Finance

How To Raise Your Capital One Credit Limit

Published: March 5, 2024

Learn how to increase your Capital One credit limit and manage your finances effectively. Discover tips and strategies to boost your credit line and improve your financial flexibility. Explore expert advice on managing your credit wisely.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Welcome to the world of credit limits and the potential to raise your Capital One credit limit! Understanding how credit limits work and the steps to increase them can significantly impact your financial flexibility and credit score. Whether you're aiming to boost your purchasing power, improve your credit utilization ratio, or enhance your overall financial standing, increasing your Capital One credit limit can be a valuable strategy.

In this comprehensive guide, we'll delve into the intricacies of credit limits, explore the factors that influence credit limit increases, and provide actionable steps to request a higher credit limit from Capital One. Additionally, we'll share essential tips to increase your chances of a successful credit limit raise. By the end of this article, you'll be equipped with the knowledge and confidence to navigate the process of elevating your Capital One credit limit.

So, whether you're eyeing a higher credit limit to accommodate larger purchases, strengthen your financial foundation, or simply take advantage of the benefits that come with a higher limit, this guide is tailored to help you achieve your goals. Let's embark on this insightful journey to unlock the potential of raising your Capital One credit limit and harness the benefits it can offer for your financial well-being.

Now, let's delve into the fundamental aspects of credit limits and the pivotal role they play in shaping your financial landscape. Understanding these dynamics will lay the groundwork for comprehending the strategies involved in increasing your Capital One credit limit.

**

Understanding Credit Limits

**

Before delving into the process of raising your Capital One credit limit, it’s crucial to grasp the fundamental concept of credit limits and their significance in your financial life. A credit limit represents the maximum amount of credit extended to you by a financial institution, delineating the cap on your borrowing capacity. In the context of a Capital One credit card, your credit limit dictates the highest balance you can carry on the card at any given time.

Understanding your credit limit is essential for managing your finances prudently and optimizing your credit utilization, a key factor in determining your credit score. Credit utilization is the ratio of your outstanding credit card balances to your credit limits, and it holds considerable weight in credit scoring models. Maintaining a low credit utilization ratio, ideally below 30%, demonstrates responsible credit usage and can positively impact your credit score.

Moreover, your credit limit influences your purchasing power and financial flexibility. A higher credit limit affords you the ability to make larger purchases and handle unexpected expenses with greater ease. It also provides a cushion against maxing out your credit card, which can have adverse effects on your credit score and financial stability.

It’s important to note that credit limits are not static and can be subject to change based on various factors, including your credit history, income, and the financial institution’s policies. By comprehending the dynamics of credit limits and their implications, you can make informed decisions regarding your credit utilization and leverage strategies to enhance your credit limit when needed.

Now that we’ve established a foundational understanding of credit limits, let’s explore the factors that come into play when seeking to increase your Capital One credit limit.

**

Factors Affecting Credit Limit Increases

**

When contemplating a credit limit increase on your Capital One card, it’s essential to consider the key factors that can influence the decision-making process of the credit card issuer. Understanding these factors empowers you to present a compelling case for a higher credit limit and enhances the likelihood of a successful outcome.

1. Credit History: Your credit history serves as a pivotal determinant in the evaluation of credit limit increase requests. A demonstrated track record of responsible credit management, including on-time payments, low credit utilization, and a history of managing credit accounts prudently, can bolster your case for a higher credit limit.

2. Income: The level of income you earn plays a significant role in assessing your ability to manage a higher credit limit. A steady and substantial income indicates financial stability and the capacity to support increased credit responsibilities, thereby strengthening your case for a credit limit raise.

3. Payment History: Your payment history, encompassing the consistency and timeliness of your credit card payments and overall debt obligations, is a critical factor in the credit limit increase evaluation. A history of prompt payments reflects positively on your creditworthiness and can contribute to a favorable decision.

4. Credit Score: While not the sole determining factor, your credit score provides a holistic view of your creditworthiness and financial behavior. A higher credit score, indicative of responsible credit management and low credit risk, can bolster your case for a credit limit increase.

5. Usage Patterns: The manner in which you utilize your existing credit limit, including your credit utilization ratio and spending patterns, is closely scrutinized. Responsible usage, demonstrated by maintaining a low credit utilization and managing credit balances prudently, can strengthen your case for a higher credit limit.

6. Account History: The duration and history of your account with Capital One, including your tenure as a cardholder and your track record of managing the card, are considered. A positive account history, characterized by longevity and responsible account management, can work in your favor when seeking a credit limit increase.

By comprehending these influential factors, you can strategically position yourself to present a compelling case for a credit limit increase. Armed with this knowledge, let’s proceed to explore the actionable steps involved in requesting a credit limit raise from Capital One.

**

Steps to Request a Credit Limit Increase

**

Initiating the process to request a credit limit increase from Capital One involves a systematic approach and thoughtful preparation. By following these steps, you can navigate the process with confidence and optimize your chances of a successful outcome.

1. Assess Your Eligibility: Before submitting a request for a credit limit increase, evaluate your eligibility based on the factors that influence credit limit decisions, such as your credit history, income, and payment behavior. Ensure that your financial standing aligns with the criteria typically considered for credit limit raises.

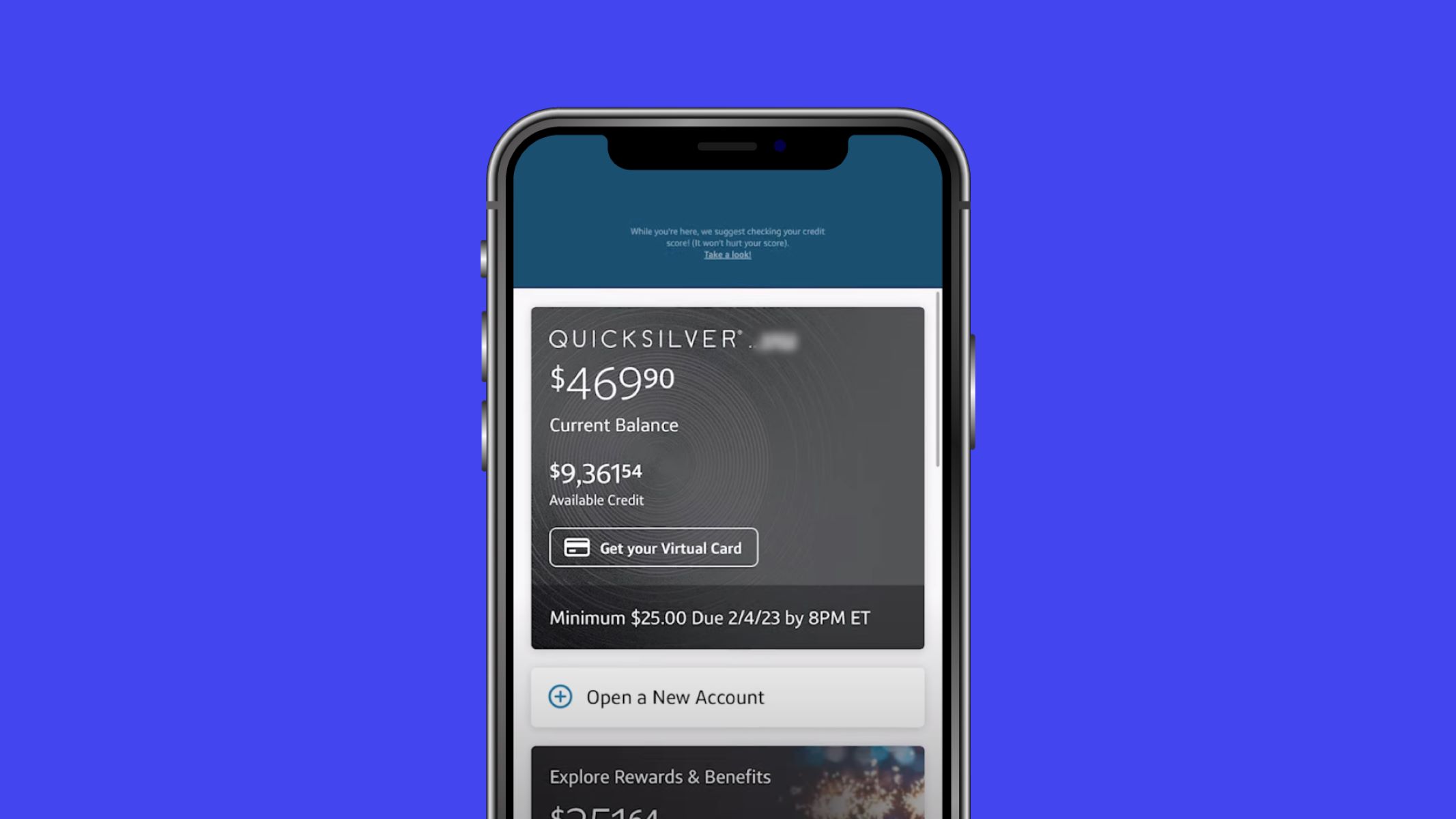

2. Log into Your Account: Access your Capital One online account or mobile app to initiate the credit limit increase request. Navigate to the credit limit increase option, which may be found in the account management or customer service section.

3. Provide Required Information: When prompted, furnish the necessary details, which may include your current income, employment information, and any additional sources of income. Capital One may also request permission to perform a credit inquiry to assess your eligibility for a credit limit increase.

4. Specify the Increase Amount: Indicate the desired amount by which you wish to raise your credit limit. It’s advisable to request a conservative increase aligned with your financial capacity and consistent with your spending needs.

5. Submit the Request: Once you have completed the required fields and reviewed the information provided, submit your credit limit increase request through the designated channel. Ensure that all details are accurate and up to date to facilitate the processing of your request.

6. Await the Decision: After submitting your request, await the decision from Capital One. The processing time for credit limit increase requests may vary, and you may receive an immediate decision or a follow-up communication outlining the outcome of your request.

7. Follow Up if Necessary: In the event that your request is not approved or you receive a partial increase, consider reaching out to Capital One’s customer service to understand the rationale behind the decision and explore potential avenues for reconsideration.

By adhering to these steps, you can navigate the process of requesting a credit limit increase from Capital One in a strategic and informed manner. Now, let’s delve into essential tips to enhance the prospects of a successful credit limit raise.

**

Tips for Success

**

When endeavoring to secure a credit limit increase from Capital One, incorporating these strategic tips into your approach can amplify the likelihood of a favorable outcome and optimize the effectiveness of your request.

1. Maintain a Strong Payment History: Consistently making on-time payments on your Capital One credit card demonstrates responsible credit management and enhances your creditworthiness. Prioritize timely payments to fortify your case for a credit limit increase.

2. Manage Your Credit Utilization: Keeping your credit utilization ratio low, ideally below 30%, showcases prudent credit usage and can bolster your request for a higher credit limit. Aim to manage your balances judiciously to reflect responsible credit behavior.

3. Update Your Income Information: Ensure that your current income details are accurately reflected in your Capital One account. An updated income profile provides a clear picture of your financial capacity and can support your case for a credit limit raise.

4. Demonstrate Financial Stability: Highlighting your overall financial stability, including steady employment and a healthy income, can strengthen your position when seeking a credit limit increase. Presenting a robust financial profile enhances the confidence of the credit card issuer in extending a higher credit limit.

5. Request a Modest Increase: When specifying the desired credit limit increase, consider requesting a conservative amount aligned with your needs and financial capability. A modest request increases the likelihood of approval and demonstrates responsible credit management.

6. Engage in Regular Card Usage: Actively using your Capital One credit card for transactions and payments showcases ongoing engagement and responsible utilization of your credit limit. Regular usage, coupled with prudent financial management, can bolster your case for a credit limit increase.

7. Monitor Your Credit Score: Stay attuned to changes in your credit score and overall credit profile. A positive trajectory in your credit score can serve as a compelling indicator of your creditworthiness and enhance the prospects of a credit limit increase.

By integrating these tips into your credit limit increase strategy, you can position yourself for a successful outcome and optimize the potential of securing a higher credit limit from Capital One. With these insights in mind, you are well-equipped to navigate the process of raising your Capital One credit limit with confidence and strategic acumen.

**

Conclusion

**

Congratulations on embarking on the journey to elevate your financial flexibility and credit standing by exploring the nuances of raising your Capital One credit limit. As you conclude this insightful guide, it’s imperative to underscore the transformative impact that a higher credit limit can have on your financial landscape.

By comprehending the pivotal role of credit limits, understanding the influential factors that shape credit limit increases, and assimilating the actionable steps and strategic tips delineated in this guide, you are empowered to navigate the process of requesting a credit limit increase from Capital One with confidence and acumen. Armed with this knowledge, you possess the tools to optimize your credit utilization, bolster your creditworthiness, and strategically position yourself for a higher credit limit.

It’s important to approach the endeavor of raising your credit limit with a proactive and informed mindset, leveraging prudent financial management and a strategic approach to maximize your chances of success. Whether your goal is to accommodate larger purchases, enhance your financial flexibility, or fortify your credit score, the pursuit of a higher credit limit reflects a deliberate and astute approach to managing your financial resources.

As you navigate the process of requesting a credit limit increase from Capital One, remember to align your request with your financial capacity, demonstrate responsible credit behavior, and leverage the insights and strategies outlined in this guide to optimize your prospects for a favorable outcome.

Ultimately, the journey to raise your Capital One credit limit embodies a proactive step towards enhancing your financial well-being and leveraging the benefits of a higher credit limit to support your financial goals. By integrating the knowledge and strategies presented in this guide, you are poised to harness the potential of an increased credit limit and propel your financial journey towards greater empowerment and stability.

With these insights at your disposal, you are well-prepared to embark on the process of raising your Capital One credit limit with confidence, strategic foresight, and a clear understanding of the transformative impact it can yield for your financial future.