Home>Finance>Which Budgeting Approach Is Most Favorable To Obtain Employee Support

Finance

Which Budgeting Approach Is Most Favorable To Obtain Employee Support

Published: October 11, 2023

Discover the most favorable budgeting approach to obtain employee support in Finance. Find out how financial strategies can drive employee engagement and productivity.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to budgeting, organizations have various approaches to determine their financial plans. These approaches differ in their methodologies, level of employee involvement, and impact on employee support. Budgeting is not just a financial exercise; it is also a management tool that affects employee morale, engagement, and motivation. Therefore, selecting the most favorable budgeting approach is crucial to obtain employee support.

In this article, we will explore different budgeting approaches and analyze their impact on employee support. The four main budgeting approaches we will discuss are traditional budgeting, zero-based budgeting, activity-based budgeting, and beyond budgeting. Each approach has its pros and cons, and understanding them will help organizations make informed decisions.

Traditional budgeting is the most widely used approach, based on historical data and incremental adjustments. It focuses on year-over-year comparisons and generally doesn’t involve a high level of employee input. Zero-based budgeting, on the other hand, starts from scratch each year, requiring departments to justify all expenses regardless of past budgets. This approach promotes cost-consciousness and encourages employee involvement in the budgeting process.

Activity-based budgeting takes a more detailed approach by allocating resources based on specific activities and their associated costs. It provides a clearer picture of spending patterns and facilitates resource optimization. Finally, beyond budgeting challenges the traditional budgeting mindset by advocating for more flexible, decentralized decision-making. It focuses on setting goals and providing autonomy, requiring a high level of employee engagement and accountability.

As we delve into each approach, we will analyze their strengths and weaknesses and consider the factors influencing employee support. Factors such as transparency, communication, employee involvement, and alignment with organizational goals play a significant role in determining the level of support from employees. By understanding these factors, organizations can select the most favorable budgeting approach that promotes employee engagement and buy-in.

Continue reading to learn more about the different budgeting approaches and how they impact employee support.

Traditional Budgeting Approach

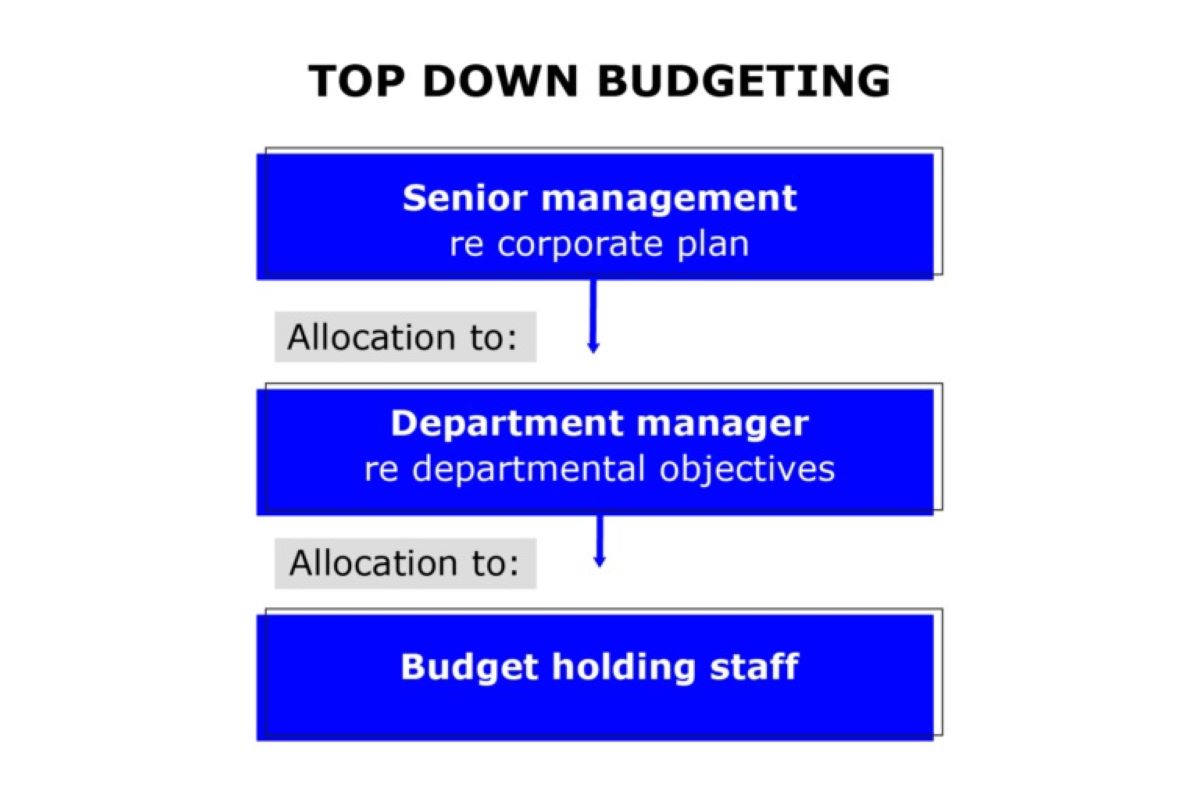

The traditional budgeting approach is the most commonly used method for financial planning in organizations. It relies on historical data and incremental adjustments to determine the budget for the upcoming year. The primary goal of traditional budgeting is to maintain stability and ensure the smooth continuation of operations based on previous spending patterns.

Under the traditional budgeting approach, each department receives a budget allocation based on historical spending and anticipated changes. The budget is typically adjusted by a certain percentage, allowing for inflation and company growth. However, this approach often lacks flexibility and may result in a rigid budget that doesn’t align with changing business needs.

Employee involvement in the traditional budgeting approach is usually limited. Budget decisions are made by top-level management, with little input from lower-level employees. This lack of involvement can lead to a sense of disconnect and reduced employee support for the budgeting process. Employees may feel that their suggestions and insights are not valued, which can impact their motivation and engagement.

One of the advantages of traditional budgeting is its simplicity and familiarity. Many organizations are comfortable with this approach as it provides a clear guideline for financial planning. However, there are also several drawbacks to consider. The reliance on historical data may not accurately reflect future needs or changes in the business environment. Additionally, the static nature of traditional budgeting may hinder innovation and adaptive decision-making.

To obtain employee support within the traditional budgeting approach, organizations can take certain steps. First, it is important to improve transparency and communication about the budgeting process. Employees should understand how budget decisions are made and have access to relevant information. Regular updates and feedback sessions can help bridge the gap between management and employees.

Furthermore, involving employees in the budgeting process to some extent can enhance their sense of ownership and engagement. Their input can provide valuable insights and lead to more realistic and effective budget plans. Creating opportunities for collaboration and brainstorming can foster a sense of teamwork and shared responsibility.

Overall, the traditional budgeting approach provides a baseline for financial planning, but it may not be the most favorable method for obtaining employee support. The lack of employee involvement and flexibility can hinder motivation and innovation. To counter these challenges, organizations should focus on improving transparency, communication, and employee engagement within the traditional budgeting framework.

Zero-based Budgeting Approach

The zero-based budgeting approach takes a different approach than traditional budgeting. Rather than basing the budget on previous spending patterns, zero-based budgeting requires departments to justify all expenses from scratch, regardless of historical budgets. This method aims to promote cost-consciousness, eliminate unnecessary expenses, and encourage careful evaluation of every budget item.

With zero-based budgeting, each department starts the budgeting process with a budget of zero and must build their case for each expense. This approach forces departments to critically evaluate their needs and prioritize spending based on organizational goals. Consequently, zero-based budgeting fosters a greater level of employee involvement and accountability throughout the budgeting process.

One of the benefits of zero-based budgeting is that it encourages a more thorough review of expenses. It prompts departments to analyze the necessity and effectiveness of each expenditure, leading to potential cost savings. This approach also promotes cross-departmental collaboration as employees work together to justify expenses and ensure alignment with organizational objectives.

However, zero-based budgeting is not without its challenges. It can be time-consuming and resource-intensive, requiring extensive documentation and analysis for each budget item. Some departments may find it overwhelming to justify every expense, especially when it comes to routine or necessary expenses that may not have a direct revenue impact. The level of detail required in zero-based budgeting can also lead to a delay in the budgeting process.

To obtain employee support within the zero-based budgeting approach, organizations should provide clear guidelines and training to employees involved in the process. Employees need to understand the purpose and methodology behind zero-based budgeting to effectively justify their expenses. Additionally, organizations should create a supportive environment where employees feel comfortable asking questions, seeking guidance, and sharing their insights.

Regular communication and feedback sessions are essential in the zero-based budgeting approach. These sessions allow for open dialogue, ensuring that employee concerns and suggestions are heard and considered. By involving employees in the budgeting process and valuing their input, organizations can foster a sense of ownership and engagement, leading to higher levels of employee support.

Overall, zero-based budgeting provides organizations with an opportunity to thoroughly evaluate expenses and promote employee involvement. While it has its challenges, such as increased complexity and time requirements, the benefits of cost-consciousness and accountability make it an appealing option for organizations looking to obtain employee support in the budgeting process.

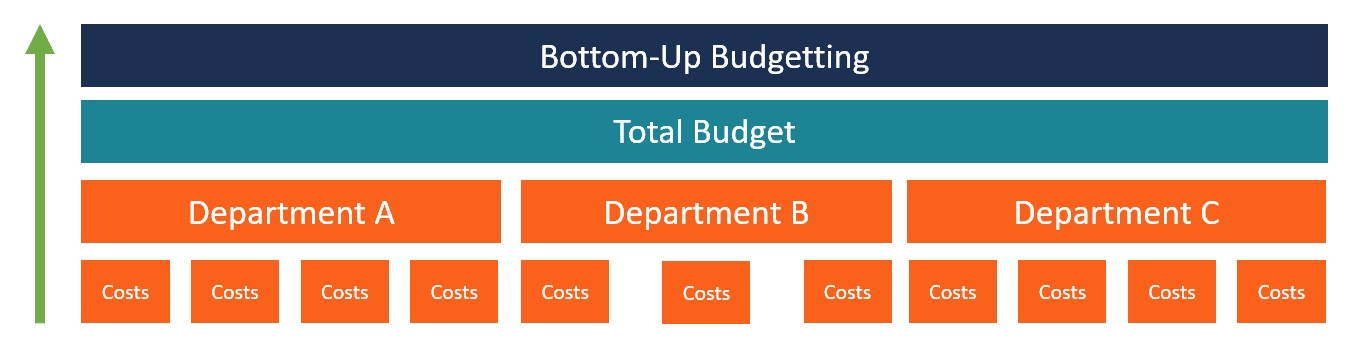

Activity-based Budgeting Approach

The activity-based budgeting approach takes a more detailed and granular approach to budgeting by allocating resources based on specific activities and their associated costs. This method aims to provide a clearer picture of spending patterns, resource utilization, and cost drivers. Activity-based budgeting focuses on understanding the “why” behind expenses and aims to optimize resource allocation based on the activities that drive value within the organization.

Under the activity-based budgeting approach, departments identify and analyze various activities that contribute to their overall goals. These activities are then assigned a budget based on the resources required to carry them out effectively. This method allows for more accurate budget estimates and helps identify areas where resources can be reallocated or optimized to enhance efficiency.

One of the advantages of activity-based budgeting is its ability to identify non-value-added activities that can be eliminated or streamlined. By analyzing activities and their associated costs, organizations can identify areas of waste and inefficiency. This approach also encourages cross-functional collaboration, as teams must work together to understand and allocate resources based on shared activities and goals.

However, activity-based budgeting can be complex and time-consuming, as it requires a thorough understanding of each activity and its cost drivers. It also relies on accurate data collection and analysis to ensure the budgets align with the underlying activities. Without proper data and analysis, the effectiveness of activity-based budgeting may be compromised.

To obtain employee support within the activity-based budgeting approach, organizations should involve employees in the identification and analysis of activities. By engaging employees in the process, they gain a deeper understanding of how their work contributes to the overall goals of the organization. This involvement promotes a sense of ownership and accountability, leading to higher levels of employee support for the budgeting process.

Additionally, organizations should provide training and resources to employees involved in activity-based budgeting. It is important for employees to understand the methodology and significance of this approach to effectively allocate resources. Organizations should also create a culture that encourages continuous improvement, allowing employees to propose ideas for enhancing activities and reducing costs.

Communication and transparency are crucial in the activity-based budgeting approach. Employees need to understand how activities are evaluated and how the budget is determined. Regular updates and feedback sessions can help employees understand the rationale behind budget decisions and provide an opportunity for them to voice their opinions and concerns.

Overall, activity-based budgeting provides organizations with a more detailed and accurate way of allocating resources. By involving employees in the process and promoting a culture of continuous improvement, organizations can obtain higher levels of employee support and engagement within the activity-based budgeting approach.

Beyond Budgeting Approach

The beyond budgeting approach challenges the traditional budgeting mindset by advocating for a more flexible and adaptive approach to financial planning. This method recognizes the limitations of traditional budgeting and aims to foster a culture of decentralized decision-making and autonomy within organizations.

Under the beyond budgeting approach, organizations shift their focus from fixed budgets to setting goals and providing guidelines for decision-making. Rather than relying on detailed budgets, departments are empowered to make resource allocation decisions based on changing business needs and opportunities. This approach promotes agility, responsiveness, and innovation within the organization.

One of the key principles of the beyond budgeting approach is the elimination of annual budget cycles. Instead, organizations adopt rolling forecasts and continuous planning, allowing for real-time adjustments based on market conditions and internal dynamics. This flexibility enables organizations to respond swiftly to changes and make informed, timely decisions.

Employee involvement is a critical aspect of the beyond budgeting approach. By decentralizing decision-making and empowering employees, organizations tap into the creativity and expertise of their workforce. Employees are encouraged to take ownership of their responsibilities, set goals, and make decisions that support the overall strategic direction of the organization.

While the beyond budgeting approach offers numerous benefits, it also comes with its challenges. Shifting from a budget-driven culture to a more decentralized and empowered model requires changes in mindset, processes, and systems. Organizations need to establish clear communication channels, provide training on decision-making frameworks, and create a supportive environment that encourages risk-taking and learning.

To obtain employee support within the beyond budgeting approach, organizations should prioritize open and transparent communication. Employees need to understand the strategic goals of the organization and how their individual roles contribute to those goals. Regular feedback sessions and performance conversations can help align employee efforts with organizational priorities and foster a sense of purpose.

Organizations should also provide continuous learning and development opportunities for employees to enhance their decision-making skills and business acumen. This empowers employees to make informed decisions and promotes a sense of competence and ownership in their role.

Finally, organizations should celebrate successes and learn from failures. Acknowledging and rewarding employees for their achievements encourages a culture of innovation and learning. By embracing a growth mindset and recognizing that failures are opportunities for learning and improvement, organizations can foster a supportive environment that encourages employee engagement.

Overall, the beyond budgeting approach offers organizations the opportunity to break free from traditional budget constraints and embrace a more agile, decentralized, and employee-centric approach to financial planning. By promoting autonomy, emphasizing continuous learning, and fostering a culture of transparency, organizations can obtain high levels of employee support and drive innovation and success.

Comparison of Approaches

Now that we have explored the traditional budgeting, zero-based budgeting, activity-based budgeting, and beyond budgeting approaches, let’s compare them to understand their strengths and weaknesses.

The traditional budgeting approach is straightforward and familiar to most organizations. It provides a baseline for financial planning and stability. However, it may lack flexibility and employee involvement, leading to decreased employee support and limited adaptability to changing business conditions.

Zero-based budgeting promotes cost-consciousness and employee involvement. It encourages departments to justify every expense and prioritize spending based on organizational goals. However, it can be time-consuming and overwhelming, and routine expenses may require extensive justification.

Activity-based budgeting provides a detailed and granular view of spending patterns and resource utilization. It helps identify non-value-added activities and fosters cross-functional collaboration. However, it requires accurate data collection and analysis, and the complexity can be a challenge for some organizations.

On the other hand, beyond budgeting emphasizes flexibility, agility, and decentralized decision-making. It allows organizations to respond quickly to changes and empowers employees. However, it requires a shift in mindset and culture, and the absence of fixed budgets may create challenges in financial planning and control.

When comparing these approaches, several factors come into play. The size and nature of the organization, industry dynamics, and the level of employee involvement and accountability all influence the choice of approach. Additionally, the organization’s goals, risk appetite, and culture play a significant role in determining which approach is most suitable.

It is important to note that there is no one-size-fits-all approach to budgeting. Each organization must carefully consider its unique needs and circumstances to select the most favorable approach. Some organizations may opt for a hybrid approach, combining elements from different methodologies to create a customized budgeting framework that aligns with their goals and promotes employee support.

Ultimately, the key is to find a balance between stability and flexibility, employee involvement and accountability, and adaptability to changing business conditions. By considering the advantages and challenges of each approach and evaluating them within the context of the organization, leaders can make informed decisions that promote employee support and drive organizational success.

Factors Influencing Employee Support

Obtaining employee support is crucial for the success of any budgeting approach within an organization. Several factors influence the level of employee support and engagement in the budgeting process:

- Transparency: Open and transparent communication about the budgeting process, goals, and financial results helps build trust and understanding among employees. When employees have a clear view of how their efforts contribute to the organization’s financial health, they are more likely to support the budgeting decisions.

- Employee Involvement: Involving employees in the budgeting process, whether through feedback sessions, brainstorming sessions, or collaborative decision-making, increases their sense of ownership and commitment. When employees feel their opinions are valued and their input is considered, they are more likely to support and actively participate in the budgeting process.

- Alignment with Organizational Goals: When budgeting decisions align with the larger strategic goals of the organization, employees can see the direct link between their work and the overall success of the organization. This alignment increases motivation and support for the budgeting process as employees understand the importance of their contributions.

- Communication of Impact: Clearly communicating how budgeting decisions impact various departments, teams, and individuals within the organization is key to gaining employee support. Employees want to understand how budget allocations affect their resources, workload, and ability to achieve their goals. Clear communication helps mitigate potential concerns and increases employee buy-in.

- Training and Development: Providing training and development opportunities related to budgeting and financial literacy can improve employee understanding and confidence in the budgeting process. When employees have a clear understanding of budgeting concepts and how their roles are connected to financial outcomes, they can provide valuable insights and contribute to better budgeting decisions.

- Recognition and Reward: Recognizing and rewarding employees for their contributions to cost-saving initiatives or achieving budget targets can foster a positive and supportive environment. Appreciation for their efforts motivates employees to actively support and engage in the budgeting process, potentially leading to more innovative ideas and cost-saving strategies.

- Leadership Support: Strong leadership support and endorsement of the budgeting process are essential to gain employee buy-in. When leaders actively participate and demonstrate their commitment to the budgeting process, employees are more likely to follow suit and support the decisions that have been made.

- Continuous Improvement: Embracing a culture of continuous improvement and learning reinforces employee support for the budgeting process. Encouraging employees to provide feedback, suggesting improvements, and learning from past budgeting experiences helps create an environment where employees feel empowered to contribute and make a difference.

These factors intertwine and build upon one another. The more organizations focus on factors such as transparency, employee involvement, goal alignment, communication of impact, training and development, recognition and reward, leadership support, and continuous improvement, the more likely they are to obtain high levels of support and engagement from their employees.

Most Favorable Budgeting Approach for Employee Support

When considering employee support in the budgeting process, the most favorable approach is one that incorporates elements of transparency, employee involvement, and alignment with organizational goals. Based on these criteria, the beyond budgeting approach emerges as the most favorable for obtaining employee support.

The beyond budgeting approach challenges the traditional budgeting mindset by replacing fixed budgets with goal-setting and decentralized decision-making. This approach promotes transparency by providing employees with a clear understanding of the organization’s strategic goals and how their individual roles contribute to those goals. When employees have a profound sense of purpose and can connect their work to the big picture, their support for the budgeting process significantly increases.

Employee involvement is also a key component of the beyond budgeting approach. By empowering employees to make decisions and allocate resources based on the organization’s goals, organizations tap into their expertise and creativity. When employees are given autonomy and the opportunity to contribute their insights, they feel a sense of ownership and responsibility, leading to higher levels of support for the budgeting process.

Furthermore, aligning budgeting decisions with organizational goals is crucial for gaining employee support. The beyond budgeting approach focuses on setting goals and providing guidelines, allowing flexibility while keeping the strategic direction intact. When employees can see how their budgeting decisions contribute to the attainment of these goals, they become more invested in the process and are more likely to support budgeting decisions.

However, it is important to acknowledge that each organization is unique, and there is no one-size-fits-all approach to budgeting. What works well for one organization may not necessarily work for another. It is important to consider the specific needs, culture, and context of the organization when determining the most favorable approach for obtaining employee support.

Hybrid approaches that combine elements of different budgeting methodologies can also be beneficial. By leveraging the strengths of different approaches, organizations can create a customized budgeting framework that aligns with their goals and promotes employee support. For example, combining elements of beyond budgeting, such as transparency and employee involvement, with elements of activity-based budgeting, such as detailed analysis of resource utilization, can provide a well-rounded approach that balances employee engagement and financial discipline.

In summary, the most favorable budgeting approach for obtaining employee support is one that emphasizes transparency, employee involvement, and alignment with organizational goals. While the beyond budgeting approach excels in these areas, organizations should carefully evaluate their unique needs and consider incorporating elements from different budgeting approaches to create a customized framework that best suits their requirements and cultivates strong employee support in the budgeting process.

Conclusion

The budgeting approach organizations choose significantly impacts their ability to obtain employee support. Traditional budgeting, zero-based budgeting, activity-based budgeting, and beyond budgeting each have their strengths and weaknesses. However, considering the factors influencing employee support, the most favorable budgeting approach emerges as the beyond budgeting approach.

The beyond budgeting approach challenges the traditional budgeting mindset by emphasizing flexibility, employee involvement, and goal alignment. It promotes transparency by connecting employees to the organization’s strategic goals, empowering them to make decisions and allocate resources accordingly. This involvement fosters a sense of ownership and brings higher levels of support to the budgeting process.

While the beyond budgeting approach is favored for employee support, it is important to customize the budgeting framework to the organization’s specific needs. A hybrid approach that combines elements from different budgeting methodologies may be beneficial. By leveraging the strengths of different approaches, organizations can create a balanced budgeting framework that aligns with their goals while cultivating strong employee support.

In conclusion, organizations should prioritize elements such as transparency, employee involvement, and alignment with organizational goals to cultivate employee support in the budgeting process. By selecting the most favorable approach and considering the unique needs of the organization, organizations can optimize employee engagement, enhance decision-making, and drive overall success in their financial planning endeavors.