Finance

Why Financial Risk Management

Modified: December 30, 2023

Discover the importance of financial risk management in the world of finance and learn how to navigate potential risks to protect your investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Financial risk management is a crucial aspect of every organization, regardless of its size or industry. In an ever-changing and unpredictable business environment, managing financial risk is essential for ensuring the stability and growth of a company. By identifying, evaluating, and mitigating potential risks, organizations can make informed decisions and protect their financial well-being.

Financial risk is inherent in various aspects of business operations, including investments, loans, foreign exchange, interest rates, credit, and market fluctuations. Without proper risk management strategies in place, companies are susceptible to significant financial losses, reputational damage, and even bankruptcy.

The goal of financial risk management is to minimize the negative impact of uncertainties and unexpected events on the organization’s financial performance. It involves a systematic and proactive approach to identify, assess, and address potential risks, allowing businesses to make informed decisions and allocate resources effectively. Effective risk management helps in ensuring business continuity, protecting investments and assets, enhancing stakeholder confidence, and maintaining a competitive edge in the market.

In this article, we will explore the concept of financial risk management in detail, including its benefits, various types of financial risk, the importance of risk management, the steps in the risk management process, and the techniques and tools used in mitigating risk. Additionally, we will discuss the challenges faced by organizations in effectively managing financial risks.

Whether you are a business owner, a finance professional, or an individual interested in understanding the dynamics of managing financial risk, this article will provide you with valuable insights and practical guidance to navigate the complexities and uncertainties of the financial landscape.

What is Financial Risk Management?

Financial risk management refers to the process of identifying, evaluating, and mitigating potential risks that can have a negative impact on an organization’s financial performance. It involves implementing strategies and measures to minimize the adverse effects of uncertainties and unexpected events on a company’s financial stability and profitability.

Financial risks can arise from various sources, such as economic factors, market volatility, credit defaults, interest rate fluctuations, currency exchange rates, and regulatory changes. These risks can lead to financial losses, reduced cash flow, increased expenses, and overall instability in the organization.

Financial risk management involves a comprehensive approach that encompasses several key steps. The first step is the identification of risks, where the potential sources of risk are identified and assessed. This includes analyzing the internal and external factors that can pose a threat to the organization’s financial well-being.

Once the risks are identified, the next step is the evaluation of their potential impact. This involves assessing the likelihood of occurrence and measuring the severity of the anticipated consequences. By quantifying and analyzing the risks, organizations can prioritize their mitigation efforts and allocate resources effectively.

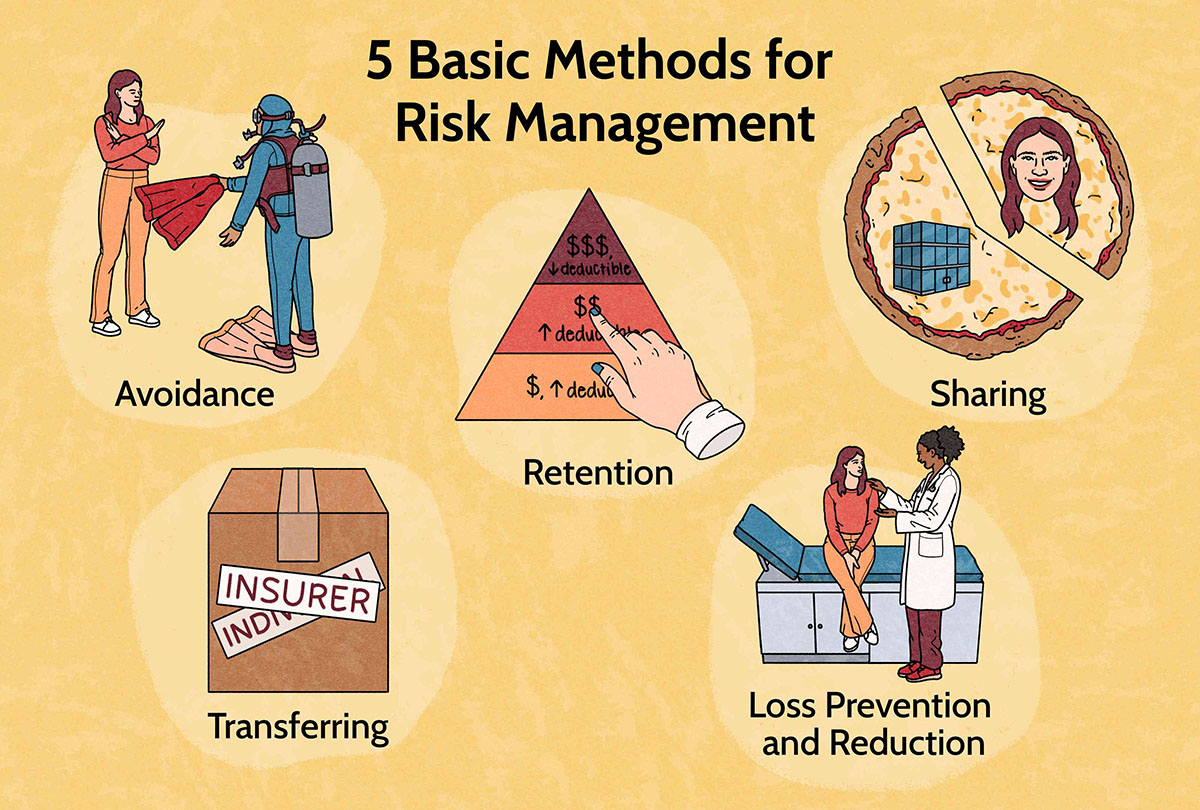

The third step in financial risk management is the development and implementation of risk mitigation strategies. This involves designing and executing plans to reduce and control the identified risks. Strategies may include hedging techniques, portfolio diversification, insurance coverage, and setting up internal controls and policies to mitigate potential risks.

Monitoring and continuous review of risks is also a crucial aspect of financial risk management. This ensures that the organization stays vigilant and adapts its risk mitigation strategies as needed. Regular monitoring allows for the early detection and timely response to any changes or emerging risks.

Overall, financial risk management is essential for organizations to navigate the uncertainties and challenges of the global financial landscape. By effectively managing risks, companies can minimize their exposure to potential financial losses and ensure their long-term financial stability and success.

Benefits of Financial Risk Management

Implementing a robust financial risk management framework offers numerous benefits to organizations. Let’s explore some of the key advantages:

- Protection against financial losses: One of the primary benefits of financial risk management is to safeguard an organization from potential financial losses. By identifying and mitigating risks, companies can minimize the negative impact of unexpected events, ensuring their financial stability and preventing severe financial setbacks.

- Improved decision-making: Effective risk management provides organizations with valuable insights and information about their potential risks and vulnerabilities. This enables decision-makers to make informed and strategic choices, considering the potential risks and rewards associated with different business decisions. With a clear understanding of the risks involved, organizations can allocate resources wisely and avoid making costly mistakes.

- Enhanced operational efficiency: Implementing risk management practices promotes operational efficiency within an organization. By identifying and addressing potential risks, businesses can streamline their processes and allocate resources effectively. This enables organizations to optimize their operations and improve overall productivity.

- Better financial planning and forecasting: Financial risk management provides organizations with a comprehensive view of their potential risks and challenges. This helps in creating more accurate financial plans and forecasts, taking into account the potential impact of various risks. It enables organizations to set realistic financial goals, develop contingency plans, and make necessary adjustments to ensure financial stability and growth.

- Increased stakeholder confidence: Demonstrating effective financial risk management practices can significantly enhance stakeholder confidence. Shareholders, investors, lenders, and customers prefer to engage with organizations that have risk management strategies in place. Sound risk management practices demonstrate a commitment to financial stability and responsible business practices, instilling confidence in stakeholders and attracting potential investors.

- Regulatory compliance: Financial risk management helps organizations stay compliant with relevant industry regulations and standards. By identifying and addressing risks associated with regulatory changes, organizations can ensure that they adhere to legal requirements. This mitigates the risk of penalties, fines, and reputational damage that may arise from non-compliance.

Overall, financial risk management equips organizations with the necessary tools and strategies to safeguard their financial well-being, make informed decisions, and adapt to changing market conditions. By proactively managing risks, organizations can achieve long-term financial stability, enhance their competitiveness, and thrive in a volatile business environment.

Types of Financial Risk

Financial risk can manifest in various forms, depending on the nature of business operations and the external factors affecting an organization. Here are a few common types of financial risks:

- Market Risk: Market risk refers to the potential losses that can arise due to changes in market conditions. It includes risks associated with fluctuations in stock prices, commodity prices, interest rates, exchange rates, and market volatility. Market risk can affect both investment portfolios and individual securities.

- Credit Risk: Credit risk is the risk of financial loss arising from the failure of a counterparty to fulfill its contractual obligations. This includes the risk of default on loans, non-payment of invoices, and failure to honor financial obligations. Credit risk is prevalent in lending and trade activities, and it is essential for organizations to carefully assess the creditworthiness and reliability of their counterparties.

- Operational Risk: Operational risk encompasses the risks arising from inadequate internal processes, systems, and human errors. It includes risks associated with technology failures, fraud, legal and regulatory compliance, supply chain disruption, and other operational inefficiencies. Operational risk can have a significant impact on an organization’s financial performance and reputation.

- Liquidity Risk: Liquidity risk is the risk of not being able to readily convert assets into cash without incurring significant losses. It refers to the inability of an organization to meet its financial obligations due to a lack of available funds or difficulty in selling assets. Liquidity risk can arise during financial crises, economic downturns, or when there is an unexpected withdrawal of funds by investors or customers.

- Foreign Exchange Risk: Foreign exchange risk, also known as currency risk, refers to the potential losses or gains that can arise due to fluctuations in exchange rates. It affects companies engaged in international trade or those with foreign currency exposure. Changes in exchange rates can impact the value of international transactions, import/export costs, and the overall profitability of the organization.

- Interest Rate Risk: Interest rate risk is the risk of financial loss arising from changes in interest rates. It affects organizations that borrow or lend money, have variable interest rate investments, or issue fixed-rate securities. Changes in interest rates can impact borrowing costs, the value of investments, and the profitability of organizations.

It’s important for organizations to analyze and understand the different types of financial risks they may face. By identifying these risks, organizations can develop appropriate risk management strategies and implement measures to mitigate their potential impact.

Importance of Financial Risk Management

Financial risk management plays a vital role in the success and sustainability of organizations. Here are some key reasons why financial risk management is important:

- Protecting Financial Stability: Financial risk management helps organizations safeguard their financial stability by identifying and mitigating potential risks. By proactively addressing risks, organizations can prevent significant financial losses and ensure their long-term viability.

- Enhancing Decision-Making: Effective risk management provides valuable insights and information that can inform strategic decision-making. By understanding potential risks and their impact, organizations can make informed and confident decisions, maximizing opportunities and minimizing threats.

- Improving Business Performance: By managing financial risks, organizations can improve their overall business performance. Risk management practices help in streamlining operations, reducing costs, optimizing resource allocation, and enhancing operational efficiency.

- Gaining Competitive Advantage: Organizations with strong risk management practices gain a competitive edge in the market. Demonstrating a proactive approach to managing risks enhances stakeholders’ confidence and attracts potential investors, customers, and business partners.

- Ensuring Regulatory Compliance: Effective risk management ensures compliance with relevant industry regulations and standards. By actively identifying and addressing risks related to compliance, organizations can avoid penalties, legal issues, and reputational damage.

- Protecting Stakeholder Interests: Financial risk management is crucial for protecting the interests of key stakeholders, including shareholders, investors, and employees. By managing risks, organizations can safeguard their investments, maintain stakeholder confidence, and protect jobs.

- Responding to Market Changes: Markets are dynamic and subject to constant changes. Effective financial risk management enables organizations to respond swiftly and effectively to market shifts, economic fluctuations, and evolving customer demands.

- Ensuring Sustainable Growth: By managing financial risks, organizations can maintain a steady growth trajectory. Effective risk management enables businesses to identify potential pitfalls and take proactive measures to mitigate risks, ensuring long-term sustainability.

- Building Resilience: Financial risk management helps organizations build resilience against unexpected events and crises. By having risk mitigation strategies in place, organizations can weather challenging times, recover quickly, and continue operations with minimal disruption.

Overall, financial risk management is essential for organizations to navigate the complex and uncertain landscape of finance. By proactively identifying and managing risks, organizations can thrive, protect their financial well-being, and seize opportunities for growth and success.

Steps in Financial Risk Management Process

The financial risk management process involves several key steps that organizations can follow to effectively identify, assess, and mitigate potential risks. Here are the main steps in the financial risk management process:

- Identification of Risks: The first step in the risk management process is to identify the potential risks that an organization may face. This includes analyzing internal factors, such as business operations, finance, and policies, as well as external factors, such as market conditions, economic trends, and regulatory changes. Risk identification can be done through various methods, including risk assessments, brainstorming sessions, and historical data analysis.

- Assessment and Prioritization: Once potential risks are identified, the next step is to assess their likelihood of occurrence and potential impact. This involves evaluating the probability of risks and measuring their potential consequences on the organization’s financial performance. Risks can be prioritized based on their level of severity and the organization’s tolerance for risk.

- Development of Risk Mitigation Strategies: After assessing and prioritizing risks, organizations need to develop risk mitigation strategies. These strategies involve implementing measures to reduce the likelihood of risk occurrence and minimize its impact if it does occur. The selection of risk mitigation strategies depends on the specific risks identified and their complexity. Common strategies include diversifying investments, hedging, implementing internal controls, and obtaining insurance coverage.

- Implementation: Once risk mitigation strategies are established, organizations need to put them into action. This involves integrating risk management practices into the organization’s operations, policies, and procedures. It also requires clear communication of risk management protocols to all relevant stakeholders and ensuring their understanding and compliance.

- Monitoring and Review: Risk management is an ongoing process that requires continuous monitoring and review. Organizations should regularly assess the effectiveness of their risk mitigation strategies and adjust them as necessary. Monitoring involves tracking key risk indicators, reviewing financial reports, and staying updated on industry trends and regulatory changes. Regular reviews also help organizations identify new risks that may emerge over time.

- Reporting and Communication: Effective communication and reporting are vital aspects of the risk management process. Organizations need to establish a system for reporting risks, incidents, and their impact on the organization’s financial performance. This includes reporting to key stakeholders such as management, board of directors, investors, and regulatory authorities. Transparent and timely communication ensures that all relevant parties are informed about the status of risks and the organization’s efforts to manage them.

- Learning and Improvement: The final step in the risk management process involves learning from past experiences and continuously improving risk management practices. Organizations should analyze the outcomes of risk management actions, identify areas for improvement, and incorporate feedback to enhance their risk management strategies.

By following these steps, organizations can establish a systematic and comprehensive approach to financial risk management. This helps in minimizing potential risks, maximizing opportunities, and ensuring the long-term financial stability and success of the organization.

Techniques and Tools for Financial Risk Management

Financial risk management involves the use of various techniques and tools to identify, assess, and mitigate potential risks. Here are some commonly used techniques and tools:

- Risk Assessment Models: Risk assessment models use quantitative and qualitative methods to evaluate the potential impact and likelihood of risks. These models assign numerical values to risks based on various factors such as historical data, statistical analysis, and expert judgment. Risk assessment models provide organizations with a systematic way to prioritize risks and allocate resources effectively.

- Diversification: Diversification involves spreading investments across different assets, industries, or geographic regions to reduce the impact of individual risks. By diversifying their portfolio, organizations can minimize the risk of significant losses from a single investment or market segment. This technique is commonly used in investment management to mitigate market risk.

- Hedging: Hedging is a risk management strategy that involves entering into derivative contracts to offset potential losses from adverse price movements. For example, organizations can use futures contracts or options to protect against fluctuations in commodity prices, foreign exchange rates, or interest rates. Hedging helps organizations limit their exposure to specific risks and stabilize their financial performance.

- Scenario Analysis: Scenario analysis involves simulating various scenarios to assess the potential impact of different risks. Organizations create hypothetical situations based on different variables and evaluate their financial outcomes. This technique helps in understanding how different risk factors can affect the organization’s performance and identifying appropriate risk management strategies.

- Value-at-Risk (VaR): VaR is a statistical technique used to estimate the maximum potential loss an organization may face within a specified time frame and level of confidence. VaR measures the downside risk of a portfolio by providing an estimate of the maximum loss under typical market conditions. Organizations can use VaR to set risk limits and determine appropriate capital reserves.

- Stress Testing: Stress testing involves subjecting an organization’s financial portfolio to extreme and adverse scenarios to assess its ability to withstand economic shocks. By subjecting the portfolio to extreme conditions, organizations can identify vulnerability and potential risks that may arise in such circumstances. Stress testing helps organizations assess their resilience and determine appropriate risk mitigation strategies.

- Risk Management Software: Risk management software provides organizations with tools and platforms to manage and monitor different aspects of financial risk. These software solutions offer features such as risk assessment, data analysis, modeling, reporting, and scenario analysis. They help streamline risk management processes, improve data accuracy, and provide real-time insights to support informed decision-making.

These techniques and tools are not exhaustive but represent common practices used in financial risk management. Organizations may adopt a combination of these tools and techniques to develop a comprehensive risk management strategy that aligns with their specific needs and objectives.

Challenges in Financial Risk Management

Financial risk management is a complex and dynamic process that comes with its own set of challenges. Here are some common challenges organizations may face when implementing financial risk management practices:

- Uncertainty and Volatility: Financial markets and economic conditions can be highly unpredictable and volatile. Uncertainty regarding market trends, interest rates, exchange rates, and other factors make it challenging to accurately assess and predict financial risks.

- Data Quality and Availability: Effective risk management relies heavily on accurate and reliable data. The quality and availability of data can pose a significant challenge, particularly when dealing with complex financial instruments and rapidly evolving markets.

- Integration and Coordination: Risk management efforts often involve multiple departments and stakeholders within an organization. Coordinating these efforts and integrating risk management practices across various functions can be a challenge, as it requires collaboration, communication, and alignment of goals and strategies.

- Regulatory Compliance: Compliance with regulatory requirements adds another layer of complexity to risk management. Staying updated with changing regulations, ensuring compliance across different jurisdictions, and navigating complex regulatory landscapes can be challenging and time-consuming.

- Model Limitations: Risk assessment models and tools are valuable for analyzing and quantifying risks, but they come with certain limitations. Models may be based on certain assumptions or historical data, which may not fully capture emerging risks or events that have not been previously experienced.

- Risk Perception and Culture: The perception of risk and the organizational culture surrounding risk can impact effective risk management. Over-optimism or complacency about risks can lead to inadequate risk mitigation measures, while a risk-averse culture may stifle innovation and growth opportunities.

- Emerging Risks: Financial risk management practices need to continuously evolve to address emerging risks. As technology advances, new risks such as cybersecurity threats, cryptocurrency volatility, and climate change-related risks emerge, requiring organizations to keep pace and develop strategies to mitigate these evolving risks.

- Resource Constraints: Allocating adequate resources, such as financial investments, skilled personnel, and technology infrastructure, to support efficient risk management can be a challenge for organizations. Limited resources may hinder the implementation of robust risk management practices.

While these challenges exist, organizations can overcome them through proactive planning, continuous monitoring, adapting to new technologies, and promoting a risk-aware culture within the organization. Flexibility, agility, and a commitment to ongoing improvement are key to successfully managing financial risks in a dynamic business environment.

Conclusion

Financial risk management is a critical component of a successful and resilient organization. It involves identifying, assessing, and mitigating potential risks that can impact an organization’s financial performance. By implementing effective risk management practices, organizations can protect their financial stability, enhance decision-making, and navigate the uncertainties of the dynamic business environment.

The benefits of financial risk management are multi-fold. It helps protect organizations from financial losses, improve operational efficiency, and enhance stakeholder confidence. Additionally, it enables better financial planning, ensures regulatory compliance, and boosts competitive advantage in the market.

The financial risk management process consists of several key steps, including risk identification, assessment, mitigation, implementation, monitoring, reporting, and continuous improvement. Organizations can utilize various techniques and tools such as risk assessment models, diversification, hedging, scenario analysis, and risk management software to support their risk management efforts.

While financial risk management brings immense value, there are challenges to overcome. These challenges include managing uncertainty and volatility, ensuring data quality and availability, coordinating risk management efforts across departments, and staying compliant with ever-changing regulations. Organizations must also navigate the limitations of risk models and address emerging risks effectively.

In conclusion, by embracing financial risk management as an integral part of their operations, organizations can proactively protect their financial stability, make informed decisions, and navigate the complexities of the business landscape. With effective risk management practices in place, organizations are better positioned to achieve sustainable growth, adapt to market changes, and thrive in an uncertain and competitive business environment.