Finance

Why Are Dividends Recorded With Debits

Published: January 2, 2024

Discover why dividends are recorded with debits in finance. Gain insights into the accounting principles that govern dividend transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Dividends are an important aspect of finance and investing, offering investors a portion of a company’s profits as a return on their investment. As dividends have become a popular way for companies to reward their shareholders, it is crucial to accurately record these transactions in financial statements. This is where the concept of debits comes into play.

In accounting and finance, the fundamental principle is the use of debits and credits to record transactions. Debits represent an increase in assets and expenses, while credits represent an increase in liabilities, equity, and revenue. By understanding how debits and credits work, we can delve deeper into why dividends are recorded with debits.

The recording of dividends with debits helps to maintain the balance of the accounting equation, which states that assets must always equal liabilities plus equity. Dividends, being a distribution of profits, directly affect a company’s equity. Therefore, they are recorded as debits to reflect the decrease in the company’s overall equity.

Accurately recording dividends is crucial for maintaining the accuracy and transparency of financial statements. This ensures that investors and stakeholders have a clear understanding of a company’s financial performance. In this article, we will explore the importance of recording dividends accurately and provide examples of how dividend recording is done in practice.

Definition of Dividends

Before diving into the details of why dividends are recorded with debits, let’s first establish a clear understanding of what dividends are. In the realm of finance, dividends refer to a distribution of a company’s profits to its shareholders. These distributions are typically made in the form of cash, additional shares of stock, or other assets.

Dividends are an important incentive for investors to purchase and hold shares in a company. By receiving a portion of the profits, shareholders can generate a return on their investment even if the stock price does not appreciate significantly. Dividends can be seen as a way for companies to reward their shareholders and attract new investors.

It’s important to note that not all companies pay dividends. Some companies, especially those in the growth stage, may choose to reinvest their profits back into the business to fuel expansion and maximize future returns. These companies may offer investors the potential for capital gains through stock price appreciation instead of regular dividend payments.

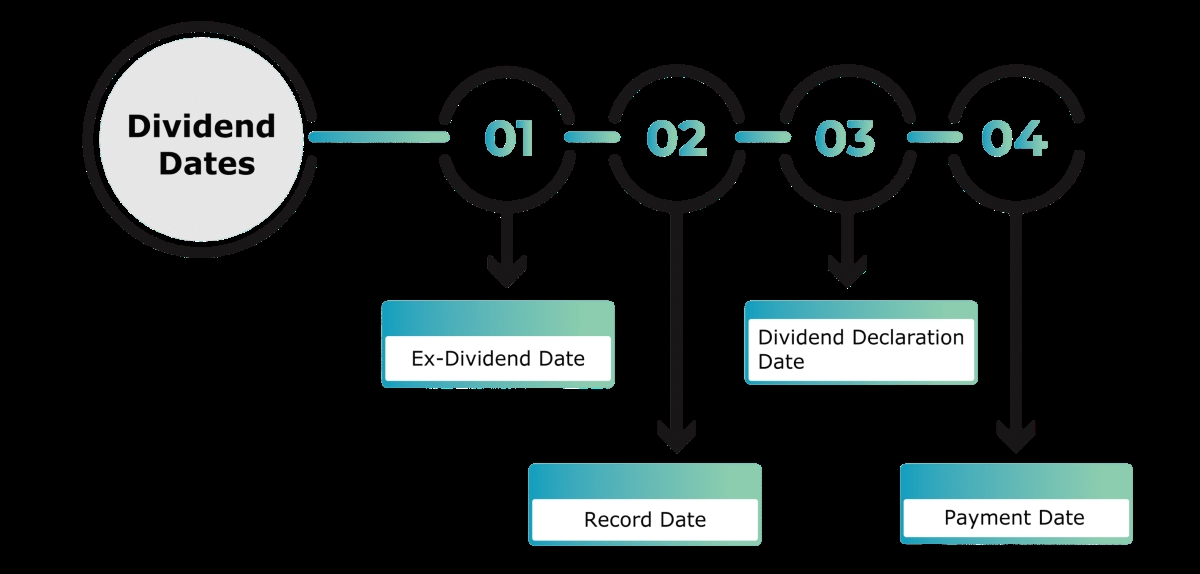

Dividend payments are typically made on a periodic basis, such as quarterly, semi-annually, or annually. The amount of dividends paid to shareholders is determined by the company’s board of directors and can vary based on the company’s profitability, financial health, and strategic goals.

In addition to regular dividends, companies may also issue special dividends or one-time dividend payments. These are often declared when a company realizes exceptional profits, receives a windfall from a strategic decision, or wants to distribute excess cash reserves to shareholders.

Overall, dividends play a crucial role in the financial landscape, providing investors with a tangible return on their investment and adding to the attractiveness of investing in certain stocks. Now that we have established a clear understanding of dividends, let’s explore how they are recorded using the debits and credits system in accounting.

Understanding Debits and Credits

In the field of accounting, debits and credits are fundamental principles used to record financial transactions. This system is based on the concept of double-entry bookkeeping, which ensures that the accounting equation remains balanced.

Debits and credits represent the increase or decrease in different types of accounts. Debits are used to record increases in assets and expenses, while credits are used to record increases in liabilities, equity, and revenue.

Here’s a breakdown of how debits and credits work:

- Debits (+): Debits are used to record the following types of transactions:

- Increases in assets, such as cash, accounts receivable, and inventory

- Increases in expenses, such as salaries, rent, and utilities

- Decreases in liabilities and equity, such as payments to suppliers or dividends distributed to shareholders

- Credits (-): Credits are used to record the following types of transactions:

- Increases in liabilities, such as accounts payable and loans payable

- Increases in equity, such as contributions from shareholders or retained earnings

- Increases in revenue, such as sales or interest income

It’s important to understand that debits and credits affect different types of accounts in opposite ways. For example, an increase in an asset account is recorded with a debit, while an increase in a liability account is recorded with a credit.

By using the double-entry bookkeeping system, each financial transaction is recorded with both a debit and credit, ensuring that the accounting equation remains in balance. This system provides a reliable way to track and analyze the financial activities of a business.

Now that we have a solid understanding of debits and credits, we can explore why dividends, as a distribution of profits, are recorded with debits in the accounting process.

Dividends and the Accounting Equation

The accounting equation provides the foundation for recording financial transactions accurately. It states that assets must always equal liabilities plus equity. Dividends, being a distribution of profits, directly impact a company’s equity.

When a company declares and pays dividends to its shareholders, it reduces its retained earnings, which is a component of equity. This decrease in retained earnings must be balanced by an equal decrease in another component of equity, such as the capital stock or additional paid-in capital.

By recording the decrease in retained earnings as a debit, the accounting equation remains balanced. Debits increase the asset and expense accounts while decreasing the equity and liability accounts. Therefore, debiting the retained earnings account appropriately reflects the reduction in equity resulting from the payment of dividends.

The accounting equation can be presented as follows:

Assets = Liabilities + Equity

To keep the equation balanced after the declaration and payment of dividends, the equity portion must be reduced, which is done through a debit to the retained earnings account. It is important to accurately account for dividends to maintain the integrity of financial statements and provide stakeholders with a clear picture of the company’s financial position.

It’s worth noting that recording dividends as debits does not imply that dividends are expenses. Dividends are a distribution of profits to shareholders and not considered an expense incurred in the normal course of business. Instead, they represent a reduction in the company’s equity.

Now that we understand how dividends impact the accounting equation, let’s explore how dividends are recorded with debits in the financial statements.

Recording Dividends with Debits

When recording dividends in the financial statements, the debits and credits system is employed to ensure accuracy and maintain the balance of the accounting equation. As mentioned earlier, dividends are recorded as debits to reflect the decrease in a company’s overall equity.

The specific accounts involved in recording dividends may vary depending on the company’s organizational structure, but the most common approach is to debit the retained earnings account. This account represents the accumulated profits that have not been distributed to shareholders.

By debiting the retained earnings account, the company decreases its equity, aligning with the reduction caused by the distribution of dividends. The credit for the same amount is typically recorded in the dividends payable account to show the liability owed to the shareholders.

It’s important to note that the dividends payable account is used to record the amount of dividends declared by the company but not yet paid to the shareholders. Once the dividends are actually paid, the liability is settled, and the dividends payable account is reduced to zero.

Let’s look at an example to illustrate the recording of dividends with debits:

ABC Corporation declares a dividend of $10,000 to its shareholders. The entry to record the dividend payment would look as follows:

- Debit: Retained Earnings $10,000

- Credit: Dividends Payable $10,000

This entry reduces the retained earnings by $10,000, which reflects the distribution of profits to the shareholders. At the same time, it establishes a liability in the form of dividends payable, representing the amount owed to the shareholders.

Once the dividend is paid to the shareholders, the dividends payable account is reduced, and the payment is recorded as follows:

- Debit: Dividends Payable $10,000

- Credit: Cash $10,000

This entry reduces the dividends payable account to zero, reflecting the settlement of the liability, and decreases the cash account as the payment is made.

By accurately recording dividends with debits, companies can ensure the integrity of their financial statements, provide accurate information to stakeholders, and maintain the balance of the accounting equation.

Now that we understand the process of recording dividends with debits, let’s explore the importance of accurately recording dividends in the financial statements.

Importance of Recording Dividends Accurately

Accurately recording dividends in the financial statements is of utmost importance for several reasons. It ensures the transparency and reliability of financial information and allows stakeholders to make informed decisions about the company. Here are the key reasons why accurately recording dividends is crucial:

1. Investor Confidence: Accurate recording of dividends helps build trust and confidence among existing and potential investors. Shareholders rely on financial statements to assess the performance and financial health of a company. By providing accurate and transparent information about dividend distributions, companies can foster investor confidence and attract new investors.

2. Financial Analysis: Accurate dividend recording enables financial analysts and investors to analyze a company’s financial performance more effectively. Dividends are a key indicator of a company’s profitability and its commitment to rewarding shareholders. Proper recording allows analysts to assess the trends and consistency of dividend payments, impacting their valuation models and investment decisions.

3. Legal and Regulatory Compliance: Companies are legally required to prepare and disclose accurate financial statements that comply with accounting standards and regulations. Properly recording dividends ensures compliance with these standards and helps prevent potential legal and regulatory issues that could arise from inaccurate or misleading financial reporting.

4. Taxation and Reporting: Accurate dividend recording is crucial for proper tax reporting and compliance. Dividends received by shareholders are often subject to taxation, and companies must accurately report and document these distributions. Failing to record dividends accurately can result in tax compliance issues and penalties.

5. Decision-Making and Planning: Accurate dividend recording provides management with essential information for decision-making and future planning. By analyzing past dividend payments, managers can assess the impact on cash flow, evaluate the company’s ability to sustain dividend payments, and make informed decisions regarding future distributions.

6. Intercompany Comparisons: Accurate dividend recording allows for meaningful comparisons between companies within the same industry. Investors and analysts often look at dividend policies and practices when assessing a company’s performance relative to its peers. Consistent and accurate recording enhances the reliability of these comparisons and provides a clearer picture of a company’s position within the market.

Overall, accurate recording of dividends is crucial for maintaining investor confidence, complying with legal and regulatory requirements, facilitating financial analysis, and supporting decision-making processes. By ensuring the integrity and transparency of financial statements, companies can establish trust with stakeholders and make more informed strategic decisions.

Examples of Dividend Recording

Now, let’s explore a couple of examples to demonstrate how dividends are recorded in practice. These examples will showcase different scenarios and the corresponding accounting entries for recording dividends.

Example 1: Company A declares a cash dividend of $50,000 to be paid to its shareholders. The entry to record this dividend payment is as follows:

- Debit: Retained Earnings $50,000

- Credit: Dividends Payable $50,000

This entry reduces the retained earnings by $50,000, representing the distribution of profits to shareholders. It also establishes a liability in the form of dividends payable, indicating the amount owed to the shareholders.

Example 2: Company B issues a special dividend in the form of additional shares of stock. For every 10 shares held, each shareholder will receive an additional share of stock. Suppose a shareholder owns 100 shares. The entry to record this special dividend is as follows:

- Debit: Retained Earnings $10,000 (100 shares x $100 per share)

- Credit: Common Stock Dividend Distributable $10,000

This entry reduces the retained earnings by the fair value of the additional shares to be distributed to the shareholders. It also establishes a liability in the form of common stock dividend distributable, representing the value of the additional shares owed to the shareholders.

These examples demonstrate how dividends can be recorded using debits to reflect the decrease in equity and ensure the accuracy and balance of the accounting equation. It’s important to note that the specific accounts used may vary depending on the company’s accounting policies and practices.

Additionally, it’s crucial to maintain proper documentation and record-keeping when recording dividends. This includes keeping track of dividend declaration dates, payment dates, the number of shares involved (if applicable), and any relevant tax implications.

By accurately recording dividends, companies can provide transparency and reliability in their financial reporting, facilitating decision-making, and supporting investors and stakeholders in assessing the company’s financial performance.

Conclusion

Recording dividends with debits is an essential aspect of accurately reflecting the distribution of profits to shareholders and maintaining the balance of the accounting equation. Dividends are an important incentive for investors, and proper recording ensures transparency, compliance, and informed decision-making.

Understanding the concepts of debits and credits is fundamental to comprehending the recording of dividends. Debits represent increases in assets and expenses, while credits represent increases in liabilities, equity, and revenue.

The accounting equation serves as a guide for recording dividends, as it demands that assets always equal liabilities plus equity. By debiting the retained earnings account, the decrease in equity caused by dividend distributions is accurately reflected.

Accurate dividend recording is vital for maintaining investor confidence, complying with legal and regulatory requirements, facilitating financial analysis, and supporting decision-making processes. It enables stakeholders to assess a company’s performance, analyze trends, and make informed investment decisions.

Examples of dividend recording demonstrate the practical application of these concepts, showcasing the specific accounting entries involved in recording dividends.

In conclusion, accurately recording dividends with debits is crucial for the overall integrity and transparency of financial statements. By adhering to proper accounting practices and maintaining accurate records, companies can enhance investor trust, comply with regulations, and provide stakeholders with reliable financial information.

By understanding the significance of dividend recording and employing the principles of debits and credits, companies can navigate the complex world of finance and ensure the accurate representation of dividend distributions to shareholders.