Finance

When Does AMC Pay Dividends?

Published: January 3, 2024

Find out when AMC pays dividends and how it can benefit your finances. Stay informed and make the most of your investment opportunities with AMC.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the fascinating world of dividends! If you are an investor or someone interested in finance, you have probably heard of AMC Entertainment Holdings, Inc., commonly known as AMC. As one of the largest movie theater chains in the world, AMC has a significant presence in the entertainment industry. But have you ever wondered when AMC pays dividends?

Dividends are an integral part of investing in stocks. They represent a share of the company’s profits distributed to its shareholders. Dividends can be a valuable source of passive income and a way to benefit from a company’s success.

In the case of AMC, the company’s dividend history provides insights into its dividend payment practices. Understanding when AMC pays dividends and the factors influencing those payments can be essential for investors looking to maximize their returns. Let’s dive deeper into AMC’s dividend journey, explore the factors influencing dividend payments, and shed light on the company’s dividend payment schedule.

Understanding Dividends

Before we explore when AMC pays dividends, it’s important to have a solid understanding of what dividends are and how they work. Dividends are a portion of a company’s profits that are distributed to its shareholders as a form of compensation for their investment.

Dividends can be issued in different forms, including cash dividends, where shareholders receive a cash payment, or stock dividends, where shareholders receive additional shares of the company’s stock. Dividends are typically paid out on a regular basis, often quarterly or annually, but the frequency can vary depending on the company’s financial performance and dividend policy.

For investors, dividends can provide a steady stream of income, especially for those who rely on their investments for passive income during retirement. Dividend-paying stocks are often viewed as more stable investments, as they indicate that the company is generating consistent profits and is willing to share them with its shareholders.

However, it’s important to note that not all companies pay dividends. Some growing companies in high-growth industries may choose to reinvest their profits back into the business to fuel further expansion. In such cases, investors may not receive dividends but instead benefit from capital appreciation as the company’s stock price increases.

Now that we have a basic understanding of dividends, let’s explore the dividend history of AMC and see when they typically pay dividends.

AMC Dividend History

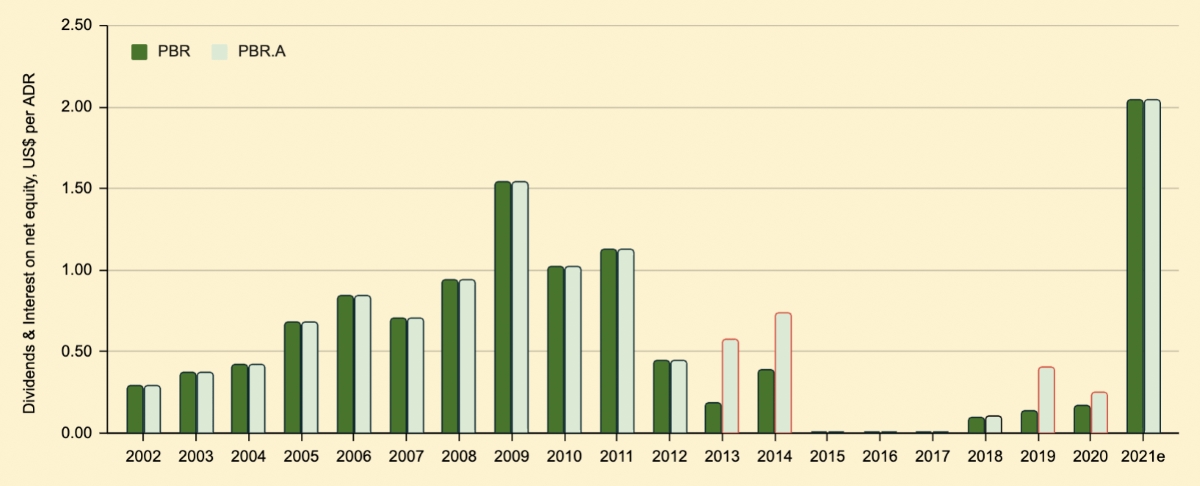

AMC Entertainment Holdings, Inc. has an interesting dividend history that investors should be aware of. Historically, AMC has not been a consistent dividend-paying company. While it has paid dividends in the past, the frequency and amount of these payments have varied over time.

In recent years, AMC suspended its dividend payments due to various factors, including the impact of the COVID-19 pandemic on the entertainment industry. The closure of movie theaters and restrictions on capacity significantly affected AMC’s revenues, leading the company to prioritize financial stability and liquidity.

However, prior to the suspension of dividend payments, AMC did have a dividend program. One notable example was in 2017 when AMC announced a quarterly cash dividend of $0.20 per share. This dividend was paid to shareholders who held the stock on the designated record date.

It’s important to note that dividend payments are not guaranteed, and AMC’s dividend history is subject to change based on various factors, including the company’s financial performance, cash flow, and strategic priorities.

As an investor, it’s crucial to stay updated on AMC’s financial reports, earnings releases, and announcements regarding dividend payments. This information can provide insights into the company’s financial health and its future dividend policies.

Keep in mind that dividends are just one aspect to consider when investing in stocks. It’s essential to assess the overall financial strength of a company, its growth prospects, and other relevant factors before making investment decisions.

Now that we have looked at AMC’s dividend history, let’s explore the factors that influence when AMC pays dividends.

Factors Influencing AMC Dividends

Several factors can influence when AMC pays dividends and the amount of those payments. Understanding these factors can provide insights into the company’s dividend policy and help investors make informed decisions. Here are some key factors that influence AMC’s dividends:

- Financial Performance: AMC’s financial performance is a critical factor in determining its ability to pay dividends. If the company is generating substantial profits and maintaining a strong cash flow, it is more likely to have the resources to distribute dividends to its shareholders. On the other hand, if AMC faces financial challenges or experiences significant losses, it may choose to retain its earnings for future growth and expansion rather than paying dividends.

- Economic Conditions: The general economic conditions also impact AMC’s dividend policy. During periods of economic uncertainty or recession, companies may be more cautious about distributing dividends to conserve cash and ensure financial stability.

- Industry Trends: The entertainment industry is subject to various trends and changes. Factors such as the popularity of certain movie genres, competition from streaming platforms, and shifts in consumer preferences can impact AMC’s revenues and profitability. These factors, in turn, can influence the company’s dividend payments.

- Debt Obligations: AMC’s debt obligations can affect its ability to pay dividends. If the company has significant debt repayments or other financial obligations, it may prioritize using its cash flow to meet those obligations rather than distributing dividends.

- Management Priorities: The management team’s priorities and strategic vision for the company also play a role in dividend decisions. They may choose to reinvest profits back into the business for expansion, acquisitions, or research and development instead of distributing dividends.

It’s important to note that these factors are not exhaustive, and other unique circumstances can influence AMC’s dividend payments. As an investor, it is essential to stay updated on the company’s announcements, financial reports, and management’s comments regarding dividend policies. This information can provide valuable insights into the company’s priorities and its commitment to returning value to shareholders.

Now that we understand the factors influencing AMC’s dividends, let’s delve into the dividend payment schedule of the company.

Dividend Payment Schedule

AMC’s dividend payment schedule refers to the frequency and timing at which the company distributes dividends to its shareholders. It is essential for investors to be aware of this schedule to plan their investment strategies effectively. However, it’s important to note that as of the time of writing, AMC has temporarily suspended its dividend payments.

Prior to the suspension, AMC had followed a quarterly dividend payment schedule, which is a common practice among many publicly traded companies. This means that dividends were typically paid out every three months, providing shareholders with a regular income stream.

The specific dates related to the dividend payment schedule are as follows:

- Declaration Date: The declaration date is when the company’s board of directors announces the payment of dividends. It indicates the dividend amount and the record date.

- Record Date: The record date is the date set by the company to determine which shareholders are eligible to receive dividends. To qualify for the dividend payment, investors must own shares of AMC before this date.

- Ex-Dividend Date: The ex-dividend date is typically set two business days before the record date. Investors who purchase AMC’s shares on or after this date will not receive the upcoming dividend payment.

- Payment Date: The payment date is when the actual dividend payment is made to eligible shareholders. On this date, investors who owned AMC shares before the record date will see the dividend amount credited to their brokerage account or receive the payment via check or direct deposit.

It’s important to keep in mind that the specific dividend payment schedule may vary from one company to another, and changes can occur based on various factors. As an investor, it’s crucial to regularly check for updates from AMC regarding dividend payments and review the company’s financial reports for any changes to the dividend payment schedule.

Although AMC has temporarily suspended its dividend payments, it’s always a good idea to stay informed about the company’s dividend policy and monitor any future announcements. This will help you make informed investment decisions and stay updated on any potential changes to the dividend payment schedule.

To conclude, while AMC’s dividend payment schedule is currently on hold, understanding the schedule when it was active and being aware of the factors influencing dividends can provide valuable insights for investors.

Conclusion

Dividends play an important role in the investment world, providing investors with a share of a company’s profits and a potential source of passive income. When it comes to AMC Entertainment Holdings, Inc., understanding when they pay dividends can be essential for investors looking to capitalize on their investment.

While AMC has historically paid dividends, it’s important to note that the company has currently suspended its dividend payments. This is due to various factors, including the impact of the COVID-19 pandemic on the entertainment industry.

To understand when AMC pays dividends, it’s crucial to study the company’s dividend history, which reveals the frequency and amount of past payments. Additionally, factors such as the company’s financial performance, economic conditions, industry trends, debt obligations, and management priorities all influence dividend decisions.

Prior to the temporary suspension, AMC followed a quarterly dividend payment schedule, which included declaration dates, record dates, ex-dividend dates, and payment dates. These dates were critical for investors to determine their eligibility for receiving dividends.

It’s important for investors to stay updated on AMC’s financial reports, announcements, and management’s comments regarding the resumption of dividend payments. This information can provide valuable insights into the company’s financial health and its commitment to returning value to shareholders.

In conclusion, while the dividend payment schedule for AMC is currently interrupted, understanding the company’s dividend history, the factors influencing dividends, and the payment schedule can help investors make informed decisions and stay prepared for potential future dividend payments. As with any investment, it’s essential to conduct thorough research and consider other aspects beyond dividends when evaluating AMC’s potential as an investment opportunity.