Finance

How To Record Declared Dividends

Published: January 2, 2024

Learn how to record declared dividends in your financial statements with this comprehensive guide. Improve your finance management skills and ensure accurate accounting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What are Declared Dividends?

- Importance of Recording Declared Dividends

- Step 1: Gather Necessary Information

- Step 2: Create a Record Keeping System

- Step 3: Document Date and Amount of Dividends

- Step 4: Classify Dividends by Type

- Step 5: Update General Ledger

- Step 6: Reconcile Dividend Payments

- Step 7: Store Dividend Records Safely

- Conclusion

Introduction

Welcome to our comprehensive guide on how to record declared dividends. Whether you are a business owner, an accountant, or a finance enthusiast, understanding how to properly document and track dividends is essential. Declared dividends are a common practice in the finance world, and it is important to have a systematic approach in recording them.

In this article, we will walk you through the step-by-step process of recording declared dividends to ensure accurate financial records and compliance with regulatory requirements. We will cover the importance of recording dividends, the necessary information you need to gather, creating a record keeping system, documenting dates and amounts, classifying dividends by type, updating your general ledger, reconciling dividend payments, and storing dividend records safely.

Effective dividend recording not only helps you keep track of your finances but also provides a clear picture of the financial health of your business. Accurate dividend records are essential for financial reporting, tax compliance, and decision-making purposes. By implementing proper dividend recording practices, you can manage your business efficiently and make well-informed financial decisions.

It’s important to note that each business may have its own unique dividend recording procedures and requirements, depending on its organizational structure and jurisdiction. This guide aims to provide a general framework that can be adapted to different scenarios. Always consult with a professional accountant or financial advisor for specific guidance tailored to your business needs.

So, let’s dive into the world of recording declared dividends and equip ourselves with the knowledge and skills to maintain accurate financial records.

What are Declared Dividends?

Declared dividends refer to the portion of a company’s profits that is distributed to its shareholders. These dividends are typically declared by the company’s board of directors and are paid out in the form of cash, additional shares, or other assets.

Dividends serve as a way for companies to share their profits with their shareholders, providing them with a return on their investment. They are often paid on a regular basis, such as quarterly, semi-annually, or annually, depending on the company’s dividend policy.

There are different types of declared dividends, including:

- Cash Dividends: This is the most common type of dividend, where shareholders receive a cash payment directly into their bank accounts. Cash dividends are typically expressed as a fixed amount per share or as a percentage of the company’s earnings.

- Stock Dividends: In this case, instead of receiving cash, shareholders are given additional shares of the company’s stock. These stock dividends are distributed proportionally to the number of shares held by each shareholder.

- Property Dividends: Some companies may choose to distribute dividends in the form of property or assets, such as real estate, equipment, or securities. This type of dividend is less common but can provide additional value to shareholders.

- Special Dividends: Special dividends are one-time payments that are not part of the regular dividend schedule. These dividends are usually paid when a company has exceptional profits or surplus cash and wants to reward its shareholders. Special dividends may be in the form of cash or other assets.

It is important to note that not all companies pay dividends. Some companies may choose to reinvest their profits back into the business for growth and expansion, while others may have different capital allocation strategies. The decision to pay dividends is influenced by various factors, including the company’s financial performance, cash flow position, future growth prospects, and the preferences of its shareholders.

By recording and tracking declared dividends accurately, shareholders can keep track of their income from investments and make informed decisions. Additionally, businesses can maintain transparent financial records, comply with regulatory requirements, and demonstrate their commitment to shareholder value.

Importance of Recording Declared Dividends

Recording declared dividends is a crucial aspect of financial record-keeping for both businesses and individual shareholders. Accurate and timely documentation of dividends helps in maintaining transparency, complying with regulatory requirements, and making well-informed financial decisions. Here are a few reasons why recording declared dividends is important:

- Financial Reporting: Properly recorded dividends are important for financial reporting purposes. Companies need to accurately report their dividend payments in their financial statements to provide stakeholders with a clear view of the company’s financial performance.

- Tax Compliance: For individual shareholders, recording dividends is crucial for tax compliance. Dividend income is subject to taxation, and it is important to accurately report dividend payments on tax returns. Failure to properly record and report dividends can lead to penalties and legal issues.

- Shareholder Communication: Recording declared dividends helps companies communicate with their shareholders effectively. By maintaining accurate dividend records, companies can provide shareholders with detailed information about dividend payments, including dates, amounts, and types of dividends. This enhances transparency and helps build trust and loyalty among shareholders.

- Investment Analysis: Individual investors and financial analysts rely on dividend information to evaluate the performance of a company. By recording dividends, companies provide valuable data that can be used in investment analysis, such as calculating dividend yields, analyzing dividend growth rates, and assessing a company’s ability to generate consistent returns for shareholders.

- Legal Compliance: In many jurisdictions, companies are legally required to maintain accurate records of dividend payments. Failing to comply with these requirements can result in penalties or legal consequences. By properly recording dividends, companies can ensure compliance with the applicable laws and regulations.

- Tracking Shareholder Wealth: For individual shareholders, recording dividends is essential for tracking their investment returns and assessing the performance of their portfolio. By keeping a record of dividend payments, shareholders can calculate their income, monitor dividend growth over time, and make informed decisions about their investment strategy.

Recording declared dividends is not only a compliance issue but also a best practice in financial management. It provides transparency, facilitates accurate reporting, and enables effective decision making. Whether you are a company distributing dividends or an individual receiving them, maintaining proper dividend records is essential for financial well-being and success.

Step 1: Gather Necessary Information

Before you start recording declared dividends, it is important to gather all the necessary information to ensure accurate and comprehensive documentation. Here are the key pieces of information you need:

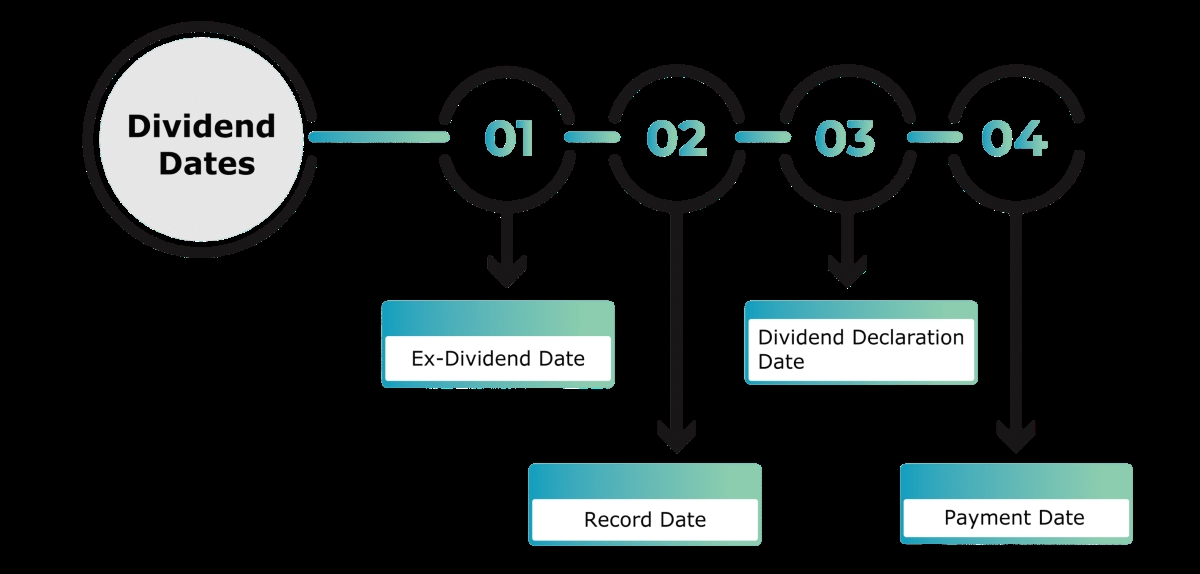

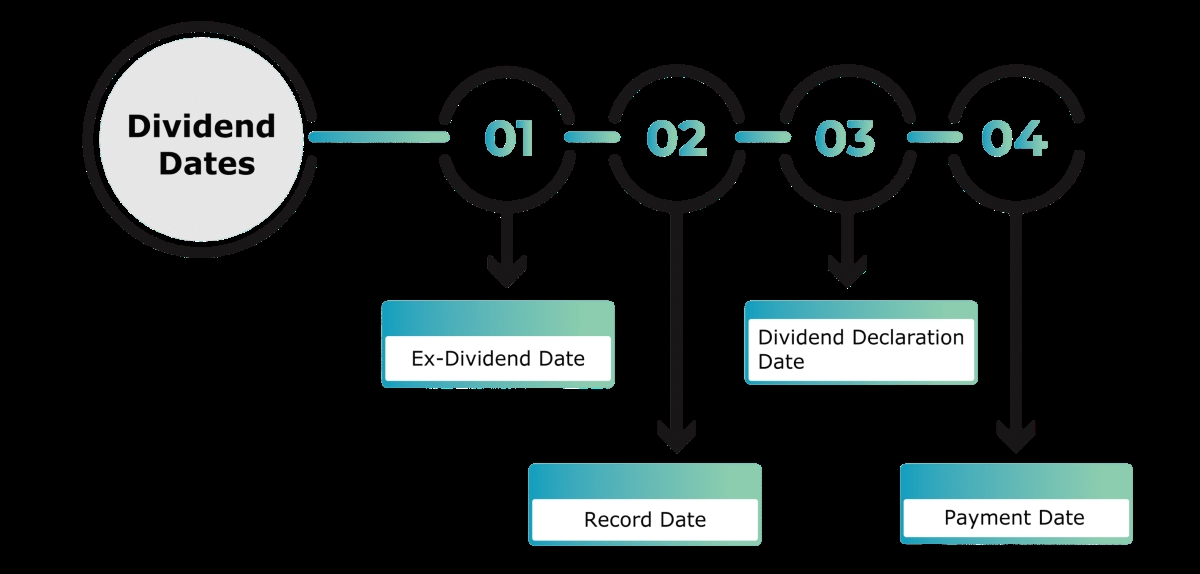

- Dividend Declaration Date: Determine the date on which the dividend was officially declared by the board of directors. This is the date from which the dividend becomes a liability for the company.

- Payment Date: Identify the date when the dividend will be paid to the shareholders. This is the date on which the actual cash or other assets will be distributed.

- Dividend Amount: Determine the total amount of the dividend to be paid. This information can often be found in the dividend declaration announcement or the company’s financial statements. It is important to record the dividend amount accurately to ensure proper financial reporting.

- Shareholder Information: Collect the necessary details of the shareholders who are eligible to receive the dividend. This includes their names, contact information, and the number of shares they hold. Maintaining accurate shareholder information is crucial for dividend distribution and communication purposes.

- Dividend Reinvestment Plan (if applicable): If the company offers a dividend reinvestment plan (DRIP), gather information related to shareholders who have opted to reinvest their dividends. This includes the number of reinvested shares and any relevant instructions provided by the shareholders.

- Tax Withholding Requirements: Understand any tax withholding obligations associated with dividend payments. Depending on the jurisdiction, companies may need to withhold a certain percentage of the dividend as taxes and remit them to the appropriate tax authorities.

- Legal and Regulatory Requirements: Familiarize yourself with the legal and regulatory requirements related to dividend payments in your jurisdiction. This includes any reporting or documentation obligations that need to be fulfilled. Compliance with these requirements is vital to avoid legal issues and penalties.

Gathering the necessary information before recording declared dividends ensures that you have all the relevant data needed for accurate documentation. It enables smooth dividend processing, facilitates proper financial reporting, and helps maintain compliance with legal and regulatory obligations.

Once you have gathered all the required information, you are ready to move on to the next step: creating a record keeping system to document the declared dividends effectively.

Step 2: Create a Record Keeping System

Creating a well-organized and efficient record keeping system is essential for accurately tracking and documenting declared dividends. A structured system will enable you to easily retrieve dividend-related information, ensure compliance, and maintain transparent financial records. Follow these steps to create a record keeping system:

- Choose an Organizational Method: Determine how you want to organize your dividend records. You can choose to use physical folders and files or opt for a digital system using spreadsheets or specialized accounting software. Select a method that aligns with your resources and business requirements.

- Establish File Names and Folders: Create a consistent naming convention for your dividend files and set up folders to categorize different types of dividend records. Common categories may include dividend declarations, payment confirmations, shareholder information, and tax documents.

- Define Record Retention Period: Identify the duration for which you need to retain dividend records based on legal and regulatory requirements. Different jurisdictions have varying retention periods. Ensure that you comply with these guidelines to avoid any penalties or legal issues.

- Ensure Data Security: Implement security measures to protect the confidentiality and integrity of your dividend records. This may include encryption, restricted access, regular backups, and secure storage options. Safeguarding sensitive financial information is crucial to maintain trust and compliance.

- Maintain Clear Documentation: Create a document outlining your record keeping system, including the procedures, responsibilities, and workflows associated with recording dividends. This will provide a clear reference and ensure consistency in your dividend tracking process.

- Regularly Review and Update: Periodically review your record keeping system to ensure it remains effective and relevant. As your business evolves, you may need to adapt your system to accommodate new requirements or changes in regulations.

A well-designed record keeping system will not only streamline the process of recording declared dividends but also enhance transparency, accuracy, and compliance. It will provide you with easy access to historical dividend records, facilitate tax reporting, and support effective communication with shareholders and regulatory authorities.

Remember, maintaining a systematic record keeping system is an ongoing process. Regularly assess and refine your system to ensure it continues to meet your business needs and keeps pace with evolving best practices and regulatory requirements.

Step 3: Document Date and Amount of Dividends

Once you have gathered the necessary information, the next step in recording declared dividends is to document the date and amount of the dividends accurately. This step is crucial for maintaining accurate financial records and providing transparency to shareholders and regulatory authorities. Follow these guidelines:

- Record the Declaration Date: Document the date on which the dividend was officially declared by the company’s board of directors. This is the date from which the dividend becomes a liability for the company and should be noted in your dividend records.

- Note the Payment Date: Record the date when the dividend is scheduled to be paid to shareholders. This is the date on which the actual cash or assets will be distributed. Make sure to accurately record this date in your dividend records as it is crucial for financial reporting and shareholder communication.

- Record the Dividend Amount: Document the total amount of the dividend to be paid. This information can usually be found in the dividend declaration announcement or the company’s financial statements. Clear and accurate documentation of the dividend amount is essential for financial reporting purposes and investor analysis.

- Specify the Currency: Indicate the currency in which the dividend will be paid. This is important for international investors and ensures consistency in your dividend records.

- Consider Dividend Per Share: If the dividend is expressed as an amount per share, calculate and document the dividend per share by dividing the total dividend amount by the number of outstanding shares. This helps in providing precise information to shareholders.

- Document Dividend Frequency: If the company pays dividends on a regular schedule, note the frequency, such as quarterly, semi-annually, or annually. This information provides a clear picture of the company’s dividend distribution pattern.

- Enter Additional Information: Depending on your specific requirements, you may want to record additional details, such as the reason for the dividend payment, any applicable tax withholding rates, or any special considerations related to the dividend.

Accurate documentation of the date and amount of declared dividends is crucial for financial reporting, shareholder communication, and compliance with regulatory requirements. It provides transparency, facilitates tax reporting, and enables accurate calculation of returns for investors. By following these guidelines, you can ensure that your dividend records are reliable and serve as a valuable resource for both internal and external stakeholders.

Step 4: Classify Dividends by Type

After documenting the date and amount of declared dividends, the next step in recording dividends is to classify them by type. Depending on the dividend policy of the company, different types of dividends may be distributed to shareholders. Classifying dividends by type allows for accurate financial reporting, tax compliance, and investor analysis. Follow these guidelines to classify dividends:

- Cash Dividends: If the dividend is in the form of cash, classify it as a cash dividend. This is the most common type of dividend, where shareholders receive a cash payment directly into their bank accounts.

- Stock Dividends: If the dividend is in the form of additional shares of the company’s stock, classify it as a stock dividend. Shareholders receive additional shares proportionally to their existing shareholding.

- Property Dividends: If the dividend is in the form of property or assets, such as real estate, equipment, or securities, classify it as a property dividend. This type of dividend is less common but provides shareholders with tangible assets instead of cash or stock.

- Special Dividends: If the dividend is a one-time payment that is not part of the regular dividend schedule, classify it as a special dividend. This type of dividend is usually paid when a company has exceptional profits or surplus cash and wants to reward its shareholders.

- Dividend Reinvestment: If the company offers a dividend reinvestment plan (DRIP), classify the reinvested dividends separately. This allows you to track the number of shares reinvested by shareholders and differentiate them from cash or stock dividends.

- Other Categories (if applicable): Depending on the specific dividend policies and practices of the company, you may need to create additional categories to classify dividends. For example, if the company issues preferred stock and pays dividends on both common and preferred shares, you may need separate classifications for each.

By classifying dividends based on their types, you maintain clear and accurate records of the different ways in which the company distributes profits to shareholders. Classification enables you to provide detailed information in financial statements, track different types of dividend payments, and analyze the impact of dividends on shareholder returns.

It’s important to note that the classification may vary depending on the specific terminology and practices in your industry or jurisdiction. It’s recommended to consult accounting standards or seek guidance from a professional accountant to ensure compliance with applicable regulations and best practices.

Step 5: Update General Ledger

Once you have recorded and classified the declared dividends, the next step is to update the general ledger. The general ledger is a central accounting record that summarizes all financial transactions of a company. Updating the general ledger with dividend information ensures accurate financial reporting and maintains a complete and organized record of dividend distributions. Follow these guidelines to update the general ledger:

- Create a Dividend Account: If you don’t already have a dedicated account for dividends in your general ledger, create one. This account will serve as the central repository for recording all dividend-related transactions.

- Update the Dividend Account: Record the declared dividends in the dividend account, segregating them by type (cash, stock, property, special, etc.), and noting the respective amounts for each dividend type. This ensures that the dividend transactions are properly classified and can be easily tracked.

- Include Dividend Dates: Document the dividend declaration date and the payment date in the general ledger. This provides a clear timeline of when the dividends were declared and when they were distributed to shareholders.

- Record Dividend Payments: When the dividends are distributed to shareholders, record the payment transactions in the general ledger. This includes crediting the dividend account and debiting the corresponding cash or asset accounts, depending on the type of dividend.

- Consider Withholding Taxes: If applicable, record any withholding taxes associated with dividend payments. This involves crediting the dividend account for the tax withheld and debiting an appropriate tax account. Compliance with tax withholding requirements is essential for accurate financial reporting and tax compliance.

- Reconcile Dividend Account: Regularly reconcile the dividend account in the general ledger with the dividend payments made and ensure that the balances match. This helps to identify any discrepancies and maintain the accuracy of dividend records.

Updating the general ledger with dividend information provides a comprehensive view of the company’s dividend activities. It enables accurate financial reporting, supports investor analysis, and ensures compliance with accounting standards. By maintaining a well-maintained and up-to-date general ledger, you can easily track dividend transactions and have a clear picture of the financial impact of dividend distributions.

Remember to follow your company’s accounting policies and procedures, as well as any relevant accounting standards or regulations specific to your industry, when updating the general ledger with dividend transactions.

Step 6: Reconcile Dividend Payments

Reconciling dividend payments is a crucial step in the process of recording declared dividends. Reconciliation ensures that the dividend payments made to shareholders align with the financial records and serves as a critical control measure to identify and resolve any discrepancies. Follow these guidelines to reconcile dividend payments:

- Review Payment Records: Gather all documentation related to dividend payments, such as bank statements, payment confirmations, and shareholder records. Ensure that you have accurate records of the amounts paid, dates of payment, and recipients of the dividends.

- Compare with Dividend Records: Compare the dividend payment records with the information recorded in the dividend account of the general ledger. Verify that the dividend amounts, payment dates, and recipient details match between the two sets of records.

- Investigate Discrepancies: If you identify any discrepancies between the payment records and the dividend account, investigate them to identify the cause. Common discrepancies may include incorrect payment amounts, missing payments, or discrepancies in shareholder information.

- Adjust Entries if Required: If discrepancies are found, make the necessary adjustments in the general ledger and dividend account. This may involve correcting the payment amounts, updating shareholder information, or reconciling any outstanding payments or errors.

- Document Reconciliation Adjustments: Document any adjustments made during the reconciliation process. Note the reason for the adjustment, the supporting documentation, and the date of the adjustment. This provides a clear audit trail and ensures transparency in the reconciliation process.

- Perform Regular Reconciliations: Reconcile dividend payments on a regular basis, such as monthly or quarterly, depending on the volume of dividend transactions. Regular reconciliations help identify and resolve discrepancies in a timely manner, ensuring the accuracy of dividend records and financial reporting.

Reconciling dividend payments is a critical control measure to maintain the integrity and accuracy of dividend records. By comparing payment records with the dividend account in the general ledger, investigating discrepancies, and making any necessary adjustments, you ensure that dividend payments are properly accounted for and reconciled with the company’s financial records.

Remember to follow your company’s internal controls and review the reconciliation process for accuracy and completeness. Documentation is key during the reconciliation process, as it provides evidence of the reconciliation steps taken and helps with internal and external audits.

Step 7: Store Dividend Records Safely

Storing dividend records safely is a crucial final step in recording declared dividends. Proper storage ensures the security and integrity of the records, facilitates easy access when needed, and helps with compliance and audit requirements. Follow these guidelines to store dividend records safely:

- Choose a Secure Storage Method: Select a secure storage method for your dividend records. This can include physical file cabinets or digital storage solutions, such as secure cloud-based platforms or encrypted drives. The chosen method should provide protection against unauthorized access, loss, or damage.

- Organize and Label Records: Organize dividend records in a logical and consistent manner. Use clear labels or file names that accurately describe the contents of each record. This facilitates easy retrieval and minimizes the risk of misplacing or losing important documents.

- Implement Access Controls: Restrict access to dividend records by implementing appropriate access controls. This can involve limiting physical access to file cabinets or designating specific individuals with authorized access to digital storage. Regularly review and update access privileges to ensure that only authorized personnel can access the records.

- Back up Digital Records: If you store dividend records digitally, implement regular backup procedures to prevent data loss. Backing up the records ensures that you have a secondary copy in case of accidental deletion, system failure, or other unforeseen events. Regularly test the backup and ensure that it is securely stored and easily retrievable.

- Retain Records for Appropriate Periods: Understand the legal and regulatory requirements for record retention in your jurisdiction. Maintain dividend records for the required time period, disposing of them only after the specified retention period has elapsed. This ensures compliance with regulations and facilitates efficient record management.

- Monitor Record Integrity: Regularly verify the integrity of dividend records by conducting periodic reviews or audits. Check for completeness, accuracy, and the presence of all necessary documentation. This helps identify any potential issues or gaps in the record-keeping process.

- Protect Physical Records from Damage: If you have physical dividend records, take precautions to protect them from damage or loss. Store them in a secure location away from water, fire hazards, or other potential threats. Consider using fire-resistant cabinets or off-site storage for added protection.

By storing dividend records safely, you ensure that the records are protected from unauthorized access, loss, or damage. This promotes efficient record management, compliance with legal and regulatory requirements, and helps maintain the integrity and security of dividend-related information.

Remember to regularly review your record storage practices, update access controls as needed, and stay informed about any changes in record retention requirements to ensure that your dividend records remain secure and accessible over time.

Conclusion

Recording declared dividends is a critical process for businesses and shareholders alike. Accurate and systematic documentation of dividends ensures transparent financial records, compliance with regulatory requirements, and informed decision-making. By following the step-by-step guide outlined in this article, you can establish a robust framework for recording declared dividends.

We started by understanding what declared dividends are and the different types that companies may distribute to their shareholders. We then explored the importance of recording dividends, emphasizing the significance of financial reporting, tax compliance, shareholder communication, and investment analysis.

We then delved into the practical steps involved in recording declared dividends. We discussed the importance of gathering necessary information, creating a record keeping system, documenting dates and amounts of dividends, classifying dividends by type, updating the general ledger, reconciling dividend payments, and storing dividend records safely.

Following these steps ensures accurate financial records, enhances transparency, supports regulatory compliance, and provides valuable information for shareholders, investors, and other stakeholders.

Remember, while this guide provides a general framework, it is important to adapt the process to your specific business needs, industry regulations, and jurisdictional requirements. Always consult with a professional accountant or financial advisor for tailored guidance to ensure compliance with applicable laws and best practices.

By diligently recording declared dividends, you demonstrate your commitment to sound financial management, provide stakeholders with accurate and transparent information, and lay the foundation for successful business operations.