Home>Finance>Where Will The Credit Inquiry For Capital One Be

Finance

Where Will The Credit Inquiry For Capital One Be

Published: March 5, 2024

Find out where the credit inquiry for Capital One will show up and how it may impact your finance. Learn more about managing credit inquiries.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit inquiries and the impact they can have on your financial well-being. Whether you're a seasoned credit user or just starting to build your credit history, understanding the nuances of credit inquiries is crucial for making informed financial decisions. In this article, we'll delve into the realm of credit inquiries, with a specific focus on Capital One credit inquiries. By the end of this journey, you'll be equipped with the knowledge to navigate credit inquiries with confidence and make sound credit-related choices.

Credit inquiries, often referred to as "hard pulls" or "hard inquiries," occur when a lender or creditor reviews your credit report as part of their decision-making process. This typically happens when you apply for credit, such as a loan or a credit card. The purpose of these inquiries is to assess your creditworthiness and determine the risk of lending to you. It's important to note that there are two types of credit inquiries: hard inquiries, which can impact your credit score, and soft inquiries, which do not affect your score.

Understanding the nature of credit inquiries is essential for maintaining a healthy credit profile. Moreover, for those specifically interested in Capital One credit inquiries, we'll explore where to find information about these inquiries and how to mitigate their potential impact on your credit score. So, let's embark on this enlightening journey into the realm of credit inquiries and uncover the mysteries surrounding Capital One credit inquiries.

Understanding Credit Inquiries

Credit inquiries, also known as credit pulls, occur when a third party, such as a lender or creditor, requests to view your credit report. These inquiries can be classified as either hard inquiries or soft inquiries, each serving different purposes and affecting your credit score differently.

Hard inquiries are triggered when you apply for credit, such as a mortgage, auto loan, or credit card. These inquiries become a part of your credit report and may impact your credit score. On the other hand, soft inquiries are generated for non-lending purposes, such as when you check your own credit report or when a potential employer conducts a background check. Unlike hard inquiries, soft inquiries do not affect your credit score.

It’s important to note that while hard inquiries can slightly lower your credit score, the impact is typically minimal and temporary. However, multiple hard inquiries within a short time frame can signal to lenders that you may be taking on too much debt, which could affect your creditworthiness.

Understanding the distinction between hard and soft inquiries is crucial for managing your credit health. By being aware of when and why these inquiries occur, you can make informed decisions about when to apply for credit and minimize any potential negative effects on your credit score.

Impact of Credit Inquiries on Credit Score

Credit inquiries, particularly hard inquiries, can have a notable impact on your credit score. When a hard inquiry is recorded on your credit report, it may cause a temporary decrease in your score. The extent of this impact varies from person to person and depends on their overall credit history and financial behavior.

Typically, a single hard inquiry may result in a minor decrease in your credit score, often by a few points. However, the impact of multiple inquiries within a short period can be more significant. Lenders may interpret numerous inquiries as a sign that you are actively seeking credit, which could potentially indicate financial distress or a higher risk of default.

It’s important to note that credit scoring models are designed to account for rate shopping, particularly when it comes to certain types of loans, such as mortgages and auto loans. When you are actively shopping for the best rates on these types of loans, multiple inquiries within a specific timeframe (often around 14-45 days, depending on the scoring model) are typically treated as a single inquiry, minimizing the impact on your credit score.

While hard inquiries may cause a temporary dip in your credit score, their impact diminishes over time. Typically, hard inquiries remain on your credit report for two years but only affect your credit score for the first 12 months. After this period, they are no longer factored into your credit score calculation.

Understanding the impact of credit inquiries on your credit score is essential for making informed decisions about when to apply for credit. By being mindful of how inquiries can affect your score, you can strategically manage your credit applications and minimize any potential negative effects on your creditworthiness.

Capital One Credit Inquiry: Where to Find It

If you’re a Capital One credit cardholder or have applied for a Capital One financial product, you may be curious about where to find information regarding the credit inquiries associated with your interactions with the company. Fortunately, accessing this information is relatively straightforward.

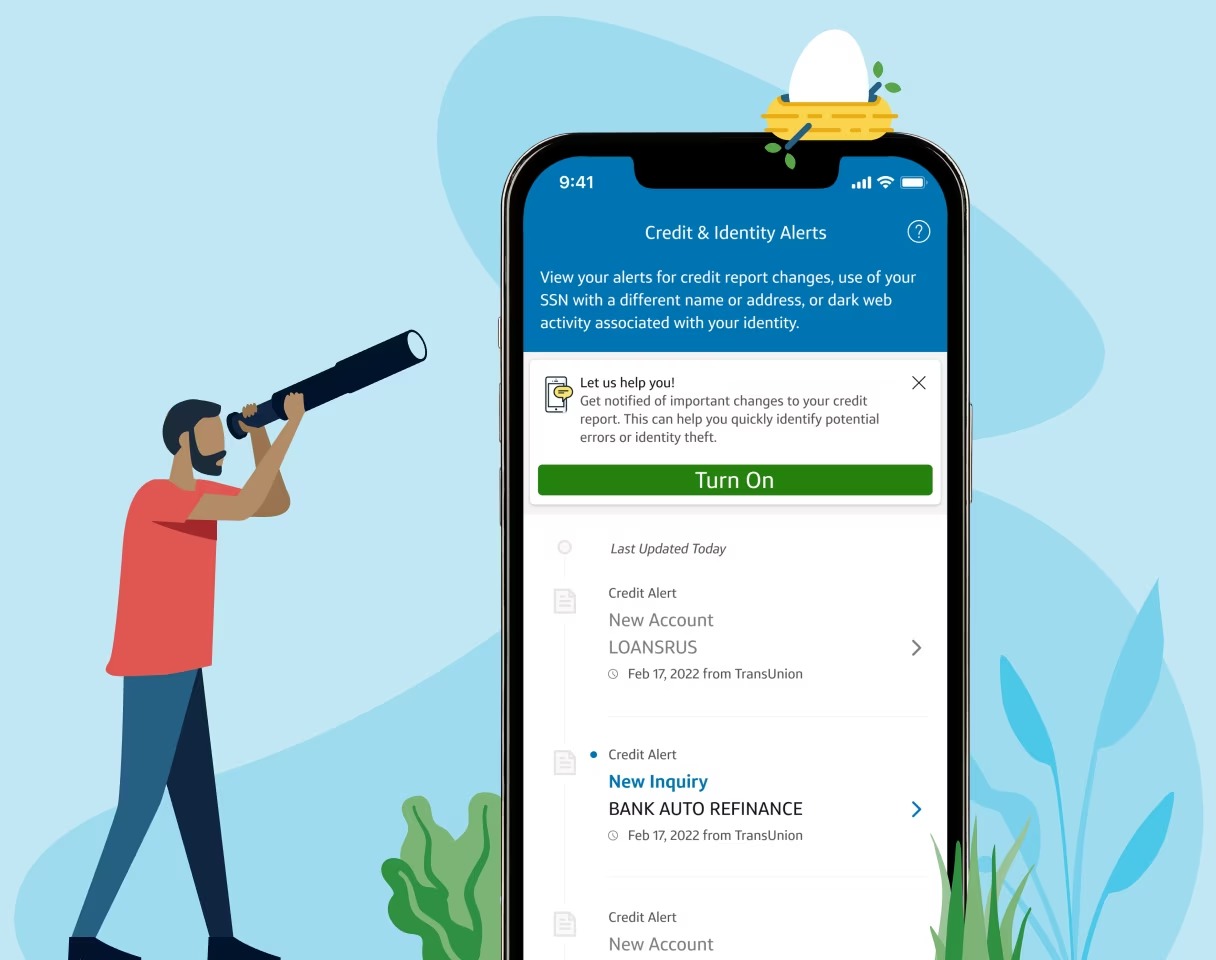

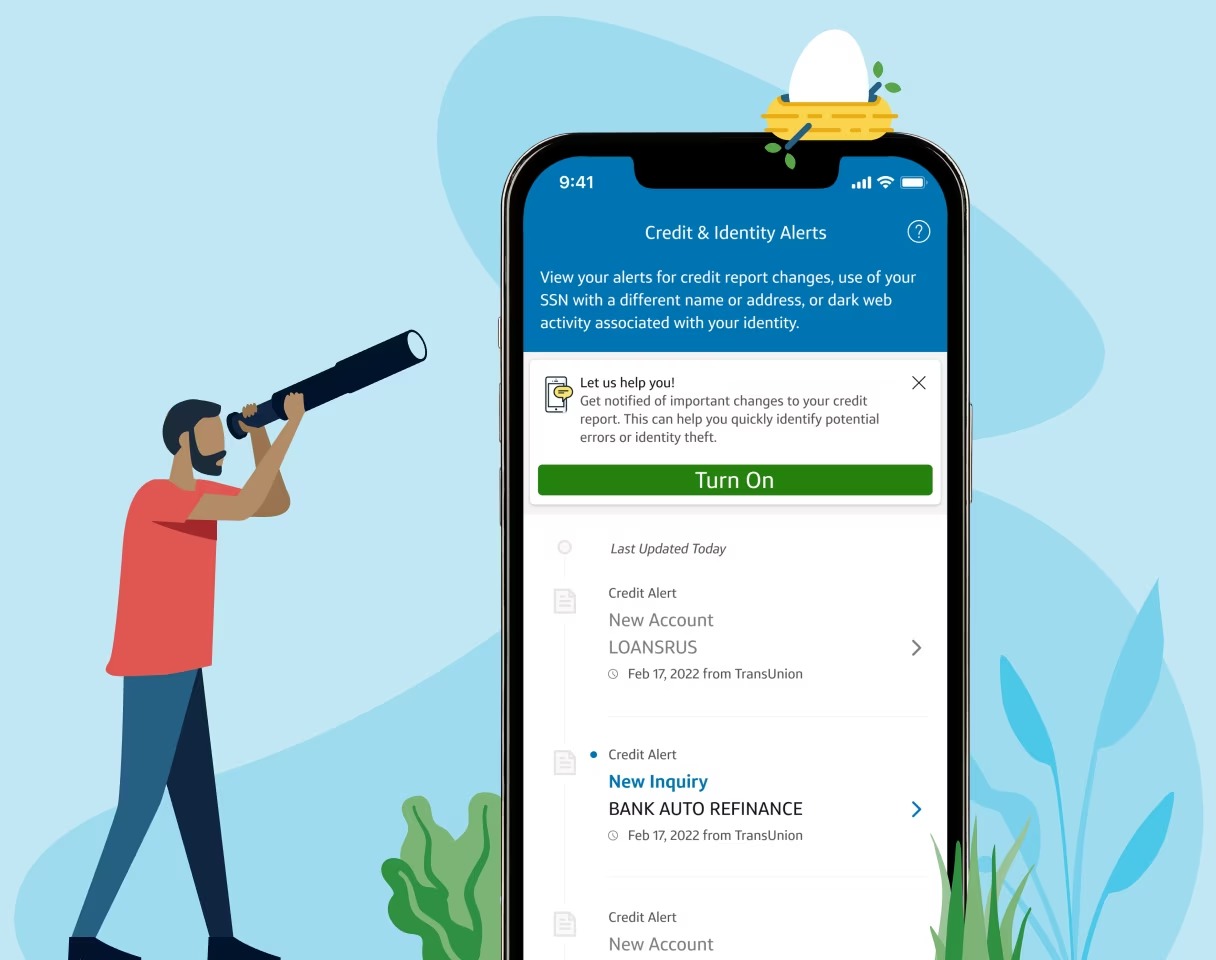

One of the primary ways to discover if Capital One has made a credit inquiry is by reviewing your credit report. You are entitled to a free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once every 12 months. By obtaining your credit report, you can scrutinize the list of inquiries and identify any made by Capital One. It’s important to note that the inquiries section of your credit report distinguishes between hard and soft inquiries, providing clarity on the impact of each type of inquiry.

Additionally, if you’re a Capital One customer, you can often access information about credit inquiries by logging into your online account. Many financial institutions, including Capital One, offer detailed account management tools that allow customers to view recent account activities, including credit inquiries initiated by the institution.

Furthermore, if you have received correspondence from Capital One regarding a credit application or account review, it may explicitly state that a credit inquiry was conducted as part of the process. Reviewing any communication from Capital One, whether digital or physical, can provide insights into any credit inquiries associated with your account.

By leveraging these avenues, you can effectively track and monitor credit inquiries made by Capital One, enabling you to stay informed about the impact of these inquiries on your credit profile.

How to Minimize the Impact of Credit Inquiries

While credit inquiries can have a temporary impact on your credit score, there are several strategies you can employ to minimize their effects and maintain a healthy credit profile.

1. Rate Shopping Awareness: When shopping for a major loan, such as a mortgage or auto loan, aim to complete your loan applications within a condensed timeframe. Credit scoring models typically recognize this as rate shopping and treat multiple inquiries within a specific period as a single inquiry, reducing the impact on your credit score.

2. Apply Selectively: Be strategic about applying for credit. Avoid submitting numerous credit applications within a short timeframe, as this can signal financial distress to potential lenders. Instead, carefully consider when and where to apply for credit, focusing on opportunities that align with your financial goals.

3. Monitor Your Credit Report: Regularly reviewing your credit report allows you to stay informed about any inquiries made and detect any unauthorized or erroneous inquiries. By promptly addressing any inaccuracies, you can safeguard your credit score from unnecessary harm.

4. Consider the Long-Term Impact: While credit inquiries may cause a temporary dip in your credit score, their impact diminishes over time. By maintaining healthy credit habits and making timely payments, you can mitigate the effects of inquiries and bolster your creditworthiness in the long run.

5. Utilize Prequalification Tools: Many lenders, including Capital One, offer prequalification tools that allow you to gauge your likelihood of approval for credit products without triggering a hard inquiry. Leveraging these tools can help you assess your eligibility without impacting your credit score.

By implementing these proactive measures, you can navigate credit inquiries with confidence, minimize their impact on your credit score, and maintain a solid foundation for your financial future.

Conclusion

Understanding credit inquiries and their implications is a fundamental aspect of managing your financial well-being. Whether you’re navigating the world of credit for the first time or seeking to optimize your credit profile, being informed about credit inquiries empowers you to make sound decisions and protect your creditworthiness.

Throughout this exploration, we’ve delved into the nuances of credit inquiries, distinguishing between hard and soft inquiries and elucidating their impact on credit scores. We’ve also shed light on where to find information about Capital One credit inquiries, providing you with the tools to monitor and comprehend the credit-related activities associated with the company.

Moreover, we’ve discussed strategies for minimizing the impact of credit inquiries, emphasizing the importance of thoughtful credit application practices and proactive credit monitoring. By implementing these strategies, you can navigate credit inquiries with prudence and safeguard your credit score from unnecessary fluctuations.

As you continue your financial journey, remember that credit inquiries are a natural part of the credit application process, and their effects are manageable with informed decision-making and responsible credit management. By staying attuned to your credit activities, leveraging available resources, and making strategic credit decisions, you can cultivate a robust credit profile that serves as a foundation for your financial aspirations.

Armed with this knowledge, you’re well-equipped to approach credit inquiries, including those related to Capital One, with confidence and clarity. By integrating these insights into your financial practices, you can navigate the realm of credit inquiries with finesse, ensuring that your credit remains a valuable asset in your financial landscape.