Finance

Who Sells Vacant Land Insurance?

Published: November 12, 2023

Looking for vacant land insurance? Find out who sells it and get the coverage you need to protect your finance investment.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Vacant Land Insurance

- Importance of Vacant Land Insurance

- Factors to Consider when Buying Vacant Land Insurance

- Insurance Companies that Sell Vacant Land Insurance

- Comparing Vacant Land Insurance Policies

- The Cost of Vacant Land Insurance

- Tips for Choosing the Right Vacant Land Insurance Provider

- Conclusion

Introduction

Investing in vacant land can be a lucrative venture, whether you plan to develop it in the future or simply hold onto it as an investment. However, it is essential to mitigate the risks associated with owning vacant land. One way to protect your investment is by securing vacant land insurance.

Vacant land insurance provides coverage for risks specific to vacant land, such as vandalism, theft, natural disasters, and liability claims. While vacant land may seem less prone to hazards compared to developed properties, it is still susceptible to various risks that can result in financial loss.

In this article, we will delve into the importance of vacant land insurance, factors to consider when buying a policy, and provide insights into reputable insurance companies that specialize in vacant land insurance. Additionally, we will discuss how to compare policies, the cost of coverage, and tips for selecting the right insurance provider for your vacant land.

By understanding vacant land insurance and its significance, you can make informed decisions to safeguard your investment and mitigate potential financial risks.

Understanding Vacant Land Insurance

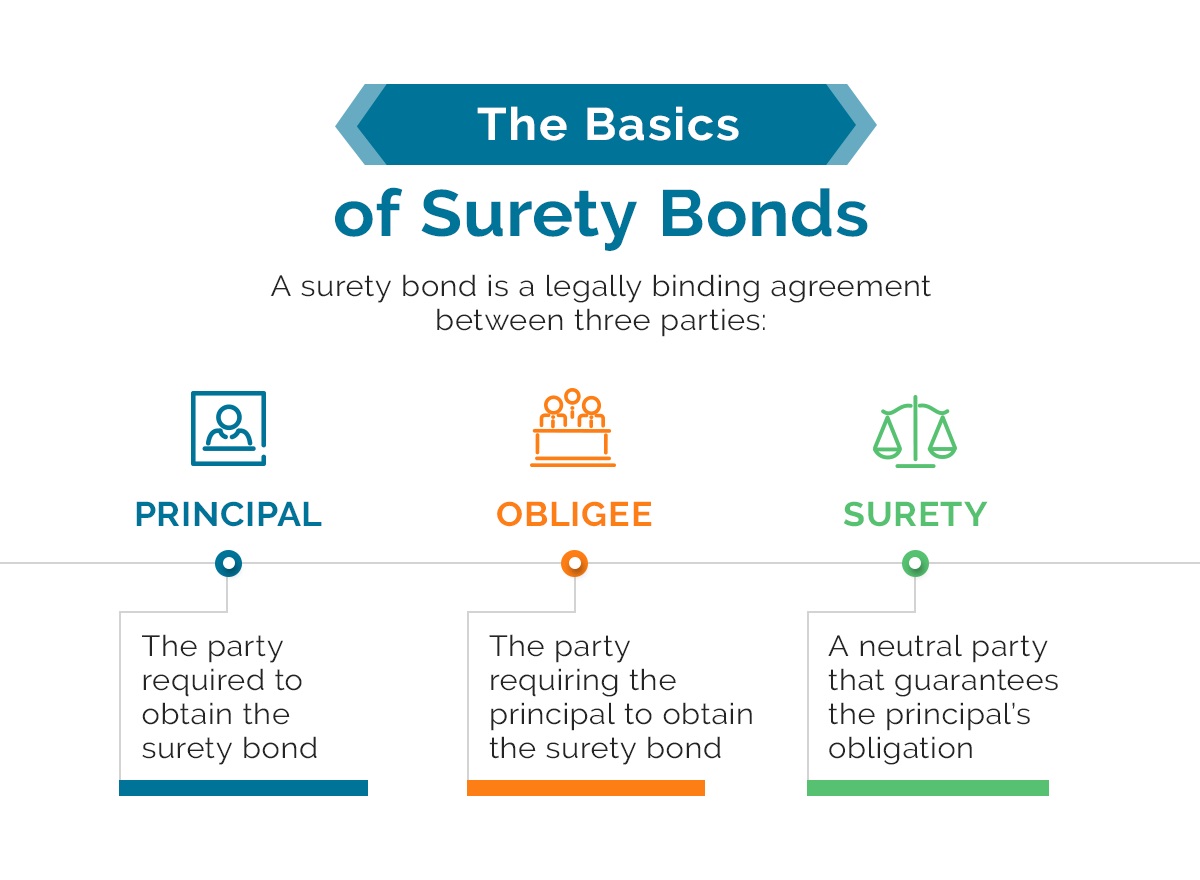

Vacant land insurance is a specialized type of insurance coverage designed to protect owners of vacant or undeveloped land from various risks and liabilities. Unlike traditional homeowners insurance or commercial property insurance, vacant land insurance focuses specifically on the unique risks associated with owning vacant land.

One of the main risks of owning vacant land is the potential for vandalism and theft. Vacant properties are often targets for criminals, who may cause extensive damage or steal valuable fixtures, equipment, or building materials. Vacant land insurance can provide coverage for these losses, ensuring that you are protected financially.

Another significant risk that vacant land insurance addresses is liability claims. Even if your land is empty and undeveloped, you could still be held legally responsible for accidents or injuries that occur on your property. Vacant land insurance can help cover the costs of any liability claims or legal fees that may arise as a result.

In addition to vandalism, theft, and liability risks, vacant land insurance can provide coverage for natural disasters such as wildfires, floods, and earthquakes. These events can cause significant damage to the land itself or any structures or improvements that may be present. With vacant land insurance, you can have peace of mind knowing that you are protected against these unforeseen events.

It’s important to note that vacant land insurance typically does not cover issues related to land value or market fluctuations. This type of insurance is primarily focused on protecting against physical damage, liability claims, and certain other specific risks. If you are considering purchasing vacant land or already own it, it’s essential to understand the specific coverage provisions and limitations of the policy you are considering.

Now that we have a better understanding of what vacant land insurance entails, let’s explore why it is essential to have this type of coverage for your vacant land investment.

Importance of Vacant Land Insurance

While it may be tempting to overlook the need for insurance when it comes to vacant land, it is essential to recognize the importance of having vacant land insurance. Here are several reasons why it is crucial to protect your vacant land investment with adequate coverage:

- Protection against financial loss: Vacant land is not immune to risks and hazards. Without insurance, you would bear the full financial burden of any damage, theft, or liability claims that may arise. Vacant land insurance provides you with financial protection and ensures that you do not suffer significant losses in the event of an unfortunate incident.

- Coverage for property damage: Even though undeveloped, vacant land can still sustain damage from natural disasters, such as wildfires, floods, or storms. These events can cause erosion, uproot trees, or even destroy any structures or improvements on your land. Vacant land insurance can help cover the costs of repairing or rebuilding these damages, saving you from potentially substantial expenses.

- Liability protection: Accidents can happen anywhere, even on vacant land. If someone were to get injured while on your property, you could be held legally responsible. Without insurance, you would be liable for medical expenses, legal fees, and potential settlements. Vacant land insurance can provide liability coverage, ensuring that you are protected in case of such incidents.

- Peace of mind: Having vacant land insurance brings peace of mind. Knowing that your investment is protected against various risks and liabilities allows you to focus on other aspects of land ownership. Whether you plan to develop the land in the future or hold it as an investment, insurance provides reassurance and mitigates potential financial stress.

- Compliance with lender requirements: If you have obtained financing for purchasing vacant land, your lender may require you to have vacant land insurance as a condition of the loan. Lenders want to ensure that their investment is protected, and having insurance in place serves as a safeguard for both you and the lender.

It is important to assess the specific risks associated with your vacant land and choose a policy that provides comprehensive coverage tailored to your needs. By investing in vacant land insurance, you can protect your investment, mitigate potential liabilities, and gain the peace of mind you need to make the most of your vacant land ownership.

Factors to Consider when Buying Vacant Land Insurance

When purchasing vacant land insurance, it is important to consider several factors to ensure that you are getting the right coverage for your specific needs. Here are some key factors to consider:

- Policy Coverage: Evaluate the coverage options offered by different insurance providers. Make sure the policy covers the specific risks associated with vacant land, such as vandalism, theft, natural disasters, and liability claims. The policy should also include coverage for any structures or improvements on the land.

- Policy Exclusions: Read the policy exclusions carefully. Understand what risks are not covered by the insurance policy. Certain exclusions, such as specific natural disasters or damage caused by certain activities, can vary from one policy to another. Ensure that any specific risks associated with your vacant land are adequately covered.

- Deductibles and Limits: Review the deductible amount and policy limits. The deductible is the amount you must pay out of pocket before the insurance coverage kicks in. Higher deductibles might lower your premiums but also increase your financial responsibility in the event of a claim. Ensure that the policy limits are sufficient to cover potential losses that may occur.

- Insurance Company Reputation: Research the reputation and financial stability of the insurance company. Look for customer reviews, ratings, and feedback to gain insights into their customer service and claims handling process. It is important to choose an insurance provider with a solid reputation and a track record of reliable service.

- Premiums: Compare premium rates from different insurance providers, but keep in mind that cost should not be the sole determining factor. Look for a balance between affordability and appropriate coverage. Lower premiums may result in limited coverage, while higher premiums may provide more comprehensive protection. Consider your budget and the level of risk you are comfortable with.

- Additional Coverage Options: Inquire about any additional coverage options that may be available. Some insurance providers offer optional endorsements or riders that can enhance your coverage. Examples include coverage for environmental hazards or loss of rental income if you plan to use the land for leasing purposes.

- Policy Terms and Conditions: Carefully read and understand the terms and conditions of the policy. Be aware of any restrictions, limitations, or requirements that the insurance provider may have. Ensure that you comply with all policy conditions to avoid potential claim denials.

By considering these factors and conducting thorough research, you can make an informed decision when purchasing vacant land insurance. Remember to review and reassess your insurance coverage periodically to ensure it aligns with any changes in your vacant land ownership or the level of risk associated with the property.

Insurance Companies that Sell Vacant Land Insurance

When it comes to purchasing vacant land insurance, it is important to choose a reputable insurance company that specializes in this type of coverage. Here are a few well-known insurance companies that offer vacant land insurance policies:

- Foremost Insurance: Foremost Insurance is a leading provider of specialty insurance products, including vacant land insurance. They offer coverage options for both residential and commercial vacant land, providing protection against risks such as vandalism, theft, natural disasters, and liability claims.

- Progressive Insurance: Progressive is known for offering a wide range of insurance products, and vacant land insurance is no exception. Their policies are tailored to the specific risks associated with owning vacant land, providing coverage for property damage, liability claims, and more.

- Markel Specialty: Markel Specialty is a specialty insurance company that offers vacant land insurance coverage. They provide customizable policies to suit the unique needs of vacant land owners, including protection against property damage, theft, liability claims, and other potential risks.

- US Assure: US Assure is a property and casualty insurance company that offers vacant land insurance policies. Their coverage options include protection against property damage, theft, liability claims, and even coverage for vacant land being used for construction purposes.

- American Modern Insurance Group: American Modern Insurance Group specializes in providing insurance coverage for unique and non-traditional properties, including vacant land. They offer comprehensive insurance options to protect against various risks, ensuring that your vacant land investment is safeguarded.

While these insurance companies are known for offering vacant land insurance policies, it is always recommended to obtain multiple quotes and compare coverage options before making a decision. Each insurance company may have different policy features, exclusions, and premium rates. It is important to evaluate your specific needs and select a provider that offers the best combination of coverage and affordability.

Additionally, consider consulting with an insurance broker who specializes in vacant land insurance. They can provide expert advice and help you navigate through the various options available in the market, ensuring that you make an informed decision based on your unique circumstances.

Comparing Vacant Land Insurance Policies

When shopping for vacant land insurance, it is crucial to compare different policies to ensure you select the one that best suits your needs. Here are some key factors to consider when comparing vacant land insurance policies:

- Coverage: Review the coverage provided by each policy. Look for comprehensive protection against risks such as vandalism, theft, natural disasters, and liability claims. Ensure that the policy covers any structures or improvements on the land. Consider the specific risks associated with your vacant land and choose a policy that addresses them adequately.

- Exclusions: Carefully examine the policy exclusions. Different insurance companies may have different exclusions for specific perils or situations. Make sure you understand what risks are not covered and weigh the importance of those exclusions in relation to your vacant land.

- Deductibles and Limits: Compare the deductible amounts and policy limits. Higher deductibles may result in lower premiums but also increase your out-of-pocket expenses in the event of a claim. Ensure that the policy limits are sufficient to cover potential losses that may occur on your vacant land.

- Premiums: Compare premium rates from different insurance providers. However, keep in mind that cost should not be the sole determining factor. Look for a balance between affordability and appropriate coverage. Consider the value of your land, the level of risk associated with it, and the coverage provided by the policy.

- Additional Coverage Options: Inquire about any optional endorsements or riders that can enhance your coverage. Some insurance companies offer additional coverage options for specific risks or situations. Consider your specific needs and determine if any of these additional coverages are necessary for your vacant land.

- Customer Service: Research the reputation and customer service of the insurance companies you are considering. Look for customer reviews and ratings to gain insights into their claims handling process and overall customer satisfaction. A responsive and reliable insurance company is essential in times of need.

- Policy Terms and Conditions: Carefully read and understand the terms and conditions of each policy. Be aware of any restrictions, limitations, or requirements that may be outlined. Ensure that you comply with the policy conditions to avoid potential claim denials.

By comparing vacant land insurance policies based on these factors, you can make a well-informed decision that provides the necessary coverage for your vacant land investment. Remember to assess your needs periodically and review your policy to ensure it continues to meet your requirements as your circumstances evolve.

The Cost of Vacant Land Insurance

The cost of vacant land insurance can vary depending on several factors. Insurance companies take into consideration various elements when determining the premium for a vacant land insurance policy. Here are some factors that can influence the cost:

- Location: The location of the vacant land can play a role in determining the insurance premium. Factors such as the crime rate in the area, proximity to bodies of water, and susceptibility to natural disasters can impact the risk associated with the property and, subsequently, the cost of insurance.

- Land Characteristics: The specific characteristics of the vacant land may affect the insurance premium. Factors like the size of the land, topography, accessibility, and the presence of any structures or improvements can influence the level of risk and impact the cost of coverage.

- Risk Factors: Insurance companies assess the risk factors associated with vacant land, such as the likelihood of vandalism, theft, natural disasters, and liability claims. The higher the perceived risk, the higher the insurance premium is likely to be.

- Desired Coverage: The extent of coverage you select for your vacant land insurance policy will affect the premium. Additional coverage options, higher liability limits, and specialized endorsements or riders may increase the cost of the policy.

- Insurance Company: Different insurance companies may have varying pricing structures and guidelines. It is wise to obtain quotes from multiple insurers to compare premiums and ensure you are getting the most competitive rate for the coverage you need.

- Policy Deductible: The deductible is the amount you are responsible for paying out of pocket before the insurance coverage kicks in. Generally, higher deductibles result in lower premiums, while lower deductibles may lead to higher premium costs. Consider your budget and the level of financial risk you are comfortable with when selecting your deductible amount.

It is important to note that the cost of vacant land insurance is typically lower than insurance for developed properties since vacant land is generally perceived as a lower risk. However, specific factors unique to your property can still influence the cost. To get an accurate idea of the cost, it is recommended to reach out to insurance providers and request personalized quotes based on your vacant land’s characteristics and your desired coverage.

While cost is an important consideration, it is equally important to ensure that your vacant land is adequately protected. Balancing affordability with appropriate coverage allows you to mitigate potential risks while protecting your investment and providing you with the peace of mind needed for land ownership.

Tips for Choosing the Right Vacant Land Insurance Provider

Choosing the right vacant land insurance provider is crucial to ensure that your investment is adequately protected. Here are some helpful tips to consider when selecting an insurance provider:

- Research and Compare: Take the time to research and compare multiple insurance providers. Look for companies that specialize in vacant land insurance and have a good reputation in the industry. Read reviews, seek recommendations, and gather information about their claims process and customer service.

- Evaluate Coverage Options: Look for insurance providers that offer comprehensive coverage options tailored to the risks associated with vacant land. Ensure that the policy covers property damage, theft, liability claims, and any other specific risks relevant to your land. Assess the policy exclusions and limitations to fully understand the scope of coverage.

- Financial Stability: Consider the financial stability of the insurance provider. Check their financial ratings from reputable rating agencies to ensure that they have the resources to honor claims and provide reliable service. A financially stable insurance company gives you peace of mind that they will be there for you when you need them.

- Customer Service: Choose an insurance provider with excellent customer service. Look for companies that are responsive, helpful, and have a reputation for handling claims efficiently and fairly. Prompt and reliable customer service is crucial, especially during times of emergency or when filing a claim.

- Customization Options: Consider whether the insurance provider offers customization options to tailor the policy to your specific needs. Each vacant land is unique, and having the flexibility to adjust coverage and limits can ensure that you are adequately protected without paying for unnecessary coverage.

- Compare Premiums: Obtain quotes from different insurance providers and compare premiums. However, be cautious not to solely focus on price. Consider the coverage provided and the reputation of the company. It’s better to pay a slightly higher premium for a policy that offers comprehensive coverage and reliable service.

- Consult with an Insurance Professional: If you are unsure about the vacant land insurance process or need assistance in selecting the right provider, consider consulting with an insurance professional or an independent insurance agent. They can provide valuable advice based on their expertise and help you navigate the complexities of insurance policies.

By following these tips, you can make an informed decision when choosing the right vacant land insurance provider. Remember, securing adequate insurance coverage is crucial for protecting your investment and mitigating potential risks. Take the time to assess your needs, compare options, and select a reputable provider that offers the right coverage at a fair price.

Conclusion

Investing in vacant land can be a smart financial move, but it’s vital to protect your investment with vacant land insurance. Vacant land insurance provides coverage against risks such as vandalism, theft, natural disasters, and liability claims. It offers financial protection and peace of mind, ensuring that you are safeguarded from potential financial losses.

When purchasing vacant land insurance, consider factors such as policy coverage, exclusions, deductibles, and limits. Compare quotes from reputable insurance companies that specialize in vacant land coverage, and evaluate their customer service and financial stability. While cost is important, prioritize finding the right coverage for your specific needs.

Understanding vacant land insurance and its importance allows you to make informed decisions to mitigate risks associated with vacant land ownership. It protects you from potential liabilities, unexpected property damage, and liability claims that may arise on your property.

Remember to reassess your insurance coverage periodically to ensure it aligns with any changes in your vacant land ownership or the level of risk associated with the property. Consult with insurance professionals or independent agents for expert advice and personalized guidance.

By taking the necessary steps to secure the right vacant land insurance, you can confidently protect your investment, knowing that you are financially covered against various risks and liabilities. Enjoy the benefits of vacant land ownership with the peace of mind that comes from being adequately insured.