Finance

What To Look For In A Savings Account

Published: November 26, 2023

Looking for the perfect savings account? Discover key factors to consider when choosing a savings account that suits your financial needs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Overview

A savings account is a key component of any personal financial strategy. It offers a safe and convenient way to store money while also earning interest on your deposits. Whether you are saving for a rainy day, a big purchase, or your future retirement, finding the right savings account is essential.

When considering a savings account, there are several factors to take into account. These include interest rates, fees, minimum balance requirements, access to funds, online and mobile banking options, customer service, safety and security measures, and additional features and benefits. By understanding these elements and comparing different options, you can make an informed decision and choose a savings account that aligns with your financial goals.

Interest rates play a crucial role in determining the growth of your savings. Different banks offer varying rates, so it’s important to find an account with a competitive rate. A higher interest rate means your money will grow faster over time. Look for savings accounts that offer compound interest, as this allows your earnings to accrue on both your initial deposit and the interest earned.

Another consideration is the fees associated with the account. Some savings accounts charge maintenance fees or transaction fees, which can eat into your savings. Look for accounts that have low or no fees, or ones that offer fee waivers when certain conditions are met, such as maintaining a minimum balance.

Minimum balance requirements are also important to factor in. Some savings accounts require a minimum deposit to open the account and/or a minimum balance to avoid fees. Make sure to choose an account where the minimum balance requirement aligns with your financial situation.

Interest Rates

Interest rates are a critical factor to consider when choosing a savings account. The interest rate determines how much your money will grow over time. By earning interest on your deposits, you can increase your savings and meet your financial goals faster.

When comparing savings accounts, look for accounts that offer competitive interest rates. Higher interest rates will allow your money to grow more quickly. Keep in mind that interest rates can vary between banks and even between different types of savings accounts offered by the same bank.

It’s also important to consider whether the interest is compounded. Compounding interest means that your earnings will accumulate not only on your original deposit but also on the interest you have already earned. This can have a significant impact on the growth of your savings over time. Look for savings accounts that offer compound interest to maximize your earnings.

Some banks may offer promotional or introductory interest rates for a certain period. While these rates may be attractive initially, it’s important to understand if and when the rate will change after the promotional period ends. Consider the long-term interest rate prospects when evaluating the overall value of the savings account.

Furthermore, be aware of the difference between fixed-rate and variable-rate savings accounts. Fixed-rate accounts offer a consistent interest rate throughout the account’s term. On the other hand, variable-rate accounts can fluctuate based on the prevailing market conditions. While variable-rate accounts may offer higher interest rates during certain periods, they also pose the risk of rates decreasing.

It’s worth noting that the interest earned on savings accounts is generally subject to taxes. Ensure you understand the tax implications and consult with a tax professional if necessary to accurately account for any taxes owed on the interest earned.

By considering the interest rates and the compounding factors, you can select a savings account that will help you maximize the growth of your savings over time and align with your financial goals.

Fees

When choosing a savings account, it’s essential to carefully consider the fees associated with the account. Fees can significantly impact the overall return on your savings and can vary widely between different banks and types of accounts.

Common fees to look out for include maintenance fees, transaction fees, ATM fees, and overdraft fees. Maintenance fees are typically charged on a monthly or annual basis for the upkeep of the account. Transaction fees may be applied every time you make a withdrawal or transfer funds out of the account. ATM fees are charged when you use an ATM that is not affiliated with your bank. Overdraft fees are incurred if you withdraw more money than you have in your account, resulting in a negative balance.

Some banks may waive certain fees based on specific account requirements. For example, some savings accounts may offer fee waivers if you maintain a minimum account balance or if you set up direct deposit. It’s important to understand the conditions for fee waivers and assess whether they align with your financial habits and goals.

In addition to regular fees, banks may also have additional fees for special services or circumstances. These can include wire transfer fees, paper statement fees, account closure fees, or fees for requesting copies of past statements. Be sure to review the fee schedule provided by the bank to have a clear understanding of potential charges.

To minimize fees, consider opting for savings accounts with low or no fees. Many online banks and credit unions offer fee-free savings accounts as they have lower overhead costs compared to traditional brick-and-mortar banks. However, be sure to check for any hidden fees or conditions that may apply.

When comparing savings accounts, consider not only the interest rate but also the fee structure. By choosing an account with lower fees or fee waivers, you can optimize your savings potential and avoid unnecessary costs.

Minimum Balance Requirements

When selecting a savings account, it’s important to consider the minimum balance requirements set by the bank. Minimum balance requirements refer to the minimum amount of money that must be maintained in the account to avoid fees or restrictions.

Some savings accounts have a minimum deposit requirement to open the account. This initial deposit can vary significantly between different banks and account types. Make sure to choose an account that aligns with your available funds and financial goals.

In addition to the initial deposit, some savings accounts have ongoing minimum balance requirements. These requirements dictate the minimum amount of money that must be kept in the account at all times. If the balance falls below this threshold, the bank may charge a fee or apply restrictions to the account.

It’s essential to review the specific terms and conditions of the savings account to understand the minimum balance requirements. Some accounts may have tiered minimum balance requirements, where different interest rates or benefits are offered based on meeting certain balance criteria.

Consider your financial situation and cash flow when evaluating the minimum balance requirements. If you anticipate regular fluctuations in your account balance, ensure that the minimum balance requirement is manageable for you without incurring fees or restrictions.

Keep in mind that some savings accounts offer the ability to waive minimum balance requirements if you meet certain conditions. For example, maintaining a certain number of linked accounts or setting up direct deposit can often waive the minimum balance requirement. Be sure to explore these options if you believe they align with your financial habits and goals.

Remember, the purpose of a savings account is to grow your money over time, so it’s important to choose an account that allows you to do so while still accommodating your financial needs and circumstances.

Access to Funds

When considering a savings account, it’s crucial to assess the accessibility of your funds. While a primary goal of a savings account is to save money over time, you may still need to access your funds for various reasons such as emergencies or planned expenses.

One factor to consider is the number and location of ATMs associated with the savings account. Some banks have a wide ATM network, allowing you to withdraw cash conveniently. Additionally, consider whether your bank reimburses any fees incurred when using out-of-network ATMs, as this can save you money in the long run.

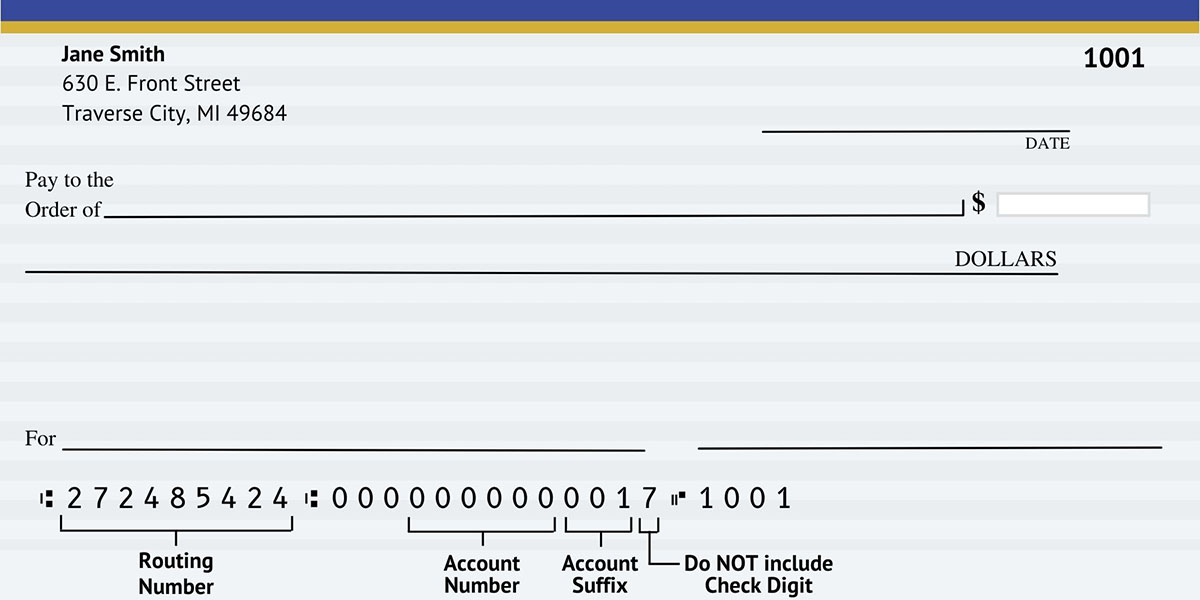

Many savings accounts also offer the option to link the account to a checking account or provide a debit card. This allows for easy transfers between accounts and the ability to make purchases directly from the savings account. However, be aware that some banks may limit the number of monthly transactions from a savings account due to federal regulations.

Another consideration is the ability to access funds through online and mobile banking platforms. Ensure that the savings account you choose provides convenient and user-friendly online and mobile banking options. This can include features such as transferring funds, viewing account balances and transaction history, and setting up automatic transfers or bill payments.

It’s important to note that savings accounts are subject to federal regulations, such as Regulation D, which limits certain transactions, such as online and mobile transfers, to six per month. This regulation is in place to encourage savings behavior and maintain the account’s status as a savings vehicle rather than a transactional account.

Before opening a savings account, be sure to understand any limitations or restrictions on accessing your funds. Assess whether the account provides the flexibility and convenience you require to meet your financial needs while still maintaining the primary goal of saving and growing your money over time.

Online and Mobile Banking Options

In our digital age, having convenient and secure online and mobile banking options is a significant consideration when choosing a savings account. Online and mobile banking provide you with the flexibility to manage your finances from anywhere at any time.

When comparing savings accounts, assess the online and mobile banking features offered by each bank. Look for features such as the ability to view account balances, transaction history, and account statements online. Some banks also provide customizable budgeting tools and spending trackers to help you manage your finances effectively.

Mobile banking apps are becoming increasingly popular, providing access to your savings account through your smartphone or tablet. Consider the availability and functionality of the bank’s mobile app. Look for features like mobile check deposit, the ability to transfer funds, and set up alerts for account activity.

Another important aspect to consider is the security measures in place for online and mobile banking. Ensure that the bank utilizes strong encryption methods to protect your personal and financial information. Two-factor authentication, where you need to provide a second form of verification, adds an extra layer of security to your account.

Additionally, check whether the bank offers customer support services through their online and mobile platforms. The ability to reach customer service representatives via chat or secure messaging can be invaluable if you have questions or encounter issues with your account.

It’s worth noting that some banks have more advanced online and mobile banking platforms than others. Larger banks and online-only banks tend to invest more heavily in their digital banking capabilities, offering a wider range of features and a smoother user experience. However, don’t discount smaller regional banks or credit unions that may still provide robust online and mobile banking options tailored to their customers’ needs.

Ultimately, the convenience and functionality of online and mobile banking can greatly enhance your banking experience. Choose a savings account that offers user-friendly online and mobile banking options to have easy access to and full control over your savings.

Customer Service

When selecting a savings account, it’s essential to consider the level of customer service provided by the bank. Having access to reliable and responsive customer service can make a significant difference in your banking experience.

Firstly, consider the availability of customer service channels offered by the bank. Look for options such as phone support, email or online chat, and in-person branch assistance. A bank that offers multiple channels of communication ensures that you can reach out for help or assistance whenever you need it.

Pay attention to the bank’s customer service hours of operation. Some banks provide 24/7 customer service, which can be particularly helpful if you encounter an issue outside of regular business hours. Other banks may have more limited customer service hours or certain days of the week when customer service is not available.

It’s also important to assess the quality of customer service provided by the bank. Check online reviews and ratings to gauge other customers’ experiences with the bank’s customer service representatives. Look for signs of responsiveness, knowledgeability, and helpfulness. A bank that values customer satisfaction will prioritize providing prompt and effective support to its customers.

Consider the bank’s reputation for resolving issues. Look for information on how the bank handles customer complaints and whether they have a history of addressing issues in a satisfactory manner. A bank that prioritizes customer satisfaction will have mechanisms in place to handle and resolve any problems that may arise.

Lastly, take into account any additional customer service features offered by the bank. This can include online educational resources, financial planning tools, or personalized guidance from financial advisors. These additional resources demonstrate the bank’s commitment to helping customers succeed in their financial journey.

Remember, a savings account is not just about the features and interest rates; it’s also about the overall banking experience. By choosing a bank that provides excellent customer service, you can ensure that your needs will be met and that you’ll have a positive and hassle-free banking experience.

Safety and Security Measures

When entrusting your hard-earned money to a savings account, it’s crucial to prioritize the safety and security of your funds. Understanding the safety measures implemented by a bank can provide peace of mind and ensure that your money is protected.

One of the key safety measures to consider is the Federal Deposit Insurance Corporation (FDIC) insurance. The FDIC is an independent agency of the U.S. government that provides deposit insurance to customers of member banks. This insurance protects your deposits up to $250,000 per depositor, per insured bank. Verify that the bank you choose is a member of the FDIC to ensure your funds are protected.

Additionally, assess the bank’s security protocols for online and mobile banking. Look for features such as encrypted transmission of data, secure login procedures, and monitoring systems for suspicious activity. The bank should employ industry-standard security practices to protect your personal and financial information from unauthorized access.

Two-factor authentication is another security measure to look for. This adds an extra layer of protection by requiring you to provide a second form of verification, such as a unique code sent to your mobile device, in addition to your username and password.

Stay vigilant for any alerts or notifications offered by the bank to notify you of any unusual account activity. Some banks provide real-time alerts via email, SMS, or mobile notifications, allowing you to quickly respond to any potential security threats.

Furthermore, inquire about the bank’s policies and procedures in the event of fraud or unauthorized account access. Determine how the bank handles such situations and whether they offer protection against fraudulent transactions.

It’s also essential to consider the physical security of the bank’s facilities. If in-person branch visits are important to you, ensure that the bank has security measures in place, such as surveillance cameras and secure access controls, to protect their premises and customers.

Lastly, take note of any additional security features offered by the bank, such as the ability to set up account alerts for specific transactions or the option to place temporary holds on your account if suspicious activity is detected.

By choosing a savings account with robust safety and security measures, you can have confidence that your funds are protected and your banking experience is secure.

Additional Features and Benefits

When comparing savings accounts, it’s important to consider the additional features and benefits offered by each bank. These features can enhance your banking experience and provide added value to your savings account.

One common feature to look for is the ability to set up automatic transfers or recurring deposits. This allows you to easily save a portion of your income or set specific savings goals. The bank can automatically transfer funds from other accounts or allocate a portion of your paycheck directly into your savings account, helping you build your savings effortlessly.

Some banks offer rewards programs or loyalty incentives for savings account holders. These rewards can range from cashback on purchases to discounts on products and services. Assess the benefits offered by the bank and determine if they align with your personal preferences and financial goals.

Consider if the bank provides additional financial products or services that complement a savings account. For example, some banks offer mortgage loans, personal loans, or investment services. Having these options available from the same institution can simplify your financial management and potentially provide cost-saving benefits.

Another feature to consider is the availability of educational resources or financial planning tools. Some banks provide online resources, webinars, or one-on-one financial counseling to help you make informed financial decisions and optimize your savings strategy.

It can also be beneficial to assess the bank’s reputation for excellent customer service or their commitment to community involvement and social responsibility. Banks that prioritize these aspects demonstrate a commitment to their customers and the broader community, which can be a motivating factor for choosing their savings account.

Special promotions or limited-time offers can also be attractive additional features. Keep an eye out for any promotional interest rates, fee waivers, or sign-up bonuses that may make a particular savings account more enticing.

Lastly, review any unique benefits offered by the bank that set them apart from competitors. This could include perks like free financial planning consultations, discounts on certain products or services, or exclusive access to events or experiences.

By considering these additional features and benefits, you can choose a savings account that not only meets your basic financial needs but also provides added value and enhances your overall banking experience.

Conclusion

Choosing the right savings account is a critical aspect of managing your personal finances. To make an informed decision, it’s important to consider various factors such as interest rates, fees, minimum balance requirements, access to funds, online and mobile banking options, customer service, safety and security measures, and additional features and benefits.

Interest rates play a significant role in determining the growth of your savings, so look for accounts with competitive rates and consider the compounding of interest. Factor in the fees associated with the account, including maintenance fees, transaction fees, and overdraft fees, and opt for accounts that have low or no fees, or ones that offer waivers based on certain conditions.

Minimum balance requirements are essential to consider to avoid potential fees or restrictions. Assess whether these requirements align with your financial situation. Additionally, evaluate the accessibility of your funds through ATMs, linked accounts, or online and mobile banking platforms.

Online and mobile banking options are crucial in today’s digital world. Ensure the bank offers user-friendly platforms with features like mobile check deposit, fund transfers, and secure login procedures. Also, consider the availability and quality of customer service, as well as the safety and security measures implemented by the bank, such as FDIC insurance, encryption protocols, and two-factor authentication.

Lastly, explore any additional features and benefits provided by the bank, such as automatic transfers, rewards programs, educational resources, and community involvement. These can enhance your savings journey and provide added value to your banking experience.

By carefully considering these factors, you can select a savings account that aligns with your financial goals, offers convenient and secure banking options, and provides valuable additional features. Remember, finding the right savings account is a stepping stone towards achieving financial stability and success.