Home>Finance>Which Budgeting Approach Requires Justification For All Expenditures

Finance

Which Budgeting Approach Requires Justification For All Expenditures

Published: November 2, 2023

Discover the budgeting approach in finance that requires justification for all expenditures. Stay on top of your finances and make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of personal finance, budgeting is a crucial tool for managing expenses, tracking income, and attaining financial goals. However, there isn’t a one-size-fits-all approach to budgeting. Different individuals and organizations adopt various methods to suit their unique financial situations and objectives. In this article, we will explore different budgeting approaches and focus on one particular approach that requires justification for all expenditures.

Budgeting is essentially the process of allocating funds for different expenses and ensuring that the overall income is sufficient to cover these expenses. It helps individuals and organizations prioritize their spending and make informed financial decisions.

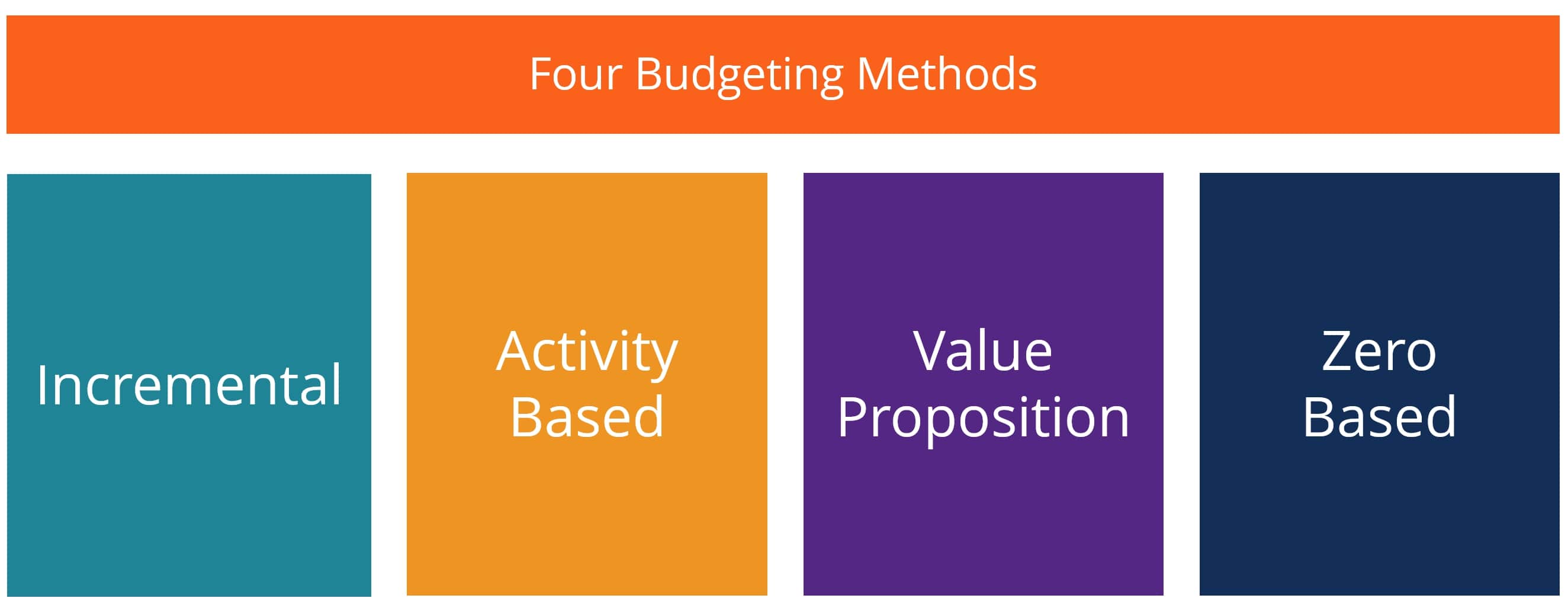

The traditional budgeting approach is perhaps the most common method used by many. It involves creating a budget based on historical data, past spending patterns, and estimated income. This method is relatively simple and allows for some flexibility, but it may not be the most effective when it comes to accountability and justifying expenditures.

A more rigorous approach to budgeting is zero-based budgeting. In this method, every expense must be justified from scratch, regardless of whether it has been included in previous budgets. This means that each expenditure is evaluated and must have a clear purpose and value. Zero-based budgeting can help identify unnecessary expenses and redirect funds to more critical areas.

Another approach worth mentioning is activity-based budgeting. This method focuses on identifying and allocating funds based on specific activities or projects. It provides a more detailed overview of how money is being spent and helps determine the financial implications of each activity. Activity-based budgeting allows for better decision-making and resource allocation.

Lastly, there is the performance-based budgeting approach. This method aligns budgeting with performance goals and objectives. It requires clear targets to be set and measures performance against these targets. By linking budgeting to performance, organizations can ensure that resources are allocated effectively and efficiently.

Now, let’s delve into the budgeting approach that requires justification for all expenditures. This approach takes budgeting to the next level by demanding accountability and scrutiny for every expense. It goes beyond justifying new expenses in zero-based budgeting and extends to every transaction, regardless of its nature. This level of scrutiny ensures that expenditures are truly necessary and in line with the financial goals and values of the individual or organization.

Throughout this article, we will examine the benefits and challenges of this approach, as well as provide practical tips for implementing it effectively in your personal or professional life. So, let’s dive in and explore this budgeting approach that demands justification for all expenditures.

Traditional Budgeting Approach

The traditional budgeting approach is a widely adopted method used by individuals and organizations to manage their finances. It involves creating a budget based on historical data, past spending patterns, and estimated income. This method provides a baseline for allocating funds to various categories and allows for some flexibility in adjusting spending throughout the budget cycle.

One of the key features of the traditional budgeting approach is that it generally assumes that the previous year’s budget is a good starting point for the current year. Expenses are often adjusted by a certain percentage to account for inflation or changes in income. This approach is relatively straightforward and familiar to many, making it easy to implement.

However, the traditional budgeting approach does have its limitations. Firstly, it relies heavily on historical data, which may not accurately reflect future needs or changing circumstances. This can lead to potential discrepancies and oversights in budgeting. Additionally, this method may not encourage accountability and justification for expenditures, as it primarily focuses on rolling over previous budget allocations.

Another drawback of the traditional budgeting approach is that it may not effectively prioritize spending or identify unnecessary expenses. It can perpetuate the inclusion of expenses that are no longer essential or fail to allocate adequate resources to critical areas. As a result, there might be a missed opportunity to optimize financial resources and achieve financial goals more efficiently.

Despite its limitations, the traditional budgeting approach is still widely used because of its simplicity and familiarity. It provides a starting point for budgeting and allows for adjustments based on changing circumstances. Organizations that have well-established systems and historical data may find this approach sufficient for their needs.

However, for those seeking a more rigorous and accountable budgeting approach, it may be worth exploring alternative methods such as zero-based budgeting, activity-based budgeting, or performance-based budgeting. These approaches offer a more detailed evaluation of expenses and require a justification process that ensures every expenditure adds value and aligns with financial goals.

In the next sections, we will delve into these alternative budgeting approaches and discuss their benefits and challenges. We will explore how they provide more substantial accountability and help individuals and organizations make well-informed financial decisions. So, let’s get ready to explore the world of modern budgeting approaches.

Zero-based Budgeting Approach

Zero-based budgeting (ZBB) is a budgeting approach that requires every expense to be justified from scratch, regardless of whether it has been included in previous budgets. In other words, the budget starts at zero, and each expenditure is evaluated and must have a clear purpose and value.

Unlike the traditional budgeting approach, which often carries forward previous budget allocations, zero-based budgeting challenges individuals and organizations to re-examine and justify every expense. This method helps identify unnecessary or redundant expenses that may have been overlooked in the past. It promotes a more detailed and critical assessment of financial resources.

Implementing zero-based budgeting involves breaking down the budget into various cost centers or activities. Each cost center or activity is then evaluated and analyzed to determine its necessity and potential impact. This thorough evaluation ensures that resources are allocated efficiently and only to areas that provide the most value.

One of the significant benefits of zero-based budgeting is the ability to align financial resources with changing priorities and goals. As circumstances change, priorities may shift, and certain expenses may become more or less crucial. With zero-based budgeting, individuals and organizations can reallocate funds based on current needs, ensuring that resources are utilized effectively.

However, it’s important to note that zero-based budgeting can be a time-consuming process, especially when implemented on a large scale. It requires careful analysis of each expenditure, including gathering relevant data and justifying the value it brings. This level of scrutiny can be challenging, but it also ensures a higher level of accountability and transparency in budgeting decisions.

Adopting zero-based budgeting also requires a shift in mindset and organizational culture. It requires individuals and teams to think critically about each expense and consider its alignment with strategic objectives. This method promotes a more proactive and responsible approach to budgeting.

Overall, zero-based budgeting offers several benefits, including the ability to identify unnecessary costs, optimize resource allocation, and align financial resources with changing priorities. However, implementing this approach requires a careful balance between detailed analysis and practicality. It may be more suitable for organizations or individuals who are committed to a thorough evaluation of their financial resources.

In the next section, we will explore another budgeting approach known as activity-based budgeting, which focuses on allocating funds based on specific activities or projects. Stay tuned to learn more about this method!

Activity-based Budgeting Approach

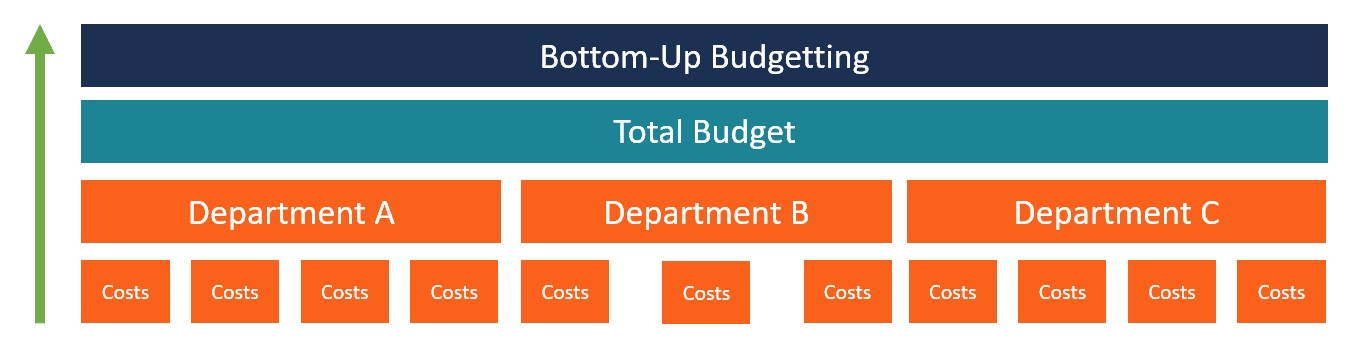

Activity-based budgeting (ABB) is a budgeting approach that aims to allocate funds based on specific activities or projects within an organization. Instead of assigning funds to broad categories, ABB breaks down the budget into individual activities and allocates resources accordingly.

The key principle behind activity-based budgeting is to align financial resources with the activities that drive the most value and contribute to the organization’s goals. By focusing on specific activities, ABB provides a more detailed overview of how money is being spent and allows for better decision-making and resource allocation.

To implement activity-based budgeting, organizations first identify and define their various activities or projects. These activities may include departments, projects, or specific tasks. Each activity is then assigned a budget based on its estimated costs and expected outcomes.

This approach enables organizations to prioritize investment in high-value activities and reallocate funds from low-value or non-essential activities. By assessing the financial implications of each activity, ABB promotes effective resource management and optimizes the allocation of financial resources.

Activity-based budgeting also encourages a more accountable and transparent budgeting process. It requires individuals and teams responsible for each activity to provide detailed justifications for their budget requests. This level of transparency ensures that all expenses are aligned with the objectives of the organization and that funds are utilized efficiently.

One of the key advantages of activity-based budgeting is that it provides a clearer understanding of the relationship between resources and outcomes. Organizations can evaluate the return on investment for each activity and make informed decisions about resource allocation and prioritization.

However, implementing activity-based budgeting can be challenging, especially for larger organizations or those with complex structures. It requires careful analysis and categorization of activities, as well as ongoing monitoring and evaluation of financial performance.

Despite these challenges, activity-based budgeting offers significant benefits, such as improved decision-making, resource optimization, and increased accountability. By aligning financial resources with specific activities, organizations can ensure that their budgets are more closely aligned with their strategic objectives.

Now that we have explored activity-based budgeting, let’s move on to the next section where we will discuss the performance-based budgeting approach. Stay tuned!

Performance-based Budgeting Approach

Performance-based budgeting (PBB) is a budgeting approach that links the allocation of financial resources to performance goals and objectives. It focuses on measuring and evaluating performance outcomes to determine resource allocation, rather than relying solely on historical data.

In a performance-based budgeting system, organizations set clear targets and indicators of success. These targets can be quantitative, such as revenue growth or cost reduction, or qualitative, such as customer satisfaction or employee engagement. The budget is then allocated based on the achievement of these targets.

Performance-based budgeting provides several advantages. Firstly, it encourages a results-oriented mindset, as it requires individuals and departments to align their activities and resource needs with performance outcomes. It promotes a culture of accountability and supports continuous improvement efforts.

Another benefit of performance-based budgeting is the ability to prioritize resources towards areas that contribute the most to success. By evaluating performance indicators, organizations can identify which activities or projects are delivering the best results and allocate resources accordingly. This ensures that limited resources are focused on the most valuable initiatives.

Performance-based budgeting also facilitates better decision-making by providing real-time feedback on the effectiveness of resource allocation. By tracking performance metrics throughout the budget cycle, organizations can make timely adjustments and optimize resource allocation to achieve desired outcomes.

However, implementing performance-based budgeting can be a complex process. It requires a thorough understanding of performance metrics, clear communication of targets and expectations, and effective measurement and evaluation systems. Organizations need to have robust data collection and analysis processes in place to accurately assess performance and make informed decisions.

Additionally, performance-based budgeting requires ongoing monitoring and reporting to track progress towards targets. Regular evaluations are necessary to ensure that resources are allocated effectively and that adjustments are made as needed.

Despite these challenges, performance-based budgeting offers significant benefits for organizations that prioritize transparency, accountability, and outcomes. It enables better resource management, supports strategic decision-making, and fosters a results-driven culture.

Now that we have explored the performance-based budgeting approach, let’s conclude our discussion in the next section.

Conclusion

In conclusion, budgeting is a fundamental tool for managing finances and achieving financial goals. While the traditional budgeting approach provides a starting point based on historical data, there are alternative methods that offer greater accountability and value. Zero-based budgeting requires justification for all expenditures, ensuring that resources are allocated efficiently and unnecessary expenses are eliminated. Activity-based budgeting focuses on allocating funds to specific activities or projects, promoting resource optimization and transparency. Performance-based budgeting links resource allocation to performance goals, driving a results-oriented culture and facilitating better decision-making.

Each budgeting approach has its own benefits and challenges. Traditional budgeting is simple and familiar but may lack accountability and prioritization. Zero-based budgeting demands scrutiny for every expense but can be time-consuming. Activity-based budgeting provides a detailed overview of spending but requires careful analysis and categorization. Performance-based budgeting aligns resources with performance objectives but necessitates a robust measurement and evaluation system.

Ultimately, the choice of budgeting approach depends on the goals, values, and complexity of the individual or organization. It may be beneficial to combine elements from different approaches or tailor the approach to suit specific needs. The goal is to cultivate a budgeting process that is effective, transparent, and aligned with strategic objectives.

Regardless of the budgeting approach chosen, it is important to regularly review and adjust the budget based on changing circumstances, priorities, and performance. Budgeting is not a static process but a dynamic one that requires ongoing monitoring, evaluation, and adaptation.

By adopting a comprehensive and thoughtful budgeting approach, individuals and organizations can make informed financial decisions, allocate resources efficiently, and work towards achieving their financial objectives. Whether it is through justifying all expenditures, allocating resources based on activities, or linking budgeting to performance, a well-executed budgeting approach is essential for financial success.

Now, armed with knowledge about different budgeting approaches, take the time to evaluate your own financial goals and needs. Choose the approach that suits you best and embark on a journey towards a more effective and purposeful budgeting process. Remember, a well-planned budget can pave the way for financial stability, growth, and peace of mind.