Home>Finance>Where Can I Get Historical Currency Futures Contracts Bloomberg

Finance

Where Can I Get Historical Currency Futures Contracts Bloomberg

Modified: December 29, 2023

Looking for historical currency futures contracts? Find comprehensive information on Bloomberg about where to get finance-related historical data.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to the world of finance, understanding the past can often be the key to predicting the future. This holds true for the foreign exchange market, where historical currency futures contracts play a crucial role in providing valuable insights and opportunities for traders and investors.

Currency futures contracts are derivatives that allow market participants to speculate on the future exchange rate of one currency against another at a specific date and price. These contracts are traded on exchanges and are standardized in terms of size, maturity, and contract specifications.

By analyzing historical currency futures contracts, traders can gain a deeper understanding of past market behavior, identify trends and patterns, and make more informed decisions in their trading strategies. These historical contracts can provide valuable information on currency price movements, volatility, and market sentiment.

One popular platform where traders can access historical currency futures contracts is Bloomberg. Bloomberg is a leading financial information and analytics provider that offers a wide range of tools and resources for market participants. Through Bloomberg, traders can access historical data on currency futures contracts, allowing them to backtest trading strategies, conduct quantitative analysis, and generate trading signals.

In this article, we will explore the benefits and drawbacks of trading historical currency futures contracts, as well as where to find these contracts on Bloomberg. Whether you are an experienced trader looking to refine your strategy or a novice investor interested in delving into the world of currency trading, understanding historical currency futures contracts can be a valuable asset in your financial journey.

Understanding Currency Futures Contracts

Currency futures contracts are standardized agreements to buy or sell a specific amount of a currency at a predetermined price and date in the future. These contracts are traded on regulated exchanges and are used by market participants to hedge against currency risk or speculate on currency price movements.

Unlike spot currency trading, where currencies are bought and sold for immediate delivery, currency futures contracts have a fixed maturity date. Traders can choose from various contract sizes, typically representing a specific amount of the base currency, such as 100,000 units.

When trading currency futures contracts, one currency is always bought or sold against another currency. For example, a trader might buy a currency futures contract that represents buying the British pound (base currency) against the US dollar (counter currency).

The price of a currency futures contract is determined by the prevailing market exchange rate, interest rates, and any other factors affecting the supply and demand for a particular currency. This means that the price of a currency futures contract can fluctuate based on market conditions.

Traders can take two positions in currency futures contracts: long or short. Going long means buying a contract in anticipation of a currency’s appreciation, while going short involves selling a contract with the expectation that a currency will decline in value.

One advantage of currency futures contracts is the ability to leverage your trading position. This allows traders to control a larger position with a smaller amount of capital. However, leverage can also amplify losses, so it’s essential to manage risk and use appropriate risk management strategies.

It’s important to note that currency futures contracts are regulated financial instruments, and trading them requires knowledge and understanding of the market. It’s recommended to conduct thorough research, seek advice from professionals, and practice trading in a simulated environment before engaging in live trading.

By understanding the mechanics and characteristics of currency futures contracts, traders can make informed decisions, manage risk effectively, and take advantage of the opportunities presented by the foreign exchange market.

Historical Currency Futures Contracts on Bloomberg

Bloomberg is a widely used financial information platform that provides a wealth of data and tools for traders and investors. One of its key features is the availability of historical data on currency futures contracts, which can be invaluable for market analysis and strategy development.

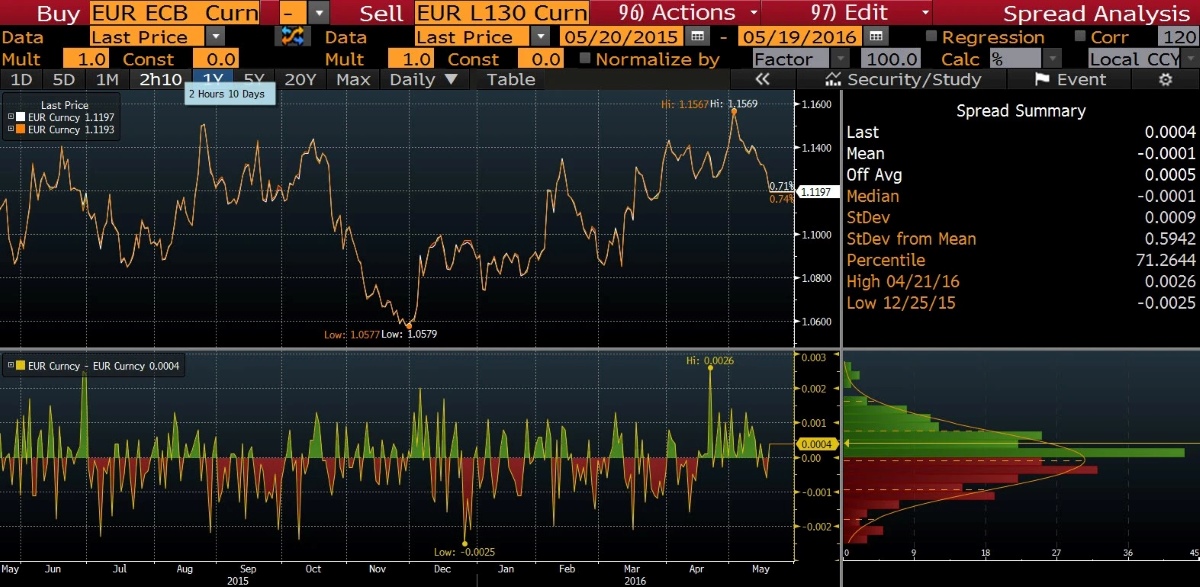

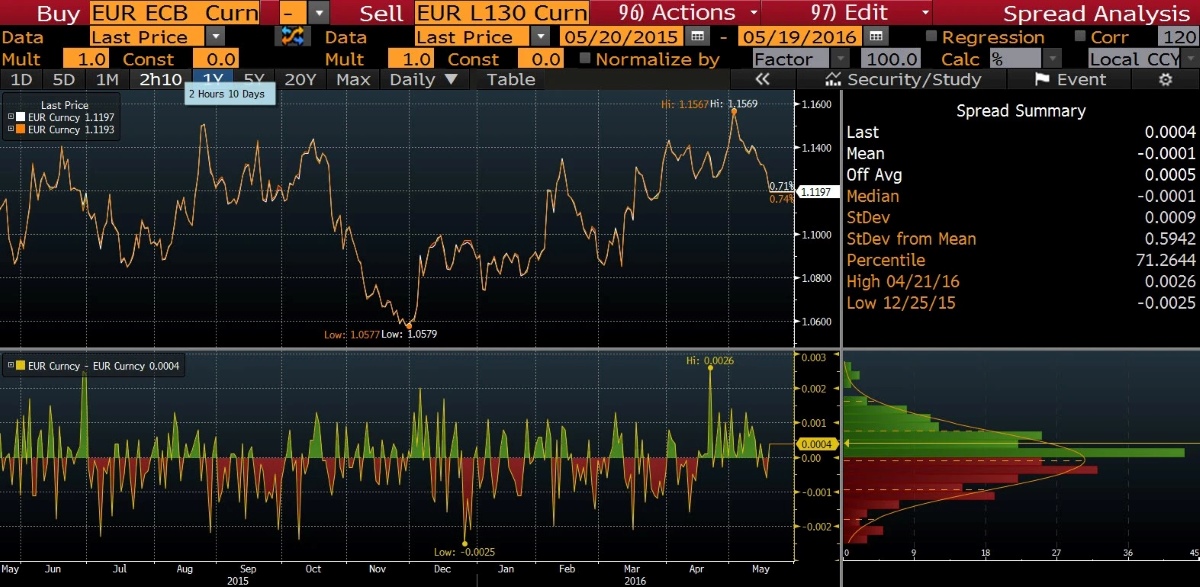

On Bloomberg, users can access historical currency futures contract data for a wide range of currencies, including major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as cross pairs and emerging market currencies. The data includes information such as the opening and closing prices, high and low prices, volume, and open interest for each contract.

Traders can choose the time frame for which they want to retrieve historical data, ranging from daily, weekly, monthly, or custom time periods. This allows for detailed analysis over specific time frames, enabling traders to identify historical patterns, trends, and correlations between different currencies.

Bloomberg also offers advanced charting capabilities, allowing users to visualize the historical data in various chart types, including line charts, candlestick charts, and bar charts. These charts can be customized to display different indicators, such as moving averages, Bollinger Bands, and volume overlays, to aid in technical analysis.

In addition to accessing historical data, Bloomberg provides users with a vast array of analytical tools and functions to perform quantitative analysis on currency futures contracts. Traders can create custom formulas and metrics, backtest trading strategies using historical data, and generate trading signals based on specific criteria.

Another valuable feature of Bloomberg is its news and market insights section. Traders can stay updated with the latest news, economic releases, and market analysis from around the world. This information can be crucial for understanding the macroeconomic factors that influence currency prices and making well-informed trading decisions.

Overall, the availability of historical currency futures contracts on Bloomberg empowers traders with the necessary information and tools to analyze past market behavior, develop trading strategies, and make informed decisions. Traders can leverage the comprehensive data, advanced charting capabilities, and analytical tools offered by Bloomberg to gain a competitive edge in the currency futures market.

Benefits of Trading Historical Currency Futures Contracts

Trading historical currency futures contracts can provide numerous benefits for traders and investors looking to navigate the foreign exchange market. Here are some key advantages:

- Insights into Market Behavior: By analyzing historical currency futures contracts, traders can gain valuable insights into past market behavior. This includes identifying trends, patterns, and cyclical movements in currency prices. This historical perspective can help traders anticipate future market movements and make more informed trading decisions.

- Strategy Development: Historical currency futures contracts can serve as a foundation for developing and testing trading strategies. Traders can backtest their strategies using historical data to assess their effectiveness over different market conditions. This allows traders to refine their strategies, identify optimal entry and exit points, and improve overall trading performance.

- Risk Management: Historical currency futures contracts can be utilized for risk management purposes. By examining historical volatility and price movements, traders can assess the potential risks associated with specific currency pairs. This information can help traders set appropriate stop-loss levels, manage position sizes, and implement risk management techniques to protect their capital.

- Quantitative Analysis: Historical currency futures contracts enable traders to conduct quantitative analysis using statistical models and indicators. Traders can apply technical analysis tools and indicators to historical data to identify potential trading opportunities and generate trading signals. This quantitative approach can provide a systematic and objective framework for decision-making.

- Market Sentiment Analysis: Analyzing historical currency futures contracts can shed light on market sentiment and investor behavior. Traders can gauge the level of bullish or bearish sentiment by examining historical open interest and volume data. This information can be useful in assessing market dynamics and identifying potential reversals or trend continuations.

Overall, trading historical currency futures contracts allows traders to leverage the wealth of information and insights provided by historical market data. By understanding past market behavior and using it as a guide, traders can develop effective trading strategies, manage risk efficiently, and make well-informed trading decisions in the dynamic foreign exchange market.

Drawbacks of Trading Historical Currency Futures Contracts

While trading historical currency futures contracts offers several benefits, it is important for traders to be aware of the potential drawbacks associated with this approach. Here are some key considerations:

- No Guarantee of Future Performance: One of the main drawbacks of relying solely on historical currency futures contracts is that past performance does not guarantee future results. Market conditions can change, and historical patterns may not always repeat themselves. Therefore, traders should use historical data as a guide alongside other factors, such as current market conditions and fundamental analysis.

- Limitations in Data Quality: Historical currency futures contract data may sometimes have limitations in terms of accuracy and completeness. Data gaps, errors, or inconsistencies can occur, which could impact the reliability of the analysis. Traders should carefully review and validate the data to ensure its quality before making decisions based on historical data.

- Market Dynamics Evolve: The foreign exchange market is dynamic and constantly evolving. Economic, political, and global events can significantly impact currency prices and market sentiment. Historical data may not always capture these factors. Traders should stay informed about current market conditions and consider them alongside historical analysis.

- Over-Reliance on Technical Analysis: Relying solely on historical data for technical analysis can lead to over-reliance on patterns and indicators. Traders should consider other forms of analysis, such as fundamental analysis, market news, and macroeconomic factors, to obtain a more comprehensive view of the market and make well-rounded trading decisions.

- Backtesting Limitations: While backtesting trading strategies using historical data can be valuable, it is important to be aware of its limitations. Backtesting does not account for slippage, transaction costs, and market liquidity, which can significantly impact real-time trading results. Traders should validate their strategies and performance through live trading and continuous monitoring.

Despite these drawbacks, historical currency futures contracts remain a valuable tool for traders. By understanding the limitations and using historical data in conjunction with other forms of analysis, traders can make more informed and well-rounded trading decisions in the dynamic foreign exchange market.

Where to Find Historical Currency Futures Contracts on Bloomberg

If you are looking to access historical currency futures contracts data on Bloomberg, there are a few key steps to follow:

- Open the Bloomberg terminal: To access Bloomberg’s extensive financial data and tools, you will need to have a Bloomberg terminal account. Contact Bloomberg or your financial institution to set up an account if you do not already have one.

- Launch the Historical Data Wizard: Once you have logged into the Bloomberg terminal, open the Historical Data Wizard by typing “HDP” into the Command Line. This will bring up the menu where you can specify the parameters for retrieving historical data.

- Select the desired currency futures contract: In the Historical Data Wizard, you can choose the specific currency futures contract you want to analyze. Bloomberg provides a wide range of futures contracts for various currency pairs. Select the desired currency pair and contract maturity date.

- Choose the time frame: Specify the time frame for which you want to retrieve historical data. You can choose from daily, weekly, monthly, or custom time periods, depending on your analysis requirements. Bloomberg allows for flexible customization in this regard.

- Customize additional parameters: Depending on your analysis needs, you can customize additional parameters such as data format, output options, and data ranges. This will allow you to tailor the data presentation and format to suit your preferences.

- Retrieve and analyze the data: Once you have specified all the necessary parameters, click the “Submit” or “Get Data” button to retrieve the historical currency futures contracts data. Bloomberg will compile and present the data in a format that can be easily analyzed and visualized.

Remember to validate and cross-reference the retrieved data to ensure its accuracy and consistency. Bloomberg provides extensive support and resources to assist users in navigating the platform and accessing historical data effectively.

By utilizing the powerful tools and resources offered by Bloomberg, traders can access and analyze historical currency futures contracts data to gain valuable insights, develop trading strategies, and make informed decisions in the dynamic foreign exchange market.

Conclusion

Understanding historical currency futures contracts and their availability on Bloomberg can greatly enhance a trader’s ability to navigate the foreign exchange market. By accessing historical data, traders can gain valuable insights into market behavior, develop trading strategies, and make informed decisions.

Bloomberg offers a wide range of historical currency futures contracts data, allowing traders to analyze past market behavior, identify trends and patterns, and backtest their trading strategies. The platform provides advanced charting capabilities, analytical tools, and news updates, enabling traders to stay informed and make well-rounded trading decisions.

While trading historical currency futures contracts offers numerous benefits, traders should be mindful of the potential drawbacks. Historical data does not guarantee future performance, and traders should consider current market conditions and other forms of analysis alongside historical analysis.

To access historical currency futures contracts data on Bloomberg, traders need to have a Bloomberg terminal account and utilize the Historical Data Wizard. By following the appropriate steps and customizing parameters, traders can retrieve and analyze the historical data they need.

In conclusion, historical currency futures contracts and their availability on Bloomberg offer a valuable resource for traders and investors. By leveraging this historical data and combining it with other forms of analysis, traders can gain a deeper understanding of the foreign exchange market, develop effective trading strategies, and make better-informed decisions.