Finance

Who Oversees Pension Funds?

Modified: February 21, 2024

Looking for oversight of pension funds? Learn about the role of regulatory authorities and government agencies in managing finance and pension funds.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Oversight of Pension Funds

Pension funds play a pivotal role in securing the financial well-being of individuals post-retirement. These funds are designed to provide a steady income stream for retirees, ensuring that they can maintain a comfortable standard of living. As such, the oversight of pension funds is a critical aspect of the financial landscape, aimed at safeguarding the interests of pensioners and ensuring the stability of these funds.

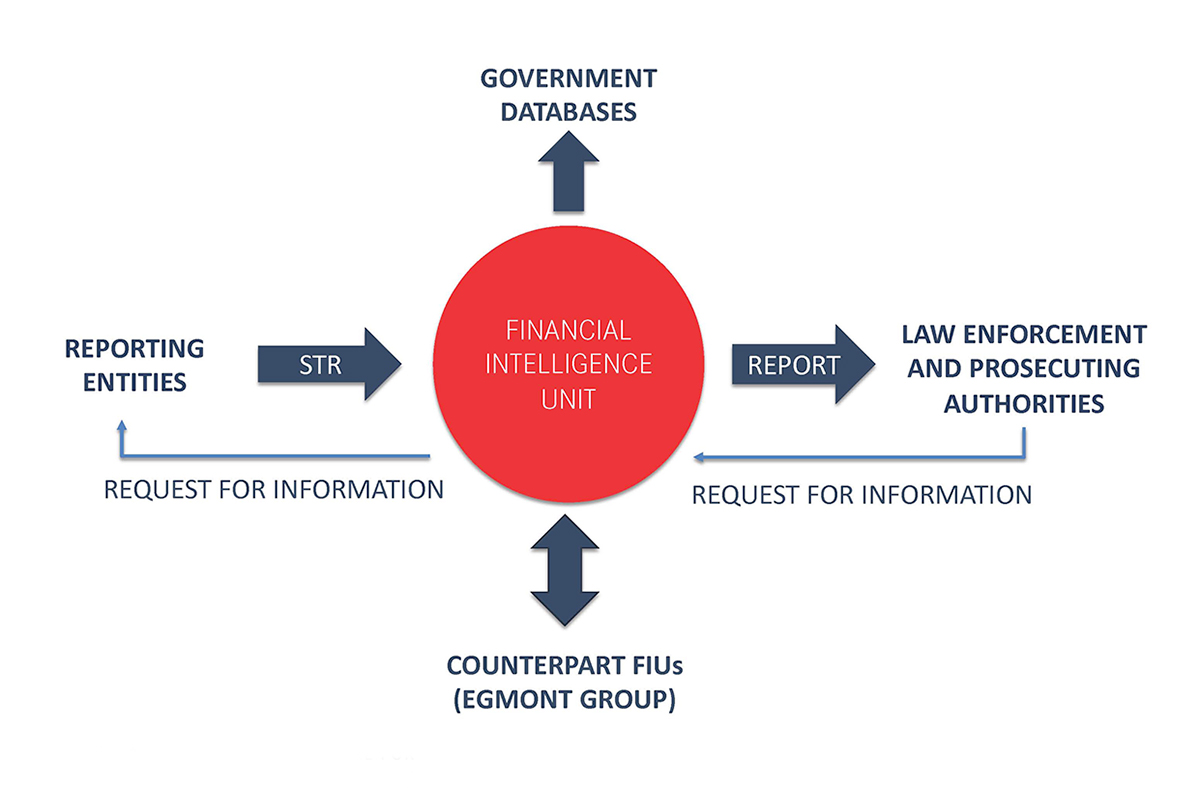

The oversight of pension funds encompasses a multi-faceted approach, involving regulatory bodies, government agencies, and industry self-regulation. Each entity plays a distinct role in supervising and monitoring the activities of pension funds, with the overarching objective of maintaining transparency, accountability, and adherence to established regulations.

This article delves into the intricate web of oversight surrounding pension funds, shedding light on the various entities responsible for ensuring the integrity and reliability of these crucial financial instruments. By understanding the mechanisms through which pension funds are overseen, individuals can gain insight into the robust framework that underpins the management and operation of these essential retirement assets.

Role of Pension Funds

Empowering Financial Security in Retirement

Pension funds serve as a cornerstone of financial security for individuals during their retirement years. These funds are designed to accumulate and invest contributions over the course of an individual’s working life, ultimately providing a reliable source of income once they reach retirement age. The primary role of pension funds is to mitigate the risk of financial insecurity in old age, offering a sustainable means of support for retirees.

One of the key functions of pension funds is to facilitate long-term financial planning, enabling individuals to build a nest egg that will sustain them through their retirement years. By pooling contributions from employees and employers, pension funds amass a substantial corpus that is strategically invested in diverse assets, such as stocks, bonds, and real estate, with the aim of generating returns that will fund pension payments.

Moreover, pension funds play a vital role in bolstering national economies by channeling investments into various sectors, thereby fostering economic growth and stability. Through their investment activities, pension funds contribute to the development of infrastructure, businesses, and capital markets, exerting a positive influence on the overall financial landscape.

Furthermore, pension funds serve as a means of incentivizing and rewarding long-term employment, as they offer a tangible benefit for employees who commit to a particular organization for an extended duration. By providing a secure retirement income, pension funds serve as a crucial tool for attracting and retaining talent, thereby fostering a sense of loyalty and commitment among the workforce.

Overall, the role of pension funds extends far beyond individual financial security, permeating into the broader economic fabric and serving as a catalyst for sustainable growth and stability.

Regulatory Bodies

Overseeing Pension Fund Operations

Regulatory bodies play a pivotal role in overseeing the operations and activities of pension funds, ensuring compliance with established guidelines and safeguarding the interests of pensioners. These entities are tasked with setting and enforcing regulations that govern the management, investment, and disbursement of pension funds, thereby upholding transparency and accountability within the pension fund ecosystem.

One of the primary functions of regulatory bodies is to establish prudential standards for pension fund management, encompassing aspects such as risk management, asset allocation, and governance practices. By delineating clear guidelines, regulatory bodies aim to mitigate potential risks and safeguard the financial stability of pension funds, ultimately protecting the retirement savings of beneficiaries.

Furthermore, regulatory bodies undertake the crucial responsibility of conducting regular audits and inspections of pension funds to assess their financial health and adherence to regulatory requirements. Through these oversight mechanisms, regulatory bodies can identify any irregularities or non-compliance issues, thereby mitigating the likelihood of mismanagement or malpractice within pension fund operations.

Moreover, regulatory bodies often serve as conduits for disseminating information and educating stakeholders about pension fund regulations and best practices. By fostering awareness and understanding of regulatory requirements, these entities empower pension fund managers, trustees, and beneficiaries to navigate the regulatory landscape effectively, thereby promoting a culture of compliance and diligence.

Additionally, regulatory bodies may engage in collaborative efforts with other supervisory authorities and industry stakeholders to enhance the regulatory framework governing pension funds. By fostering partnerships and knowledge-sharing initiatives, regulatory bodies can leverage collective expertise to address emerging challenges and adapt regulations to evolving market dynamics.

Overall, regulatory bodies play a critical role in upholding the integrity and stability of pension funds, serving as vigilant guardians of the retirement savings entrusted to these essential financial vehicles.

Government Oversight

Safeguarding Pension Fund Integrity

Government oversight constitutes a fundamental aspect of the regulatory framework governing pension funds, encompassing legislative and executive measures aimed at ensuring the prudent management and protection of pension assets. As stewards of public interest, governments wield substantial influence in shaping the regulatory environment within which pension funds operate, thereby safeguarding the financial security of retirees and fostering confidence in the pension system.

One of the primary functions of government oversight is the formulation and enactment of pension-related legislation and policies designed to uphold the rights and entitlements of pension fund beneficiaries. By codifying legal provisions that govern pension fund operations, governments establish a robust legal framework that delineates the rights and obligations of all stakeholders, thereby fostering a conducive environment for the effective functioning of pension funds.

Moreover, government oversight extends to the establishment of regulatory authorities and supervisory bodies tasked with monitoring and enforcing compliance with pension regulations. These entities operate under the purview of governmental directives, leveraging their authority to conduct investigations, impose sanctions for non-compliance, and foster a culture of adherence to regulatory standards within the pension fund industry.

Furthermore, government oversight plays a pivotal role in safeguarding pension funds from external economic and market risks, wherein governments may implement measures to mitigate systemic risks that could impact the stability and solvency of pension funds. By instituting macroprudential regulations and risk-mitigation strategies, governments endeavor to shield pension funds from external shocks and market volatilities, thereby fortifying the resilience of the pension system.

Additionally, government oversight often encompasses the provision of social safety nets and welfare programs aimed at supporting vulnerable segments of the population, including retirees who may be reliant on pension funds as their primary source of income. Through these initiatives, governments seek to alleviate financial hardships and enhance the social well-being of retirees, thereby reinforcing the overarching objective of pension fund sustainability and inclusivity.

In essence, government oversight serves as a linchpin in the regulatory architecture surrounding pension funds, exerting influence through legislative, supervisory, and protective measures to uphold the integrity and efficacy of the pension system.

Industry Self-Regulation

Fostering Accountability and Best Practices

Industry self-regulation constitutes a proactive approach adopted by pension fund stakeholders to uphold ethical standards, promote best practices, and ensure the responsible management of pension assets. This self-governing mechanism empowers industry participants to collaboratively establish guidelines, codes of conduct, and governance frameworks that complement statutory regulations, thereby fostering a culture of accountability and integrity within the pension fund landscape.

One of the primary facets of industry self-regulation is the formulation and implementation of codes of conduct and ethical guidelines that govern the behavior and decision-making processes of pension fund managers, trustees, and administrators. By adhering to these self-imposed standards, industry participants pledge to uphold principles of transparency, fiduciary duty, and prudent stewardship, thereby instilling confidence in the integrity of pension fund operations.

Moreover, industry self-regulation encompasses the establishment of professional standards and accreditation mechanisms aimed at enhancing the competencies and qualifications of individuals involved in pension fund management. By promoting continuous professional development and adherence to industry best practices, self-regulatory initiatives seek to elevate the caliber of talent within the pension fund sector, thereby enhancing the quality of governance and decision-making.

Furthermore, industry self-regulation often entails the creation of self-monitoring and reporting mechanisms that enable pension fund entities to assess their compliance with regulatory requirements and ethical standards. Through internal audits, self-assessments, and disclosure protocols, industry participants can proactively identify areas for improvement and demonstrate their commitment to upholding robust governance practices.

Additionally, industry self-regulation fosters a culture of collective responsibility and knowledge-sharing, wherein industry associations and professional bodies serve as forums for dialogue, collaboration, and the exchange of insights pertaining to pension fund management. These collaborative endeavors enable stakeholders to stay abreast of emerging trends, regulatory developments, and industry benchmarks, thereby fostering a dynamic and responsive pension fund ecosystem.

In essence, industry self-regulation complements statutory oversight by infusing the pension fund sector with a sense of ownership, professionalism, and commitment to excellence, thereby reinforcing the broader objectives of financial prudence and stakeholder protection.

Conclusion

Nurturing the Integrity and Resilience of Pension Funds

The oversight of pension funds is a multifaceted endeavor that encompasses the collective efforts of regulatory bodies, government agencies, and industry stakeholders. This collaborative approach is underpinned by a shared commitment to safeguarding the financial security of retirees, fostering transparency, and upholding the integrity of pension fund operations.

Throughout this article, we have explored the pivotal role of pension funds in empowering individuals with financial security during their retirement years. These funds serve as a testament to long-term financial planning, incentivizing loyalty in the workforce, and contributing to the economic vitality of nations.

Furthermore, we have delved into the intricate web of oversight mechanisms that govern pension funds, highlighting the indispensable role of regulatory bodies in setting and enforcing standards, conducting audits, and disseminating knowledge. Additionally, we have underscored the significance of government oversight in formulating legislation, establishing supervisory entities, and mitigating systemic risks that could impact pension fund stability.

Moreover, our exploration has extended to the realm of industry self-regulation, where stakeholders collaborate to uphold ethical standards, promote professional development, and foster a culture of accountability and continuous improvement within the pension fund sector.

As we reflect on the comprehensive framework of oversight surrounding pension funds, it becomes evident that the resilience and sustainability of these crucial financial instruments hinge upon the collective diligence, stewardship, and collaboration of all involved entities. By harmonizing regulatory oversight, governmental stewardship, and industry self-regulation, the pension fund landscape can evolve as a bastion of financial security, trust, and responsible governance.

In conclusion, the oversight of pension funds stands as a testament to the unwavering commitment to honoring the trust placed in these essential retirement assets, ensuring that retirees can embrace their golden years with confidence and peace of mind.