Finance

When Does Vale Pay Dividends

Published: January 3, 2024

Find out when Vale, a leading finance company, pays dividends and maximize your financial returns. Stay informed about dividend payouts with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of dividends! In the realm of finance, dividends play a vital role, serving as a financial reward for investors who hold shares in a company. These periodic payouts are a way for companies to distribute their profits to shareholders and can be a significant incentive for investors when considering which stocks to invest in.

Understanding the dynamics behind dividend payments can help investors make informed decisions and strategize their investment portfolios. In this article, we will delve into the world of dividends and take a closer look at when Vale, a prominent mining company, pays dividends to its shareholders.

Dividends serve as a reflection of a company’s financial position, profitability, and commitment to returning value to its shareholders. By paying out dividends, companies reward their shareholders for their loyalty and provide an additional stream of income, making dividend-paying stocks an attractive option for investors seeking regular cash flows.

Nowadays, many companies opt to reinvest their profits back into the business for growth and expansion instead of issuing dividends. However, certain sectors, such as utilities, consumer staples, and real estate investment trusts (REITs), have a strong tradition of paying consistent dividends due to their stable cash flows and mature business models.

Let’s now turn our attention to Vale, a global leader in the mining industry.

What are dividends?

Dividends are a form of payment made by a company to its shareholders, typically in the form of cash or additional shares of stock. They are distributed based on the number of shares a shareholder owns, providing them with a portion of the company’s profits.

Dividends are a way for companies to share their financial success with their shareholders. When a company generates profits, it can choose to retain those profits for reinvestment or distribute them to shareholders in the form of dividends. The decision to pay dividends depends on various factors, including the company’s financial health, growth prospects, and dividend policy.

Dividends can be classified into two main types: cash dividends and stock dividends. Cash dividends are the most common form, where shareholders receive a specific amount of cash per share they hold. Stock dividends, on the other hand, involve the distribution of additional shares to existing shareholders based on their current holdings.

Dividends can provide a steady stream of income for investors, especially those who rely on their investments for income during retirement. Companies that consistently pay dividends are often seen as stable and reliable, attracting investors who seek consistent returns.

Furthermore, dividends can also impact a company’s stock price and overall shareholder value. When a company announces a dividend, it signals to investors that the company is financially sound and expects future profitability. This positive news can often lead to an increase in demand for the company’s stock, causing the stock price to rise.

It’s important to note that not all companies pay dividends. Growth-oriented companies, particularly in the technology and pharmaceutical sectors, tend to reinvest their profits back into the company to fuel expansion and innovation. These companies focus on capital appreciation rather than providing immediate income through dividends.

Now that we have a clear understanding of what dividends are, let’s explore why companies choose to pay them and the specific dividend policy of Vale.

Why do companies pay dividends?

Companies pay dividends for various reasons, all of which are centered around rewarding their shareholders and enhancing shareholder value. Let’s explore some of the key reasons why companies choose to distribute dividends:

- Return value to shareholders: One of the primary reasons for paying dividends is to provide a direct return on investment to shareholders. By distributing a portion of the company’s profits, companies reward their shareholders for their ownership and loyalty.

- Attract investors: Paying regular dividends can attract new investors to a company’s stock. Dividend-paying stocks tend to be particularly appealing to income-focused investors who seek stable cash flows. A company that consistently pays dividends may be seen as financially stable and reliable, which can help attract a broader investor base.

- Indicate financial health: Companies that consistently pay dividends often signal to investors that they are financially healthy and generating consistent profits. Dividend payments can provide valuable insight into a company’s financial strength and stability, creating a positive perception among investors.

- Enhance shareholder loyalty: Dividends can foster shareholder loyalty by providing a direct benefit to shareholders. By consistently paying dividends, companies can establish a loyal shareholder base, which can contribute to long-term stability and investor confidence.

- Discipline in capital allocation: Paying dividends requires careful financial management and discipline. It forces companies to evaluate their investment opportunities and allocate capital efficiently. Companies that consistently pay dividends often demonstrate discipline in their capital allocation strategies.

It’s important to note that the decision to pay dividends is not taken lightly by companies. When determining the dividend amount and frequency, companies consider various factors, including their financial position, cash flow, profitability, growth prospects, and legal requirements.

Now that we understand why companies pay dividends, let’s explore Vale, a prominent player in the mining industry, and its approach to dividends as part of its overall dividend policy.

Vale: An overview

Vale S.A., commonly known as Vale, is a global mining company headquartered in Brazil. With operations in over 30 countries, Vale is one of the world’s largest producers of iron ore and nickel and a major player in the production of copper, coal, and fertilizers. The company’s diverse portfolio and strong foothold in the mining industry make it a significant player in the global commodities market.

Founded in 1942 as Companhia Vale do Rio Doce, Vale has grown and expanded over the years through strategic acquisitions and investments. Today, the company’s operations span across exploration, extraction, processing, and distribution of various minerals and metals.

Vale’s commitment to sustainable mining practices and social responsibility sets it apart in the industry. The company places a strong emphasis on environmental stewardship, safety, and community engagement. It actively invests in research and development to drive innovation and improve its operational efficiency.

As a result of its global presence and extensive operations, Vale has established itself as a key player in the mining industry. It holds a strong position in the market and is well-positioned to navigate the complexities and challenges of the industry.

Now that we have an overview of Vale, let’s delve into its dividend policy and explore the factors that influence the company’s dividend payments.

The dividend policy of Vale

Vale follows a dividend policy that aims to provide a consistent and sustainable return to its shareholders while considering the company’s financial performance, cash flow generation, and future growth prospects. The company’s dividend policy is designed to strike a balance between rewarding shareholders and reinvesting profits back into the business for future expansion and development.

The specific dividend policy of Vale is determined by its Board of Directors, who make decisions regarding the dividend amount and frequency based on a number of factors. These factors include the company’s financial position, profitability, cash flow, debt levels, capital expenditure requirements, market conditions, and regulatory considerations.

The dividend policy of Vale takes into account the cyclical nature of the commodities market and the potential volatility in financial performance. The company aims to avoid overextending its dividend commitments during periods of economic downturn or uncertainty. By maintaining a conservative approach to dividend payments, Vale can ensure the long-term financial stability and resilience of the company.

Vale’s dividend policy also considers the importance of retaining a portion of the company’s earnings for reinvestment and growth. The mining industry requires significant capital investments in exploration, development, and infrastructure to sustain and expand operations. Retaining earnings allows Vale to fund these investments internally, reducing the need for external financing and maintaining control over its growth trajectory.

While Vale strives to maintain a sustainable and consistent dividend policy, it is important to note that dividend payments are not guaranteed. The company’s dividend payments are subject to change based on market conditions, operational performance, regulatory requirements, and the discretion of the Board of Directors.

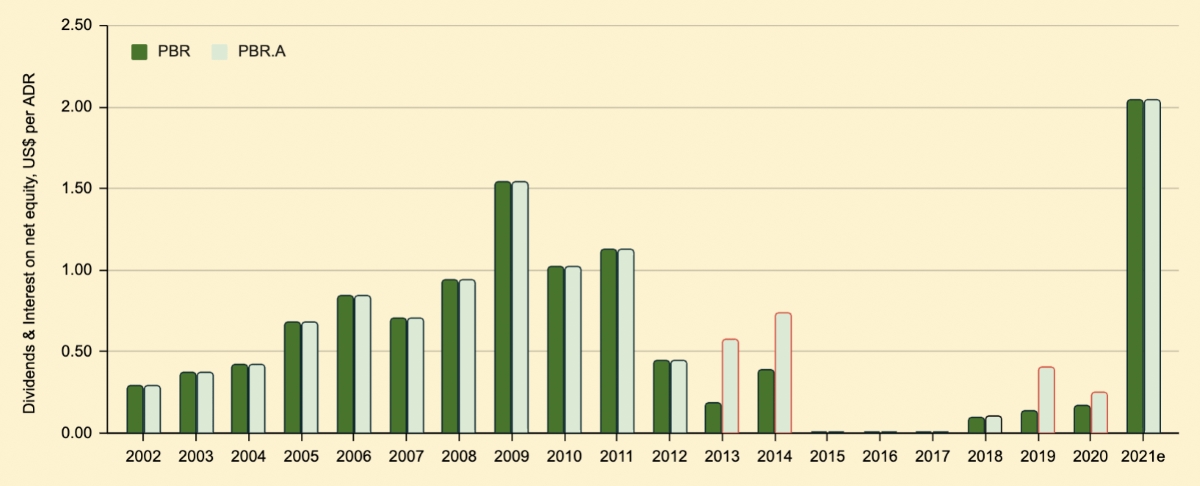

In recent years, Vale has demonstrated its commitment to rewarding shareholders by paying regular dividends. However, the specific dividend amount and timeline vary from year to year, reflecting the company’s financial performance and market conditions.

Now that we understand Vale’s dividend policy, let’s explore the factors that influence the timing of dividend payments by the company.

Factors affecting Vale’s dividend payments

Several factors come into play when considering the timing and amount of dividend payments by Vale. Understanding these factors can provide insights into the company’s dividend distribution decisions. Here are some key factors that influence Vale’s dividend payments:

- Financial performance: The financial health and profitability of Vale play a significant role in determining dividend payments. If the company experiences strong financial performance and generates healthy profits, it is more likely to distribute higher dividend payments to shareholders.

- Cash flow generation: Vale’s ability to generate cash flow is a critical consideration for dividend payments. Positive cash flow indicates that the company has sufficient funds to distribute dividends without compromising its day-to-day operations or growth initiatives.

- Commodity prices: Vale’s profitability is closely tied to the prices of the commodities it produces, such as iron ore, nickel, and copper. Fluctuations in commodity prices can impact the company’s overall revenue and subsequently influence dividend payments.

- Market conditions: The broader market conditions and investor sentiment can also influence Vale’s dividend decisions. Economic uncertainties, geopolitical factors, and industry trends can impact the company’s outlook, leading to adjustments in dividend payments.

- Debt obligations: Vale’s debt levels and interest payments are important factors to consider in dividend distribution. The company needs to fulfill its debt obligations and maintain a healthy debt-to-equity ratio before allocating funds for dividend payments.

- Growth opportunities: Vale’s growth strategy and investment opportunities also come into play when determining dividend payments. If the company identifies promising growth prospects that require significant capital investment, it may choose to retain earnings for future expansion, resulting in lower dividend payouts.

- Legal and regulatory requirements: Vale operates in various countries and is subject to specific legal and regulatory frameworks. Compliance with these regulations, including dividend distribution rules and restrictions, can impact the timing and amount of dividend payments.

Considering these factors, Vale aims to strike a balance between rewarding shareholders through dividends and ensuring the long-term sustainability and growth of the company.

Now that we have explored the factors that influence Vale’s dividend payments, let’s examine when shareholders can expect to receive dividends from the company.

When does Vale pay dividends?

Vale pays dividends to its shareholders on a semi-annual basis, typically in April and October. Shareholders who hold Vale’s common shares are eligible to receive these dividend payments. The specific dates for dividend declaration, record date, and payment date are determined and announced by the company’s Board of Directors.

It’s important to note that the timing and amount of dividend payments can vary from year to year, depending on various factors such as the company’s financial performance, cash flow generation, market conditions, and growth opportunities. The decision to pay dividends is ultimately at the discretion of the Board of Directors, who consider these factors before making any dividend distribution decisions.

When Vale declares a dividend, it establishes a record date. Shareholders who are listed on the company’s records as of the specified record date are eligible to receive the dividend payment. It’s crucial for investors to be registered as shareholders before the record date to participate in the dividend distribution.

After the record date, Vale processes the dividend payments and distributes them to eligible shareholders on the designated payment date. The payment date is typically a few weeks after the record date, allowing the company sufficient time to reconcile shareholder records and ensure a smooth dividend distribution process.

Shareholders have the option to receive their dividend payments in the form of cash or through the dividend reinvestment program (DRIP) offered by Vale. The DRIP allows shareholders to use their dividends to automatically purchase additional shares of Vale’s common stock, providing them with the opportunity to reinvest and potentially increase their ownership in the company.

It’s important for shareholders to stay informed and monitor the announcements made by Vale regarding dividend payments. The company releases relevant information, including dividend declarations, record dates, and payment dates, through official channels such as press releases and the company’s investor relations website.

As with any investment, it’s advisable for shareholders to consult with their financial advisors or brokerage firms for specific details and advice related to Vale’s dividend payments.

With this understanding of Vale’s dividend payment schedule, let’s now conclude our exploration of dividends and their significance within the context of Vale and the mining industry as a whole.

Conclusion

Dividends play a crucial role in the world of finance, providing a means for companies to distribute profits to their shareholders. Vale, a global mining company, follows a dividend policy that aims to strike a balance between rewarding shareholders and reinvesting in the company’s growth and development.

Companies like Vale pay dividends to return value to their shareholders, attract investors, indicate financial health, enhance shareholder loyalty, and maintain discipline in capital allocation. Dividend payments can also impact a company’s stock price and overall shareholder value.

Vale, as a major player in the mining industry, has established itself as a key global producer of various minerals and metals. By adhering to sustainable mining practices and prioritizing social responsibility, Vale has positioned itself as a responsible and respected industry leader.

Factors affecting Vale’s dividend payments include financial performance, cash flow generation, commodity prices, market conditions, debt obligations, growth opportunities, and legal requirements. These factors help the company make informed decisions regarding the amount and timing of dividend distributions.

Vale pays dividends on a semi-annual basis, typically in April and October, to shareholders who hold its common shares. Shareholders should ensure they are registered as shareholders before the designated record date to be eligible for dividend payments.

Understanding Vale’s dividend policy and the factors influencing its dividend distributions provides valuable insights for investors and shareholders. Monitoring announcements from Vale regarding dividend declarations, record dates, and payment dates is crucial for staying informed.

In conclusion, dividends serve as a means for companies like Vale to reward shareholders, attract investors, indicate financial health, and maintain capital discipline. By adhering to its dividend policy and considering various factors, Vale seeks to provide consistent and sustainable returns while fueling the company’s growth and maintaining long-term financial stability.