Finance

Who Has To File A Florida Tax Return?

Published: November 2, 2023

Learn about who is required to file a Florida tax return and stay updated with the latest finance regulations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Florida Tax Filing Requirements

- Individuals Required to File a Florida Tax Return

- Non-Residents Required to File a Florida Tax Return

- Part-Year Residents Required to File a Florida Tax Return

- Exemptions from Filing a Florida Tax Return

- Types of Florida Tax Returns

- Deadline for Filing a Florida Tax Return

- Consequences of Failing to File a Florida Tax Return

- How to File a Florida Tax Return

- Conclusion

Introduction

Welcome to our comprehensive guide on filing a Florida tax return! Tax filing can be a complex process, but understanding your obligations and requirements is essential to avoiding penalties and ensuring compliance with state laws. Whether you are a resident, non-resident, or a part-year resident, this article will provide you with valuable information on who needs to file a Florida tax return.

Florida is known for its favorable tax climate, as it does not impose a state income tax on individuals. However, despite this benefit, there are still certain circumstances in which individuals may need to file a tax return in the Sunshine State. It’s important to note that while Florida may not have a state income tax, individuals are still subject to federal income tax and other tax obligations.

In this article, we will explore the different categories of individuals who are required to file a Florida tax return, including residents, non-residents, and part-year residents. We will also discuss exemptions from filing, the types of tax returns available, the filing deadline, and the consequences of failing to file. Additionally, we will provide guidance on how to file your Florida tax return.

Whether you are a first-time filer or have been filing taxes for years, this guide aims to provide you with the information you need to navigate the Florida tax system with confidence. So, let’s delve into the details and determine who exactly has to file a Florida tax return!

Florida Tax Filing Requirements

Before we dive into the specific categories of individuals who are required to file a Florida tax return, let’s understand the general tax filing requirements in the state. Although Florida does not impose a state income tax, there are still certain tax obligations that individuals must fulfill.

Firstly, it’s important to note that if you are an employee or receive other types of income in Florida, you may still be subject to federal income tax. This means you must file a federal tax return with the Internal Revenue Service (IRS) even if you are not required to file a Florida tax return.

Additionally, individuals who own businesses or have self-employment income in Florida may also have additional tax obligations, such as filing federal self-employment tax returns. It’s crucial to consult with a tax professional or the IRS to understand your specific obligations.

For Florida-specific tax filing requirements, keep in mind the following:

- Residency Status: Your residency status plays a significant role in determining whether you need to file a Florida tax return. Florida recognizes three residency statuses – resident, non-resident, and part-year resident.

- Income Thresholds: Florida has income thresholds that determine whether you need to file a tax return. These thresholds vary depending on your filing status and age.

- Taxable Income: Even if your income is below the filing threshold, you may still want to file a Florida tax return to claim credits or deductions that could reduce your tax liability.

Understanding these general requirements will provide a solid foundation as we now move on to discuss the specific categories of individuals who are required to file a Florida tax return. In the following sections, we will explore the filing requirements for residents, non-residents, and part-year residents in more detail, along with exemptions and consequences for failing to file.

Individuals Required to File a Florida Tax Return

Florida imposes tax filing requirements on individuals based on their residency status. Let’s take a closer look at each category:

- Residents: If you are a resident of Florida for tax purposes, you are generally required to file a Florida tax return if your federal adjusted gross income (AGI) exceeds the specified threshold. The threshold varies depending on your filing status and age. It is important to note that Florida does not tax income, but there may be other tax obligations for residents, such as intangible personal property tax or local taxes.

- Non-Residents: Non-residents of Florida are generally not required to file a Florida tax return unless they have Florida-sourced income that is subject to state taxes. Florida-sourced income may include wages earned for work performed in Florida, rental income from Florida properties, or income from a business conducted in Florida.

- Part-Year Residents: If you were a part-year resident of Florida, meaning you moved in or out of the state during the tax year, you may be required to file a Florida tax return. Part-year residents must report all income earned while they were a Florida resident and any Florida-sourced income during the non-resident period.

It’s important to carefully evaluate your residency status to determine whether you are required to file a Florida tax return. If you are unsure about your residency status or have complex tax situations, it is recommended to consult with a qualified tax professional or review the guidelines provided by the Florida Department of Revenue.

Now that we have discussed the filing requirements for residents, non-residents, and part-year residents, let’s move on to explore exemptions from filing a Florida tax return in the next section.

Non-Residents Required to File a Florida Tax Return

Non-residents of Florida are generally not required to file a Florida tax return, as they are not subject to the state’s income tax. However, there are circumstances in which non-residents may still be required to file a Florida tax return.

If you are a non-resident of Florida but have earned income from Florida sources, you may be subject to state taxes on that income. Florida considers income sourced within the state as taxable, regardless of your residency status. Some common examples of Florida-sourced income include:

- Wages: If you worked in Florida and earned wages for services performed within the state, that income is considered Florida-sourced.

- Rental Income: If you own rental properties located in Florida and receive rental income from those properties, that income is subject to Florida taxes.

- Business Income: If you operate a business in Florida or have income from a business conducted within the state, that income is considered Florida-sourced and may be subject to state taxes.

If you have Florida-sourced income, you will need to file a non-resident tax return (Form F-1040NR) with the Florida Department of Revenue. On this return, you will report the income earned from Florida sources and calculate the appropriate tax liability based on the state’s tax rates.

It’s important to keep accurate records of your income and expenses related to your Florida-sourced income. This will help ensure that you file an accurate and complete tax return. Additionally, you may be eligible for certain deductions or exemptions that could reduce your tax liability.

If you are unsure about whether you have Florida-sourced income or if you have complex tax situations, it is advisable to consult with a qualified tax professional or the Florida Department of Revenue for guidance. Now that we have covered non-resident tax filing requirements, let’s explore the specific requirements for part-year residents in the next section.

Part-Year Residents Required to File a Florida Tax Return

If you were a part-year resident of Florida during the tax year, meaning you moved in or out of the state, you may have specific tax filing requirements. Part-year residents are individuals who were not residents of Florida for the entire year but established or terminated residency within the year.

As a part-year resident, you are required to file a Florida tax return if you meet any of the following criteria:

- Florida Resident Income Threshold: If your federal adjusted gross income (AGI) exceeds the specified threshold for your filing status and age, you are required to file a Florida tax return. The threshold varies depending on your circumstances.

- Florida-Sourced Income: If you had income from Florida sources during the period when you were a resident of Florida, you must report and pay taxes on that income, regardless of the income threshold.

It’s important to understand that as a part-year resident, you will need to allocate and report your income based on the periods of residency in and out of Florida. Income earned while you were a resident of Florida and any Florida-sourced income during the non-resident period will be subject to state taxes.

To file your Florida tax return as a part-year resident, you will use Form F-1040. On this form, you will report your income, deductions, and credits for the period you were a resident in Florida. You will also report any Florida-sourced income earned during the non-resident period.

Ensure that you keep accurate records of your income and expenses during both periods of residency to accurately calculate your tax liability. It is also recommended to review the guidelines provided by the Florida Department of Revenue or seek assistance from a qualified tax professional to ensure compliance with the filing requirements for part-year residents.

Now that we have covered the filing requirements for part-year residents, let’s explore the exemptions from filing a Florida tax return in the next section.

Exemptions from Filing a Florida Tax Return

While there are certain circumstances in which individuals are required to file a Florida tax return, there are also exemptions available that may relieve individuals from this obligation. Let’s take a look at some exemptions from filing a Florida tax return:

- Income below Filing Threshold: If your income falls below the specified threshold for your filing status and age, you are not required to file a Florida tax return. However, it’s important to note that even if you are not required to file, filing may still be beneficial if you qualify for credits or deductions that could reduce your tax liability.

- Dependent Filers: Dependents who have earned income below the federal filing threshold may not have to file their own Florida tax return. Instead, they may be included on their parents’ or guardians’ tax return.

- Exempt Types of Income: Certain types of income are exempt from taxation in Florida, such as Social Security benefits, retirement income, disability payments, and certain types of interest and dividends. If your income consists solely of these exempt categories, you may not be required to file a Florida tax return.

It’s important to note that while you may be exempt from filing a Florida tax return, you may still have federal tax filing obligations or other tax obligations related to specific types of income or circumstances. Therefore, it is always advisable to consult with a tax professional or review the guidelines provided by the Florida Department of Revenue to understand your specific tax obligations.

If you believe you are exempt from filing a Florida tax return, it’s a good practice to keep proper documentation and records to support your exemption claims. This will help you in case of any inquiries or audits from the tax authorities.

Now that we have covered exemptions from filing, in the next section, let’s discuss the different types of Florida tax returns that individuals may need to file.

Types of Florida Tax Returns

Although Florida does not have a state income tax, there are still various types of tax returns that individuals may need to file in certain circumstances. Let’s explore the different types of Florida tax returns:

- Form F-1040: This is the standard tax return form for Florida residents. If you are a resident of Florida and meet the income threshold requirements, you will file Form F-1040 to report your income, deductions, credits, and calculate your potential tax liability.

- Form F-1040NR: Non-residents who have earned income from Florida sources may need to file Form F-1040NR. This form is used to report and pay taxes on the Florida-sourced income you received during the tax year.

- Form F-1040ES: If you are required to make estimated tax payments throughout the year or expect to owe additional tax when you file your return, you may need to file Form F-1040ES. This form helps individuals calculate and pay their estimated quarterly taxes to the Florida Department of Revenue.

- Form F-7004: If you need additional time to file your Florida tax return, you can request an extension by filing Form F-7004. This form grants you an automatic six-month extension to file your return, but it does not grant an extension for paying any taxes owed.

It’s important to use the correct form that corresponds to your filing status, residency status, and specific tax situation. Using the wrong form may result in processing delays or inaccuracies in your tax return.

Whether you are a resident, non-resident, or part-year resident, it is recommended to review the instructions and guidelines provided with each form or seek assistance from a qualified tax professional to ensure accurate completion and filing of your Florida tax return.

Next, let’s move on to discuss the deadline for filing a Florida tax return.

Deadline for Filing a Florida Tax Return

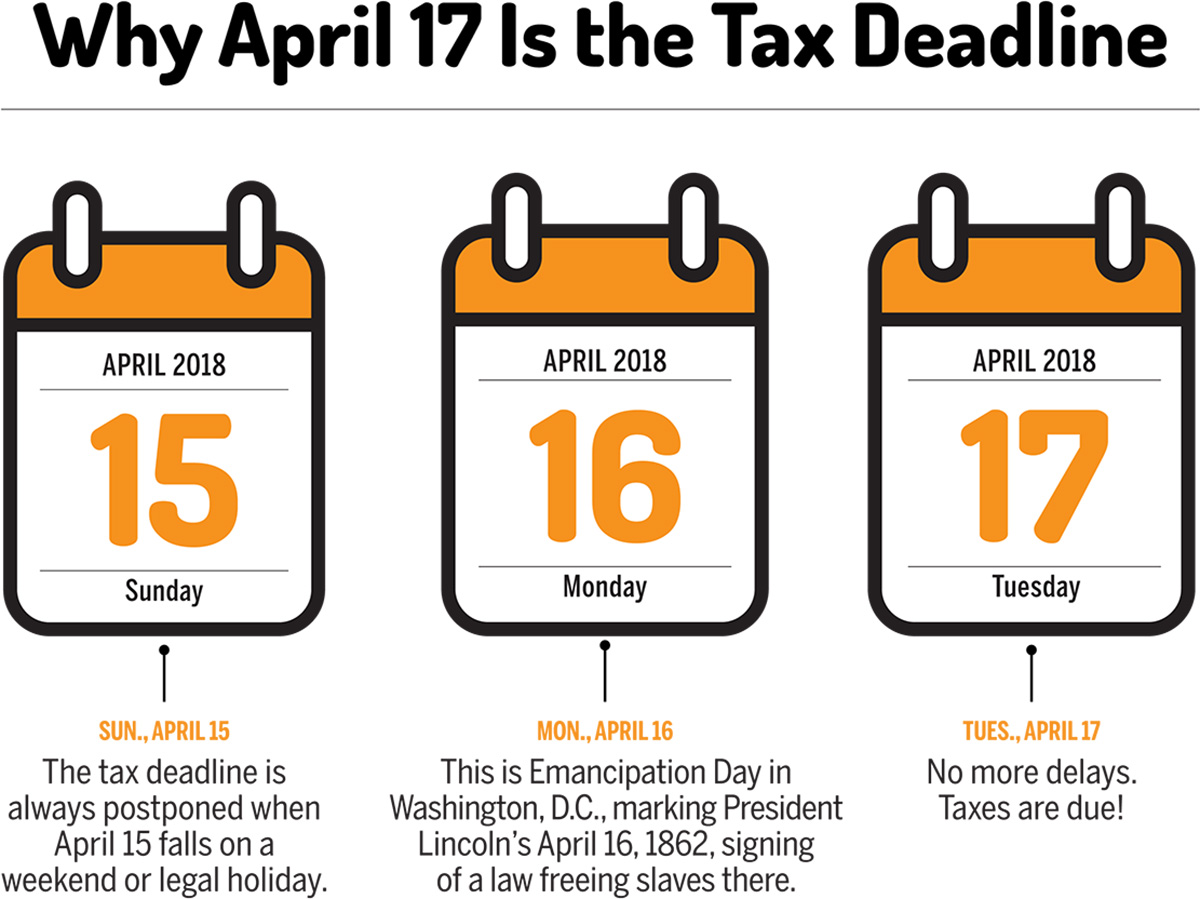

When it comes to filing your Florida tax return, it’s crucial to be aware of the deadline to avoid any penalties or late filing fees. The deadline for filing a Florida tax return typically aligns with the federal tax filing deadline, which is April 15th of each year.

However, if April 15th falls on a weekend or a holiday, the deadline may be extended to the next business day. It’s always a good practice to double-check the specific deadline for each tax year as it may vary.

If you need more time to file your Florida tax return, you can request a filing extension by submitting Form F-7004. This will grant you an automatic extension of six months to file your return. However, keep in mind that an extension to file does not grant an extension for paying any taxes owed. You are still required to pay any tax liability by the original deadline to avoid interest and penalties.

It’s important to note that even if you are not able to pay the full amount of taxes owed, it’s still in your best interest to file your tax return by the deadline to avoid additional penalties for late filing.

For individuals who make estimated tax payments, the deadline to submit these payments throughout the year typically aligns with the federal estimated tax payment schedule. These payments are due on April 15th, June 15th, September 15th, and January 15th of the following year.

Make sure to mark your calendar and keep track of the deadlines to ensure timely filing of your Florida tax return. Missing the deadline could result in penalties, interest charges, and potential loss of refunds.

Next, let’s explore the consequences of failing to file a Florida tax return.

Consequences of Failing to File a Florida Tax Return

Filing a tax return is not optional—it is a legal requirement. Failing to file your Florida tax return can have serious consequences. Here are some potential repercussions of failing to file a Florida tax return:

- Penalties and Interest: If you fail to file your tax return by the deadline, you may be subject to penalties and interest charges. The penalty for late filing can be as high as 25% of the tax owed. Additionally, interest accrues on any unpaid tax amount until the balance is fully paid.

- Loss of Refunds: If you are entitled to a refund, failing to file your tax return means you won’t receive that refund. Refunds are typically issued within a specific timeframe, and if you don’t file your return, you forfeit the opportunity to claim any refunds you are owed.

- IRS Audit: If you fail to file your Florida tax return, it may raise red flags with the Internal Revenue Service (IRS). This can increase the likelihood of an audit, which may lead to further penalties, interest, and potential legal consequences if any discrepancies or non-compliance are discovered.

- Negative Credit Impact: Unresolved tax debt, including failure to file, can have negative implications on your credit score. These negative marks can make it difficult to secure loans, credit cards, or other forms of financing.

- Criminal Charges: In severe cases of intentional tax evasion or fraud, failure to file a tax return can result in criminal charges. It’s essential to take your tax obligations seriously to avoid legal repercussions.

Filing your tax return is not only a legal obligation but also an opportunity to report your income accurately, claim eligible deductions and credits, and ensure compliance with tax laws. Even if you are unable to pay the full amount of taxes owed, it’s better to file your return on time and explore payment options or negotiate with tax authorities regarding any outstanding liabilities.

If you are concerned about filing your Florida tax return or have complex tax situations, consider consulting with a qualified tax professional who can provide guidance and help you navigate the process while ensuring compliance with all applicable laws and regulations.

In the next section, we will discuss how to file your Florida tax return.

How to File a Florida Tax Return

Filing a Florida tax return can seem daunting, but with the right approach and understanding of the process, it can be relatively straightforward. Here are the steps to file your Florida tax return:

- Gather Your Documents: Collect all the necessary documents and forms required to file your tax return. This includes your W-2s, 1099s, and any other income statements, as well as documentation for deductions, credits, and other relevant financial information.

- Choose the Correct Form: Determine the appropriate form to use based on your filing status, residency status, and specific tax situation. Florida residents typically use Form F-1040, while non-residents may need to use Form F-1040NR. Part-year residents will also use Form F-1040 but may have additional considerations.

- Fill Out the Form: Carefully and accurately complete the appropriate form, including all required personal information, income figures, deductions, and credits. Be sure to review the instructions and guidelines provided with the form to ensure accurate completion.

- Calculate Your Tax Liability: Use the information provided on the form to calculate your tax liability or potential refund. Double-check all calculations and ensure that you have maximized your deductions and credits to reduce your tax liability, if applicable.

- Submit Your Return: Once you have completed the form and calculated your tax liability, it’s time to submit your Florida tax return. You can choose to file electronically through the Florida Department of Revenue’s website or mail a paper copy of your completed return to the appropriate address.

- Pay Any Taxes Owed: If you have a tax liability, make sure to submit the payment along with your tax return. Florida offers various payment options, including electronic payment, payment by check, or money order. Remember to include any necessary forms or documentation regarding your payment.

- Keep a Copy for Your Records: After filing your Florida tax return, make sure to keep a copy of the filed return, along with all supporting documents. These records will be important for reference purposes and in the event of any future inquiries or audits.

If you find the tax filing process complex or have unique circumstances, it is recommended to seek assistance from a qualified tax professional. They can provide guidance, ensure compliance with tax laws, and help you navigate any intricacies related to your specific tax situation.

By following these steps and timely filing your Florida tax return, you will fulfill your legal obligations and avoid penalties or late-filing fees. Be proactive and organized when it comes to your tax filing responsibilities to ensure a smooth and successful tax season.

Now that we have explored the process of filing a Florida tax return, let’s conclude our guide.

Conclusion

Filing a Florida tax return is an important responsibility for individuals residing in or earning income from the Sunshine State. While Florida does not have a state income tax, there are still specific filing requirements and obligations that individuals must adhere to.

In this comprehensive guide, we covered the various categories of individuals who are required to file a Florida tax return, including residents, non-residents, and part-year residents. We also explored exemptions from filing, the types of tax returns available, the deadline for filing, and the consequences of failing to file.

It’s crucial to understand your residency status and income thresholds to determine whether you need to file a Florida tax return. Additionally, taking advantage of exemptions and being aware of the different types of tax returns can help you navigate the process more effectively and ensure compliance with state tax laws.

Remember, filing your Florida tax return on time is essential to avoid penalties, interest charges, or loss of potential refunds. It’s always recommended to consult with a qualified tax professional or the Florida Department of Revenue if you have complex tax situations or uncertainties about your filing obligations.

By following the steps outlined in this guide and staying organized throughout the tax season, you can confidently meet your filing requirements and fulfill your tax obligations in the state of Florida. Remember, being proactive and informed will help streamline the process and ensure a smooth tax season experience.

We hope this guide has provided you with valuable insights and guidance on filing a Florida tax return. Stay informed, stay compliant, and make the most of your tax season!