Finance

When Does Exxon Pay Dividends

Published: January 3, 2024

Learn about Exxon's dividend payments and find out when you can expect to receive dividends from this leading finance company.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Dividends

- The Basics of Exxon’s Dividend Policy

- Factors Influencing Exxon’s Dividend Payments

- The Importance of Dividends for Exxon Shareholders

- Key Dates and Details of Exxon’s Dividend Payments

- Exploring Exxon’s Dividend History

- Dividend Performance Compared to Competitors

- Conclusion

Introduction

Welcome to the world of finance, where businesses strive to create value for their shareholders. One of the ways companies reward their shareholders is through the distribution of dividends. Dividends are cash payments made to shareholders as a portion of their ownership in a company. They provide a steady stream of income and serve as a key indicator of a company’s financial health.

In this article, we will explore the dividend policy of Exxon, one of the largest publicly traded energy companies in the world. Exxon is renowned for its vast reserves of oil and gas, as well as its commitment to delivering long-term value to its shareholders.

We will delve into key details such as when Exxon pays its dividends, the factors influencing its dividend payments, and the significance of dividends for the company’s shareholders. Additionally, we will explore the history of Exxon’s dividend payments and compare its dividend performance to that of its competitors.

Whether you are an investor looking to understand the potential income from Exxon stock or simply curious about dividend policies in the finance world, this article will provide valuable insights into the dividend landscape of one of the most prominent companies in the energy sector.

So, let’s dive in and explore When Does Exxon Pay Dividends.

Understanding Dividends

Dividends are cash payments that companies distribute to their shareholders as a way to distribute profits. When a company generates excess cash, it can choose to reinvest it back into the business or distribute it to the shareholders in the form of dividends. Dividends are typically paid on a regular basis, such as quarterly or annually, and are based on the number of shares an investor owns.

Dividends serve as a rewarding mechanism for shareholders who provide capital to the company. By receiving dividends, shareholders can enjoy a portion of the company’s profits without having to sell their shares. Dividends are particularly attractive to income-focused investors, such as retirees, who rely on the steady stream of income.

Dividends are an essential component of a company’s overall return to its shareholders, alongside capital appreciation from any increase in the stock’s price. The combination of dividends and potential stock price growth provides investors with a comprehensive return on their investment.

Dividends are typically expressed as a dividend yield, which is the annual dividend amount divided by the current stock price. The dividend yield allows investors to compare the income potential of different stocks and make informed investment decisions.

It’s important to note that not all companies pay dividends. Some companies, particularly in the technology sector, prefer to reinvest their profits back into the business to fuel growth and expansion. These companies may prioritize capital appreciation over regular dividend payments.

Now that we have a general understanding of dividends, let’s explore the dividend policy of Exxon, one of the leading companies in the energy industry.

The Basics of Exxon’s Dividend Policy

Exxon has a long-standing commitment to delivering value to its shareholders through its dividend policy. The company’s dividend policy is shaped by its financial performance, cash flow generation, and long-term strategic objectives.

Exxon maintains a consistent and disciplined approach to its dividend payments, aiming to provide shareholders with a steady and reliable source of income. The company’s dividend policy is designed to prioritize the sustainability and growth of its dividend payments over time.

Exxon’s dividend payments are influenced by various factors, including its financial performance and cash flow generation. The company aims to pay out a significant portion of its earnings to shareholders in the form of dividends, while also retaining sufficient funds for reinvestment in the business.

Additionally, Exxon takes into account the prevailing economic conditions, industry trends, and regulatory considerations when determining its dividend payments. The company strives to balance the distribution of dividends with the need for capital allocation to support long-term growth and enhance shareholder value.

Exxon’s dividend policy is implemented through its Board of Directors, who assess the company’s financial position, earnings outlook, and future cash flow projections. They make informed decisions on the timing, amount, and frequency of dividend payments.

It’s important to note that while Exxon has a history of consistent dividend payments, there is no guarantee of future dividends. The company’s dividends are subject to various factors, including market conditions, regulatory requirements, and the company’s financial performance.

Now that we have a grasp of the basics of Exxon’s dividend policy, let’s delve into the factors that influence its dividend payments.

Factors Influencing Exxon’s Dividend Payments

Exxon’s dividend payments are influenced by a variety of factors that reflect the company’s financial performance, operational efficiency, and strategic priorities. Understanding these factors can provide insights into the stability and growth potential of Exxon’s dividend payments. Here are some key factors that influence Exxon’s dividend payments:

1. Earnings and Cash Flow: Exxon’s dividend payments are closely tied to its earnings and cash flow generation. The company aims to distribute a significant portion of its earnings to shareholders in the form of dividends while maintaining financial stability. Strong earnings and healthy cash flow provide the foundation for reliable and growing dividend payments.

2. Oil and Gas Prices: As an energy company, Exxon’s dividend payments are influenced by the price trends of oil and gas commodities. Higher oil and gas prices can boost the company’s earnings and cash flow, which may translate into increased dividend payments. Conversely, a decline in oil and gas prices may put pressure on dividend growth.

3. Capital Investment: Exxon allocates a portion of its earnings for capital investments in exploration, production, and other strategic initiatives. The level of capital investment required to sustain and grow the business can impact the amount available for dividend payments. Higher capital investment needs may lead to more conservative dividend increases.

4. Debt Levels and Financial Stability: Exxon’s financial stability is an important consideration in determining dividend payments. The company strives to maintain a strong balance sheet and manage its debt levels effectively. Insufficient cash flow or a high debt burden may limit the capacity for dividend growth.

5. Regulatory Environment: The energy sector operates in a highly regulated environment, and changes in regulations can impact Exxon’s operations and financial performance. Regulatory developments, such as changes in taxation or environmental policies, can have implications for the company’s cash flow and, consequently, its dividend payments.

6. Global Economic Conditions: Exxon’s dividend payments are influenced by the broader economic landscape. Factors such as economic growth, inflation rates, and currency fluctuations can affect the company’s profitability and cash flow generation. Adverse economic conditions may impact dividend growth or even lead to dividend cuts.

7. Competitive Landscape: Exxon operates in a competitive industry, and its dividend policy is influenced by the need to attract and retain investors. The company may adjust its dividend payments to remain competitive with peers and meet investors’ expectations.

These factors, along with various other internal and external factors, shape Exxon’s dividend policy and determine the amount and stability of its dividend payments. It’s important for investors to monitor these factors and stay informed about the company’s financial health and outlook when assessing the attractiveness of Exxon’s dividend yield.

Now that we understand the factors influencing Exxon’s dividend payments, let’s explore the importance of dividends for Exxon shareholders.

The Importance of Dividends for Exxon Shareholders

Dividends play a crucial role for shareholders of Exxon, providing several benefits and serving as a key driver of shareholder value. Here are some reasons why dividends are important for Exxon shareholders:

1. Steady Income Stream: Dividends from Exxon provide shareholders with a reliable and consistent stream of income. This is particularly valuable for income-focused investors, such as retirees, who rely on dividends for their living expenses. The stability of Exxon’s dividend payments allows shareholders to plan and budget their finances more effectively.

2. Compounding Effect: Reinvesting dividend payments can significantly enhance long-term returns for shareholders. By reinvesting dividends to purchase additional shares of Exxon stock, shareholders can take advantage of the compounding effect. Over time, this can lead to substantial growth in the value of their investment.

3. Indication of Financial Health: Exxon’s ability to consistently pay dividends indicates a strong financial position. It demonstrates the company’s profitability, cash flow generation, and commitment to returning value to shareholders. Investors often consider dividend payments as a sign of stability and confidence in the company’s future prospects.

4. Attractive Total Return: Dividends, along with potential capital appreciation, contribute to the total return for shareholders. While capital appreciation reflects the change in stock price, dividends provide a tangible and immediate return on investment. The combination of dividends and potential stock price growth offers a comprehensive return for shareholders.

5. Alignment of Interests: Dividend payments align the interests of Exxon’s management and shareholders. Since management’s compensation often includes stock-based incentives, dividend payments motivate management to focus on generating profits and delivering sustainable shareholder returns.

6. Dividend Reinvestment Plans (DRIPs): Exxon offers a dividend reinvestment plan that allows shareholders to reinvest their dividends automatically into purchasing additional shares at a discounted price. This provides an efficient and convenient way for shareholders to compound their investment over time.

7. Long-Term Value Creation: Exxon’s commitment to paying dividends reflects its long-term focus on creating value for shareholders. By distributing a portion of its earnings to shareholders, the company aims to provide a tangible return on investment and reward shareholders for their trust and support.

Overall, dividends play a vital role in Exxon’s shareholder value proposition. They provide a steady income stream, enhance long-term returns through compounding, indicate financial health and stability, and align the interests of management and shareholders. These factors contribute to the overall attractiveness of owning Exxon stock and reinforce the importance of dividends in the investment decision-making process.

Now let’s explore the key dates and details of Exxon’s dividend payments.

Key Dates and Details of Exxon’s Dividend Payments

Exxon follows a schedule for its dividend payments, which includes several important dates that shareholders should be aware of. Here are the key dates and details to keep in mind regarding Exxon’s dividend payments:

1. Declaration Date: This is the date on which Exxon’s Board of Directors declares the dividend. The declaration typically occurs a few weeks before the payment date. It is an official announcement of the dividend amount and signals the company’s commitment to distributing dividends to its shareholders.

2. Ex-Dividend Date: The ex-dividend date is an important date for shareholders. To be eligible to receive the dividend payment, shareholders must own the stock before the ex-dividend date. If shares are purchased on or after this date, the buyer will not receive the upcoming dividend payment. The ex-dividend date is usually a business day before the record date.

3. Record Date: The record date is the date when shareholders must be registered as owners of the stock to be eligible for the dividend payment. It is the cutoff date determined by the company to identify eligible shareholders. Shareholders who own the stock on the record date will receive the dividend payment.

4. Payment Date: The payment date is the date on which the dividend is actually paid to eligible shareholders. This is when shareholders receive the cash payment in their brokerage accounts or, if enrolled, reinvest the dividend through a dividend reinvestment plan (DRIP). Exxon typically pays dividends on a quarterly basis.

5. Dividend Amount: The dividend amount represents the cash payment per share that Exxon distributes to its shareholders. The specific amount is determined by the Board of Directors based on various factors, including the company’s financial performance, earnings, and cash flow generation.

It’s important for shareholders to keep track of these key dates to ensure they meet the eligibility requirements and receive their dividend payments. Shareholders can refer to Exxon’s investor relations website or contact their brokerage firm for specific details related to dividend payments.

Exxon has established a consistent history of dividend payments, showcasing its commitment to providing value to shareholders. However, it’s important to note that dividend payments are subject to change based on the company’s financial performance and other factors that may impact its ability to distribute dividends.

Now let’s uncover Exxon’s dividend history and how it compares to its competitors.

Exploring Exxon’s Dividend History

Exxon has a long-standing history of paying dividends to its shareholders, reflecting its commitment to delivering consistent returns. Let’s take a closer look at the dividend history of Exxon and how it has evolved over time.

Exxon’s dividend history dates back several decades, and the company has consistently increased its dividend payments for many years. This track record of dividend growth is a testament to Exxon’s strong financial performance and its ability to generate substantial cash flow from its operations.

Throughout its history, Exxon has prioritized dividend payments as a means to reward shareholders and provide them with a consistent income stream. The company’s dividend growth has been driven by a combination of its earnings growth, favorable industry conditions, and a commitment to sharing profits with shareholders.

It’s important to note that while Exxon has a history of dividend increases, the growth rate may vary from year to year, depending on factors such as financial performance, market conditions, and capital allocation priorities. The company’s dividend payments may be subject to adjustment based on prevailing circumstances.

Exxon’s dividend history reflects a commitment to maintaining a sustainable dividend payout ratio, which is the percentage of earnings paid out as dividends. This ensures that the company retains sufficient funds for reinvestment and future growth opportunities, while still providing an attractive return to shareholders.

Investors interested in Exxon’s dividend history can access historical dividend data through various financial websites, including Exxon’s investor relations website. The dividend history provides insights into the company’s consistency in dividend payments, dividend growth trends over time, and the overall stability of its dividend policy.

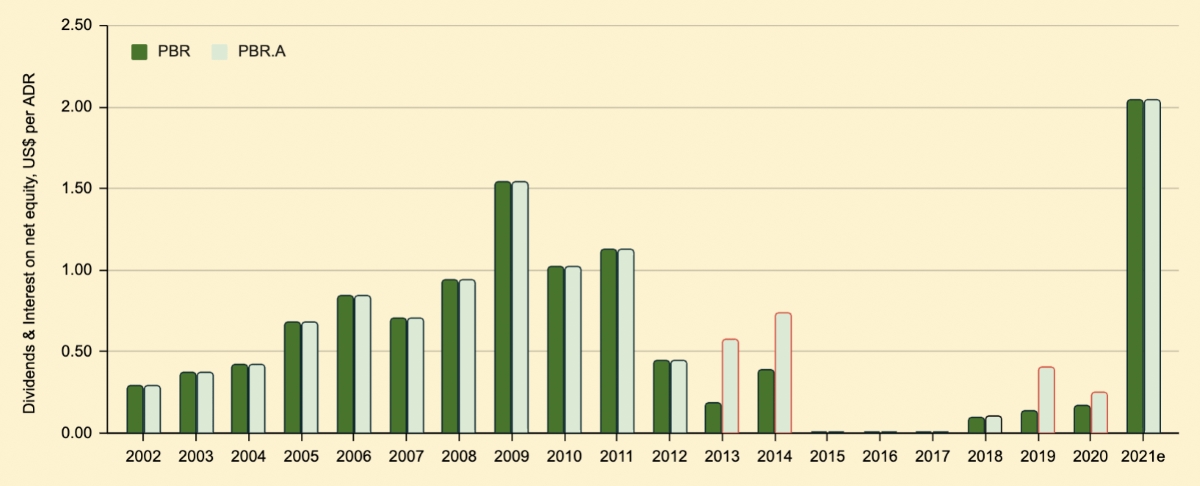

Furthermore, investors can compare Exxon’s dividend history with its competitors in the energy industry to assess its relative performance. This comparison can be made based on metrics such as dividend yield, dividend growth rate, and payout ratio.

By examining Exxon’s dividend history, investors can gain a deeper understanding of the company’s commitment to shareholder value and its ability to generate sustainable cash flow. It provides valuable insights into the company’s financial stability, long-term performance, and alignment with shareholder interests.

Now, it’s time to compare Exxon’s dividend performance to that of its competitors in the energy sector.

Dividend Performance Compared to Competitors

Exxon, as one of the key players in the energy sector, faces competition from other companies within the industry. When evaluating a company’s dividend performance, it is essential to compare it to its competitors. Let’s examine how Exxon’s dividend performance stacks up against its peers within the energy sector.

Exxon has a strong dividend track record and has historically been considered a reliable dividend-paying company. The company has consistently increased its dividend payments over the years, with a focus on providing shareholders with a steady income stream and long-term value creation.

However, it’s important to note that the energy sector as a whole is influenced by the fluctuations in oil and gas prices, which can impact the financial performance of companies operating within the industry. This can, in turn, affect their ability to sustain and grow dividend payments.

When comparing Exxon’s dividend performance to its competitors, key factors to consider include:

1. Dividend Yield: Dividend yield is a critical metric for measuring the income potential of a stock. It is calculated by dividing the annual dividend per share by the current stock price. By comparing Exxon’s dividend yield to that of its competitors, investors can gain insights into the relative income generation potential of each company.

2. Dividend Growth: Examining the dividend growth rate of Exxon compared to its competitors reveals the company’s ability to consistently increase dividend payments over time. Companies that demonstrate higher dividend growth rates may be more attractive to income-focused investors seeking long-term income growth.

3. Payout Ratio: The payout ratio indicates the proportion of earnings that a company distributes as dividends. Comparing Exxon’s payout ratio to that of its competitors offers insights into how aggressively each company allocates its earnings towards dividend payments. A lower payout ratio suggests a company retains more earnings for reinvestment or growth opportunities.

4. Financial Stability: Assessing the financial stability and cash flow generation of Exxon compared to its competitors is crucial. Companies with stronger financial positions and healthier cash flows are more likely to sustain and grow dividend payments even during challenging market conditions.

5. Industry Trends: Understanding the broader industry trends and the impact on energy companies can provide context when comparing dividend performance. Factors such as changes in oil prices, demand-supply dynamics, and regulatory shifts may affect the dividend potential of all companies within the sector.

Comparing Exxon’s dividend performance, including yield, growth, payout ratio, and financial stability, with that of its competitors allows investors to make informed decisions based on their investment goals and risk tolerance.

Investors can access financial metrics, dividend history, and comparative analysis through various financial websites, research reports, or consulting with financial advisors. It’s essential to evaluate dividend performance within the broader context of a company’s financial health, strategic direction, and industry dynamics.

Now, let’s conclude our exploration of Exxon’s dividend policy and its significance for shareholders.

Conclusion

In conclusion, Exxon’s dividend policy is an integral part of the company’s commitment to delivering value to its shareholders. The company has a long-standing history of consistent dividend payments, reflecting both its financial strength and its dedication to providing shareholders with a reliable and growing income stream.

Understanding dividends and their importance is essential for investors considering Exxon as an investment opportunity. Dividends not only provide a steady income stream but also contribute to the overall total return of an investment in Exxon stock through potential capital appreciation and the compounding effect of dividend reinvestment.

Exxon’s dividend payments are influenced by various factors, including its financial performance, cash flow generation, oil and gas prices, regulatory environment, and industry trends. The company’s dividend policy is designed to strike a balance between rewarding shareholders and allocating capital for future growth initiatives.

Investors should also consider Exxon’s dividend performance in comparison to its competitors within the energy sector. Comparing key metrics such as dividend yield, growth rate, payout ratio, and financial stability can provide valuable insights into the company’s relative dividend strength.

It’s important to note that dividend payments are subject to change based on company performance, market conditions, and other factors. Investors should keep track of key dates, such as the declaration date, ex-dividend date, record date, and payment date, to ensure they are eligible for dividend payments.

Overall, Exxon’s dividend policy reflects its commitment to delivering long-term value to shareholders. Whether you are an income-focused investor seeking a reliable income stream or looking for an attractive investment opportunity with potential for capital appreciation, Exxon’s dividend policy and history should be a key consideration in your investment decision-making process.

Remember, before making any investment decisions, it is always recommended to conduct thorough research, consult with financial advisors, and consider your own investment goals and risk tolerance.