Finance

When Does ZIM Pay Dividends?

Published: January 3, 2024

Discover when ZIM pays dividends and stay informed about finance. Get valuable insights and updates on dividend distribution from ZIM.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where investments, stocks, and dividends play a significant role in building wealth. In this article, we will delve into the fascinating topic of ZIM dividends, exploring when and how this popular investment opportunity pays out.

ZIM is a renowned company in the finance industry, known for its strong and reliable performance. Investors are attracted to ZIM for its potential to generate income through its dividend payments. But what exactly are dividends? And why are they important for investors?

Dividends are a distribution of a company’s profits to its shareholders. When a company like ZIM generates revenue and profits, a portion of those earnings is set aside to reward their shareholders. Dividends are typically paid out on a regular basis, providing investors with a steady stream of income. For many investors, dividends are a crucial component of their investment strategy, offering both income and the potential for long-term capital appreciation.

Understanding how and when ZIM pays dividends is essential for investors looking to maximize their returns. In the following sections, we will explore the dividend payment schedule for ZIM and discuss the various factors that can influence these payments. By the end of this article, you will have a comprehensive understanding of ZIM dividends and be better equipped to make informed investment decisions.

Understanding ZIM Dividends

In order to understand ZIM dividends, it’s important to grasp the concept of dividend yield. Dividend yield is a financial ratio that indicates the annual dividend per share relative to the stock price. It is expressed as a percentage and is a key metric for investors seeking income from their investments.

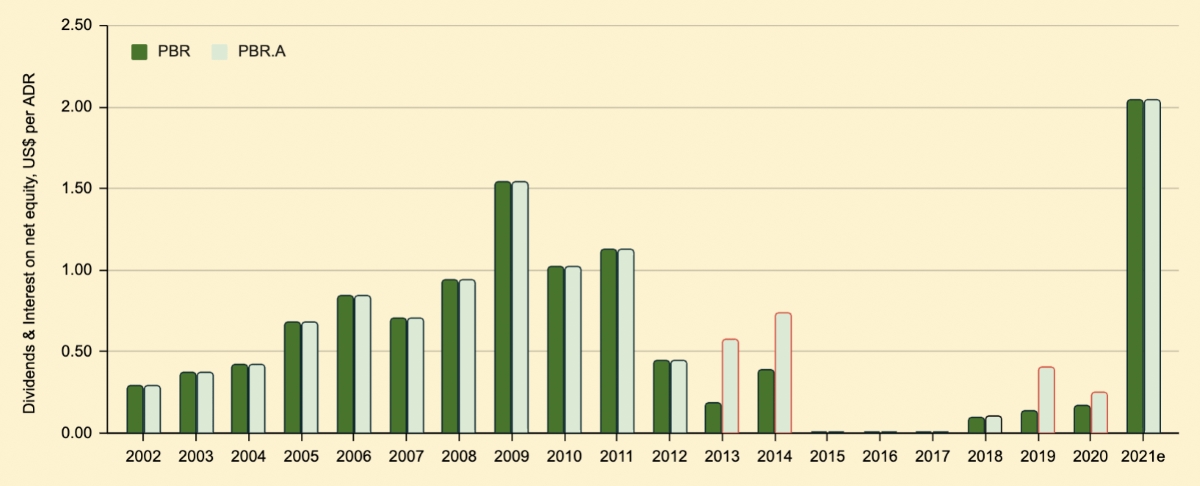

ZIM’s dividend yield is typically influenced by several factors, including the company’s profitability, cash flow, and overall financial health. If ZIM experiences strong financial performance and consistently generates profits, it is more likely to pay out higher dividends to its shareholders.

Another crucial aspect to consider is the dividend payout ratio. This ratio indicates the proportion of earnings that a company distributes as dividends. A higher payout ratio suggests that ZIM is distributing a larger percentage of its earnings to shareholders. Conversely, a lower payout ratio indicates that the company is retaining a larger portion of its profits for reinvestment or other purposes.

When considering ZIM’s dividends, it’s also important to assess its dividend history. Examining the company’s track record of dividend payments can provide valuable insights into its reliability and commitment to rewarding shareholders. Investors often look for consistent dividend growth or a stable dividend payment history when considering ZIM as an investment opportunity.

As an investor, it is crucial to understand that dividends are not guaranteed. While many established companies, like ZIM, have a history of paying dividends, there are instances where companies may reduce or even eliminate dividend payments. This can occur during challenging economic times, when the company faces financial difficulties, or when management decides to reinvest the profits back into the business.

Investors interested in ZIM dividends should also be aware of the ex-dividend date. This is the date on which a buyer of ZIM shares would not be entitled to receive the upcoming dividend payment. In other words, if an investor purchases ZIM shares after the ex-dividend date, they would not be eligible for the next dividend payment.

By understanding these key concepts and factors, investors can gain a deeper understanding of how ZIM dividends work, allowing them to make informed investment decisions. In the next section, we will explore the dividend payment schedule for ZIM in more detail.

ZIM Dividend Payment Schedule

ZIM follows a specific dividend payment schedule, which outlines when shareholders can expect to receive their dividend payments. This schedule is important for investors as it helps them plan their finances and make informed decisions regarding their investments.

Typically, ZIM declares its dividend on a quarterly basis. Once the dividend is declared, the company announces the ex-dividend date, record date, and payment date. Let’s take a closer look at each of these dates:

- Ex-dividend date: This is the date on which the stock begins trading without the right to receive the upcoming dividend. If you purchase ZIM shares on or after the ex-dividend date, you will not be eligible to receive the current dividend.

- Record date: This is the date on which the company determines the shareholders who are eligible to receive the dividend. Only shareholders who own ZIM shares on or before the record date will be entitled to the dividend.

- Payment date: This is the date on which the dividend is actually paid to eligible shareholders. It is the day when you can expect to receive the dividend amount in your account.

It’s important to note that the dividend payment schedule may vary from one quarter to another. ZIM typically announces the dividend payment schedule in advance, allowing investors to plan accordingly.

Investors can usually find the specific dividend payment dates on ZIM’s investor relations website or through their brokerage account. It’s crucial to stay updated with the latest information to ensure you don’t miss out on any dividend payments.

It’s also worth mentioning that there may be instances where ZIM pays special dividends in addition to regular quarterly dividends. Special dividends are typically one-time payments made by the company when it has excess cash on hand or when there is a significant event that warrants the distribution of additional funds to shareholders. These special dividends can be a pleasant surprise for investors, but they are not guaranteed and may not follow a regular schedule.

By monitoring the dividend payment schedule and staying informed about any special dividend announcements, investors can effectively manage their cash flow and make strategic investment decisions. However, it’s important to remember that dividend payments are subject to the company’s profitability and other factors that may impact their ability to distribute dividends.

Now that we have explored the dividend payment schedule for ZIM, let’s delve into the factors that can influence the amount and frequency of dividend payments.

Factors Affecting ZIM Dividend Payments

There are several factors that can influence the amount and frequency of dividend payments by ZIM. Understanding these factors is essential for investors seeking to predict and optimize their dividend income. Let’s explore the key factors that can impact ZIM’s dividend payments:

- Profitability: The most significant factor affecting dividend payments is ZIM’s profitability. As a company earns profits, it can allocate a portion of those earnings towards dividend payments. Higher profitability typically results in larger dividends for shareholders.

- Cash Flow: In addition to profitability, cash flow is a crucial consideration for dividend payments. ZIM needs to generate sufficient cash flow to support dividend distributions. Even if a company is profitable, it may not have enough cash flow to sustain dividend payments.

- Financial Health: ZIM’s overall financial health is an important factor. The company needs to maintain a strong balance sheet and sufficient reserves to consistently pay dividends. Lenders and investors monitor ZIM’s financial health as an indicator of its ability to sustain dividend payments.

- Growth Opportunities: The company’s growth prospects and investment opportunities can impact dividend payments. If ZIM decides to reinvest its profits in expanding the business, it may decide to lower or suspend dividend payments to allocate more funds towards growth.

- Industry Conditions: The conditions of the broader industry in which ZIM operates can influence dividend payments. If the industry is facing challenges or economic downturns, ZIM may prioritize retaining earnings to navigate through the tough times, resulting in lower dividends or no dividends at all.

- Tax Considerations: Tax laws and regulations can impact dividend payments. Companies often consider tax implications when determining dividend amounts and timing to optimize tax efficiency for their shareholders.

- Management Decisions: Ultimately, the decisions made by ZIM’s management team play a vital role in dividend payments. The management team considers many factors to strike a balance between rewarding shareholders and maintaining the financial health and growth of the company.

It’s important to note that these factors are not mutually exclusive, and they can interact and influence each other. For example, if ZIM’s profitability decreases due to industry challenges, it may impact cash flow and, consequently, dividend payments.

Investors should carefully analyze these factors and monitor ZIM’s financial reports, management statements, and industry trends to assess the potential impact on dividend payments. By staying informed and understanding the underlying factors, investors can make more informed decisions regarding their ZIM investments.

With an understanding of the factors affecting ZIM dividend payments, let’s conclude our discussion on ZIM dividends.

Conclusion

In conclusion, ZIM dividends provide investors with a valuable opportunity to earn a steady stream of income from their investments. Understanding the various aspects of ZIM dividend payments is essential for investors looking to optimize their returns and make informed investment decisions.

We explored the concept of dividends and their importance in the world of finance. Dividends are a distribution of a company’s profits to its shareholders and can be a crucial component of an investor’s strategy, offering both income and potential long-term growth.

We discussed the dividend payment schedule for ZIM, which typically follows a quarterly cycle. The ex-dividend date, record date, and payment date are key dates for investors to keep in mind when expecting dividend payments. Monitoring ZIM’s investor relations website or brokerage account can provide the most up-to-date information on dividend payment dates.

Factors such as profitability, cash flow, financial health, growth opportunities, industry conditions, tax considerations, and management decisions can influence the amount and frequency of ZIM dividend payments. Investors should carefully analyze these factors to make informed decisions about their investments.

It’s essential to recognize that dividend payments are not guaranteed and can be impacted by various factors. While ZIM has a history of paying dividends, there may be instances where dividend amounts fluctuate or dividend payments are suspended.

By staying informed, monitoring ZIM’s financial reports, and understanding the factors influencing dividend payments, investors can better navigate the world of ZIM dividends and make informed investment decisions.

Remember, investing in ZIM or any other company involves risks, and it’s important to conduct thorough research and consult with a financial advisor before making any investment decisions.

With this knowledge in hand, you are better equipped to navigate the world of ZIM dividends and make informed investment decisions.