Finance

When Does PXD Pay Dividends?

Published: January 3, 2024

Find out when PXD pays dividends and plan your finance accordingly. Stay updated with the dividend payment schedule.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of investing in finance. As an investor, it is important to understand the various aspects of a company, including its dividend payment schedule. In this article, we will focus on PXD, an abbreviation for a well-known company in the financial sector. PXD is known for its consistent dividend payments, which can be a valuable source of income for shareholders.

Diving into the subject of PXD dividends can provide insight into how dividends work and how investors can benefit from them. Whether you are a seasoned investor or just starting out, understanding the timing and factors affecting PXD dividend payments can be crucial in maximizing your investment potential.

In this article, we will explore the factors that influence PXD dividend payments, the dividend payment schedule, and key dates to keep in mind when investing in PXD. By the end of this article, you will have a comprehensive understanding of when and how PXD pays dividends.

Understanding PXD Dividends

Dividends are a portion of a company’s profits that are distributed to its shareholders. They are typically paid in cash or additional shares of stock. PXD, as a company, follows a similar dividend payment structure.

PXD dividends are usually paid out on a quarterly basis, although some companies may have different schedules. The amount of dividends paid to shareholders is determined by the company’s board of directors. They consider various factors, such as the company’s financial health, profitability, and future growth prospects when deciding the dividend amount.

Investors who hold shares of PXD are eligible to receive dividends. The more shares an investor has, the greater their dividend payout will be. Dividends are typically calculated on a per-share basis, meaning that each share you own entitles you to a certain amount of the dividend payment.

It’s important to note that dividend payments can fluctuate over time. Companies may increase or decrease dividend amounts based on their financial performance. As an investor, it’s essential to keep an eye on the financial health of PXD and any changes in the dividend policy.

PXD dividends can be a valuable source of income for investors. They provide a regular stream of cash flow, which can help supplement other investment returns or meet financial goals. Dividends can also signify a company’s stability and success, as consistent dividend payments indicate a healthy financial position.

However, it’s important to remember that dividends are not guaranteed. While PXD has a history of paying dividends, there may be instances where the company decides to suspend or reduce dividend payments. Economic downturns or financial challenges can impact a company’s ability to pay dividends. Therefore, it’s crucial to do thorough research and monitor the financial health of PXD before making any investment decisions solely based on potential dividend income.

Factors Affecting PXD Dividends

Several factors influence PXD dividend payments. Understanding these factors can provide insights into the stability and potential growth of the company, as well as the likelihood of consistent dividend distributions. Here are some key factors that can impact PXD dividends:

- Financial Performance: The financial health and performance of PXD play a significant role in determining dividend payments. A company with consistent revenue growth, strong profitability, and positive cash flow is more likely to pay dividends regularly and potentially increase them over time.

- Industry Trends: The performance of the energy industry, in which PXD operates, can influence its dividend payments. Factors such as oil and gas prices, demand-supply dynamics, and regulatory changes can impact the profitability and cash flow of energy companies, including PXD.

- Debt Levels: The amount of debt a company carries can affect its ability to pay dividends. Companies with high debt levels may prioritize debt repayment over dividend distributions to maintain financial stability and creditworthiness.

- Investment Opportunities: PXD may choose to invest its profits back into the business rather than distributing them as dividends. If the company sees promising growth opportunities or expansion plans, it may allocate funds towards those initiatives instead of paying higher dividends.

- Legal and Regulatory Factors: PXD’s dividend policy can also be influenced by legal and regulatory requirements. Companies must comply with laws and regulations regarding dividend payments, such as the amount of retained earnings required and restrictions on distributing dividends during financial distress.

- Management Decisions: The decision-making of PXD’s board of directors and management team also plays a role in dividend payments. They consider various factors, including the company’s financial goals, future prospects, and shareholder expectations when determining dividend amounts.

It is important for investors to carefully analyze these factors and monitor any changes in PXD’s financial situation and industry dynamics. By staying informed, investors can make more informed decisions regarding their potential investments in PXD and gain a better understanding of the potential dividends they may receive.

PXD Dividend Payment Schedule

Understanding the dividend payment schedule of PXD is essential for investors to plan their investment strategies and manage their cash flows effectively. PXD follows a regular dividend payment schedule, providing predictability and consistency to its shareholders.

The dividend payment schedule for PXD typically follows a quarterly pattern. This means that dividends are paid out every three months to eligible shareholders. However, it’s important to note that companies may adjust their dividend payment schedule at their discretion.

PXD usually announces its dividend payment schedule well in advance, giving shareholders time to prepare. The schedule includes specific dates for important milestones related to dividends, such as the ex-dividend date, record date, and payment date.

Let’s take a closer look at each of these dates:

- Ex-Dividend Date: The ex-dividend date is the date on which a stock begins trading without the dividend. To be eligible to receive the upcoming dividend payment, investors must own PXD shares on or before this ex-dividend date.

- Record Date: The record date is the date on which a company reviews the list of shareholders eligible to receive the upcoming dividend. Shareholders who own PXD shares on the record date will be entitled to receive the dividend.

- Payment Date: The payment date is when the dividend is actually distributed to eligible shareholders. On this date, shareholders will receive the dividend payment either in cash or additional shares of PXD stock, depending on the company’s preference and dividend policy.

It’s important to keep track of these dates and understand their significance when planning your investment strategy. Missing the ex-dividend date, for example, would mean that you would not be eligible for the upcoming dividend payment, potentially impacting your expected income from PXD dividends.

Investors can usually find the dividend payment schedule, along with other important announcements, on PXD’s investor relations website or through financial news sources. It’s a best practice to proactively monitor these sources regularly to stay informed about any changes or updates to the dividend payment schedule.

By understanding and adhering to the PXD dividend payment schedule, investors can ensure that they are maximizing their dividend potential and properly managing their investment portfolios.

Ex-Dividend Date for PXD

The ex-dividend date is an important milestone for investors looking to receive dividends from their investment in PXD. The ex-dividend date is the date on which a stock begins trading without the dividend. It is essentially the cutoff point for determining who is eligible to receive the upcoming dividend payment.

To be eligible for the dividend, investors must own shares of PXD on or before the ex-dividend date. This means that if you purchase shares of PXD on the ex-dividend date or after, you will not be entitled to receive the dividend payment for that particular period.

The ex-dividend date is set by the stock exchange and is typically two business days prior to the record date. This allows for the settlement process and ensures that shareholders who acquire shares right before the dividend announcement do not receive the dividend without actually owning the stock.

It’s important to note that the stock price of PXD may adjust on the ex-dividend date to reflect the dividend payment. Generally, the stock price will decrease by an amount equivalent to the dividend per share. This adjustment is based on market forces and investor expectations.

Understanding the ex-dividend date is crucial for dividend-focused investors. If their goal is to receive dividends, they need to ensure they own PXD shares before the ex-dividend date. This requires careful planning and monitoring of the dividend payment schedule, as missing the ex-dividend date could result in missing out on the dividend payment for that particular period.

Investors can find the ex-dividend date for PXD through various sources, such as financial news websites, broker platforms, or by directly contacting the company’s investor relations department. It’s important to stay updated on the ex-dividend date and other related dividend information to optimize dividend income and investment decisions.

Record Date for PXD Dividends

The record date is an important milestone in the dividend payment process for PXD shareholders. It is the date on which the company reviews its records to determine the shareholders who are eligible to receive the upcoming dividend payment.

To be eligible for the dividend, investors must own shares of PXD on or before the record date. Unlike the ex-dividend date, which is set by the stock exchange and typically occurs a few days before the record date, the record date is determined by PXD itself.

Once the record date has been established, the company will review its shareholder records to identify those who are entitled to receive the dividend. Shareholders listed on the record as owners of PXD shares on or before the record date will be deemed eligible to receive the dividend payment.

It is important to note that the record date is separate from the ex-dividend date, which is the date on which a stock begins trading without the dividend. The ex-dividend date is typically two business days prior to the record date, allowing for the settlement process and ensuring that only those who have held PXD shares before the ex-dividend date are eligible for the dividend.

While the record date is an important step in the dividend payment process, investors should be aware that it does not determine when the dividend payment will be received. The payment date, which is typically a few weeks after the record date, is the actual date on which shareholders receive the dividend payment.

It’s important for PXD shareholders to keep track of the record date and ensure that they hold shares of PXD on or before that date to be eligible for the dividend. This requires staying informed about the dividend payment schedule and monitoring any updates or changes communicated by the company.

Investors can usually find the record date for PXD dividends through official announcements from the company, their investor relations website, financial news sources, or broker platforms. By staying informed about the record date and other important dividend-related information, shareholders can properly plan and manage their investments to optimize their dividend income.

Payment Date for PXD Dividends

The payment date is the highly anticipated date on which PXD distributes dividend payments to its eligible shareholders. After the ex-dividend date and record date have passed, shareholders who qualified for the dividend will receive their payment on the designated payment date.

The payment date for PXD dividends is typically announced well in advance, giving shareholders time to prepare for the arrival of their dividend income. This date signifies the actual distribution of the dividend and can vary from company to company. PXD generally sets the payment date a few weeks after the ex-dividend date to allow for the necessary administrative processes.

On the payment date, shareholders who are entitled to receive the dividend will receive it in their preferred form, which is typically in the form of cash or additional shares of PXD stock. The payment is made directly to the shareholders’ brokerage accounts or through other designated payment methods.

The payment date is a crucial aspect for dividend-focused investors since it determines when they will receive their dividend income. By knowing the payment date, investors can plan their finances, account for the expected cash flow, and make informed decisions regarding their investment portfolio.

It’s important to note that the payment date is distinct from the record date, ex-dividend date, and even the declaration date. Each of these dates serves a different purpose in the dividend payment process, with the payment date being the final step where shareholders see the actual financial benefit.

To keep track of the payment date for PXD dividends, investors can refer to the company’s official announcements, investor relations websites, financial news sources, or their brokerage platforms. By staying updated on the payment date and other important dividend-related information, shareholders can effectively manage their investment strategies and make the most of their dividend income.

Conclusion

Understanding the dividend payment schedule of PXD is crucial for investors looking to maximize their returns and manage their investment portfolios effectively. By comprehending the various aspects of PXD dividends, investors can make informed decisions and harness the potential income from their investments.

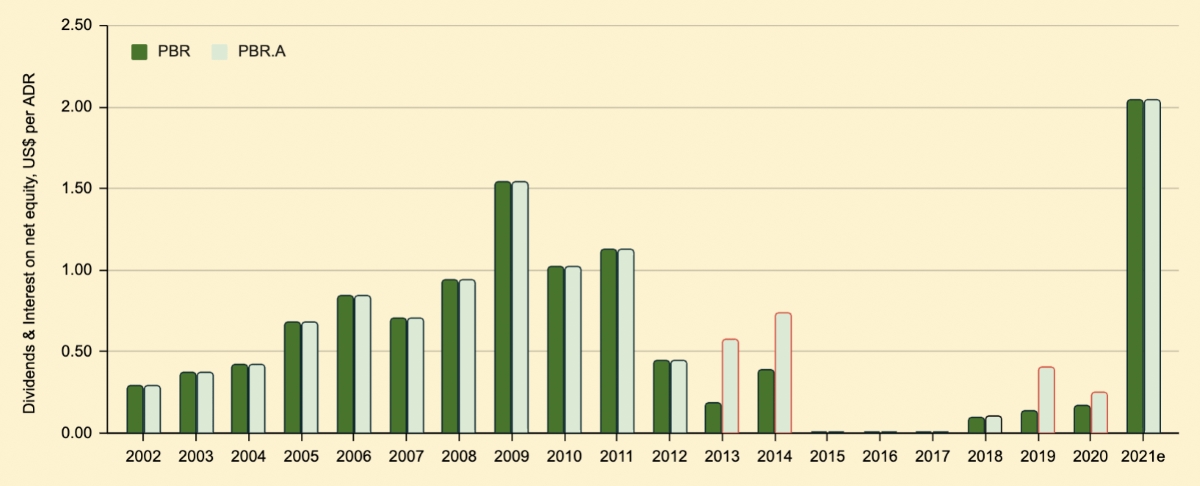

In this article, we explored the fundamentals of PXD dividends, including how they work and the factors that influence their payments. We discussed how PXD follows a regular dividend payment schedule, usually on a quarterly basis, and examined the significance of the ex-dividend date, record date, and payment date in relation to dividend payments.

Furthermore, we highlighted the factors that can affect PXD dividend payments, such as the company’s financial performance, industry trends, debt levels, investment opportunities, legal and regulatory factors, and management decisions. Understanding these factors can help investors evaluate the stability and growth potential of PXD and make informed decisions about dividend-focused investments.

Lastly, we emphasized the importance of staying informed about the dividend-related dates and updates, such as the ex-dividend date, record date, and payment date. By actively monitoring these dates and conducting thorough research, investors can optimize their dividend potential and align their investment strategies with PXD’s dividend payment schedule.

Investing in PXD can provide shareholders with a valuable income stream through regular dividend payments. However, it’s crucial to remember that dividends are not guaranteed, and their amounts can fluctuate based on various factors. Investors should do their due diligence, analyze PXD’s financial health, and consider their investment goals and risk tolerance before making any investment decisions.

In conclusion, understanding PXD’s dividend payment schedule, the factors influencing dividend payments, and the importance of key dates can empower investors to make informed decisions and potentially enhance their overall investment experience. By staying knowledgeable and engaged with the dividend payment process, investors can take advantage of the potential benefits that come with investing in companies like PXD.