Home>Finance>Why Are Private And Public Pension Funds Underfunded?

Finance

Why Are Private And Public Pension Funds Underfunded?

Published: January 23, 2024

Discover the reasons behind the underfunding of private and public pension funds in the finance sector and learn about potential solutions. Explore the impact and implications of pension fund underfunding.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Dilemma of Underfunded Pension Funds

- Deciphering the Role and Mechanisms of Pension Funds

- Unraveling the Complex Web of Underfunding Determinants

- Unveiling the Ramifications of Pension Fund Underfunding

- Navigating Toward Solutions for Pension Fund Sustainability

- Forging a Path Toward Resilient and Sustainable Pension Systems

Introduction

Understanding the Dilemma of Underfunded Pension Funds

Pension funds play a pivotal role in securing the financial future of millions of individuals, serving as a reliable source of income during retirement. However, the issue of underfunded pension funds has become a cause for concern in both the private and public sectors. This phenomenon arises when the assets held by a pension fund are insufficient to cover its future liabilities, casting a shadow of uncertainty over the retirement security of countless workers.

The underfunding of pension funds poses a multifaceted challenge, impacting not only the retirees who depend on these funds but also the financial stability of the organizations responsible for managing them. Understanding the underlying causes and consequences of underfunded pension funds is crucial in formulating effective strategies to mitigate this issue and safeguard the retirement prospects of current and future generations.

This article delves into the intricate landscape of pension fund underfunding, shedding light on the factors contributing to this predicament and the far-reaching implications it engenders. By exploring the complexities surrounding underfunded pension funds, we can glean insights into potential solutions and preventive measures, ultimately striving to fortify the resilience and sustainability of pension systems.

Understanding Pension Funds

Deciphering the Role and Mechanisms of Pension Funds

Pension funds, whether managed by private corporations or public entities, serve as instrumental vehicles for individuals to accumulate savings and secure a steady income stream during retirement. These funds operate on the fundamental principle of long-term investment, pooling contributions from employees, employers, or both, and channeling these funds into a diversified portfolio of assets such as stocks, bonds, and real estate.

The mechanism of pension funds revolves around the concept of compounding returns, wherein the contributions made by participants are invested over extended periods, allowing the funds to grow and generate returns that accrue over time. This approach aims to harness the power of financial markets to build a substantial corpus that can support retirees in their post-employment years.

Private pension funds are typically sponsored by employers, offering a retirement benefit as part of the employee compensation package. In contrast, public pension funds are established by governmental bodies to provide retirement and related benefits to public sector employees. Both private and public pension funds are subject to regulatory oversight and are entrusted with the fiduciary responsibility of prudently managing the assets to fulfill their long-term obligations to beneficiaries.

Understanding the intricate workings of pension funds is pivotal in comprehending the challenges associated with underfunding. The sustainability of pension funds hinges on their ability to generate investment returns that outpace the growth of liabilities, ensuring that the promised benefits can be met without depleting the fund’s assets. However, the reality of underfunded pension funds underscores the complexities and vulnerabilities inherent in these financial instruments, necessitating a closer examination of the factors contributing to this predicament.

Factors Contributing to Underfunding

Unraveling the Complex Web of Underfunding Determinants

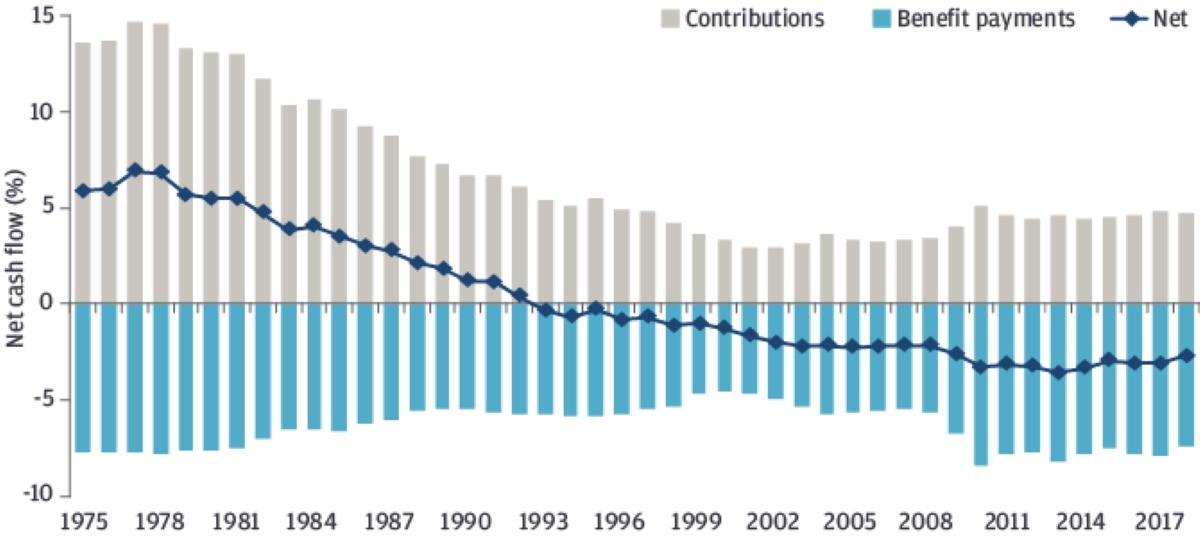

The underfunding of pension funds can be attributed to a confluence of factors that collectively exert pressure on the financial viability of these retirement vehicles. One of the primary contributors to underfunding is demographic shifts, characterized by an aging population and declining birth rates. As the proportion of retirees relative to the working-age population increases, pension funds face heightened obligations to disburse benefits without a proportional surge in contributions, straining their financial reserves.

Furthermore, economic volatility and prolonged periods of low interest rates pose significant challenges to pension funds. These conditions diminish the investment returns generated by the fund’s assets, impeding their capacity to grow at a rate that aligns with the escalating liabilities. Inadequate investment performance, stemming from market downturns or suboptimal asset allocation, amplifies the underfunding predicament, compelling pension funds to grapple with diminished resources to meet their long-term commitments.

Another pivotal factor contributing to underfunding is the discrepancy between actuarial assumptions and actual outcomes. Flawed projections regarding life expectancies, wage growth, and inflation rates can result in miscalculations of future liabilities, leading to underestimations of the funds required to fulfill pension obligations. Moreover, inadequate funding discipline and governance lapses within pension fund management can exacerbate underfunding, as suboptimal decision-making and lax oversight compromise the fund’s financial health.

Regulatory changes and accounting standards also influence the underfunding dynamics of pension funds. Alterations in funding requirements, such as adjustments to contribution levels or funding targets, can impact the fund’s financial position, potentially exacerbating underfunding. Additionally, the adoption of more stringent accounting methodologies may reveal previously unrecognized underfunding, necessitating corrective measures to address the newfound shortfall.

Understanding the multifaceted nature of these contributing factors is essential in devising strategies to mitigate underfunding and fortify the resilience of pension funds. By scrutinizing the interplay of demographic, economic, regulatory, and governance elements, stakeholders can proactively address the root causes of underfunding, steering pension systems toward greater stability and sustainability.

Impact of Underfunded Pension Funds

Unveiling the Ramifications of Pension Fund Underfunding

The repercussions of underfunded pension funds reverberate across multiple facets of society, exerting profound effects on retirees, workers, organizations, and the broader economy. For retirees reliant on pension benefits, underfunding precipitates heightened financial insecurity, jeopardizing their ability to maintain a comfortable standard of living during retirement. The specter of benefit cuts or diminished payouts looms large, impinging on the well-being and quality of life of retirees who had anticipated a secure financial cushion in their later years.

Workers actively contributing to underfunded pension funds also face a precarious scenario, as the sustainability of their future retirement benefits becomes increasingly uncertain. Fears of reduced or deferred pension payouts may instill anxiety and prompt individuals to seek alternative retirement savings avenues, thereby disrupting long-term financial planning and potentially impeding overall workforce morale and productivity.

From an organizational standpoint, entities responsible for managing underfunded pension funds encounter a slew of challenges. The financial strain imposed by underfunding can encumber the capacity of organizations to allocate resources toward core business operations and growth initiatives. Moreover, the specter of escalating pension liabilities may erode investor confidence and credit ratings, exerting adverse implications on the organization’s financial standing and market competitiveness.

On a macroeconomic scale, the prevalence of underfunded pension funds poses systemic risks, potentially precipitating fiscal crises and necessitating government intervention to mitigate the fallout. The strain exerted by underfunded pension obligations on public finances can impede the allocation of resources toward critical public services and infrastructure, impinging on overall economic development and societal well-being.

Moreover, the intergenerational equity implications of underfunded pension funds are profound, as the burden of rectifying underfunding often falls on future generations. The need to bridge funding shortfalls may necessitate heightened contributions from younger workers, engendering disparities in the distribution of financial obligations across different cohorts and fueling intergenerational tensions.

By comprehending the far-reaching ramifications of underfunded pension funds, stakeholders can galvanize efforts to implement reforms aimed at mitigating underfunding and fortifying the sustainability of pension systems. Addressing the multifaceted impacts of underfunding is imperative in safeguarding the retirement security of current and future generations, fostering economic stability, and nurturing a climate of financial resilience and inclusivity.

Addressing Underfunding

Navigating Toward Solutions for Pension Fund Sustainability

Effectively addressing the underfunding conundrum necessitates a multifaceted approach that encompasses proactive measures at the regulatory, governance, investment, and demographic levels. Heightened regulatory oversight and enforcement can play a pivotal role in fortifying the financial robustness of pension funds, ensuring adherence to prudent funding requirements and bolstering transparency in reporting and disclosure. Regulatory reforms aimed at aligning actuarial assumptions with demographic realities and imposing stringent funding discipline can mitigate the risk of underfunding.

Enhancing governance practices within pension fund management is paramount in mitigating underfunding. Implementing robust risk management frameworks, fostering prudent investment decision-making, and fortifying fiduciary responsibilities can fortify the resilience of pension funds against underfunding risks. Moreover, fostering greater stakeholder engagement and transparency in governance processes can engender trust and confidence in the management of pension assets, reinforcing the long-term sustainability of these funds.

Strategic investment approaches tailored to the unique risk profiles and long-term obligations of pension funds are instrumental in mitigating underfunding. Diversifying investment portfolios, optimizing asset allocation, and embracing innovative investment strategies can enhance the capacity of pension funds to generate robust, sustainable returns, mitigating the impact of economic volatility and low interest rate environments on fund performance.

Addressing demographic shifts and their implications for pension fund sustainability necessitates proactive measures to recalibrate funding mechanisms and retirement age dynamics. Adapting contribution structures, incentivizing longer work tenures, and fostering public awareness on the importance of retirement planning can alleviate the strain imposed by demographic trends, bolstering the long-term viability of pension funds.

Furthermore, fostering a culture of financial literacy and retirement preparedness among workers can engender a proactive approach toward retirement savings, potentially alleviating the burden on pension funds and fortifying individual financial resilience during retirement. Educating individuals on the nuances of pension planning, investment principles, and the implications of underfunding can empower them to make informed decisions that complement the sustainability of pension systems.

By embracing a comprehensive array of measures spanning regulatory, governance, investment, and demographic domains, stakeholders can navigate toward a landscape of pension fund sustainability, mitigating underfunding risks and fortifying the retirement security of current and future generations. Proactive, collaborative efforts aimed at addressing the multifaceted dimensions of underfunding are pivotal in nurturing resilient, inclusive pension systems that uphold the financial well-being and dignity of retirees.

Conclusion

Forging a Path Toward Resilient and Sustainable Pension Systems

The specter of underfunded pension funds casts a pervasive shadow over the retirement landscape, posing formidable challenges to the financial security of retirees, the stability of organizations, and the broader socioeconomic fabric. The intricate interplay of demographic shifts, economic dynamics, regulatory frameworks, and governance practices underscores the multifaceted nature of underfunding, demanding a concerted, holistic approach to address this predicament.

By unraveling the complexities surrounding underfunded pension funds and delving into the far-reaching implications of this phenomenon, stakeholders can galvanize efforts to forge a path toward resilient and sustainable pension systems. Proactive regulatory reforms aimed at fortifying funding requirements, enhancing transparency, and aligning actuarial assumptions with demographic realities can mitigate the risk of underfunding, fostering greater financial stability within pension systems.

Moreover, bolstering governance practices, fostering prudent investment strategies, and embracing demographic recalibration measures can fortify the resilience of pension funds against underfunding risks, nurturing a climate of long-term sustainability and inclusivity. Fostering a culture of financial literacy and retirement preparedness among workers can engender a proactive approach toward retirement savings, potentially alleviating the burden on pension funds and fortifying individual financial resilience during retirement.

By embracing a comprehensive array of measures spanning regulatory, governance, investment, and demographic domains, stakeholders can navigate toward a landscape of pension fund sustainability, mitigating underfunding risks and fortifying the retirement security of current and future generations. Proactive, collaborative efforts aimed at addressing the multifaceted dimensions of underfunding are pivotal in nurturing resilient, inclusive pension systems that uphold the financial well-being and dignity of retirees.

Ultimately, the endeavor to address underfunded pension funds transcends financial considerations, encapsulating a commitment to fostering a climate of security, dignity, and empowerment for retirees. By navigating toward sustainable pension systems, fortified against the specter of underfunding, stakeholders can illuminate a path toward a future where retirement security is upheld as a fundamental pillar of societal well-being, nurturing a legacy of financial resilience and inclusivity for generations to come.