Home>Finance>Where Can I Get Historical Currency Futures Contracts

Finance

Where Can I Get Historical Currency Futures Contracts

Published: December 24, 2023

Looking for historical currency futures contracts? Find out where to get them and enhance your finance knowledge with valuable insights and data.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Currency Futures Contracts

- Importance of Historical Currency Futures Contracts

- Where to Find Historical Currency Futures Contracts

- Exchange-Traded Futures Contracts

- Online Financial Data Providers

- Historical Currency Futures Data Services

- Government Agencies and Economic Institutes

- Conclusion

Introduction

Currency futures contracts are financial derivatives that allow individuals and businesses to hedge against currency risk or speculate on the future movement of exchange rates. These contracts function as agreements to buy or sell a specific currency at a predetermined price and date in the future.

Historical currency futures contracts provide valuable insights into past market trends and can help inform investment decisions. By analyzing the historical performance of currency futures, traders can gain a better understanding of market dynamics and potential patterns.

For individuals or businesses looking to access historical currency futures contracts, there are various sources to consider. In this article, we will explore different avenues for obtaining historical currency futures contract data, including exchange-traded futures contracts, online financial data providers, and government agencies.

Whether you are a seasoned investor or just starting in the world of finance, understanding where to find historical currency futures contract data is essential for making informed trading decisions and developing effective trading strategies.

In the following sections, we will delve into the importance of historical currency futures contracts, as well as explore the different sources that can provide you with the data you need.

Understanding Currency Futures Contracts

Currency futures contracts are standardized agreements that bind two parties to buy or sell a specific currency at a predetermined price and date in the future. These contracts are traded on regulated futures exchanges, such as the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE).

Unlike spot forex trading, where currencies are traded for immediate delivery, currency futures contracts have a specified expiration date. This provides investors and businesses with a clear timeline for their trading activities.

Each currency futures contract represents a specific amount of the underlying currency. For example, a standard EUR/USD currency futures contract represents 125,000 euros. The contract also specifies the delivery month, such as March, June, September, or December.

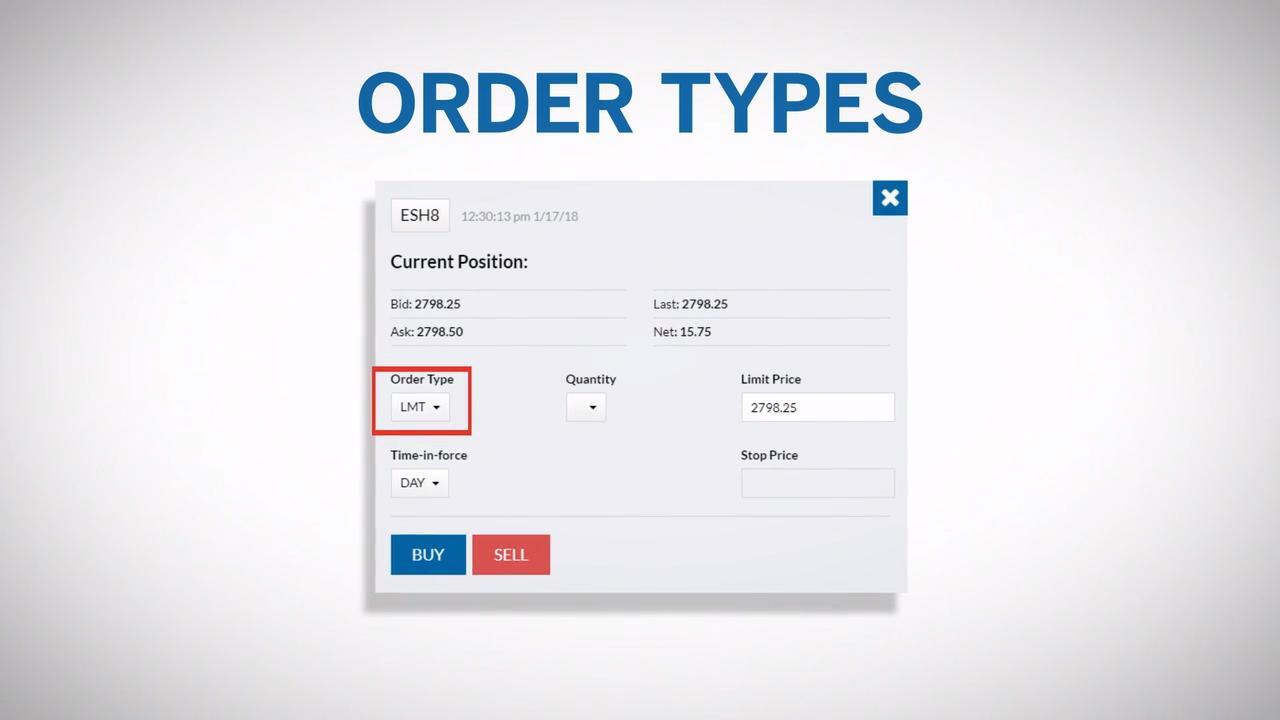

One of the key features of currency futures contracts is the use of margin. Traders are required to deposit an initial margin, which is a fraction of the total contract value, to enter into a futures position. This allows traders to control a larger contract size with a smaller upfront investment. However, it’s important to note that trading futures involves leverage and carries risks, so proper risk management is crucial.

The price of a currency futures contract is determined by the interaction of supply and demand in the market. It reflects the market’s expectation of the future value of the underlying currency.

Traders can take two types of positions in currency futures contracts: long or short. Going long means buying a contract in anticipation of a price increase, while going short involves selling a contract with the expectation of a price decline. Profits or losses are realized by offsetting or closing the position before the contract’s expiration.

Currency futures contracts are widely used by businesses and investors for various purposes. Hedgers use these contracts to mitigate currency risk associated with international trade or investments. By locking in a specific exchange rate in advance, businesses can protect themselves from adverse currency fluctuations.

Speculators, on the other hand, trade currency futures contracts to profit from anticipated currency movements. They leverage their market knowledge and analysis to speculate on the direction of exchange rates and make profit from price fluctuations.

Understanding the mechanics and fundamentals of currency futures contracts is essential for anyone interested in trading or participating in the currency markets. Now that we have a foundation of knowledge, let’s explore the importance of historical currency futures contracts.

Importance of Historical Currency Futures Contracts

Historical currency futures contracts play a crucial role in financial analysis and decision-making. They provide valuable insights into previous market trends and can help traders, investors, and businesses make well-informed decisions for the future.

Here are a few reasons why historical currency futures contracts are important:

- Analysis of Market Trends: By examining historical currency futures data, traders can identify patterns and trends that can guide their trading strategies. They can analyze how various economic events and geopolitical factors have influenced currency prices in the past, which can provide valuable insights for predicting future market movements.

- Evaluation of Trading Strategies: Historical currency futures data allows traders to backtest and evaluate different trading strategies. By simulating trades based on past data, traders can assess the performance of their strategies and make necessary adjustments to improve profitability. This helps in developing robust and reliable trading approaches.

- Risk Management: Historical currency futures contracts data is crucial for risk management purposes. By studying historical market volatility and correlation patterns, traders and businesses can assess the potential risks associated with their positions. This knowledge helps them determine appropriate stop-loss orders and position sizing to protect against unfavorable market movements.

- Business Planning: For businesses operating in international markets, historical currency futures data is essential for budgeting and forecasting purposes. By analyzing past currency trends, businesses can anticipate the potential impact of exchange rate fluctuations on their revenues, expenses, and profit margins. This information aids in making informed financial decisions and adjusting business strategies accordingly.

- Educational Purposes: Historical currency futures contracts serve as a valuable educational resource for students, researchers, and those seeking to deepen their understanding of the forex market. They provide real-world examples and data that can be used for academic research, case studies, and learning about the dynamics of currency markets.

Overall, historical currency futures contracts are an invaluable tool that allows market participants to gain insights, analyze market trends, evaluate strategies, manage risk, and make informed decisions. By studying the historical performance of currency futures, traders and businesses can enhance their financial acumen and improve their chances of success in the currency markets.

Now that we understand the importance of historical currency futures contracts, let’s explore where to find reliable sources of this data.

Where to Find Historical Currency Futures Contracts

Obtaining historical currency futures contracts data is crucial for conducting thorough market analysis and making informed trading decisions. Here are some reliable sources for finding historical currency futures contracts:

Exchange-Traded Futures Contracts:

One of the primary sources of historical currency futures contracts is the exchanges themselves. Exchanges like the Chicago Mercantile Exchange (CME) and Intercontinental Exchange (ICE) provide historical data on currency futures contracts traded on their platforms. These exchanges typically offer data for different currency pairs, delivery dates, and contract sizes. Market participants can access archives of historical prices, volumes, and other relevant market data directly through the exchange’s website or by using their data subscription services.

Online Financial Data Providers:

There are various online financial data providers that offer comprehensive databases of historical currency futures contracts data. These providers aggregate data from multiple exchanges and offer it to traders, investors, and researchers through their platforms or APIs. Examples of popular data providers include Bloomberg, Thomson Reuters, and Interactive Brokers. These platforms often offer customizable data sets, allowing users to select specific currency pairs, timeframes, and contract specifications to suit their needs. Subscription fees may apply to access these services.

Historical Currency Futures Data Services:

Specialized data services focus solely on providing historical currency futures contracts data. These services collect and archive vast amounts of historical data from various exchanges and offer it to customers through their platforms. Examples of such services include DTN IQFeed, CQG Data Factory, and Quandl. These services often provide user-friendly interfaces and tools for quickly accessing and analyzing historical currency futures data. Subscription plans are typically available to cater to different user requirements and budgets.

Government Agencies and Economic Institutes:

Government agencies and economic institutes also offer historical currency futures contracts data, particularly for economic research and analysis purposes. These organizations may provide access to historical exchange rate data and other relevant financial market information. Examples include central banks, statistical agencies, and international financial institutions like the International Monetary Fund (IMF) and the World Bank. These sources can be especially useful for macroeconomic analysis and studying the interaction between currency futures and broader economic indicators.

When sourcing historical currency futures contracts data, it’s crucial to ensure the reliability and accuracy of the data. It’s recommended to verify the data from multiple sources and cross-reference with other reputable sources to ensure consistency.

By leveraging these sources, market participants can access comprehensive historical currency futures contracts data to inform their market analysis, validate trading strategies, and make well-informed decisions in the dynamic currency markets.

Now that we have explored where to find historical currency futures contracts data, let’s summarize our findings.

Exchange-Traded Futures Contracts

Exchange-traded futures contracts are one of the primary sources for accessing historical currency futures data. Futures exchanges such as the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE) provide a wealth of historical data on currency futures contracts traded on their platforms.

These exchanges offer a wide range of currency pairs, including major currencies such as the US dollar (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), and Swiss Franc (CHF), among others. They also provide futures contracts for emerging market currencies.

To access historical currency futures data from these exchanges, market participants can visit the exchange website or subscribe to their data services. Archives of historical prices, volumes, open interest, and other relevant market data are usually available. The data can be accessed directly through the exchange’s website or via their APIs.

Exchange-traded futures contracts offer several advantages when it comes to accessing historical currency futures data:

- Accuracy and Reliability: Data from exchanges is considered highly reliable as it is sourced directly from the trading platforms. Exchanges adhere to strict regulatory guidelines, ensuring data accuracy and integrity.

- Depth and Coverage: Exchange-traded futures contracts cover a wide range of currency pairs, contract specifications, and delivery dates. This broad coverage allows for comprehensive analysis of historical trends and price movements.

- Timeliness of Data: Data from exchanges is typically available in real-time or with minimal delay. This up-to-date information enables traders to stay current with market developments and make timely decisions.

- Access to Market Data: In addition to historical price data, exchanges often provide other market data such as trading volumes, open interest, and settlement prices. This additional information can be valuable for in-depth analysis and understanding market dynamics.

While accessing historical currency futures data from exchanges is advantageous, there are a few considerations to keep in mind:

- Data Subscription Costs: Some exchanges may require a subscription or payment to access their historical data. The cost will vary based on the specific data required and the duration of data access.

- Technical Expertise: Extracting and analyzing data from exchange sources may require some technical expertise, especially when working with APIs or large datasets. Traders may need to engage with developers or utilize data analysis tools to effectively utilize the data.

- Data Formatting: Exchange data may not be readily formatted for direct analysis. Traders may need to clean and manipulate the data to fit their analysis requirements, which can add additional time and effort.

Despite these considerations, accessing historical currency futures data from exchange-traded futures contracts remains a reliable and popular choice for market participants. By leveraging the data provided by exchanges, traders and analysts can gain valuable insights into past market trends and make better-informed decisions in the currency futures market.

Next, let’s explore another avenue for obtaining historical currency futures contracts data, which is through online financial data providers.

Online Financial Data Providers

Online financial data providers offer a convenient and comprehensive source for accessing historical currency futures contracts data. These providers aggregate data from various exchanges and offer it to traders, investors, and researchers through their platforms or APIs.

Here are a few popular online financial data providers that offer historical currency futures contracts data:

- Bloomberg: Bloomberg is a leading provider of financial data and offers a wide range of historical currency futures data. Their platform provides access to historical prices, trading volumes, and other relevant market data.

- Thomson Reuters: Thomson Reuters is a trusted provider of financial information and offers comprehensive historical currency futures contracts data. Their platform allows users to access past prices, analyze market trends, and conduct in-depth research.

- Interactive Brokers: Interactive Brokers is a popular online brokerage that offers historical currency futures contracts data. Traders can access historical prices, volumes, and other trading data through their platform, which is widely used by active traders.

These online financial data providers offer customizable data sets, allowing users to select specific currency pairs, timeframes, and contract specifications to suit their needs. They often provide user-friendly interfaces and tools for quickly accessing and analyzing historical currency futures data.

While some online financial data providers offer free access to limited historical data, more comprehensive and in-depth historical currency futures contracts data may require a paid subscription. The subscription fees can vary based on the level of access and the frequency of data updates required.

There are several advantages to using online financial data providers for accessing historical currency futures contracts data:

- Comprehensive Coverage: These platforms consolidate data from multiple exchanges, providing a wide range of currency pairs and contract specifications. This comprehensive coverage enables users to analyze and compare data from different sources easily.

- Analysis Tools: Online financial data providers often provide advanced analysis tools, charts, and indicators that can be used to analyze historical currency futures data effectively. These tools can help identify trends, patterns, and correlations to make better-informed trading decisions.

- Convenience: Accessing data from online financial data providers is convenient and can be done from anywhere with an internet connection. Users can save time by quickly retrieving historical currency futures data without the need to visit multiple exchanges or access raw data files.

Before selecting an online financial data provider, it’s essential to consider factors such as data accuracy, reliability, user interface, additional features, and customer support. It’s also recommended to compare prices and subscription plans to ensure the chosen provider meets your specific requirements.

Now that we have explored online financial data providers, let’s move on to the next section, which discusses specialized historical currency futures data services.

Historical Currency Futures Data Services

Specialized historical currency futures data services focus solely on providing comprehensive and reliable historical currency futures contracts data. These services collect and archive vast amounts of data from various exchanges and offer it to customers through their platforms or APIs.

Here are a few examples of popular historical currency futures data services:

- DTN IQFeed: DTN IQFeed is a widely used data service that provides historical currency futures contracts data. They offer a vast selection of historical data for multiple currency pairs, delivery dates, and contract specifications. Their platform allows users to access and download the data in various formats for further analysis.

- CQG Data Factory: CQG Data Factory focuses on providing high-quality historical currency futures data. They offer a wide range of currency pairs and contract specifications, allowing users to retrieve and analyze data according to their specific needs. CQG Data Factory offers flexible download options and data customization features.

- Quandl: Quandl is a popular data service platform that aggregates historical currency futures contracts data from multiple sources. They provide easy access to reliable and accurate data, allowing users to explore historical trends, perform quantitative analysis, and build trading models based on the historical currency futures data available on their platform.

These specialized historical currency futures data services typically offer user-friendly interfaces, data customization options, and various data formats for easy integration into different analysis platforms. They often provide data in clean and standardized formats, which reduces the need for extensive data manipulation and cleaning.

While these services focus specifically on historical currency futures data, they may also provide additional features such as real-time data, data analytics tools, and data visualization capabilities. Some may offer APIs for programmatic access and integration with third-party software and platforms.

Keep in mind that accessing historical currency futures data from specialized data services may require a paid subscription. The subscription costs can vary depending on the level of access, the duration of data availability, and the frequency of data updates required.

When selecting a specialized historical currency futures data service, consider factors such as data accuracy, reliability, data coverage, customization options, support, and the ease of data integration into your existing analysis tools or trading platforms.

Using specialized historical currency futures data services can provide traders, investors, and analysts with comprehensive and reliable data to conduct in-depth analysis, develop trading strategies, and make informed decisions based on historical trends and patterns in the currency futures market.

Now that we have explored historical currency futures data services, let’s move on to another avenue for finding historical currency futures contracts data, which is through government agencies and economic institutes.

Government Agencies and Economic Institutes

Government agencies and economic institutes offer another avenue for obtaining historical currency futures contracts data. These organizations provide access to data that is crucial for economic research, analysis, and policymaking.

Here are a few examples of government agencies and economic institutes that offer historical currency futures contracts data:

- Central Banks: Central banks play a pivotal role in the management of a country’s currency and monetary policy. Many central banks provide historical exchange rate data, including currency futures contracts. This data can be accessed through their websites or economic data portals. Central bank data is often considered reliable and comprehensive, providing insights into currency market trends and macroeconomic factors.

- Statistical Agencies: National statistical agencies collect and publish various economic data, including information on currency futures contracts. These agencies provide official statistics on topics such as exchange rates, trade balances, and international financial transactions. Their data can be accessed through their websites or economic data portals and can offer valuable historical insights for economic analysis.

- International Financial Institutions: Organizations such as the International Monetary Fund (IMF) and the World Bank also publish historical currency futures contracts data. These institutions provide comprehensive data on global economic indicators, including exchange rates and financial market statistics. Their data is often used for macroeconomic research and analysis.

Government agencies and economic institutes often provide data in standardized formats that are suitable for academic research, economic modeling, and policy analysis. The data is reliable, as it is maintained and updated by reputable institutions with transparent methodologies.

While accessing historical currency futures data from government agencies and economic institutes can provide valuable insights, it’s important to consider a few factors:

- Data Availability: Some government agencies and economic institutes may have limitations on the availability of historical currency futures data. It’s essential to check their data archives or contact the relevant authorities to ensure the data you require is accessible.

- Narrower Focus: Government agencies and economic institutes typically focus on economic indicators and may not provide as extensive coverage of currency futures contracts as specialized data providers. The data they offer may be more suitable for broader economic analysis rather than specific trading strategies.

- Data Interpretation: Government agencies and economic institutes may provide raw data that requires further interpretation and analysis. Users will need to apply their own methodologies and tools to analyze and extract insights from the data.

Despite these considerations, accessing historical currency futures contracts data from government agencies and economic institutes can be valuable for studying the relationship between currency futures and economic indicators, conducting macroeconomic analyses, and gaining a broader understanding of the financial markets.

Now that we have explored various sources for finding historical currency futures contracts data, let’s summarize our findings.

Conclusion

Obtaining historical currency futures contracts data is essential for market analysis, trading strategies, risk management, and decision-making. By analyzing past market trends and patterns, traders, investors, and businesses can gain valuable insights into the currency futures market.

In this article, we explored different avenues for accessing historical currency futures contracts data, including exchange-traded futures contracts, online financial data providers, specialized historical data services, and government agencies/economic institutes.

Exchange-traded futures contracts offer accurate and reliable data directly from the exchanges themselves. They provide comprehensive coverage and timely access to historical currency futures data. Online financial data providers aggregate data from multiple sources and offer customizable data sets and analysis tools for traders and investors. Specialized historical data services focus solely on providing comprehensive and accessible historical currency futures contracts data.

Government agencies and economic institutes also offer historical currency futures contracts data, providing valuable insights into economic indicators and macroeconomic trends.

When accessing historical currency futures contracts data, it’s important to consider factors such as data accuracy, reliability, coverage, usability, and cost. Cross-referencing data from multiple sources can help ensure consistency.

Whether you are a seasoned trader, an investor, or a student seeking to deepen your understanding of the currency futures market, historical currency futures contracts data is a vital resource. It allows you to analyze market trends, evaluate strategies, manage risk, and make well-informed decisions.

By leveraging the aforementioned sources, you can access comprehensive and reliable historical currency futures contracts data, enabling you to enhance your market analysis, develop robust trading strategies, and navigate the dynamic landscape of the currency futures market with confidence.

So, wherever you choose to obtain historical currency futures contracts data, remember to utilize it wisely and adapt your trading approach based on the insights gained. With a solid understanding of historical market behavior, you can position yourself for success in currency futures trading.