Finance

What Type Of Math Does Accounting Use

Published: October 10, 2023

Discover the connection between finance and accounting as we explore the various types of math utilized in the field. Gain insights into financial calculations, data analysis, and more.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Accounting is a fundamental aspect of business operations, providing a systematic way to record, analyze, and report financial transactions. While many people may associate accounting primarily with numbers and calculations, it is crucial to understand the role that mathematics plays in this field.

Mathematics is the language of accounting, enabling professionals to make accurate financial statements, perform analyses, and make well-informed decisions. By utilizing various mathematical concepts, accountants can interpret complex data, identify trends, and assess the financial health of a business.

In this article, we will explore the different types of math that accounting employs. From basic calculations to more advanced mathematical principles, we will uncover the role of algebra, probability and statistics, calculus, and linear programming in accounting. We will also discuss how the concept of time value of money influences financial calculations in this field.

By understanding the diverse mathematical tools used in accounting, individuals can gain a deeper appreciation for the precision, accuracy, and insights that this discipline provides. Whether you are an aspiring accountant, a business owner, or simply curious about the inner workings of finance, this article will offer valuable insights into the mathematics driving the world of accounting.

Basic Mathematical Concepts in Accounting

At the foundation of accounting lies a set of basic mathematical concepts that are essential for accurate recordkeeping and financial analysis. These concepts include arithmetic, percentages, ratios, and proportions.

Arithmetic is a fundamental mathematical operation used in accounting to perform calculations such as addition, subtraction, multiplication, and division. Accountants use arithmetic to calculate total revenue, expenses, assets, and liabilities. These calculations are essential for preparing financial statements and determining the financial position of a business.

Percentages are another crucial concept in accounting. They allow accountants to express ratios or proportions as a fraction of 100. Percentages are often used to analyze financial performance, such as calculating the gross profit margin or the return on investment. They also help in comparing financial data over time or against industry benchmarks.

Ratios are a powerful tool in financial analysis, allowing accountants to make meaningful comparisons between different financial variables. Common ratios used in accounting include the current ratio, which measures a company’s ability to meet its short-term obligations, and the debt-to-equity ratio, which assesses a company’s leverage. These ratios help stakeholders evaluate the financial health and stability of a business.

Proportions are used in accounting to allocate costs or revenues between different entities or departments. For example, a manufacturing company may use proportions to distribute overhead costs to its various products. By understanding proportions, accountants can accurately allocate resources and determine the true cost and profitability of different business activities.

In summary, these basic mathematical concepts form the building blocks of accounting. They provide the necessary tools for accountants to perform calculations, analyze financial data, and make informed decisions. By mastering these foundational concepts, individuals can develop a strong mathematical foundation to excel in the field of accounting.

Algebraic Equations in Accounting

Algebraic equations play a significant role in accounting, enabling accountants to solve complex problems and make accurate financial calculations. Algebraic concepts such as variables, equations, and formulas are used extensively in various accounting applications.

Variables represent unknown quantities in accounting equations. They are commonly used to denote values such as revenues, expenses, assets, and liabilities. By assigning variables to these values, accountants can formulate equations that help in determining the financial position of a business or solving specific accounting problems.

Equations in accounting are mathematical statements that express the relationship between different variables. These equations often involve addition, subtraction, multiplication, and division, and can help accountants solve for unknown values. For example, the basic accounting equation, Assets = Liabilities + Equity, is an algebraic equation that provides a framework for understanding a company’s financial position.

Formulas are derived from equations and are used in accounting to calculate specific values or perform specific functions. For instance, the formula for calculating the depreciation expense of an asset over time involves variables such as the initial cost, expected life, and salvage value of the asset. By plugging in these values, accountants can determine the depreciation expense and allocate it accordingly.

Algebraic equations also come into play when analyzing financial statements and performing financial ratio analysis. Accountants use ratios such as the return on assets (ROA) and the net profit margin to assess a company’s profitability. These ratios can be derived from algebraic equations, allowing accountants to evaluate a company’s financial performance and compare it with industry benchmarks.

In summary, algebraic equations are a vital tool in accounting that support accurate financial calculations and problem-solving. Whether it’s determining the financial position of a business, allocating costs, or analyzing financial data, algebraic concepts help accountants make sense of complex financial information and provide valuable insights to stakeholders.

Financial Statements and Ratios

Financial statements are a key component of accounting, providing a snapshot of a company’s financial performance and position. These statements are prepared using various accounting principles and rely on mathematical ratios to interpret the data effectively.

The income statement is one of the primary financial statements used in accounting. It outlines a company’s revenues, expenses, gains, and losses over a specific period. Ratios such as gross profit margin and net profit margin are derived from the income statement and illustrate the profitability of a business. Gross profit margin calculates the percentage of revenue remaining after deducting the cost of goods sold, while net profit margin measures the percentage of revenue converted into net income.

The balance sheet is another essential financial statement that provides a snapshot of a company’s financial position at a specific point in time. Ratios such as the current ratio and the debt-to-equity ratio are derived from the balance sheet and assess a company’s liquidity and leverage, respectively. The current ratio measures a company’s ability to meet its short-term obligations, while the debt-to-equity ratio compares a company’s debt to its shareholders’ equity.

The cash flow statement showcases a company’s cash inflows and outflows during a specific period. It helps assess a company’s ability to generate and manage cash. Ratios such as the cash flow-to-debt ratio and the cash flow return on investment (CFROI) can be derived from the cash flow statement to evaluate a company’s cash management and Return on Investment (ROI).

Financial ratios provide valuable insights into a company’s financial health and performance. They allow stakeholders to compare a company’s performance to industry benchmarks, identify strengths and weaknesses, and make informed investment decisions. These ratios are often used by investors, creditors, and management to assess a company’s profitability, liquidity, solvency, and overall financial stability.

By utilizing ratios derived from financial statements, accountants and financial analysts can analyze a company’s financial performance, identify trends, and make sound financial decisions. The ratios act as a quantitative tool, providing a common language for stakeholders to assess and measure a company’s financial well-being.

Probability and Statistics in Accounting

Probability and statistics play a crucial role in accounting, providing tools and techniques for analyzing and interpreting financial data. By applying probability theory and statistical methods, accountants can make informed decisions and mitigate risks associated with financial transactions.

Probability is the branch of mathematics that deals with uncertainty and the likelihood of events occurring. In accounting, probability theory is used to estimate the likelihood of different outcomes and the potential impact they may have on financial statements. For example, accountants may use probability to estimate the likelihood of customer defaults, inventory losses, or unexpected expenses.

Statistics, on the other hand, involves collecting, organizing, analyzing, interpreting, and presenting numerical data. In accounting, statistical methods are used to analyze financial data, identify trends, and make forecasts. Accountants may use statistical techniques such as regression analysis, time series analysis, and hypothesis testing to analyze historical financial data and predict future outcomes.

Accountants often rely on statistical measures such as the mean, median, and standard deviation to summarize and interpret financial data. These measures provide insights into the central tendency, dispersion, and variability of data, helping accountants make sound financial decisions. For example, the mean can be used to calculate the average selling price of a product, while the standard deviation can measure the variability of sales revenue.

In addition to analyzing historical data, probability and statistics are also important in auditing and fraud detection. Accountants use statistical sampling techniques to select a subset of data for auditing purposes, ensuring a representative sample is examined. They also leverage statistical methods to detect anomalies, patterns, and red flags that may indicate fraudulent activities.

By incorporating probability and statistics into accounting practices, accountants can gain deeper insights into financial data, make accurate forecasts, and make informed decisions. These tools allow accountants to assess risks, evaluate the reliability of financial information, and provide valuable recommendations to stakeholders.

In summary, probability and statistics provide the foundation for analyzing and interpreting financial data in accounting. By leveraging these tools, accountants can identify patterns, assess uncertainties, and make reliable predictions, leading to effective financial planning, risk management, and decision-making.

Calculus in Accounting

While calculus may not be as immediately apparent in accounting as arithmetic or algebra, it is still a valuable tool for analyzing and understanding financial data. Calculus provides accountants with the ability to study changes, rates, and accumulation of financial quantities, offering a deeper understanding of various accounting concepts.

One of the key applications of calculus in accounting is in understanding the concept of revenue and profit maximization. Calculus allows accountants to analyze functions and determine the maximum point, helping businesses identify the optimal level of production or pricing to maximize their revenue or profit. By using calculus, accountants can find the critical points of a function to determine where revenue or profit is maximized.

Another important application of calculus in accounting is in understanding the concept of cost and production functions. Accountants can use calculus to calculate marginal cost and marginal revenue, which provide important insights into production decisions. By taking the derivative of the cost function, accountants can determine how much the cost changes with respect to a change in production level, aiding in cost analysis and decision-making.

Calculus is also used in financial analysis to understand rates of change and growth. For example, accountants can analyze data using calculus to determine the rate of change of revenue or profit over time, allowing for trend analysis and forecasting. Calculus is also used to calculate compound interest, which is important in determining the future value of investments or loans over time.

Additionally, calculus plays a role in understanding the concept of elasticity, which measures the responsiveness of demand or supply to changes in price or other factors. Accountants can use calculus to calculate price elasticity and income elasticity, providing insights into consumer behavior and the impact of price changes on sales revenue.

Overall, calculus is a valuable tool in accounting that allows professionals to analyze changes, rates, and accumulation of financial quantities. It enables accountants to make informed decisions when it comes to revenue maximization, cost analysis, trend analysis, and elasticity calculations. By utilizing the principles of calculus, accountants can develop a deeper understanding of financial data and provide valuable insights to support business decision-making.

Linear Programming in Accounting

Linear programming is a mathematical technique widely used in accounting to optimize resource allocation and decision-making. It enables accountants to maximize profits, minimize costs, and allocate resources efficiently while considering various constraints.

In accounting, linear programming can be applied to various scenarios. For instance, it can help determine the optimal production mix to maximize profit when faced with limited resources. By formulating a linear programming model, accountants can assign production quantities to different products in order to achieve the highest possible profit, considering factors such as demand, production capacity, and resource availability.

Linear programming can also be applied to optimize investment portfolios. Accountants can use this technique to determine the best combination of investments that maximize return while considering risk constraints. By incorporating factors such as expected returns, risk tolerance, and asset correlations, linear programming models can help accountants construct portfolios that align with the investor’s goals and risk preferences.

Furthermore, linear programming is instrumental in determining optimal pricing strategies. Accountants can use this technique to calculate the optimal price levels that maximize revenue or profit, taking into account factors such as demand elasticity, production costs, and market competition. By incorporating these variables into a linear programming model, accountants can make informed pricing decisions and optimize profitability.

Linear programming is also beneficial in budgeting and resource allocation. Accountants can use this technique to allocate limited resources, such as labor or production capacity, in the most efficient manner. By formulating a linear programming model, accountants can assign resources to different projects or departments to maximize overall output or minimize costs, while considering any constraints or limitations on resources.

In summary, linear programming is a powerful tool in accounting that enables accountants to optimize resource allocation, decision-making, and profitability. By formulating mathematical models and considering various constraints, accountants can make informed choices that lead to efficient resource usage, improved financial performance, and better overall business outcomes.

Time Value of Money in Accounting

The principle of time value of money is a fundamental concept in accounting that recognizes the changing worth of money over time. It is based on the understanding that the value of a dollar today is different from its value in the future due to factors such as inflation, interest rates, and opportunity costs.

In accounting, the time value of money is essential for accurately measuring and comparing cash flows that occur at different points in time. By incorporating this principle, accountants can make informed decisions, analyze investment opportunities, and assess the financial viability of projects.

One key application of the time value of money in accounting is the calculation of present value and future value. Present value involves determining the current worth of an amount of money to be received or paid in the future. Future value, on the other hand, calculates the value of an investment or cash flow at a specific future date.

The time value of money is particularly important in computing the net present value (NPV) and internal rate of return (IRR) of investment projects. NPV determines the value of future cash flows by discounting them back to their present value using a specified discount rate. IRR, on the other hand, calculates the rate of return that makes the NPV of an investment equal to zero.

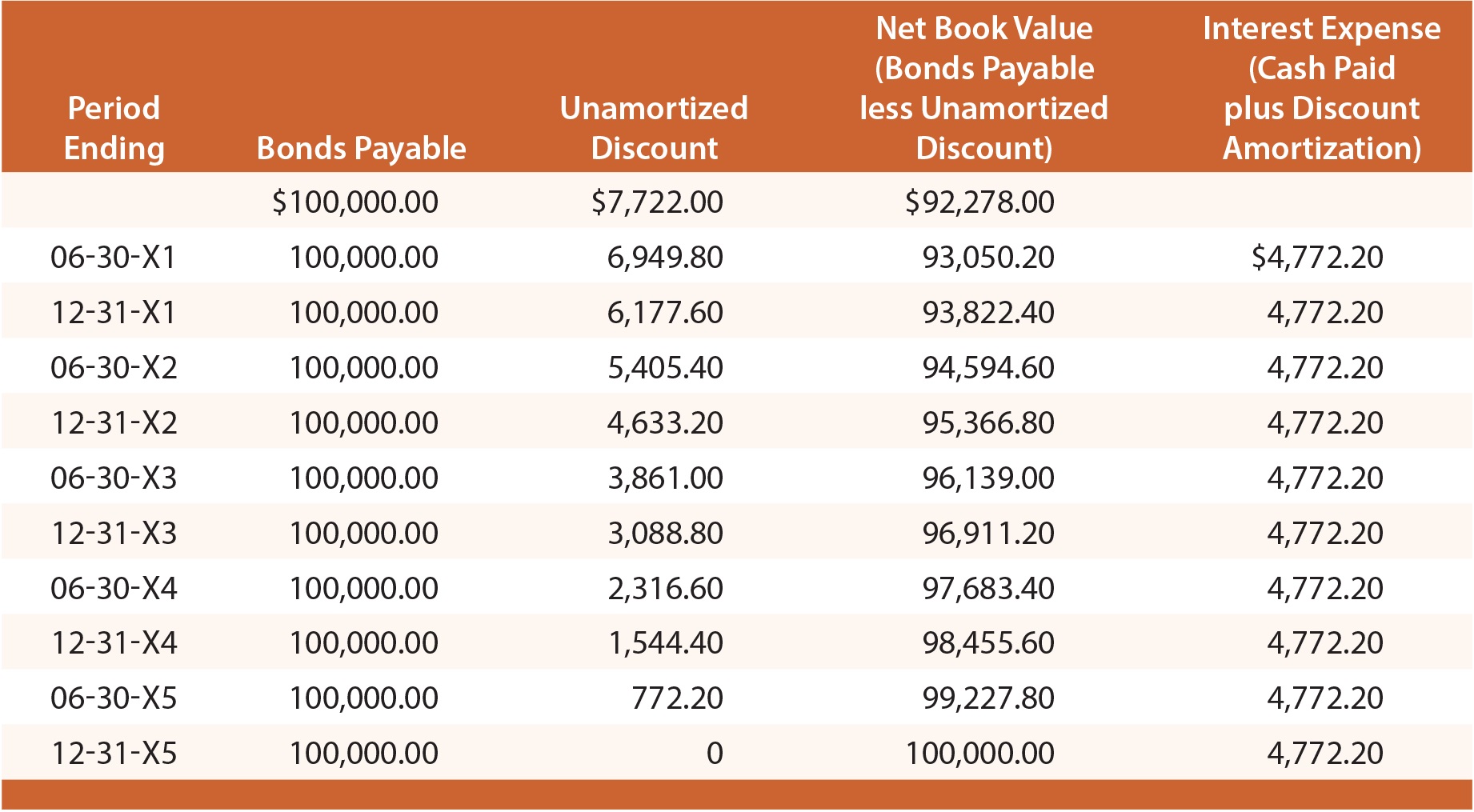

Accountants also use the time value of money to calculate annuities and amortization schedules. Annuities involve a series of equal cash flows received or paid at regular intervals. By discounting or compounding these cash flows based on their timing, accountants can determine their present value or future value. Amortization schedules, on the other hand, allocate the repayment of a loan or the depreciation of an asset over time, taking into account the time value of money.

Furthermore, the time value of money is crucial for evaluating financial instruments such as bonds, loans, and leases. Accountants use this principle to calculate interest and principal payments, determine the fair value of financial assets, and assess the costs and benefits associated with different financing options.

In summary, the time value of money is a fundamental concept in accounting that recognizes the changing worth of money over time. By understanding this principle, accountants can make accurate calculations, evaluate investment opportunities, and make informed financial decisions that consider the impact of time and cash flow timing on the value of money.

Conclusion

Mathematics is a vital component of accounting, providing the framework and tools necessary for accurate financial analysis and decision-making. From basic arithmetic to complex calculus, various mathematical concepts are utilized in accounting to interpret financial data, calculate ratios, optimize resource allocation, and assess the financial health of a business.

In this article, we have explored the different types of math that accounting employs. We delved into the basic mathematical concepts such as arithmetic, percentages, ratios, and proportions, which form the foundation of accounting calculations. We also discussed the role of algebraic equations in solving complex accounting problems and formulating formulas to make accurate financial calculations.

Probability and statistics play an important role in analyzing financial data, identifying trends, and making informed decisions in accounting. These mathematical disciplines allow accountants to assess risk, make reliable forecasts, and detect anomalies that may indicate fraudulent activities.

Calculus enriches accounting by enabling accountants to study changes, rates, and accumulation of financial quantities. It helps in understanding revenue and profit maximization, optimizing resource allocation, analyzing trends, and evaluating elasticity.

Linear programming provides a powerful technique for optimizing resource allocation, pricing strategies, and investment portfolios in accounting. It enables accountants to make informed decisions, consider constraints, and maximize profitability.

Finally, the time value of money is a crucial concept that accounts for the changing worth of money over time, allowing accountants to accurately measure cash flows, evaluate investment opportunities, and assess financial viability.

In conclusion, mathematics is deeply intertwined with accounting, enhancing its precision, accuracy, and ability to provide valuable insights into the financial operations of a business. By understanding and leveraging various mathematical concepts, accountants can effectively interpret financial data, make informed decisions, and contribute to the financial success of an organization.