Home>Finance>Who Should Be The Owner Of A Life Insurance Policy?

Finance

Who Should Be The Owner Of A Life Insurance Policy?

Published: November 5, 2023

Find out who should be the owner of a life insurance policy and make wise financial decisions. Ensure your family's future with proper estate planning and financial responsibility.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Life insurance is an essential financial tool that provides financial security to individuals and their loved ones in the event of an untimely death. It acts as a safety net by providing a predetermined sum of money, known as the death benefit, to the designated beneficiaries. However, when it comes to life insurance policies, there is an important decision to be made – who should be the owner of the policy?

While it may seem like a trivial detail, choosing the right owner of a life insurance policy is crucial. The owner of the policy holds the rights and responsibilities associated with it. This includes the authority to make changes, pay premiums, and choose beneficiaries. Therefore, it is essential to understand the implications of different ownership options and make an informed decision.

In this article, we will dive into the various factors to consider when determining the owner of a life insurance policy. We will explore the different ownership options, including individual ownership, spousal ownership, ownership by beneficiaries, corporate ownership, trust ownership, and co-ownership. By understanding the pros and cons of each option, you can make a well-informed decision that aligns with your financial goals and circumstances.

Understanding Life Insurance Policies

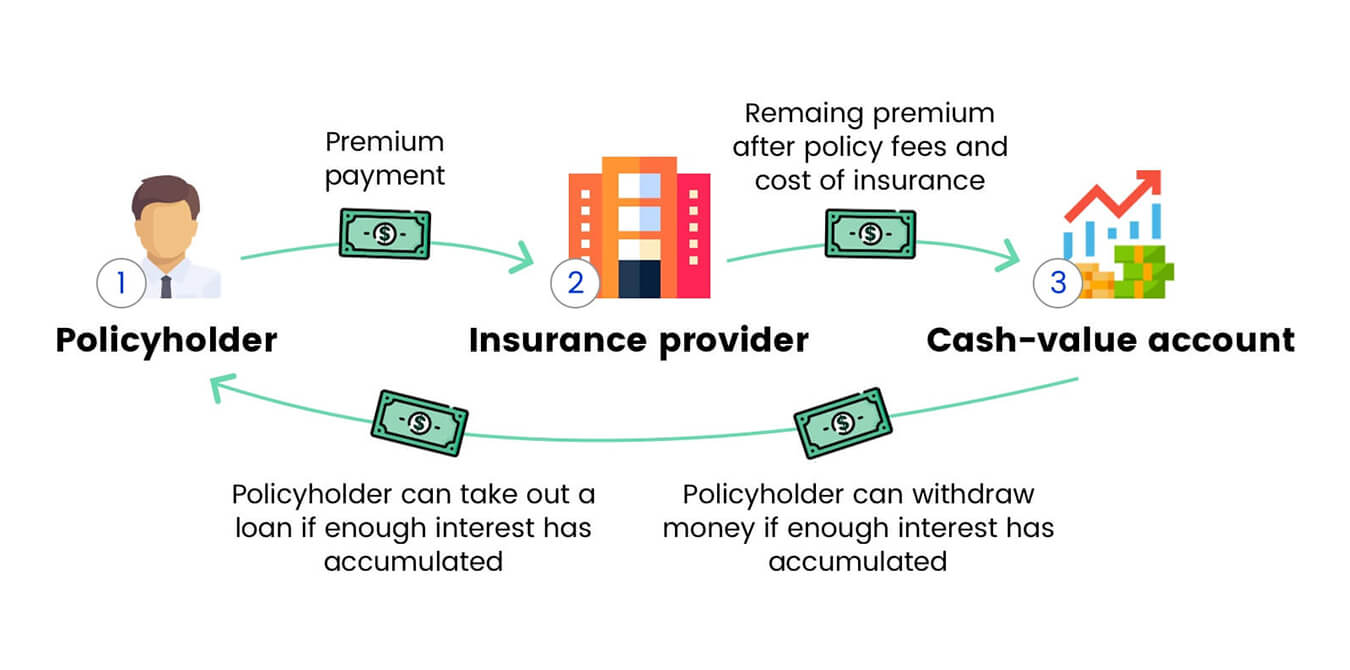

Before delving into the importance of determining the owner of a life insurance policy, it is essential to have a clear understanding of how life insurance works. Life insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays regular premiums in exchange for a death benefit paid out to their beneficiaries upon their passing.

There are various types of life insurance policies, including term life insurance, whole life insurance, and universal life insurance. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. Whole life insurance, on the other hand, provides coverage for the entire lifetime of the policyholder as long as the premiums are paid. Universal life insurance combines a death benefit with a cash value component that can grow over time.

The owner of a life insurance policy holds legal rights and controls certain aspects of the policy. This includes the ability to make changes to the policy, select beneficiaries, and determine how the death benefit will be distributed. The owner is responsible for paying premiums and ensuring the policy remains in force.

It’s important to note that the policyholder, insured individual, and owner can be the same person, or they can be different individuals or entities depending on the circumstances. When it comes to determining the owner of a life insurance policy, it’s crucial to consider various factors to make the best decision for your unique needs and goals.

Importance of Determining the Owner

Choosing the owner of a life insurance policy is a decision that shouldn’t be taken lightly. The owner of the policy holds significant control over its terms and beneficiaries. Here are a few key reasons why determining the owner is important:

- Control and Flexibility: The owner has the authority to make changes to the policy, such as adjusting the death benefit, changing beneficiaries, or selecting different premium payment options. This allows the owner to adapt the policy to meet their changing needs and financial circumstances.

- Legal Rights: As the legal owner of the policy, the owner has the right to access the policy’s cash value, if applicable. They also have the right to surrender or cancel the policy, subject to any penalties or limitations outlined in the policy contract.

- Responsibility for Premium Payments: The owner of the policy is responsible for paying the premiums to keep the policy in force. Selecting an owner who is financially responsible and committed to honoring the premium payments is vital to ensure the policy remains active and the beneficiaries receive the intended benefits upon the insured’s passing.

- Decision-Making Authority: The owner has the final say in crucial decisions related to the policy. This includes the ability to change beneficiaries, assign or transfer ownership, or take out a policy loan against the cash value, if applicable. By carefully considering who should hold this decision-making authority, you can ensure that your wishes and intentions regarding the policy are carried out effectively.

- Estate Planning Considerations: The ownership of a life insurance policy can have significant implications for estate planning. The way the policy is owned and the identity of the owner can impact estate taxes, the probate process, and the distribution of assets. By strategically selecting the owner of the policy, you can align it with your overall estate planning goals and potentially minimize any tax liabilities or complications.

Given the importance of selecting the right owner, it is crucial to carefully evaluate your options and consider the long-term implications of each before making a decision. Factors such as financial stability, trustworthiness, and the ability to fulfill the responsibilities associated with ownership should all be taken into account.

Factors to Consider in Choosing the Owner

When determining the owner of a life insurance policy, it is essential to consider various factors to ensure that the decision aligns with your financial goals and circumstances. Here are some key factors to consider:

- Relationship to the Insured: Consider the relationship between the potential owner and the insured individual. If the policy is being purchased for personal purposes, such as to financially protect a spouse or child, it may be beneficial for the insured to be the owner to maintain control over the policy.

- Financial Responsibility: Evaluate the financial stability and responsibility of the potential owner. The policy’s premiums must be paid to keep the policy in force, so selecting an owner who can reliably manage the financial aspect is crucial to ensure the policy remains effective.

- Estate Planning Objectives: Consider your overall estate planning goals. If the primary purpose of the policy is to provide for your beneficiaries upon your passing, you may consider choosing an owner who is aligned with your estate planning strategy and can effectively manage the policy during and after your lifetime.

- Trustworthiness: Selecting an owner who is trustworthy is essential. The owner has control over important decisions regarding the policy, such as beneficiary changes. Ensuring that the owner will carry out your wishes and act in the best interests of your beneficiaries is vital.

- Tax Implications: Understand the tax implications associated with different ownership options. Depending on your jurisdiction, the ownership structure may impact estate taxes, gift taxes, and tax-free policy exchanges. Consulting with a tax professional can help you make an informed decision that minimizes any tax liabilities.

- Long-Term Commitment: Consider the long-term commitment of the potential owner. Life insurance policies can span several decades, so it is vital to select an owner who is willing and able to manage the policy throughout its duration.

- Ownership Structure: Evaluate the different ownership structures available, such as individual ownership, spousal ownership, ownership by beneficiaries, corporate ownership, trust ownership, or co-ownership. Each structure has its own advantages and considerations, so understanding the implications of each is essential.

It is important to carefully evaluate these factors and assess the unique circumstances surrounding your life insurance policy. Consulting with an experienced insurance professional or financial advisor can provide valuable insights and guidance in making the best decision for your individual needs and goals.

Individual Ownership

Individual ownership is the most common form of life insurance policy ownership. In this structure, the insured individual is also the owner of the policy. This means that they have full control over the policy’s terms, including making changes, choosing beneficiaries, and managing premium payments.

There are several benefits to individual ownership. Firstly, it allows for maximum control and flexibility over the policy. The insured individual can make adjustments to the coverage, such as increasing or decreasing the death benefit, as their needs change over time. They also have the freedom to choose and update beneficiaries as necessary.

Individual ownership also simplifies the administrative aspects of the policy. Since the insured individual is already responsible for their own financial affairs, they can easily manage premium payments and ensure the policy remains in force. Additionally, individual ownership eliminates the need for complex legal arrangements or additional parties.

On the downside, individual ownership may not be suitable in certain situations. If the policy is intended to provide financial protection for dependents or business partners, individual ownership may not be the ideal choice. In these cases, alternative ownership structures like trust ownership or co-ownership may be more appropriate.

Furthermore, it is important to consider the potential implications of individual ownership for estate planning purposes. If the insured individual is also the primary beneficiary of the policy, the death benefit may be subject to estate taxes upon their passing. Consulting with an estate planning professional can help ensure that your individual ownership structure aligns with your overall estate planning goals.

In summary, individual ownership provides maximum control and flexibility over a life insurance policy. It is suitable for individuals who want to maintain complete authority over their policy and have the capacity to manage the associated administrative tasks. However, it is important to carefully assess your individual circumstances and consider alternative ownership options if individual ownership does not align with your specific needs and goals.

Spousal Ownership

Spousal ownership is a common form of life insurance policy ownership for married couples. In this structure, one spouse is designated as the owner of the policy, while the other spouse is the insured individual. This arrangement allows for the seamless transfer of policy ownership and benefits between spouses.

There are several advantages to spousal ownership. Firstly, it simplifies the administrative aspects of the policy. The spouse who owns the policy can handle premium payments and policy management, ensuring that it remains in force. This can be especially beneficial if one spouse takes on financial responsibilities or has a better understanding of insurance matters.

Spousal ownership also allows for increased flexibility in beneficiary designations. If the insured spouse passes away, the policy owner can easily update and redirect the death benefit to new beneficiaries, such as children or other family members. This can be useful in adjusting the policy to reflect changing family dynamics or estate planning goals.

One key consideration with spousal ownership is the potential impact on estate taxes. If the policy owner is also the primary beneficiary of the policy and inherits the death benefit, it may be subject to estate taxes upon their passing. However, if the policy owner designates other individuals, such as children, as beneficiaries, the death benefit may bypass the owner’s estate and be received tax-free.

It is important for spouses to maintain open communication and transparency regarding the policy. Both parties should understand the terms of the policy and discuss any changes or updates together. Moreover, it is advisable to consult with a professional estate planner or insurance advisor to ensure that spousal ownership aligns with your overall estate planning goals and that any potential tax implications are taken into account.

In summary, spousal ownership of a life insurance policy provides a convenient and flexible arrangement for married couples. It simplifies policy management and allows for easy transfer of benefits. However, it’s important to carefully consider the potential impact on estate taxes and consult with professionals to ensure that spousal ownership aligns with your specific needs and goals.

Ownership by Beneficiary

Ownership by beneficiary is a unique form of life insurance policy ownership where the designated beneficiary becomes the owner of the policy. In this structure, the insured individual typically names a specific person or entity as both the beneficiary and the owner.

There are several reasons why someone may choose ownership by beneficiary. Firstly, it can simplify the distribution of the death benefit. By making the beneficiary the owner, there is no need for probate or complex legal processes to transfer the benefits. The ownership automatically transfers to the beneficiary upon the insured individual’s passing.

Ownership by beneficiary also ensures that the intended recipient of the death benefit has full control over the policy. This can be particularly beneficial if the insured individual wants to provide financial support to a specific individual, such as a child or a loved one with special needs. The beneficiary-owner can then make decisions regarding the policy, such as adjusting the death benefit or updating beneficiaries, to align with their evolving needs.

However, there are some considerations to keep in mind with ownership by beneficiary. The beneficiary-owner must be capable of managing the policy and ensuring that the necessary premium payments are made to keep it in force. Additionally, the beneficiary-owner should understand the financial responsibilities and implications associated with owning a life insurance policy.

If the insured individual wants to retain some level of control over the policy, ownership by beneficiary may not be the best option. Moreover, it is important to consider any potential tax implications and seek guidance from a professional estate planner or insurance advisor to ensure that this ownership structure aligns with your overall estate planning goals.

In summary, ownership by beneficiary provides a streamlined and direct transfer of the policy’s benefits to the intended recipient. It simplifies the distribution process and provides the beneficiary with full control over the policy. However, it is important to carefully assess the capabilities and responsibilities of the beneficiary-owner and seek professional guidance to ensure that this ownership structure is appropriate for your unique circumstances.

Corporate Ownership

Corporate ownership of life insurance policies involves a company or business entity owning the policy on the life of one or more individuals associated with the organization. This ownership structure is commonly used for key person insurance or business succession planning purposes.

There are several advantages to corporate ownership of life insurance. Firstly, it provides financial protection for the company in the event of the death of a key employee or owner. The death benefit can help cover any financial losses, debts, or expenses related to the individual’s passing, ensuring the business can continue its operations smoothly.

Corporate ownership also offers potential tax advantages. In some jurisdictions, the premiums paid by the company may be tax-deductible as business expenses. Additionally, under certain conditions, the death benefit paid to the company may be tax-free, serving as a tax-efficient way of accumulating funds or providing income to surviving shareholders or partners.

It is important to consider potential drawbacks and complexities with corporate ownership. Premium payments on the policy are typically considered a taxable benefit for employees, which can increase their personal tax liability. Additionally, transferring ownership of the policy or designations of beneficiaries can be more complex within the corporate structure, requiring legal and professional assistance.

Corporate ownership of a life insurance policy requires careful consideration and professional advice. Reviewing the legal and tax implications, assessing the financial stability of the company, and understanding the specific needs and goals of the organization are essential steps in determining if corporate ownership is the right choice.

In summary, corporate ownership of life insurance policies is primarily used for key person insurance or business continuity purposes. It provides financial protection for the company and potential tax advantages. However, it is important to navigate the complexities associated with this ownership structure and seek expert guidance to ensure compliance with legal and tax requirements.

Trust Ownership

Trust ownership of a life insurance policy involves creating a trust and designating the trust as the owner of the policy. A trust is a legal arrangement where a trustee holds and manages assets on behalf of beneficiaries. Trust ownership can provide significant benefits in terms of estate planning, asset protection, and control over the distribution of the life insurance proceeds.

There are several advantages to trust ownership of a life insurance policy. Firstly, it allows for greater control and flexibility in determining how the death benefit will be distributed. The trust document specifies the terms and conditions under which the proceeds will be distributed to the beneficiaries. This can be particularly useful in cases where the beneficiaries may not be capable of managing a large sum of money or when the policyholder wants to provide for specific needs such as education or healthcare expenses.

Trust ownership also enables efficient estate planning. Placing the life insurance policy inside a trust can help minimize estate taxes and probate costs. By removing the policy from the insured individual’s estate, the death benefit may not be subject to estate taxes, which can preserve more of the funds for the intended beneficiaries. Additionally, the distribution of the death benefit can be handled privately and without the delays and expenses of probate.

Asset protection is another benefit of trust ownership. By placing the policy in a trust, the funds are safeguarded and shielded from potential creditors or legal claims. This can be particularly valuable if the policyholder wants to protect the death benefit for the financial security of their beneficiaries.

Trust ownership, however, involves certain considerations. Establishing and managing a trust requires careful planning, legal assistance, and ongoing administration. The policyholder must also choose a trustee who will carry out the terms of the trust and ensure compliance with legal requirements. Additionally, the policyholder must be comfortable relinquishing control over the policy to the trust and must consider the impact of any trust-related fees or expenses.

In summary, trust ownership of a life insurance policy can offer significant advantages in terms of control, estate planning, and asset protection. It provides a structured and efficient mechanism for distributing the death benefit and can help minimize estate taxes and probate costs. However, trust ownership requires careful planning and ongoing administration, and it is important to seek legal and financial advice to ensure that it aligns with your specific needs and goals.

Co-ownership

Co-ownership of a life insurance policy involves multiple individuals jointly owning the policy. This can include spouses, siblings, business partners, or any other combination of individuals. Co-ownership can provide various benefits, including shared financial responsibilities and the ability to designate multiple beneficiaries.

One of the primary advantages of co-ownership is the ability to share the cost of premiums. Each co-owner contributes to the payment of premiums, making it more manageable and affordable. This can be particularly useful for family members or business partners who want to pool their resources to secure life insurance coverage.

Moreover, co-ownership allows for the distribution of the death benefit to multiple beneficiaries. Each co-owner can designate their own beneficiaries, ensuring that the proceeds are distributed according to their individual wishes. This can be advantageous in blended families, where multiple spouses or children from different relationships need to be included as beneficiaries.

However, co-ownership also comes with potential complexities and considerations. All co-owners must agree upon the terms of the policy, including premium payments and beneficiary designations. Communication and coordination among co-owners are essential to avoid conflicts or misunderstandings.

Furthermore, the death benefit is typically divided among the co-owners based on their proportionate ownership. This means that the portion of the death benefit received by each co-owner may not align with their individual financial needs or commitments. It is important to consider this aspect and ensure that the distribution of funds is fair and equitable.

Additionally, it’s crucial to address the issue of what happens in the event of a co-owner’s death or desire to exit the co-ownership arrangement. A clear agreement or contract should be established to outline the rights and responsibilities in such circumstances, including the possibility of buying out the departing co-owner’s ownership interest.

In summary, co-ownership of a life insurance policy allows for shared financial responsibilities and the ability to designate multiple beneficiaries. It can be beneficial for families or business partners who want to combine their resources and ensure the fair distribution of the death benefit. However, effective communication, coordination, and clear agreements are essential to successfully navigate the complexities that come with co-ownership.

Conclusion

Choosing the owner of a life insurance policy is a critical decision that should not be taken lightly. The owner holds significant control and responsibility over the policy, making it essential to consider various factors and align with your financial goals and circumstances.

Individual ownership provides maximum control and flexibility, allowing the insured to make changes and choose beneficiaries. Spousal ownership simplifies policy management for married couples. Ownership by beneficiary offers a streamlined transfer of benefits and control over the policy for the intended recipient. Corporate ownership protects businesses in the event of a key person’s death and provides potential tax advantages. Trust ownership allows for control, efficient estate planning, and asset protection. Co-ownership enables shared financial responsibilities and the designation of multiple beneficiaries.

Considerations such as the relationship to the insured, financial responsibility, estate planning objectives, trustworthiness, tax implications, long-term commitment, and ownership structure should all be carefully evaluated in selecting the owner of a life insurance policy.

Ultimately, consulting with insurance professionals, financial advisors, and estate planners is crucial in making an informed decision that aligns with your unique circumstances. These experts can provide guidance and help navigate the complexities associated with different ownership options and their implications.

By carefully considering these factors, you can choose the right owner of a life insurance policy and ensure that it serves as a valuable financial tool that provides the intended protection and benefits to you and your loved ones.