial protection in the event of an accident, but it is also required by law in most states, including Maryland. Understanding the minimum requirements for car insurance in Maryland is essential for any driver in the state.

Car insurance requirements vary from state to state, and it’s important to know what is expected of you as a driver in Maryland. Failing to meet the minimum car insurance requirements can result in fines, license suspension, or even legal trouble. To avoid these consequences, it is crucial to familiarize yourself with the specific requirements set forth by the state.

In Maryland, drivers are required to carry liability insurance, which covers bodily injury and property damage caused to others in an accident. Additionally, the state requires personal injury protection and uninsured/underinsured motorist coverage to provide additional protection for you and your vehicle.

It’s worth noting that while these are the minimum requirements set by the state, many drivers choose to opt for higher coverage limits or additional optional coverages to further protect themselves and their vehicles. Understanding the options available to you can help you make an informed decision when selecting car insurance.

In this article, we will delve deeper into the car insurance requirements in Maryland, exploring the specific coverage types and minimum limits set by the state. We will also discuss the penalties for driving without insurance and the consequences that may arise from non-compliance. By the end of this article, you will have a comprehensive understanding of what is expected of you as a driver in terms of car insurance in the state of Maryland.

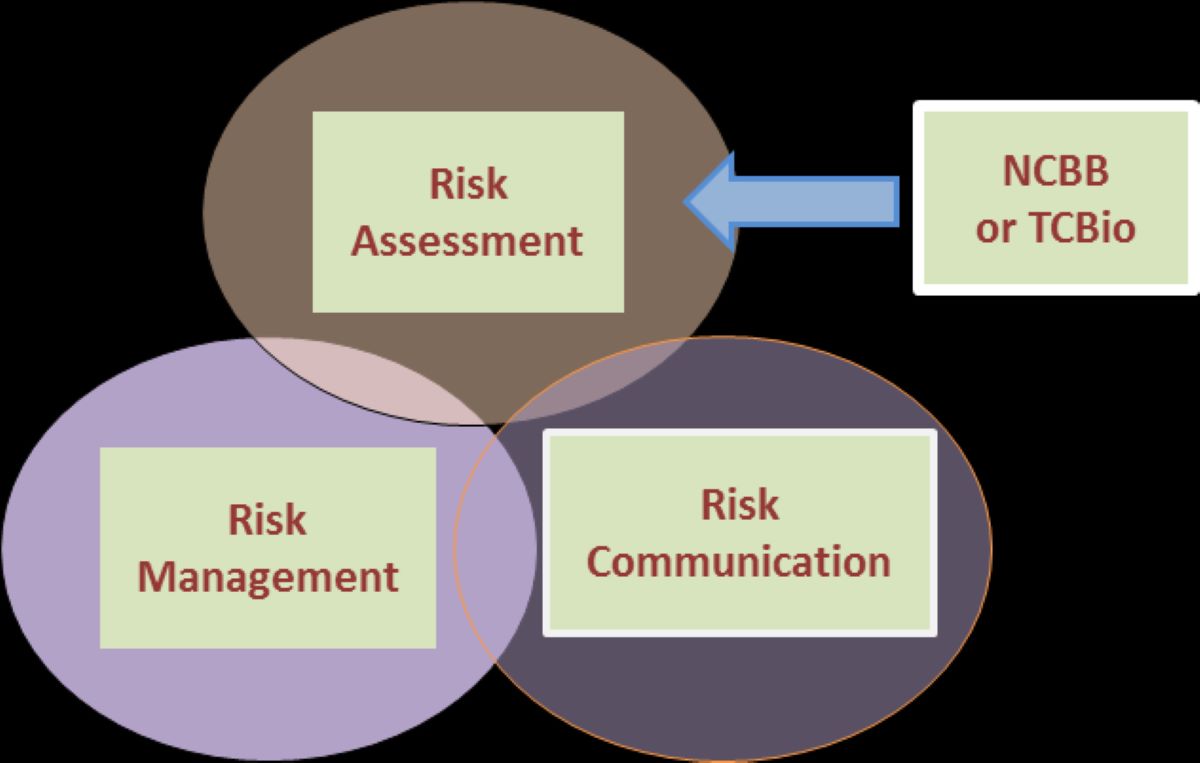

Understanding Car Insurance Requirements in Maryland

When it comes to car insurance, Maryland has specific requirements that all drivers must adhere to. These requirements are set in place to ensure that drivers have adequate financial protection in the event of an accident. Understanding these requirements is crucial to ensure compliance with the law and safeguard yourself and others on the road.

The primary car insurance requirement in Maryland is liability coverage. Liability coverage consists of two components: bodily injury liability coverage and property damage liability coverage.

Bodily injury liability coverage is designed to cover medical expenses, lost wages, and other damages if you cause an accident that results in injuries to another person. In Maryland, the minimum required bodily injury liability coverage is $30,000 per person and $60,000 per accident. This means that if you are at fault in an accident and cause injuries, your insurance will cover up to $30,000 for each injured individual, with a maximum limit of $60,000 per accident.

Property damage liability coverage, on the other hand, covers the cost of repairing or replacing another person’s property that you damage in an accident. The minimum required property damage liability coverage in Maryland is $15,000. This coverage ensures that if you are at fault in an accident and cause damage to someone else’s vehicle or property, your insurance will cover up to $15,000 to repair or replace their property.

In addition to liability coverage, Maryland also requires drivers to carry personal injury protection (PIP) coverage. PIP coverage is designed to provide medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident. The minimum required PIP coverage in Maryland is $2,500.

Another essential coverage required in Maryland is uninsured/underinsured motorist coverage (UM/UIM). This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. The minimum required UM/UIM coverage in Maryland is $30,000 per person and $60,000 per accident, matching the bodily injury liability coverage limits.

It’s important to note that these are the minimum required coverages in Maryland. Many drivers choose to opt for higher coverage limits or additional optional coverages to provide increased protection. Discussing your specific needs with an insurance agent can help you determine the appropriate coverage amounts for your situation.

Now that we have a better understanding of the car insurance requirements in Maryland, let’s explore some additional optional coverages you may want to consider to further protect yourself and your vehicle.

Bodily Injury Liability Coverage

Bodily injury liability coverage is a crucial component of car insurance in Maryland. This coverage is designed to protect you financially if you cause an accident that results in injuries to another person. It helps cover medical expenses, lost wages, and other related costs that may arise as a result of the accident.

In Maryland, the minimum required bodily injury liability coverage is $30,000 per person and $60,000 per accident. This means that if you are at fault in an accident and cause injuries to others, your insurance will cover up to $30,000 for each injured individual, with a maximum limit of $60,000 per accident. It’s important to note that these are just the minimum limits, and you may choose to opt for higher coverage limits for added protection.

Having adequate bodily injury liability coverage is essential because it helps protect your assets in the event of a lawsuit. If you cause an accident and the injured party decides to pursue legal action, your insurance can help cover the legal expenses and any resulting settlements or judgments. Without sufficient coverage, you may be personally responsible for paying for these costs, which can be financially devastating.

It’s worth noting that bodily injury liability coverage extends beyond just medical expenses. It can also cover other costs such as rehabilitation, pain and suffering, and even funeral expenses in the case of a fatal accident. Having this coverage in place ensures that you are not held personally liable for these expenses, providing peace of mind and financial protection.

When selecting bodily injury liability coverage, it’s important to consider factors such as your financial situation and assets. If you have significant assets, it’s advisable to opt for higher coverage limits to protect those assets in case of a severe accident. Additionally, if you frequently drive with passengers, having adequate coverage is crucial to protect both yourself and your passengers in the event of an accident.

Remember that car insurance is not just about meeting the minimum requirements set by the state. It’s about ensuring that you have the necessary protection to handle any unforeseen circumstances and protect your financial well-being. Discussing your needs and concerns with an insurance agent can help you determine the appropriate bodily injury liability coverage for your specific situation.

Next, let’s dive into another important coverage requirement in Maryland, which is property damage liability coverage.

Property Damage Liability Coverage

Property damage liability coverage is a crucial aspect of car insurance in Maryland. This coverage helps protect you financially in case you cause an accident that results in damage to someone else’s property, such as their vehicle or other physical structures.

In Maryland, the minimum required property damage liability coverage is $15,000. This means that if you are at fault in an accident and cause damage to someone else’s property, your insurance will cover up to $15,000 to repair or replace their property.

Property damage liability coverage is important because it helps ensure that you are not financially responsible for the full cost of repairing or replacing someone else’s property that you damaged in an accident. Without this coverage, you may have to pay for these expenses out of pocket, which can be a significant financial burden.

This coverage extends beyond just damage to other vehicles. It also covers damage to buildings, fences, utility poles, and any other physical structures that may be involved in the accident. Having property damage liability coverage gives you peace of mind, knowing that you are protected from the potential financial consequences of damaging someone else’s property in an accident.

It’s important to note that property damage liability coverage does not cover damage to your own vehicle or property. For that, you would need collision and comprehensive coverage, which are optional coverages that you can add to your policy.

When determining the appropriate property damage liability coverage, it’s important to consider factors such as the value of the property you may potentially damage and the potential legal costs that may arise from such incidents. If you frequently drive in areas with expensive vehicles or travel through areas with valuable property, it may be wise to consider higher coverage limits for added protection.

Remember that car insurance requirements are set to protect both you and other drivers on the road. By having adequate property damage liability coverage, you can fulfill your financial obligations in case of an accident and ensure that you are prepared for any unexpected events.

Now let’s move on to the next required coverage in Maryland, which is Personal Injury Protection (PIP) coverage.

Personal Injury Protection (PIP) Coverage

Personal Injury Protection (PIP) coverage is a mandatory requirement for car insurance in Maryland. This coverage is designed to provide medical expenses and lost wages for you and your passengers in the event of an accident, regardless of who is at fault.

In Maryland, the minimum required PIP coverage is $2,500. This means that if you or your passengers sustain injuries in an accident, your insurance will cover up to $2,500 for medical expenses and lost wages.

PIP coverage is essential because it ensures that you and your passengers receive prompt medical attention and necessary treatment, regardless of the circumstances of the accident. It helps cover expenses such as ambulance fees, hospitalization, doctor’s visits, surgeries, and rehabilitation services.

Additionally, PIP coverage provides coverage for lost wages if you or your passengers are unable to work due to injuries sustained in the accident. This can alleviate financial strain during the recovery period and ensure that you can maintain your financial obligations.

It’s important to note that PIP coverage applies to injuries sustained by you and your passengers, but it does not cover injuries sustained by other parties involved in the accident. For this reason, it is crucial to have liability coverage in place to protect yourself from potential lawsuits or claims made by others involved in the accident.

PIP coverage is typically a no-fault coverage, meaning that it applies regardless of who is responsible for the accident. This ensures that you and your passengers receive the necessary medical attention and compensation without having to negotiate with the at-fault driver’s insurance company.

When considering PIP coverage, it’s important to evaluate your personal circumstances. Factors such as your health insurance coverage, the nature of your work, and potential medical expenses should be taken into account. If you have a comprehensive health insurance plan that covers accident-related injuries, you may choose to have lower PIP coverage. However, if you have limited health insurance coverage or work in a field with a higher risk of injuries, it may be beneficial to opt for higher PIP coverage limits.

Understanding the importance of PIP coverage and how it can protect you and your passengers in the event of an accident is crucial. By having the appropriate PIP coverage, you can ensure that medical expenses and lost wages are taken care of and focus on recovering without financial stress.

Next, let’s explore the requirement for uninsured/underinsured motorist coverage in Maryland.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is a vital component of car insurance in Maryland. This coverage protects you and your vehicle in the event of an accident with a driver who either doesn’t have insurance or does not have enough insurance to cover your damages.

In Maryland, UM/UIM coverage is required, and the minimum limits are the same as the bodily injury liability coverage limits: $30,000 per person and $60,000 per accident. This means that if you are involved in a car accident caused by an uninsured or underinsured driver, your insurance will cover up to $30,000 per individual, with a maximum limit of $60,000 per accident.

The purpose of UM/UIM coverage is to ensure that you are not left financially responsible for medical expenses, property damage, and other losses caused by an uninsured or underinsured driver. It provides an added layer of protection in case the at-fault driver does not have sufficient coverage or any coverage at all.

Unfortunately, not all drivers on the road carry the required liability insurance, despite it being a legal requirement. In the event of an accident with one of these drivers, UM/UIM coverage can save you from significant financial hardships. It can help cover your medical expenses, vehicle repairs, and other losses that result from the accident.

UM/UIM coverage also extends to hit-and-run accidents. If you are involved in a hit-and-run accident where the at-fault driver flees the scene and cannot be identified, your UM/UIM coverage can step in to provide the necessary coverage for your damages.

Having UM/UIM coverage is essential, as it ensures that you are protected even when the other driver fails to meet their financial obligations. It provides peace of mind and financial security, allowing you to focus on your recovery rather than dealing with the financial burden of the accident.

When considering UM/UIM coverage, it’s important to evaluate your personal circumstances, including the number of uninsured or underinsured drivers in your area and the potential risks involved. If you frequently drive in areas with a high rate of uninsured motorists or in areas with a history of hit-and-run accidents, it may be prudent to consider higher UM/UIM coverage limits.

Remember, UM/UIM coverage is not just a requirement; it is a crucial layer of protection for you and your vehicle. By having the appropriate coverage in place, you can ensure that you are prepared for any situation on the road.

Now, let’s explore some additional optional coverages that you may want to consider to enhance your car insurance protection in Maryland.

Additional Optional Coverages

While Maryland has specific requirements for car insurance coverage, it’s important to note that you have the option to add additional coverages to enhance your protection. These optional coverages can provide added peace of mind and financial security in various situations. Let’s explore some of the additional optional coverages you may want to consider.

Collision Coverage: Collision coverage helps cover the costs of repairing or replacing your vehicle if it is damaged in a collision, regardless of who is at fault. This coverage is particularly beneficial if you have a newer or more valuable vehicle. It ensures that you are not solely responsible for the costs of repairing or replacing your vehicle after an accident.

Comprehensive Coverage: Comprehensive coverage protects your vehicle from non-collision-related damages, such as theft, vandalism, natural disasters, and falling objects. This coverage is valuable for safeguarding your vehicle against unexpected events that are beyond your control.

Rental Reimbursement Coverage: Rental reimbursement coverage helps cover the cost of renting a vehicle while your car is being repaired after an accident. This coverage can be convenient and provide peace of mind by ensuring that you have transportation while your vehicle is in the shop.

Emergency Roadside Assistance: Emergency roadside assistance coverage provides services like towing, jump-starts, tire changes, and fuel delivery if your vehicle becomes disabled on the road. This coverage can be particularly helpful if you find yourself stranded due to a breakdown or other roadside emergency.

GAP Insurance: GAP insurance covers the gap between the actual cash value of your vehicle and the amount you still owe on your auto loan. This coverage is valuable if you owe more on your vehicle than its actual value, as it helps protect you from financial loss in case of a total loss accident.

Medical Payments Coverage: Medical payments coverage helps cover medical expenses for you and your passengers, regardless of who is at fault in an accident. This coverage can complement your personal health insurance and provide additional coverage for medical expenses resulting from an accident.

It’s important to consider your specific needs, budget, and level of risk when deciding which optional coverages to add to your car insurance policy. Discussing your options with an insurance agent can help you determine the most suitable coverages for your circumstances.

While these optional coverages come at an additional cost, they can provide invaluable protection and peace of mind. They offer an extra layer of financial security to ensure that you are well-protected on the road.

Now let’s discuss the penalties for driving without insurance in Maryland.

Penalties for Driving Without Insurance in Maryland

Driving without insurance is not only risky but also illegal in Maryland. The state takes car insurance requirements seriously to ensure the financial protection of its residents and other drivers on the road. Failing to maintain the required insurance coverage can result in severe penalties and consequences.

If you are caught driving without insurance in Maryland, you may face the following penalties:

- Fines: For the first offense, the fine is $150. Subsequent offenses can lead to fines of up to $2,500.

- License Suspension: Your driver’s license and vehicle registration may be suspended if you are unable to provide proof of insurance or fail to pay the fines associated with driving without insurance. The length of the suspension period can vary depending on the number of previous offenses.

- Vehicle Impoundment: In some cases, your vehicle may be impounded if you are caught driving without insurance. You will be responsible for any impound fees and related expenses.

- SR-22 Requirement: If your license and registration are suspended due to driving without insurance, you may be required to obtain an SR-22 certificate. An SR-22 is a document that verifies you have the necessary liability insurance coverage. This requirement may result in higher insurance premiums.

- Legal Consequences: Driving without insurance is a misdemeanor offense in Maryland. This means that if you are involved in an accident while uninsured, you may face legal consequences, including potential lawsuits for damages and injuries caused.

It’s important to note that these penalties and consequences are in place to discourage people from driving without the necessary insurance coverage. The aim is to protect both the insured drivers and those who may be involved in an accident with uninsured motorists.

To avoid these penalties and ensure compliance with the law, it is essential to maintain the minimum required car insurance coverage in Maryland. Regularly review your policy, ensure it meets the state’s requirements, and promptly renew or update your coverage as necessary.

Remember, car insurance is not just a legal requirement, but also a vital protection for you, your vehicle, and others on the road. By maintaining the necessary insurance coverage, you can drive with confidence, knowing that you are financially protected in case of an accident.

Now let’s conclude our discussion on car insurance requirements in Maryland.

Conclusion

Car insurance requirements in Maryland are in place to ensure that drivers have the necessary financial protection in the event of an accident. Understanding and complying with these requirements is essential for all drivers in the state.

In Maryland, the minimum car insurance requirements include bodily injury liability coverage, property damage liability coverage, personal injury protection (PIP) coverage, and uninsured/underinsured motorist coverage. These coverages provide protection for injuries and damages caused to others, as well as medical expenses and lost wages for yourself and your passengers.

While meeting the minimum requirements is mandatory, drivers have the option to add additional coverages to further protect themselves and their vehicles. Optional coverages such as collision coverage, comprehensive coverage, rental reimbursement coverage, and roadside assistance can provide additional peace of mind and financial security.

Driving without insurance in Maryland can result in significant penalties, including fines, license suspension, vehicle impoundment, and potential legal consequences. It is crucial to maintain valid and sufficient insurance coverage to avoid these penalties and ensure compliance with the law.

By understanding and meeting the car insurance requirements in Maryland, you can drive with confidence, knowing that you have the necessary protection in place. Discussing your insurance needs with an agent can help you determine the appropriate coverage limits and optional coverages for your specific situation.

Remember, car insurance is not just a legal obligation, but a crucial safeguard for yourself, your vehicle, and others on the road. By prioritizing insurance coverage and making informed decisions, you can drive safely and confidently in Maryland.

Finally, always remember to review and update your insurance policy regularly to ensure that it aligns with your needs and provides the necessary protection. Safe driving and proper insurance coverage go hand in hand to create a secure and responsible driving experience.