Finance

What Stocks Are In VTI

Published: January 17, 2024

Discover which stocks are included in VTI, a finance-focused exchange-traded fund (ETF). Stay updated with the latest financial market trends and invest wisely.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on the stocks included in VTI, one of the most popular exchange-traded funds (ETFs) in the market. VTI, short for Vanguard Total Stock Market ETF, is designed to track the performance of the CRSP US Total Market Index. It offers investors exposure to the entire U.S. equity market, covering large, mid, small, and micro-cap stocks across various sectors and industries.

Whether you’re a seasoned investor or just starting to explore the world of stock market investing, understanding the holdings within VTI can provide valuable insights into the performance and composition of this widely-traded ETF. In this article, we will take an in-depth look at the stocks that make up VTI, along with an overview of its sector allocation and historical performance.

By gaining a better understanding of the stocks held within VTI, investors can make more informed decisions, build diversified portfolios, and align their investment strategies with their financial goals. So, let’s dive into the fascinating world of VTI and explore the top companies and sectors that have a significant presence in this popular ETF.

What is VTI?

VTI, or Vanguard Total Stock Market ETF, is an exchange-traded fund offered by Vanguard, one of the largest investment management companies in the world. The purpose of VTI is to provide investors with broad exposure to the entire U.S. equity market.

VTI is designed to track the performance of the CRSP US Total Market Index, which represents the investment results of a broad range of U.S. companies. This index includes large-cap, mid-cap, small-cap, and micro-cap stocks, capturing the entire market capitalization spectrum. By investing in VTI, investors gain exposure to companies across various sectors and industries, making it a popular choice for those seeking diversification.

One of the notable benefits of investing in VTI is its low expense ratio. Vanguard is known for its commitment to offering low-cost investment products, and VTI is no exception. With an expense ratio significantly lower than the industry average, VTI is an attractive option for long-term investors who prioritize keeping costs low.

Moreover, VTI offers investors the advantage of being an ETF. Unlike traditional mutual funds, ETFs trade on an exchange, allowing investors to buy and sell shares throughout the trading day. This provides flexibility and liquidity, as investors can take advantage of market opportunities and easily adjust their investment positions.

In summary, VTI is an ETF that seeks to replicate the performance of the CRSP US Total Market Index, providing investors with a convenient and cost-effective way to gain exposure to the entire U.S. equity market. Its broad diversification and low expense ratio make it an appealing choice for both novice and experienced investors.

Overview of VTI Holdings

VTI provides investors with exposure to a wide range of stocks that collectively make up the CRSP US Total Market Index. As of [current date], VTI has holdings in thousands of companies across various sectors and industries. Let’s explore some key points about VTI holdings:

- Size and Market Capitalization: VTI includes stocks from companies of all market capitalizations, ranging from mega-cap giants to small-cap and micro-cap firms. This ensures a balanced representation of companies across the U.S. equity market.

- Diversification: VTI is designed to provide investors with a diversified portfolio of U.S. stocks. By holding a large number of stocks across different sectors, VTI aims to mitigate the risk associated with any single company or sector.

- Weighting Methodology: The weights of individual stocks in VTI are determined by their respective market capitalizations. This means that companies with larger market caps have a greater influence on the performance of the ETF.

- Rebalancing: VTI undergoes periodic rebalancing to ensure that the holdings align with the target index. This helps to maintain the desired exposure to different sectors and market segments.

It is worth noting that VTI’s holdings are subject to change periodically as companies enter or exit the index. Therefore, it is important for investors to regularly review the portfolio structure and understand the current holdings of VTI.

By investing in VTI, investors gain exposure to a diverse array of companies, including established industry leaders, up-and-coming growth companies, and smaller innovative firms. This broad range of holdings allows investors to participate in the overall performance of the U.S. equity market while spreading their investment risk.

Now that we have an understanding of the overview of VTI holdings, let’s take a closer look at the top stocks that make up the ETF and their respective sector allocation.

Top Stocks in VTI

VTI is comprised of a vast number of stocks, but there are several companies that have a significant presence within the ETF. These top stocks encompass a wide range of industries and have a substantial impact on VTI’s overall performance. Here are some of the notable top stocks in VTI:

- Apple Inc. (AAPL) – As one of the world’s most valuable companies, Apple holds a prominent position within VTI. Known for its innovative technology products, Apple’s stock performance has a significant influence on the ETF’s overall returns.

- Microsoft Corporation (MSFT) – Microsoft is another heavyweight within VTI. With its expansive range of software, hardware, and cloud-based services, the company has consistently delivered strong financial results, making it a top holding in the ETF.

- Amazon.com Inc. (AMZN) – The e-commerce giant, Amazon, is a key player within VTI. Its dominance in the retail industry and robust cloud computing services have propelled its stock to new heights, contributing to the ETF’s performance.

- Facebook Inc. Class A (FB) – Facebook, the social media giant, is a prominent holding in VTI. With its global user base and diverse digital platforms, Facebook’s stock plays a significant role in the ETF’s returns.

- Alphabet Inc. Class C (GOOG) – Alphabet, the parent company of Google, is a major presence within VTI. As a leader in internet-related products and services, Alphabet’s stock performance impacts the ETF’s overall performance.

These top stocks highlight the influence of technology companies within VTI. However, it’s important to note that VTI is not solely focused on the technology sector. The ETF includes a diverse range of stocks from various industries, such as finance, healthcare, consumer discretionary, and more.

It is crucial for investors to be aware of the top stocks in VTI, as the performance of these companies can heavily impact the overall returns of the ETF. By keeping an eye on the performance and news surrounding these stocks, investors can gain insights into VTI’s performance as a whole.

Next, let’s take a closer look at the sector allocation within VTI to understand the weightage of different industries within the ETF.

Sector Allocation in VTI

VTI offers investors exposure to a diverse range of sectors within the U.S. equity market. The sector allocation within the ETF provides valuable insights into how the portfolio is distributed across different industries. By understanding the sector allocation, investors can assess their exposure to specific sectors and make informed decisions about their investment strategies. Here is an overview of the sector allocation within VTI:

- Information Technology: The information technology sector dominates the sector allocation of VTI. This sector includes companies involved in software development, hardware manufacturing, telecommunications, and other technology-related services. High-profile technology companies like Apple, Microsoft, and Alphabet contribute significantly to the sector’s weightage within the ETF.

- Healthcare: The healthcare sector also has a substantial presence in VTI. This sector encompasses pharmaceutical companies, biotechnology firms, healthcare equipment manufacturers, and healthcare service providers. Companies such as Johnson & Johnson, Pfizer, and Merck play a pivotal role in the healthcare sector’s allocation within the ETF.

- Financials: The financial sector, which includes banks, insurance companies, and diversified financial services, holds a significant weightage within VTI. Well-known financial institutions like JPMorgan Chase, Bank of America, and Wells Fargo are among the key contributors to the sector’s allocation.

- Consumer Discretionary: The consumer discretionary sector consists of companies that manufacture non-essential goods and provide consumer services. This sector includes companies involved in retail, automotive, leisure, and entertainment. Popular consumer discretionary companies within VTI include Amazon, Home Depot, and Walt Disney.

- Communication Services: The communication services sector encompasses companies involved in telecommunications, media, and entertainment. This sector includes companies like AT&T, Verizon, and Disney, which contribute to the sector’s allocation within VTI.

These are just a few examples of the sector allocation within VTI. The ETF also includes exposure to sectors such as industrials, consumer staples, energy, utilities, and more. The sector allocation within VTI is designed to provide investors with a diversified portfolio that represents a broad range of industries.

Understanding the sector allocation can help investors gauge their exposure and manage their risk effectively. By diversifying their investments across sectors, investors can potentially reduce the impact of any underperforming industry on their overall portfolio.

Now that we have an understanding of the sector allocation within VTI, let’s explore the performance of the stocks held in the ETF.

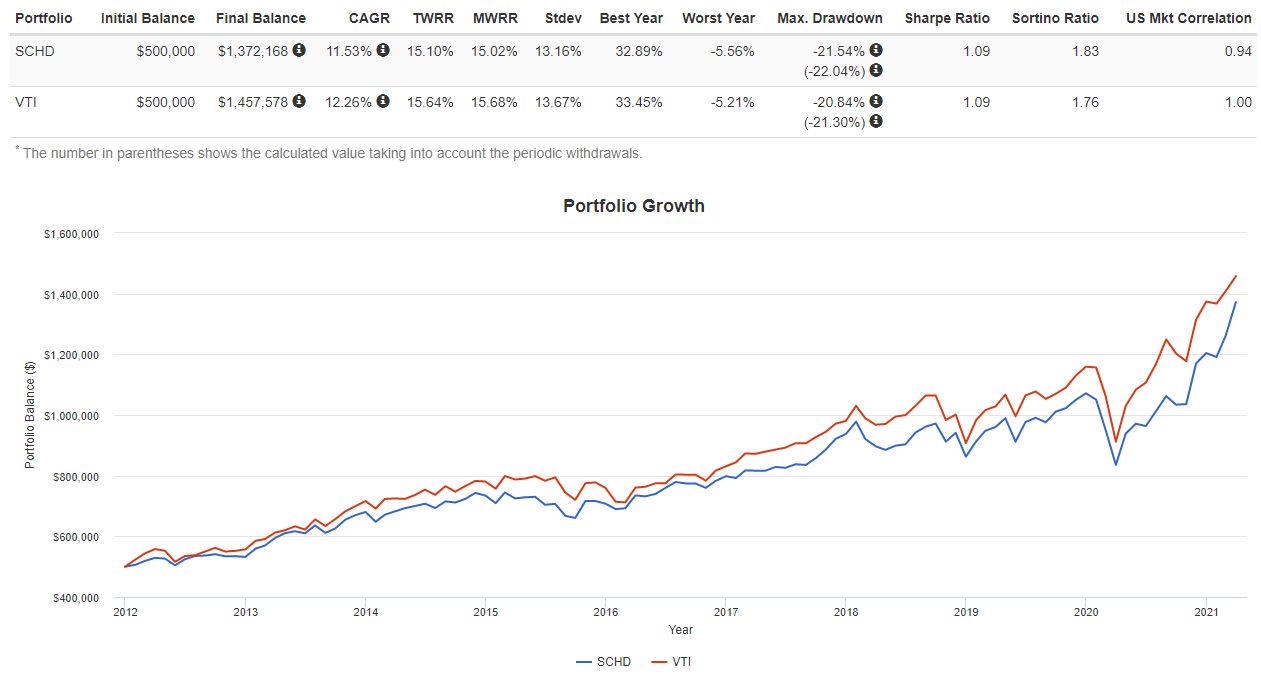

Performance of VTI Stocks

The performance of the stocks held within VTI plays a crucial role in determining the overall returns of the ETF. It is important for investors to analyze the historical performance of these stocks to gain insights into their potential for future growth. Here’s an overview of the performance of VTI stocks:

1. Historical Returns: The stocks within VTI have delivered strong historical returns over the long term. However, it’s essential to note that past performance does not guarantee future results. Investors should conduct thorough research and consider other factors, such as market conditions and company fundamentals, when evaluating the potential for future returns.

2. Volatility: Like any investment, stocks within VTI are susceptible to market volatility. The prices of individual stocks can fluctuate based on various factors, such as economic conditions, industry trends, and company-specific news. Investors should be prepared for periods of market volatility and consider their risk tolerance when investing in VTI.

3. Diversification Benefits: The diversified nature of VTI, with its exposure to a wide range of stocks across different sectors, can help mitigate some of the volatility associated with individual stocks. Through diversification, investors spread their risk and potentially smooth out the impact of any individual stock’s performance on the overall portfolio.

4. Dividends: Some stocks within VTI may pay dividends to their shareholders. Dividends can provide a regular income stream for investors and may enhance the overall returns of VTI. It’s important to note that not all stocks within VTI pay dividends, and dividend payments, if any, are subject to the individual company’s performance and dividend policies.

When analyzing the performance of VTI stocks, it is also crucial to compare the performance of the ETF against relevant benchmark indices and other investment options. This comparison can provide insights into the relative performance and risk-adjusted returns of VTI.

Investors should also consider their investment time horizon and financial goals before investing in VTI. The performance of VTI stocks may vary over different market cycles, and investors should be prepared to hold their investments for the long term to potentially benefit from market trends and growth opportunities.

Finally, it’s important to conduct thorough research and stay informed about the individual stocks held within VTI. Analyzing company financials, market trends, and industry developments can help investors make informed decisions and navigate the dynamic landscape of the stock market.

Now that we have explored the performance of VTI stocks, let’s conclude our comprehensive guide on the stocks included in VTI.

Conclusion

VTI, the Vanguard Total Stock Market ETF, offers investors a convenient and cost-effective way to gain exposure to the entire U.S. equity market. With its broad diversification and low expense ratio, VTI has become a popular choice among both novice and experienced investors.

In this comprehensive guide, we have explored various aspects of VTI, including its composition, top stocks, sector allocation, and performance. Understanding these key elements can provide valuable insights for investors looking to incorporate VTI into their investment portfolios.

By investing in VTI, investors gain exposure to a wide range of stocks, including industry giants in technology, healthcare, finance, consumer discretionary, communication services, and more. The sector allocation within VTI ensures diversification and helps investors spread their risk across different industries.

While past performance is not indicative of future results, analyzing the historical performance of VTI stocks can provide insights into their potential for growth. However, it is important for investors to conduct thorough research and consider other factors, such as market conditions and company fundamentals, when evaluating investment opportunities.

Ultimately, investing in VTI should align with an investor’s financial goals, risk tolerance, and time horizon. It is recommended to consult with a financial advisor to determine if VTI is suitable for your unique investment objectives.

At the end of the day, VTI offers investors the opportunity to participate in the overall performance of the U.S. equity market and potentially benefit from its long-term growth. By understanding the stocks held within VTI and staying informed about market trends, investors can make well-informed decisions and navigate the dynamic world of stock market investing.

Thank you for joining us on this journey through the stocks included in VTI. May your investments flourish and your financial goals be achieved!