Finance

What Would A FICO Score Of 810 Be Considered?

Published: March 6, 2024

Find out what a FICO score of 810 means in the world of finance and how it can impact your financial opportunities. Learn about the benefits and considerations of having a high FICO score.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Welcome to the world of credit scoring, where numbers hold the key to your financial opportunities. Among the various credit scoring models, the FICO score is one of the most widely used and influential. Understanding what a FICO score represents and how it impacts your financial life is crucial for making informed decisions and achieving your goals.

In this article, we will delve into the realm of FICO scores, focusing on the significance of attaining a score of 810. By exploring the implications, benefits, contributing factors, and maintenance strategies associated with a FICO score of 810, you will gain valuable insights into this financial milestone.

A FICO score of 810 is not just a number; it's a reflection of your financial responsibility and creditworthiness. It can open doors to favorable interest rates, access to premium financial products, and a range of opportunities that can significantly impact your financial well-being. Let's embark on this journey to uncover the significance of a FICO score of 810 and the steps you can take to attain and sustain this impressive credit standing.

Understanding FICO Scores

Before diving into the specifics of a FICO score of 810, it’s essential to grasp the fundamentals of FICO scores. The Fair Isaac Corporation (FICO) developed the FICO scoring model, which is widely utilized by lenders to assess an individual’s credit risk.

A FICO score is a three-digit number ranging from 300 to 850, with higher scores indicating lower credit risk. This score is derived from information in your credit reports, including payment history, credit utilization, length of credit history, new credit accounts, and the mix of credit types.

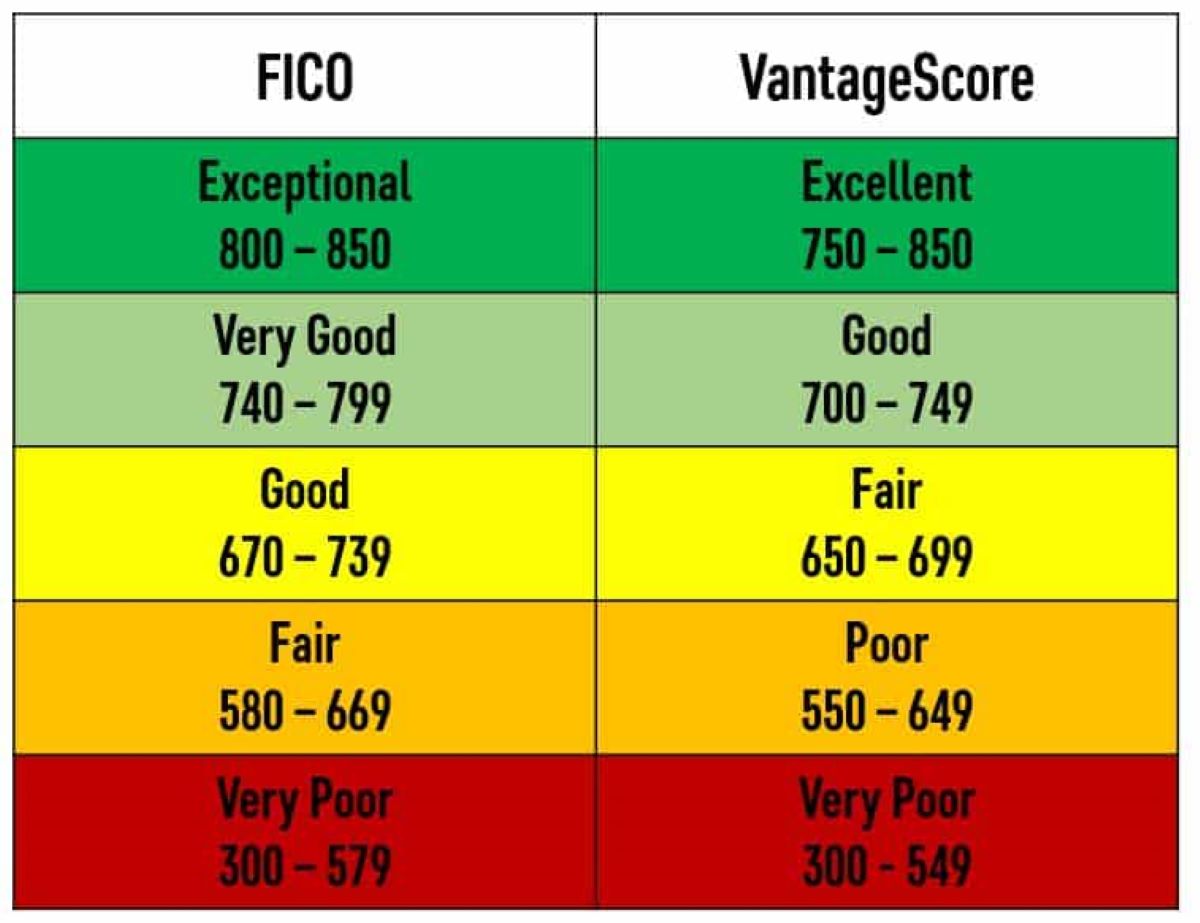

FICO scores are categorized as follows:

- Excellent: 800 and above

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

Understanding the significance of these score ranges is crucial for gauging your creditworthiness and the potential impact on your financial endeavors. A FICO score of 810 falls within the excellent range, signifying a high level of creditworthiness and financial responsibility.

As we proceed, we will delve deeper into the implications and advantages of holding a FICO score of 810, shedding light on the doors it can open and the financial benefits it can yield.

What Does a FICO Score of 810 Mean?

A FICO score of 810 holds significant weight in the realm of credit assessment. It represents an exceptional credit standing, positioning individuals in the top tier of creditworthiness. Lenders view a FICO score of 810 as a strong indicator of financial responsibility, trustworthiness, and low credit risk.

Individuals with a FICO score of 810 are likely to enjoy numerous benefits, including:

- Favorable Interest Rates: Lenders are inclined to offer the most competitive interest rates to individuals with a FICO score of 810, translating to substantial savings over the life of loans and credit lines.

- Premium Credit Card Offers: Those with a FICO score of 810 often receive invitations for premium credit cards with attractive rewards, perks, and benefits, reflecting their elite credit status.

- Higher Credit Limits: Individuals with a FICO score of 810 are more likely to secure higher credit limits, providing greater financial flexibility and purchasing power.

- Approval for Loans and Mortgages: Attaining a FICO score of 810 significantly enhances the likelihood of swift approval for various loans, including mortgages, with favorable terms and conditions.

- Insurance Premium Discounts: Some insurance providers offer lower premiums to individuals with excellent credit scores, leading to potential savings on insurance costs.

Furthermore, a FICO score of 810 reflects a history of timely payments, low credit utilization, a diverse credit mix, and a lengthy and positive credit history. It underscores an individual’s ability to manage credit responsibly and showcases a solid financial foundation.

Overall, a FICO score of 810 is a testament to disciplined financial habits and serves as a gateway to a myriad of financial opportunities and privileges.

Benefits of Having a FICO Score of 810

Attaining a FICO score of 810 bestows a multitude of advantages, positioning individuals in an enviable position within the realm of credit and finance. Let’s explore the compelling benefits associated with holding a FICO score of 810:

- Access to the Best Financing Offers: Individuals with a FICO score of 810 are offered the most favorable interest rates and terms across various financing options, including mortgages, auto loans, and personal loans. This translates to substantial savings over the life of the loans.

- Premium Credit Card Privileges: A FICO score of 810 opens the door to premium credit card offers with lucrative rewards, exclusive perks, and elevated credit limits, empowering cardholders with exceptional financial flexibility and benefits.

- Approval for Multiple Credit Lines: Lenders are eager to extend credit to individuals with a FICO score of 810, leading to swift approvals and the ability to secure multiple credit lines, thereby enhancing financial flexibility and opportunities.

- Enhanced Negotiating Power: Individuals with a FICO score of 810 have enhanced negotiating power when applying for loans or credit cards, allowing them to secure the most advantageous terms and conditions.

- Lower Insurance Premiums: Some insurance providers offer reduced premiums to individuals with excellent credit scores, resulting in potential savings on insurance costs, including auto and homeowners insurance.

- Financial Security and Peace of Mind: A FICO score of 810 reflects a strong financial foundation, providing individuals with a sense of security and peace of mind, knowing that they are well-positioned to achieve their financial goals and weather unexpected expenses.

These benefits collectively demonstrate the far-reaching impact of a FICO score of 810, paving the way for substantial savings, enhanced financial opportunities, and a heightened sense of financial well-being.

Factors That Contribute to a FICO Score of 810

Several key factors contribute to the attainment of a FICO score of 810, reflecting a combination of prudent financial habits and responsible credit management. Understanding these contributing elements provides valuable insights into the characteristics that underpin an exceptional credit score.

- Timely Payments: Consistently making on-time payments across all credit accounts is a fundamental driver of a high FICO score. This demonstrates reliability and financial discipline, positively impacting the payment history component of the score.

- Low Credit Utilization: Maintaining low credit card balances relative to credit limits is pivotal in achieving a FICO score of 810. This showcases responsible credit utilization, a key factor in credit scoring models.

- Diverse Credit Mix: A healthy credit mix, encompassing a variety of credit types such as installment loans and revolving credit, contributes positively to the overall score. A well-managed mix demonstrates the ability to handle different credit obligations effectively.

- Lengthy and Positive Credit History: A lengthy credit history with a track record of positive credit management reinforces the creditworthiness of an individual. Long-standing accounts with a history of on-time payments bolster the credit score.

- Limited New Credit Applications: Minimizing the frequency of new credit applications and inquiries is conducive to a higher score. Multiple credit inquiries within a short timeframe can potentially lower the score, whereas a conservative approach to seeking new credit reflects stability and prudence.

- No Negative Events: A FICO score of 810 is indicative of a clean credit profile devoid of derogatory marks such as bankruptcies, foreclosures, or collections. Avoiding negative events is pivotal in maintaining an exceptional score.

By embodying these credit behaviors, individuals can pave the way for a FICO score of 810, positioning themselves as prime candidates for favorable financing offers and premium credit opportunities.

How to Maintain a FICO Score of 810

Maintaining a FICO score of 810 requires ongoing diligence and a commitment to sound financial practices. While achieving this elite credit standing is commendable, preserving it necessitates continued attention to key credit management principles. Here are essential strategies to sustain a FICO score of 810:

- Punctual Payments: Consistently prioritize on-time payments across all credit accounts, including credit cards, loans, and other obligations. Setting up payment reminders or automatic debits can help ensure payments are never missed.

- Optimal Credit Utilization: Aim to keep credit card balances low relative to credit limits, ideally below 30%. This demonstrates prudent credit utilization and supports a high credit score.

- Strategic Credit Applications: Exercise caution when applying for new credit. Limiting credit inquiries and new accounts can help preserve the stability of your credit profile and prevent unnecessary score fluctuations.

- Regular Credit Monitoring: Stay vigilant by routinely reviewing your credit reports from all three major credit bureaus. Promptly address any inaccuracies or suspicious activities that could potentially impact your score.

- Maintain a Diverse Credit Mix: Continue managing a healthy mix of credit types, including installment loans and revolving credit. This showcases your ability to handle various credit responsibilities effectively.

- Long-Term Credit Management: Nurture long-standing credit accounts with positive payment histories. Avoid closing old accounts, as they contribute to the length and strength of your credit history.

- Financial Prudence: Practice sound financial habits, such as living within your means, budgeting effectively, and avoiding excessive debt accumulation. These practices support overall financial stability and credit health.

By adhering to these guidelines and remaining proactive in managing your credit, you can sustain a FICO score of 810, ensuring continued access to advantageous financing offers and premium credit opportunities.

Conclusion

Attaining and maintaining a FICO score of 810 is a testament to disciplined financial management, responsible credit behavior, and a strong foundation of creditworthiness. This exceptional credit standing opens doors to a myriad of financial opportunities, including favorable interest rates, premium credit offers, and enhanced negotiating power.

Individuals with a FICO score of 810 enjoy the peace of mind that comes with a robust financial profile, positioning them as prime candidates for loans, mortgages, and credit lines with advantageous terms and conditions. Moreover, the potential for lower insurance premiums and the overall financial security afforded by this elite credit status further underscore the far-reaching benefits of a FICO score of 810.

By adhering to prudent financial practices, including punctual payments, strategic credit utilization, and vigilant credit monitoring, individuals can sustain this exceptional credit score, ensuring continued access to the best financing offers and premium credit privileges.

As you navigate your financial journey, remember that a FICO score of 810 is not merely a number, but a reflection of your financial acumen and the gateway to a wealth of opportunities. By prioritizing sound credit management and maintaining a steadfast commitment to responsible financial habits, you can continue to reap the rewards of an exceptional FICO score, paving the way for a brighter and more secure financial future.