Finance

When Did Online Banking Start

Modified: February 21, 2024

Discover the origins of online banking and its impact on the world of finance. Learn when online banking first emerged and how it has revolutionized the way we manage our finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Origins of Online Banking

- The Emergence of Electronic Funds Transfer

- The First True Online Banking Systems

- Early Adopters and Expansion

- Advancements in Online Banking Technology

- Online Banking Goes Mainstream

- The Impact of Mobile Technology on Online Banking

- The Future of Online Banking

- Conclusion

Introduction

Online banking has revolutionized the way we manage our finances, providing convenience and accessibility like never before. Instead of visiting physical bank branches, customers can now perform various banking tasks from the comfort of their own homes or on-the-go using their smartphones. But have you ever wondered when online banking first came into existence?

The origins of online banking can be traced back to the early stages of computer technology and the development of electronic funds transfer systems. Over the years, these systems evolved and merged with the growing internet infrastructure, leading to the birth of the first true online banking platforms. Since then, online banking has continued to evolve, embracing new technologies and innovations to make banking easier and more secure for customers.

In this article, we’ll delve into the history of online banking, exploring its origins, the advancements it has undergone, and the impact it has had on the financial industry.

So, let’s travel back in time and discover how online banking came into existence and how it has transformed the way we manage our money!

Origins of Online Banking

The concept of online banking can be traced back to the late 1960s and early 1970s when banks began exploring new ways to automate their processes and provide faster services to their customers. During this time, banks started experimenting with the concept of electronic funds transfer (EFT) systems, which allowed the electronic transfer of money from one bank account to another.

In 1971, the first successful demonstration of online banking took place in New York City by Citibank. The system, called the “Electronic Money Transfer System” (EMTS), allowed customers to perform banking transactions and access account information using a computer terminal.

Soon after, in 1973, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) was established to facilitate secure communication and financial transactions between banks across the globe. This laid the foundation for the development of international online banking systems in the future.

It was not until the 1980s that online banking started gaining more traction. The advancements in computer and telecommunications technology allowed banks to develop more sophisticated online banking systems. However, these early systems were still limited to a select group of large institutions due to the high costs involved in implementing and maintaining the infrastructure.

During the 1990s, with the rise of the internet, online banking started becoming more accessible to the general public. Banks began offering basic online services such as checking account balances and transferring funds between accounts. This was a significant milestone in the history of online banking, as it marked the shift towards a more customer-centric approach and the possibility of conducting financial transactions without visiting a physical bank branch.

With the advent of the World Wide Web in the mid-1990s, banks started developing web-based platforms that allowed customers to access their accounts and perform banking tasks through a browser. This further democratized online banking and made it more accessible to a larger number of people.

Since then, online banking has continued to evolve rapidly, incorporating new features and technologies such as mobile banking, biometric authentication, and personalized financial management tools. Today, online banking has become an integral part of our daily lives, providing convenience, security, and flexibility in managing our finances.

The Emergence of Electronic Funds Transfer

In order to understand the origins of online banking, it is essential to delve into the emergence of electronic funds transfer (EFT) systems. EFT paved the way for the development of online banking by enabling electronic transactions and the transfer of funds between bank accounts.

The concept of EFT originated in the 1960s as a solution to streamline and expedite financial transactions. At that time, most banking processes were paper-based and involved manual handling of checks and cash. This manual approach was time-consuming and prone to errors.

With the rise of computer technology, banks saw an opportunity to automate and digitize various banking processes. In 1968, the Federal Reserve introduced the Automated Clearing House (ACH) system to facilitate the electronic transfer of funds. The ACH system allowed banks to exchange financial transactions electronically, eliminating the need for physical checks.

Additionally, in 1972, a consortium of major U.S. banks formed the National Data Corporation (NDC) to develop a centralized database for processing financial transactions. The resulting system, known as the “Bank Americard System,” enabled electronic fund transfers between banks connected to the network.

These early EFT systems set the stage for the eventual emergence of online banking. They established the foundation for electronic transactions and laid the groundwork for future innovations in the financial industry.

As computer technology continued to advance, banks realized the potential of online systems to provide more efficient and convenient banking services. The integration of the internet into the financial sector further catalyzed the development of online banking, enabling customers to access their accounts, conduct transactions, and manage their finances from anywhere with an internet connection.

Overall, the emergence of electronic funds transfer systems was a crucial stepping stone for the evolution of online banking. It showcased the possibilities of a digital financial landscape and served as a precursor to the comprehensive online banking platforms we enjoy today.

The First True Online Banking Systems

After the initial experiments with electronic funds transfer systems, the development of the first true online banking systems was a groundbreaking milestone in the history of online banking. These systems laid the foundation for the modern online banking platforms we use today.

One of the first true online banking systems was introduced by Stanford Federal Credit Union (SFCU) in 1983. Known as ‘Home Banking,’ this system allowed SFCU members to access their accounts, view balances, and transfer funds using personal computers connected to a phone line. While Home Banking was limited to a small group of users, it marked the beginning of online banking as we know it.

In the late 1980s and early 1990s, a number of banks began developing their own online banking systems. The first bank to offer internet-based banking services was the Nottingham Building Society in the United Kingdom in 1997. The system allowed customers to perform basic transactions, such as checking their balances and transferring funds, through their home computers.

Following suit, in the same year, Wells Fargo became the first major U.S. bank to offer online banking services to its customers. Wells Fargo’s system allowed users to access account information, pay bills, transfer funds, and even trade stocks online.

During this period, security concerns were paramount, and banks implemented various measures to protect customer data. Encrypted communication channels, personal identification numbers (PINs), and secure login processes were implemented to ensure the safety of online banking transactions.

While these early systems provided basic functionalities, they laid the groundwork for the rapid expansion and advancements in online banking technology that were soon to come.

It is worth mentioning that the 1990s also saw the emergence of specialized online banking providers, known as neobanks or digital banks. These digital-only banks focused solely on providing online banking services, without the physical branch presence. This further accelerated the accessibility and popularity of online banking, as customers were able to enjoy the convenience of managing their finances without ever visiting a physical bank location.

Overall, the development of the first true online banking systems in the 1980s and 1990s marked a significant milestone in the history of online banking. These systems paved the way for the widespread adoption of online banking services and set the stage for the rapid advancements and innovations that would follow.

Early Adopters and Expansion

After the emergence of the first online banking systems, early adopters began to embrace this new way of managing their finances. While online banking was initially limited to a select group of tech-savvy individuals, it quickly gained momentum and expanded its reach.

Financial institutions recognized the potential of online banking to attract and retain customers. Many banks started investing in the development of robust online banking platforms, aiming to provide a seamless user experience and convenience to their customers.

In the late 1990s and early 2000s, online banking started to gain widespread popularity. With the increasing availability of personal computers and internet access, more and more people began to adopt online banking as their preferred method of managing their finances.

Furthermore, the convenience and time-saving nature of online banking appealed to busy professionals and individuals who were looking for ways to simplify their financial tasks. The ability to check account balances, view transaction history, and transfer funds at their own convenience became a significant selling point for online banking.

As online banking expanded, it also brought about a change in consumer behavior. Users became more comfortable with conducting financial transactions online and gradually shifted away from traditional banking methods. Online bill payment, for example, became increasingly popular, allowing customers to pay their bills electronically without the need for writing and mailing physical checks.

Expanding beyond personal computers, the advent of smartphones and mobile internet further accelerated the growth of online banking. Banks began developing mobile apps, enabling customers to access their accounts and perform banking tasks on-the-go. This mobile accessibility brought a new level of convenience and flexibility, allowing users to manage their finances anytime, anywhere.

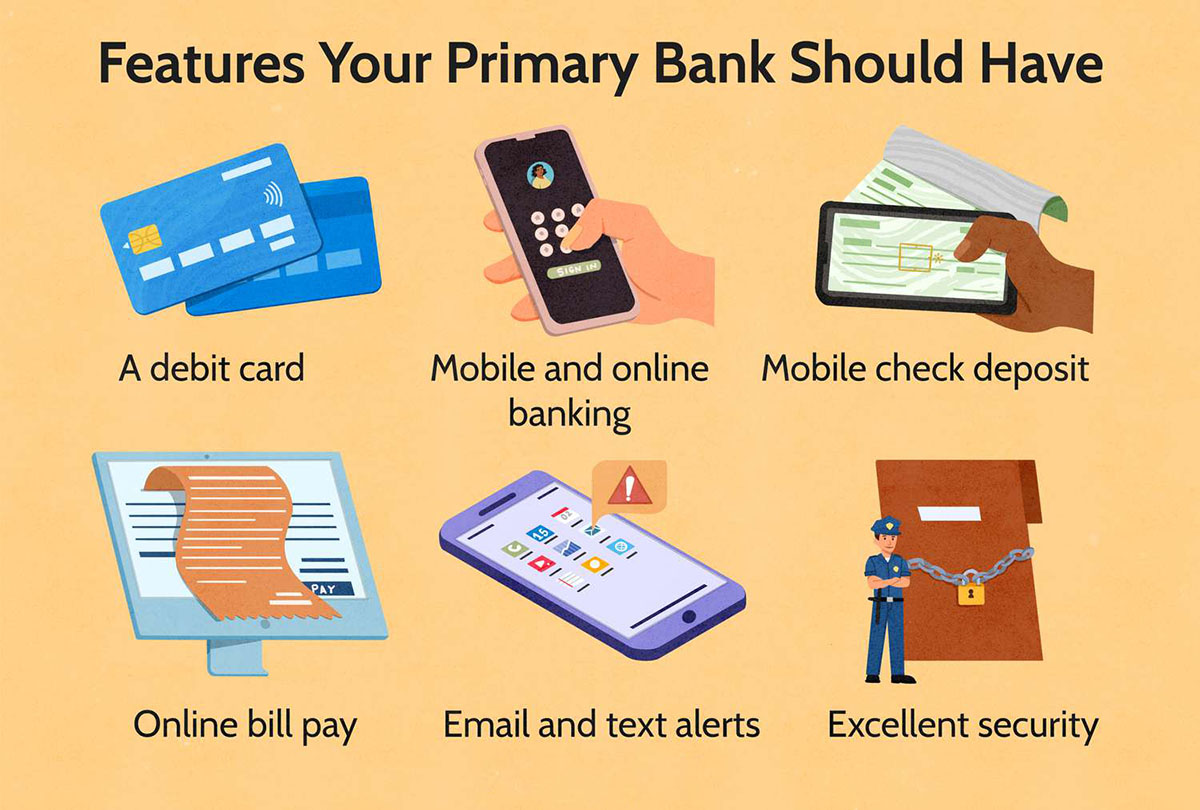

With the expansion of online banking and the increasing adoption of mobile banking, banks started offering a wider range of services. Features like electronic statements, online loan applications, and investment management tools became standard offerings in online banking platforms.

Furthermore, the integration of third-party payment platforms and digital wallets into online banking systems provided a seamless and integrated experience for customers. This allowed users to link their accounts with various payment services and easily make online purchases, further blurring the lines between traditional banking and e-commerce.

Today, online banking has become the norm rather than the exception. Financial institutions worldwide offer comprehensive online banking services, addressing the diverse needs and preferences of their customers. Online banking has transformed the way people manage their finances, providing convenience, accessibility, and a wide range of financial tools and services at their fingertips.

As online banking continues to evolve, we can expect further advancements in user experience, security, and integration with emerging technologies. The future of online banking looks promising, with innovations such as artificial intelligence, voice assistants, and biometric authentication shaping the next generation of digital banking experiences.

Advancements in Online Banking Technology

Over the years, online banking has witnessed significant advancements in technology, enhancing the user experience and improving the security and functionality of these platforms. These advancements have revolutionized the way we interact with online banking systems and have made managing our finances more efficient and convenient.

One of the notable advancements in online banking technology is the development of sophisticated user interfaces. Early online banking systems had basic interfaces with limited features. However, with advancements in web design and user experience, modern online banking platforms offer intuitive interfaces that are easy to navigate and provide a seamless user experience across different devices.

Additionally, the integration of artificial intelligence (AI) and machine learning has brought about significant improvements in online banking. AI-powered chatbots and virtual assistants allow customers to interact with their bank and receive real-time assistance for various banking tasks, such as checking account balances, making payments, and answering frequently asked questions. These AI-powered features automate customer service interactions and provide a more personalized experience for users.

Another key advancement in online banking technology is the implementation of enhanced security measures. Online banking platforms now incorporate robust authentication systems, including biometric authentication methods like fingerprint and facial recognition. Multi-factor authentication adds an extra layer of security, ensuring that only authorized individuals can access sensitive financial information.

Furthermore, advancements in data encryption and secure communication protocols have made online banking more secure than ever before. Banks employ industry-standard encryption techniques to protect customers’ data and secure financial transactions, giving users peace of mind when conducting online banking activities.

The integration of financial management tools and personalized insights is another significant advancement in online banking technology. Many online banking platforms now offer budgeting tools, expense tracking, and spending analysis features. These tools provide users with a comprehensive overview of their financial health, enabling them to make informed decisions and set financial goals.

In recent years, the rise of open banking and application programming interfaces (APIs) has fueled further innovation in online banking. Open banking allows customers to securely share their financial data with third-party applications, such as personal finance management apps or loan comparison websites. This enables users to have a holistic view of their financial situation and access tailored financial services from various providers.

Moreover, the advancements in mobile technology have significantly impacted online banking. Mobile banking apps now offer a range of features and capabilities, such as mobile check deposit, cardless ATM withdrawals, and person-to-person payment options. The seamless integration of mobile devices with online banking has made it even more accessible and convenient for users to manage their finances on the go.

As technology continues to evolve, we can expect further advancements in online banking. Innovations such as voice banking, augmented reality, and blockchain technology are being explored to enhance the online banking experience and provide users with more seamless and secure ways to manage their finances.

Online Banking Goes Mainstream

Online banking has come a long way since its early days, and today it has become a mainstream method of managing personal finances. The advancements in technology, a shift in consumer behavior, and the convenience it offers have propelled online banking into the mainstream.

One of the key factors that contributed to the mainstream adoption of online banking is the widespread availability of internet access. With the increasing penetration of broadband internet and the ubiquity of smartphones, more people than ever have the means to connect to online banking platforms.

Online banking has also gained trust and acceptance from consumers due to the robust security measures implemented by financial institutions. Banks have invested heavily in encryption technologies, secure authentication methods, and fraud detection systems to ensure the safety of users’ financial information. As a result, customers feel confident and comfortable performing financial transactions online.

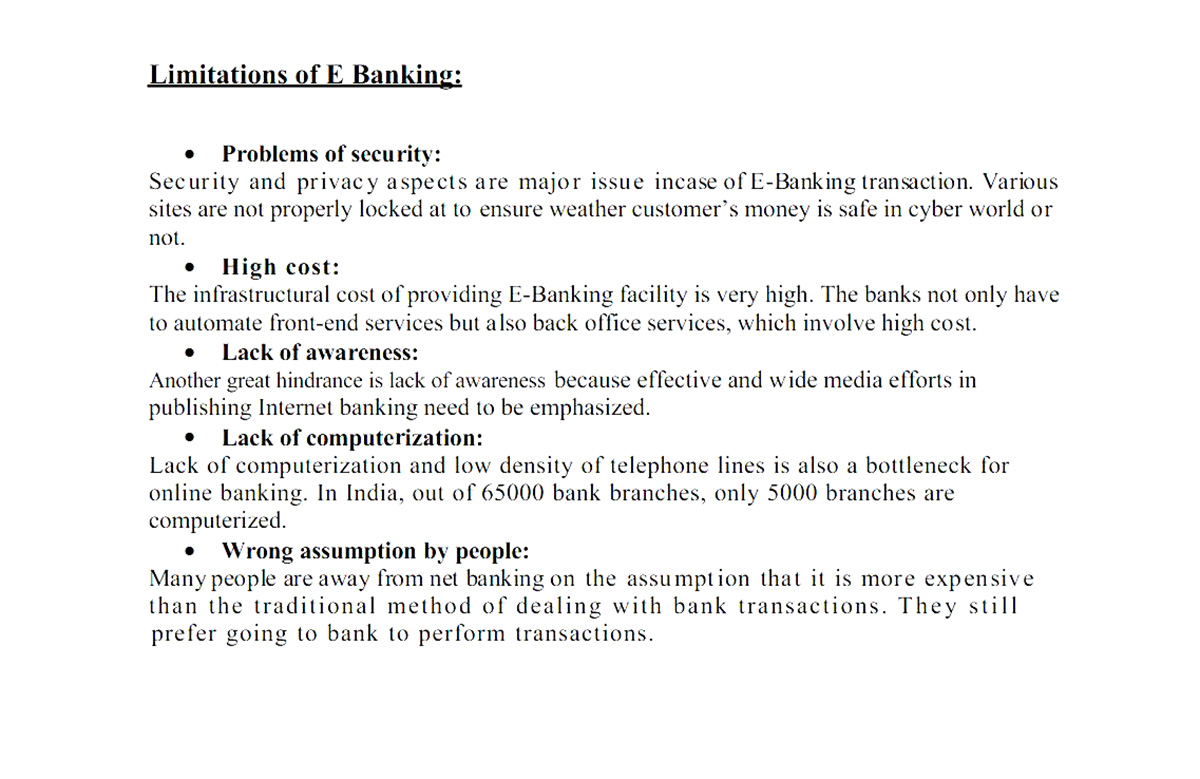

Moreover, the convenience offered by online banking has been a driving force in its mainstream adoption. Customers no longer have to visit physical bank branches during limited hours to perform basic banking tasks. With online banking, users can access their accounts around the clock and perform various transactions, such as transferring funds, paying bills, and managing investments, from the comfort of their own homes or on-the-go using mobile apps.

Another factor that has contributed to the mainstream popularity of online banking is the continual expansion of available services. Online banking platforms have evolved to offer a wide range of features and capabilities that meet the diverse needs of users. From managing multiple accounts and setting up automatic bill payments to applying for loans and tracking spending patterns, online banking has become a comprehensive tool for financial management.

The COVID-19 pandemic further accelerated the adoption of online banking. With lockdowns and social distancing measures in place, physical bank visits were limited, leading more people to embrace the convenience and safety of online banking. The pandemic acted as a catalyst, pushing individuals who were hesitant to transition to online banking to give it a try, and once they experienced its benefits, many opted to continue using it even after the restrictions were lifted.

The mainstream adoption of online banking has also led to the consolidation of physical bank branches. As more customers shifted to online banking, banks reassessed their brick-and-mortar presence and optimized their branch networks. This shift allowed banks to allocate resources more efficiently and invest in digital banking platforms that cater to the changing needs of customers.

Online banking has become a fundamental part of the financial industry, with banks heavily promoting their online banking services. Institutions now prioritize the development of seamless and user-friendly digital banking platforms, focusing on delivering exceptional experiences to their customers.

Looking ahead, online banking will continue to evolve and adapt to new technologies and customer demands. The increasing integration of AI, automation, and open banking will shape the future of online banking, providing users with even more personalized and tailored financial services.

As online banking becomes even more accessible and advanced, it will solidify its place as the primary method of managing personal finances, further cementing its position as a mainstream staple of the modern banking landscape.

The Impact of Mobile Technology on Online Banking

The advent and widespread adoption of mobile technology have had a profound impact on the evolution of online banking. Mobile devices, such as smartphones and tablets, have transformed the way we access and interact with online banking platforms, making it more convenient, accessible, and personalized than ever before.

Mobile banking apps have become a cornerstone of online banking, allowing customers to manage their finances on the go. These apps have revolutionized the banking experience, offering a range of features and functionalities that cater to the needs of modern users.

Perhaps the greatest impact of mobile technology on online banking is the convenience it provides. With mobile banking apps, users can access their accounts anytime, anywhere. They can check balances, review transaction history, transfer funds, and pay bills with just a few taps on their mobile devices. This level of accessibility has made it easier for people to stay on top of their finances, even when they are constantly on the move.

Moreover, mobile banking has introduced a new level of personalization. Banks can leverage mobile technology to offer customized experiences, tailoring the app interface and recommendations based on the user’s financial habits and preferences. This personalization enhances the user experience, making banking more intuitive and engaging.

Security has always been a vital aspect of online banking, and mobile technology has played a significant role in enhancing it. Mobile banking apps incorporate advanced security measures, such as biometric authentication (fingerprint or facial recognition) and device recognition, to protect user data and prevent unauthorized access to accounts. These additional layers of security give users peace of mind, knowing that their financial information is protected.

The convenience and security offered by mobile banking have not only benefited individual consumers but also made banking services more accessible to traditionally underserved populations. Mobile banking has bridged the gap for individuals who may not have had access to traditional bank branches, allowing them to open accounts, make payments, and access financial services through their mobile devices.

Mobile technology has also played a crucial role in the rise of mobile payments. By integrating mobile payment systems like Apple Pay, Google Pay, and Samsung Pay into banking apps, users can make secure contactless payments with their smartphones, eliminating the need for physical cash or cards. This seamless integration of payment systems with online banking has simplified the payment process and elevated the overall user experience.

Furthermore, the use of mobile technology has opened doors for innovative banking solutions. Mobile-only banks, also known as neobanks or digital banks, have emerged as agile and technology-driven alternatives to traditional banks. These banks operate exclusively through mobile apps, offering a range of banking services tailored to the needs of digital-savvy consumers.

Looking ahead, the impact of mobile technology on online banking will continue to evolve. Technologies such as near-field communication (NFC), augmented reality (AR), and artificial intelligence (AI) hold the potential to further enhance the mobile banking experience, providing users with even more seamless and personalized financial services.

Mobile technology has undoubtedly transformed online banking, making it more accessible, convenient, and secure. As mobile devices continue to evolve, so will online banking, pushing the boundaries of what is possible and shaping the future of digital banking.

The Future of Online Banking

The future of online banking is filled with exciting possibilities as advancements in technology continue to reshape the financial industry. Here are some key trends and innovations that are likely to shape the future of online banking:

1. Artificial Intelligence and Machine Learning: AI-powered chatbots and virtual assistants will become more sophisticated, providing personalized and intuitive customer experiences. Machine learning algorithms will analyze customer data to offer tailored financial advice and recommend personalized products and services.

2. Voice Banking: Voice-enabled banking systems, integrated with virtual assistants like Amazon’s Alexa or Apple’s Siri, will enable users to perform banking tasks, such as checking balances or making transfers, using natural language commands.

3. Biometric Authentication: Biometric authentication methods, such as fingerprint or facial recognition, will become even more prevalent, offering enhanced security and convenience for users accessing their online banking accounts.

4. Open Banking and APIs: Open banking initiatives will enable customers to securely share their financial data with authorized third-party applications, allowing for more integration with external financial services and creating a holistic and customized banking experience.

5. Blockchain Technology: Blockchain, the underlying technology behind cryptocurrencies like Bitcoin, has the potential to revolutionize online banking by enabling secure and transparent transactions, reducing costs, and increasing efficiency.

6. Personalized Financial Management: Online banking platforms will offer more sophisticated financial management tools, providing customers with detailed insights into their spending patterns, personalized budgeting recommendations, and real-time financial goal tracking.

7. Enhanced Security Measures: As cyber threats evolve, online banking will continue to invest in robust security measures. Multi-factor authentication, advanced encryption techniques, and real-time fraud detection systems will be key to ensuring customer data remains secure.

8. Internet of Things (IoT): The integration of IoT devices with online banking will enable seamless connectivity between banking platforms and smart devices. For example, users could receive real-time notifications on their smartwatches or initiate transactions through connected home devices.

9. Augmented Reality (AR): AR could transform the way users interact with online banking by overlaying digital information onto the physical environment. Users could visualize their financial data and perform transactions in a more immersive and interactive manner.

10. Enhanced Customer Service: Online banking will continue to focus on delivering excellent customer service through various channels, including live chat, social media, and 24/7 support. AI-powered bots will seamlessly handle common queries, freeing up human agents to address more complex issues.

As technology evolves and customer expectations change, online banking will continue to adapt and innovate. The future of online banking is set to offer a more seamless, personalized, and secure banking experience, transforming the way individuals and businesses manage their finances.

Conclusion

Online banking has come a long way since its early days, revolutionizing the way we manage our finances. From its humble origins in the 1960s to its widespread adoption today, online banking has evolved alongside advancements in technology and shifts in consumer behavior.

The origins of online banking can be traced back to the emergence of electronic funds transfer systems, which paved the way for the development of the first true online banking platforms. With the rise of the internet and mobile technology, online banking has become more accessible, convenient, and secure.

Early adopters embraced online banking, recognizing the benefits of accessing their accounts and performing transactions anytime, anywhere. As online banking expanded, it went mainstream, leading to the consolidation of physical branches and the optimization of digital banking platforms.

Advancements in online banking technology have enhanced the user experience, incorporating features such as artificial intelligence, personalized financial management tools, and biometric authentication. These innovations have made online banking more intuitive, secure, and personalized.

The impact of mobile technology on online banking cannot be overlooked. Mobile banking apps have made banking even more accessible and convenient, allowing users to manage their finances on the go. Mobile technology has also enabled the rise of mobile payments, simplifying the way we make transactions.

The future of online banking holds exciting prospects. Artificial intelligence, voice banking, blockchain technology, and open banking initiatives are just a few of the trends that will shape the future online banking landscape. Enhanced security measures, personalized financial management, and seamless integration with emerging technologies will further elevate the online banking experience.

In conclusion, online banking has transformed the financial industry, offering unparalleled convenience, accessibility, and security. As technology continues to evolve and consumer demands evolve, online banking will continue to adapt, delivering innovative solutions and meeting the evolving needs of customers. The future of online banking is bright, promising a more seamless, personalized, and connected financial experience for individuals and businesses alike.