Home>Finance>Why Did I Have To Verify My Identity With The IRS?

Finance

Why Did I Have To Verify My Identity With The IRS?

Published: November 1, 2023

Discover the reasons why the IRS required you to verify your identity, and how it relates to your personal finance. Uncover the importance of complying with the identity verification process.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Verifying your identity with the Internal Revenue Service (IRS) can be a frustrating and time-consuming process. As you wonder why you have to go through this additional step, it’s important to understand the reasons behind it and the importance of securing the integrity of financial transactions.

As the nation’s tax collection agency, the IRS is responsible for ensuring that individuals and businesses accurately report their income and pay the appropriate amount of taxes. However, with the rise in identity theft and fraudulent activities, the IRS has implemented various measures, including identity verification, to protect taxpayers and prevent fraudulent tax filings.

So, why did you have to verify your identity with the IRS? The answer lies in the increasing sophistication of cybercriminals and the need for the IRS to safeguard taxpayers’ sensitive information. By verifying your identity, the IRS can establish that you are the rightful owner of the Social Security number or Taxpayer Identification Number (TIN) associated with your tax returns.

Identity verification is a crucial step in the tax filing process, as it helps the IRS validate the authenticity of tax returns and detect any potential fraudulent activity. While it may seem like an inconvenience, it ultimately protects you and other taxpayers from falling victim to identity theft and tax fraud.

In this article, we will delve deeper into the background of identity verification with the IRS, explore the reasons behind it, provide steps to successfully verify your identity, and discuss common issues and challenges that taxpayers may encounter during the process. By understanding the purpose and significance of identity verification, you can navigate the process with confidence and ensure your tax filings are secure.

Background on Identity Verification with the IRS

Identity verification has become an essential component of the tax filing process, as the IRS aims to protect taxpayers from identity theft and ensure the accuracy of tax returns. The IRS utilizes identity verification to confirm that the individuals filing the returns are indeed the legitimate taxpayers.

The need for identity verification arose due to an increase in fraudulent activities, particularly in the realm of tax filing. In the past, scammers would file false tax returns using stolen Social Security numbers, claiming fraudulent refunds. To combat this issue, the IRS implemented various safeguards, including the Identity Protection PIN and the Identity Verification Service (IVS).

The Identity Protection PIN (IP PIN) is a six-digit number assigned to eligible taxpayers that provides an extra layer of security to their tax accounts. By using this PIN, taxpayers can prevent anyone else from filing taxes using their Social Security number.

The Identity Verification Service (IVS) is a process through which taxpayers are required to verify their identities before their tax returns are processed. This verification process involves answering a series of questions based on the taxpayer’s previous financial activities or personal information, which helps the IRS confirm the taxpayer’s identity.

Furthermore, the IRS collaborates with third-party credit reporting agencies to verify taxpayer identities. These agencies provide information about the taxpayer’s credit history, loan applications, and other financial activities, which helps the IRS assess the validity of the tax return.

While identity verification may seem like an inconvenience, it plays a vital role in preventing tax fraud and protecting taxpayers’ sensitive information. By implementing these measures, the IRS can identify and halt fraudulent tax returns, saving both the government and taxpayers significant amounts of money.

It is important to note that not all taxpayers are required to go through the identity verification process. The IRS typically selects taxpayers randomly or based on certain risk factors such as unusual filing patterns, large refunds, or other suspicious activities. If you receive a notice from the IRS requesting identity verification, it is essential to follow the instructions promptly to avoid any delays in the processing of your tax return.

In the next section, we will explore the reasons behind the IRS’s implementation of identity verification and the importance of this process in safeguarding taxpayers’ financial information.

Reasons for Identity Verification

The IRS has implemented identity verification as a crucial step in the tax filing process for several reasons. Let’s explore the key reasons behind the IRS’s emphasis on verifying taxpayer identities:

- Prevention of Identity Theft: Identity theft has become a widespread issue in recent years, and tax filings are a prime target for scammers. By verifying taxpayer identities, the IRS can detect and prevent fraudulent tax returns filed using stolen personal information, such as Social Security numbers or TINs. This not only protects individual taxpayers from financial loss but also helps maintain the integrity of the tax system.

- Protection Against Tax Fraud: Tax fraud involves deliberate misrepresentation or concealment of information on tax returns to evade taxes owed or claim undeserved refunds. Identity verification acts as a deterrent, as it makes it more challenging for individuals to engage in fraudulent activities. By confirming the accuracy of taxpayer identities, the IRS can minimize the occurrence of tax fraud and ensure that tax revenues are collected appropriately.

- Enhanced Security of Financial Information: Verifying taxpayer identities helps ensure the security of sensitive financial information, such as income, deductions, and credits. By confirming that the individuals filing tax returns are the rightful owners of their tax identification numbers, the IRS can mitigate the risk of unauthorized access to financial data. This provides taxpayers with peace of mind, knowing that their private information is protected from potential misuse.

- Reduction of Erroneous Refunds: Identity verification plays a crucial role in reducing erroneous tax refunds. Scammers often file fraudulent returns claiming large refunds, resulting in undeserved financial gains at the expense of the government and honest taxpayers. By verifying taxpayer identities, the IRS can identify inconsistencies or irregularities in tax filings and prevent erroneous refunds from being issued.

- Compliance with Legal Requirements: The IRS is bound by legal obligations to safeguard taxpayer information and ensure the accuracy of tax filings. Implementing identity verification measures helps the IRS fulfill these obligations and maintain transparency and accountability in the tax system. It also helps protect taxpayers from potential legal consequences resulting from identity theft or fraudulent activities using their personal information.

Identity verification is a necessary step in protecting both taxpayers and the integrity of the tax system. By ensuring that the individuals filing tax returns are legitimate taxpayers, the IRS can detect and prevent fraudulent activities, maintain the security of sensitive financial information, and uphold the trust of taxpayers in the tax filing process.

Next, we will explain the steps involved in verifying your identity with the IRS, guiding you through the process and helping you navigate any challenges you may encounter along the way.

Steps to Verify Your Identity with the IRS

When the IRS requires you to verify your identity, it is essential to follow the necessary steps in order to successfully complete the process. Here’s a breakdown of the steps involved in verifying your identity with the IRS:

- Review the IRS Notice: If the IRS determines that your identity needs to be verified, they will send you a notice explaining the process. Carefully read and understand the notice to ensure you have all the information required for the verification process.

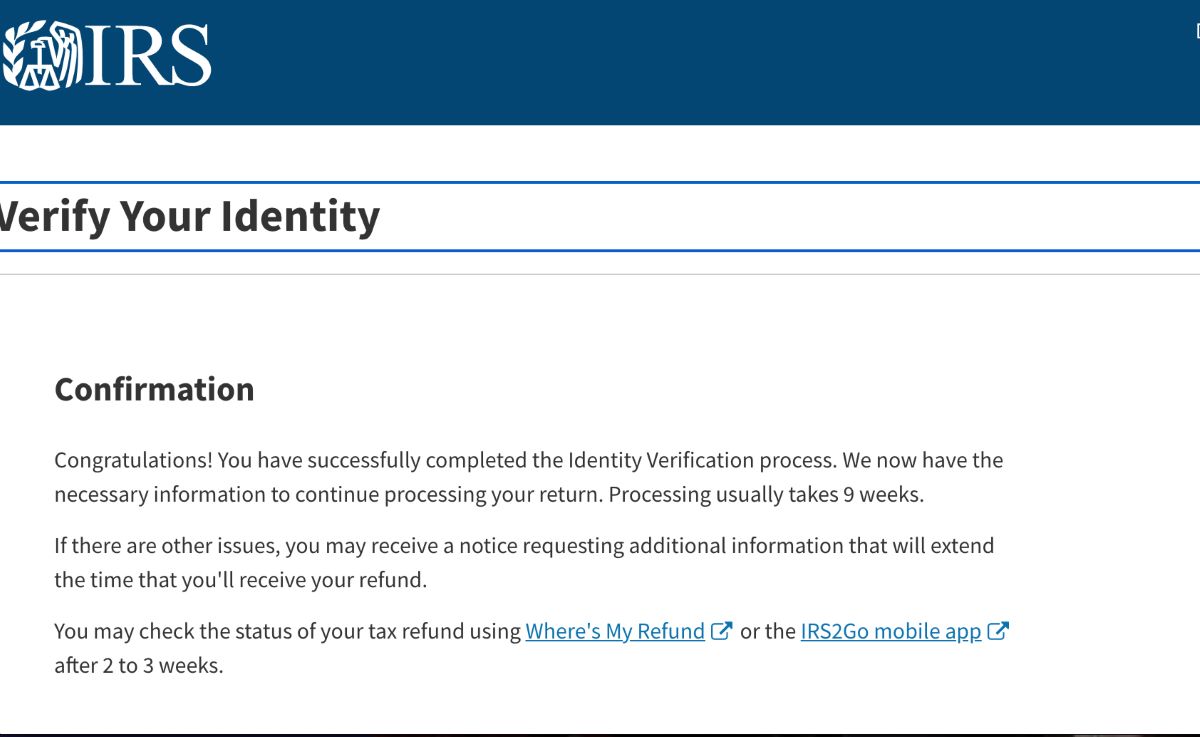

- Access the IRS Online Portal: The IRS provides an online portal called “Identity Verification Service” where you can initiate the identity verification process. Access the portal by visiting the IRS website and following the provided instructions.

- Provide Personal Information: In the online portal, you will be asked to provide personal information, such as your Social Security number or Taxpayer Identification Number (TIN), date of birth, and address. Ensure that you enter the information accurately to avoid any delays or complications.

- Answer Identity Verification Questions: The IRS will present you with a series of questions based on your personal and financial history. These questions may involve specific details of your past tax filings, loans, or other financial activities. Carefully read each question and provide accurate responses to the best of your knowledge.

- Provide Additional Documentation if Required: In some cases, the IRS may request additional documentation to verify your identity. This may include copies of identification documents, such as a driver’s license or passport, as well as any supporting documents related to your tax filings. Ensure that you submit the requested documents promptly and securely.

- Submit the Verification Request: Once you have provided all the necessary information and answered the verification questions, submit the verification request through the online portal. Double-check all the entered details to ensure accuracy before submitting.

- Wait for Confirmation: After submitting your verification request, you will receive a confirmation from the IRS. This confirmation may be in the form of an email or a notice sent through traditional mail. The confirmation will inform you of the status of your identity verification and any further actions required.

It is crucial to complete the identity verification process within the designated timeframe provided by the IRS. Failure to do so may result in delays in processing your tax return or other related transactions.

If you encounter any issues or have questions during the identity verification process, reach out to the IRS directly for assistance. They have dedicated customer service representatives who can provide guidance and support to help you navigate the process successfully.

Next, we will discuss some common issues and challenges that taxpayers may face during the identity verification process and provide tips for overcoming them.

Common Issues and Challenges with the Verification Process

The identity verification process with the IRS can sometimes present challenges and issues that taxpayers may encounter. Understanding these common problems and knowing how to overcome them can help streamline the verification process. Here are some of the common issues and challenges you may face when verifying your identity with the IRS:

- Difficulty answering the verification questions: The IRS uses a series of questions based on your financial and personal history to verify your identity. Sometimes, the questions may be challenging or confusing. If you have trouble answering them accurately, you can request an alternative method of verification, such as providing documentation or speaking with an IRS representative.

- Mismatched personal information: If the personal information you provide during the verification process does not match the information the IRS has on file, it can cause issues. Double-check that you enter your details correctly and ensure that the information you provide aligns with your previous tax filings to avoid any discrepancies.

- Difficulty accessing the online portal: Some taxpayers may encounter technical difficulties when trying to access the IRS online portal. If you experience issues, it is recommended to try using a different web browser or device. You can also reach out to the IRS for assistance or request alternative methods of verification.

- Request for additional documentation: In certain cases, the IRS may require additional documentation to verify your identity. This can cause delays if you are unable to provide the requested documents promptly. Make sure to gather all the necessary documentation in advance and submit them securely to the IRS to avoid any further complications.

- Deadline for verification: The IRS sets a deadline for completing the identity verification process. Failing to meet this deadline can result in delays in processing your tax return or other related transactions. It is crucial to prioritize the verification process and complete it within the designated timeframe.

If you encounter any of these issues or face any challenges during the identity verification process, it is important to remain calm and proactive. Contact the IRS directly for assistance by calling the appropriate helpline or reaching out to their customer service representatives. They will be able to provide guidance and help resolve any issues you may be facing.

Now that we have addressed some of the common challenges with the verification process, let’s move on to the next section, where we will provide tips for successfully verifying your identity with the IRS.

Tips for a Successful Identity Verification with the IRS

Verifying your identity with the IRS can be a meticulous process, but with the right approach, you can increase your chances of a successful verification. Here are some helpful tips to ensure a smooth identity verification process:

- Read the instructions carefully: When you receive a notice from the IRS regarding identity verification, take the time to read the instructions provided thoroughly. Understand the requirements and gather any necessary documents or information before starting the verification process.

- Double-check your personal information: Before entering your personal information into the IRS online portal, carefully review and verify the accuracy of the details you provide. Typos or discrepancies in your information can lead to delays or complications in the verification process.

- Prepare supporting documentation in advance: Anticipate the possibility of the IRS requesting additional documentation to validate your identity. Gather supporting documents such as your driver’s license, passport, or previous year’s tax return in advance. Having these documents ready will help expedite the process if you are asked to provide them.

- Carefully read and understand the verification questions: When answering the identity verification questions, be sure to read each question carefully. Take your time and provide accurate responses based on your personal and financial history. If you are unsure of an answer, take a moment to think it through or consider requesting an alternative verification method.

- Be responsive and timely: Respond promptly to any requests or communications from the IRS regarding your identity verification. Adhere to the provided deadlines to avoid any setbacks in processing your tax return or related transactions. Proactive and timely communication with the IRS can help resolve issues efficiently.

- Seek assistance if needed: If you encounter challenges or have questions during the identity verification process, don’t hesitate to reach out to the IRS for assistance. Use the designated helpline or customer service channels to get the guidance you need. IRS representatives can provide clarification, address concerns, and help navigate any issues you may be facing.

- Keep records of your communication and documentation: Maintain a record of all communication with the IRS, including notes from phone calls, emails, or any documentation you submit during the verification process. This will help you track your progress and provide proof of your cooperation if needed in the future.

By following these tips, you can increase the chances of a successful identity verification process with the IRS. Remember, patience and attention to detail are key. Stay organized, be proactive, and seek assistance when necessary to ensure a smooth and efficient verification process.

Now let’s conclude our discussion on identity verification with the IRS.

Conclusion

Verifying your identity with the IRS may seem like an inconvenience, but it serves a vital purpose in protecting taxpayers and the integrity of the tax system. By implementing identity verification measures, the IRS aims to prevent identity theft, detect tax fraud, and ensure the accuracy of tax returns.

In this article, we explored the background of identity verification with the IRS and the reasons behind its implementation. We discussed the steps involved in verifying your identity, common issues and challenges that taxpayers may face, and provided tips for a successful verification process.

It is important to understand the significance of identity verification and its role in safeguarding your sensitive financial information. By complying with the identity verification requirements, you contribute to a secure tax system and protect yourself from potential fraudulent activities.

If you encounter any difficulties during the identity verification process, do not hesitate to reach out to the IRS for assistance. They have dedicated customer service representatives who can provide guidance and support.

Remember to stay organized, review instructions carefully, and promptly respond to any requests from the IRS. By taking these proactive steps, you can ensure a smooth and successful identity verification process.

Thank you for reading this article, and we hope it has provided you with valuable insights into the importance of identity verification with the IRS. Stay vigilant, protect your personal information, and file your taxes with confidence.