Home>Finance>What Is A Realistic Return On Investment For Pension Funds?

Finance

What Is A Realistic Return On Investment For Pension Funds?

Published: January 23, 2024

Discover realistic return on investment for pension funds and make informed financial decisions. Explore finance strategies for maximizing pension fund returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Pension funds play a pivotal role in securing the financial future of individuals post-retirement. These funds are designed to generate returns on the contributions made by employees and employers over the course of their working years. Understanding the realistic return on investment for pension funds is crucial for both the fund managers and the contributors. It sets the stage for informed decision-making, ensuring that retirement expectations align with the actual performance of the fund.

The quest for a realistic return on investment is not only a concern for pension fund managers, but also for the individuals who are eagerly anticipating a comfortable post-retirement life. As such, it's essential to delve into the intricacies of pension funds and the factors that influence their performance. By gaining a comprehensive understanding of these elements, individuals can set realistic expectations and make informed decisions regarding their retirement plans.

In the following sections, we will explore the dynamics of pension funds, the factors that impact their return on investment, the historical performance of these funds, and how individuals can set realistic expectations for their pension fund returns. This exploration will provide valuable insights for both fund managers and contributors, shedding light on the complexities and opportunities within the realm of pension investments.

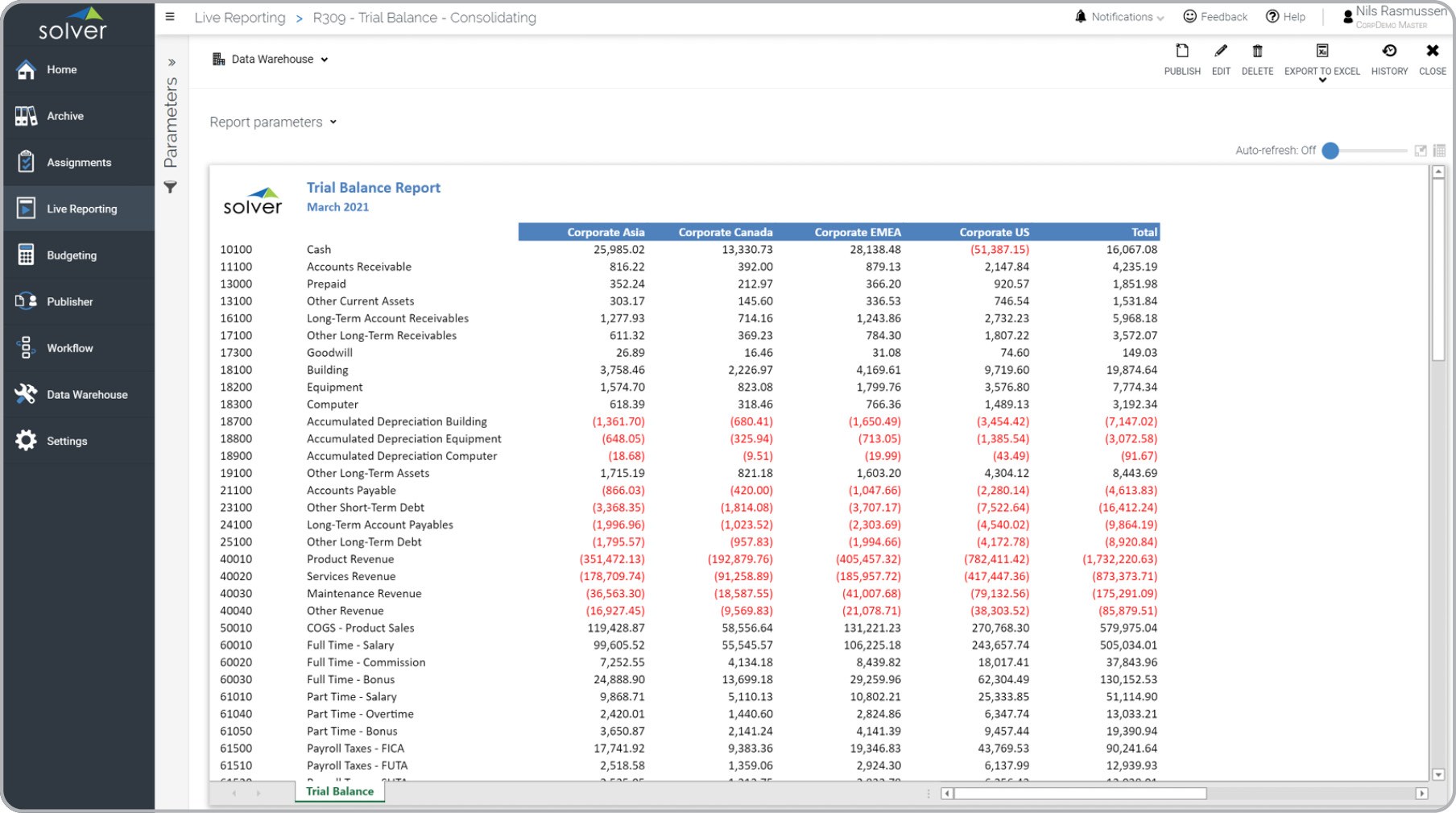

Understanding Pension Funds

Pension funds are investment pools that accumulate contributions from employers, employees, or both, with the primary objective of providing financial security during retirement. These funds are typically managed by financial institutions, investment professionals, or designated fund managers who oversee the allocation of assets to generate returns over the long term.

One of the key distinctions of pension funds is their long-term investment horizon. Unlike other investment vehicles, pension funds are designed to grow and provide returns over several decades, aligning with the extended period of an individual’s working life and subsequent retirement. This long-term approach allows pension funds to invest in a diverse range of assets, including stocks, bonds, real estate, and alternative investments, aiming to leverage the power of compounding and mitigate short-term market fluctuations.

Moreover, pension funds are subject to regulatory frameworks and guidelines that govern their operations and investment strategies. These regulations are designed to safeguard the interests of the fund contributors and ensure prudent management of the fund’s assets. Additionally, pension funds are often structured to provide defined benefits or contributions, offering a degree of financial predictability for retirees.

Understanding the intricacies of pension funds is essential for both fund managers and contributors. Fund managers must navigate the complexities of investment management, risk mitigation, and regulatory compliance to uphold the long-term sustainability of the fund. On the other hand, contributors need to comprehend the fundamental principles of pension funds to make informed decisions about their retirement planning, including contribution levels, investment options, and expected returns.

By gaining a deeper understanding of pension funds, individuals can appreciate the role of these investment vehicles in securing their financial future and make well-informed choices to optimize their retirement savings.

Factors Affecting Return on Investment

The return on investment (ROI) for pension funds is influenced by a myriad of factors that collectively shape the fund’s performance over time. Understanding these factors is crucial for both fund managers and contributors, as it provides insights into the dynamics that drive the fund’s returns and long-term sustainability.

1. Asset Allocation: The strategic allocation of assets within a pension fund is a critical determinant of its investment performance. A well-diversified portfolio that encompasses various asset classes, such as equities, fixed income securities, real estate, and alternative investments, can help mitigate risk and enhance potential returns. The allocation strategy is tailored to the fund’s objectives, risk tolerance, and market conditions, aiming to optimize the balance between risk and reward.

2. Market Conditions: The prevailing market environment significantly impacts the performance of pension funds. Factors such as interest rates, inflation, geopolitical events, and macroeconomic trends can influence the valuation of assets within the fund’s portfolio. Fund managers must adeptly navigate these market conditions, making informed investment decisions to capitalize on opportunities and mitigate potential risks.

3. Regulatory Environment: The regulatory landscape governing pension funds can have a profound impact on their investment strategies and overall performance. Compliance with regulatory requirements, reporting standards, and fiduciary responsibilities is paramount for fund managers. Changes in regulations can also prompt adjustments in investment approaches, asset allocation, and risk management practices.

4. Fund Expenses and Fees: The operational expenses and management fees associated with running a pension fund can directly affect its net returns. Efficient cost management and fee structures are essential to maximize the fund’s performance and ensure that a significant portion of the investment gains accrue to the contributors.

5. Long-Term Economic Trends: Long-term economic developments, such as demographic shifts, technological advancements, and global market dynamics, can shape the investment landscape for pension funds. Fund managers need to assess these trends and align the fund’s investment strategies with the evolving economic realities to capitalize on growth opportunities and mitigate potential challenges.

By comprehensively understanding the factors that influence the return on investment for pension funds, both fund managers and contributors can gain valuable insights into the dynamics that drive the fund’s performance. This understanding forms the foundation for strategic decision-making, risk management, and the pursuit of realistic investment objectives within the realm of pension funds.

Historical Performance of Pension Funds

Examining the historical performance of pension funds provides valuable insights into their long-term investment outcomes and the dynamics that have shaped their returns over time. By analyzing historical data, both fund managers and contributors can gain a deeper understanding of the fund’s performance trends, volatility, and the impact of various market conditions on investment outcomes.

Over the past decades, pension funds have demonstrated a resilient ability to generate returns, albeit amid market fluctuations and economic cycles. The historical performance of pension funds reflects the interplay of diverse factors that have influenced their investment outcomes:

- Market Cycles: Pension funds have navigated through multiple market cycles, including periods of economic expansion, recessions, and financial crises. The historical performance data illustrates the fund’s resilience and adaptability across these cycles, shedding light on the strategies employed to mitigate risks and capitalize on market opportunities.

- Asset Class Performance: Analysis of historical data reveals the performance of different asset classes within pension fund portfolios. Equities, fixed income securities, real estate, and alternative investments have exhibited varying levels of performance over time, influencing the overall returns of the fund.

- Long-Term Growth Trends: Historical performance data provides insights into the long-term growth trends of pension funds, showcasing their ability to generate compounded returns over extended periods. This data underscores the power of long-term investment strategies and the benefits of consistent contributions towards retirement savings.

- Risk-Adjusted Returns: The historical performance of pension funds allows for an assessment of risk-adjusted returns, highlighting the fund’s ability to deliver competitive performance while managing investment risks. This analysis aids in evaluating the fund’s efficiency in balancing risk and reward to achieve sustainable long-term returns.

Furthermore, historical performance data serves as a foundation for setting realistic expectations regarding the potential returns of pension funds. It enables contributors to gauge the historical performance trends and make informed decisions about their retirement planning, contribution levels, and investment strategies.

By examining the historical performance of pension funds, both fund managers and contributors can glean valuable insights into the fund’s resilience, long-term growth prospects, and the strategies employed to navigate through diverse market conditions. This historical perspective forms a cornerstone for informed decision-making and the pursuit of realistic investment objectives within the realm of pension funds.

Setting Realistic Expectations

Setting realistic expectations for the return on investment of pension funds is essential for individuals planning their retirement and the fund managers responsible for optimizing investment outcomes. Realistic expectations are grounded in a comprehensive understanding of the factors that influence pension fund performance, historical trends, and the dynamics of long-term investment growth.

1. Educating Contributors: Empowering contributors with financial literacy and a clear understanding of pension fund dynamics is crucial for setting realistic expectations. Educational initiatives aimed at explaining the long-term nature of pension investments, the potential impact of market fluctuations, and the historical performance of pension funds can help contributors align their expectations with the realities of long-term investing.

2. Long-Term Investment Perspective: Communicating the long-term nature of pension fund investments is pivotal for setting realistic expectations. Emphasizing the benefits of consistent contributions, compounded returns, and the ability of pension funds to weather short-term market volatility can instill a perspective that aligns with the fund’s investment horizon.

3. Transparent Communication: Open and transparent communication from fund managers regarding investment strategies, asset allocation decisions, and the potential impact of market conditions on returns fosters realistic expectations among contributors. Providing clear insights into the factors that drive investment outcomes can help contributors appreciate the complexities of pension fund management.

4. Risk and Return Trade-Off: Educating contributors about the relationship between risk and return within pension fund investments is essential for setting realistic expectations. Contributors need to comprehend that higher potential returns are often associated with increased investment risks, and that the fund’s long-term objectives are balanced with prudent risk management.

5. Historical Performance Insights: Leveraging historical performance data, fund managers can provide contributors with insights into the fund’s past performance, its resilience across market cycles, and the strategies employed to navigate through diverse economic conditions. This historical perspective can help contributors form realistic expectations based on the fund’s long-term performance trends.

By setting realistic expectations for the return on investment of pension funds, both fund managers and contributors can foster a shared understanding of the fund’s long-term objectives, investment dynamics, and the potential outcomes of consistent contributions. Realistic expectations serve as a cornerstone for informed decision-making, financial planning, and the pursuit of sustainable retirement savings within the realm of pension funds.

Conclusion

Understanding the realistic return on investment for pension funds is a critical endeavor that encompasses the perspectives of both fund managers and contributors. The intricacies of pension funds, the factors that influence their performance, historical trends, and the establishment of realistic expectations collectively shape the landscape of retirement planning and investment management.

For fund managers, navigating the complexities of pension fund management requires a strategic approach to asset allocation, risk management, and regulatory compliance. By comprehensively understanding the factors that affect the fund’s performance and leveraging historical insights, fund managers can optimize investment outcomes and uphold the long-term sustainability of pension funds.

Contributors, on the other hand, play a pivotal role in securing their financial future through informed decision-making and a clear understanding of pension fund dynamics. Educating contributors about the long-term nature of pension investments, transparently communicating investment strategies, and leveraging historical performance insights are essential steps in fostering realistic expectations and empowering individuals to make sound retirement planning decisions.

Ultimately, the pursuit of a realistic return on investment for pension funds is rooted in the alignment of long-term investment perspectives, prudent risk management, and the pursuit of sustainable growth opportunities. By embracing a shared understanding of the fund’s objectives and performance dynamics, both fund managers and contributors can collaborate towards the common goal of securing financial well-being during retirement.

As the landscape of pension funds continues to evolve amid changing market conditions and regulatory frameworks, the quest for a realistic return on investment remains a cornerstone of retirement planning. By weaving together the threads of understanding, historical insights, and transparent communication, pension funds can serve as robust vehicles for long-term wealth accumulation and financial security, aligning the aspirations of individuals with the opportunities presented by the realm of pension investments.