Finance

Preferred Dividend Coverage Ratio Definition

Published: January 10, 2024

Learn about the definition and importance of the preferred dividend coverage ratio in finance. Enhance your understanding of this key financial metric.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Preferred Dividend Coverage Ratio Definition: Everything You Need to Know

Welcome to our Finance category! In today’s blog post, we’ll delve into the world of preferred dividend coverage ratio and break down its definition, significance, and how it can help investors make informed decisions. If you’ve ever wondered how to determine if a company can comfortably meet its preferred dividend obligations, you’re in the right place!

Key Takeaways:

- The preferred dividend coverage ratio is a financial metric that assesses a company’s ability to cover its preferred dividend payments.

- Investors use this ratio to evaluate the financial health and sustainability of a company’s dividend payments.

Now, let’s dive into the preferred dividend coverage ratio definition and explore its intricacies. Essentially, this financial metric provides insight into a company’s ability to meet its financial obligations towards preferred shareholders. Preferred shares are a type of ownership in a company that typically receive fixed dividend payments before common shareholders.

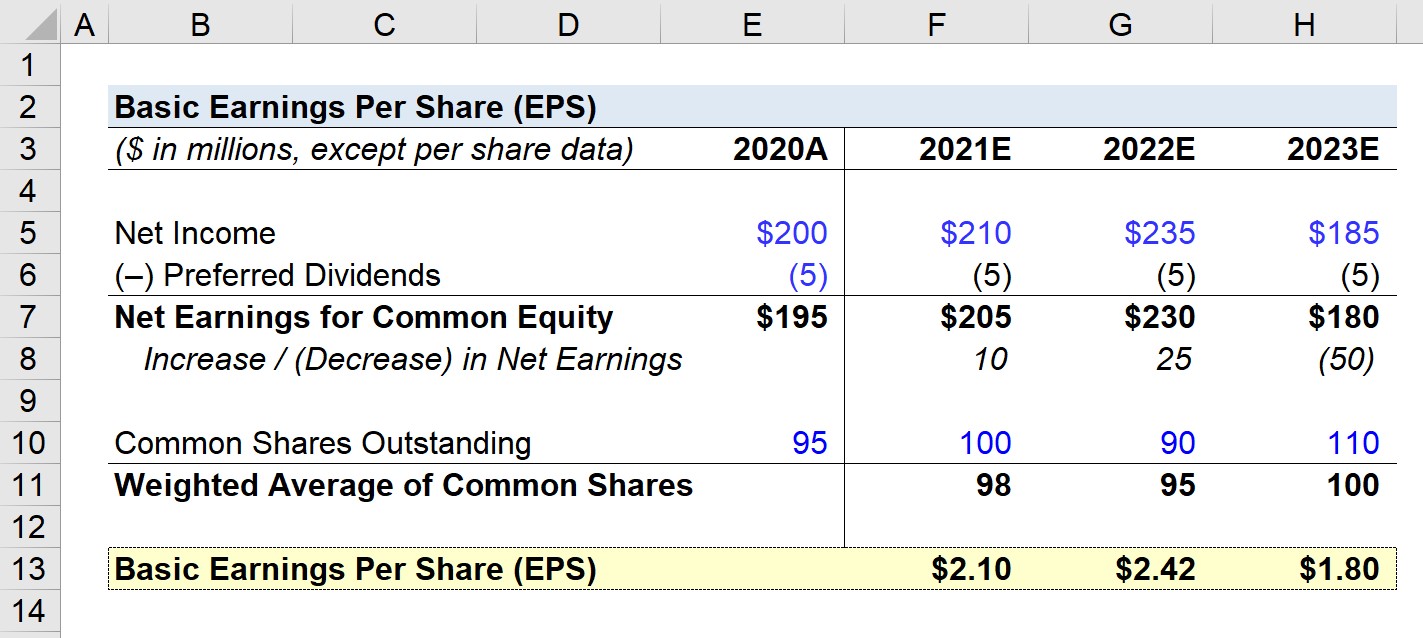

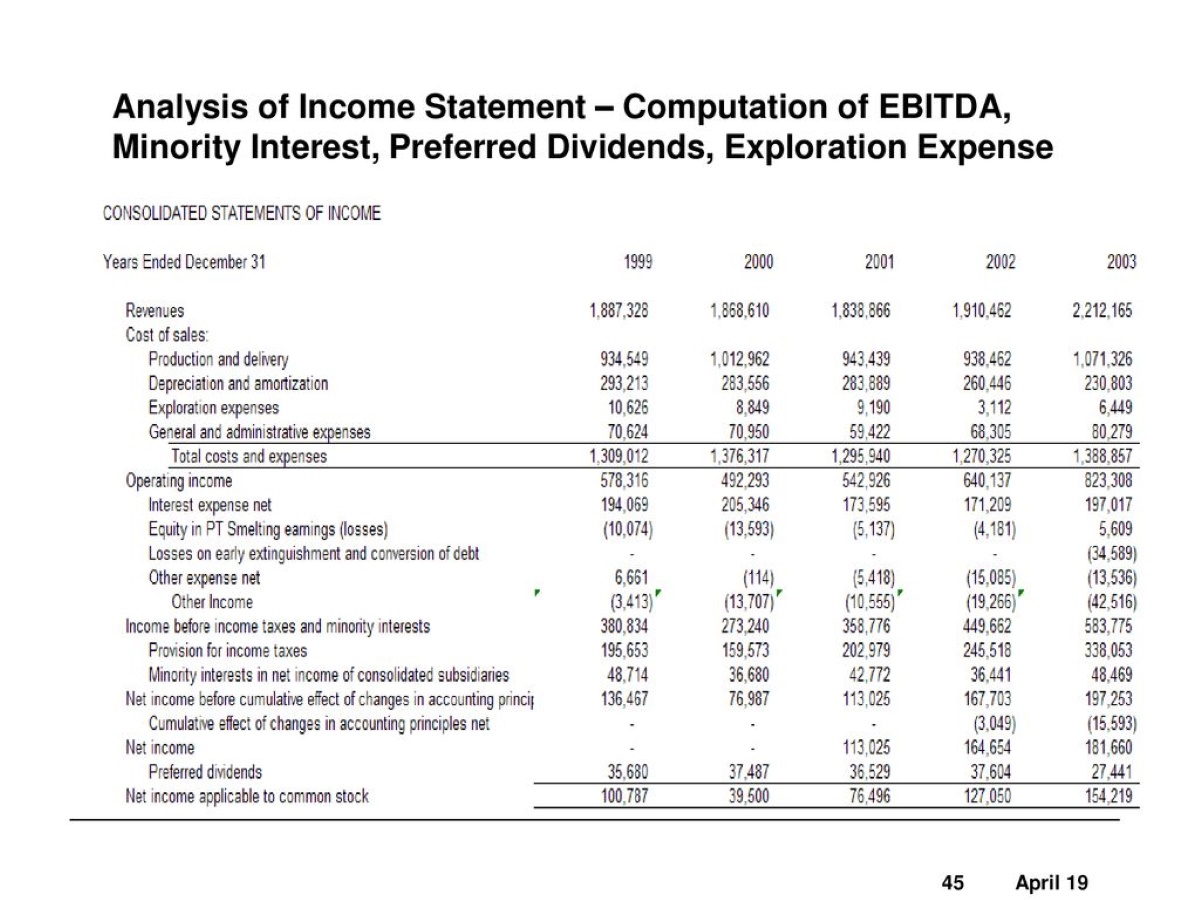

Calculating the preferred dividend coverage ratio is relatively straightforward. It involves dividing a company’s net income available to preferred shareholders by the total preferred dividend payments owed by the company during a specific period. The resulting ratio indicates how many times the company can cover its preferred dividend obligations.

While the preferred dividend coverage ratio may vary across different industries, analysts generally consider a ratio higher than 1 as a sign of financial strength. A ratio below 1 implies that a company may not have sufficient earnings to fulfill its preferred dividend payments, raising concerns for potential investors.

The preferred dividend coverage ratio is an essential metric for both potential investors and existing shareholders. Here are some key reasons why:

- Assessing financial stability: A high preferred dividend coverage ratio indicates that a company has a strong financial position and can comfortably meet its obligations. This is particularly important for investors who rely on dividend income as a source of regular cash flow.

- Predicting dividend sustainability: The ratio is a crucial tool in evaluating the sustainability of dividend payments. A company with a consistently high preferred dividend coverage ratio is more likely to continue paying dividends in the future, providing investors with greater confidence.

Ultimately, the preferred dividend coverage ratio provides valuable insights into a company’s financial health, its commitment to preferred shareholders, and the potential risks associated with its dividend payments. However, it’s essential to consider other financial metrics and factors when making investment decisions, as the ratio alone does not provide a complete picture.

In conclusion, understanding the preferred dividend coverage ratio definition is essential for investors seeking stability and predictability in dividend payments. By incorporating this metric into their analysis, investors can make more informed decisions about purchasing preferred shares and potentially benefit from regular dividend income.

Thank you for reading our blog post today. Stay tuned for more insightful articles in the Finance category!