Home>Finance>What Would Minimum Payment Be On $11600 At 5.9% Credit Card

Finance

What Would Minimum Payment Be On $11600 At 5.9% Credit Card

Published: February 27, 2024

Calculate the minimum payment on a $11600 credit card balance at 5.9% interest rate. Use our finance calculator to manage your credit card payments efficiently.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Credit cards have become an integral part of modern-day finances, offering convenience and flexibility in managing expenses. However, it's crucial to understand the implications of credit card usage, especially when it comes to making minimum payments. Many cardholders may wonder, "What would the minimum payment be on $11600 at 5.9% credit card?" This question reflects a common concern about managing credit card debt and the associated financial responsibilities.

In this article, we will delve into the concept of minimum payments on credit cards, providing a comprehensive understanding of how these payments are calculated and the factors that influence them. By exploring the specific scenario of a $11600 balance on a credit card with a 5.9% interest rate, we will illustrate the process of determining the minimum payment. Through this exploration, readers will gain valuable insights into the dynamics of credit card minimum payments and the implications for their financial well-being.

Understanding the nuances of minimum payments is essential for responsible financial management, as it directly impacts a cardholder's ability to manage and eventually eliminate credit card debt. By shedding light on this topic, we aim to empower individuals with the knowledge and tools to make informed decisions regarding their credit card usage and payment strategies. Let's embark on this enlightening journey to unravel the intricacies of minimum payments on credit cards and gain a deeper understanding of their significance in the realm of personal finance.

**

Understanding Minimum Payments

Minimum payments on credit cards represent the lowest amount that a cardholder must pay each month to maintain the account in good standing. While these payments offer a degree of flexibility, they are accompanied by long-term financial implications, particularly when carrying a balance from month to month. Understanding the key aspects of minimum payments is crucial for making informed financial decisions and effectively managing credit card debt.

One of the fundamental aspects of minimum payments is that they typically comprise a small percentage of the total outstanding balance, often ranging from 1% to 3% of the balance. Additionally, the minimum payment may include any interest accrued during the billing cycle and a portion of the principal balance. However, it’s important to recognize that making only the minimum payment can lead to prolonged debt and substantial interest payments over time.

Moreover, the structure of minimum payments can vary among credit card issuers, and the specific calculation methods may differ. Some issuers set a minimum dollar amount, ensuring that the payment covers at least the interest and a portion of the principal, while others determine the minimum as a percentage of the total balance. Understanding the issuer’s minimum payment calculation method is essential for cardholders to effectively manage their repayment strategy.

Furthermore, it’s crucial to comprehend the implications of making only the minimum payment. By doing so, cardholders may face extended repayment periods, increased interest costs, and potential impacts on their credit score. As interest continues to accrue on the remaining balance, the overall cost of the debt escalates, potentially leading to financial strain and limitations on future borrowing opportunities.

By gaining a comprehensive understanding of minimum payments, individuals can make informed decisions about their credit card usage, repayment strategies, and overall financial well-being. This knowledge empowers cardholders to proactively manage their credit card debt and work towards achieving greater financial stability and freedom.

**

Calculating Minimum Payment on a Credit Card

The calculation of the minimum payment on a credit card involves several key factors, each influencing the amount due and the long-term financial implications. Understanding these factors is essential for cardholders seeking to manage their credit card debt effectively and make informed decisions regarding their repayment strategy.

One of the primary components in the calculation of the minimum payment is the outstanding balance on the credit card. Typically, the minimum payment is determined as a percentage of this balance, often ranging from 1% to 3%. Additionally, the minimum payment may include any interest accrued during the billing cycle and a portion of the principal balance. By considering these elements, cardholders can gauge the minimum amount due and plan their finances accordingly.

Moreover, the annual percentage rate (APR) of the credit card significantly influences the minimum payment calculation. The APR represents the cost of borrowing on the card, encompassing the interest rate and any additional fees. A higher APR results in increased interest charges, consequently impacting the minimum payment amount. Understanding the APR and its implications on the minimum payment empowers cardholders to assess the long-term cost of carrying a balance on their credit card.

Furthermore, some credit card issuers may establish a minimum dollar amount for the payment, ensuring that it covers at least the interest accrued and a portion of the principal balance. This approach provides a safeguard against prolonged debt accumulation and excessive interest costs. By familiarizing themselves with the issuer’s minimum payment calculation method, cardholders can gain clarity on the minimum amount due and strategize their repayment efforts accordingly.

By comprehending the intricacies of minimum payment calculation, individuals can proactively manage their credit card debt and make informed decisions regarding their financial well-being. This knowledge equips cardholders with the tools to navigate the complexities of credit card usage and repayment, ultimately fostering greater financial stability and control.

**

Example: Minimum Payment on $11600 at 5.9% Credit Card

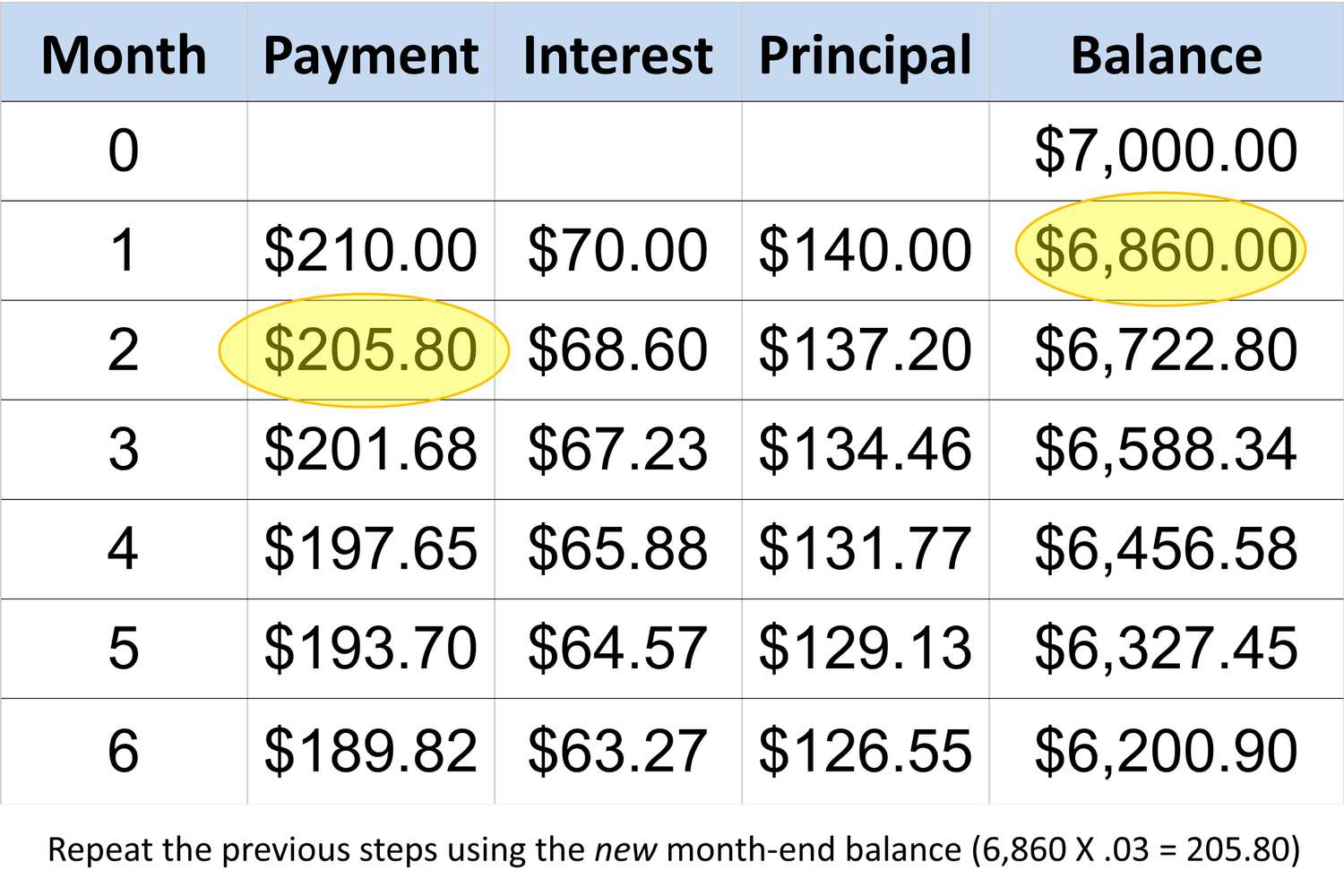

Let’s delve into a practical example to illustrate the calculation of the minimum payment on a credit card with a $11600 balance and a 5.9% interest rate. This scenario offers valuable insights into the dynamics of minimum payments, empowering individuals to grasp the implications of credit card debt and make informed financial decisions.

Assuming a minimum payment percentage of 2% of the outstanding balance, the calculation would involve multiplying the balance by the minimum payment percentage. In this case, 2% of $11600 amounts to $232. However, it’s essential to consider any additional factors that contribute to the minimum payment, such as accrued interest during the billing cycle.

The interest accrued on the $11600 balance at a 5.9% annual interest rate can be calculated by multiplying the balance by the monthly interest rate. With a monthly interest rate of approximately 0.492%, the interest accrued for the billing cycle would amount to approximately $57.03. Adding this interest to the minimum payment based on the percentage of the outstanding balance yields a total minimum payment of approximately $289.03 for the given billing cycle.

By examining this example, individuals gain a practical understanding of the minimum payment calculation process and its implications for managing credit card debt. This insight enables cardholders to make informed decisions regarding their repayment strategy, financial planning, and overall debt management.

Furthermore, this example highlights the long-term impact of carrying a balance on a credit card, emphasizing the importance of proactive debt management and responsible credit card usage. By applying this knowledge to their financial endeavors, individuals can navigate the complexities of credit card debt with confidence and work towards achieving greater financial stability and freedom.

**

Conclusion

Understanding the dynamics of minimum payments on credit cards is paramount for individuals striving to manage their finances effectively and navigate the complexities of credit card debt. By unraveling the intricacies of minimum payments and their calculation, cardholders can make informed decisions regarding their repayment strategy, financial planning, and long-term debt management.

Through our exploration of the minimum payment on a $11600 balance at a 5.9% credit card, we have shed light on the process of calculating the minimum payment and the factors influencing this calculation. This example serves as a practical illustration of the implications of credit card debt, empowering individuals to grasp the financial dynamics at play and make informed decisions regarding their credit card usage.

Furthermore, our journey into understanding minimum payments has underscored the significance of proactive debt management and responsible credit card usage. By leveraging this knowledge, individuals can navigate the complexities of credit card debt with confidence, working towards achieving greater financial stability and freedom.

Ultimately, the insights gained from comprehending minimum payments empower individuals to take control of their financial well-being, effectively manage their credit card debt, and make informed decisions that align with their long-term financial goals. By applying this knowledge to their financial endeavors, individuals can embark on a path towards financial empowerment and security, transcending the challenges posed by credit card debt and embracing a future of fiscal resilience and prosperity.