Finance

Who Does Land Equity Loans?

Published: February 17, 2024

Looking for land equity loans? Finance experts can help you secure the financing you need to purchase land or improve your property. Contact us today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of land equity loans, where the value of your land can be leveraged to secure a loan for various financial needs. Whether you’re considering building your dream home, making property improvements, or investing in a new venture, land equity loans can provide a valuable financing option. Understanding the intricacies of these loans and the lenders who offer them is crucial for making informed financial decisions.

Land equity loans are a unique financial tool that allows individuals to borrow against the equity in their land. This type of loan can be particularly advantageous for landowners who have substantial equity but may not qualify for traditional mortgage loans. By tapping into the equity of their land, borrowers can access funds for a wide range of purposes, from consolidating debt to funding major projects.

In this comprehensive guide, we will delve into the world of land equity loans, exploring the types of lenders who offer these loans, the qualifications and requirements for obtaining them, and the benefits and risks associated with this financial product. By the end of this journey, you will have a deeper understanding of land equity loans and be well-equipped to navigate the landscape of borrowing against the value of your land.

Understanding Land Equity Loans

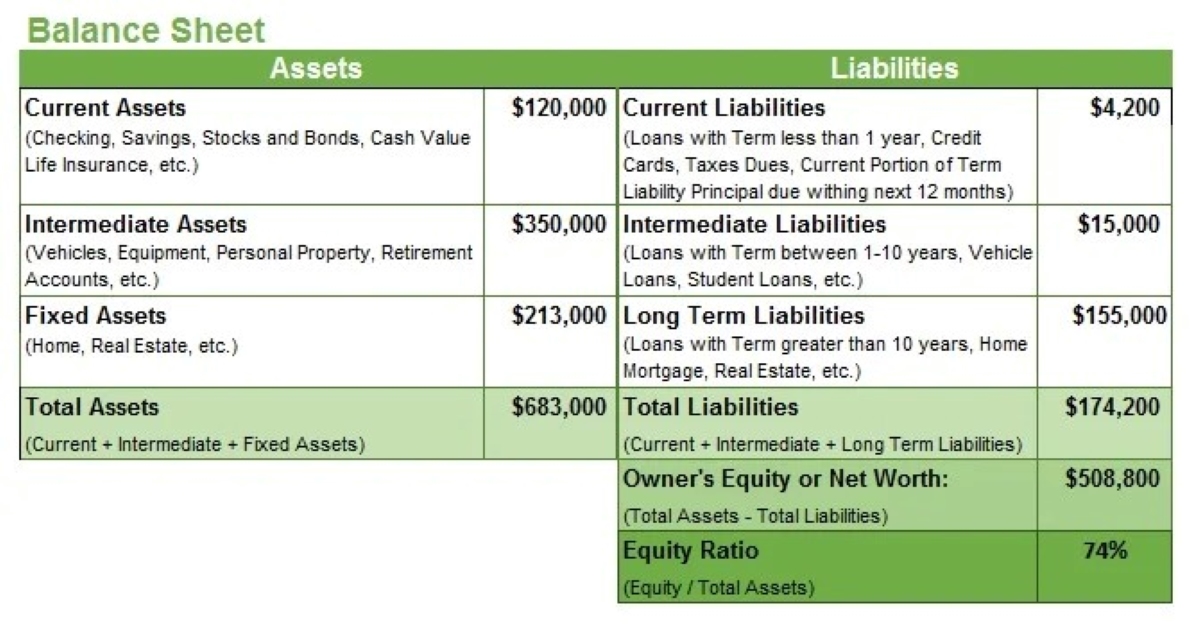

Land equity loans are a financial instrument that allows landowners to borrow against the equity in their property. Equity is the difference between the current market value of the land and the outstanding balance on any existing loans secured by the property. This type of loan is secured by the value of the land itself, making it a viable option for individuals who own land outright or have a significant amount of equity in their property.

Unlike traditional mortgage loans, which are used to purchase a home or property, land equity loans are specifically designed for borrowers who already own land and wish to leverage its value to access funds. These loans can be used for a variety of purposes, including construction projects, property improvements, debt consolidation, and other financial needs.

It’s important to note that land equity loans are distinct from home equity loans, which are secured by the equity in a home or residential property. Land equity loans are tailored to the unique circumstances of landowners and offer a flexible financing option for unlocking the potential of their land assets.

When considering a land equity loan, it’s essential to understand the potential benefits and risks associated with this type of borrowing. By gaining a clear understanding of how land equity loans work and the implications of leveraging the equity in your land, you can make informed decisions about your financial future.

Types of Lenders Offering Land Equity Loans

When seeking a land equity loan, it’s important to explore the various types of lenders that offer this financial product. While traditional banks and credit unions may provide land equity loans, there are also alternative lenders and specialized financial institutions that cater to individuals seeking financing options specifically tailored to land ownership.

1. Traditional Banks and Credit Unions: Many well-established banks and credit unions offer land equity loans as part of their mortgage and lending services. These institutions may have specific eligibility criteria and loan terms for land equity loans, and their offerings are often subject to the same rigorous application and approval processes as traditional mortgage loans.

2. Specialized Lenders: Some lenders specialize in providing land equity loans and other financing options for landowners. These specialized lenders understand the unique dynamics of land equity and may offer more flexible terms and eligibility requirements tailored to the specific needs of landowners. Working with a specialized lender can provide access to expertise and resources dedicated to land-based financing.

3. Online Lenders: With the rise of online lending platforms, borrowers can explore land equity loan options from online lenders that specialize in real estate and land-based financing. Online lenders may offer streamlined application processes and quick access to funds, making them a convenient option for individuals seeking land equity loans.

4. Private Investors and Equity Firms: In some cases, private investors and equity firms may provide land equity loans to qualified borrowers. These arrangements can offer unique financing opportunities, but they often involve more complex terms and may require a thorough assessment of the land’s value and potential collateral.

When evaluating potential lenders for a land equity loan, it’s essential to consider factors such as interest rates, loan terms, repayment options, and the lender’s expertise in land-based financing. By exploring a diverse range of lenders, borrowers can identify the most suitable options for their specific land equity borrowing needs.

Qualifications and Requirements for Land Equity Loans

Obtaining a land equity loan involves meeting certain qualifications and fulfilling specific requirements set forth by lenders. While the exact criteria may vary depending on the lender and the borrower’s unique circumstances, there are common qualifications and requirements associated with land equity loans.

1. Equity in the Land: One of the primary qualifications for a land equity loan is having sufficient equity in the land. Lenders typically require a minimum amount of equity, often expressed as a percentage of the land’s appraised value, to consider a borrower eligible for this type of loan.

2. Land Appraisal: Lenders may require a professional appraisal of the land to determine its current market value. The appraisal helps establish the amount of equity available for borrowing and provides assurance to the lender regarding the property’s worth as collateral.

3. Creditworthiness: While land equity loans are secured by the value of the land, lenders may still consider the borrower’s credit history and financial standing. Demonstrating a solid credit history and a stable financial profile can strengthen the borrower’s position when applying for a land equity loan.

4. Loan-to-Value Ratio: Lenders assess the loan-to-value (LTV) ratio, which compares the loan amount to the appraised value of the land. A lower LTV ratio indicates a lower risk for the lender and may result in more favorable loan terms for the borrower.

5. Intended Use of Funds: Borrowers may need to provide details about the intended use of the loan funds, especially for construction or development projects. Lenders may have specific requirements related to the purpose of the loan and may request documentation outlining the planned use of the borrowed funds.

6. Stable Income and Financial Documentation: Some lenders may require evidence of stable income and financial documentation, such as tax returns, bank statements, and employment verification, to assess the borrower’s ability to repay the loan.

It’s important for potential borrowers to engage in open communication with lenders to understand the specific qualifications and requirements for land equity loans. By preparing necessary documentation, demonstrating equity in the land, and showcasing financial responsibility, borrowers can position themselves for a successful application process and favorable loan terms.

Benefits and Risks of Land Equity Loans

Before pursuing a land equity loan, it’s crucial to weigh the potential benefits and risks associated with this type of borrowing. By carefully assessing the advantages and drawbacks, borrowers can make informed decisions about leveraging the equity in their land for financial purposes.

Benefits:

- Access to Financing: Land equity loans provide a means for landowners to access funds without selling their property, allowing them to pursue construction, property improvements, or other financial needs.

- Utilization of Land Equity: Borrowers can leverage the equity in their land, which may otherwise remain dormant, to secure financing for projects or investments that can enhance the value of the property.

- Potential Tax Benefits: In some cases, the interest paid on a land equity loan may be tax-deductible, providing potential tax advantages for borrowers. It’s advisable to consult with a tax professional to understand the specific implications for individual circumstances.

- Flexible Use of Funds: Land equity loan funds can be used for a wide range of purposes, offering flexibility to borrowers for various financial endeavors, including debt consolidation, business ventures, and property development.

- Asset Preservation: By using a land equity loan instead of selling the property, landowners can retain ownership of their valuable asset while still accessing the financial resources they need.

Risks:

- Property as Collateral: Land equity loans are secured by the property, putting it at risk of foreclosure if the borrower is unable to meet the loan obligations. It’s essential to carefully consider the potential consequences of defaulting on the loan.

- Interest Rates and Terms: Land equity loans may carry higher interest rates and shorter repayment terms compared to traditional mortgage loans, leading to increased financial costs and potentially higher monthly payments.

- Market Fluctuations: The value of the land, which serves as collateral for the loan, may be subject to market fluctuations, impacting the overall risk associated with the loan and the lender’s assessment of the property’s value.

- Project Risks: If the loan funds are used for construction or development projects, there are inherent risks associated with project completion, market conditions, and potential unforeseen expenses that could impact the borrower’s ability to repay the loan.

- Financial Obligations: Borrowers must carefully assess their ability to meet the financial obligations of a land equity loan, considering factors such as income stability, cash flow, and the impact of loan repayments on their overall financial well-being.

By carefully evaluating the benefits and risks of land equity loans, borrowers can make informed decisions aligned with their financial goals and risk tolerance. Seeking guidance from financial advisors and real estate professionals can provide valuable insights for navigating the complexities of land-based financing.

Conclusion

As we conclude our exploration of land equity loans, it’s evident that these financial instruments offer a valuable opportunity for landowners to unlock the potential of their properties and access funds for various financial endeavors. Whether it’s embarking on a construction project, making property improvements, or pursuing new business ventures, land equity loans provide a flexible and tailored financing option.

Understanding the qualifications, types of lenders, benefits, and risks associated with land equity loans is essential for individuals considering this form of borrowing. By carefully assessing the eligibility criteria, engaging with diverse lenders, and weighing the potential advantages and drawbacks, borrowers can make informed decisions aligned with their unique financial goals and circumstances.

It’s important to recognize that while land equity loans offer opportunities for utilizing the equity in one’s land, they also entail financial responsibilities and potential risks. Borrowers must approach these loans with a clear understanding of the implications, including the use of the property as collateral and the impact of loan terms on their financial well-being.

Ultimately, the decision to pursue a land equity loan should be guided by thorough consideration of individual financial objectives, risk tolerance, and the potential impact on the land’s value and ownership. Seeking guidance from financial advisors, real estate professionals, and reputable lenders can provide valuable support in navigating the complexities of land-based financing and making well-informed borrowing decisions.

With a comprehensive understanding of land equity loans and the landscape of lenders offering these financial products, landowners can confidently explore the opportunities for leveraging their land assets to achieve their financial aspirations.