Home>Finance>When Are Life Insurance Premiums Tax Deductible?

Finance

When Are Life Insurance Premiums Tax Deductible?

Published: October 15, 2023

Discover if life insurance premiums can be tax deductible and learn how to optimize your finances with helpful tips from our experts in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding life insurance premiums

- General rules for tax deductions on life insurance premiums

- Employer-provided life insurance coverage

- Self-employed individuals and life insurance premiums

- Life insurance premiums as business expenses

- Premiums paid for key person insurance

- Premiums paid for buy-sell agreements

- Life insurance premiums for charitable contributions

- State-specific tax deduction rules for life insurance premiums

- Conclusion

Introduction

Life insurance is an essential financial tool that provides protection and peace of mind to individuals and their loved ones. It offers financial support in case of an individual’s untimely death, ensuring that their family members or beneficiaries are financially secure.

While the primary purpose of life insurance is to provide financial protection, it’s also important to understand that there are certain tax implications associated with life insurance premiums. The question that often arises is: are life insurance premiums tax deductible?

In this article, we will explore the tax deductibility of life insurance premiums and shed light on specific circumstances where premiums may or may not be eligible for deductions. It is important to note that the information provided here is general in nature, and it is advisable to consult with a qualified tax professional or financial advisor to understand the specific tax rules that apply in your situation.

Before delving into the details, it is crucial to have a solid understanding of what life insurance premiums are and how they are calculated.

Understanding life insurance premiums

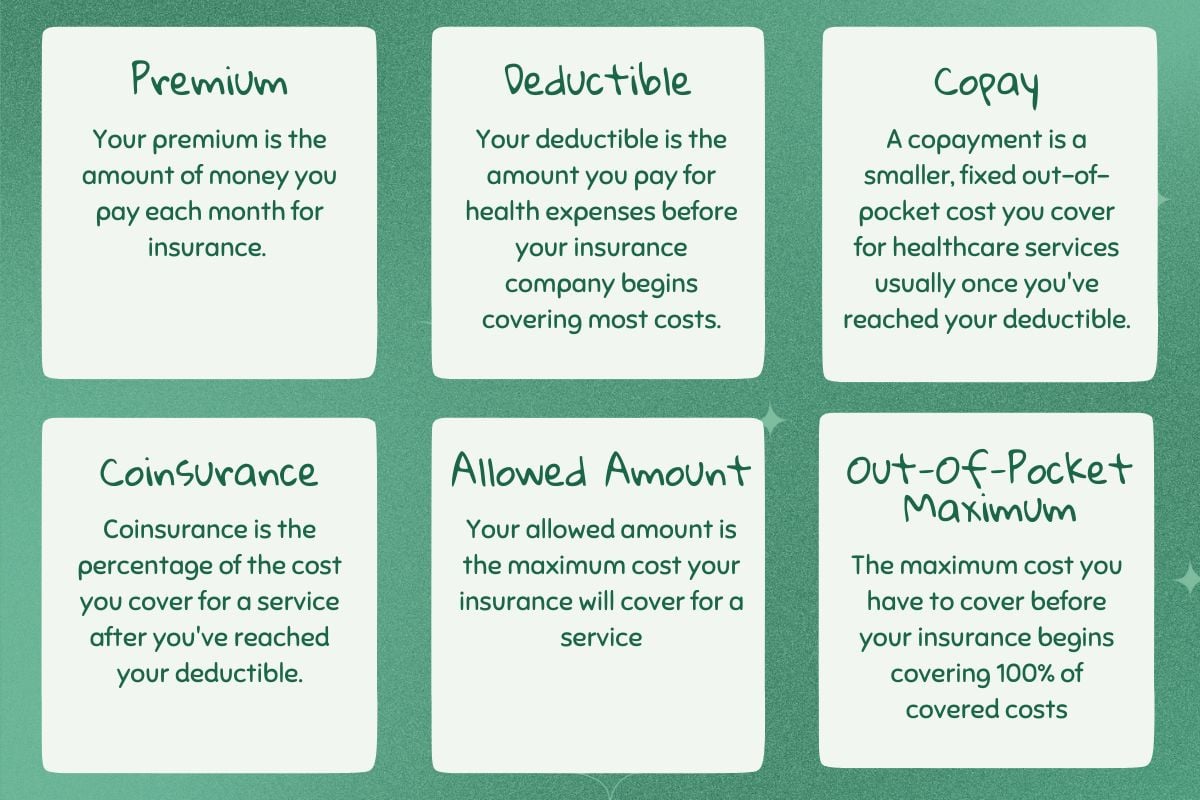

Life insurance premiums are the regular payments individuals make to their insurance provider in exchange for coverage. The amount of the premium is determined by various factors, including the individual’s age, health, lifestyle, and the type and amount of coverage chosen.

Life insurance policies come in different forms, such as term life insurance, whole life insurance, and universal life insurance. Term life insurance provides coverage for a specific period, while whole life insurance and universal life insurance offer coverage for the insured’s entire life, provided the premiums are paid.

The premium amount for life insurance policies can vary significantly depending on the individual’s risk factors. Younger individuals who are in good health generally pay lower premiums compared to older individuals or those with pre-existing medical conditions.

It is important to note that life insurance premiums are typically not tax-deductible expenses. This is because life insurance is considered a personal expense rather than a business expense or investment. However, there are limited circumstances where life insurance premiums may be tax deductible, which we will explore in the following sections.

Before making any decisions regarding life insurance and tax deductions, it is advisable to consult with a tax professional or financial advisor to understand how the specific rules and regulations apply to your situation.

General rules for tax deductions on life insurance premiums

As mentioned earlier, in most cases, life insurance premiums are not tax-deductible expenses for individuals. This is because the purpose of life insurance is to provide financial protection for personal reasons rather than for business or investment purposes.

However, there are a few exceptions to this general rule. Here are some scenarios where life insurance premiums may be eligible for tax deductions:

- Business-related coverage: If you have life insurance coverage as part of a business agreement or for the benefit of your business, the premiums may be tax deductible. This includes situations where the insurance policy is owned by the business, and the company pays the premiums.

- Self-employed individuals: Self-employed individuals may be eligible to deduct a portion of their life insurance premiums as a business expense. The deduction amount varies based on factors such as the type of coverage and the proportion of the coverage used for business purposes.

- Employer-provided coverage: If your employer offers life insurance as part of a group plan and you pay the premiums, the portion of the premium attributed to the coverage amount exceeding $50,000 may be taxable. However, if the coverage amount is below $50,000, the premiums are generally not taxable.

- Dividends used to pay premiums: If you have a participating life insurance policy that pays dividends, and you use these dividends to pay for future premiums, the dividends used may be excluded from your taxable income.

It is important to note that even in these scenarios, specific rules and limitations apply, and the deductibility of life insurance premiums may vary based on individual circumstances and applicable tax laws. To ensure accurate and up-to-date information regarding tax deductions on life insurance premiums, consult with a tax professional or financial advisor.

Employer-provided life insurance coverage

Many employers offer life insurance coverage as part of their employee benefits package. This coverage provides financial protection to employees and their families in the event of the employee’s death.

When it comes to employer-provided life insurance coverage, it’s important to understand the tax implications associated with the premiums. In general, if the coverage amount is below $50,000, the premiums paid by the employer are not taxable to the employee. This means that the employee does not have to include the cost of the coverage in their taxable income.

However, there is an exception to this rule. If the coverage amount exceeds $50,000, the portion of the premium attributed to the coverage above $50,000 is considered taxable income to the employee. In this case, the employee will need to include the excess amount in their taxable income on their W-2 form.

It is important for employees to be aware of this tax consequence when evaluating their employer-provided life insurance coverage. Depending on the coverage amount and the employee’s tax bracket, the additional taxable income may result in a higher tax liability.

Furthermore, it’s worth noting that if the employee pays a portion of the premium for the additional coverage exceeding $50,000, that portion may not be tax-deductible. The tax treatment of the premium payments made by the employee should be discussed with a tax professional to ensure compliance with applicable tax laws.

Overall, employer-provided life insurance coverage can be a valuable employee benefit. However, it is crucial for employees to understand the tax implications associated with the coverage and to factor this into their financial planning.

Self-employed individuals and life insurance premiums

Self-employed individuals face unique challenges when it comes to obtaining life insurance coverage and managing the associated premiums. Unlike employees who may have access to employer-provided insurance, self-employed individuals must secure their own coverage to protect themselves and their families.

From a tax perspective, self-employed individuals have the opportunity to potentially deduct a portion of their life insurance premiums as a business expense. However, there are specific criteria that need to be met to qualify for this deduction.

To be eligible for a tax deduction on life insurance premiums, the coverage must be directly related to the self-employed individual’s business. This means that the purpose of the coverage should be to protect the business or its assets.

The deductible amount of the premiums may depend on various factors, including the proportion of the coverage used for business purposes and the individual’s overall business expenses. It is important to maintain accurate records and documentation to substantiate the deductibility of the premiums in case of an audit.

It’s worth noting that if the self-employed individual has both personal and business life insurance coverage, only the portion directly related to the business can be claimed as a deduction. The personal portion of the premiums is not tax-deductible.

Additionally, the total deduction for all types of medical insurance, including life insurance, cannot exceed the individual’s net self-employment income. If the premiums paid exceed the net self-employment income, the excess amount cannot be claimed as a deduction in the current year.

Self-employed individuals should consult with a tax professional or financial advisor who can provide guidance on the specific rules and regulations regarding the deductibility of life insurance premiums for their business.

Furthermore, when considering life insurance options, self-employed individuals should carefully evaluate their coverage needs, taking into account factors such as income replacement, business debts, and future financial obligations. Working with an insurance professional can help ensure that the coverage is adequate and appropriate for their unique circumstances.

Life insurance premiums as business expenses

For many businesses, life insurance plays a crucial role in protecting the company and its stakeholders from financial uncertainty. In certain circumstances, life insurance premiums can be treated as business expenses and may be tax deductible.

When determining whether life insurance premiums qualify as business expenses, the key factor is the purpose of the coverage. The coverage must be directly related to the business and its operations.

Businesses often use life insurance to provide financial protection in the event of the death of a key employee or business owner. This type of coverage is commonly referred to as key person insurance. If the business pays the premiums for key person insurance, the premiums can generally be deducted as a legitimate business expense.

It’s important to consider that in order for the premiums to be deductible, the business must be a direct beneficiary of the policy. This means that the proceeds from the policy would go to the business, rather than to an individual or their family members. Proper documentation and record-keeping are crucial to ensure the deductibility of these premiums.

Another scenario where life insurance premiums may qualify as a business expense is when they are part of a buy-sell agreement. Buy-sell agreements are common among businesses with multiple owners and outline how the ownership interests will be transferred in the event of a business owner’s death, disability, or retirement. If the business pays the premiums for the buy-sell agreement, the premiums may be deductible as a business expense.

It’s important to consult with a tax professional or financial advisor to ensure compliance with tax laws and regulations when considering life insurance premiums as a business expense. They can provide guidance specific to your business and help you understand the documentation requirements and deductibility limitations that may apply.

Additionally, businesses should regularly review their life insurance policies and ensure that the coverage aligns with their current needs and circumstances. As business operations evolve, it’s important to reassess the level of coverage and adjust the premiums accordingly.

Premiums paid for key person insurance

In the business world, certain individuals play a critical role in the success and stability of a company. Key person insurance, also known as key man insurance or key employee insurance, is a type of coverage that provides financial protection to the business in the event of the death or disability of a key person.

Key person insurance policies are specifically designed to compensate the business for financial losses that may result from the absence of a key individual. These policies typically cover individuals who have unique skills, knowledge, or expertise, and whose contributions are essential to the business’s operations and profitability.

When it comes to premiums paid for key person insurance, they are generally considered to be legitimate business expenses. As a result, they may be tax deductible for the business.

To qualify for tax deductions, the key person insurance policy must meet certain requirements. First and foremost, the policy should be directly related to the business, and the business should be the policyholder and beneficiary. This ensures that the proceeds from the policy would go to the business in the event of the key person’s death or disability.

The amount of the premiums that can be deducted as a business expense depends on various factors, including the coverage amount, the key person’s role and responsibilities, and the overall financial impact their absence would have on the business. It’s important to remember that the premiums must be reasonable and necessary for the business’s continued operation.

Proper documentation is crucial when deducting premiums paid for key person insurance. It is recommended to keep detailed records, including the purpose of the coverage, the justification of the coverage amount, and any other relevant information that supports the deduction.

It’s worth noting that the tax treatment of key person insurance premiums may differ based on the jurisdiction and specific tax laws applicable to the business. Consulting with a qualified tax professional or financial advisor can provide clarity on the rules and regulations that govern key person insurance deductions in your area.

Considering the financial impact that the loss of a key individual can have on a business, key person insurance can be an important component of a company’s risk management strategy. By providing financial protection and ensuring business continuity, this type of coverage offers peace of mind to both the business and its stakeholders.

Premiums paid for buy-sell agreements

Buy-sell agreements are commonly used among businesses with multiple owners or shareholders to establish a plan for the transfer of ownership interests in certain situations, such as the death, disability, or retirement of an owner. These agreements ensure a smooth transition of ownership and provide financial protection to the business and its owners.

One important aspect of buy-sell agreements is funding. To ensure that the agreed-upon buyout of an owner’s interest can be carried out, businesses often use life insurance policies to provide the necessary funds. These policies, known as buy-sell insurance, are specifically designed to cover the cost of purchasing the ownership interest from a departing owner or their estate.

When it comes to the premiums paid for buy-sell insurance, they are typically treated as a business expense and may be tax deductible. The deductibility of these premiums depends on several factors and the specific circumstances of the business.

To qualify for tax deductions, the premiums must be directly related to the buy-sell agreement and the transfer of ownership interests. The business must be the policyholder and beneficiary of the life insurance policy, ensuring that the proceeds will be used for the purpose of executing the buyout when the need arises.

It’s important to work with a qualified tax professional or financial advisor to determine the deductibility of the premiums based on the specific terms of the buy-sell agreement and applicable tax laws. They can provide guidance on ensuring compliance and help navigate any limitations or restrictions that may apply.

Proper documentation is key when deducting premiums paid for buy-sell insurance. Businesses should maintain records that clearly outline the purpose of the coverage, the participants involved in the buy-sell agreement, and the justification for the premium amounts. This documentation will serve as evidence to support the deduction in case of an audit.

It’s important to review the terms of the buy-sell agreement and the corresponding insurance policy periodically to ensure they align with the business’s current needs and circumstances. As ownership interests and business dynamics change over time, it may be necessary to update the coverage and adjust the premiums accordingly.

By utilizing buy-sell agreements and funding them with appropriate life insurance coverage, businesses can safeguard their continuity and protect the interests of their owners. The tax deductibility of buy-sell insurance premiums provides an additional benefit, contributing to the overall financial stability and security of the business.

Life insurance premiums for charitable contributions

Life insurance policies can provide an avenue for individuals to make significant contributions to charitable organizations while also enjoying potential tax benefits. By designating a charitable organization as the beneficiary of a life insurance policy, individuals can ensure that their philanthropic goals are fulfilled even after their passing.

When it comes to the premiums paid for life insurance policies that name a charitable organization as the beneficiary, they are generally not tax deductible as a charitable contribution. This is because the premiums are considered personal expenses rather than direct donations to the charity.

However, there is an exception to this rule. In some cases, if the individual transfers ownership of the life insurance policy to the charitable organization, the premiums paid by the organization may be tax deductible under certain circumstances. The charitable organization must be the owner and beneficiary of the policy for this deduction to apply.

It’s important to note that when the charitable organization becomes the owner of the policy, they also assume responsibility for paying the premiums. The individual making the donation is relieved of the obligation to pay future premiums, and any additional premiums paid by the organization may be treated as a tax-deductible charitable contribution.

However, it’s crucial to consult with a tax professional or financial advisor to understand the specific rules and regulations that apply in your jurisdiction. They can provide guidance on the eligibility requirements and limitations for claiming tax deductions related to life insurance premiums transferred to charitable organizations.

Additionally, individuals interested in making charitable contributions through life insurance policies should carefully evaluate their financial and estate planning needs. They should consider factors such as the impact on their overall estate, the potential tax advantages, and the suitability of the chosen charitable organization as a beneficiary.

By taking the necessary precautions and seeking professional advice, individuals can maximize the impact of their philanthropy through life insurance policies while potentially deriving tax benefits within the applicable legal framework.

State-specific tax deduction rules for life insurance premiums

When it comes to tax deductions on life insurance premiums, it’s important to understand that the rules can vary from one state to another. While certain general guidelines apply at the federal level, each state has the authority to establish its own tax regulations and policies.

Some states may offer specific tax incentives or deductions related to life insurance premiums. These deductions can vary in terms of eligibility criteria, limitations, and the types of policies that qualify. Therefore, it’s crucial to consult the tax laws of your specific state or seek advice from a tax professional or financial advisor who is knowledgeable about state-specific regulations.

For example, some states may allow a deduction for premiums on long-term care insurance or policies that incorporate long-term care benefits. These deductions can help individuals offset the costs associated with long-term care insurance, providing additional financial relief.

In certain states, there may be deductions available for premiums on health savings account (HSA)-compatible high deductible health plans. These deductions can help individuals reduce their taxable income while promoting the use of HSAs for healthcare expenses.

Additionally, some states may offer incentives for purchasing life insurance for education savings, such as 529 plans. Deductions for these premiums can encourage individuals to invest in education savings accounts and provide educational opportunities for their loved ones.

It’s important to note that not all states provide specific deductions for life insurance premiums. In such cases, the general federal tax rules regarding deductibility, as mentioned in previous sections, would apply.

Keep in mind that tax laws are subject to change, and new legislation may be enacted at any time. It’s crucial to stay up-to-date with the latest tax regulations in your state to ensure compliance and to take advantage of any available deductions or incentives.

Consulting with a tax professional or financial advisor who specializes in state tax matters can provide valuable insights into the specific state rules and help you navigate the complexities of tax deductions on life insurance premiums in your jurisdiction.

Conclusion

Understanding the tax implications of life insurance premiums is essential for individuals and businesses alike. While life insurance premiums are generally not tax deductible, there are specific circumstances where deductions may be possible.

For employees, employer-provided life insurance coverage is typically not taxable unless the coverage amount exceeds $50,000. In that case, the portion of the premium related to the excess coverage may be considered taxable income.

Self-employed individuals may have the opportunity to deduct a portion of their life insurance premiums as a business expense if the coverage is directly related to their business. It’s important to consult with a tax professional to determine eligibility and understand the specific rules that apply.

In certain cases, life insurance premiums can be treated as a business expense. This includes premiums paid for key person insurance, which protects businesses from the financial impact of losing a key employee, and premiums paid for buy-sell agreements, which facilitate the smooth transfer of ownership interests in a business. These premiums are generally tax deductible as legitimate business expenses.

Another consideration is life insurance premiums for charitable contributions. While premiums paid personally are not tax deductible, if a policy is transferred to a charitable organization and the organization becomes the owner and beneficiary, any additional premiums paid by the organization may be tax-deductible.

It’s also important to be aware that state-specific tax rules regarding life insurance premiums can vary. Some states may offer specific deductions or incentives, so it’s advisable to consult the tax laws of your state or seek advice from a tax professional who specializes in state tax matters.

In conclusion, when it comes to tax deductions on life insurance premiums, it’s crucial to understand the specific rules and regulations that apply to your situation. Seeking guidance from a qualified tax professional or financial advisor will ensure compliance with tax laws and help maximize any potential deductions or benefits available to you.