Home>Finance>When Do ICE Commodity Options Contracts Rollover?

Finance

When Do ICE Commodity Options Contracts Rollover?

Published: February 29, 2024

Learn when ICE commodity options contracts rollover and stay updated with the latest rollover dates in the finance industry. Keep track of rollover schedules for successful trading.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

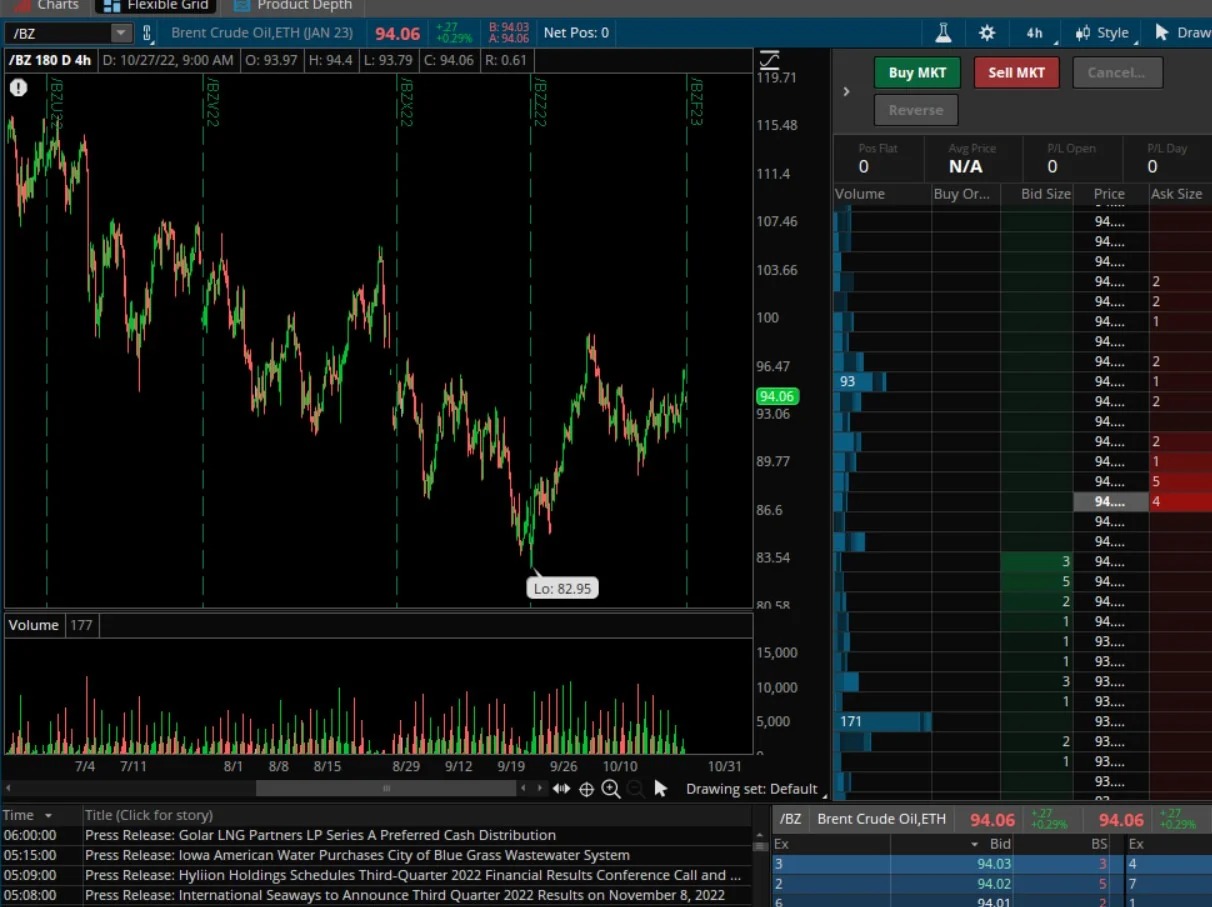

Commodity options contracts are essential financial instruments that provide traders with the right, but not the obligation, to buy or sell a specific quantity of a commodity at a predetermined price within a set timeframe. These contracts are traded on various exchanges, including the Intercontinental Exchange (ICE), which offers a wide range of commodities such as crude oil, natural gas, agricultural products, and precious metals.

Understanding the rollover dates for ICE commodity options contracts is crucial for traders and investors who actively engage in the commodities market. Rollover dates signify the expiration of the current contract and the transition to a new contract period. This process is vital for maintaining trading continuity and managing exposure to price fluctuations in the underlying commodities.

In this article, we will delve into the intricacies of ICE commodity options contracts and explore the factors that influence rollover dates. Additionally, we will examine the rollover process for these contracts, shedding light on the essential steps involved. By gaining a comprehensive understanding of rollover dates and processes, traders can make informed decisions and effectively navigate the dynamic landscape of commodity options trading on the ICE platform.

Understanding ICE Commodity Options Contracts

ICE commodity options contracts are financial derivatives that provide traders with the opportunity to participate in the price movements of various commodities without the need to own the physical assets. These contracts offer the flexibility to buy (call option) or sell (put option) a specified quantity of a commodity at a predetermined price, known as the strike price, within a specific time frame.

Commodity options traded on the ICE platform cover a diverse range of underlying assets, including energy products like crude oil and natural gas, agricultural commodities such as coffee and sugar, as well as precious metals like gold and silver. The availability of options contracts for multiple commodities enables traders to diversify their portfolios and capitalize on price fluctuations across different sectors of the commodities market.

Unlike futures contracts, which mandate the buy or sell obligation at the contract’s expiration, options contracts provide the holder with the right to execute the trade but not the obligation. This characteristic affords traders the flexibility to assess market conditions and decide whether to exercise the option based on their profit objectives and risk tolerance.

ICE commodity options contracts are traded on regulated exchanges, ensuring transparency and standardized contract terms. Traders can access these contracts through authorized brokerage firms and electronic trading platforms, facilitating efficient and accessible market participation.

Understanding the mechanics and intricacies of ICE commodity options contracts is fundamental for traders seeking to leverage these financial instruments effectively. By staying informed about the underlying commodities, contract specifications, and market dynamics, traders can make well-informed decisions and navigate the complexities of options trading with confidence.

Factors Affecting Rollover Dates

Rollover dates for ICE commodity options contracts are influenced by a confluence of factors that contribute to the dynamics of the commodities market. Understanding these factors is imperative for traders and investors, as it enables them to anticipate and adapt to the transition from one contract period to the next. Several key elements play a pivotal role in determining rollover dates:

- Expiration Cycle: ICE commodity options contracts follow specific expiration cycles, which dictate the frequency of rollover dates. Common cycles include monthly, quarterly, and annual expirations, with each cycle offering distinct opportunities for market participation and risk management.

- Market Liquidity: The liquidity of the underlying commodity market influences rollover dates, as higher liquidity often corresponds to smoother rollover processes. Enhanced liquidity facilitates seamless transition between contract periods, enabling traders to execute transactions with minimal market impact.

- Seasonal Factors: Certain commodities exhibit seasonal price patterns, leading to variations in rollover dates based on supply and demand dynamics. Agricultural commodities, for instance, may have rollover dates aligned with planting and harvest seasons, reflecting the cyclical nature of agricultural production.

- Regulatory Changes: Regulatory developments and changes in exchange policies can impact rollover dates for commodity options contracts. Traders should stay informed about regulatory updates to anticipate any shifts in rollover schedules and ensure compliance with relevant trading regulations.

- Macro-Economic Events: Major economic events, such as geopolitical tensions, interest rate decisions, and macroeconomic data releases, can influence rollover dates by affecting market volatility and participant behavior. Traders need to monitor these events to gauge their potential impact on rollover processes and market sentiment.

By considering these factors, traders can gain insights into the dynamics of rollover dates for ICE commodity options contracts, empowering them to adapt their trading strategies and risk management approaches in response to evolving market conditions.

Rollover Process for ICE Commodity Options Contracts

The rollover process for ICE commodity options contracts involves the transition from expiring contracts to new contract periods, ensuring continuity in trading activities and risk management. This process is essential for maintaining a seamless trading experience and managing exposure to price fluctuations in the underlying commodities. The following steps outline the typical rollover process for ICE commodity options contracts:

- Evaluation of Expiring Contracts: As rollover dates approach, traders assess their positions in expiring contracts, considering factors such as market conditions, open interest, and potential price movements. This evaluation is crucial for determining whether to roll positions to the next contract period or close out existing positions.

- Selection of New Contracts: Traders identify and select the appropriate new contracts based on their trading objectives, market outlook, and risk management strategies. Factors such as contract specifications, expiration dates, and liquidity are taken into account when choosing new positions.

- Execution of Rollover Trades: Upon selecting new contracts, traders execute rollover trades to transition their positions from expiring contracts to the chosen new contracts. This process involves closing out existing positions in the expiring contracts and simultaneously establishing equivalent positions in the new contracts.

- Adjustment of Risk Parameters: Traders may need to adjust risk parameters, such as position size and option strategies, when rolling over contracts to align with their evolving market outlook and risk tolerance. This step ensures that the new positions effectively reflect the trader’s updated market perspectives and risk management goals.

- Monitoring Market Impact: Throughout the rollover process, traders monitor the market impact of their transactions, particularly regarding price movements and order execution. This vigilance allows traders to assess the effectiveness of their rollover strategies and make any necessary adjustments to optimize their positions.

By following these steps, traders can effectively navigate the rollover process for ICE commodity options contracts, leveraging this transition to adapt their trading positions and risk exposures in response to changing market conditions. Additionally, maintaining a thorough understanding of the rollover process empowers traders to capitalize on opportunities and manage risks with agility and precision.

Conclusion

Understanding the rollover dates and processes for ICE commodity options contracts is paramount for traders seeking to navigate the dynamic landscape of commodities trading with confidence and precision. By comprehending the intricacies of these financial instruments and the factors that influence rollover dates, traders can effectively manage their positions and adapt to evolving market conditions.

The flexibility and diversity offered by ICE commodity options contracts enable traders to capitalize on price movements across various commodities, leveraging options strategies to optimize risk and reward. By actively monitoring expiration cycles, market liquidity, seasonal factors, regulatory changes, and macroeconomic events, traders can anticipate rollover dates and tailor their trading approaches to align with prevailing market dynamics.

Furthermore, the rollover process for ICE commodity options contracts entails a strategic transition from expiring contracts to new contract periods, encompassing evaluation, selection, execution, and risk adjustment. This process empowers traders to optimize their positions and adapt to changing market sentiment, fostering agility and responsiveness in their trading endeavors.

In conclusion, a comprehensive understanding of ICE commodity options contracts, rollover dates, and the rollover process equips traders with the knowledge and insight needed to navigate the complexities of commodities trading effectively. By staying informed, proactive, and adaptable, traders can harness the potential of these financial instruments to pursue their trading objectives with clarity and confidence.