Home>Finance>When Are Life Insurance Premiums Tax Deductible?

Finance

When Are Life Insurance Premiums Tax Deductible?

Published: December 19, 2023

Learn about the tax deductibility of life insurance premiums and how it can impact your finances. Get all the information you need to make an informed decision.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Life insurance is a critical financial tool that provides protection and peace of mind for individuals and their loved ones. It offers a way to secure financial stability in the event of a family member’s death. While the primary purpose of life insurance is to provide a death benefit to beneficiaries, policyholders may also be eligible for certain tax benefits.

Understanding the tax implications of life insurance premiums is essential for making informed financial decisions. In this article, we will explore when life insurance premiums may be tax-deductible and highlight the key considerations that individuals should be aware of.

It’s important to note that every individual’s tax situation is unique, and it is recommended to consult with a tax professional or financial advisor for personalized guidance. However, having a general understanding of the tax deductions related to life insurance can help individuals make better-informed decisions.

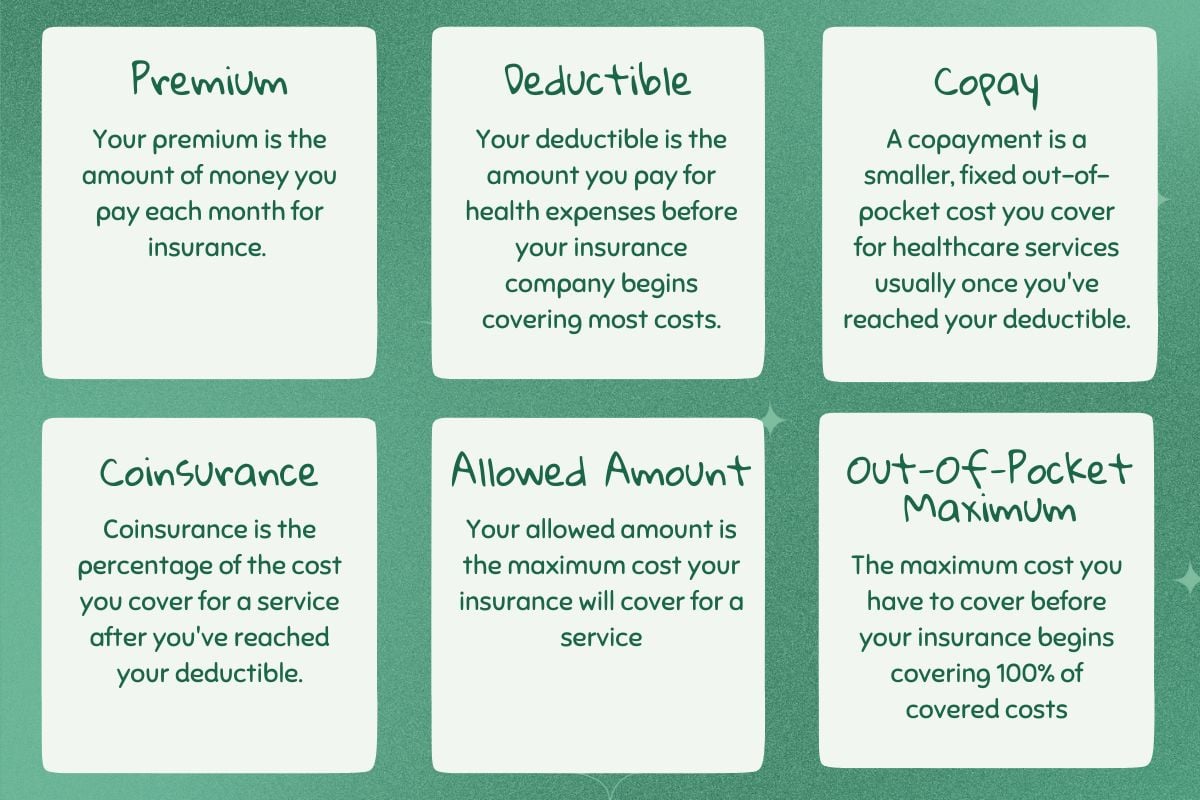

Before diving into the various scenarios where life insurance premiums can be tax-deductible, let’s understand the basic premise of tax deductions. A tax deduction is an expense that can be subtracted from an individual’s taxable income, resulting in a reduction in the overall tax liability.

Now, let’s explore some situations where life insurance premiums can be tax-deductible, offering potential tax benefits for policyholders.

Medical Expenses Tax Deduction

One situation where life insurance premiums can be tax-deductible is when the policyholder includes them as part of their medical expenses. According to the Internal Revenue Service (IRS), individuals who itemize their deductions on their tax returns may be eligible to deduct medical expenses that exceed a certain percentage of their adjusted gross income (AGI).

Generally, the IRS allows taxpayers to deduct medical expenses that exceed 7.5% of their AGI. This means that if an individual’s AGI is $50,000, they can deduct medical expenses that exceed $3,750 (7.5% of $50,000). If the life insurance premiums paid during the tax year are considered part of the medical expenses and exceed the threshold, they can be deducted.

It’s important to note that not all life insurance premiums can be classified as medical expenses. Typically, only premiums paid for qualified long-term care insurance policies or policies that have a specific provision for providing long-term care benefits are eligible for the medical expenses tax deduction. Traditional life insurance policies, which focus on providing a death benefit to beneficiaries, do not qualify for this deduction.

Additionally, to claim this deduction, individuals must itemize their deductions on Schedule A of their tax return and provide documentation supporting their medical expenses. This documentation may include medical bills, receipts, and insurance statements that clearly indicate the portion of premiums attributable to qualified long-term care coverage.

It’s worth noting that the medical expenses tax deduction can be subject to further limitations and restrictions, so it’s essential to consult with a tax professional or financial advisor for specific guidance regarding individual circumstances.

By including life insurance premiums as part of their medical expenses, individuals may be able to reduce their taxable income, resulting in potential tax savings. However, it’s crucial to understand the specific criteria and requirements set by the IRS to ensure eligibility for this deduction.

Self-Employed Health Insurance Deduction

If you are self-employed and pay for your own health insurance, you may be eligible for a tax deduction on your life insurance premiums. The Self-Employed Health Insurance Deduction allows self-employed individuals to deduct their health insurance premiums, including those for life insurance coverage, as a business expense.

To qualify for this deduction, you must meet certain requirements. First, you must be self-employed and not eligible for coverage under an employer-sponsored health insurance plan. Additionally, you must have a net profit from your self-employment activities that exceeds the amount of your health insurance premiums.

It’s important to note that the deduction for self-employed health insurance premiums is available regardless of whether the individual itemizes their deductions or takes the standard deduction. This makes it a valuable tax benefit for self-employed individuals.

However, there are some limitations to consider. The deduction cannot exceed the net profit you earned from your self-employment activities. Additionally, the deduction is subject to certain percentage limitations based on your income. It’s recommended to consult with a tax professional to understand the specific rules and regulations surrounding the self-employed health insurance deduction.

By taking advantage of this deduction, self-employed individuals can reduce their taxable income, resulting in potential tax savings. It’s essential to keep detailed records of your life insurance premiums and other healthcare expenses to substantiate the deduction and comply with IRS requirements.

Remember, the self-employed health insurance deduction applies only to health insurance premiums that provide medical and dental coverage, including life insurance policies that offer health benefits. Traditional life insurance policies that solely offer a death benefit may not qualify for this deduction.

Understanding and utilizing the self-employed health insurance deduction can be beneficial for self-employed individuals, providing tax savings and the opportunity to invest in life insurance coverage while managing business expenses effectively.

Business-Owned Life Insurance Premiums Deduction

For business owners who have life insurance policies on key employees or business partners, there is the potential for a tax deduction on the premiums paid. This is known as the Business-Owned Life Insurance Premiums Deduction, which allows businesses to deduct the premiums they pay for life insurance policies that meet specific criteria.

In order for the premiums to be eligible for deduction, the business must have a legitimate financial interest in the insured individual. This usually includes key employees and business partners whose death could have a significant financial impact on the company. Additionally, the policy must be directly related to the business, and the insured employee or partner must give consent.

The amount that can be deducted as a business expense is typically limited to the cost of the premiums. However, it’s important to note that if the death benefit of the policy exceeds certain limits, a portion of the proceeds may be subject to taxation.

It’s crucial for businesses to properly document their ownership interest and demonstrate the insurable interest in the key employee or partner to be eligible for this deduction. Consulting with a tax professional or financial advisor who specializes in business tax matters can provide guidance on the specific requirements and documentation needed for this deduction.

It’s worth noting that the requirements and regulations surrounding the Business-Owned Life Insurance Premiums Deduction can vary depending on the jurisdiction and the type of policy. Therefore, it’s important to stay up to date on the latest tax rules and regulations.

By taking advantage of this deduction, businesses can reduce their taxable income and mitigate the financial risk associated with the loss of a key employee or business partner. Business-owned life insurance can provide valuable protection while offering potential tax benefits, making it an attractive financial strategy for many businesses.

Premiums for Qualified Long-Term Care Insurance Deduction

Qualified long-term care insurance (LTCI) policies provide coverage for individuals who need assistance with activities of daily living or have a cognitive impairment. If you have a qualified LTCI policy, you may be eligible for a tax deduction on the premiums you pay.

The IRS allows individuals who itemize deductions to include premiums for qualified LTCI policies as medical expenses. To qualify for this deduction, the policy must meet certain criteria set by the IRS. These criteria include coverage for necessary medical and personal care services required by individuals who have a chronic illness or disability.

It’s also important to note that the LTCI deduction has age-based limits determined annually by the IRS. The limits are based on the policyholder’s age at the end of the tax year. The deduction is also subject to a percentage-of-income limit, which means the premiums must exceed a certain percentage of the individual’s adjusted gross income (AGI) to be deductible.

It’s essential to consult with a tax professional or financial advisor to understand the specific rules and limitations surrounding the premium deduction for qualified LTCI policies. They can help determine if your policy meets the necessary requirements and guide you through the documentation process.

By taking advantage of this deduction, individuals can reduce their taxable income and potentially receive tax savings. It’s important to keep detailed records of the LTCI premiums paid and other medical expenses to support the deduction.

When considering LTCI policies, it’s crucial to evaluate the financial implications and potential tax benefits. While LTCI premiums can be tax-deductible, it’s also important to consider the overall cost of the policy and the coverage it provides. Consulting with a financial advisor can help you make an informed decision that aligns with your long-term care needs and overall financial goals.

Accelerated Death Benefits Deduction

Life insurance policies often offer accelerated death benefits (ADB) as an option, allowing policyholders to receive a portion of the death benefit early if they are diagnosed with a terminal illness. The ADB provides financial support during a challenging time and can also have tax implications.

Under the tax code, the accelerated death benefits received due to a terminal illness are typically tax-free. The IRS considers these benefits to be an advance payment of the death benefit, not additional income. This means that the benefits are not subject to income tax when received.

However, it’s important to note that the tax treatment of ADB can vary depending on the specific terms of the policy and the nature of the illness. For example, if the policyholder has a chronic illness rather than a terminal illness, the tax treatment may be different. Consulting with a tax professional or financial advisor can help clarify the tax implications based on individual circumstances.

It’s also important to consider the potential impact of accelerated death benefits on Medicaid or other government assistance programs. Receiving a substantial sum of money through ADB could affect eligibility for certain benefits. It’s crucial to understand the eligibility requirements and consult with a financial advisor or Medicaid expert to ensure that receiving ADB does not have unintended consequences.

Accelerated death benefits can provide policyholders with financial relief during a challenging time, but it’s essential to consider the potential tax implications and the impact on other benefits. Proper planning and consultation with professionals can help individuals make informed decisions and navigate the complexities of the ADB option.

Deduction for Policy Loans

Policy loans are a common feature of certain types of life insurance policies, allowing policyholders to borrow against the cash value of their policies. These loans can be a valuable source of funds for individuals in need of extra cash. What’s more, the interest paid on policy loans may be tax-deductible under certain circumstances.

According to IRS guidelines, the interest paid on policy loans is generally not tax-deductible if the loan was used for personal expenses. However, if the loan proceeds are used for business or investment purposes, the interest may be eligible for a deduction. This means that if you borrow against your life insurance policy to finance a business venture or make investments, you can potentially deduct the interest paid on the loan when filing your tax return.

It’s important to keep in mind that not all policy loans will qualify for a tax deduction. The IRS considers the purpose of the loan and whether the interest represents a valid business expense. Additionally, the policy loan must meet specific criteria outlined in the tax code.

When claiming a deduction for policy loan interest, it’s crucial to keep accurate records of the loan and its purpose. Maintaining documentation that clearly demonstrates the business or investment activities funded by the loan can help substantiate the deduction in case of an audit.

It’s worth noting that while the interest on policy loans may be tax-deductible, policyholders should carefully consider the financial implications of borrowing against their life insurance policies. Policy loans reduce the death benefit and can have an impact on cash value accumulation. It’s essential to consult with a financial advisor to weigh the pros and cons of policy loans and assess their suitability for individual financial goals.

By taking advantage of the deduction for policy loan interest, individuals can potentially reduce their taxable income and maximize their tax savings. However, it’s crucial to ensure that the loan is used for qualifying purposes and meet the IRS guidelines for deductibility.

Estate Tax Deduction

When it comes to estate planning, life insurance can play a pivotal role in providing liquidity and financial security for beneficiaries. In certain circumstances, the proceeds of a life insurance policy may be eligible for an estate tax deduction.

Estate taxes, also known as inheritance taxes or death taxes, are taxes imposed on the transfer of property upon an individual’s death. These taxes can significantly impact the value of an estate and the financial well-being of beneficiaries. However, life insurance policies with a designated beneficiary can help mitigate the burden of estate taxes.

Under the current tax laws, the death benefit payable to a named beneficiary is generally exempt from estate taxes. This means that the value of the life insurance proceeds does not contribute to the taxable estate, reducing the potential tax liability for beneficiaries.

It’s important to note that there are limitations to this estate tax deduction. If the policyholder is also the owner of the policy, the death benefit may be included in the taxable estate if certain criteria are not met. This is why it’s common for individuals to employ estate planning techniques like irrevocable life insurance trusts (ILITs) to remove the policy from their taxable estate.

Consulting with an estate planning attorney or financial advisor who specializes in estate tax matters can help individuals navigate the intricacies of estate planning and make informed decisions regarding life insurance policies. They can assist with structuring trusts and developing strategies to minimize estate taxes.

It’s essential to regularly review and update estate plans to ensure they align with current tax laws and individual circumstances. Tax laws can change, and estate planning strategies may need to be adjusted accordingly to maximize the estate tax deduction provided by life insurance policies.

By leveraging the estate tax deduction, individuals can preserve the value of their estate and provide financial security for their loved ones. Life insurance can be a valuable tool in reducing the impact of estate taxes and ensuring a smooth transfer of assets to beneficiaries.