Finance

Automatic Reinvestment Plan (ARP) Definition

Published: October 11, 2023

Looking to invest in finance? Learn about the Automatic Reinvestment Plan (ARP), a powerful tool for reinvesting dividends and capital gains.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlock the Power of Automatic Reinvestment Plans (ARP) for Your Financial Future

Welcome to our Finance category, where we dive deep into various topics to help you better understand and navigate the world of personal finance. In this blog post, we’re going to shed light on Automatic Reinvestment Plans (ARP) definition, a term you may have come across while exploring investment options. By the end of this article, you’ll have a clear understanding of what ARP is and how it can benefit you.

Key Takeaways:

- An Automatic Reinvestment Plan (ARP) allows you to reinvest dividends or capital gains from your investments without any manual intervention.

- ARP provides a convenient way to steadily grow your investment portfolio and compound returns over time.

Now, let’s delve into the world of Automatic Reinvestment Plans (ARP) and discover how they can contribute to your financial success.

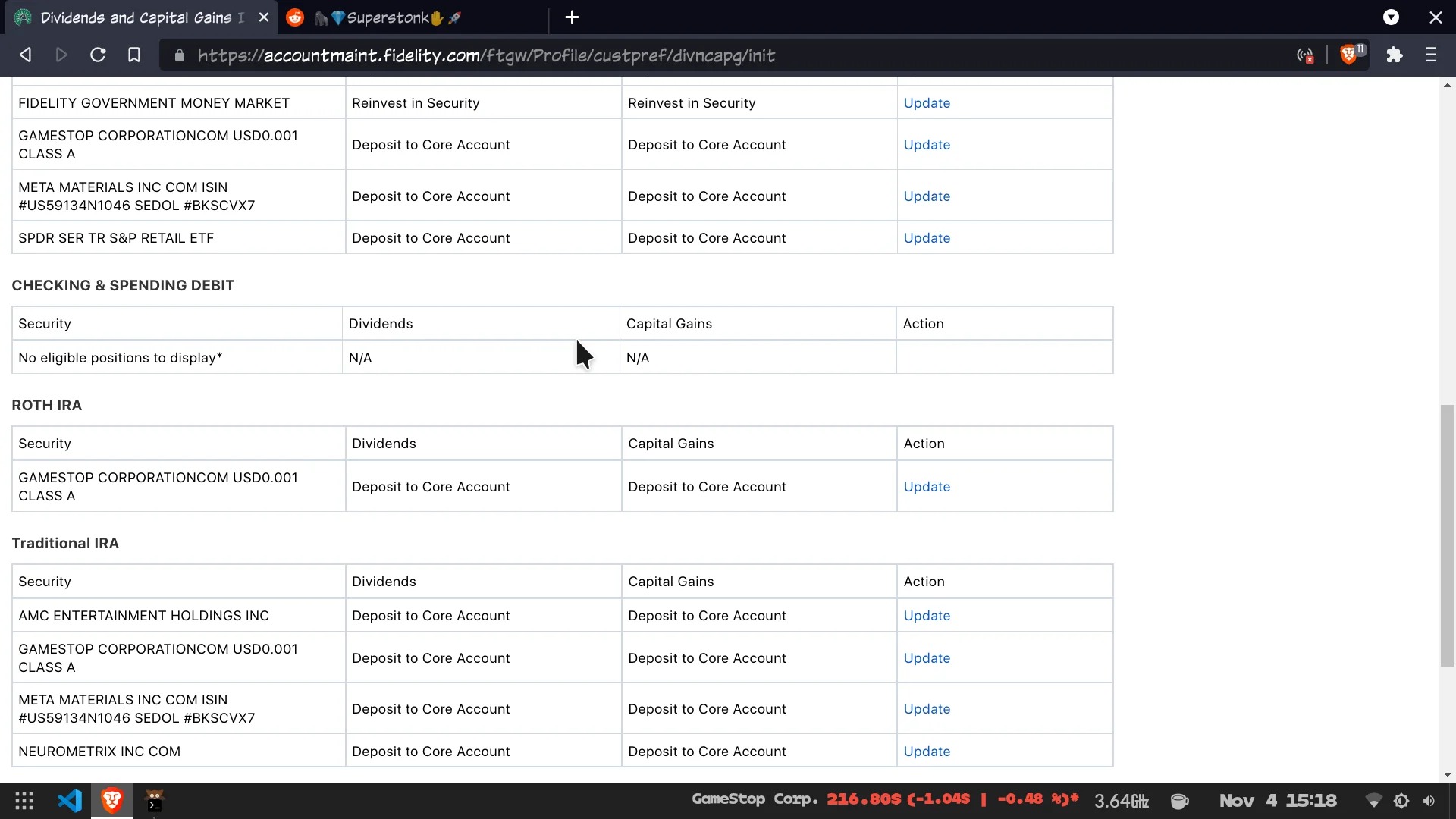

Let’s start with the basics: What is an Automatic Reinvestment Plan (ARP)? Simply put, an ARP is an investment method that enables you to automatically reinvest any dividends or capital gains generated by your investments back into the same investment, without requiring any manual action on your part. This means that each time you receive a dividend or capital gain payment, it is automatically reinvested to purchase additional shares of the same investment.

Automatic Reinvestment Plans (ARP) offer several advantages for investors. Here are some key benefits:

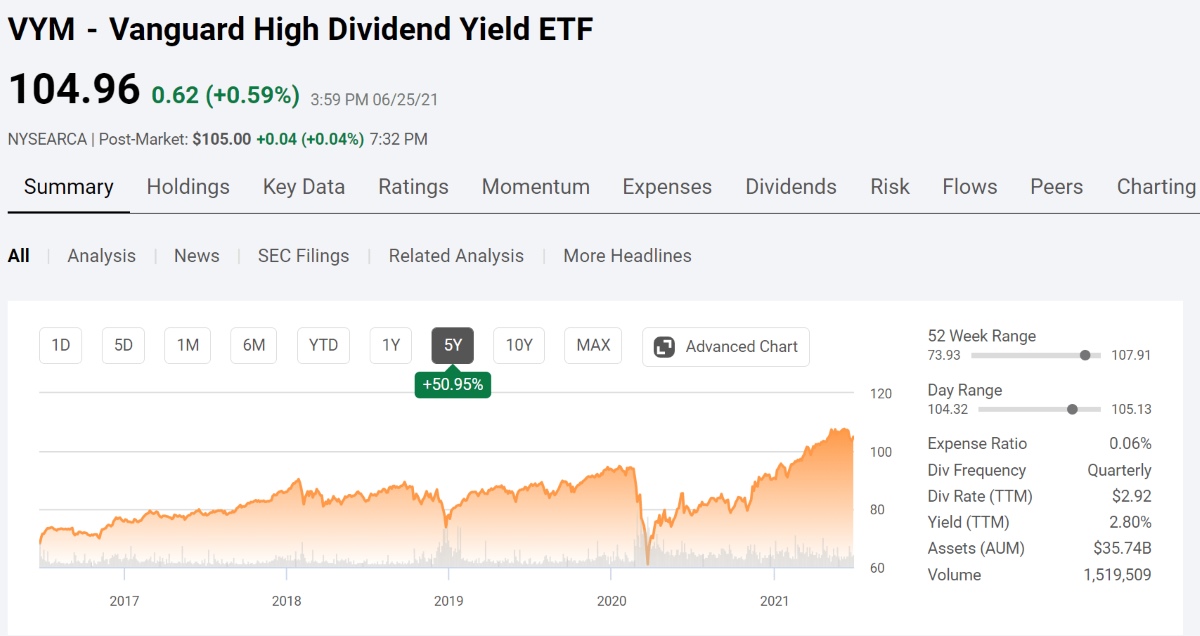

- Compound Returns: By reinvesting your dividends or capital gains, you can take advantage of compounding returns. Over time, this can significantly boost your investment value and help you accumulate more wealth.

- Convenience: ARP eliminates the need for you to manually reinvest your dividends or capital gains. This saves you time, effort, and potential delays, as the entire reinvestment process happens automatically.

- Dollar-Cost Averaging: ARP enables you to engage in dollar-cost averaging. This means that you purchase more shares when prices are lower and fewer shares when prices are higher, ultimately reducing the impact of market fluctuations on your investment performance.

- Long-Term Growth: Automatic Reinvestment Plans (ARP) are particularly beneficial for long-term investors looking to grow their investment portfolio steadily. By reinvesting dividends or capital gains, you can harness the power of compounding over a longer period, increasing your potential for significant growth.

There are a few key considerations to keep in mind if you’re interested in implementing an Automatic Reinvestment Plan (ARP). Firstly, not all investments offer this feature, so it’s important to check if the investment you’re interested in supports ARP. Additionally, some ARP options may come with fees or minimum investment requirements, so it’s crucial to read the fine print and understand the associated costs.

To conclude, Automatic Reinvestment Plans (ARP) provide a hassle-free way to reinvest your investment returns automatically. By taking advantage of compounding returns and the convenience offered by ARP, you can achieve long-term growth and steadily build wealth. Consider exploring this investment strategy and consult with a financial advisor to determine if it aligns with your financial goals.

We hope this article has provided valuable insights into the world of Automatic Reinvestment Plans (ARP) and how they can contribute to your financial future. Stay tuned for more informative content on our Finance category, where we unravel even more personal finance topics to help you prosper.