Finance

What Time Is Considered The Next Banking Day?

Modified: February 21, 2024

Learn what time is considered the next banking day in the world of finance. Stay ahead with key information and plan your financial transactions effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The concept of the next banking day is an essential component of the financial system that affects various transactions and operations. Understanding what time is considered the next banking day is crucial for individuals and businesses when it comes to processing payments, depositing funds, or managing their financial activities. In this article, we will delve into the definition of the next banking day, how it is determined, and the implications it has on financial transactions.

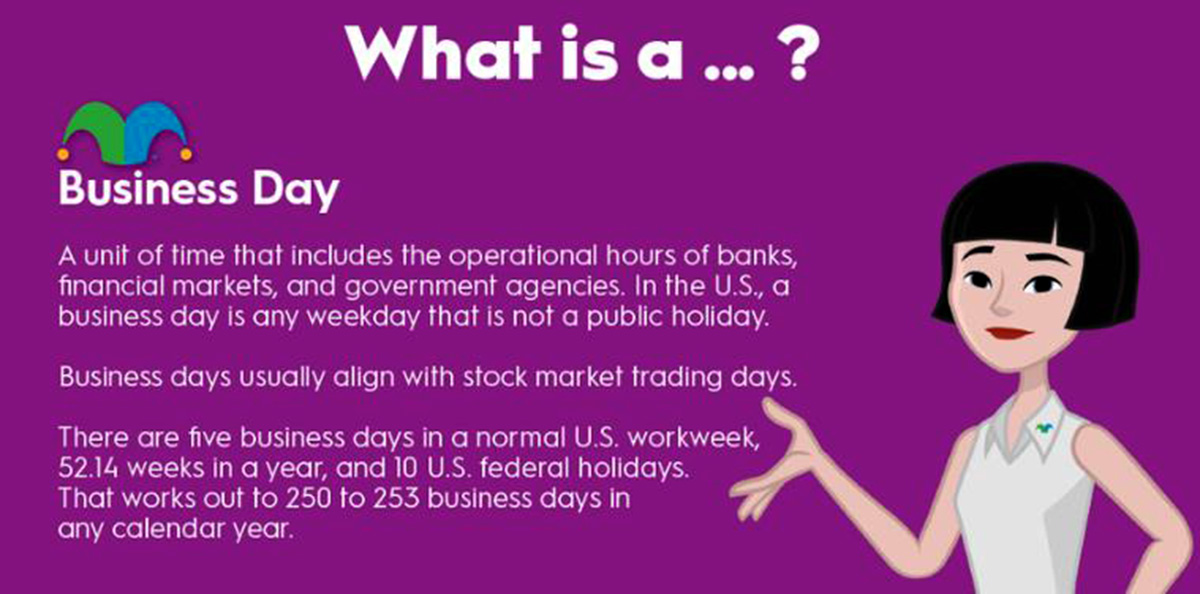

The next banking day refers to the next working day when financial institutions, such as banks, credit unions, or other financial organizations, resume their regular business operations. It is the day when these institutions are open for business, allowing customers to carry out various financial activities such as deposits, withdrawals, transfers, and other transactions.

Understanding the concept of the next banking day is essential because it helps individuals and businesses plan their financial activities effectively. Whether it is making a time-sensitive payment, depositing funds to earn interest, or initiating a transaction, knowing when the next banking day starts and ends is crucial.

Definition of the Next Banking Day

The next banking day is the term used to refer to the next working or business day when financial institutions are open for business. It is the day on which these institutions process transactions, accept deposits, and provide services to their customers. This concept is particularly important when it comes to time-sensitive financial activities, such as transferring funds, making payments, or initiating other transactions.

The next banking day is determined based on various factors, including the institution’s operating hours, their scheduled holidays or closures, and the specific cut-off times for different types of transactions. It is important to note that the definition of the next banking day can vary from one financial institution to another, as each may have its own policies and operating hours.

In most cases, the next banking day follows the regular working days, typically Monday through Friday, excluding weekends and public holidays. However, it is important to check with your specific financial institution to confirm their operating hours and any additional closures or holidays they may observe.

Financial institutions usually have designated cut-off times for various types of transactions. For example, if you initiate a payment or transfer request before the specified cut-off time on a particular banking day, it will typically be processed on the same day. However, if you initiate the transaction after the cut-off time, it will be processed on the next banking day.

Knowing the definition and determining the start and end of the next banking day is crucial for managing your financial activities and ensuring timely processing of transactions. It helps in avoiding any delays or complications that may arise from processing your requests on non-business days or outside of the designated cut-off times.

Determining the Start and End of the Next Banking Day

The start and end of the next banking day are determined by the operating policies and schedules of financial institutions. While the general rule is that the next banking day begins after the end of the previous banking day, there are certain factors and considerations that may affect these timings.

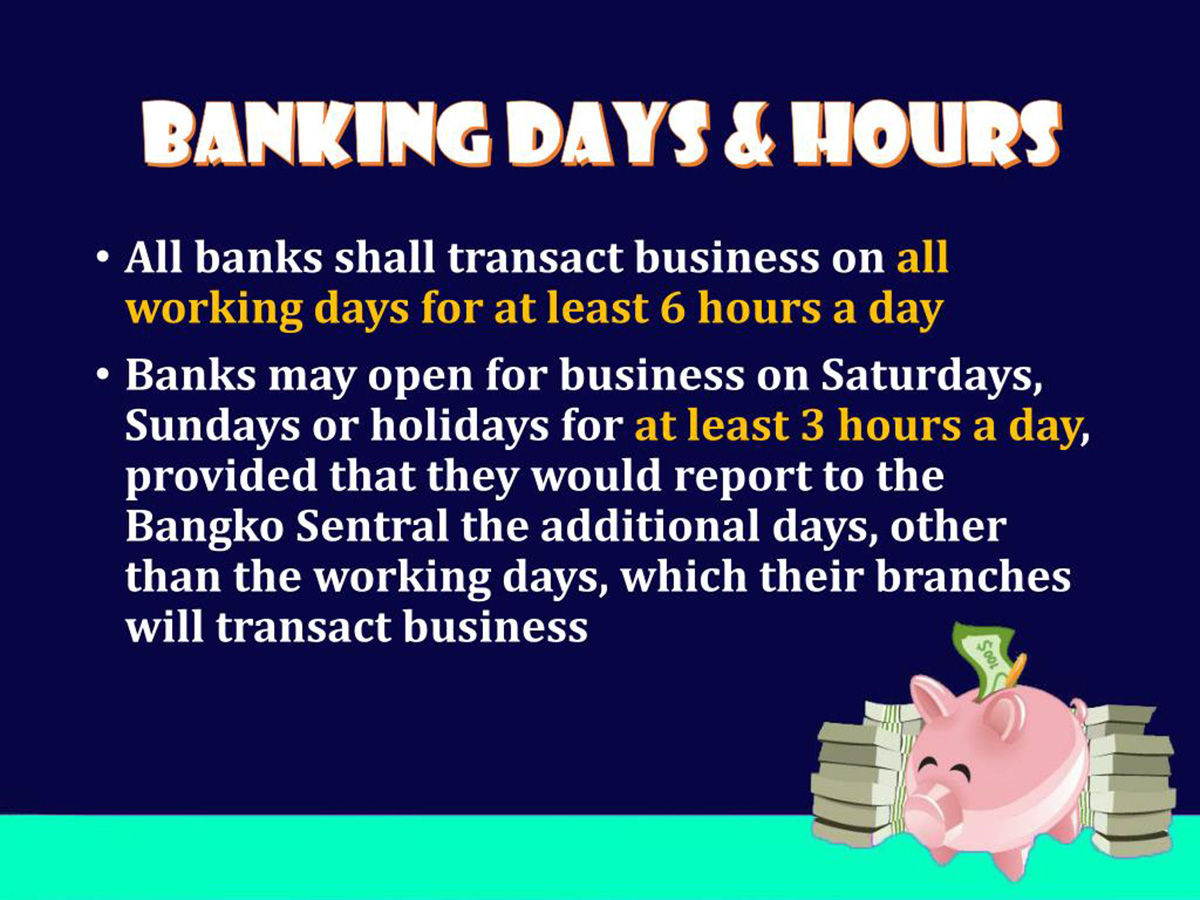

1. Regular Business Hours: Financial institutions have specific operating hours during which they are open for business. Generally, banks and other financial establishments follow a standard schedule of starting their operations in the morning and closing in the afternoon or early evening. The start of the next banking day is usually aligned with these regular business hours.

2. Cut-Off Times: Financial institutions often have cut-off times for various transactions, such as fund transfers, bill payments, and check deposits. These cut-off times define the latest time by which a transaction must be initiated to ensure same-day processing. Transactions initiated after the cut-off time are typically processed on the next banking day. It’s important to be aware of these cut-off times to avoid any potential delays in the processing of your transactions.

3. Weekends and Public Holidays: Weekends and public holidays are non-business days for financial institutions. If the next banking day falls on a weekend or a public holiday, the start of the next banking day will typically be on the following business day. This means that transactions initiated on weekends or public holidays will be processed on the next applicable banking day.

4. Time Zones: Financial institutions may operate across different time zones. The start and end of the next banking day can vary depending on the specific time zone in which an institution is located. It’s important to consider the time zone of your financial institution to ensure accurate timing for your financial activities.

To determine the start and end of the next banking day, it is recommended to consult the specific policies and guidelines of your financial institution. These institutions often provide information on their website, customer service helplines, or physical branches regarding their operating hours, cut-off times, and any special considerations for weekends or public holidays.

By understanding the factors that influence the start and end of the next banking day, you can plan your financial activities accordingly and ensure that your transactions are processed in a timely and efficient manner.

Implications of the Next Banking Day

The next banking day has significant implications for various financial transactions and activities. Understanding these implications is crucial for individuals and businesses to effectively manage their finances and ensure timely processing of transactions.

1. Processing Timelines: The next banking day determines when financial transactions, such as transfers, payments, and withdrawals, will be processed. Transactions initiated before the cut-off time on a banking day are typically processed on the same day. However, if a transaction is initiated after the cut-off time or on a non-business day, it will be processed on the next banking day. This can have implications for the time it takes for funds to be credited or debited from your account.

2. Availability of Services: The next banking day impacts the availability of various banking services. For example, if you need to visit a branch for a specific service, such as opening an account or requesting a loan, it is important to plan your visit on a banking day when the branch is open. Additionally, the availability of customer support services and assistance may also be limited on non-business days.

3. Deposit Interest Accumulation: The next banking day affects the calculation of interest on deposits. If you deposit funds into an interest-bearing account, such as a savings account or a certificate of deposit, the interest will typically start accruing from the next banking day. This means that deposits made on non-business days may result in a delay in the accumulation of interest.

4. Transaction Deadlines: The next banking day determines the deadlines for various financial transactions. This is especially important for time-sensitive payments, such as bill payments and loan repayments, where missing a deadline can result in late fees or penalties. Understanding the next banking day is crucial for ensuring that you meet payment deadlines and avoid any negative consequences.

5. Funds Availability: The next banking day also affects the availability of funds in your account. For example, if you deposit a check on a non-business day, the funds may not be available for withdrawal until the next banking day. Similarly, if you receive a direct deposit, it may not be credited to your account until the next banking day.

It is important to keep these implications in mind when managing your finances. Planning ahead and understanding the next banking day can help you avoid delays, ensure timely payments, and effectively manage your financial activities.

Common Practices and Policies

While the specific practices and policies surrounding the next banking day may vary from one financial institution to another, there are some common practices that are followed by most banks and credit unions. Familiarizing yourself with these practices can help you navigate your financial activities more effectively.

1. Cut-Off Times: Financial institutions typically have cut-off times for various transactions, such as fund transfers and bill payments. These cut-off times determine whether a transaction will be processed on the same banking day or the next banking day. It is important to be aware of these cut-off times and initiate transactions accordingly to ensure timely processing.

2. Weekends and Public Holidays: Financial institutions typically follow a standard schedule of Monday through Friday for their business operations. Weekends (Saturday and Sunday) are considered non-business days, and transactions initiated on these days are usually processed on the next banking day, which is typically the following Monday. Public holidays are also considered non-business days, and transactions initiated on these days may be processed on the next banking day.

3. Operating Hours: Financial institutions have specific operating hours during which they provide services to their customers. These operating hours may vary from one institution to another, but they usually align with regular business hours. It is important to be aware of your institution’s operating hours, especially if you need to visit a branch or require customer support assistance.

4. Online and Mobile Banking: Many financial institutions offer online and mobile banking services, which allow customers to access their accounts and perform various transactions outside of regular banking hours. These services often have extended availability, providing convenience and flexibility to manage financial activities even on non-business days.

5. Clearing and Settlement Times: The next banking day also affects the clearing and settlement of certain transactions. For example, checks deposited on non-business days may have a longer clearing period compared to checks deposited on a banking day. It is important to consider these timelines when you need to access funds from check deposits or expect incoming payments.

It is important to note that while there are common practices and industry standards, each financial institution may have its own specific policies and nuances regarding the next banking day. It is always recommended to refer to your institution’s terms and conditions or consult their customer service for the most accurate and up-to-date information.

By understanding the common practices and policies surrounding the next banking day, you can plan your financial activities accordingly and ensure smooth and timely processing of transactions.

Conclusion

The concept of the next banking day plays a crucial role in our financial lives, shaping the timing and processing of various transactions. Understanding what time is considered the next banking day is essential for individuals and businesses alike to effectively manage their finances and ensure timely processing of payments, deposits, and other financial activities.

Throughout this article, we have explored the definition of the next banking day and how it is determined. We have discussed the implications that the next banking day has on transaction processing, availability of services, interest accrual, transaction deadlines, and funds availability. By being aware of these implications, we can make informed decisions and avoid any complications or delays in our financial activities.

Furthermore, we have highlighted some common practices and policies followed by financial institutions, such as cut-off times, considerations for weekends and public holidays, operating hours, and online/mobile banking services. Being familiar with these practices can help us navigate our financial activities more effectively and make the most of the services provided by our chosen financial institutions.

In conclusion, understanding what time is considered the next banking day is crucial for managing our financial affairs efficiently. By staying informed about the start and end times of the next banking day, being aware of cut-off times, and planning our transactions accordingly, we can ensure the smooth processing of our financial activities and avoid any unnecessary complications or delays.

Remember to check the specific policies and guidelines of your financial institution to confirm their operating hours, cut-off times, and any special considerations for weekends or public holidays. By doing so, you can confidently navigate the world of finance and make the most of the services provided by your chosen financial institution.