Finance

What Are Banking Days

Modified: February 21, 2024

Discover the concept of banking days and how they relate to finance. Learn about the importance of understanding banking days for managing your financial transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Banking days play a crucial role in the financial operations of individuals, businesses, and institutions around the world. Whether you’re depositing a check, transferring funds, or applying for a loan, understanding the concept of banking days is essential.

In simple terms, banking days refer to the days when banks are open and actively processing financial transactions. These days are determined by various factors, including national holidays, weekends, and internal bank policies. The notion of banking days has a significant impact on the speed and efficiency of conducting financial transactions.

It is important to understand the rules and limitations surrounding banking days, as they can affect when your transactions are processed and how quickly you have access to your funds. This article will delve deeper into the definition of banking days, how they are determined, their importance, and how they can affect financial transactions. So, let’s dive in and explore the world of banking days.

Definition of Banking Days

Banking days are the specific days on which banking institutions are open and provide services to their customers. These days include weekdays, excluding weekends (Saturday and Sunday), as well as public holidays when banks are closed. The exact definition of banking days can vary from country to country and even between different financial institutions within the same country.

During banking days, customers can visit bank branches to conduct various transactions such as depositing or withdrawing money, transferring funds, applying for loans, opening new accounts, and seeking financial advice. Additionally, banking days also cover online banking services and mobile banking, allowing customers to perform financial transactions and access account information electronically.

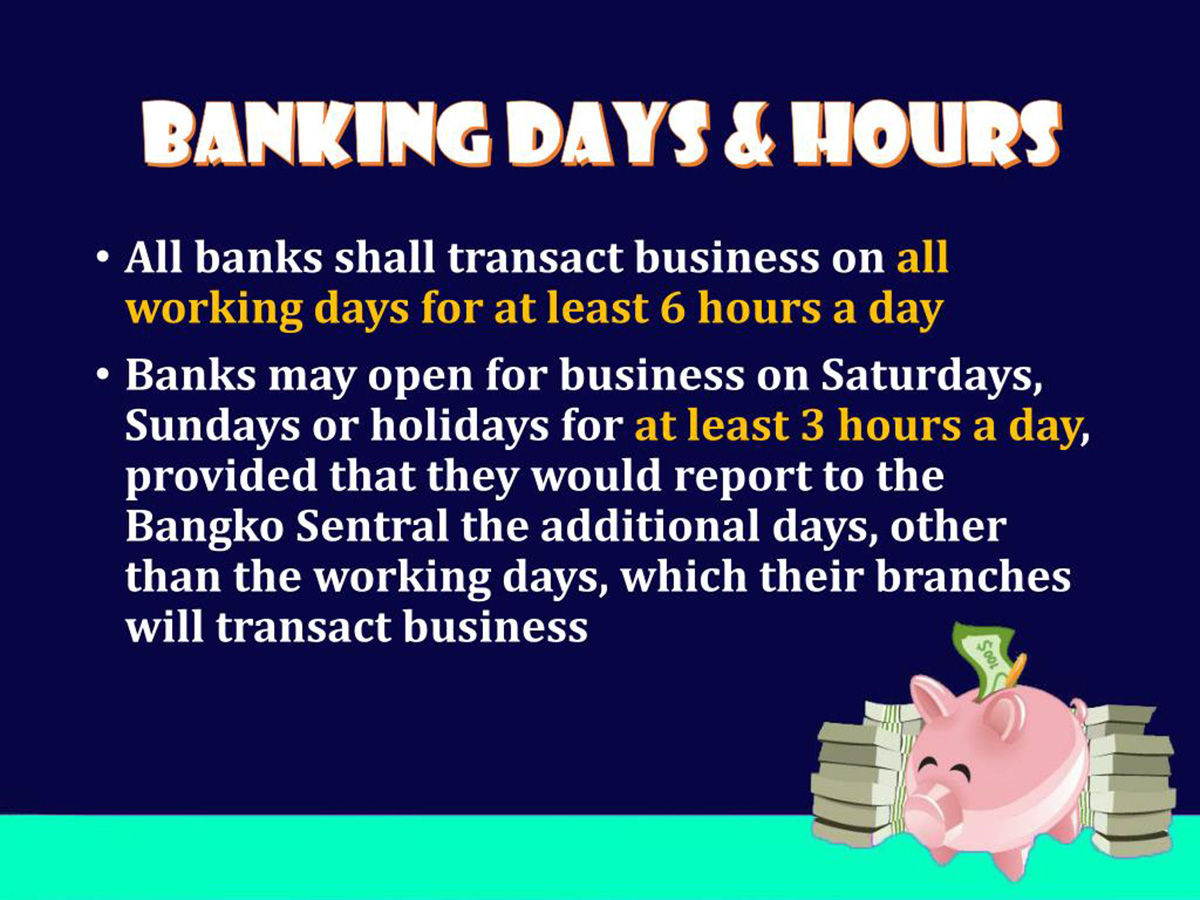

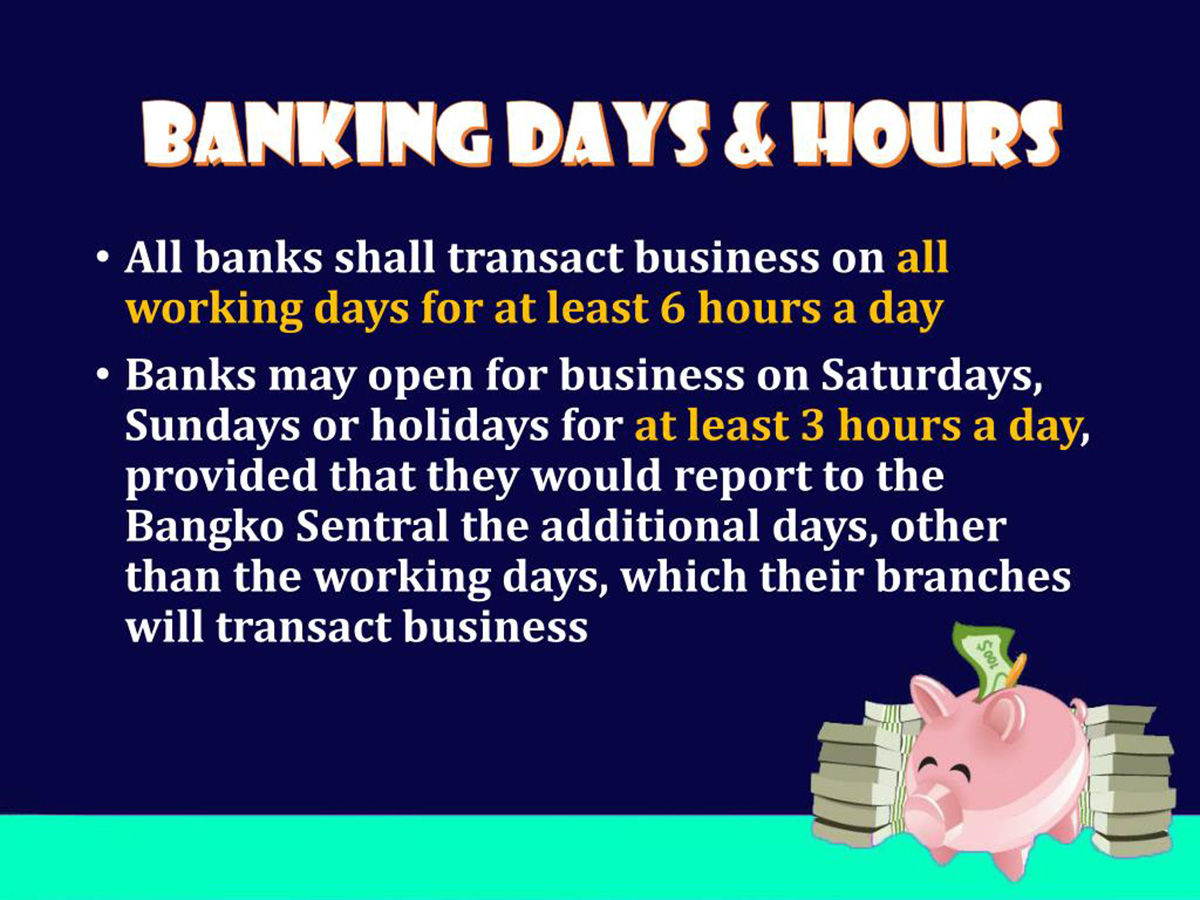

Financial institutions typically have set operating hours during banking days. However, with the rise of digital banking, many banks now offer 24/7 access to certain services, allowing customers to manage their finances outside of traditional banking hours.

It is important to note that each banking institution may have its own specific definition and policies regarding their banking days. Some banks may be open for extended hours or on certain weekends. It is always advisable to check with your specific bank for their operating hours and any potential deviations from the standard banking days.

Understanding the definition of banking days is essential for individuals and businesses alike, as it allows them to plan their financial activities accordingly. Being aware of which days are considered banking days can help ensure that transactions are processed in a timely manner and that necessary banking services are accessed when needed.

How Banking Days Are Determined

The determination of banking days is influenced by a combination of factors, including national holidays, weekends, and internal bank policies. Let’s take a closer look at how these factors come together to determine the specific days on which banks operate:

1. National Holidays: The observance of national holidays plays a significant role in determining banking days. Banks generally remain closed on public holidays, which vary from country to country. These holidays can include events such as New Year’s Day, Independence Day, Christmas, and other nationally recognized holidays. It’s important to note that different countries may have different sets of holidays, so banking days may vary accordingly.

2. Weekends: Weekends, which typically encompass Saturdays and Sundays, are non-working days for banks in most countries. This means that banks are closed during these days, and no banking transactions are processed. However, some banks may have limited services available on Saturdays, such as customer service support or certain self-service options.

3. Internal Bank Policies: In addition to national holidays and weekends, each bank has its own internal policies regarding banking days. These policies may determine the number of hours the bank operates, the specific days it remains closed, and any exceptions or special services offered outside of regular banking days. These internal policies can vary between different banks and even between branches of the same bank.

It’s important to remember that banks may have different policies and operating hours in different regions or countries, especially if they have an international presence. Therefore, people who travel or conduct international transactions should be aware of the banking days and local holidays in the respective countries.

Overall, the determination of banking days is a combination of national holidays, weekends, and internal bank policies. By considering these factors, banks establish their operating schedules and allow customers to plan their financial activities accordingly.

Importance of Banking Days

The importance of banking days cannot be overstated, as they dictate when financial transactions can be processed and when individuals and businesses have access to their funds. Here are some reasons highlighting the significance of banking days:

1. Transaction Processing: Banking days determine when financial transactions, such as deposits, withdrawals, and transfers, are processed. If a transaction is initiated on a non-banking day, it will typically be processed on the next available banking day. Understanding banking days helps individuals and businesses plan their transactions to ensure timely processing.

2. Accessibility to Banking Services: Knowing the banking days is important for accessing various banking services, such as in-branch services, customer support, and online banking. Being aware of when banks are open allows customers to seek assistance, resolve issues, and access their accounts and services when needed.

3. Timely Bill Payments: Many people rely on banking services to pay their bills, such as credit card payments, utility bills, or loan installments. Understanding the banking days ensures that individuals can schedule these payments accordingly and avoid late fees or penalties.

4. Salary Deposits: For employees who receive their salaries through direct deposit, banking days determine when the funds will be available in their accounts. Knowing the banking days helps individuals plan their expenses and financial obligations based on when their salaries are credited.

5. Loan Applications and Approvals: When applying for loans, banking days are crucial in determining the processing timeline. Understanding the banking days allows borrowers to submit their loan applications within the necessary timeframe and ensures prompt processing and approvals.

6. Financial Planning: Banking days are vital for effective financial planning. Whether it’s budgeting, investment planning, or managing cash flow, knowing when banking services are available allows individuals and businesses to make informed decisions and take necessary actions.

7. International Transactions: Banking days also play a role in international transactions. Different countries have varying banking days and holidays, which can impact the processing time of cross-border transactions and currency conversions. Being aware of the banking days in different countries helps avoid delays and ensure smooth international financial transactions.

Overall, understanding the importance of banking days helps individuals and businesses manage their finances effectively, ensure timely transaction processing, and access necessary banking services when needed. By planning and aligning financial activities with banking days, individuals can have better control over their finances and avoid unnecessary delays or complications.

How Banking Days Affect Transactions

Banking days have a significant impact on the processing and timing of various financial transactions. Understanding how banking days affect transactions is crucial for individuals and businesses alike. Here are some key ways in which banking days can influence different types of transactions:

1. Deposit and Withdrawal Transactions: When depositing or withdrawing money from a bank account, the availability of funds depends on banking days. For example, if you deposit a check on a non-banking day, the funds may not be credited to your account until the next banking day. Similarly, if you withdraw cash from an ATM on a non-banking day, the transaction may be processed on the next available banking day.

2. Fund Transfers: Transferring funds between accounts, whether within the same bank or to another financial institution, is subject to banking days. The timing of the transfer usually depends on the initiation date and the processing time of the banks involved. If a transfer is initiated on a non-banking day, it may be processed on the next available banking day, resulting in a delay in the funds’ availability to the recipient.

3. Loan Payments: Making loan payments is influenced by banking days. If your loan payment due date falls on a non-banking day, you may need to make the payment in advance or on the next available banking day to avoid late fees or penalties. Banks generally consider the payment as made on the banking day it is processed, so it’s crucial to factor in banking days when making loan payments.

4. Check Clearing: The processing and clearing of checks are affected by banking days. If you deposit a check on a non-banking day, it may take longer for the funds to become available in your account. Similarly, if you write a check on a non-banking day, it may not be debited from your account until the next banking day. It’s important to keep this in mind when dealing with checks to ensure accurate tracking of funds and avoid potential overdrafts.

5. International Transactions: Banking days play a significant role in international transactions. Cross-border transfers, currency conversions, and international wire transfers are subject to the respective banking days and holidays of the involved countries. It’s important to consider these factors to minimize delays and ensure the smooth processing of international financial transactions.

6. Trading and Investment Transactions: Banking days can impact trading and investment transactions. Stock market trades, mutual fund transactions, and other investment activities may be processed based on banking days. It’s crucial to be mindful of banking days when executing trades or managing investment portfolios to ensure accurate timing and minimize any potential impact on investment decisions.

By understanding how banking days affect transactions, individuals and businesses can effectively plan their financial activities, minimize delays, and ensure smoother processing of various transactions. Being aware of the operational schedules and policies of financial institutions helps in avoiding unnecessary complications and ensuring timely and accurate financial management.

Banking Days vs. Business Days

While the terms “banking days” and “business days” are often used interchangeably, they have slightly different meanings and implications. Let’s compare and clarify the differences between banking days and business days:

Banking Days: Banking days specifically refer to the days when banks are open and actively processing financial transactions. These days typically include weekdays (Monday to Friday), excluding weekends (Saturday and Sunday). However, banking days can vary between different countries, financial institutions, and even specific bank branches.

Banking days are essential for individuals and businesses to conduct various banking transactions, such as deposits, withdrawals, transfers, loan applications, and in-person services at bank branches. It is during banking days that customers can expect their transactions to be processed, funds to be credited or debited from their accounts, and access to various banking services.

Business Days: Business days, on the other hand, refer to the standard working days within a specific industry or the general days when businesses operate. While business days often align with banking days, there are instances where they may not always coincide.

Business days can vary depending on the industry, location, and specific business operating hours. For example, in some countries or regions, businesses may operate on a different schedule, such as having a day off in the middle of the week or operating on Saturdays as a regular business day. Additionally, businesses may observe holidays or have specific operational hours outside of typical banking days.

It’s important to note that not all business transactions necessarily involve banking activities. For instance, meetings, appointments, deliveries, and other business-related activities may occur on business days without any direct involvement with banking institutions.

While there may be overlap between banking days and business days, it’s crucial to consider the specific context and industry when using these terms. Banking days are primarily focused on financial transactions and services provided by banks, while business days encompass a broader range of business-related activities.

Understanding the distinction between banking days and business days is important for individuals and businesses to effectively plan their activities, manage their finances, and ensure smooth interactions with both banking institutions and other businesses.

Conclusion

Banking days are a fundamental aspect of the financial system that determine when individuals and businesses can engage in banking activities and access necessary services. Whether you’re depositing funds, transferring money, making loan payments, or seeking financial advice, understanding banking days is crucial for effective financial management.

In this article, we have explored the definition of banking days, how they are determined, and their significance in various financial transactions. We have seen that banking days are typically weekdays excluding weekends (Saturday and Sunday), although specific banking days can vary between countries and financial institutions.

We have also discussed how banking days affect transactions, highlighting the importance of considering banking days when conducting financial activities. From depositing checks and making loan payments to conducting international transactions, understanding the impact of banking days helps individuals and businesses plan their finances and avoid unnecessary delays or complications.

Furthermore, we have clarified the distinction between banking days and business days. While they may overlap, banking days specifically refer to the operational days of banks for financial transactions, while business days encompass a broader range of business-related activities in various industries.

In conclusion, being aware of banking days and how they influence financial transactions is essential for effective financial planning and management. By understanding when banks are open, individuals and businesses can ensure timely processing of transactions, access necessary services, and avoid potential issues or delays. It is important to stay informed about banking days and any specific policies or operational hours of your financial institution to ensure smooth financial dealings.