Home>Finance>When Do You Pay Interest For Making The Minimum Payment

Finance

When Do You Pay Interest For Making The Minimum Payment

Published: February 25, 2024

Learn when you'll be charged interest for making only the minimum payment on your finances. Understanding the implications of minimum payments is crucial for managing your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Dynamics of Minimum Payments and Interest Accrual

Welcome to the world of credit and finance, where the concept of minimum payments often intersects with the accrual of interest. In this article, we will delve into the crucial details surrounding the timing of interest payments when making only the minimum payment on credit accounts. Understanding this dynamic is essential for anyone seeking to manage their finances effectively and minimize the long-term cost of borrowing.

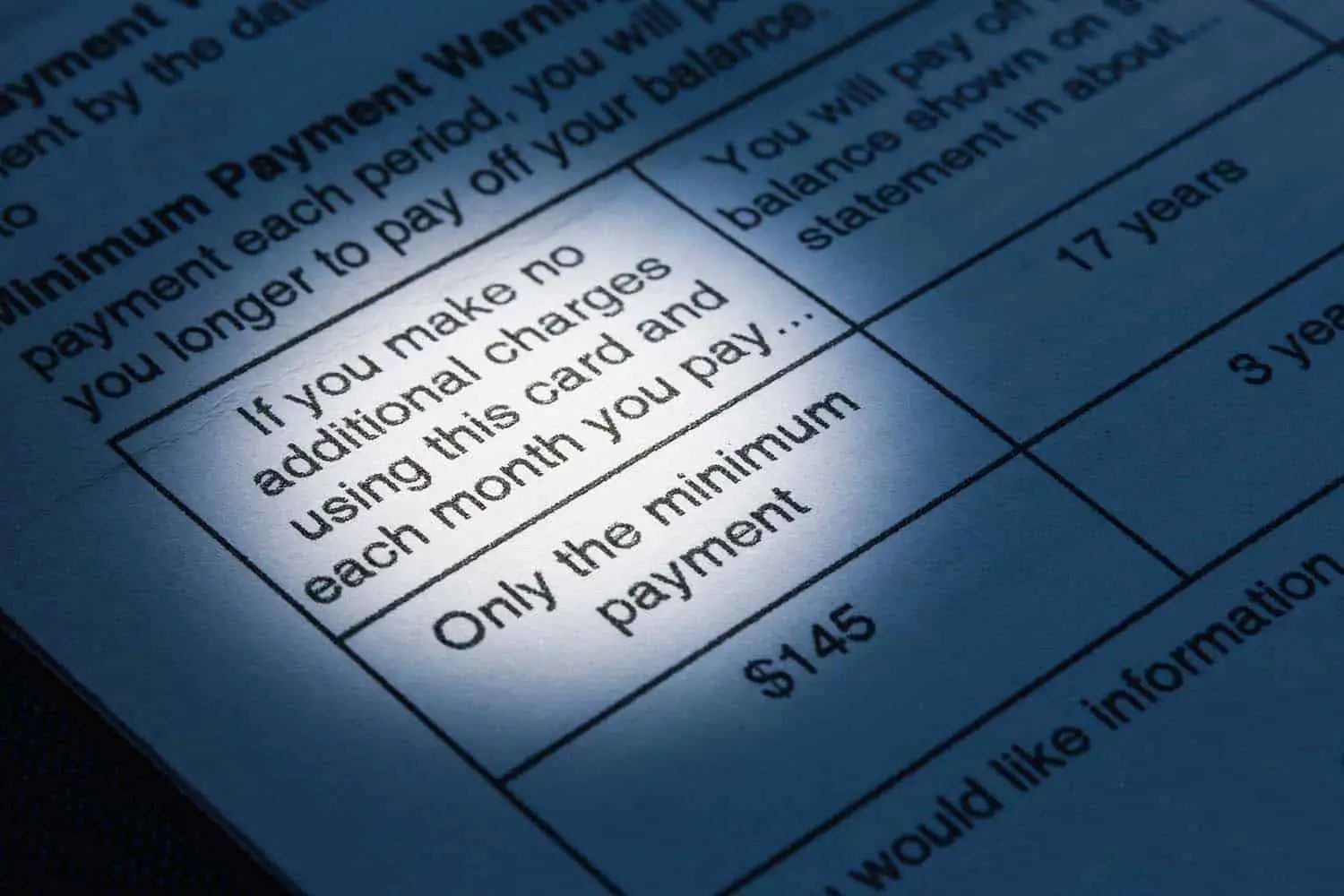

Many individuals are familiar with the scenario: the credit card statement arrives, displaying the minimum amount due, and a sense of relief washes over them. After all, making the minimum payment appears to be a manageable and convenient option, especially during tighter financial periods. However, what may not be immediately apparent is the impact of this decision on the overall interest accrued and the extended duration of debt repayment.

Through this exploration, we aim to shed light on the critical factors that come into play when opting for minimum payments. By gaining insight into the timing of interest accrual in such scenarios, individuals can make informed decisions and take proactive steps toward financial stability and debt management.

Understanding Minimum Payments

Minimum payments represent the lowest amount that a borrower must remit to the lender by a specified due date. This figure is calculated based on various factors, including the outstanding balance, interest rate, and a percentage of the principal. While making the minimum payment is a common practice, it is essential to comprehend the implications of adhering to this approach.

When borrowers opt for minimum payments, they are essentially meeting the basic requirement to avoid penalties or default, yet they are also prolonging the debt repayment period. This is due to the fact that a significant portion of the minimum payment often goes towards covering the interest accrued, with only a fraction contributing to reducing the principal balance.

Moreover, the minimum payment is designed to ensure that the borrower remains in good standing with the lender, thereby preventing adverse consequences such as late fees or negative impacts on credit scores. However, it is crucial to recognize that while making the minimum payment safeguards immediate repercussions, it may not be conducive to long-term financial well-being.

Understanding the nature of minimum payments involves acknowledging the trade-offs associated with this approach. While it provides a temporary reprieve and maintains the borrower’s creditworthiness, it also leads to an extended repayment timeline and higher overall interest payments. By grasping these nuances, individuals can make informed decisions regarding their financial obligations and adopt strategies that align with their broader fiscal goals.

When Interest Accrues on Minimum Payments

Interest accrual on minimum payments occurs as soon as the billing cycle ends and the statement is generated. When a borrower opts to make only the minimum payment, the remaining balance, including the interest, continues to accrue interest on a daily basis until it is fully repaid. This means that even though the minimum payment has been made, interest continues to accumulate on the outstanding balance, perpetuating the cycle of debt.

It is crucial to recognize that the timing of interest accrual is independent of the minimum payment deadline. Regardless of when the minimum payment is made within the billing cycle, interest accrues on the remaining balance from the moment the statement is issued. Consequently, the longer it takes to clear the outstanding balance, the more interest will accumulate, resulting in a higher overall cost of borrowing.

Furthermore, the compounding nature of interest exacerbates the impact of delaying full repayment. As interest accrues on the existing balance, it is added to the principal, leading to a larger amount on which future interest calculations are based. This compounding effect can significantly inflate the total interest paid over time, underscoring the importance of addressing outstanding balances promptly and minimizing reliance on minimum payments.

By understanding the mechanics of interest accrual on minimum payments, borrowers can gain insight into the potential long-term consequences of this approach. It highlights the significance of actively managing outstanding balances and devising strategies to mitigate the impact of interest accrual, ultimately fostering greater financial prudence and control.

Impact of Paying Only the Minimum on Interest

Opting to pay only the minimum amount due can have a substantial impact on the overall interest incurred on a credit account. By making minimum payments, borrowers essentially extend the repayment period, leading to a prolonged exposure to interest accrual. This extended timeline translates to a higher total interest cost over the life of the debt.

One of the key implications of paying only the minimum is the perpetuation of a cycle where a significant portion of the payment goes towards servicing the interest rather than reducing the principal balance. As a result, the outstanding balance diminishes at a slower pace, allowing interest to continue accumulating on a larger portion of the principal, thereby amplifying the total interest paid over time.

Moreover, the cumulative impact of paying solely the minimum amount can be staggering. Borrowers may find themselves in a situation where the total interest paid over the repayment period far exceeds the initial amount borrowed. This underscores the critical importance of considering the long-term repercussions of minimum payments and evaluating alternative strategies to mitigate the adverse effects of prolonged interest accrual.

Furthermore, the compounding nature of interest exacerbates the consequences of paying only the minimum. As interest continues to accrue on the outstanding balance, it is added to the principal, leading to a larger base on which future interest calculations are based. This compounding effect further amplifies the total interest paid, emphasizing the need to address outstanding balances proactively and expedite the repayment process.

By comprehending the impact of making only the minimum payment on interest, borrowers can gain a deeper appreciation for the financial ramifications of this approach. It underscores the significance of devising a repayment strategy that prioritizes reducing the principal balance and minimizing the duration of exposure to interest, ultimately fostering greater financial prudence and minimizing the overall cost of borrowing.

Alternatives to Paying Only the Minimum

Recognizing the potential pitfalls of relying solely on minimum payments, borrowers can explore alternative strategies to manage their credit accounts more effectively. By adopting proactive approaches to debt repayment, individuals can mitigate the impact of prolonged interest accrual and expedite their journey toward financial freedom.

One viable alternative is to allocate additional funds towards reducing the outstanding balance beyond the minimum requirement. By making payments that exceed the minimum amount due, borrowers can accelerate the reduction of the principal balance, thereby curbing the long-term impact of interest accrual. This approach enables individuals to minimize the total interest paid and expedite the path to debt clearance.

Consolidating high-interest debt through balance transfers or debt consolidation loans presents another avenue for borrowers to manage their obligations more efficiently. By consolidating multiple high-interest debts into a single, lower-interest account, individuals can streamline their repayment efforts and potentially reduce the overall interest burden. This strategy can offer relief from the cycle of prolonged interest accrual associated with minimum payments.

Furthermore, maintaining a disciplined approach to budgeting and financial management can empower individuals to allocate more substantial payments towards their credit accounts. By identifying areas where expenses can be trimmed and funds reallocated towards debt repayment, borrowers can expedite the reduction of outstanding balances, thereby mitigating the impact of interest accrual and fostering a more sustainable financial outlook.

Exploring these alternatives equips individuals with the tools to proactively address their credit obligations and minimize the long-term impact of interest accrual. By embracing strategies that prioritize the reduction of the principal balance and expedite the repayment timeline, borrowers can navigate their financial journey with greater confidence and control, ultimately paving the way for enhanced financial well-being.

Conclusion

Understanding the interplay between minimum payments and interest accrual is paramount for individuals seeking to navigate the complexities of credit and debt management. By delving into the nuances of this dynamic, borrowers can make informed decisions that align with their long-term financial goals and minimize the overall cost of borrowing.

It is evident that opting to pay only the minimum amount due can have far-reaching implications, leading to prolonged exposure to interest accrual and a higher total interest cost over the life of the debt. The cycle of extended repayment periods perpetuated by minimum payments underscores the need for proactive strategies that prioritize reducing the principal balance and expediting the path to debt clearance.

Exploring alternatives such as allocating additional funds towards repayment, consolidating high-interest debt, and maintaining disciplined financial management can empower individuals to mitigate the impact of prolonged interest accrual and foster a more sustainable financial outlook. By embracing these proactive approaches, borrowers can curtail the long-term consequences of minimum payments and pave the way for enhanced financial well-being.

In essence, the decision to pay only the minimum amount due on credit accounts warrants careful consideration, as it carries implications that extend far beyond the immediate term. By gaining insight into the timing of interest accrual, the impact of prolonged debt repayment, and the available alternatives, individuals can navigate their financial obligations with greater prudence and control, ultimately forging a path toward financial freedom and stability.

Armed with this knowledge, borrowers can approach their credit accounts with a heightened awareness of the long-term ramifications of their repayment decisions. By prioritizing strategies that expedite the reduction of outstanding balances and minimize the duration of exposure to interest, individuals can chart a course toward financial empowerment and resilience, ensuring that their financial journey is characterized by informed choices and sustainable practices.